Three Arrows Capital returns to launch a Meme fund, but 80% of the supply is concentrated in the hands of insiders...

TechFlow Selected TechFlow Selected

Three Arrows Capital returns to launch a Meme fund, but 80% of the supply is concentrated in the hands of insiders...

In short: What's the real meme here? Token allocation.

Author: 0xLouisT

Translation: TechFlow

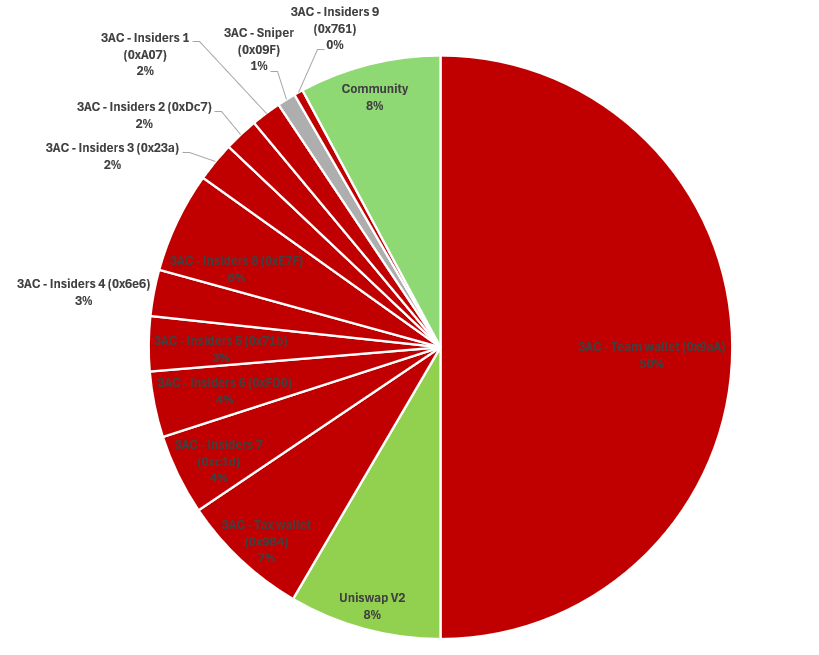

Three days ago, 3AC launched a meme fund called $3AC. Users from @bubblemaps quickly noticed that 80% of the supply is concentrated within a single cluster.

Still, curiosity drove me to dig deeper—what exactly are Su and Kyle up to? Are these two former billionaires really making a comeback?

Presale

On-chain trails show the team raised 750 ETH (approximately $2 million) in a private presale from around 25 investors. The participating wallets are closely linked to teams and individuals such as bobocoineth, Milady, izebel_eth, maybectrlfreak, Pandora_ERC404, and OXFUNHQ—a predictable lineup.

Token Distribution

The distribution of the 3AC token is particularly striking. The 3AC team split the proceeds from the private sale roughly in half. They allocated 317 ETH ($850,000) toward liquidity on Uniswap V2, locked for one year. The remaining 336 ETH ($880,000) was distributed across eight wallets belonging to the team that front-ran the $3AC listing. These wallets currently hold positions yielding between 10x and 30x their initial cost basis.

Another front-runner, possibly tipped off by insiders, used @BananaGunBot (great product!) to purchase $320,000 worth of $3AC, which briefly surged to a peak value of $1.23 million. He cashed out at the top but changed his mind minutes later, repurchasing the same amount. Now, those $3AC holdings have declined in value by over 50%.

Tokenomics

If you thought "low circulating supply, high FDV" was bad, just wait until you see 3AC’s "low circulation, high concentration" model.

Besides the significant portion of supply snapped up early by those eight team wallets, 3AC allocated 50% of the total supply to themselves at token genesis.

Wallet address:

0x9aA17AF45fE866f88A9a82Eb55fA250c2fF43597

The token also imposes a 1% tax on every buy and sell transaction, with proceeds flowing into a tax wallet that has already accumulated over 7% of the total supply.

Tax wallet address:

0x9B427aC936B8B25266Cd9DA54C667A8ba2353C5B

Most (but not all) of these wallets were merged hours ago into a primary team and insider wallet.

Insider wallet address:

0x60244d0DD5FDebE73E2E25577d78Ad1Ad07f2430

All in all, we arrive at this striking chart, with insider-held tokens marked in red and community and liquidity in green:

-

8% community

-

8% liquidity

-

84% team and insiders

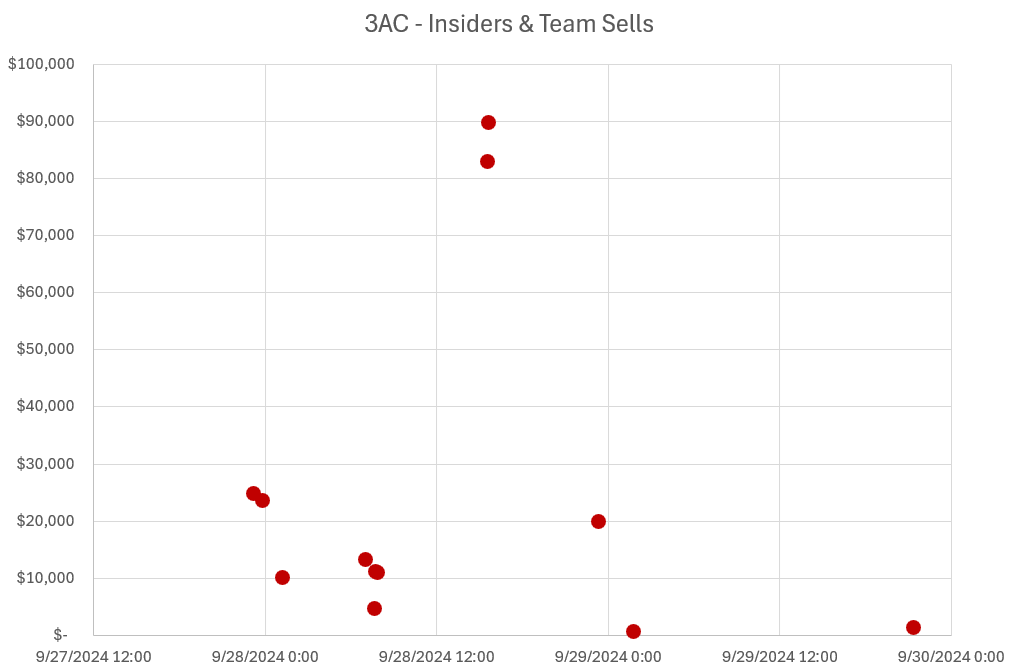

Presale participants have begun receiving distributions of 3AC tokens, with amounts ranging from $25K to $100K per wallet. Notably: fewer than 25% of presale holders have sold any of their first batch of distributed 3AC tokens. Still, several presale holders have already realized five-figure cashouts.

By now, it should be clear: buying this token means placing trust in a small group that controls over 84% of the supply. Some might even call it a centralized token. The choice is yours: decide whether you want to play this game.

In summary: what's the real meme here? The token distribution. Are these former billionaires really making a comeback?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News