Arthur Hayes' latest prediction: Bitcoin at $250K, Ethereum at $10K by year-end

TechFlow Selected TechFlow Selected

Arthur Hayes' latest prediction: Bitcoin at $250K, Ethereum at $10K by year-end

The upcoming Ethereum bull market will completely ignite the market.

Author: Arthur Hayes

Translation & Compilation: BitpushNews

Unveiling Trump's "Fascist Economy" and the Secretive Waltz of the Crypto Bull Market — Bitcoin and the "Drumbeat of Credit" in a Deadly Dance. Is Your Investment Move in Sync?

The highest praise humans can offer the universe is the joy born from dance. Most religions incorporate some form of music and dance into their worship rituals. The House Music I believe in doesn't move your body in church on Sunday morning, but rather in Club Space during the same time slot.

In college, I joined a ballroom dance club, praising rhythm through physical movement. Each ballroom dance has strict rules (for example, in Rumba you cannot place your weight on a bent leg), and for beginners, the hardest part is mastering the basic steps in time with the beat. The greatest challenge lies in first identifying the tempo of a song, then knowing exactly where each beat falls.

My favorite ballroom dance—Jive—is in 4/4 time; while Waltz is in 3/4. Once you know the time signature, your ear must identify which instrument carries the downbeat and count the remaining beats in the measure. If every song simply had a kick drum hitting "one, two, three, four," it would be extremely monotonous. What makes music compelling is how composers and producers layer other instruments and sounds to add depth and richness. But when dancing, listening to all these secondary sounds is superfluous for placing your feet correctly at the right moment.

Like music, price charts reflect the fluctuations of human emotion, and our portfolios dance along with them. Just as in ballroom dance, our decisions to buy or sell different assets must follow the specific beat and rhythm of each market. If we fall out of rhythm, we lose money. Losing money, like a dancer off-beat, is ugly. So here’s the question: if we want to remain beautiful and wealthy, what instrument in the financial markets must our ears tune into?

If there is one self-evident core belief in my investment philosophy, it is this: the most important variable in profitable trading is understanding how fiat supply changes.

This is even more critical for cryptocurrencies, especially Bitcoin, which is an asset with fixed supply. Therefore, the rate of fiat supply expansion determines the pace at which Bitcoin's price rises. Since early 2009, massive amounts of fiat have been created, chasing after a relatively insignificant Bitcoin supply, making Bitcoin the best-performing fiat-denominated asset in human history.

Currently, jarring signals emitted by financial and political events form a dissonant tritone. Markets continue rising, yet very serious, seemingly negative catalysts are creating disharmony. Should you take cover due to tariffs and/or war? Or are these merely non-essential instruments? If so, can we still hear the guiding force of the kick drum—the creation of credit?

Tariffs and war matter because a single instrument or sound can ruin a piece of music. But these two issues are interconnected and ultimately irrelevant to Bitcoin’s continued upward trajectory. U.S. President Trump cannot impose meaningful tariffs on China because China would cut off rare earth supplies to "Beautiful Country" and its vassals. Without rare earths, the U.S. cannot manufacture weapons to sell to Ukraine or Israel. Thus, the U.S. and China are engaged in a frenzied tango, cautiously probing each other without overly destabilizing their economies or geopolitics. This is why the current status quo, though tragic and deadly for people in both places, currently has no substantial impact on global financial markets.

Meanwhile, the credit kick drum continues to mark time and rhythm. America needs industrial policy—a euphemism for state capitalism, technically known by that dirty word: fascism. The U.S. needs to shift from a semi-capitalist economic system to a fascist economic system because its industrial giants cannot produce war materials in sufficient quantity, speed, and cost to meet current geopolitical demands.

The war between Israel and Iran lasted only twelve days because Israel exhausted the missiles supplied by the U.S., leaving its air defense systems unable to operate effectively. Russian President Putin remains unmoved by NATO and U.S. threats of deeper support for Ukraine because they cannot produce weapons in the same volume, speed, and low cost as Russia.

America also needs a more fascist-style economic arrangement to boost employment and corporate profits. From a Keynesian perspective, war is highly beneficial for the economy. Stagnant organic demand among the public is replaced by the government’s insatiable demand for weapons.

Eventually, the banking system is willing to extend credit to businesses because they are guaranteed profits through producing goods demanded by the government. Wartime presidents are extremely popular—at least initially—because everyone appears to become wealthier. If we adopted a more comprehensive measure of economic growth, it would be clear that wars are net destructive. But such thinking doesn’t win elections, and every politician’s primary goal is re-election—not just for themselves, but for their party members. Trump is a wartime president, like most of his American predecessors, and thus he is placing the U.S. economy into a wartime footing. This makes finding the rhythm easy; we must identify how credit is being injected into the economy.

In my article "Black or White," I explained how government-guaranteed profits lead banks to extend credit to "key" industries. I call this policy "QE for Poor People," which creates fountains of credit. I predicted this would be the method Trump’s team uses to stimulate the U.S. economy, and the MP Materials deal is our first large-scale real-world case.

The first part of this article will explain how this deal expands the dollar credit supply and will serve as a template for the Trump administration as it attempts to produce critical goods needed for 21st-century warfare—semiconductors, rare earths, industrial metals, etc.

War also requires governments to keep borrowing massive sums. Even as capital gains tax revenues rise due to inflated asset prices from increased credit supply, governments still face widening fiscal deficits. Who will buy this debt? Stablecoin issuers.

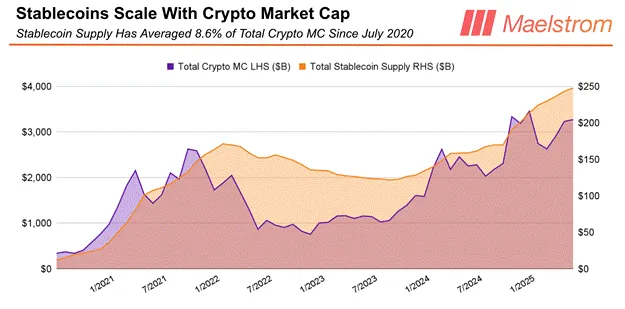

As the total crypto market cap rises, a portion of it is held in stablecoins. The vast majority of stablecoin AUC (Assets Under Custody) are invested in U.S. Treasury bills.

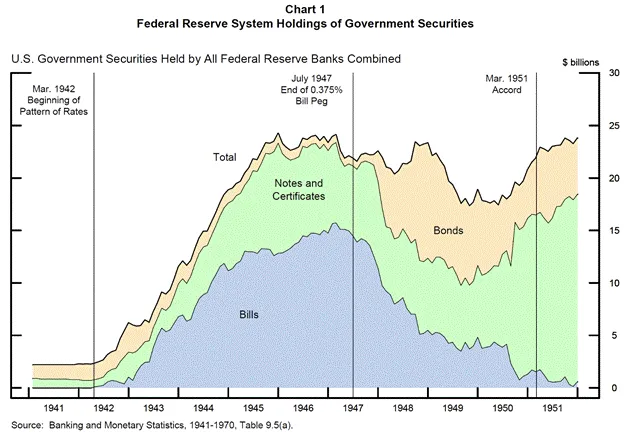

Therefore, if the Trump administration provides favorable regulatory conditions for traditional finance (TradFi) participation and investment in crypto, the total crypto market cap will surge. Consequently, stablecoin AUC will automatically increase, generating greater purchasing power for Treasuries. Treasury Secretary Bessent will continue issuing far more T-bills than notes or bonds, specifically for stablecoin issuers to purchase.

Let’s dance a credit waltz—I’ll guide readers through perfectly executing the S-shaped step.

QE for Poor People

Central bank money printing alone cannot create a powerful wartime economy. Finance has replaced rocket science. To correct failures in wartime production, the banking system is encouraged to lend credit to industries deemed critical by the government, rather than predatory corporations.

U.S. private enterprises aim for profit maximization. Since the 1970s, earning higher profits has meant performing "knowledge" work domestically while offshoring production. China was happy to elevate its manufacturing skills by becoming the world’s low-cost—and over time high-quality—factory. However, producing $1 worth of Nike shoes does not threaten the elite of "Beautiful Country." The real issue is that Beautiful Country cannot produce war materiel when its hegemony faces serious threats. Hence all the fuss about rare earths.

Rare earths aren’t actually rare, but processing them is difficult, largely due to massive environmental externalities and huge capital expenditure requirements. Over thirty years ago, Chinese leader Deng Xiaoping decided China would dominate rare earth production, and today’s leaders can leverage that foresight. Currently, all modern weapons systems require rare earths; therefore, it is China—not the U.S.—that decides how long wars last. To correct this, Trump is borrowing from China’s economic model to ensure increased U.S. rare earth output, enabling him to continue his aggressive posture.

Here are the key points from Reuters regarding the MP Materials deal:

-

The U.S. Department of Defense will become MP Materials’ largest shareholder

-

The deal will boost U.S. rare earth production and weaken China’s dominance

-

The DoD will also provide floor pricing for critical rare earth products

-

The floor price will be double the current Chinese market price

-

MP Materials' stock surged nearly 50% after the announcement

All well and good, but where does the funding come from to build the factories?

MP says JPMorgan Chase and Goldman Sachs are providing a $1 billion loan to construct its 10x capacity plant.

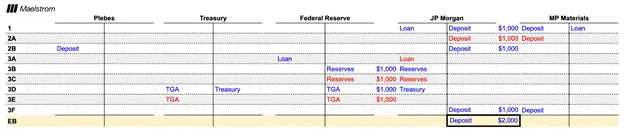

Why are banks suddenly willing to lend to real industry? Because the U.S. government guarantees profitability for this "money-burning project" for borrowers. The T-account below explains how this deal creates credit out of thin air, driving economic growth.

MP Materials (MP) needs to build a rare earth processing plant and obtains a $1,000 loan from JPMorgan (JPM). The loan creates $1,000 of new fiat (wampum), deposited into JPM.

MP then builds the plant. This requires hiring workers—the "Plebes." In this simplified example, I assume all costs are labor-based. MP pays workers, debiting $1,000 from its account and crediting $1,000 into Plebes’ accounts at JPM.

The Department of Defense (DoD) needs to pay for these rare earths. Funding comes from the Treasury, which must issue debt to fund the DoD. JPM converts its corporate loan asset to MP into reserves held at the Federal Reserve via the discount window. These reserves are used to purchase the debt, crediting the Treasury General Account (TGA). The DoD then purchases rare earths, which become revenue for MP, eventually returning as deposits to JPM.

End-of-period fiat balances (EB) are $1,000 higher than JPM’s initial loan amount. This expansion results from the money multiplier effect.

This shows how government procurement guarantees can finance new factory construction and worker hiring via commercial bank credit. Not shown in this example: JPM will now lend to these "Plebes," enabling them to buy assets and goods (houses, cars, iPhones, etc.), since they now have stable, well-paying jobs. This is another instance of new credit creation, eventually flowing into other U.S. companies whose revenues are redeposited into the banking system. As you can see, the money multiplier exceeds 1, and this wartime production increases economic activity, recorded as "growth."

Money supply, economic activity, and government debt all grow in tandem. Everyone is happy. The "Plebes" have jobs; financiers/industrialists enjoy government-guaranteed profits. If these fascist economic policies create benefits for everyone out of thin air, why haven’t they become the global economic policy for every nation-state? Because they cause inflation.

Human resources and raw materials required for production are finite. By encouraging the commercial banking system to create money out of nothing, the government crowds out financing and final production of other goods. Ultimately, this leads to shortages of raw materials and labor. Yet fiat is never in short supply. Therefore, wage and goods inflation inevitably follow, causing pain for any individual or entity not directly connected to the government or banking system. If you don’t believe me, read the daily histories of both World Wars.

The MP Materials deal is the first large-scale, significant case demonstrating the "QE for Poor People" policy. The best part of this policy is it doesn’t require congressional approval. Under instructions from Trump and his 2028 successor, the DoD can issue guaranteed purchase orders as part of its normal operations. Profit-driven banks will follow, fulfilling their "patriotic" duty by funding firms attached to the government. In fact, elected representatives from all parties will rush to argue why companies in their districts should receive DoD purchase orders.

If we know this form of credit creation won’t face political resistance, how do we protect our portfolios from the resulting inflation?

Bubble Blowing: Blow It Big

Politicians are well aware that stimulating "key" industries through accelerated credit growth causes inflation. The challenge is to use excess credit to inflate a bubble in an asset that won’t destabilize society. If wheat prices surged like Bitcoin over the past 15 years, most governments would likely be overthrown by popular revolution. Instead, governments encourage the public—who instinctively sense their declining purchasing power—to participate in the credit game and profit by investing in state-approved inflation hedges.

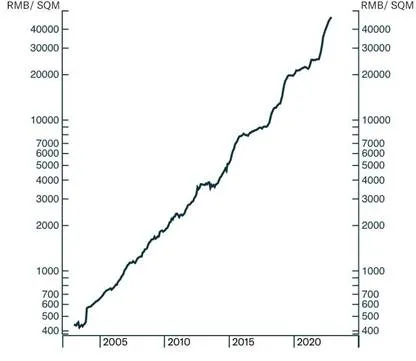

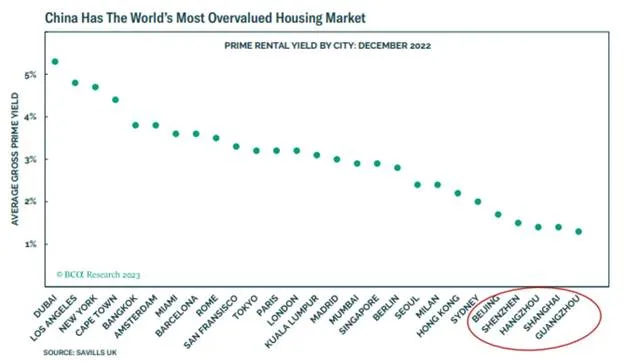

Consider a real-world, non-crypto example: China. China is the best example of a fascist economic system. Since the late 1980s, its banking system has created the largest volume of credit in the shortest time in civilized human history, allocating most of it to state-owned enterprises. They successfully became the world’s low-cost, high-quality factory; today, one-third of global manufactured goods originate from China. If you still think Chinese-made products are low quality, test-drive a BYD, then a Tesla.

China’s money supply (M2) has grown 5,000% since 1996. "Plebes" hoping to escape this credit-driven inflation face extremely low bank deposit rates. As a result, they flood into apartments, a behavior encouraged by the government as part of its urbanization strategy. Rising home prices, at least until 2020, helped suppress public hoarding of other physical goods. Residential property prices in China’s first-tier cities (Beijing, Shanghai, Shenzhen, Guangzhou) became the least affordable in the world.

Land prices rose 80-fold over 19 years, a compound annual growth rate (CAGR) of 26%.

This housing inflation did not disrupt social stability because ordinary middle-class citizens could borrow to buy at least one apartment. Thus, everyone participated. An extremely important secondary effect: local governments primarily fund social services by selling land to developers, who build apartments sold to "Plebes." As home prices rise, land prices and sales increase, boosting tax revenues accordingly.

This case shows that if the Trump administration truly intends to fully implement economic fascism, excess credit growth must inflate a bubble—one that enriches ordinary people while simultaneously funding the government.

The bubble the Trump administration will inflate will center on cryptocurrency.

Before diving into how the crypto bubble achieves various policy goals for the Trump administration, let me first explain why Bitcoin and crypto will surge as America becomes a fascist economy.

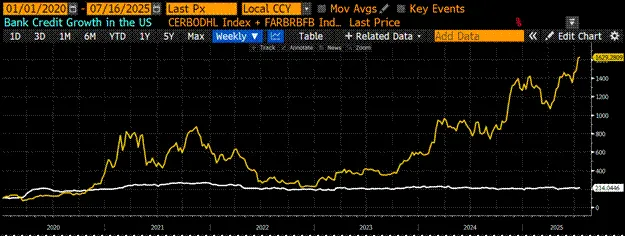

I created a custom index on Bloomberg Terminal called <.BANKUS U Index> (white line). It represents the sum of bank reserves held by the Federal Reserve plus other deposits and liabilities in the banking system—an indicator of loan growth. Bitcoin is the gold line; both are indexed to 100 as of January 2020. Credit growth doubled, while Bitcoin grew 15-fold. Bitcoin’s fiat price is highly leveraged to credit expansion.

By now, neither retail nor institutional investors can deny that if you believe more fiat will be created in the future, Bitcoin is the best investment.

Trump and Bessent have also been "orange-pilled." From their perspective, the best thing about Bitcoin and crypto is that, compared to affluent white baby boomers, traditionally underrepresented groups (youth, the poor, and non-whites) hold a higher proportion of crypto. Thus, if a crypto boom occurs, it will create a broader, more diverse group of people satisfied with the ruling party’s economic platform.

Additionally, to encourage all types of savers to invest in crypto, a recent executive order explicitly allows 401(k) retirement plans to invest in crypto assets. These plans hold approximately $8.7 trillion in assets. Boom Shak-A-Laka!

The knockout punch is President Trump’s proposal to eliminate capital gains tax on crypto. Trump is delivering war-driven explosive credit growth, regulatory permission for retirement funds to pour cash into crypto, and—TMD, no taxes! Hooray!

All great, but there’s one problem. The government must issue increasing debt to fund procurement guarantees from the DoD and other agencies to private firms. Who buys this debt? Crypto wins again.

Once capital enters the crypto capital market, it usually doesn’t leave. If an investor wants to sit on the sidelines, they can hold dollar-pegged stablecoins like USDT.

To earn yield on its custodial assets, USDT invests in the safest traditional finance (TradFi) yield instruments: Treasury bills. T-bills have maturities under one year, so interest rate risk is near zero and liquidity is cash-like. The U.S. government can print unlimited dollars at no cost, so nominal default is impossible. T-bills currently yield between 4.25–4.50%, depending on maturity. Thus, the higher the total crypto market cap, the more funds stablecoin issuers accumulate. Ultimately, most of these custodial assets will be invested in T-bills.

On average, for every $1 increase in total crypto market cap, $0.09 flows into stablecoins. Let’s assume Trump diligently pushes the total crypto market cap to $100 trillion by 2028 when he leaves office. That’s roughly a 25x increase from current levels.

If you think this impossible, you haven’t been in crypto long enough. This would generate approximately $9 trillion in T-bill purchasing power, sourced globally by stablecoin issuers.

For historical context, when the Fed and Treasury needed to fund America’s WWII adventures, they also relied heavily on issuing far more T-bills than bonds.

Now, Trump and Bessent have "closed the loop":

-

They’ve replicated the Chinese model, creating an American fascist economic system to produce goods.

-

The inflationary impulse in financial assets caused by credit growth is channeled into crypto, sending prices soaring. The broad population feels wealthier due to stunning gains and will vote Republican in 2026 and 2028… unless they have a teenage daughter… or perhaps people always vote with their wallets.

-

The rising crypto market brings massive inflows into dollar-pegged stablecoins. These issuers invest their custodial assets in newly issued T-bills, funding the ever-widening federal deficit.

The kick drum is beating. Credit is pumping. Why aren’t you fully invested in crypto yet? Don’t fear tariffs, don’t fear War, don’t fear random social issues.

Trading Strategy

It’s simple: Maelstrom is fully invested. Because we’re degens, altcoins offer incredible opportunities to outperform Bitcoin, the reserve asset of crypto.

The upcoming Ethereum bull run will blow the market wide open.

Since Solana surged from $7 to $280 from the ruins of FTX, Ethereum has been the most neglected among major cryptos. But now it’s different; Western institutional investor circles, led enthusiastically by Tom Lee, love Ethereum.

Buy first, ask questions later. Or don’t buy, then sit grumpily in the corner of the club sipping watery beer that tastes like piss, while a group of people you consider less intelligent splurge on champagne at the next table.

This isn’t financial advice, so decide for yourself. Maelstrom is all-in on Ethereum, all-in on DeFi, and all-in on the "degenerate" play driven by ERC-20 altcoins.

My year-end targets:

-

Bitcoin = $250,000

-

Ethereum = $10,000

Yacht freedom, TMD!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News