Do you really understand the relationships between stETH, 3AC, and Celsius in the encrypted "Lehman" event?

TechFlow Selected TechFlow Selected

Do you really understand the relationships between stETH, 3AC, and Celsius in the encrypted "Lehman" event?

The complex relationships among assets and institutions such as stETH, Three Arrows Capital, and Celsius.

Author: 0xCryptolee

Editor: Wu Ji

Produced by CIG Labs

The recent crash in the crypto market—most of us already know at least some of the reasons behind it.

From articles and discussions across communities, names like "stETH, 3AC (Three Arrows Capital), Celsius" are repeatedly mentioned. But do you truly understand the complex relationships between these assets and institutions? Let me break it down for you to better grasp this crypto crisis.

stETH

At the heart of this story lies stETH. Let me first explain what stETH is. stETH is a yield-bearing token issued by Lido, a liquid staking solution (think of it as a fixed-term deposit certificate). Investors holding ETH can choose to stake their ETH via Lido’s Ethereum PoS staking service, contributing to consensus layer validation on the Beacon Chain. PoS is Ethereum’s post-merge mining mechanism. ETH tokens staked into the Beacon Chain through Lido will be locked until gradually released in batches after the Shanghai hard fork following The Merge.

Until then, stakers receive stETH as a withdrawal receipt representing their future claim on the staked ETH. ETH PoS staking (locking) itself should not be liquid—but because investor demand for liquidity in staked assets is both real and strong,

the dual nature of stETH—as both a withdrawal receipt and an interest-bearing token—has led to two main paths for unlocking its liquidity:

1. Various DeFi protocols accept stETH as collateral to borrow more liquid assets, thereby freeing up capital from otherwise locked holdings,

2. Providing liquidity pools on Curve between stETH and ETH allows investors holding stETH to exit their positions in Lido. We’ll return to this later.

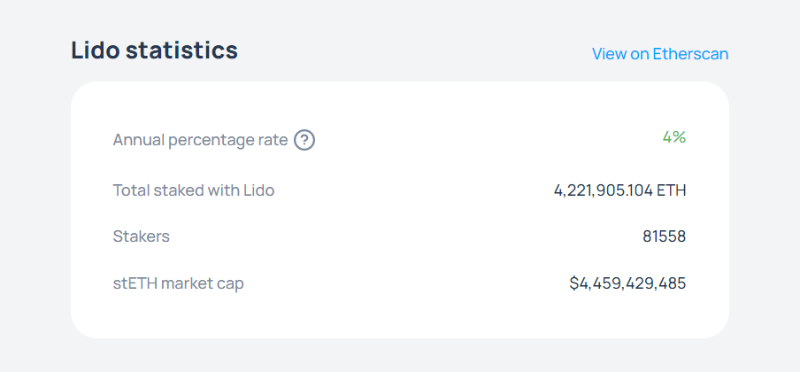

Staking volume and market cap of stETH, screenshot from Lido.fi

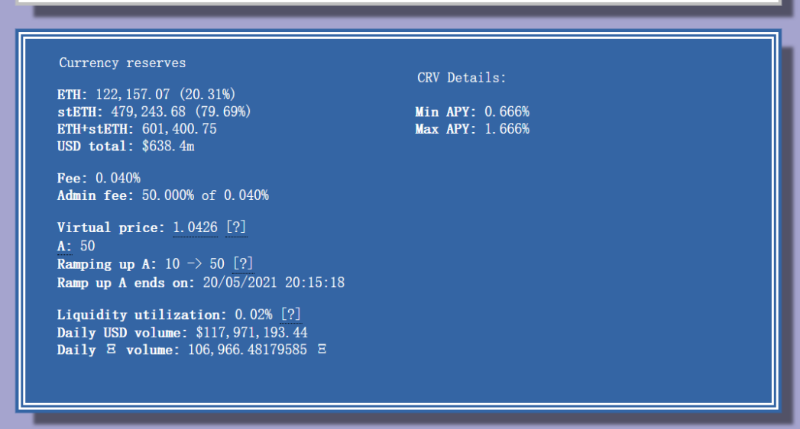

Curve pool status between stETH and ETH, screenshot from curve.fi

Lido

Compared to Ethereum’s previous PoW mining model, staked ETH on the Beacon Chain can be likened to mining hardware, while stETH acts as the ownership voucher. However, instead of physical rigs, the mining asset now consists of 32 ETH tokens (this number being the minimum required to run one validator node on Ethereum’s consensus layer). In this sense, the Lido protocol functions similarly to traditional mining pools in PoW systems. While old-school mining pools aggregated physical equipment, today's liquid staking solutions aggregate fragmented ETH deposits to participate collectively in consensus mining—the fundamental principle remains unchanged. Similarly, centralized exchanges and institutional providers also pool user funds to build validator nodes for staking.

Compared to PoW mining, PoS actually increases the risk of centralization on Ethereum. Under PoW, due to regulatory constraints, electricity costs, and environmental factors, mining farms and pools tend to be geographically dispersed, giving them natural decentralization advantages—though their high energy consumption makes them targets of criticism globally.

With PoS, anyone holding 32 ETH can become a validator, meaning those with larger ETH holdings have inherent advantages and influence in the network—such as exchanges, asset managers, and whales. Currently, major participants in Ethereum’s consensus layer include large centralized exchanges and semi-decentralized solutions like Lido.

Why is Lido considered semi-decentralized? The key reason is that Lido uses a relatively centralized approach when selecting node operators and managing withdrawal keys—only approved operators can receive delegated ETH from the protocol to run validators. This has long been criticized within the Ethereum community.

Lido consistently ranks among the top 5 DeFi protocols by TVL and is the single largest entity staking ETH on the Beacon Chain. Its influence over the Ethereum ecosystem continues to grow alongside the expanding market size of stETH.

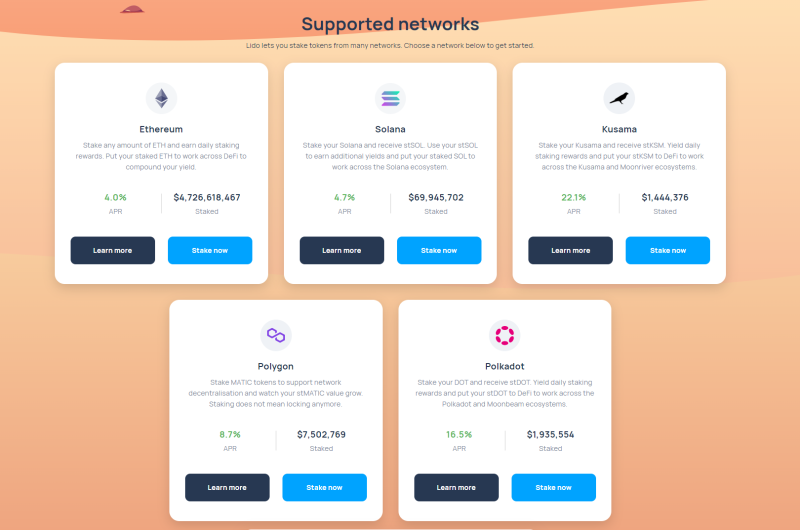

To summarize: Lido is a liquid staking solution enabling investors to participate in Ethereum PoS staking. Of course, beyond Ethereum, Lido also offers staking services on other PoS chains such as Solana, Polygon, Kusama, and Polkadot.

PoS staking services supported by Lido, screenshot from Lido.fi

Ethereum PoS Staking & Minting

Now that we’ve covered stETH and Lido, let’s briefly discuss how mining and block production work under Ethereum’s new PoS consensus. As previously mentioned, after The Merge, blocks are produced through validator consensus. Nodes that stake 32 ETH into the execution layer contract (i.e., the current Ethereum mainnet) and run both consensus and execution layer clients are randomly selected to form validator committees, which reach agreement and propose blocks using threshold signatures. Ethereum’s unique consensus mechanism and transitional state pre-Merge directly led to the creation of stETH and the demand for its liquidity.

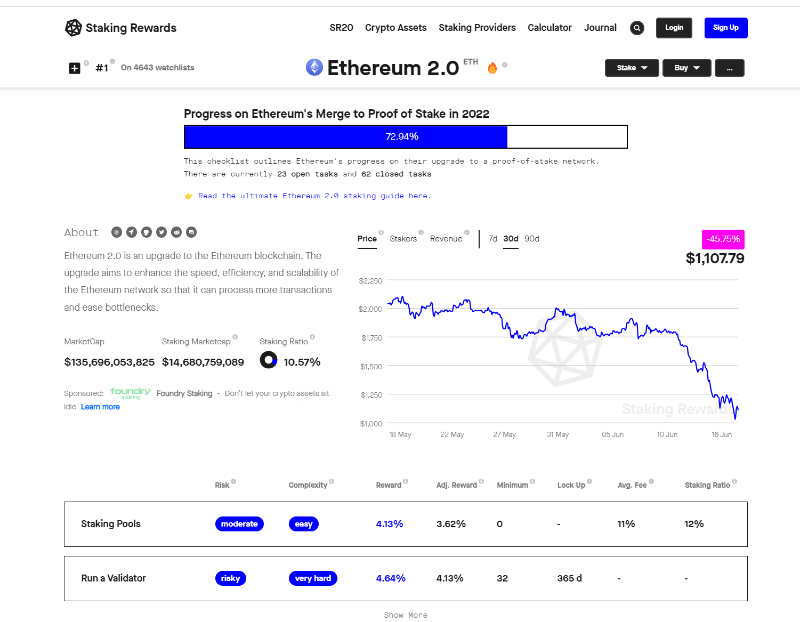

Ethereum 2.0 progress and staking details, screenshot from stakingrewards.com

3AC (Three Arrows Capital)

Founded in 2012 by Zhu Su and Kyle Davies, Three Arrows Capital invested heavily across numerous projects in the crypto space, active in both primary and secondary markets.

According to community reports, 3AC gained significant early exposure to BTC and ETH, successfully positioning itself as a top-tier VC during the bull run.

However, due to founder Zhu Su’s overly optimistic outlook on the crypto market, coupled with excessive leverage and aggressive investment strategies, 3AC fell into a liquidity crisis amid the Federal Reserve’s tightening monetary policy—triggering widespread on-chain liquidations of its assets.

Furthermore, its investment in Luna (now LUNC) resulted in nearly total losses—up to 99.9%—pushing it further into liquidity distress.

Celsius

Celsius was founded in 2017 as a cryptocurrency lending platform. Think of it as a bank. Unlike decentralized protocols such as Aave, Celsius operates centrally. Users deposit assets into wallets managed by the platform, earning relatively high yields through services including lending, trading, payments, custody, and Bitcoin mining.

Celsius attracted nearly $24 billion in assets under management by offering returns far above market averages. Thanks to its strong performance, the project secured a $400 million Series B round in October 2021, led by WestCap (founded by former Airbnb executive Laurence Tosi) and Canada’s second-largest pension fund, CDPQ. By November 2021, this funding round had expanded to $750 million.

Prior to that, Celsius received a $10 million investment from Tether—leading some to speculate that its collapse might have been a targeted attack on Tether’s stablecoin USDT.

Having introduced the key entities involved, we can now piece the full narrative together.

Three Arrows’ High Leverage

As noted earlier, 3AC held a large amount of ETH. To generate returns, 3AC staked much of its ETH via Lido’s Ethereum PoS staking service.

But before The Merge, annual staking rewards were only around 4%, clearly insufficient for capital seeking higher returns. To unlock liquidity from stETH and amplify gains, major DeFi protocols like Aave began accepting stETH as collateral. stETH holders could deposit it into Aave with over-collateralization to borrow ETH, then re-stake that borrowed ETH via Lido—repeating the cycle to earn amplified yields. This is commonly known as the “DeFi onion” or “yield stacking.”

These strategies are safe during sustained market rallies or stable conditions, since over-collateralization protects against insolvency during normal price fluctuations.

This is exactly what 3AC did—not only leveraging within decentralized lending protocols but also pledging assets to centralized institutions to borrow more. Such actions pose little risk when market liquidity is ample and prices stable. But unfortunate timing hit: the Fed’s rate hikes and balance sheet contraction drained market liquidity, putting downward pressure on BTC and ETH. As prices dropped, 3AC’s collateral value eroded, pushing it toward insolvency and forcing margin calls to avoid liquidation.

In response, 3AC sold altcoins and dumped stETH to raise funds for additional margin. Massive sell-offs flooded the market, severely unbalancing the ETH/stETH pool on Curve—increasing stETH supply while reducing ETH reserves—causing stETH to trade at a discount, dipping as low as 0.94 ETH per stETH.

(Many refer to this as stETH “depegging,” but technically, stETH isn’t pegged—it represents a redeemable claim on staked ETH and can always be redeemed 1:1 post-Shanghai. What occurred was simply a market-driven discount reflecting investor willingness to exchange stETH below parity for immediate liquidity.)

Clearly, 3AC’s overly optimistic market assumptions and high-leverage bets backfired under macroeconomic stress, triggering massive liquidations. These liquidations drove prices lower, setting off cascading collateral calls. Combined with heavy losses from its Luna position and other exchange exposures, 3AC faced complete liquidity exhaustion—even resorting to misappropriating partner funds and liquidating its NFT fund.

Three Arrows was doomed. The bull market built this top-tier firm; when the tide receded, we saw it was swimming naked! When the blowup happened, many analyzed 3AC’s failure as stemming from excessive leverage and reckless investing—but what good does that analysis do? Only by controlling greed and maintaining constant respect for the market can one endure long-term—and even transcend!

Celsius’ High Yields

Celsius, as a centralized institution, used a strategy similar to Anchor Protocol—offering high yields to attract deposits. But higher returns inherently come with higher risks.

The root cause of Celsius’ liquidity crisis lies in its investment strategy. It staked a significant portion of user funds via Ethereum PoS staking, locking up liquidity until the Shanghai hard fork enables withdrawals. Celsius also used Lido to stake a substantial amount of ETH for staking rewards.

Moreover, Celsius suffered two major investment failures. First, BadgerDAO—a DeFi platform—that lost nearly $120 million in a hack in December 2021. Second, StakeHound, an ETH2.0 staking platform, which lost about $75 million due to a lost private key. Celsius was a major victim in both incidents, further shaking depositor confidence and worsening its liquidity crunch.

Ultimately, however, the core issue was unsustainable yields. During the bull market, such returns might have been achievable via various DeFi strategies, but under tightening macro conditions, the market no longer supports the confidence and liquidity needed to maintain Celsius’ promised yields. With no withdrawal restrictions in place, users began mass redemption requests. But most of Celsius’ assets were locked or staked. Existing liquidity dried up quickly, forcing Celsius to dump stETH on Curve to obtain ETH for withdrawals. Since all data is on-chain, Celsius’ exposure became visible, amplifying panic. More users rushed to withdraw, creating a stampede. Even after selling stETH at a discount, Celsius couldn’t meet redemption demands and was forced to halt withdrawals, seeking acquisition or restructuring.

In fact, Celsius began selling stETH before 3AC did—meaning it likely accelerated and exacerbated 3AC’s liquidity crisis and losses.

Federal Reserve Tightening

Looking back, the primary driver was the Fed’s hawkish monetary tightening—rate hikes and quantitative tightening—which drained market liquidity. Falling asset prices exposed every flaw hidden during the rally. What went up fast came crashing down. Capital is greedy and chaotic, willing to ignore risks for huge profits. But as humans behind capital, we must remain vigilant and respectful. False bubbles will burst—but once they do, more people will see clearly, allowing crypto to cleanse itself and move forward!

DeFi Jenga

The maturity and composability of DeFi protocols have built a towering house of cards. This event is somewhat linked to the prior LUNA collapse. In today’s deeply interconnected DeFi landscape, no single blowup happens in isolation. Each falling block in the DeFi Lego tower may trigger an avalanche. The UST collapse set off a chain reaction affecting Celsius and 3AC—and now the fall of 3AC and Celsius could unleash further domino effects. We’ll just have to wait and see!

CIG Labs is a research lab launched by CIG DAO, providing community members with a space for innovation and collaboration, empowering contributors and the DAO through mutual growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News