Institutional sell-offs, stETH is de-pegging—what's really happening?

TechFlow Selected TechFlow Selected

Institutional sell-offs, stETH is de-pegging—what's really happening?

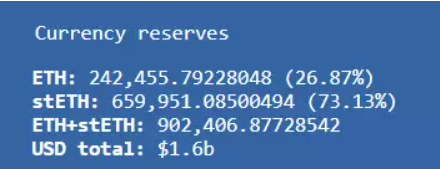

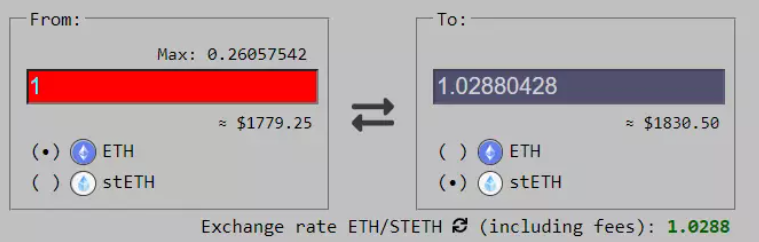

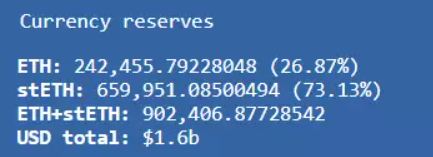

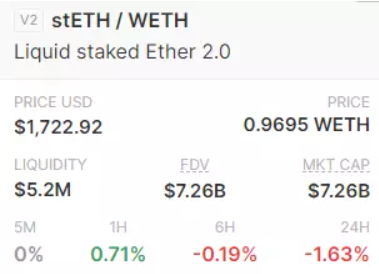

$stETH is gradually losing its peg, currently de-pegging by about 3%. The pool on Curve has become highly imbalanced, with 75% now consisting of $stETH.

Written by: @coryklippsten

Translated by: TechFlow Intern

$stETH is gradually losing its peg, currently de-pegged by about 3%. The Curve pool has become highly unbalanced, with 75% now consisting of $stETH.

Yesterday, Alameda Research exited their position, selling nearly 50,000 stETH at massive slippage... What exactly is happening?

This article synthesizes research and analysis from Small Cap Scientist and Cory Klippsten.

The $stETH/$ETH peg situation is deteriorating rapidly as liquidity dries up. This piece compiles several observations in hopes of drawing more attention to this issue.

$stETH is the staked version of ETH deposited via Lido Finance, designed to secure Ethereum post-merge. Fully backed 1:1 by $ETH, it had low liquidity months before the merge—but this wasn't an issue because a liquidity pool existed on Curve.Fi.

However, that pool has now become severely imbalanced—75% consists of $stETH, the highest ratio ever recorded. This imbalance has caused $stETH to de-peg by approximately 3%, and the gap continues to widen depending on LP and A-factor asset dynamics.

Since $stETH is fully backed 1:1 by ETH and the merge is only months away, buying and holding $stETH for arbitrage seems like a no-brainer.

This is very different from $UST—so why are people exiting?

I found that Alameda Research exited their position yesterday, selling around 50,000 stETH over several hours while absorbing massive slippage losses... Alameda always moves early.

Seven major investors created the stETH/ETH dynamic, somewhat similar to the Luna/UST mechanism. These seven institutional backers of Lido (stETH) are: A16z, Alameda (FTX / Sam Bankman-Fried), Coinbase, Paradigm (Coinbase co-founder), DCG (owner of GBTC), Jump, and Three Arrows (the same group behind the Luna/UST pump).

They are the seven key investors in Lido (stETH), holding massive positions. Any sudden exit could trigger a large-scale bank run.

Looking at other major $stETH holders reveals further clues—starting with Celsius Network...

$stETH serves as a core yield generator for Celsius, much like how GBTC arbitrage trades provided yields for BlockFi. But when premium turns into discount, this revenue stream vanishes. This staked ETH (stETH) game was the primary "yield" source for Celsius and other retail platforms.

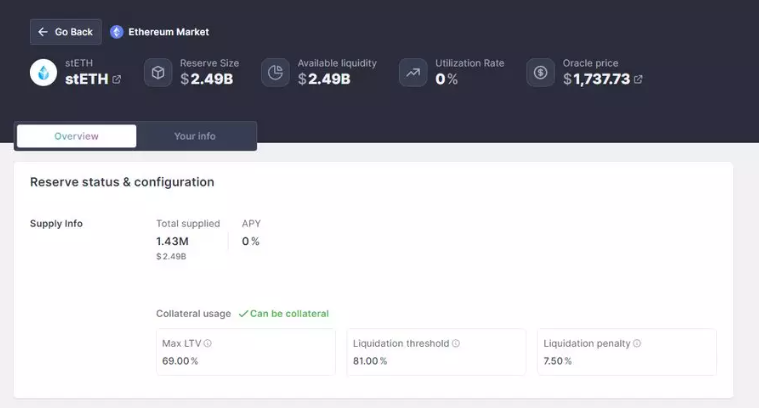

Celsius holds a massive position, including nearly 450,000 stETH worth $1.5 billion. They deposited $stETH as collateral on Aave and accumulated roughly $1.2 billion in debt.

That wouldn’t be a problem… but.

Celsius Network is rapidly burning through its liquidity reserves to repay investors redeeming their stakes. Billions are locked in illiquid positions, forcing them to take out huge loans to cover customer redemptions.

Why is a multi-billion dollar fund struggling with liquidity? Because Celsius suffered significant losses from hacks over the past year, making matters worse...

First, they lost $70 million in the StakeHound exploit, then another $50 million in the BadgerDAO front-end vulnerability.

Additionally, $500 million of customer deposits were tied up in the recently collapsed LUNA/UST Ponzi scheme. Their reckless handling of client funds shocks me—and these are just the publicly known incidents.

Investors are trying to redeem their positions at a rate of about 50,000 ETH per week, leaving Celsius with two options:

1. Sell their $stETH for $ETH, then convert to stablecoins to increase liquidity.

2. Use $stETH as collateral to borrow and repay customers.

Let’s examine option one. Their position is around 450,000 stETH, but the Curve stETH/ETH liquidity pool only has about 242,000 ETH left. Each sale pushes the pool further from its 1:1 peg, resulting in increasing slippage costs.

Uniswap offers about $5 million in stETH liquidity. I can't track the full scale of CEX liquidity. However, CEX liquidity, Uniswap, Curve, and others combined cannot fully absorb their entire position.

$stETH is paired only with $ETH, except for a small pairing with $USDC on FTX. This means $stETH must first be converted to $ETH before becoming stablecoins. Moreover, they have substantial $stETH-backed loans, and this multi-billion dollar sell pressure is weakening collateral health ratios.

Now consider option two: borrowing stablecoins against their $stETH holdings. Celsius already carries over $1 billion in debt. Nearly $2.5 billion worth of $stETH is used as collateral on Aave—a precarious situation.

Suppose $stETH de-pegs severely or market conditions worsen. Celsius faces liquidation, borrowing becomes increasingly expensive, and their collateral loses value due to market movements. De-pegging amplifies price drops, liquidity evaporates—triggering a negative feedback loop...

One thing to consider: I’m unsure how Aave’s liquidations would proceed if stETH becomes completely illiquid.

Would they be held responsible, or forced to remain illiquid for months amid falling $ETH prices? What would they do?

Before being liquidated, Celsius will likely freeze withdrawals. They may only have weeks of cash left, facing heavy losses from the broken peg, rising borrow/lend fees, and risks of merge delays. When will they halt redemptions?

We must remember they aren’t the only whales in this scenario. Once other whales detect weakness, they could short the futures market and force Celsius to dump other positions. Hence, Alameda dumped 50,000 stETH and converted heavily into stablecoins...

Other whales include Swissborg, whose asset management platform holds about 80,000 stETH ($145 million).

Examining the Swissborg wallet, they have $27 million in $stETH within the Curve LP and 52,000 stETH available ($91 million). If they sell their Curve position, Celsius won’t stand a chance. Whales are exiting... who will get out first?

Looking at today's transactions, there have already been large sales—including a single transaction of 24,000 stETH ($4.2 million).

Checking Zapper and doing a quick Twitter search reveals this matches Celsius' withdrawal/deposit volume on FTX. Today alone, they’ve dumped over 5,000 stETH.

Reviewing previous Celsius wallets, I’d start monitoring their other positions closely. As stETH liquidity dwindles, forced liquidations will become inevitable.

Many retail users are leveraged arbitrage traders on Aave. If ETH prices crash, this could turn extremely ugly. Everyone will rush to cover their leverage with collateral and offload other positions.

If I were a VC or market maker, I’d set my sights on Celsius:

1. Liquidate them and go short.

2. Break the $stETH peg, triggering a bank run, causing $ETH prices to plummet, then buy $stETH cheaply before the merge.

Disclaimer

None of this is financial advice. Please do your own research. I am merely compiling information and sharing findings.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News