에어월렉스 창립자가 말하는 스테이블코인이 왜 잘못되었는가?

결론부터 말하자면, 달러-유로 구간의 G10 골드 코리도어 안에서는 Airwallex의 '초단위 도달 + 만분의 1 수수료'가 거의 완벽한 점수를 받을 만하다. 그러나 금융 세계는 이 고속도로 하나로 끝나지 않는다. Stripe가 Bridge를 인수하고, Visa가 스테이블코인 정산을 자체 네트워크에 통합하며, Circle이 뉴욕증권거래소에서 폭발적인 IPO를 성공시킨 일련의 움직임은 더 큰 그림을 그리고 있다. 바로 '자금의 마지막 1km'를 뚫는 자가 차세대 결제 기반 시설을 재편할 기회를 얻는다는 사실이다.

1. '0.01% + 초단위 도달'의 광환은 단지 15% 영역만 감쌀 뿐

Jack Zhang은 X(트위터)에 장문의 글을 연달아 올렸으며, 핵심 주장은 매우 명확했다:

가격 — Airwallex는 USD→EUR 수수료를 이미 0.01%까지 낮췄다;

속도 — 자금 실시간 정산, 블록체인 상에서조차 더 빠르지 않다;

현장 적용 — 스테이블코인 입출금은 비용이 비고 규제에 막히며, 15년 동안 실질적 활용 사례를 보지 못했다.

무대를 런던 ↔ 뉴욕 ↔ 프랑크푸르트로 한정한다면 그의 주장은 과장이 아니다. 문제는 전 세계 85%의 국경 간 자금 흐름이 G10이라는 대로 위에 존재하지 않는다는 점이다.

-

아르헨티나 프리랜서에게 은행 송금은 여전히 최소 3일 소요되며 수수료는 최소 3% 시작이다;

-

케냐 상인이 나이지리아 공급처에 물건을 보내려면 두 개의 서브스턴딩 뱅킹(correspondent banking) '비포장 산길'을 지나야 한다;

-

터키 수입업자가 금요일 밤에 계약금을 지불하려 해도 주말 은행 휴무로 인해 속절없이 기다릴 수밖에 없다.

이처럼 '주류'가 외면한 구석구석에서 스테이블코인은 반기 만에 세 배 성장하며 들불처럼 번지고 있다.

2. "왜 하필 스테이블코인인가?"를 설명하는 세 가지 곡선

1. 라틴아메리카 곡선: 달러 부족이 체인상 달러를 낳았다

2021년 라틴아메리카 지역의 스테이블코인 규모는 200억 달러에 불과했으나, 2024년에는 680억 달러로 치솟았고 올해 상반기에는 750억 달러까지 증가했다. 고물가, 달러 부족, 주말 은행 마비 등 세 요소가 맞물려 자금을 블록체인으로 몰아갔다. 0.01% 절약을 위한 선택이 아니라 '지금 당장 도착해야 하기 때문'이다.

2. 거물들의 투자 곡선: 돈을 네트워크 안에 가두어라, 탈출하게 하지 마라

Bridge는 최근 Stripe에 11억 달러에 인수되었고, Visa는 즉시 이 연결망을 에콰도르, 페루, 콜롬비아로 확장했다. 이들이 노리는 것은 외환 스프레드가 아니라 '자사 생태계 내 자금 유치'를 통한 성장 배당이다. 자금이 더 이상 은행에 착륙하지 않게 되면, 결제사는 동시에 트러스트뱅크, 금융상품 마켓플레이스, 신용 제공 창구로 변신할 수 있다.

3. 월스트리트 평가 곡선: Circle은 금리 차익만으로도 화폐를 찍어낸다

Circle은 작년 USDC 포지션의 이자만으로 순이익 7.8억 달러를 거뒀으며, IPO 후 사흘 만에 주가는 두 배 이상 급등했다. 월스트리트가 매수한 것은 '체인상 달러+국채 스프레드'라는 현금 생성기이며, 동시에 네트워크 효과가 이미 현실화된 신호이기도 하다. USDC를 받는 기업이 하나 늘 때마다 출금 수요는 줄어들고, 수수료 논란도 자연스럽게 사라진다.

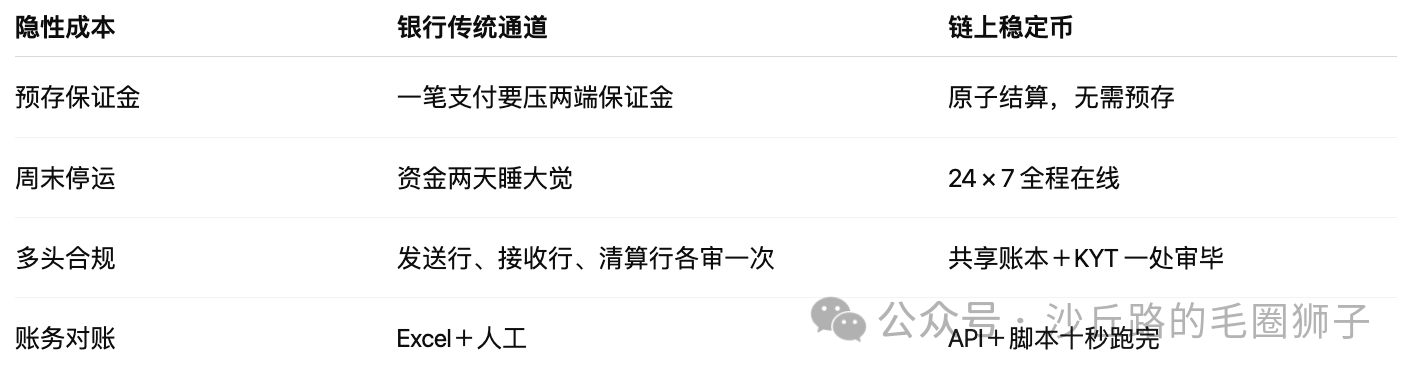

3. '저렴함'과 '빠름' 너머, 더 까다로운 비용

많은 사람들이 수수료표만 주목하지만, 실제로는 보고서 뒤에 숨겨진 T+2 유동성, Nostro 예치금, KYC 다중 검토 같은 요소들을 간과한다. 바로 이들이 국경 간 이익을 삼키는 블랙홀이다.

이러한 마찰이 모두 '코드 로직'으로 압축될 때, 0.01%의 수수료 우위는 금세 무의미해진다.

4. 지금 당장 은행을 앞지를 수 있는 세 가지 실제 시나리오

-

USD→ARS 급여 지급

은행 외환 통제와 주말 운영 중단으로 인해 송금은 다음 영업일까지 기다려야 한다. USDC 지갑은 5분 만에 도달하며, 실제 종합 수수료는 약 1%. 고용주는 안심하고 사용하며, 근로자는 기꺼이 수령한다. -

KES↔NGN 소규모 대금

케냐와 나이지리아 사이에는 직결 정산망이 없지만, 체인상 P2P는 24시간 운영되며 수수료는 1~2% 수준이다. -

주말 전 세계 유동성 운용

은행은 금요일 퇴근 후 휴면 상태에 들어가 자금이 정체된다. 재무팀은 체인상에서 초단위로 자금을 BUIDL로 이체해 연 4% 수익을 안전하게 얻은 후, 영업 개시 즉시 다시 인출하여 급여 지급에 사용할 수 있다.

이들은 화려하지 않지만, 오히려 수익률이 가장 두껍고 은행 서비스가 공백인 롱테일 영역이다.

5. 2026년 이전, 어떻게 플라이휠을 가속할 것인가?

-

은행계 발행기관: MiCA 시행 이후 유럽 지역에서 적어도 10개 이상의 지역 은행이 Société Générale의 EUR 스테이블코인 모델을 복제할 것이다.

-

슈퍼앱 진입점: Grab, MercadoPago 등은 이미 USDC 지갑을 그레이스케일 테스트 중이다. 기본 활성화만 된다면 수천만 사용자가 즉시 체인상 세계로 진입하게 된다.

-

체인상 폐쇄 루프 형성: 사업자 수취, 공급망 지불, 직원 급여, 금융 수익 모두 동일 네트워크 내에서 완결되며, 오프램프 수수료는 자연스럽게 제로로 수렴한다.

-

기업 재무 이전: 드웰은 2027년 포춘 500대 기업 중 10%가 유휴 자금을 수익형 스테이블코인 계좌에 보관할 것으로 예측하며, 이로 인해 은행 요구불예금이 대부분 빠져나갈 것이라고 분석했다.

그때가 되면 G10 코리도어의 0.01% 수수료를 논하는 것은, 마치 2010년 통신 거물들이 장거리 통화료 1센트 인하를 고집하는 사이, WhatsApp가 무료 통화로 하루 백만 명씩 신규 사용자를 늘리는 상황과 같다.

6. Circle IPO가 남긴 마지막 한마디

Circle은 아름다운 이자 마진 재무제표와 빠르게 팽창하는 네트워크 효과를 통해 시장에 다음과 같이 선언했다. "저렴한 송금은 서막일 뿐, 금융 인프라 재편이 본론이다."

Airwallex는 G10 구간을 거의 극한까지 완성했으며, 이는 15% 세상에서의 챔피언 자세다. 그러나 나머지 85% 시장은 이미 새로운 트랙과 새로운 스코어보드로 넘어가고 있다.

다음 정거장에서는 돈이 메일처럼 자유롭게 날아다닐 것이다. 그때 누가 메일 우표가 1센트인지 0.1센트인지 신경이나 쓰겠는가?

판세 변화를 조용히 지켜보며, 출발선에서 스스로 손발을 묶지 말라.

TechFlow 공식 커뮤니티에 오신 것을 환영합니다

Telegram 구독 그룹:https://t.me/TechFlowDaily

트위터 공식 계정:https://x.com/TechFlowPost

트위터 영어 계정:https://x.com/BlockFlow_News