Cobo's Secret Weapon Argus: How Web3 Institutions Manage Risk?

TechFlow Selected TechFlow Selected

Cobo's Secret Weapon Argus: How Web3 Institutions Manage Risk?

The future holds great promise.

The Russia-Ukraine war was the most significant black swan event of 2022. The outbreak of war triggered supply crises in major commodities including food and energy, while the high inflation risk caused by the U.S. dollar's massive monetary easing during the pandemic also became evident. The Federal Reserve began raising interest rates and shrinking its balance sheet to reduce the amount of dollars circulating in the market.

This was the primary factor driving the crypto market into a bear market. The shift from bull to bear is not merely semantic—it is more profoundly reflected in the availability of liquidity. A bear market is a prolonged process of liquidity withdrawal and leverage elimination. For retail investors, deleveraging means starting over. For institutions, failure to properly manage the leverage accumulated during the previous bull market—such as exiting at the peak or maintaining sufficient cash reserves—greatly increases the likelihood of being targeted by liquidations and falling into liquidity distress.

Black swan events act as catalysts for market movements.

In his book "The Black Swan," Taleb wrote: "Positive black swan events take time to reveal their impact, whereas negative black swan events happen very quickly—destruction is far easier and faster than creation."

The collapse of LUNA/UST happened faster than we imagined, and its devastation on the crypto market ran deeper than expected.

Limitations in Risk Management Among Crypto Institutions

Celsius was the first institution to face large-scale withdrawal issues.

Similar to Anchor, Celsius’s main selling point was offering users high deposit interest rates. In a growing market, Celsius could generate higher returns for users through lending, DeFi yield farming, ETH2.0 staking, and depositing UST into Anchor. However, once the market entered a zero-sum game phase, high profits were no longer easily attainable.

Celsius faced only two choices: lower customer interest rates or increase leverage to pursue higher returns.

How Celsius chose is now clear from its current predicament.

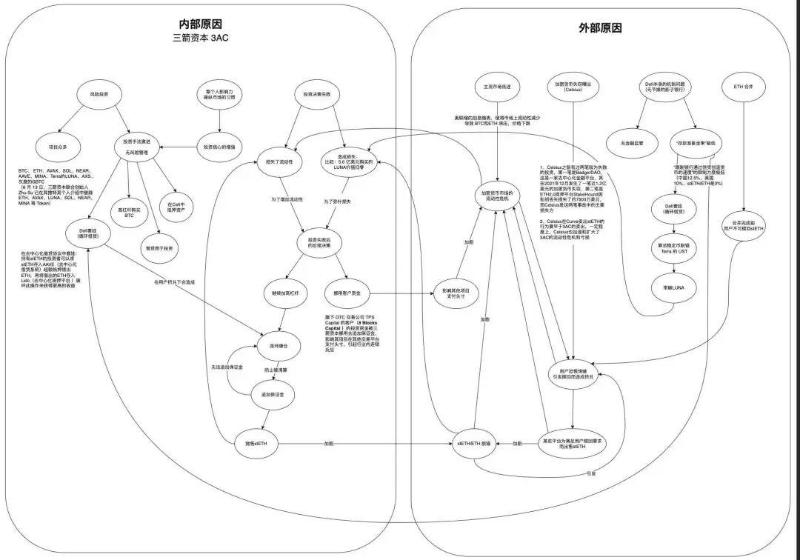

The meltdown of Three Arrows Capital was also linked to the collapse of LUNA/UST.

According to external analysis, after suffering internal investment losses (the $560 million worth of LUNA tokens it purchased went to zero), Three Arrows Capital attempted to cover losses and boost liquidity by increasing leverage and misappropriating client funds. During a broad downturn in the crypto market, the subsequent collapse of Celsius triggered user panic, leading to mass redemptions and a full-blown bank run.

After Celsius and Three Arrows Capital, more centralized institutions and exchanges began revealing liquidity problems. AEX, Beibao Financial, Hoo Exchange, and Voyager Digital were among them.

From this liquidity crisis, unlike retail investors who can directly control their assets, institutions typically handle assets with greater caution and strict procedures. Therefore, asset management within institutions often requires rigorous processes and multi-party decision-making.

Another issue is that Web3 is global. On-chain settlement bypasses national borders, enabling a globally distributed talent pool—most Web3 institutions employ staff from multiple countries. Conducting complex processes and multi-party decisions across different time zones further complicates institutional asset management. Any loophole in the process could lead to a single point of failure.

This complexity further exacerbates the limitations institutions face in risk management.

Meanwhile, the 24/7 nature of crypto markets means they react swiftly to news.

In one night, the LUNA token plummeted from $65 to $25. In another night, it crashed from fractions of a dollar to zero. These rapid market shifts left many institutions, exchanges, and DeFi protocols unable to respond effectively to fast-moving risks.

Therefore, efficiency in risk management is critical for institutions.

Cobo’s Answer

Amid this turbulent crisis, some stood out as exemplars in risk management.

Thanks to its expertise in security, risk control, and data analytics, cryptocurrency custodian Cobo remained unaffected by the LUNA/UST-triggered crypto crash. It maintained healthy cash flow and a solid investment portfolio, achieving stable growth throughout the bear market through tools such as market risk alerts, TVL monitoring, automatic withdrawal mechanisms, automated deleveraging, and whale address activity tracking.

With great power comes great responsibility.

In interviews with the Cobo team, they expressed deep regret over the industry-wide failures and a strong desire to use their professional capabilities to help prevent such systemic risks. Compared to the opacity and centralization of CeFi, DeFi has proven more robust and resilient. Thus, the Cobo team aims to launch specialized productivity tools at the DeFi layer to empower institutions with more professional and efficient on-chain asset management and investment capabilities—acting as an enabler for institutional players and helping advance the industry.

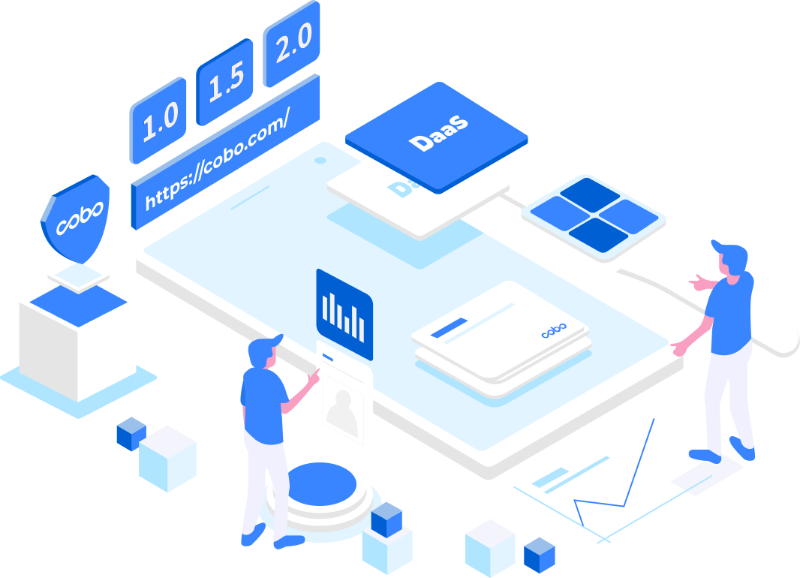

This is how Cobo Argus came into being. Cobo Argus represents a new service model: DeFi as a Service (DaaS), designed to help institutional teams and DAOs securely and efficiently access on-chain DeFi protocols.

In Greek mythology, Argus was a giant with a hundred eyes, always keeping some open even while sleeping. Cobo Argus continuously monitors on-chain activities to safeguard users' assets.

For clarity, think of Cobo Argus as a productivity tool tailored for institutional users in the DeFi space—just like workplace collaboration platforms such as DingTalk or Feishu streamline employee management, Cobo Argus streamlines institutional DeFi asset management.

So, how does Cobo Argus help institutional users manage DeFi assets?

It delivers six key enhancements:

Multi-Signature Wallets

Unlike common single-signature wallets, multi-sig wallets require two or more private keys to sign and send transactions. Compared to single-sig wallets, multi-sig offers greater security and better suits institutional capital needs. Cobo Argus uses Safe (formerly Gnosis Safe) modules as the underlying architecture for its multi-sig wallets—an asset custody solution built on smart contracts.

Regarding this, Safe (formerly Gnosis Safe) stated: "We're excited to see more developers and companies building important products on our platform. We've collaborated closely with Cobo, and Argus meets the DeFi workflow needs of many large institutional users."

On the security front, Cobo Argus achieves multi-layered protection—not only through multi-sig private key backup and custody but also via transaction pre-execution checks and risk warnings. A practical example is helping users determine whether interacting with newly deployed contracts is safe.

Role System

Cobo Argus assigns permissions based on roles within institutional teams—such as traders, liquidity miners, fund managers, accountants, and finance personnel—layering overall asset control.

Cobo Argus also supports fine-grained rules—for instance, restricting which trading pairs and amounts a trader can access.

This significantly reduces internal risks such as theft, pranks, negligence, and fraud. More practically, Cobo Argus allows customized tiered authorization workflows and automated approval tools, maximizing efficiency in institutional asset management collaboration.

Risk Control System

Cobo Argus includes alert features for collateral price fluctuations and trade adjustments, allowing institutional users to set thresholds to monitor their assets’ status within DeFi protocols. Beyond risk mitigation, the system aims to heighten users’ awareness of their holdings and encourage proactive deleveraging through real-time alerts.

For example, when borrowing USDC against ETH collateral on Aave, Cobo Argus monitors ETH prices in real time. When ETH nears the liquidation threshold, it automatically sends alerts prompting users to repay USDC or add more ETH collateral. Of course, Cobo Argus’ alert functions go beyond this—they also track changes in pool token ratios, collateral price shifts, and project smart contract code updates;

Additionally, Cobo Argus offers advanced automation—users can set predefined stop-loss levels to trigger automatic exits back to original investment tokens. For example, if a token falls below a certain price, it automatically swaps into USDT;

Custom Access Controls and Workflows

These concepts may sound complex initially, so let’s clarify with examples:

Customized Access Control (for team members)

As mentioned earlier, institutions can decentralize authority by assigning different roles to team members. Custom access controls allow institutions to grant traders permission for specific trading pairs and cap daily trading limits at "X". Based on operational requirements and internal risk controls, different investment types can be delegated to different team members.

Custom Workflows (for on-chain risk control)

Through customizable workflows, institutions can define distinct approval processes for different asset movements, restrict transaction parameters, limit access to specific protocol smart contracts, and maintain whitelists and blacklists. Additionally, role-specific members can leverage Cobo Argus’ built-in scripting functionality to drastically reduce manual effort—executing one-click withdrawals or one-click deleveraging, such as instantly pulling funds from Project A or repaying loans on Project B.

The benefit? Simplified processes. Without going through cumbersome multi-step approvals, each role can complete tasks efficiently and reliably.

Scalable Solutions and Project Information Aggregation

Considering evolving core business needs, Cobo Argus provides scalable solutions—supporting adding or removing sub-accounts—and aggregates project-related information, including security ratings, community updates, real-time security alerts, audits of partner project smart contracts, and in-depth research reports.

At its core, Cobo Argus is a productivity tool designed for institutional asset management. These extensions distinguish it from Safe (formerly Gnosis Safe).

Cobo Argus operates in three environments: centralized (custodial) platforms, smart contract platforms, and dedicated blockchains (supporting cross-chain and cross-layer asset management and protocol interactions). These three service models address the same fundamental pain points of asset control under different conditions, meeting users’ varying needs—basic, personalized, and forward-looking—enabling funds, hedge funds, DeFi funds, professional traders, family offices, traditional financial institutions, and any permissioned dApps to interact seamlessly with various DeFi protocols.

What Users Are Saying

Cobo Argus targets large-scale DeFi participants who frequently access diverse crypto assets. Therefore, TechFlow interviewed several institutional users of Cobo Argus to hear their feedback.

iZUMi Finance

iZUMi Finance is a multi-chain DeFi platform offering one-stop liquidity management services (Liquidity-as-a-Service).

When asked why they chose Cobo, the iZUMi team cited two main reasons:

-

Cobo is large enough—being the largest cryptocurrency custodian in the Asia-Pacific region—and highly secure.

-

Cobo Argus is compelling—it offers a relatively comprehensive infrastructure service spanning product to support. Moreover, Cobo Argus has made custom adjustments and developments based on iZUMi’s suggestions and needs.

Cobo Argus solved iZUMi’s core pain point—under a multi-sig framework requiring customized role assignments and workflow definitions, delegating single-signature operations for specific permissions, such as simple tasks like farming, collecting rewards, and trading specific pairs. Cobo Argus effectively separates asset usage rights from ownership rights, improving team efficiency while ensuring principal safety.

The iZUMi team summarized: “The separation between multi-sig and single-sig in Cobo Argus is the most valuable feature. Also, from a gas fee perspective, Cobo Argus has achieved good optimization, effectively reducing our gas costs.”

PandaDAO

PandaDAO is a decentralized data development DAO. For DAOs, the biggest challenge lies in inefficient internal governance and asset-level decision-making.

After using Cobo Argus, the PandaDAO team told TechFlow: “Most DAOs currently use Gnosis Safe to manage multi-sig wallets, but multi-sigs cannot efficiently withdraw funds promptly during extreme risks, such as exiting the UST 3POOL. Plus, regular multi-sig operations require majority voting for fund usage, slowing down execution. Cobo Argus allows restricted single-signature addresses to perform safe contract operations, including adding/removing LP positions and claiming rewards. Previously, routine secure multi-sig actions took up to three days; now, Cobo Argus enables completion within minutes. This greatly improves the operational efficiency of our Gnosis Safe multi-sig wallet.”

In the blockchain world where “code is law,” security is paramount—including code, legal compliance, and financial risk controls. Cobo has weathered a full Bitcoin bull-bear cycle, with all products undergoing security audits and backed by robust risk management and legal frameworks. This is the main reason PandaDAO chose Cobo.

Alfa1

Regarding user experience, Alfa1—a provider of digital asset financial solutions and asset management products—shared: “Alfa1 has started using Cobo Argus to manage part of our proprietary capital and execute on-chain DeFi strategies. Cobo Argus offers clear role and permission definitions and supports multiple EVM chains, greatly simplifying DeFi strategy fund management. Alfa1 plans to gradually deploy tens of millions of dollars worth of Uniswap V3 and other LP management strategies onto this DaaS platform.”

Cobo Argus resolves Alfa1’s trust issues in on-chain asset management by enabling role-based assignment of executable smart contracts and tokens. Strategy managers can independently execute DeFi strategies while isolated from unauthorized fund transfers or DeFi operations, making DeFi strategy management more convenient and secure.

Another Perspective

Viewed differently, the emergence of Cobo Argus also signifies the rise of productivity-focused infrastructure tools.

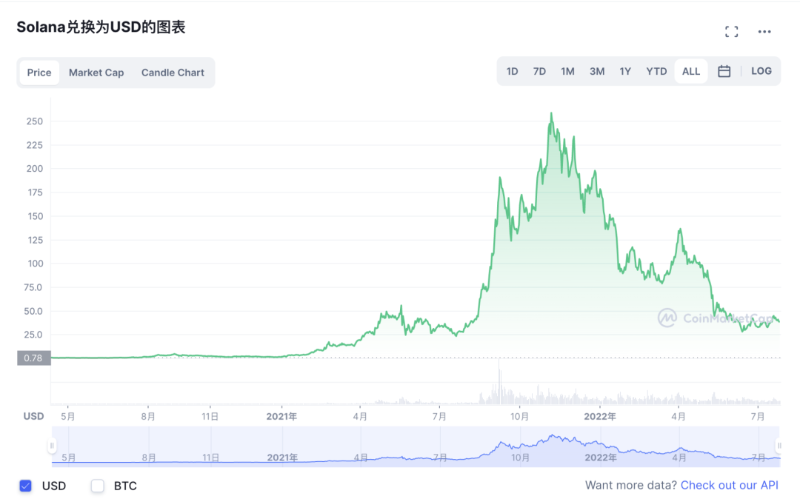

From the last bull-bear cycle, we’ve seen massive growth in Web3. The most competitive and rapidly developing area has been public blockchain infrastructure—from Ethereum, Neo, Nervos, and Tron to BSC, Solana, Avalanche, Cosmos, and Polkadot, and now emerging application-specific chains just beginning to show promise. These public chains have undergone intense innovation, with their native tokens capturing much of the value in the crypto market.

During this liquidity crisis, however, the value of these public chain tokens dropped sharply—Solana’s native token SOL, once ranked fourth in the crypto market, fell from over $250 at its peak to around $30–$40 today.

A major reason is oversupply of protocol infrastructure—during the bull market, abundant liquidity supported competition and growth in total value locked (TVL) across chains. But during market downturns, excessive protocol infrastructure cannot be sustained by limited on-chain liquidity.

Against this backdrop of oversupplied protocol infrastructure, tooling infrastructure remains scarce.

The reason is straightforward—the on-chain ecosystem is still in its early, wild-growth phase with insufficient user scale.

Developers are primarily focused on deploying, iterating, and innovating financial and gaming applications, aiming to improve capital efficiency to attract more funds and users. Tooling infrastructure, on the other hand, aims to enhance productivity for developers and end-users.

Today, we’re seeing the emergence and growth of numerous tooling infrastructures, signaling vibrant development in the Web3 ecosystem. Initiatives such as Solana launching a crypto smartphone and Cobo rolling out Cobo Argus represent pivotal milestones in Web3, reflecting strong market demand for improved productivity and warranting greater optimism.

This is precisely what makes Cobo’s launch of Cobo Argus remarkable—few teams globally possess deep expertise in blockchain infrastructure security, understand risk management and complex workflows, and can build secure, compliant, and scalable DeFi solutions through exceptional tools and strategies—even usable by entry-level administrators.

The realization of Web3 at scale—something unimaginable in 2009 or 2018—is now gradually becoming reality thanks to collective efforts. Perhaps one day soon, Web3 will truly enter the mainstream. Therefore, we now look forward even more eagerly to the next generation of Web3 productivity tools.

The future is promising.

Cobo Argus is now available in a preview version. Click the link to try it: argus.cobo.com. Limited spots available—first 50 institutional accounts get a chance to enjoy three months of free Cobo Argus service.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News