After Studying 100 Top Investors, I Found a Workable Token Risk Management Strategy

TechFlow Selected TechFlow Selected

After Studying 100 Top Investors, I Found a Workable Token Risk Management Strategy

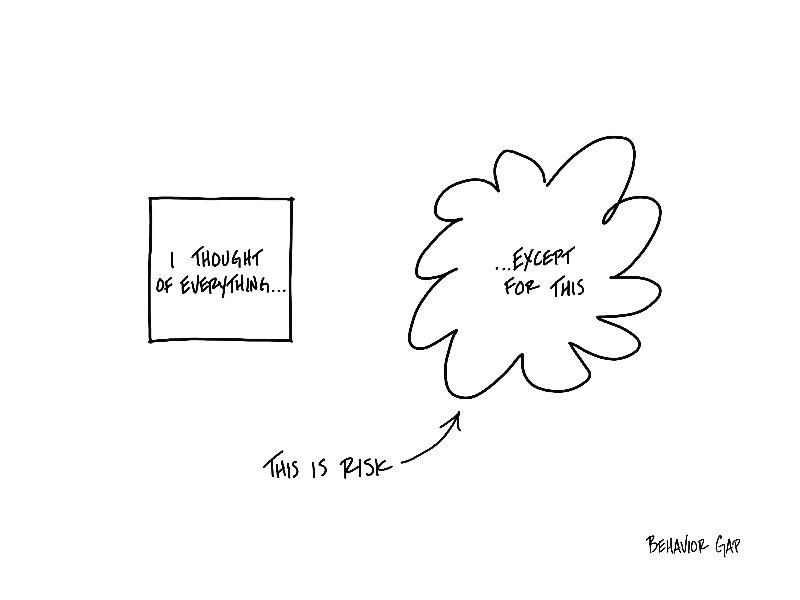

No matter how intelligent you are, failing to manage risk means ultimate failure.

Author: Crypto, Distilled

Translation: TechFlow

Everyone dreams of getting rich through altcoins, but in reality only a few succeed.

Why? Most people don't understand risk asymmetry and fail to manage risk effectively.

After studying hundreds of top investors, I’ve found an effective investment strategy.

Origin of the Strategy:

Inspired by @0x_Kun, who achieved financial freedom before age 30 through crypto investing.

His strategy is simple and works for anyone regardless of skill or capital level. It consists of six steps—bookmark this thread and come back anytime!

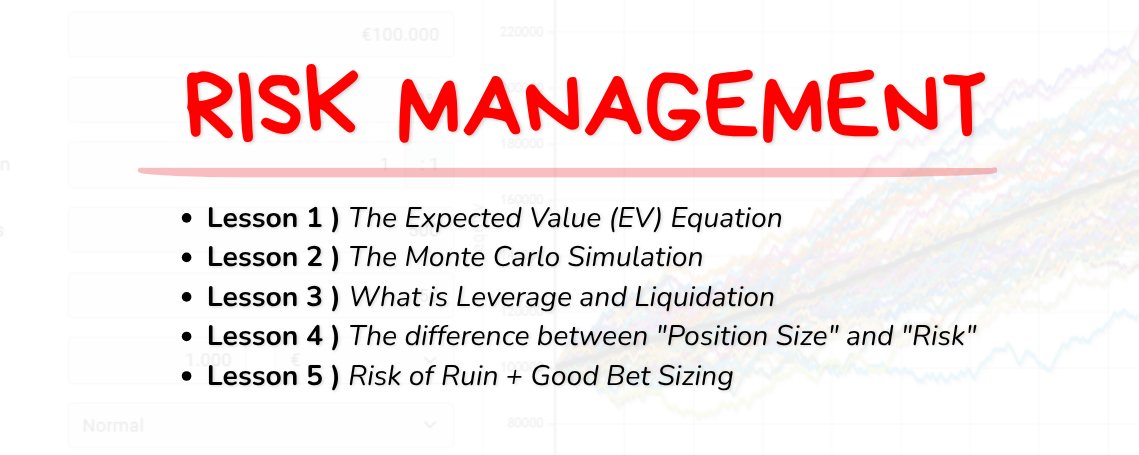

Step One: Manage Risk

The first step is all about managing risk.

No matter how smart you are, failing to manage risk means eventual failure.

What's the most effective way to manage risk? Through intelligent portfolio structuring.

"You can use the same standard for measuring risk as you do for assessing opportunity. They’re interconnected." — Earl Nightingale

Portfolio Structure?

Risk isn’t just about individual investments—it’s about how they interact with each other.

Adjusting asset types, amounts, and weights changes your overall probability of success.

Goal? Ensure your gains consistently outweigh losses over time.

Foundation: Over 50% Allocated to $BTC

Kun recommends allocating more than 50% of your portfolio to $BTC.

Why? Even if all altcoins fail, the long-term growth of $BTC typically ensures profitability.

It acts as a safety net against investment mistakes.

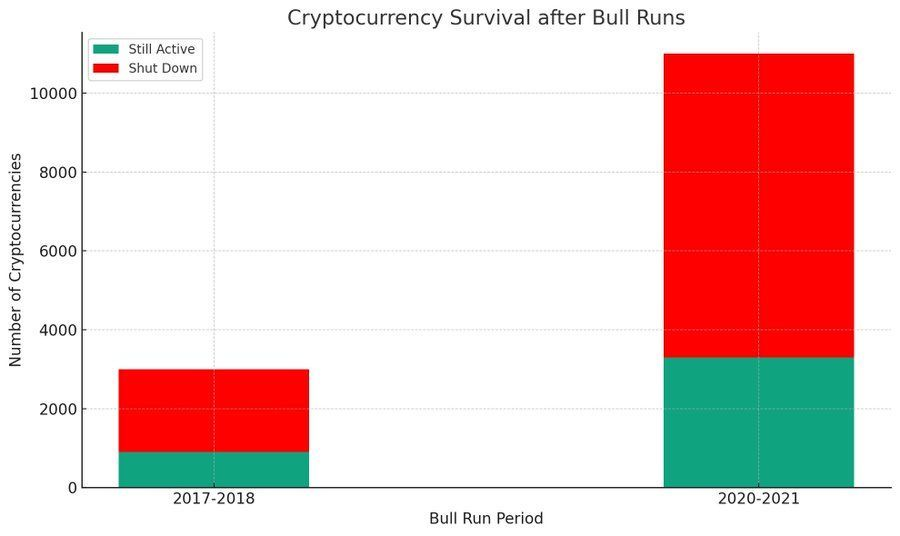

Note: Most altcoins fail (shoutout to @coingecko)

Multi-Cycle Blue Chips: 25%

Kun suggests allocating 25% to blue-chip assets capable of surviving multiple market cycles.

For most people, this usually means $ETH or $SOL.

This increases your chances of outperforming $BTC while reducing downside risk.

Remaining 25% into Small-Cap Altcoins:

The final 25% should be diversified across 4–6 small-cap altcoins with equal weighting.

Think like a venture capitalist: a few big winners can offset losses from others.

This approach allows you to pursue 10x–20x returns while still sleeping soundly at night.

Why Equal Weighting Matters:

Equal weighting gives every investment a fair chance to balance out others.

Weighting by conviction isn't logical—if you have low conviction in an asset, why include it at all?

Equal weighting more effectively balances potential gains and losses.

Structural Diversification Beyond Crypto:

Finally, build structural diversification.

Your net exposure to crypto should factor in your age and other personal circumstances.

Kun hedges his crypto holdings with gold. High-quality equities also help with diversification.

Step Two: Assume You Might Be Wrong

Most people skip this step—but it’s crucial.

Always assume you might be wrong. Focus on probabilities, not outcomes.

Prepare for various scenarios and adjust your strategy accordingly.

Visualize the Worst Case:

Imagine the maximum loss you could endure and still maintain your livelihood.

If that loss feels too high, consider increasing your $BTC allocation and reducing altcoin exposure.

Be honest with yourself. Reflect on past losses and their emotional impact.

What If Your Crypto Thesis Is Wrong?

What if your entire view on crypto is incorrect?

How would you hedge that? Gold often serves as a hedge against a failed $BTC thesis.

Alternatively, diversify income streams to further reduce risk.

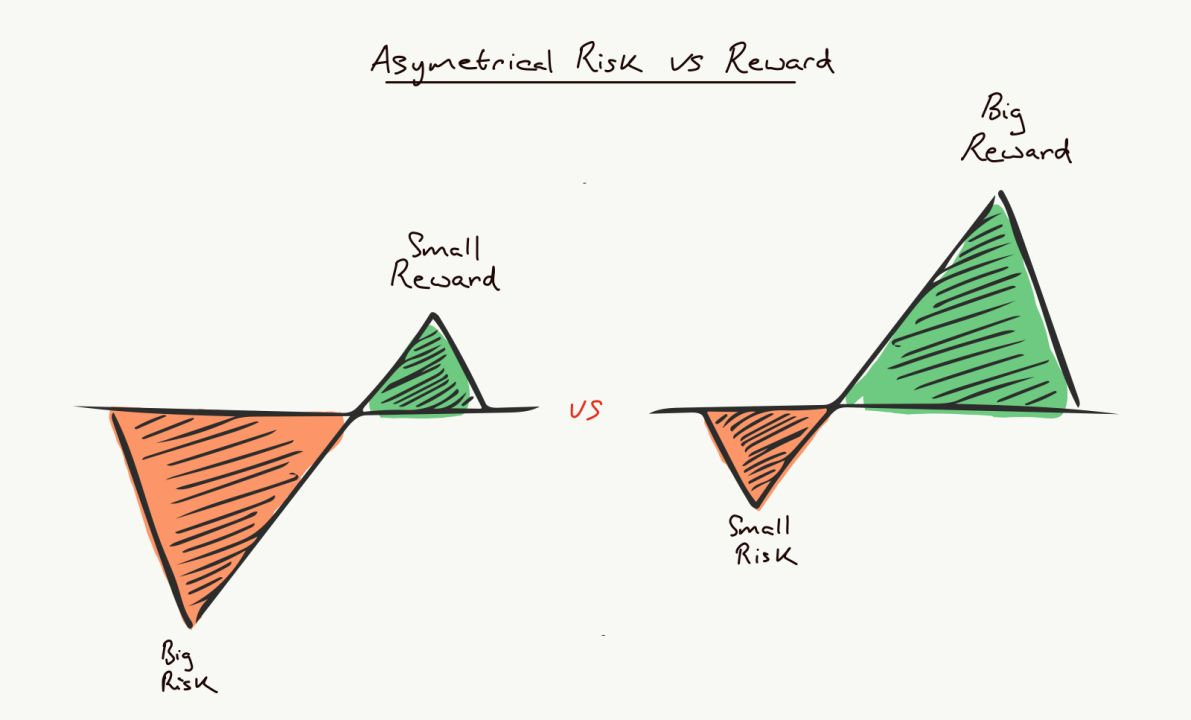

Step Three: Seek Asymmetry

Patience is key when searching for asymmetric investment opportunities.

This means potential upside far exceeds potential downside.

Kun aims for 10x–20x returns while managing only 30%–50% downside risk.

Don’t Go All-In:

After identifying an asymmetric opportunity, resist the urge to go all-in.

Remember, the goal is compounding wealth over time.

Step Four: Develop a Thesis

Once you've identified an asymmetric opportunity, develop a clear investment thesis.

This thesis should clearly explain why you're making the investment.

Then, create specific criteria to test whether your thesis holds up—or fails—over time.

Thesis Example:

A thesis could be that $BTC reaches a market cap comparable to gold.

A failure point might be if Satoshi suddenly sells all his $BTC.

While extreme, this illustrates the concept.

Multifactor Sell Strategy:

Selling is often harder than buying.

To address this, Kun recommends setting multiple sell conditions.

This helps protect against market uncertainty and personal bias.

Kun’s Three-Factor Sell Method:

Kun suggests splitting your sell points based on three factors: time, thesis, and price.

For example:

-

Sell 25% at the end of 2025

-

Sell 25% when $BTC hits $100k

-

Sell 50% when $BTC market cap exceeds gold’s market cap

Step Six: Plan for After Profits

After realizing large gains, many investors make the mistake of giving profits back.

To avoid this, return to Step One:

-

Reassess your portfolio and look for new asymmetric opportunities.

-

Avoid reinvesting profits too quickly.

Managing Psychological Stress:

Beyond financial strategy, manage your mental and emotional well-being.

Is the crypto market affecting you? After big wins, consider taking a break.

Spend time and money on things you love. Balance is the key to long-term success.

Thread Recap:

-

Manage risk through portfolio structure.

-

Assume you’re wrong—and plan accordingly.

-

Seek asymmetry and stay patient.

-

Use thesis validation and invalidation.

-

Adopt a multifactor sell strategy.

-

Return to step one and plan after profits.

Purely educational—does not constitute financial advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News