BitMEX founder: Ongoing decline hasn't shaken belief in the bull market

TechFlow Selected TechFlow Selected

BitMEX founder: Ongoing decline hasn't shaken belief in the bull market

The encrypted capital market is the last free financial market on Earth. All other major asset classes, as well as the intermediaries that help people trade these products, have become political targets of governments and central bank officials.

Author: Arthur Hayes, Founder of BitMEX

Translation: Wu Zhuocheng, Wu Talk Blockchain

Three weeks ago, I wrote an article titled "Maelstrom," in which I described the thought process behind rationalizing my crypto asset portfolio—holding only Bitcoin, Ether, and a few altcoins I have faith in.

While many appreciated my honesty and perspective, some rightly pointed out that my bearish piece was published several weeks after Bitcoin and Ether had already fallen more than 30% from their all-time highs (ATH). That's the nature of my essays—I hope they're persuasive, grounded in logic and evidence. I'm not here to help you perfectly time the market, but to challenge your thinking, and hopefully help you grow as a trader or investor.

The crypto capital market is Earth’s last truly free financial market. All other major asset classes—and the intermediaries that help people trade these products—have become political targets of governments and central bankers. “When a measure becomes a target, it ceases to be a good measure”—Goodhart’s Law.

Equity, fixed income, and foreign exchange markets are deeply influenced by central banks and those “too big to fail” banks. This means they can run infinite leverage on the backs of taxpayers, with inflation being the consequence of reckless money printing. Their balance sheets are used to peg asset prices at levels that achieve political stability. This benefits the wealthy, as ownership of financial assets is highly concentrated among the richest 10%, or even 1%, of citizens in any society.

Crypto assets exist entirely outside the TradFi system, and thus will find a market-clearing level before equities or bonds do. Crypto assets are now a legitimate asset class traded by ordinary people like us, hedge fund masters, and a few sell-side banks. As the last truly free financial market, crypto will discover a clearing price that reflects the current macroeconomic environment earlier than all other assets.

This belief presents me with a dilemma.

In the first three weeks of this year, the crypto market dropped sharply. U.S. equities—the S&P 500 and Nasdaq 100—remain slightly below their all-time highs. The stock market certainly hasn't entered a true bear market yet. But the capital losses suffered by crypto holders suggest that the Fed's new round of tightening, removing dollar liquidity, will hit equity holders in the short term.

That’s fine. But the Fed hasn’t even stopped buying bonds yet, nor raised policy rates. If I wait until the March meeting when the market expects the Fed to hike rates, would I be too greedy and miss an excellent entry point to swap dirty fiat for clean crypto assets? I can’t deny that my finger gets very excited to press the buy button if Bitcoin trades below $30,000 and Ether below $2,000. But does this eagerness align with the probability map I hold in my mind about the future?

This article aims to give readers more flexibility when deciding when to buy the dip.

Last week, the U.S. President held a solo press conference and definitively stated that fighting inflation is the Fed’s responsibility. Whether or not you believe the Fed is 100% responsible for America’s high inflation and can act meaningfully through its policy levers, the Fed must raise interest rates. The Fed never makes a 100% commitment to any policy; they always leave room to change their mind if major events occur in financial markets.

The question becomes: Can the Fed publicly reverse its future restrictive monetary policy before the March meeting? At the March meeting, everyone expects the Fed to raise policy rates by 0.25%. Here are three scenarios under which the Fed might shift course:

1. The S&P 500 and Nasdaq 100 fall at least 30% from their all-time highs (S&P 500 at 3,357, Nasdaq 100 at 11,601).

2. A collapse in the U.S. Treasury or money markets.

3. A significant widening of the spread between investment-grade and speculative-grade bond yields.

I’ve detailed the importance of the first two scenarios for the U.S. and global economic model. It’s widely believed that if either of these occurs, the Fed might restart the printing press against the ruling party’s political wishes. Less discussed is the corporate credit sector, mainly because everyone assumes the Fed solved this issue back in March 2020 when it nationalized the markets.

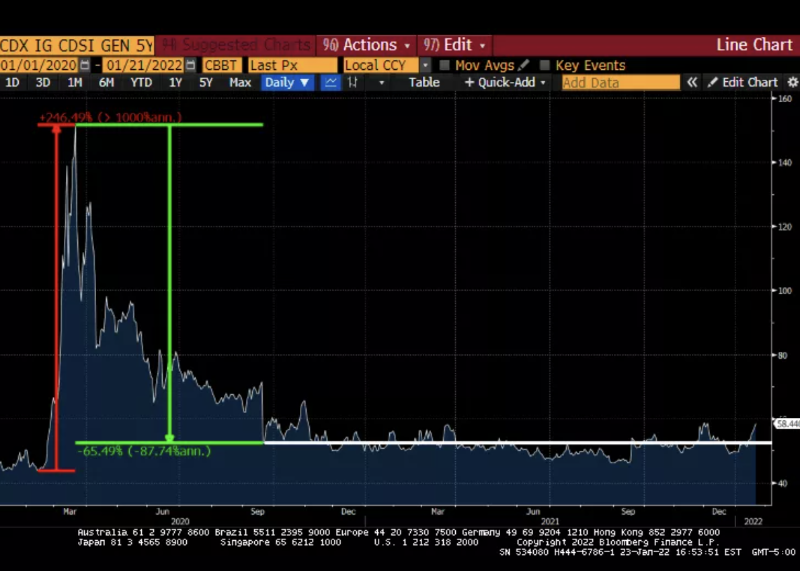

The Fed nationalized the U.S. corporate bond market by supporting all investment-grade bonds and signaling it could purchase speculative-grade bonds. The two charts below show how this nationalization squeezed CDS spreads. CDS spreads are a good indicator of how much interest companies of a given rating must pay when issuing bonds.

Speculative Grade Basis Points

Investment Grade Basis Points

Facing a pandemic of unknown severity (the red volatility phase), markets began demanding high interest payments from corporate borrowers. The Fed said “no, no, no, no,” claiming market levels were wrong—let’s nationalize it by providing unlimited money printing. Spreads fell, and large corporations maintained loose borrowing conditions. Unfortunately, small businesses, unable to access institutional credit markets, were left behind. Only recently has the market started to consolidate sideways.

If the Fed publicly announces plans to shrink its balance sheet, how then can it maintain its promise to support corporate bond issuance? Such support requires actual purchases or the threat of purchasing all eligible corporate bonds as defined by the Fed. Markets have recognized this inconsistency, and yields have begun rising slightly.

This is a problem because approximately $332.42 billion of non-financial U.S. corporate bonds will mature in 2022 (source: Bloomberg). Companies must either repay investors with cash on hand or refinance by issuing new debt. Based on 2021 issuance statistics (source: SIFMA), about 17% of annual debt must be rolled over.

Few companies have pricing power to offset the negative impact of wage and commodity inflation, which will inevitably lead to shrinking profit margins. Therefore, as inflation continues to ravage the U.S. and the world, free cash flow available to repay bondholders will decrease. If the Fed doesn’t actively suppress spreads by expanding its balance sheet, markets will demand higher interest rates on newly issued bonds.

The Fed’s worst-case scenario is if expectations of tighter monetary policy pull forward, causing markets to demand ever-higher rates on corporate debt. If companies cannot finance themselves, they’ll reduce activity—meaning job losses at a politically inconvenient time. Inflation doesn’t necessarily mean unemployment, but if a company can’t fund operations due to market-driven borrowing costs, it will lay off employees.

I believe politically, 7% unemployment is worse than 7% inflation. The Fed and their political brokers may soon be forced to choose between continuing inflation or facing a wave of unemployment following a credit market collapse. I bet loose monetary policy will return, which, as we know, is positive for crypto markets. Market conditions change rapidly—if markets believe the Fed won’t support corporate issuance, spreads will widen quickly.

Rather than waiting for the Fed to publicly announce a reversal, this strategy involves using signals from these indicators as early signs of an impending shift. Crypto assets will capture these signals and rise before the Fed officially announces a policy change.

Support levels: Bitcoin $28,500, Ethereum $1,700.

I believe the market won’t bottom until these levels are retested. If support holds, great—this issue is resolved. If not, then I expect Bitcoin and Ethereum to be liquidated down to $20,000 and $1,300 respectively. As for Bitcoin and Ethereum falling below their 2017 ATHs ($20,000 and $1,400 respectively), I don’t even want to consider that possibility.

It’s also possible Bitcoin and Ethereum won’t fall below $30,000 and $2,000 again—markets never behave exactly as expected. Then the market fails to clearly test prior lows, making the situation tricky. Depending on your ideological view of capital markets, you might look at one or more metrics such as: total open interest in contracts, net stablecoin inflows to exchanges, asset size at specific exchanges, implied volatility versus realized volatility, etc.

One can imagine a scenario where Bitcoin and Ether hold the bottom of their current trend channel when the Fed turns on the taps—but I’m certain this is impossible. We must think more flexibly about which signals will give us confidence so we can buy, buy, buy.

But as I write this, the market feels bottomless. Traditional markets haven’t scared the Fed enough to stop fighting inflation. In terms of price action, from my years as a participant in crypto capital markets, selling happens in waves. Last weekend was brutal, but it hasn’t broken the soul of the bull market.

Remember, marginal sellers set the price. If their bond and stock portfolios get hit, institutions holding small amounts of crypto will dump them without hesitation. They haven’t started selling yet (they don’t work weekends), and negative headlines from mainstream financial media haven’t provided the confirmation bias these sellers need to justify downward moves in crypto. Correlation is coming, but not yet. If the S&P 500 and Nasdaq continue to slide into quarter-end, beware—it might be tied to the post with a Hermès tie or pinned down by Louboutin heels…

Sell assets that have spiked, avoid further downside.

Original link:

https://cryptohayes.medium.com/bottomless-29160a0156cd

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News