How to manage risk in the crypto world?

TechFlow Selected TechFlow Selected

How to manage risk in the crypto world?

People are spending money they haven't earned yet, and they're struggling to repay their loans.

Written by: Pothu

Translated by: TechFlow intern

I've read many stories about people going bankrupt because of cryptocurrency. People overspend their future money, struggling to repay loans.

Everyone loses money in crypto at some point, but loss doesn't mean bankruptcy. Reliable and practical risk management can help you survive and profit—especially when markets are panicking. Risk management truly saves lives. In this article, I'll walk you through the most crucial aspects of risk management.

1. Define Your Portfolio Size

This varies from person to person—think about how much money you're willing to lose. Cryptocurrency is risky; there's no way around it. I strongly advise against putting your life savings into crypto. You probably don't want all your money turning into illiquid junk or losing funds you can't afford to lose. Keep living expenses separate—only invest what you can afford to part with.

2. Define Your Risk Tolerance

Crypto is volatile—you must avoid extremely dangerous investments to some extent. You need to be able to handle ups and downs. Many people can't tolerate a 30% drawdown in their portfolio. If that’s you, and your position size feels too large, I think major coins like BTC and ETH are more suitable than altcoins.

3. Portfolio Allocation

Your portfolio allocation should largely depend on your portfolio size and risk tolerance. Also consider your goals—what kind of returns are you aiming for? 2x? 10x? 100x? The higher your profit target, the more aggressive you’ll need to be—and the more risk you’ll have to take. If your risk tolerance is low, play it safe and allocate more funds to established assets like BTC and ETH.

Depending on your risk tolerance, it's usually wise to divide your portfolio into smaller sub-portions. Example allocation:

• 40% in majors like ETH and BTC

• 40% in layer-1 chains like AVAX

• 20% in algorithmic stablecoins

Your portfolio should vary based on market conditions. Under current market conditions, I don't recommend investing in high-risk altcoins. They tend to drop too sharply during bear markets and may never recover. When the market is weak, your portfolio should become more conservative.

4. Entry and Exit Strategies

When entering and exiting positions, remember two key things.

1. Enter with a stop-loss. Determine how much profit you aim to make from a trade. To achieve consistent profitability, stick to this target. Unless you have extreme conviction in a project or token, don’t get emotionally attached. Avoid greed—overtrading is often a quick path to burnout. It’s also important to regularly take profits, lock in cost basis early, which gives you extra room to buy other things you want later.

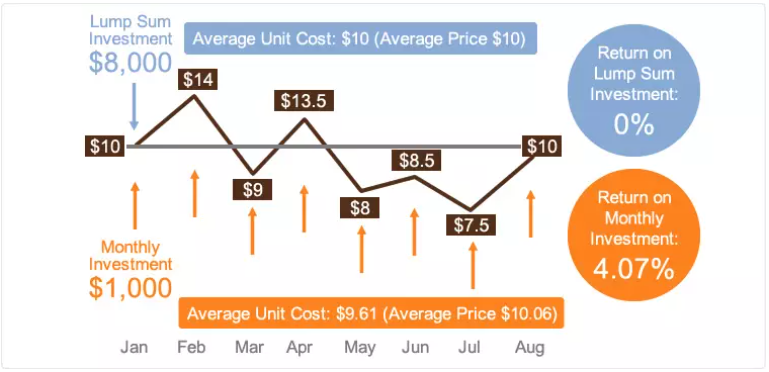

2. Don’t go all-in at once. Dollar-cost averaging (DCA) is a solid approach. Instead of investing all your capital into one asset immediately, split your investment into smaller, periodic entries. This reduces risk and increases your odds of success.

5. Manage Your Emotions

Don’t FOMO. Don’t get swept up in hype. Don’t let crypto disappoint you. Crypto is a marathon—it will exist for years to come. You’re an early participant; don’t waste this opportunity.

Emotional decisions often lead to rash actions and excessive risk-taking. Try to separate emotions from your investment strategy. If you can't do that, reconsider your portfolio allocation and risk tolerance.

Risk management is hard. It’s a form of trading discipline and goes against human nature. It takes time and practice—but there’s no excuse not to implement these strategies. They will improve your trading skills.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News