Consensys: 30 Considerations for Token Design and Issuance

TechFlow Selected TechFlow Selected

Consensys: 30 Considerations for Token Design and Issuance

The "market" will determine the value of the token, but designers can at least review all aspects of the token distribution before the token flows into the public secondary market.

Author: Clemens Wan, Consensys

Translation: Binggan, Chain捕手

If cryptocurrencies are likened to websites in the web2 world, then SEO and discoverability equate to seamless token distribution through liquidity pools and market making.

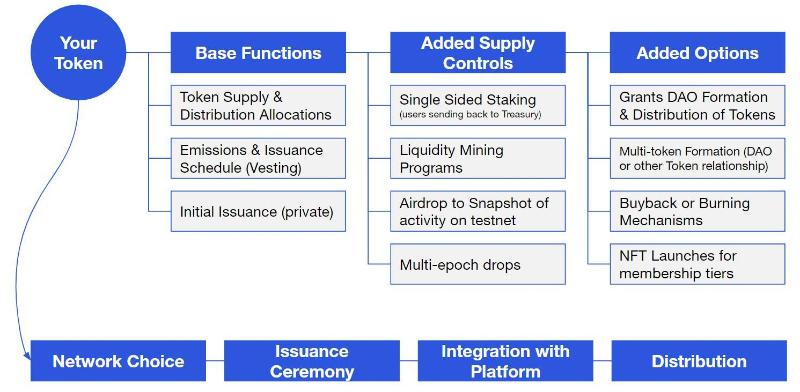

Tokenomics design is now extremely popular. I've participated in several fascinating and challenging token design projects. Designing tokens is a more niche and complex art than building conventional websites. "The market" will determine a token’s value, but designers can at least review all considerations around token issuance before it reaches public secondary markets.

1. Fungible token or non-fungible token?

Each NFT is unique, often launched via metaverse projects, with each release belonging to a collection. Fungible tokens are the focus of most economic design work, primarily covering interactions and distributions involving project tokens with exchanges and AMMs.

2. What is the token used for? (Does it always appreciate?)

Simply describe the token's purpose within the context of the project and product—this will be the starting point for whitepapers and blog posts.

3. Who in the ecosystem will buy the token, and why?

Clarify whether token buyers are speculators, platform users, or other roles such as app developers or advisors.

4. Do other partners or ecosystem participants want to use or purchase the token?

Web3 needs Web2 strength to succeed. Support from Web2 influencers as stakeholders and partners could be key to a token’s success.

5. How does the token interact with the platform?

Is the token earned through platform interaction? Does it involve voting and governance? Notable patterns include: subscriptions/access licenses, mirrored access and identity NFTs, tipping, fundraising, staking, governance, direct rewards, and B2B incentives.

6. How is the token exchanged with other tokens?

Does token exchange rely on DeFi oracle market data? Is it linked to NFTs?

7. What is the token distribution breakdown? Specific percentages?

An appealing dApp protocol might allocate over 50% of tokens to the community through user rewards, grants, marketing, liquidity incentives, and listing fees. Other portions may go toward private sales, project development (team + advisors), DeFi liquidity management, and foundation reserves.

8. What is the maximum token supply?

We observe that most tokens designed for broad distribution have circulating supplies of 10 million, 100 million, or 1 billion. This design actually depends on balancing unit price and distribution. For example, airline points are psychologically distributed as high-value integers, though redemption items lack transparent market value. A common base model for unit pricing: L1 chains typically have total circulating supplies between 100 million and 500 million, often incorporating deflationary mechanisms (e.g., burning tokens to pay transaction fees). Larger supplies like XRP’s 50 billion or DOGE’s 132 billion may struggle to achieve valuations above $1 per token.

9. What is the token vesting schedule?

A vesting schedule defines how tokens are released over time across different stages. Internal teams and investors need a clear strategy (to prevent mid-project exits or job-hopping): at least 18–24 months of equity and token vesting. Other allocations may depend on project milestones, such as airdrops for beta testers.

10. Does the token have a single-token staking mechanism?

Single-token staking allows holders to send tokens back to the project treasury, reducing circulating supply. Some advanced staking designs use these tokens to fund new initiatives or create multiple liquidity pools to balance minting/burning dynamics. Ultimately, staking increases token engagement and recycling within the project, often paying interest. This benefits “true believers” and early investors who prefer not to participate in liquidity mining.

11. Which type of liquidity mining program will be adopted?

Liquidity mining involves allocating tokens to AMM pools early in the project to establish markets with reasonable depth and minimal slippage. This means users can deposit project tokens into LP pairs with ETH or USDC, enabling all crypto players to trade across various aggregators/DEXs. LPs in these token pairs earn trading fee rewards. Uniswap or Balancer offer traditional liquidity mining programs, while Fei x Ondo, Tokemak, or Olympus Pro provide more sophisticated models.

12. Will there be token airdrops?

Airdropping tokens is another way to distribute them widely and gain support. Well-designed airdrops serve as proof of early project participation, allowing quantifiable token amounts based on such proof. However, airdrop bias can be hard to avoid—for instance, airdropping ENS tokens to early ENS address registrants. If a specific timeframe is used and earlier transaction addresses receive larger allocations, early adopters may feel more rewarded.

13. Will cryptocurrency be accepted as payment for fundraising?

While swapping project tokens and investor crypto via on-chain wallets seems straightforward, legally accepting crypto as fundraising payment in exchange for equity or tokens is tricky and can become a nightmare in fund management.

14. Can a DAO model help with project fundraising or token issuance?

There are many legal distinctions separating entity-based fundraising from crypto community fundraising. If a fungible token is required to join a DAO, or if the DAO’s valuation ties directly to its token, the project could theoretically increase token value as the community grows. DAOs created for communication and distribution purposes already exist. NFTs conducting initial launches on Discord represent another form of public offering, applicable also to NFT collections distributed on OpenSea or other NFT marketplaces.

15. Does a community DAO make sense for the token project?

Not all DAOs need to hold fungible tokens in their treasuries, but tokens create an interesting atmosphere for a project and offer advantages like transparent on-chain voting on structured proposals. I appreciate the idea of projects using basic frameworks to encourage users to engage in on-chain voting and governance over built-in protocol parameters. Creating a DAO on a project adds character and fosters community discussion—an approach akin to open-sourcing all code, where voting mechanisms and decentralized control represent a commitment to user accountability.

16. Does the token include deflationary mechanisms?

Standard protocol tokens like Ethereum operate via consensus mechanisms set at fixed block intervals (e.g., every 10 minutes). Mining rewards go to infrastructure providers and validators. Over time, burning mechanisms reduce the total token supply. Long-term, this design benefits token economics.

17. Does the project require custodians to manage core keys?

It is strongly recommended to use custodians for managing large asset pools. Similar to web2 platform admin passwords and authentication access security, developer-grade crypto wallets should not be stored solely on private GitHub repositories.

18. If the project manages its own keys, what security mechanisms and procedures are in place?

Project administrators are advised to create multiple keys and implement multi-signature mechanisms. Administrators of DAO multisigs or smart contract owners bear significant responsibility for fund security.

19. On which testnet will the token launch?

Choosing a testnet highlights the importance of project code.

20. Has the project undergone smart contract audits?

After finalizing token business logic without major changes, projects should submit their code to third-party security firms for audit. Note that most audits require booking 3–6 months in advance and cost between $60,000 and $100,000 depending on code complexity.

21. During the private sale, how do investors claim their tokens?

Initial token distribution typically requires secure wallet-generated smart contracts for disbursement and vesting schedules. Using Carta to create an on-chain shared release version could make it easier for investors to track their tokens.

22. How to monitor and measure the success of the token launch?

Project teams must not only clearly disclose all token information to buyers and market data providers but also monitor interactions with the fungible token smart contract set.

23. What is the token price discovery strategy?

Tokens lack standardized pricing mechanisms (unless fundraising has already occurred within a DAO prior to launch). One option is for the project team to fund a 50-50 pool on Uniswap or create a liquidity bootstrapping pool on Balancer, letting the market price the code.

24. Are there restrictions on token purchases based on region or user type?

This determines whether the project needs to implement whitelisting features or KYC verification via its official website.

25. Why upload a DAO charter or project documentation?

Typically, users rely on GitBook for purely technical documents and wikis for comprehensive project information.

26. What is the budget allocation for liquidity pools?

Some projects allow investors to contribute to liquidity pools as LPs, while others hire professional market makers to manage pool allocations.

27. How to communicate with token holders?

It is recommended that project teams issue announcements updating regular investors every two weeks, monthly, or quarterly. More token holders may also read Mirror or media blogs for historical context. Additionally, teams can hire social media experts to manage Twitter accounts or post announcements on Discord.

28. On which network will the token and DAO launch?

This is far from an easy choice—Ethereum mainnet has the highest fees but strongest liquidity. Project teams are advised to consult investors or the DAO for input.

29. Are the project press release and FAQ documents easy for investors to understand?

Clearly articulating the project vision and token value is important. While most people distill the vision into a one-pager, project teams also need supplementary versions for FAQs and press releases.

30. When launching the token, where should the launch event be held?

Will the launch event be open to everyone? Can I participate too?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News