Interview with Cobo's Senior Vice President Alex: Technology, Compliance, and Distribution—the Trio Driving Stablecoin Mass Adoption

TechFlow Selected TechFlow Selected

Interview with Cobo's Senior Vice President Alex: Technology, Compliance, and Distribution—the Trio Driving Stablecoin Mass Adoption

Follow Alex's perspective to explore the path to mass adoption of stablecoins in cross-border payments, and the immense potential of stablecoins as the future "internet monetary layer."

Written by: TechFlow

From the U.S. GENIUS Act to Hong Kong’s Stablecoin Ordinance, stablecoins are entering an unprecedented window of opportunity amid a new cycle of regulatory compliance.

Bolstered by Circle’s remarkable success, stablecoins have become the proverbial land of milk and honey—a space drawing not only Web3 investors but also high-profile entrants from traditional Web2 giants such as JD.com, Ant Group, and Walmart.

In this red-hot sector, how can one quickly and accurately find their place?

We’ve observed that Cobo, a full-service digital asset custody and wallet platform, launched its stablecoin solution last year. Years of深耕 in the industry have equipped Cobo with forward-looking insights, giving them valuable experience in navigating this evolving landscape.

In our conversation with Alex Zuo, Senior Vice President and Head of Payments at Cobo, the challenges of stablecoins were succinctly broken down:

Stablecoin-related businesses demand strong interdisciplinary collaboration, requiring solid expertise across finance (Fin), technology (Tech), and crypto. Currently, it's extremely difficult to find a team that excels in all three areas.

On Cobo’s role in this stablecoin-driven transformation of financial infrastructure, Alex elaborated:

Cobo has long focused on foundational infrastructure. For stablecoin clients, we offer comprehensive technical support, strong compliance advantages, extensive experience serving listed companies, and powerful distribution capabilities—enabling issuers to rapidly build out circulation and usage scenarios for their stablecoins.

Regarding entrepreneurial opportunities within the stablecoin wave, Alex noted:

As stablecoins move toward mass adoption, entirely new demands, tools, and functionalities will emerge across various use cases—offering rich ground for exploration and innovation.

In this article, let’s follow Alex’s perspective to explore the path to large-scale adoption of stablecoins in cross-border payments, and uncover the vast potential of stablecoins as the future “internet money layer.”

Cross-Border Payment Clients Came Knocking—Sparking the Evolution of Cobo’s Stablecoin Payment Product

TechFlow: Thank you for your time. To begin, could you please introduce yourself?

Alex:

Hello everyone, I’m Alex Zuo, Senior Vice President and Head of Payments at Cobo.

My early career was in venture capital. Around a decade ago, I worked at PreAngel, where our partner Wang Lijie began focusing on crypto very early on. Later, I joined Formation 8’s Asia Fund—whose co-founder came from South Korea’s LG Family—and around 2016, we invested in Coinone, once among Korea’s top three exchanges. That marked my deeper entry into the crypto space. In 2018, I started my own venture with several friends, including founders of projects previously backed by PreAngel, launching a rating agency called TokenInsight, where I served as Co-Founder and COO, overseeing business and commercial operations. I joined Cobo in 2019.

I’ve now been at Cobo for nearly six years. Initially, I worked on investment-related initiatives, including institutional lending and Cobo Ventures. After the FTX collapse, the company decided to scale back investments and focus on core business lines, so I took over BD, Sales, and domestic marketing. Today, I lead all payment and stablecoin-related operations.

TechFlow: Many may not be familiar with Cobo’s work in payments and stablecoins. Could you walk us through your current stablecoin solution and its role in the broader payment ecosystem?

Alex:

We’ve always focused on building foundational infrastructure, especially wallet-related systems. Five or six years ago, when exchanges were booming, our main clients were trading platforms. As the industry matured and moved toward compliance, our focus shifted to asset managers, mining firms, and miners. Last year, we pivoted toward BTCFi, which we see as a critical frontier.

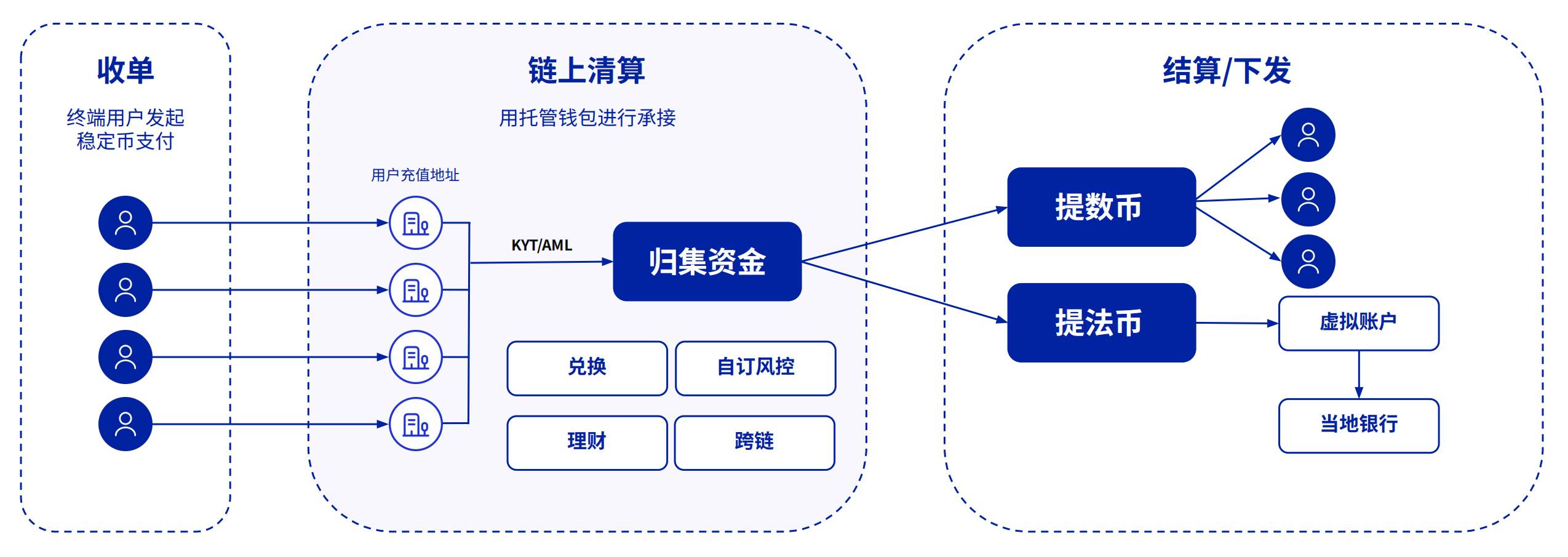

Starting last year, more and more cross-border payment clients began approaching us. Their upstream and downstream partners—either voluntarily or passively—now hold USDT or other cryptocurrencies, creating real-world pain points around receiving or sending payments. These clients asked us to provide wallet functionality, prompting us to dive deeper into research and product development in the payments space.

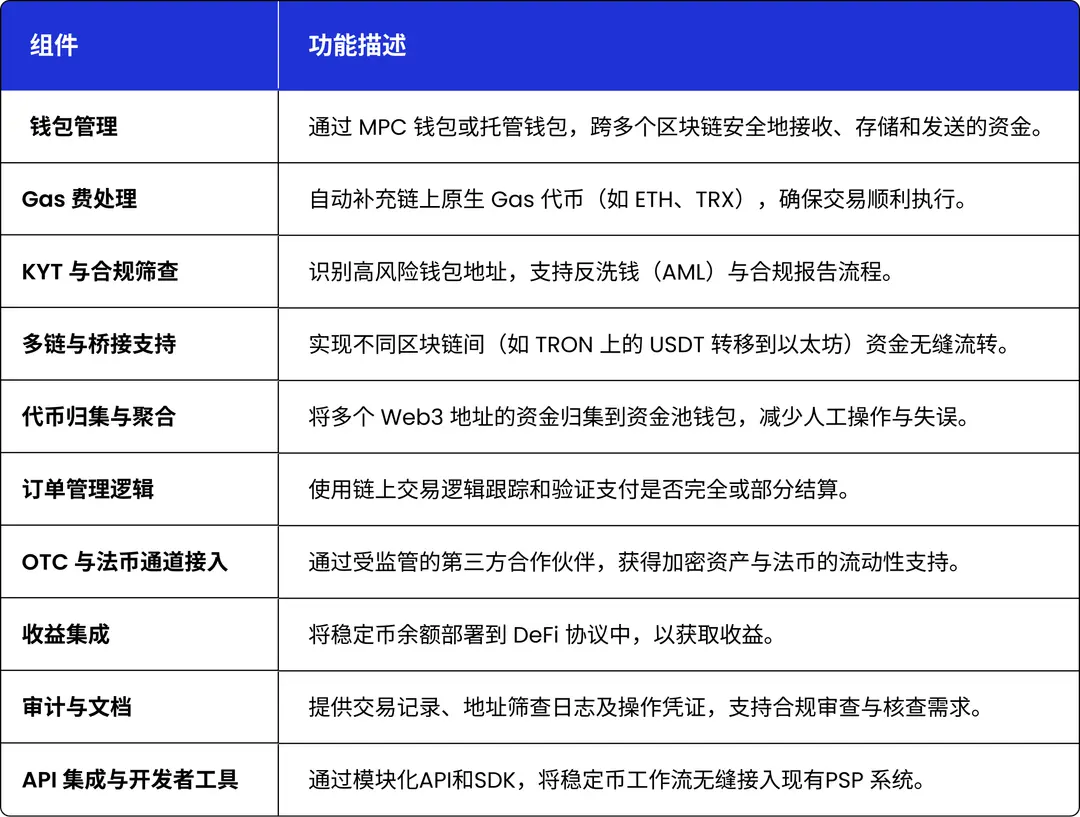

Payment clients differ significantly from native crypto users. They have weaker security awareness and limited understanding of blockchains, yet they place higher expectations on compliance, product scalability, and long-term business sustainability, even considering future licensing. We realized our existing custody and infrastructure stack couldn’t adequately serve these needs, so we undertook deep optimizations in several key areas:

First, we implemented significant chain abstraction to lower the barrier to entry. For example, paying gas fees when transferring USDT is second nature in crypto circles, but for traditional Web2 enterprises, both conceptual understanding and operational execution pose high hurdles. By abstracting the chain layer, we enable transfers denominated in USDT, drastically simplifying the user experience.

Second, anti-money laundering (AML) and compliance capabilities. Payment clients fear encountering illicit funds on-chain and are highly sensitive to the compliance status of their assets. Our product further reduces complexity and risk. Cobo’s biggest advantage is being the only company globally offering both centralized custody and MPC-based self-custody solutions. Most clients today prefer MPC, and Cobo uniquely leverages its centralized custody compliance framework to enhance MPC offerings—effectively providing on-chain AML services and reducing client risk.

Additionally, cross-border payments involve three layers: first, wallets to receive stablecoins; second, on/off-ramping; third, bank accounts. While payment firms may excel at ramping and banking, they often hesitate when entering the unfamiliar world of digital assets. We bridge this gap by introducing trusted partners to these traditional institutions. As a licensed entity in Hong Kong, we also offer licensed trust accounts to help clients resolve compliance bottlenecks.

Cobo’s strength lies in wallet and infrastructure. We aim to build a complete service network around wallet capabilities, lowering the barrier to stablecoin adoption. Ultimately, we want to help more clients seamlessly cross the “last mile” and accelerate compliant, widespread stablecoin usage.

Cobo’s Unique Value: Technology, Compliance, Distribution, and Experience

TechFlow: Cobo’s approach seems different from other stablecoin projects. You start with your strengths and evolve products based on client needs—so clients can essentially plug in and go. Is that a fair interpretation?

Alex:

Yes, because we’re more infrastructure-focused, our client base falls into two main categories.

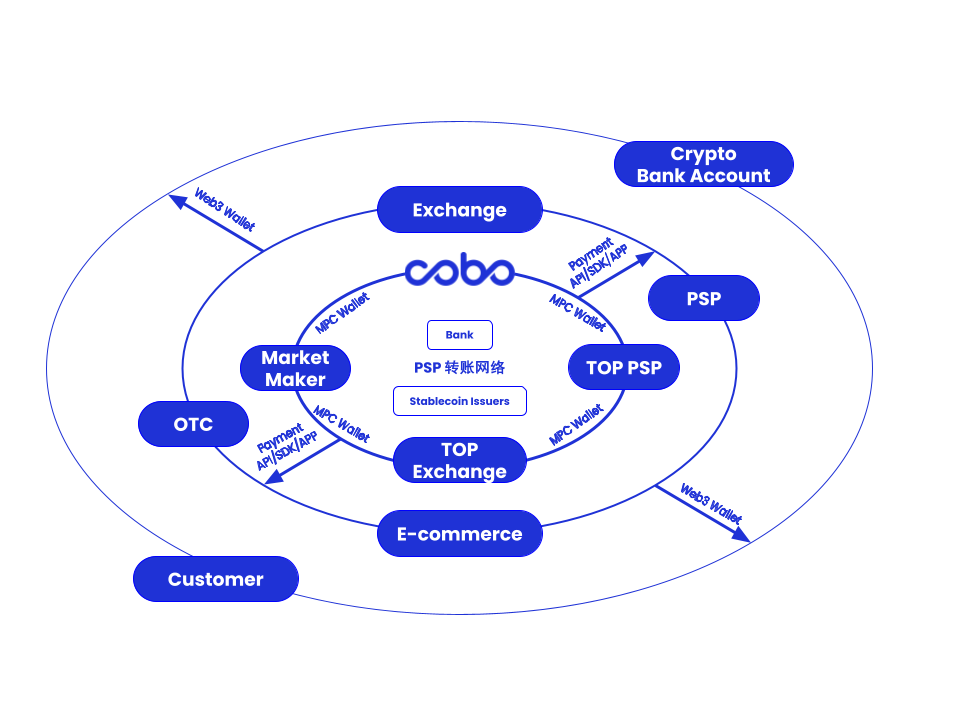

The first is cross-border payment clients. These companies don’t necessarily issue their own stablecoins, but their supply chains are increasingly engaging in stablecoin or crypto transactions. They initially seek exchange partners or OTC desks to handle settlements. But as their volumes grow, legacy solutions no longer suffice. They need a wallet provider like us to generate and manage multiple addresses across various on-ramp providers, acting as a router to find the cheapest fiat-to-crypto conversion paths. This is how we support PSPs (Payment Service Providers) and cross-border payment use cases.

The second major scenario is stablecoin issuance and circulation. Many clients—including large internet companies—weren’t in a rush months ago. They weren’t actively pursuing stablecoin licenses, preferring to observe others first. But recent momentum—from Circle’s soaring stock price to JD.com’s aggressive moves—has convinced many this is a worthwhile business, prompting serious action.

In this process, clients need legal counsel, consulting, and technical support. Cobo offers technical capabilities—such as minting, burning, freezing, and blacklisting functions—but equally important is our distribution power. We’re connected to numerous PSPs, and our existing client network already handles transaction volumes in the range of $300–400 billion annually. Stablecoin issuers want rapid distribution, and our network helps them quickly expand reach and establish circulation ecosystems—this is one of our core competitive advantages.

TechFlow: Many traditional banks claim they can help clients settle crypto transactions. Do they work with the same PSPs you mentioned? And does Cobo collaborate with banks?

Alex:

Our definition of a PSP is an entity that already has access to real-world transaction flows and established upstream/downstream relationships—this is the type of client we value most.

In the past, crypto-friendly banks wanting to support crypto settlements lacked the proper licenses, so they typically relied on OTC services, whose primary function is final conversion.

Cobo, however, aims to help clients gradually build their own crypto ecosystems—or full payment and receipt systems. We believe this kind of service delivers far greater added value.

TechFlow: You mentioned Cobo is the only company globally offering both centralized custody and MPC self-custody. What specific advantages does this bring? Some clients might consider working with two separate providers—one for each model.

Alex:

Today, most clients opt for MPC-based systems. This self-custody model supports future licensing and business scalability, making pure centralized custody less attractive. However, MPC users face challenges—private key management, compliance risks—that highlight Cobo’s dual-model advantage.

First, in certain jurisdictions, clients may directly leverage Cobo’s centralized custody license. Second, in regions where clients want to apply for their own licenses, they can adopt Cobo’s MPC solution. Third, early-stage clients without compliance teams can still benefit from Cobo’s centralized custody-level AML and risk controls—even while using MPC—lowering their compliance barriers significantly.

Moreover, having grown with the industry for years, Cobo has accumulated substantial technical depth. We’ve built various wallet types and underlying architectures. During our work on payments, we noticed some wallet models—like smart contract wallets—have yet to gain mainstream traction or clear applications. But as adoption scales, demand for these solutions is likely to surge.

TechFlow: What do you see as the main obstacles facing stablecoins?

Alex:

Stablecoin operations are highly interdisciplinary, requiring deep expertise in finance (Fin), technology (Tech), and crypto. Each domain has distinct requirements.

In finance, compliance and deep understanding of financial systems are paramount. In tech, the focus is on product design and blockchain integration. In crypto, simply offering exchange services yields razor-thin margins—down from basis points to just five basis points today. The real value lies in helping users manage, grow, and swap assets via crypto-native mechanisms, which requires profound on-chain knowledge.

From my experience, few teams excel across all three domains—most have clear weaknesses. So when evaluating a project’s potential, I always look first at the team’s overall capability and balance.

TechFlow: With Circle’s stock surging and big names like JD.com and Ant Group entering the space, how does Cobo define its role in the stablecoin race?

Alex:

Based on what I know, Hong Kong’s stablecoin licenses are extremely scarce—only a handful exist. Over 40 companies have officially applied, and dozens more are reportedly interested, according to law firms. Competition is fierce, with rivals including China’s largest financial and internet firms. Many smaller players aren’t even eligible to apply.

From an issuance standpoint, we’re currently providing technical support to several large clients—key partners we deeply value. While we hope they succeed in Hong Kong, many are also exploring licensing in Singapore, the Middle East, or Switzerland. For determined players, expansion won’t be limited to one jurisdiction.

In supporting these clients, we don’t just offer issuance tools—we help build the underlying wallet infrastructure connecting issuers and merchants. Just as Circle has a merchant network enabling mints and burns via authorized vendors, our broader goal is to become a distribution channel for stablecoins.

Currently, I see three main stablecoin distribution models:

The first is centralized and capital-intensive, exemplified by Stripe, which uses its own banking network and licenses to create a global system where clients fully depend on its ecosystem.

The second is decentralized, like Circle’s Payment Network, which relies on a whitelisted network of certified vendors. Circle doesn’t provide direct bank accounts but ensures compliance and information flow through partners.

Cobo represents a third, more balanced model: At the core, we’re building a major PSP transfer network linking exchanges, OTC providers, and Cobo. Backed by deep partnerships with crypto-friendly banks and top-tier market makers, we combine on-chain transfers with fast off-chain settlement—e.g., after a 1M USDT transfer on-chain, funds settle in a bank account within minutes off-chain. The middle layer includes mid-sized PSPs and exchanges that rely on our core-tier market makers for liquidity. The outer layer consists of small merchants and retail users.

In this structure, outer-layer users need self-custody due to regulatory constraints; middle-layer clients require advanced tools like chain abstraction and AML; core-layer clients rely on MPC-based transfers. When many participants use Cobo’s system, inter-client transfers become faster, safer, and more compliant. This resembles the CeDeFi concept Aave proposed years ago—where institutions operate in dedicated DeFi pools, with regulated custodians or wallet providers vetting participants to ensure fund safety and traceability.

Our goal is to boost transaction volume through this network. Cobo currently handles around $300–400 billion in transfers annually—far exceeding the issuance scale of many Hong Kong-based stablecoin projects, which may only issue hundreds of millions or even tens of millions. If we can provide a powerful circulation network, dramatically enhancing distribution capacity and connecting issuers with end-users via the Cobo wallet ecosystem, issuers can incentivize adoption while users generate new use cases—creating a win-win dynamic.

TechFlow: Regarding distribution networks, what shifts do you foresee in the landscape? Beyond current models, are there new distribution paradigms on the horizon?

Alex:

Our current Cobo distribution network, built on banks and top market makers with a layered dissemination logic, is proving effective. How it evolves remains to be seen.

Historically, stablecoin distribution relied heavily on exchanges—just as half of Circle’s revenue goes to Coinbase. But it’s unclear which real-world scenarios will truly drive mass stablecoin circulation. Some believe countries with weak banking systems (e.g., Latin America, Africa) will embrace stablecoins, possibly using them as direct equivalents without final redemption. But as stablecoins become more regulated, the viability of such use cases is uncertain.

Recently, our team also discussed the possibility of fundamental changes in the banking system. Cross-border transfers today depend on the Fed’s network, but in the future, banks might issue their own tokens. This could break existing constraints, potentially allowing some commercial banks to surpass even the Fed in certain aspects—an exciting long-term prospect. Others speculate AI-powered payment agents (AI Agents) could be the next big thing, though their architecture remains undefined.

TechFlow: Many companies are applying for Hong Kong licenses. What barriers do traditional enterprises face when entering stablecoins—whether applying for licenses or building crypto reserves? And what exactly are Cobo’s compliance advantages?

Alex:

For listed companies today, two paths stand out: one is following MicroStrategy’s playbook by accumulating Bitcoin—many Hong Kong-listed firms are doing this—the other is pursuing a stablecoin license.

Bitcoin accumulation has low entry barriers and is operationally simple under current lenient regulations. But the challenge lies in two areas: timing the sale, and differentiation. As more companies pile in, the strategy loses scarcity value—markets won’t reward it unless you’re a leader or create deep integration between token and equity. So the real difficulty lies in strategic execution post-acquisition.

As for stablecoin licenses, many small firms announce ambitions purely for short-term stock hype. We’ve met companies with zero prior interest suddenly issuing press releases without meaningful discussion. These are usually publicity stunts lacking real execution capability or license eligibility.

Within Hong Kong and listed company ecosystems, Cobo’s advantages are twofold:

First, we have extensive experience serving listed companies. We support numerous mining firms listed on Nasdaq and HKEX, and have developed workflows with auditors on crypto asset auditing, reporting, and coordination with consulting firms.

Second, in stablecoin licensing and technical solutions, Cobo stands out not just in technical strength but in solution completeness. We don’t just enable issuance—we support full-cycle distribution, covering everything from mint/burn to merchant wallet management, helping clients get up and running quickly. This end-to-end capability sets us apart.

The Wallet Gap—And Why Stablecoin Swaps Are Promising

TechFlow: On mass adoption: what key infrastructures are still missing, or could form powerful synergies in driving stablecoin adoption?

Alex:

First, I believe wallets are a critical missing piece. Looking at Stripe’s recent acquisitions, they’re pushing Privy to let merchants and individuals use self-custody wallets generated via email—easy to set up and integrate with Bridge-based payment processing for fast transfers. From our view, Stripe is rapidly rebuilding Alipay’s core features using blockchain, and their latest moves target the wallet layer.

Similarly, many clients now realize the wallet is the missing link in their business—or a component too hard to build quickly. This reinforces my confidence in our niche.

Other infrastructures, like payments, still face compliance as the central challenge—especially KYB and KYC integration with real-world Web2 data. Balancing privacy and reliability during transactions remains a common pain point without mature solutions.

Also worth exploring is how compliant payment systems can expand into asset management. Both centralized and decentralized asset managers still need better ways to serve traditional clients.

Finally, I’m particularly bullish on stablecoin-to-stablecoin swaps. Given current trends, large tech firms from the U.S., China, Europe, South Korea, and beyond will likely issue numerous stablecoins. Relying on legacy models like Curve won’t suffice. Building efficient cross-stablecoin swap systems presents a massive opportunity—and a key internal focus for us.

Now Is the Crucial Moment for Stablecoin Mass Adoption

TechFlow: How large is the total market for stablecoins? What share could Cobo capture?

Alex:

Based on data from centralized custody wallets and our internal MPC transfer volume, we currently hold around 5% market share.

Looking ahead, I believe our core position is secure. As more Chinese and global Web2 payment giants enter the space, and as Cobo’s fast-transfer network matures, we’ll be able to do much more. Our share could expand to 10–15%.

This is an estimate based on transfer volume. But predicting the total stablecoin market is hard—it depends on regulatory tailwinds and whether new use cases like AI Agents take off. If billions of AI agents start transacting daily, the scale could exceed today’s internet. Near-term, we see cross-border payments leading the way. Gradually, vast online, on-chain, and even agent-to-agent commerce could shift to stablecoin settlements—making the ultimate scale incalculable.

TechFlow: Among Hong Kong, Singapore, and Dubai, which region is best positioned to nurture rapid stablecoin growth?

Alex:

From our vantage point, each region has nuances. From a custody perspective: The EU is pursuing MiCA licenses; Singapore offers MAS’s DTSP and MPI/DPT licenses; Hong Kong lacks clear regulations; the U.S. has New York’s BitLicense for pure custody; Dubai has VARA licenses.

From an issuance standpoint: The U.S. imposes few issuer requirements but mandates use of compliant custodians or strict banking standards. Switzerland’s Crypto Valley is friendly, but Europe requires reserves held in European banks—historically prone to failure, posing perceived risks. The Middle East is generally welcoming, but Dubai’s banking system lacks global recognition. Hong Kong’s bottleneck is limited, stringent licensing. Singapore, despite having the earliest stablecoin law, faces ambiguity in implementation details.

Overall, we recommend exploring licenses in Switzerland, Singapore, and Dubai. But success depends on your strength—regulators care mainly about three things: whether your use case is legal, whether you’ll sell the license shortly after approval, and whether your transaction volume justifies the license. Strong use cases attract lighter scrutiny.

TechFlow: Beyond payments, stablecoins are seen as the next-gen “internet money layer.” What’s your take? What transformative impacts could they unlock? And how is Cobo preparing?

Alex:

I believe stablecoins will quickly erode fiscal autonomy in smaller nations—countries like Nigeria with unstable local currencies. Medium to long term, dollar-backed stablecoins will dominate pricing and transactions in standardized online services, severely disrupting local monetary systems.

From a banking perspective, many small and mid-sized banks will face declining competitiveness, especially among younger generations. Once people transact natively in stablecoins and design accounts around them, the need for traditional bank cards diminishes.

For centralized exchanges and banks, their future role may center on compliance—providing KYC/AML assurance when converting crypto to fiat, reducing counterparty risk. They won’t disappear, but their value proposition will shrink.

Cobo is preparing on multiple fronts: fully compliant centralized custody, client-side compliant self-custody, diverse wallet architectures, and continuous product optimization. We’re also pursuing licenses globally to meet client demand for regulated entities. We’ve even debated acquiring a bank, though concluded it’s premature for now.

The broader trend is clear: more value is moving on-chain. Coinbase created Base to capture that value internally. We, instead, aim to be the bridge to on-chain—starting with the wallet.

TechFlow: Many say stablecoins are an institutional game. Do you agree? How can ordinary users better seize opportunities in this space?

Alex:

Right now, I’d advise caution with certain A-share plays. From conversations, some are genuinely committed but lack capacity, while others are purely chasing short-term hype.

Is it an institutional game? From an issuance standpoint, yes—this space will be led by highly centralized, well-resourced institutions. But for entrepreneurs, if you believe 20–30% of future traffic will settle in stablecoins, countless new needs, tools, and functions will emerge across diverse scenarios—ripe for innovation.

I believe we’re at a true inflection point for mass adoption, opening vast entrepreneurial opportunities. Previously, the industry rebuilt traditional finance on-chain. Now, the trend is bringing on-chain innovations into forms acceptable to traditional finance—balancing compliance with on-chain flexibility.

Take USD card products—many call them a dead-end business. But beyond compliance, the core issue is poor UX. Most are debit-style: spend only what you deposit. Solving on-chain credit—or bridging traditional credit onto-chain—could revolutionize the experience. Similarly, reimagining legacy structures like trusts and insurance on-chain offers immense potential.

I’m actually more optimistic than most. In the past, projects would launch a token and a prototype and call it a day. That model is dead. Now, real clients are entering the market, demanding mature, practical products. For instance, if Coinbase’s account system integrates with Shopify, Amazon, or Walmart next year—giving everyone a wallet and on-chain identity—products must become simpler, more accessible. This is a fresh beginning.

Lastly, I believe CeDeFi is a direction worth pursuing. The old Ce meant centralized exchanges. Today’s Ce leans toward tech platforms. The key is balancing liquidity and compliance—meeting regulation while serving broad audiences. That intersection holds enormous startup potential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News