Will public blockchains still be the main narrative rotation in the next bull market?

TechFlow Selected TechFlow Selected

Will public blockchains still be the main narrative rotation in the next bull market?

The last bull market was absolutely dominated by L1s and the "L1 sector rotation"—but will this still be the case in the future?

Written by: Rektdiomedes

Compiled by: TechFlow intern

The last bull run was absolutely dominated by L1s and the "L1 rotation" narrative—but will this still be the case moving forward?

We all remember what happened in 2021... L1s absolutely dominated the top gainers, with valuations skyrocketing into the tens of billions...

If I recall correctly, at one point we had ETH, BNB, LUNA, SOL, ADA, DOT, and AVAX all within the top ten tokens by market cap, with MATIC and NEAR close behind. (Poor Fantom)

So why were these tokens able to achieve such high valuations? Here's my take:

1) A proven "model" stemming from $ETH

2) Everyone picked their "winners" in the L1 race

3) Institutional capital’s preferred digital investment category

4) 3AC (not sarcastic)

After the L1 (and L2) season ended, we saw the L1 rotation sequence as:

BNB > Polygon > Fantom > Avax > Luna > Metis > ......

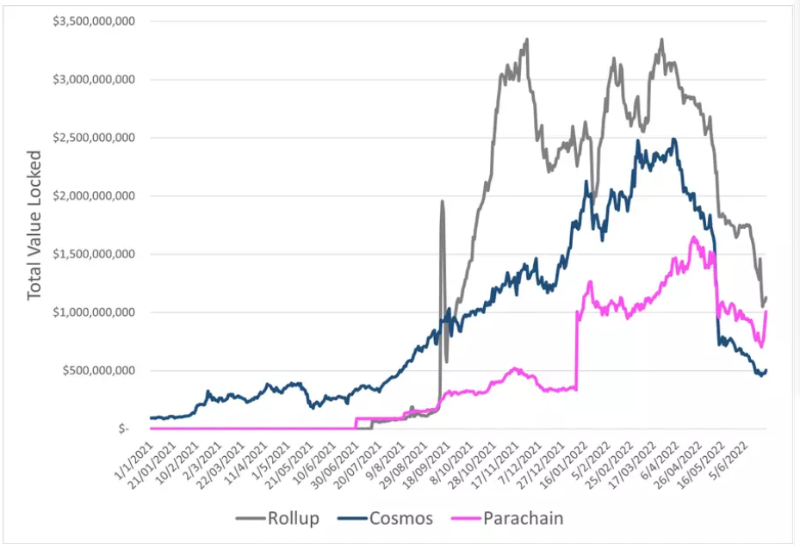

The fundamentals behind these protocols also involved massive dollar incentives to attract TVL (not necessarily a bad choice, but certainly a key variable).

Additionally, most of the relatively high-valued cryptocurrencies mentioned above were base-layer tokens, because there weren't real "protocols" built on top of them yet—will this continue?

Undoubtedly, L1s will remain very important as they provide the commodity for the digital economy (blockspace). The question is: how "scarce" is this commodity?

In my view, it isn't scarce right now because numerous L1s are competing fiercely to supply it. To some extent, through lower transaction fees and economic incentives, it has become a "race to the bottom," much like what happened when marijuana was legalized in the U.S. I live in one of the earliest states to legalize marijuana, and I remember when it happened—every neighborhood had different dispensaries, all opened by cannabis enthusiasts who saw it as their chance to get rich.

However, these players quickly started undercutting each other, as both dispensary owners and growers had to continuously lower prices to compete, squeezing profit margins. People essentially witnessed the "Walmart-ization" of the cannabis industry, and the world of L1s/L2s seems likely to follow a similar path. (Though technically, it remains an extremely important and fascinating topic—especially scaling solutions.)

So... I might be wrong, but to me, the next bull run is more likely to be defined by protocols—and potentially chain-agnostic ones. What would that look like? I think we can already see glimpses of it in several areas...

1) Major protocols will appear across many chains, just as we've seen with Aave and Curve

2) L1s will aggressively compete to attract valuable protocols

3) Increased cross-chain interoperability

4) Protocols will build their own "chains" in new ways

5) We’ll see continued growth in legitimate, organically cash-flow-generating protocols that don’t rely on chain services—such as $BIFI, $GMX, $GNS, NFT marketplaces, etc.

6) We may see (chain-agnostic) stablecoins continue gaining market share in crypto, as they appear to represent the stickiest "use case" to date—and could remain in the top 10 even as the bull market returns

That said, a common counterargument to the chain-agnostic future is the series of cross-chain bridge disasters, such as what happened to Harmony. However, it seems this issue will eventually be resolved in some way, as scaling solutions are clearly necessary to avoid prohibitive transaction costs.

Newer verticals like GameFi, NFTs, X2E, and mobile-based applications also seem poised to become increasingly significant parts of crypto, further displacing L1s as the primary beneficiaries of capital in the space.

Anyway, I might be completely wrong—and I do hold a lot of $ETH and a small amount of $FTM and $AVAX—so I certainly don’t want L1 valuations to go to zero or anything. But it seems the next bull run could bring a very different top 10.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News