From Exchanges to YBS: The Pioneer Entrepreneurial Journey of Two Trailblazers

TechFlow Selected TechFlow Selected

From Exchanges to YBS: The Pioneer Entrepreneurial Journey of Two Trailblazers

Arthur Hayes profile.

Written by: Zuo Ye

Developing perpetual contracts, making history for the first time;

Pulling the plug during 3·12, saving the universe for the first time;

YBS based on CEX, once again making history;

This time, can it save the centralized universe?

In 2025, 40-year-old Arthur Hayes was granted a pardon—Trump really does deliver when paid. Think about CZ's $4.2 billion fine; how many memes would one need to mint to earn that back?

This differs from his idol Reagan. As a staunch capitalist warrior and standard-bearer of neoliberalism, Reagan dreamed bigger—he laid the ideological foundation to defeat the Soviet Union, albeit at the cost of deindustrializing America and the West.

The familiar Chinese, Soviet (Russian), and South African emigrants—SpaceX founder Musk, Google co-founder Page, Binance founder CZ, Ethereum founder Vitalik—their parents all moved westward during that era.

The soon-to-be-famous Arthur Hayes happened to be born in 1985 in Detroit, America’s motor city, but his career peak came only after moving to Asian hubs like Hong Kong and Singapore.

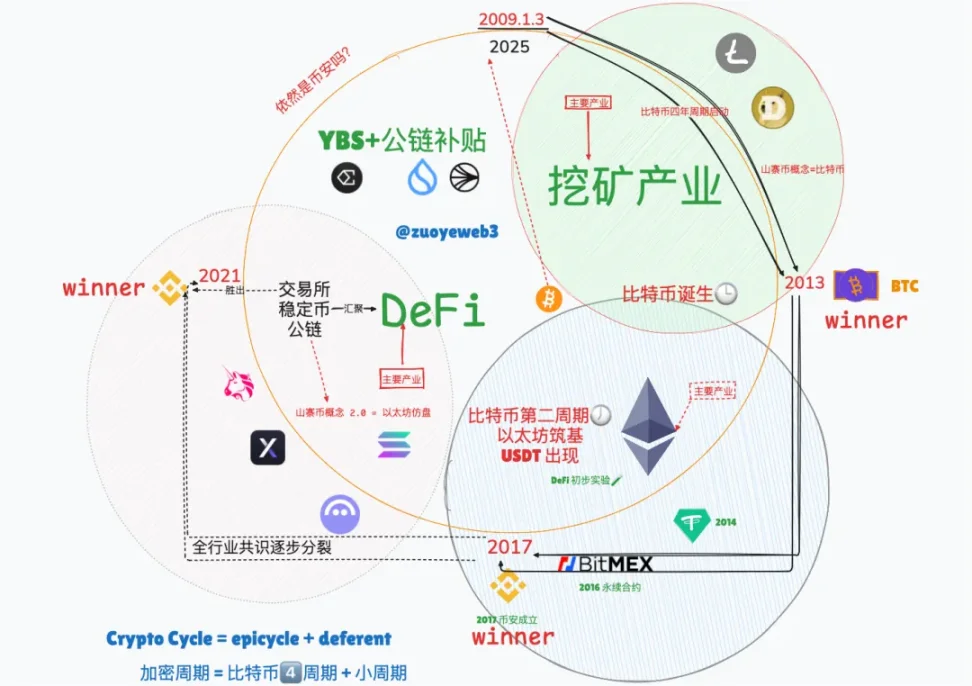

Image caption: Crypto cycles

Image source: @zuoyeweb3

-

2009–2013 Early adoption

-

2013–2017 Infrastructure development

-

2017–2021 Application attempts

-

2021–2025 The final four-year cycle before mass user adoption (assuming cycles still exist)

Back and forth, everyone has their own clock, forming the rhythm of Crypto, with Bitcoin—Ethereum—exchanges—stablecoins marking seconds, minutes, and hours.

BitMEX and Arthur’s entrepreneurial journey peaked during the 2013–2017 second Bitcoin cycle. Beyond mining, exchanges became the most lucrative sector. Before March 12, 2020, BitMEX reigned supreme as the undisputed king of crypto trading, with CZ and SBF rising only afterward.

Though Bitcoin is no longer the center of the crypto universe—and industry consensus has grown increasingly fragmented—Arthur Hayes remains less famous than figures like Justin Sun. Yet today, they are rivals, especially as the supercycle for stablecoins begins.

Arthur is among the rare few who succeeded and then launched a second venture. Unlike mere business expansion, Ethena’s emergence has stirred fresh turbulence in the stablecoin arena—the first project capable of counter-mining CEXs/USDC to nourish on-chain DeFi products. We cannot yet declare success, but it’s undeniably fascinating.

Arthur Hayes is indeed a fascinating figure.

An African American’s Years in Hong Kong

No path ever walked is wasted; every step counts.

Born in Detroit, Arthur’s parents relocated to Buffalo for better education, enrolling him in a prestigious private school—launching him onto an elite track and giving him an excellent start. A good start plus the right trajectory equals a smooth, frictionless life.

But make no mistake—Hayes is inherently rebellious. Let’s state it clearly: he is a “passive resistor of Pax Americana, a modern heir to classical liberalism.”

This explains his decision to leave America for Hong Kong, and later, Ethena’s stance of opposing fiat-backed systems without rejecting CEXs—a consistent philosophy. Moderate compromise is acceptable; extreme submission is not.

In 2004, Hayes finished prep school and entered the Wharton School at the University of Pennsylvania.

Arthur never saw 4 a.m. in Los Angeles, but he frequently hit the gym at 5 a.m., even winning “Mr. Penn.” He forged a life path distinct from fellow alumni Trump, Justin Sun, Musk, and Buffett—first dreaming of becoming a billionaire, then multiplying his net worth 100-fold.

In later interviews, Hayes said he often envisioned the future at dawn, radiating confidence as if destiny were upon him. In career choices, he consistently took the road less traveled—choosing “or” between Manhattan and Wall Street.

Or strike out across three thousand miles of ocean, or sail into Victoria Harbour.

In 2007, Hayes followed the established elite path for finance and business students: Big Name summer internships at investment banks or consulting firms during junior year, full-time offers upon graduation senior year. Top-tier schools like Wharton were prime targets for banks—an effortless mutual match. The only unusual part? Hayes chose Asia, choosing Hong Kong.

In 2008, a young man joined Deutsche Bank’s trading desk—note the timing: Lehman Brothers was about to collapse. Hayes wasn’t on the Too Big To Fail list, but luckily, he also wasn’t on the layoff list. Thus began his journey as a derivatives trader, essentially a financial workhorse.

Three years later, Hayes moved to Citigroup, continuing in familiar territory: derivatives trading, specifically Delta One. Derivatives, trading, market-making—by now, two of BitMEX’s core elements were in place. Only one was missing: Bitcoin hadn’t yet entered his life. But the seed of delta neutrality had already been planted.

It feels like many top figures active in crypto today entered around 2013—CZ did, Justin Sun did, and so did Hayes. Not surprising: the end of Bitcoin’s first cycle, bridging into the second, when wealth effects first emerged.

In 2013, amid worsening European debt crises, Hayes lost his job. Crisis in fiat became opportunity in Bitcoin. Hayes discovered an arbitrage model between Mt. Gox spot and ICBIT futures, instantly igniting his inner derivatives trader. At the time, the crypto derivatives market was tiny compared to spot trading.

Interestingly, the kimchi premium—long-standing price differences between mainland China and Hong Kong, East and West, global and Korean markets—was already robust. Hayes claimed he conducted spot arbitrage between mainland and Hong Kong exchanges, physically transporting cash earned on mainland platforms via backpack to Hong Kong.

I personally doubt this story—it likely involved organized groups rather than solo operations—but the origin point stands: this is where he started.

Of course, such capital efficiency was extremely low. Why not just become the market itself? Enter BitMEX and the story of perpetual contracts.

Rewriting Perpetual Contracts for Crypto

The U.S.-backed exchange king before the Binance era.

Beating the market is the shared dream of every retail investor, fund, and sleepless trader. Market volatility makes prediction impossible, leaving only two options: invest in the entire market, or provide the marketplace itself.

This time, Hayes chose the latter—but entered as a perpetual contract innovator.

After Mt. Gox vanished, from 2013 to 2017, the global crypto market strictly consisted of: China’s mining industry, China’s spot trading market, and everything else. Derivatives, whether on-chain or off-chain, sat at the kids’ table.

Chinese-founded exchanges dominated from the start: Li Lin’s Huobi, Xu Mingxing’s OKCoin were preparing. Bitfinex began collaborating with USDT, ICBIT invented inverse contracts, Coinbase gradually turned retail-friendly, Kraken focused on security.

In 2014, 28-year-old Hayes, along with Ben Delo and Samuel Reed, founded BitMEX—a derivatives-first exchange, unlike the spot-centric norm.

According to Hayes, BitMEX earned over $1 billion in revenue within its first year—similar to Binance and Hyperliquid, growing fast and fierce. Money gravitates toward self-replication; it always flows where it can multiply fastest.

Free spirit is the spirit of uncertainty about what is correct.

Futures contracts traditionally feature infinite leverage and mandatory settlement at expiry. Initially, users often complained that their positions mysteriously disappeared—because they didn’t understand expiry. Hayes and Ben Delo asked: could we simply remove the expiry feature, letting users manually settle and close positions?

This wasn’t pure fantasy. Crypto spot trading operates 24/7, fundamentally different from traditional markets. And in 2011, ICBIT had already developed inverse futures—a product through which Hayes made his first fortune.

Hayes combined crypto’s 24/7 spot trading nature, the leverage of futures, and removed the expiry constraint. Thus, the perpetual crypto futures contract was born—the very product we now know as the perpetual contract.

When intelligence couples with experimental design, nearly anything becomes possible.

Next came the leverage wars. We crypto gamblers truly deserve our name. BitMEX only turned profitable when it raised leverage to 50x, later increasing to 100x—meaning one BTC as collateral could open a 100 BTC position. High leverage became the exchange’s signature, and 100x Group became BitMEX’s parent company name.

From May 2016 onward, BitMEX became the undisputed CEX king. Even Binance in 2017 ruled only spot markets; derivatives competition with BitMEX didn’t begin until 2019.

In short, BitMEX succeeded by taking three correct steps: first, focusing on derivatives amid spot-dominated exchanges; second, increasing leverage; third, inventing the modern perpetual contract.

But Binance did have some luck. During the March 12, 2020 event, Hayes became the controversial hero who “pulled the plug,” much like Hyperliquid recently. No need to elaborate further—just remember: had the plug not been pulled, Bitcoin might have suffered another post-MtGox stagnation lasting many years.

So it went until 2019, with “reckless arrogance” becoming Hayes’ defining trait. Even during bear markets, BitMEX retained most of its market share and capital-attracting power.

Fear is biological instinct; courage is humanity’s anthem.

Hayes’ boldness extended beyond markets to regulators. When asked about the difference between the U.S. and Seychelles, he quipped: “Bribing the U.S. costs more, while Seychelles only needs a coconut.”

One week after that remark, the CFTC launched an investigation into BitMEX—accusing it of operating an unregistered exchange for non-U.S. persons, plus the usual money laundering charges. Bottom line: you can’t openly challenge regulators, or others will follow, leading to total disorder. Yet Jack Ma seemingly failed to learn from Hayes’ lesson.

A year later, in 2020, Hayes stepped down as BitMEX CEO. In 2021, BitMEX settled with a $100 million fine. In 2022, Hayes personally paid $10 million plus six months of home detention.

Still, CZ and SBF soon followed into prison. The three derivative gods all ended up incarcerated. From 2014 to 2020, BitMEX was Hayes’ entire world—his professional experience transitioning seamlessly into entrepreneurship, almost entirely free of setbacks or pain.

Hayes was a demigod of the 2013–2017 cycle, the culmination of the pre-Binance and pre-USDT era, a believer in Bitcoin—but not a blind follower. Unlike early miners, exchange founders like Li Lin, CZ, and SBF were far more flexible—not just in business, but also in their views on Bitcoin and decentralization. Understandable: they profited from trading, not hodling.

Yet Hayes didn’t stop. The gift of the 2021–2025 cycle is Ethena—a divergent force in the Binance and USDT era—aiming to embrace CEXs like Binance while capturing USDT’s market share.

The White Knight of Emerging Algorithmic Stables

Big things have small beginnings.

A scientist’s most “important” discovery is often their first; conversely, an artist’s deepest creation is usually their last.

Clearly, mathematically and literarily gifted, Hayes blends scientist and artist. Past experience doesn’t guarantee superiority in the stablecoin space—but one thing is certain: mere mediocrity holds zero value.

In 2023, Hayes proposed a stablecoin system backed by BTC funding rates—short positions on BTC perpetuals on CEXs hedging against volatility of on-chain BTC spot value, i.e., delta neutral.

In theory, users depositing BTC on-chain could mint an equivalent 1:1 stablecoin—avoiding DAI-style over-collateralization with low capital efficiency, and escaping USDT-style opacity, where risks fall entirely on retail while profits go solely to Tether.

Crucially, Hayes emphasized cooperation with Perp CEXs. Since BitMEX was history, partnerships with Binance, OKX, and Bybit became essential—again reflecting his stance: anti-bank, not anti-fiat, rebellious within compromise.

Essentially, involving CEXs grants them seigniorage rights and profit-sharing—much like Circle shares revenue with Binance and Coinbase. Still, exchanges supporting such stablecoins face risks: even BUSD and FDUSD have faced de-pegging and bank runs.

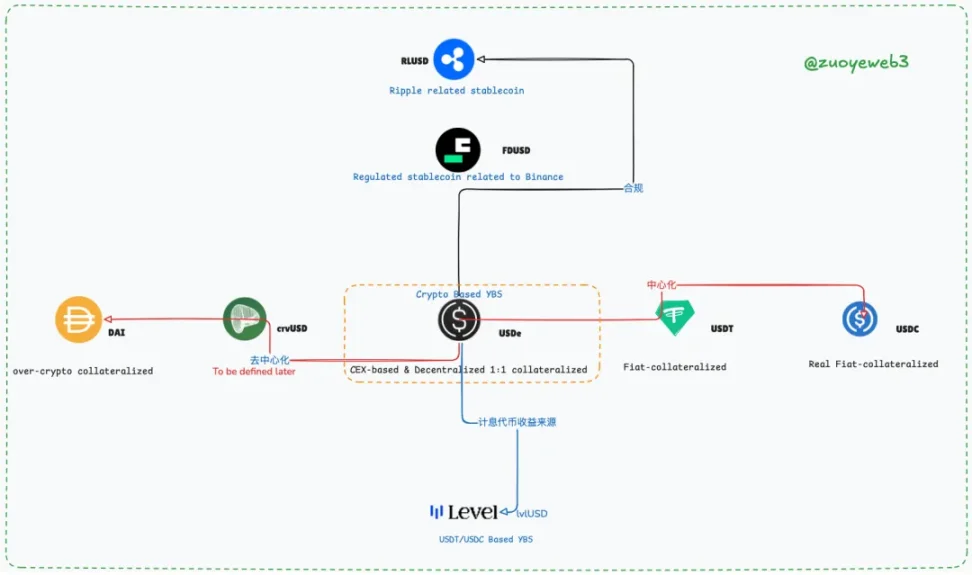

Image caption: Stablecoin classification

Image source: @zuoyeweb3

Arthur Hayes’ family office, Maelstrom, became Ethena’s founding advisor in 2023. Initially, Ethena used ETH instead of BTC as its base asset because stETH generates yield. With Hayes’ help, major CEXs joined the ecosystem. Without Hayes, Ethena would never have achieved its current market standing.

Compared to DAI and crvUSD, USDe is less decentralized—its foundation relies on exchange cooperation. But it redistributes part of USDT/USDC’s profits back to users.

Against peers like Level and Usual, USDe’s significance mirrors Uniswap’s—it’s the first product to validate feasibility, thus gaining inherent “legitimacy.” Against newly emerging compliant stablecoins, Ethena stands as a more on-chain YBS (Yield-Bearing Stablecoin).

Will stablecoins be the 2025 super-hit?

On this, I believe I possess an incomplete solution—but the margin here is too narrow to contain it. The full discussion on YBS/stablecoin futures will wait for another day.

Conclusion

At 28, Einstein completed general relativity, only to spend the rest of his life resisting and attacking quantum mechanics, failing ultimately to achieve a unified field theory.

In February 2024, rumors surfaced that BitMEX was seeking a buyer. By September, Ethena announced collaboration with BlackRock’s BUIDL. Amid turbulent 2025, Ethena’s reserves increasingly shifted toward USDC and other fiat-backed stablecoins—mirroring DAI’s later evolution.

After succeeding with BitMEX and perpetuals, Arthur Hayes remains obsessed with deep writing and exploring new mechanisms. Ethena may be just one stop on a new pilgrimage—or perhaps, the eternal finale.

But one’s greatest fortune is discovering one’s life mission during the most creative years of youth. May you and I walk such a path together.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News