A Comprehensive Overview of the New Blockchain Flare Network: Bringing Smart Contracts to Non-Turing Complete Chains, a New Player in the EVM Wars

TechFlow Selected TechFlow Selected

A Comprehensive Overview of the New Blockchain Flare Network: Bringing Smart Contracts to Non-Turing Complete Chains, a New Player in the EVM Wars

Flare is a decentralized network that can be used to create bidirectional bridges between networks. It integrates the Ethereum Virtual Machine (EVM), enabling the network to run Turing-complete smart contracts.

Author: 0xGregH

Translation: 0xbread

Will Flare explode in 2022?

Whether or not you've heard of Flare, you'll soon hear about it everywhere when it launches its mainnet and unlocks nearly 65% of the value stored in tokens...

Today, we're diving deep into Flare, covering the following sections:

1) What the protocol does

2) The problems it's solving

3) How it solves these problems with clever technical solutions

4) Who the investors are and how tokenomics will drive demand and supply

5) Why miners and validators don't matter and what replaces them

6) How Flare attracts third parties to leverage their technology

7) Summary of existing dApps and their KPIs

8) Team structure and network governance structure

9) Bull and bear cases for Flare summarized

Recap of L1 Analysis Framework

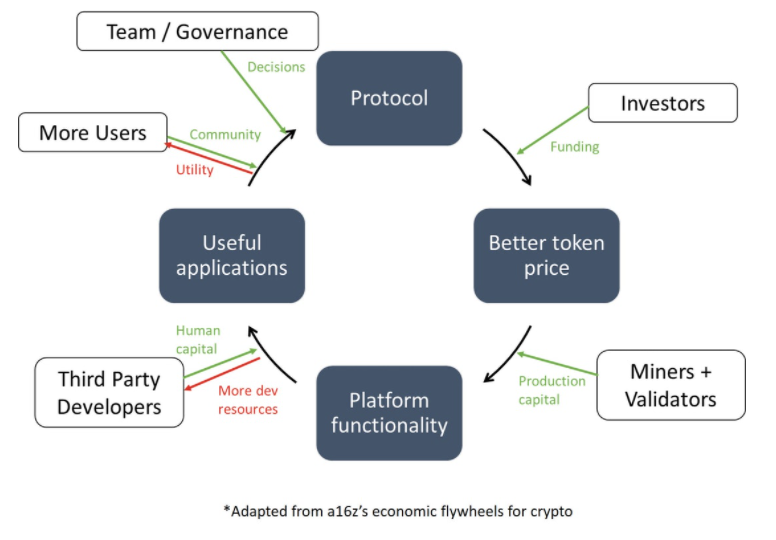

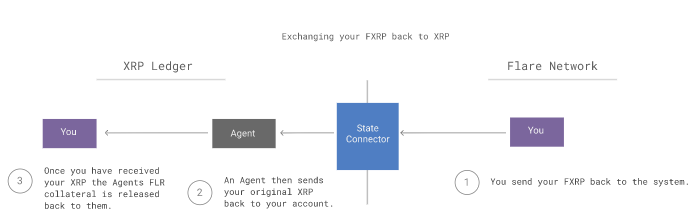

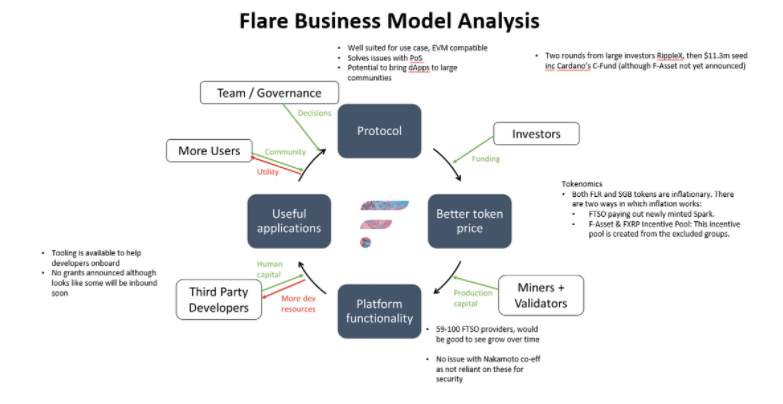

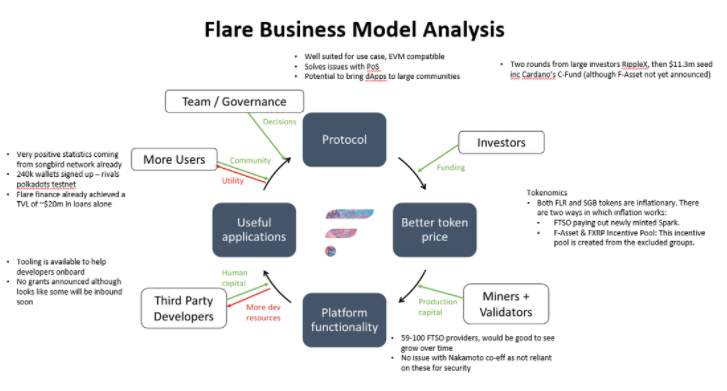

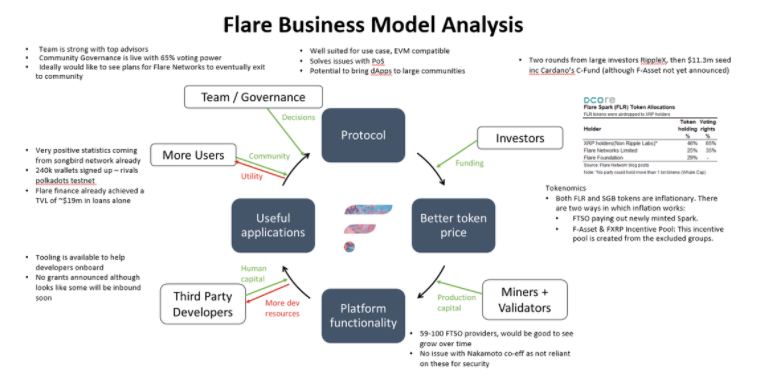

Quick reminder of how we conduct these analyses; for any L1 technology, I use a16z's economic flywheel for crypto analysis framework as follows:

In principle, what happens here is that the team designs the protocol, which attracts funding through investors who provide liquidity to the network, thereby giving the protocol an initial token price. Then, due to incentives (tokenomics), miners and validators are attracted to support the network, improving platform functionality as we now validate blocks.

We now have a working blockchain with nothing on it, so we turn to developers and try to incentivize them (through resources, grants, etc.) to build on the blockchain. They invest human capital into building dApps and other useful things people want to use, thus attracting users to the blockchain. These users form a community and eventually help manage the system.

Flare Protocol

Flare is a distributed network used to create bidirectional bridges between networks. It integrates the Ethereum Virtual Machine (EVM), enabling the network to run Turing-complete smart contracts.

Flare is a contender in the Great Alt EVM War...

Flare Networks aims to solve two problems:

1. Non-Turing complete blockchains account for approximately 65% of the total market value in cryptocurrency

2. PoS networks have some issues regarding network security

First, Flare's vision is to unlock assets from non-Turing complete chains. Turing completeness is a key aspect of chain design that enables smart contracts. Many functionalities required to build useful dApps need smart contracts.

At launch, "F-Assets"—wrapped versions of assets on the Flare network—will include: $XRP, $DOGE, $ALGO, $LTC, $XLM, and $GALA

According to my (very rough) calculations, Flare will immediately have access to a market of 38 million wallets, 218 billion coins, worth $82 billion at launch.

TVL calculation is more complex than this, but it gives us an idea of the opportunity size.

When the network launches, the biggest determinant of Flare's success (in my opinion) will be how many available tokens become F-Assets. Tracking Flare's "AUM" will be something to watch by the end of 2022.

Second, since PoS derives network security from its native token, the team has identified issues with proof-of-stake.

In the short term, this is problematic because if staking yields fall below the yields offered by DeFi protocols on the network, stakers might move tokens out of staking, compromising network security.

Long-term, the Flare team states:

"As usage of proof-of-stake networks increases and the value built on top grows, the value of stake tokens must increase, otherwise the network becomes insecure. If proof-of-stake is to become a ubiquitous way of doing business, this requires constant capital inflow. To ensure the value built on these networks, the scale of capital shifting from other endeavors would make business costs prohibitively high."

I find the second reason somewhat stretched, as I believe PoS networks will find alternatives, but the first issue is very real and well-known.

So how does Flare solve these problems?

The Spark token is Flare’s native token. It helps prevent spam attacks and can be used as collateral within DApps, providing data to on-chain oracles, and participating in protocol governance. Importantly, it is not required to secure the network!

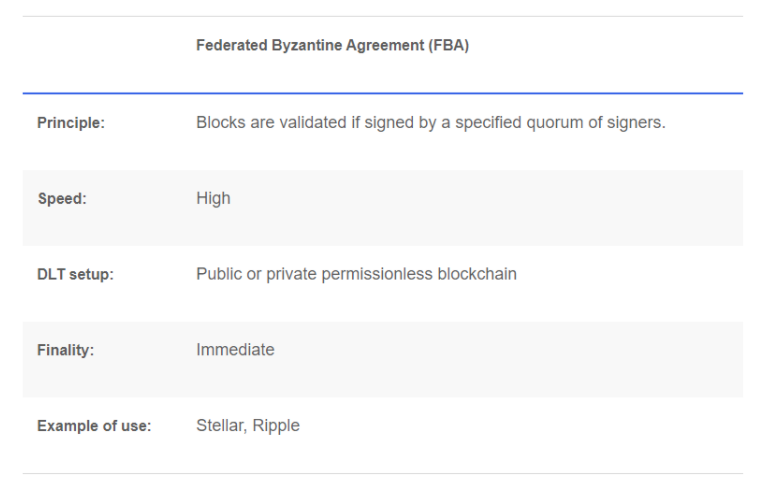

Flare is the world’s first Turing-complete Federated Byzantine Agreement (FBA) network. Nodes run the Avalanche consensus protocol, with keys adapted to the FBA consensus topology.

A key feature of FBA is that as a consensus topology, it is unique in achieving security without relying on economic incentives that could interfere with high-value and high-risk use cases. This is because it allows individual participants to independently influence quorum slice decisions.

Read the excellent full article here

Heard that Flare's FBA & UNL are centralized! Don't worry, Flare has a cunning plan for this...

Regarding transactions per second (TPS), we don’t yet have real readings, but Avalanche (the blockchain) is fast, citing up to 7k in some cases, though baseline is:

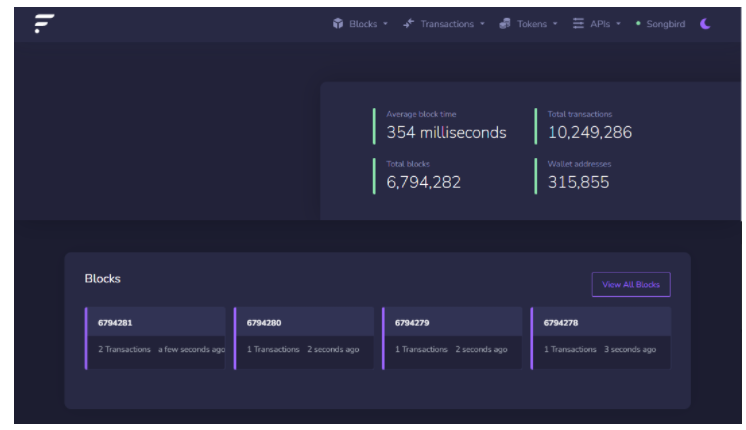

Possibly more important than TPS is Time to Finality, which due to the FBA topology should be instant even without measurement. The Songbird (Flare’s canary network mentioned in the introduction) explorer indeed looks very fast, with block times around 350ms.

See for yourself https://songbird-explorer.flare.network/...

F-Assets

I previously mentioned the idea of F-Assets. While it’s a great concept, we don’t yet know how effective it will be.

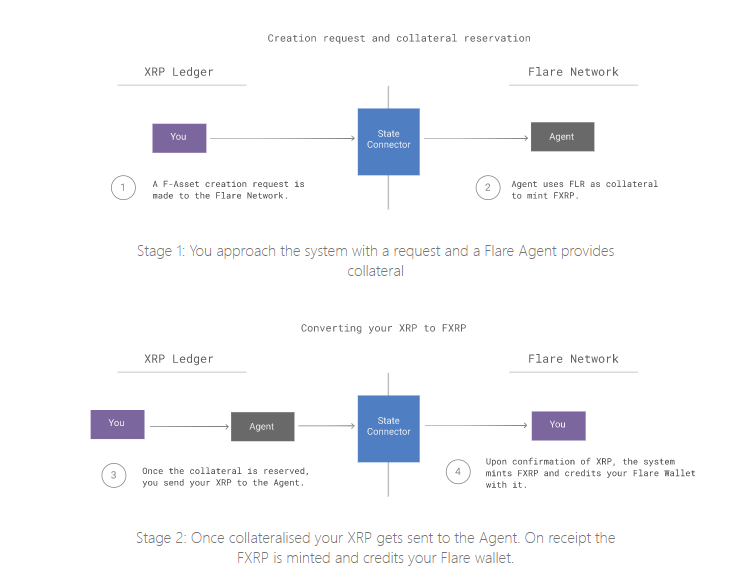

The technology itself is revolutionary—I won’t go into detail here—but the diagram below shows a high-level overview of the process. You can read more about it here.

To complete the cycle, the redemption process:

You can also read more about all this on the Flare website here.

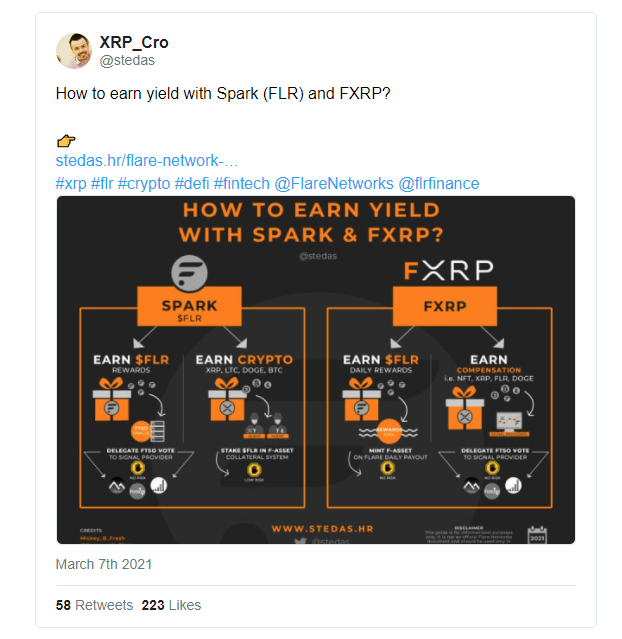

It's worth reiterating that Flare Network will reward you in Spark (FLR) for holding F-Assets.

Section 1 Summary: Vision and Protocol

Key takeaways:

1. Flare's technology is well-suited for EVM compatibility.

2. It uses FBA and Avalanche to solve PoS issues.

3. In my view, the network has the potential to bring dApps to existing large, savvy, and growth-hacking communities, as they can leverage established user bases instead of having to attract users from scratch.

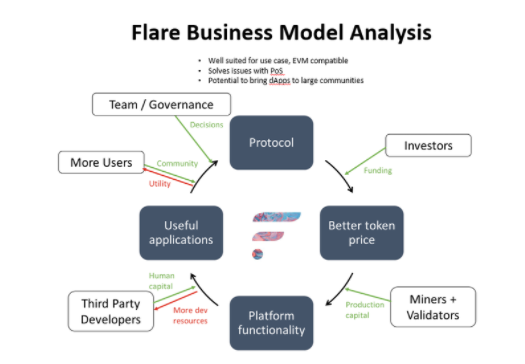

Investors

Flare's funding was split into two rounds:

1) 2019 - Xpring (RippleX), undisclosed amount.

2) June 8, 2021 - $11.3 million seed round.

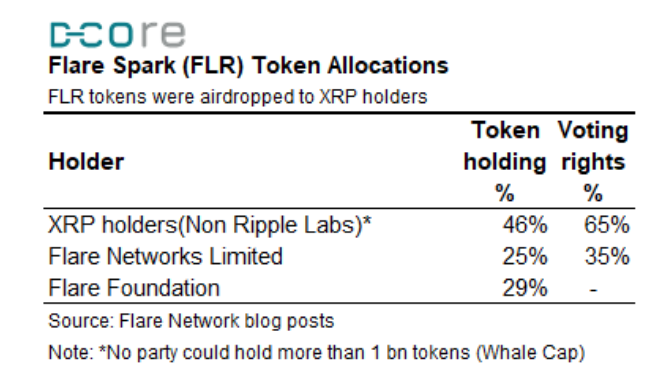

Although we know that “Flare Networks Ltd” was allocated 25 million Spark tokens, we don’t have details on what token allocations investors received for this investment. We’ll discuss these tokens in the team/governance section later.

Tokenomics

Supply

Both FLR and SGB tokens are inflationary, as they are designed for utility rather than token value. Inflation occurs in two ways:

1) FTSO participation rewards are newly minted tokens. The initial inflation rate for Spark tokens is set at 10% annually, without compounding.

2) F-Asset & FXRP incentive pools (discussed earlier): Flare tokens unlock monthly at a 3% rate for holders. These tokens may contribute to inflation until all 100 billion FLR tokens are released into the market.

Demand

Demand for the token will come from two sources:

1) FTSO contributions: Holders who don’t intend to act as FTSO data providers will lock/stake their tokens with data providers.

2) Collateral: FLR can be used as collateral in applications, such as on the FXRP system.

Stedas put together this nice infographic showing ways to earn yield on Flare:

FTSO

Since we’ve frequently mentioned FTSO in this section, let’s quickly review it…

From Alpha Oracle, these explanations of FTSO and signal providers are much more concise than I could achieve, but in summary:

1) FTSO is a key component of the network

2) It is responsible for collecting and forming accurate estimates of network data for Spark (FLR) holders and applications

3) Signal providers are rewarded based on the accuracy of their data, which is then distributed to token holders

4) FTSO has been likened to the brain of the network

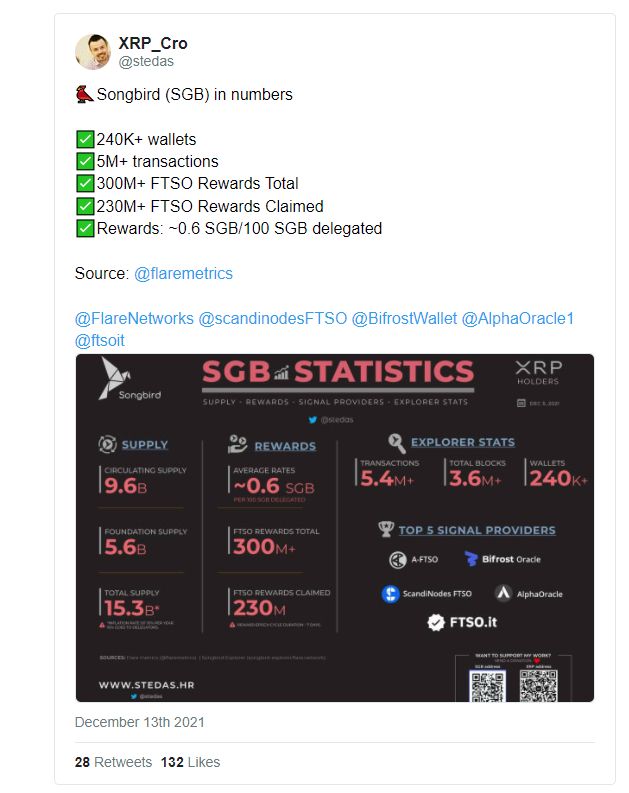

Songbird FTSO Statistics

By the end of last year, there were some impressive statistics on Songbird FTSO usage:

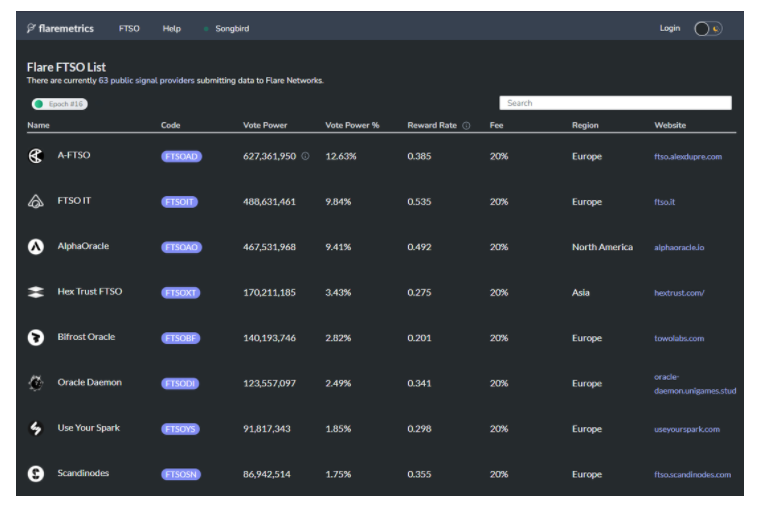

Tracking public FTSO providers can be done on flaremetrics.io:

Note: If the protocol were PoS, this list might seem too short to provide sufficient attack resistance, but since Flare uses alternative methods, Nakamoto coefficient efficiency isn't an issue.

F-Asset Agents

Agents bypass technical details to receive newly minted Spark tokens for providing services, which also adds inflationary pressure on supply. I recommend reading this article for a complete overview.

Section 2 Summary: Investors, Tokenomics, and Validators

Key takeaways:

1) Two funding rounds—one from major investor RippleX, followed by $11.3 million including Cardano’s C-Fund (though F-Asset hasn’t been announced yet)

2) Both FLR and SGB tokens are inflationary. Inflation comes from two sources: newly minted Spark via FTSO payments, and F-Asset & FXRP incentive pools. Demand arises from utility.

3) 59–100 FTSO providers, good to see growing over time

Developer Experience

A critical area needing urgent attention is developer experience. Two things stand out: developer resources such as support, tools, etc., and (primarily) developer funding.

Resources

Currently, only very basic support comes directly from the team, such as this tweet about testnet upgrades:

This isn’t surprising and should be expected, as Flare is a new chain and needs time to build tools and develop knowledge bases so developers can fully utilize the network.

While they do well with the resources they have, I believe we need to see the entire field elevated to another level.

Enter their new hire @dommoore as Head of Ecosystem. He previously served as Growth Lead at Outlier Ventures, a highly respected crypto VC and Web3 accelerator firm.

Grants

The necessity of a developer grant program is crucial, as other L1s have substantial funds supporting rapid ecosystem development.

Flare lags significantly in this area, raising a relatively small ($11.3 million) amount in 2021 compared to other L1s. Without an initial (Coin/Dex/Protocol?) proposal to raise more funds, I expect we’ll see larger fundraising rounds and release $FLR to generate additional capital (if structured as an IxO).

For example, Near’s grant program reportedly has ~$120 million in funding—so for Flare to compete, we need funding in the $100M+ range.

Is there precedent? Possibly, as Oasis $ROSE recently announced that @BinanceLabs will contribute to the Oasis ecosystem fund, bringing it to $200 million.

Time will tell whether Flare can replicate this success, but as seen from Flare’s career page, hiring is ongoing—so watch this space!

Section 3 Summary: Third-Party Developers

Key takeaways:

1) Likely the least developed area (understandably)

2) Actions are underway to address this, but they need to move fast and raise significant funds, which carries execution risk

Adoption and Traction

Here’s a good overview of Flare’s progress in 2021:

We’ll first examine how Songbird (Flare’s canary network) performed, then dive into specific dApps.

Songbird Network Stats

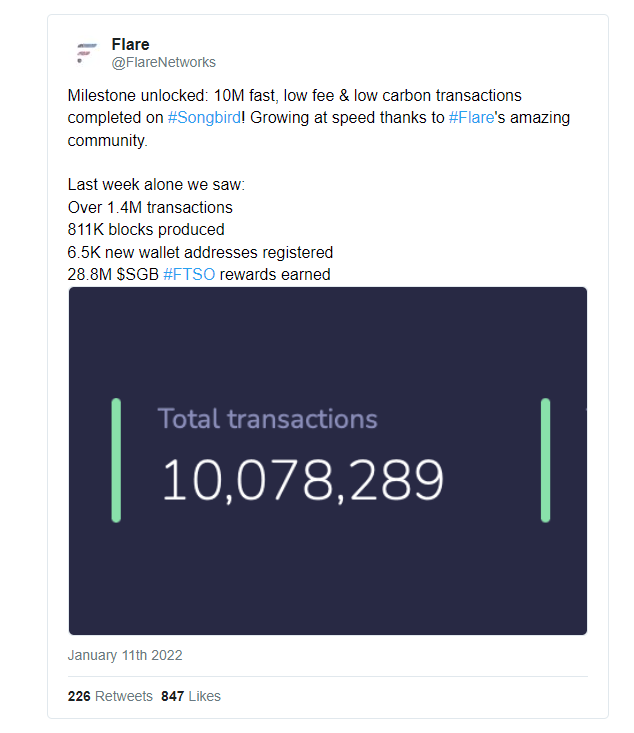

Based on the following statistics from December 13 last year, the Songbird network has demonstrated high levels of usage and functionality.

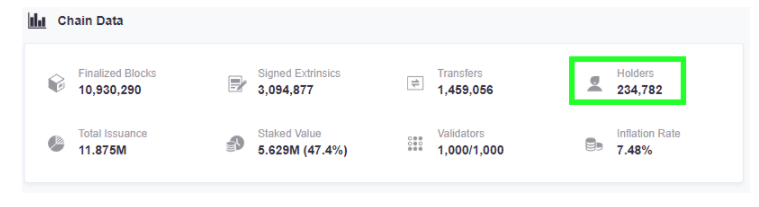

240k wallets comparable to Polkadot’s canary network Kusama, visible here:

Additionally, as of January 11, 2022, we confirmed 10 million transactions had occurred:

Projects Building on Flare

There is already a small number of projects building within the ecosystem:

1) DeFi: @FlareFinance @TrustlineInc

2) FTSO: @FTSO @ftso_au @BestFtso @lightFTSO @ftso_eu @AlphaOracle1 @ftso_uk @AureusOx @scandinodesFTSO

3) Data: @flaremetrics & https://songbird-explorer.flare.network/

4) NFT: @GoGalaGames @crypto888crypto @GE_Federation @fcflio @BoredApesXRP

@SparklesNFT @SGBPunks @BabySongbirds

5) Wallets: @BifrostWallet @UpholdInc @Ledger @Trezor @MetaMask @DCENTwallets

In my recent video and tweet thread, I detailed traction statistics for Flare and various projects.

dApp Highlight: Flare Finance

Flare Finance is an anonymous team of developers building critical DeFi infrastructure on the Flare network. They are not affiliated with the core team, although my understanding is that Flare CEO Hugo Philion has met the team and vouched for them.

Here’s how Flare Finance describes itself in its whitepaper:

Flare Finance is the first institutional-grade decentralized finance platform built on Flare Network. It offers a suite of six unique DeFi products specifically designed to bootstrap the Flare network through a single integrated DeFi solution for commercial and retail financial products. Flare Finance leverages Web3 capabilities to allow people to use our products and services trustlessly without relinquishing custody of their funds.

So far, they’ve delivered:

Flare Finance’s Experimental Finance (ExFi) Platform V2 is live on the Songbird network and already has over $20 million in TVL with only three products. Even in the past 7 days, we’ve seen some impressive things from Flare Finance’s on-demand liquidity product, FlareX:

Despite recent sell-offs, the Flare Loans product hasn’t performed too poorly either.

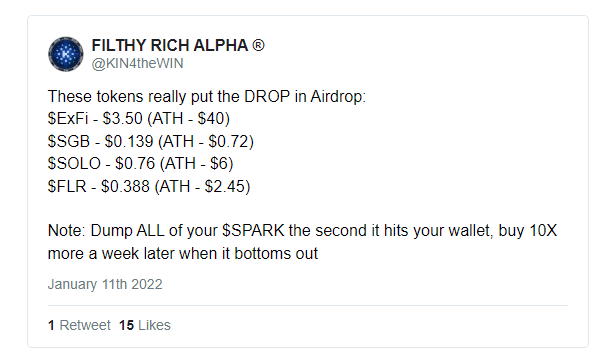

Although ExFi airdrop value wasn’t particularly good, delayed, reworked distribution, etc., it hasn’t been smooth sailing. This frustrated some in the community:

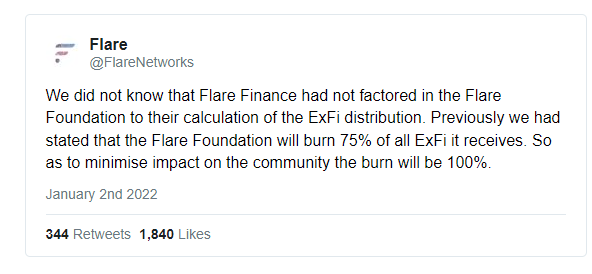

I can't comment on pricing—markets are markets—but I will say I believe the Flare team operates very transparently and acts sincerely when issues arise, as shown in this ExFi post. This leads us nicely into team and governance, but first, a quick check of our L1 flywheel.

Section 4 Summary: dApps, DeFi, etc.

Key takeaways:

1. Very positive statistics already from the Songbird network

2. 240k wallets registered – competitive with Polkadot’s testnet Kusama

3. Flare Finance has already pushed up their TVL

Flare's Structure and Governance

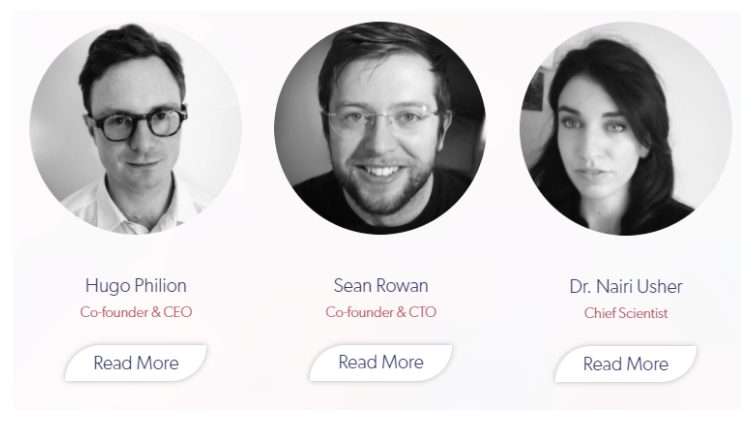

Core team:

Hugo Philion, Co-founder and CEO, founded Future Generations, a modular construction system. Commodity derivatives portfolio manager for two funds exceeding $1 billion.

Sean Rowan, Co-founder and CTO, entered blockchain in 2015 when he designed, with colleagues from UCLA and TCD, a secure vehicle communication protocol using blockchain-based public key infrastructure. R&D engineer at RAIL, Dublin, Ireland, where he developed backend network software for medical assistive robots. The latest version of the robot launched by RAIL made the cover of TIME magazine in November 2019.

Dr. Nairi Usher, Chief Scientist, previously Postdoctoral Researcher in Quantum Machine Learning at UCL. Collaborated with Siemens applying quantum algorithms to healthcare and image recognition.

Recently, with Flare’s hiring spree, the broader team has grown significantly, with approximately 20 people now in the organization.

The project has appointed eight advisors. All advisors bring business acumen and specific expertise from blockchain-related projects. Their combined experience and education are relevant to the project.

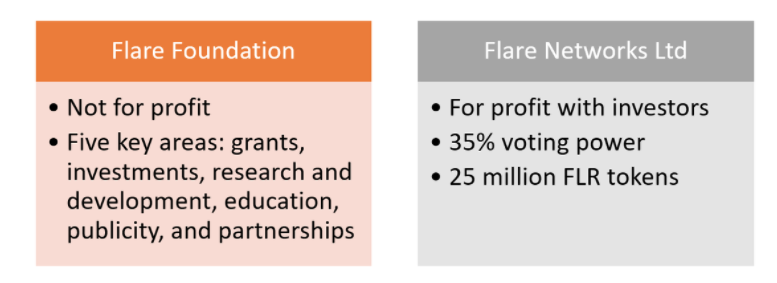

Flare Corporate Structure

As mentioned above, Flare created two entities: a foundation and a limited liability company. They play different roles, summarized as follows:

Interestingly, Flare Networks Ltd retains voting rights, unlike the foundation which typically holds them—an unusual setup. Their logic is that the company will always act in the network’s best interest because its long-term financial viability depends on the network’s success.

Token allocation details are as follows:

Full text here

Flare Community Governance

This is an evolving area, but with 65% of votes held by the community, they have significant influence over the network’s future direction.

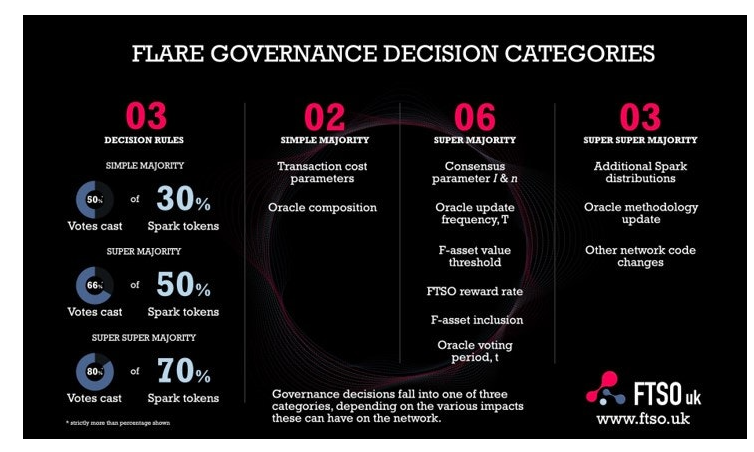

FTSO.uk breaks down decision categories into this nice infographic showing different thresholds required for passage:

Ideally, I’d like to see a gradual plan for Flare Networks Ltd to transfer partial voting rights to the community, but this may emerge over time.

This completes our analysis, so let’s place them on our L1 flywheel.

Complete L1 Business Model Breakdown

So here is the complete breakdown:

Now that we have this, let’s proceed to our bull/bear analysis!

Bull and Bear Cases

My reasons for being bullish on Flare Networks are simple:

1) Users from non-Turing complete chains convert assets to Flare seeking yield

2) Continuously expanding F-Asset roster attracts more communities indefinitely as new chains launch

3) Proof that proof-of-stake is less secure drives more user conversion

4) Flare scales seamlessly and captures a share of the L1 pie

In the bear case, several clear risks exist:

1) Technology becomes obsolete quickly—will Flare still be flexible when it launches?

2) Still no mainnet live, while other L1s have massive funding support

3) Will demand for assets exist? wBTC still only accounts for 1.4% of circulating supply and hasn’t changed since June 21…

4) Spark Dependent Applications (SDA) rely on third-party networks to sustain growth and adoption.

5) Sharp volatility in supported currencies/tokens may cause collateral issues.

Original link:

https://altcoinevolution.substack.com/p/flare-network-a-full-protocol-analysis

TechFlow is a community-driven content platform dedicated to delivering valuable information and thoughtful insights.

Community:

Official Account: TechFlow

Telegram: https://t.me/TechFlowPost

Twitter: TechFlowPost

Join WeChat group by adding assistant: TechFlow01

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News