From Food Delivery Arbitrage to a Billion-Dollar Exchange: Arthur Hayes' Crypto Adventure

TechFlow Selected TechFlow Selected

From Food Delivery Arbitrage to a Billion-Dollar Exchange: Arthur Hayes' Crypto Adventure

In an industry often heavy on hype and light on analysis, he has consistently been one of the most insightful voices.

Text: Thejaswini M A

Translation: Saoirse, Foresight News

When Arthur Hayes travels, his suitcase is packed with plush toys.

The 40-year-old cryptocurrency billionaire owns over 100 plush toys, each with its own name. He brings them along to celebrate major life events. In his Miami apartment—where he once served six months of home detention—guests can see a row of dolls arranged like in a child's bedroom: a yellow-green starfish, a fox, an armadillo, a giraffe, an elephant, an octopus, a snake, and an anthropomorphized bok choy.

This may seem odd for someone who created the financial instrument now dominating crypto trading. But Hayes has always marched to his own beat.

In 2013, Bitcoin traders faced a problem that was both absurd and mathematically compelling.

Every month, their futures contracts expired, forcing them into a repetitive cycle of rolling positions—an expensive financial version of a "Sisyphus simulator."

Roll the contract, pay the fee, repeat endlessly, until all funds gradually drain into the exchange’s pocket through transaction costs.

Arthur Hayes, a derivatives trader with years of experience at Deutsche Bank and Citigroup, had spent his career figuring out how to profit from markets barely held together by mathematical duct tape. When he looked at this predicament, an idea worth a fortune began to form:

"What if we removed time as a constraint?"

This wasn't philosophical musing—Hayes wasn't pondering existential questions about the nature of time.

He was thinking: What would it look like to design a futures contract that never expires, breaking the monthly fee-extraction cycle slowly bankrupting Bitcoin traders worldwide?

The answer turned him into a crypto giant, created the financial tool underpinning most crypto trading today, and ultimately led to federal criminal charges for launching the product without prior regulatory approval.

This is a story about traditional financial logic entering a "wild market"—built by programmers who treat regulation as "suggestions." What happens when rigorous finance collides with a world of freewheeling code?

Hayes grew up in Detroit in the 1980s, where both his parents worked at General Motors. They believed education was the only reliable escape from the auto industry’s boom-and-bust cycles. To get him into Nichols School, they moved to Buffalo—a prep school where rich kids studied Latin and poor kids learned to network with them.

He graduated second in his class and played on the school tennis team. After stints at the University of Hong Kong and Wharton, he earned a degree in economics and finance in 2008—if you enjoy witnessing the real-time collapse of the global financial system, that was the perfect timing.

Instead of staying in New York for post-crisis soul-searching about whether Wall Street was terminally ill, Hayes moved to Hong Kong. It proved prescient: there, one could trade complex derivatives with little scrutiny of systemic risk.

Learning the 'Language' of Derivatives

As a broke intern, Hayes turned food delivery into a business, charging markups on colleagues’ orders and earning hundreds weekly. During Wharton recruiting season, he took recruiters to nightclubs in Philadelphia and made such an impression that he got hired. His office attire became legendary: on a "casual Friday," he wore a tight pink polo, acid-washed jeans, and bright yellow sneakers. A department head saw him and exclaimed, “Who the hell is that?” The incident led the company to cancel casual Fridays altogether.

In 2008, Deutsche Bank’s Hong Kong branch hired Hayes as a stock derivatives trader. There, he immersed himself in the complex mathematics of derivatives—financial instruments whose value derives entirely from underlying assets.

His specialty was Delta-one trading and ETFs, the "plumbing" of finance—unsexy but essential. And if you understand how the pipes connect, you can profit from them.

(Note: Delta-one trading involves financial products whose prices move 1:1 with the underlying asset, such as ETFs or futures, to track price movements.)

After three years mastering arbitrage from spreads lasting just 17 seconds, he jumped to Citigroup in 2011. But by 2013, tighter bank regulations ended the good times. Hayes was fired—just as Bitcoin needed a skilled "financial plumber," and the market found him.

Bitcoin exchanges in 2013 were built by coders fluent in blockchain protocols—people who could write code but had never heard of margin requirements. To Hayes, the market was nonstop, with no circuit breakers, no central oversight, and virtually no risk management. It was either the future of finance or an elegant mechanism for losing money quickly—and in his view, both possibilities coexisted.

The infrastructure was crude, but the underlying mechanics fascinated him. This was clearly a market desperate for the kind of financial engineering he’d learned in traditional finance.

Building BitMEX

He teamed up with Ben Delo and Samuel Reed—Delo, a mathematician who could build trading engines; Reed, who truly understood how crypto worked. In January 2014, the trio launched BitMEX (Bitcoin Mercantile Exchange), aiming to be the "premier peer-to-peer trading platform," competing against mostly rudimentary, barely functional exchanges.

The founders’ skills complemented perfectly: Hayes knew market structure and derivatives, Delo could build complex trading engines, and Reed mastered crypto technology.

BitMEX went live on November 24, 2014, focusing on Bitcoin derivatives. The launch followed months of development and stress testing. At go-live, the founders were scattered globally—Hayes and Delo in Hong Kong, Reed remotely joining from his honeymoon in Croatia.

Early offerings included leveraged Bitcoin contracts and Quanto futures, allowing traders to express views on Bitcoin’s price without holding the underlying asset. These complex tools required deep understanding of margining, liquidation mechanisms, and cross-currency hedging—the Hayes team’s strong suit.

(Note: Quanto futures are derivative contracts where the underlying asset is priced in one currency but settled in another at a predetermined exchange rate, eliminating FX volatility at settlement.)

But their ambitions went further.

On May 13, 2016, BitMEX introduced a groundbreaking innovation: the XBTUSD perpetual contract. A futures-like instrument that never expires, it uses a funding payment mechanism between longs and shorts to anchor the contract price to Bitcoin’s spot price. It offered up to 100x leverage and was settled in Bitcoin.

Traditional futures expire monthly, trapping traders in a farcical "roll-and-pay" cycle. Hayes borrowed the funding concept from forex markets and applied it to Bitcoin futures: contracts don’t expire but self-correct via periodic payments—longs pay shorts when the contract trades above spot; shorts pay longs when below.

This design eliminated expiry dates, reduced trading costs, and proved so practical that every crypto exchange quickly copied it. Today, perpetual contracts dominate global crypto trading volume. Hayes effectively "solved" the time problem—at least in the realm of derivatives.

Explosive Growth and Regulatory Scrutiny

BitMEX’s XBTUSD contract rapidly became the world’s most liquid Bitcoin derivatives market. Its sophisticated risk management, professional-grade tools, and high leverage attracted both traditional finance traders and native crypto players.

By 2018, BitMEX’s daily notional volume exceeded $1 billion. The exchange moved into the 45th floor of Cheung Kong Center in Hong Kong—one of the city’s priciest office towers. In August that year, when BitMEX servers went down for scheduled maintenance, Bitcoin’s price surged 4%, adding $10 billion in market cap across crypto.

BitMEX nominally banned U.S. customers, but critics argued these restrictions were easily bypassed. Its influence on Bitcoin pricing drew attention from academics, regulators, and politicians newly exploring crypto markets.

In July 2019, economist Nouriel Roubini published a report accusing BitMEX of "systemic violations," enabling excessive risk-taking and potentially profiting from client liquidations. The allegations triggered regulatory investigations and congressional hearings on crypto market structure.

By late 2019, daily Bitcoin derivatives volume reached $5–10 billion—over ten times spot volume. BitMEX captured a significant share, making Hayes and his partners central figures in global crypto markets.

On October 1, 2020, the federal crackdown arrived: the CFTC filed a civil complaint, and the Department of Justice (DOJ) announced criminal charges, alleging BitMEX operated as an unregistered futures commission merchant serving U.S. clients while ignoring anti-money laundering (AML) rules. Prosecutors said Hayes and his partners deliberately avoided compliance while earning hundreds of millions in profits.

Hayes resigned as CEO that day. Reed was arrested in Massachusetts; Hayes and Delo were labeled "fugitives"—a DOJ term meaning "we know where you are, we just haven’t arrested you yet."

The legal battle lasted over two years. During this time, Hayes unexpectedly discovered a talent for writing market and monetary policy analysis. His column, *Crypto Trader Digest*, became essential reading for anyone trying to understand the links between macroeconomics, Fed policy, and crypto prices. His analytical framework explained why central bank decisions would inevitably drive people toward Bitcoin.

In August 2021, BitMEX agreed to pay $100 million to settle civil charges. On February 24, 2022, Hayes pleaded guilty to "willfully failing to establish an AML program." On May 20, 2022, he was sentenced to six months of home detention, two years of probation, and a $10 million fine.

During the litigation, Hayes emerged as one of crypto’s most insightful commentators. His analysis of Fed policy and Bitcoin price dynamics reshaped how traders and institutions viewed crypto as a macro asset. His concept of the "NakaDollar" was particularly forward-looking: creating synthetic dollar exposure via a combination of long Bitcoin and short perpetual contracts, bypassing traditional banks entirely.

Hayes also emphasized Bitcoin’s value as a hedge against currency devaluation: "In fund transfers, we’re moving from an analog society to a digital one—that will cause massive disruption. I see opportunities to build companies around Bitcoin and crypto that benefit from this chaotic transformation."

On March 27, 2025, President Trump pardoned Hayes and BitMEX’s co-founders, closing the legal chapter. By then, Hayes had already moved on, serving as Chief Investment Officer of Maelstrom, a family office fund investing in venture capital, liquidity trading strategies, and crypto infrastructure.

The fund supports Bitcoin development by granting $50,000–$150,000 to developers. As Maelstrom’s website states: "Bitcoin is the foundational asset in crypto—unlike other projects, it never issued tokens to fund technical development." This reflects Hayes’ belief in sustainable funding for open-source development.

Recent Market Moves

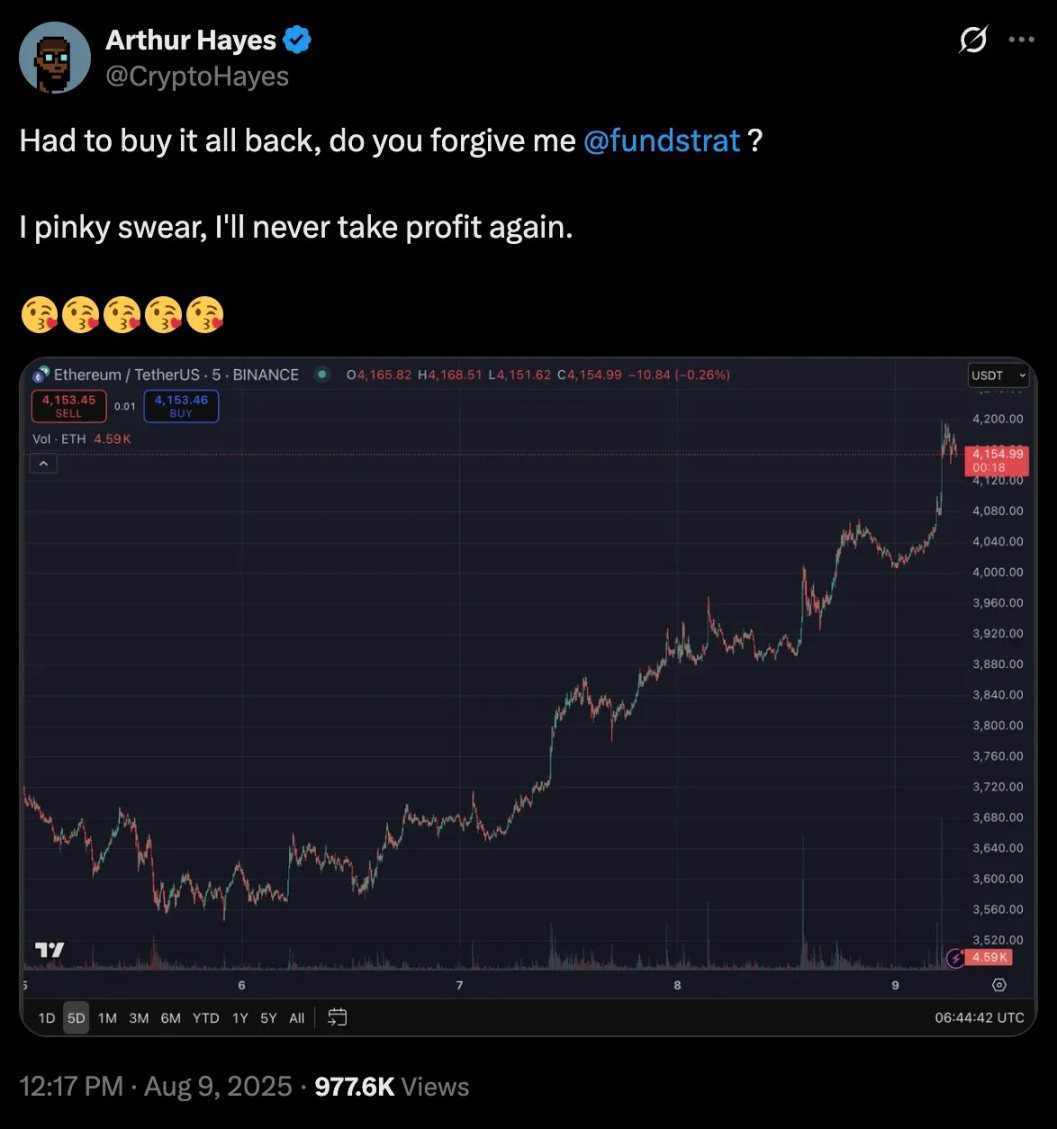

Hayes’ current investment strategy mirrors his macro outlook. In August 2025, he made headlines by buying over $15 million in crypto within five days—focusing on Ethereum and DeFi tokens, not Bitcoin. This included 1,750 ETH (worth $7.43 million) and large holdings in HYPE, ENA, and LDO tokens. His rationale: certain altcoins stand to gain from current market conditions—growing institutional interest in Ethereum, rising stablecoin adoption, and protocols monetizing by filling market gaps.

Hayes is also one of Ethena (ENA)'s most vocal supporters. This synthetic dollar protocol builds directly on the derivatives concepts he pioneered at BitMEX. In August 2025, he bought 3.1 million ENA tokens (worth $2.48 million), becoming one of the project’s largest individual holders. To him, Ethena represents the evolution of the "NakaDollar": using derivatives to create USD-pegged assets without relying on traditional banking. This investment is his bet on a new generation of projects redefining synthetic assets through perpetual swaps and funding mechanisms.

Earlier that month, amid macro concerns, he sold $8.32 million worth of Ethereum at nearly $3,500. But when ETH rebounded above $4,150, he repurchased all positions, admitting on social media: "Had to buy it all back. I swear, I’ll never take profits again."

At the core of Hayes’ current macro thesis is his belief that the Fed will inevitably resort to money printing. He points to structural pressures—real estate stress, demographic shifts, capital outflows—that will force policymakers to inject around $9 trillion into the financial system. "Without printing, the system collapses." He especially highlights the debt burden of institutions like Fannie Mae and Freddie Mac.

If this unfolds, Hayes predicts Bitcoin could reach $250,000 by year-end, as investors seek alternatives to depreciating fiat. Given his view that the current monetary system is unsustainable and Bitcoin is the most viable alternative store of value, he expects Bitcoin to hit $1 million by 2028 in the long run.

Perpetual contracts fundamentally transformed crypto trading by eliminating many frictions of early derivatives markets. By 2025, even mainstream platforms like Robinhood and Coinbase were launching their own perpetual products, while newer exchanges like Hyperliquid built entire businesses around Hayes’ original innovation.

The regulatory framework emerging from the BitMEX case also shaped industry standards: robust AML programs, customer verification, and regulatory registration became mandatory for any exchange serving global markets.

At 40, Hayes occupies a unique place in the crypto ecosystem. He experienced pre-Bitcoin traditional finance, built the infrastructure defining crypto trading, and endured both explosive success and severe legal consequences.

His story proves that sustainable success in crypto requires balancing technology and regulation, innovation and compliance. The success of perpetual contracts stemmed not just from technical ingenuity, but from solving real problems for traders—at least until regulation catches up with innovation.

"Back then, we didn’t need anyone’s permission to build all this. Name another industry where three ordinary people can create an exchange doing billions in daily volume?" Hayes reflected on building BitMEX.

This statement captures the opportunity—and responsibility—of building financial infrastructure in a rapidly evolving regulatory landscape.

Today, Hayes continues analyzing markets and placing big bets based on macro views. His influence extends far beyond single trades or investments. Through his writing, investments, and ongoing engagement with crypto markets, he remains one of the industry’s most insightful voices in a space often dominated by hype over analysis.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News