Economics PhD: Why I'm Bearish on Ethereum?

TechFlow Selected TechFlow Selected

Economics PhD: Why I'm Bearish on Ethereum?

If given initial equilibrium values for the economic scale and ETH price, a 10% growth in Ethereum's economic activity would lead to a proportional increase in ETH token demand (assuming stable token velocity). Due to relatively stable supply, this translates into a proportional increase in the ETH price.

Author: Tascha

Translation: 0xZshanzha

TechFlow is authorized to translate and publish this article.

I am bearish on Ethereum.

But probably not for the reasons you think.

The shift from a single-chain architecture to a Layer1-Layer2 structure has significant implications for ETH valuation, and most people haven't yet considered this perspective.

Previously, I wrote about comparing blockchain platform tokens to national currencies. I recommend reading that piece—it will help you understand what I'm about to say, as both articles share similar starting points and frameworks.

In short, L1 platforms are like national economies. You need the native token to pay fees for every transaction on the platform, just like how you need U.S. dollars for nearly every economic transaction in the United States. On-chain economic activity thus creates fundamental demand for the native token.

This means that given an initial equilibrium of economic scale and ETH price, if Ethereum’s economic activity grows by 10%, the demand for ETH tokens would grow proportionally (assuming stable velocity). With relatively fixed supply, this translates into a proportional increase in ETH price.

By the way, the dynamic growth of the economy and token price increases are typically mechanical, and you should disregard any valuation ceiling assumptions based on income—they are meaningless from my viewpoint.

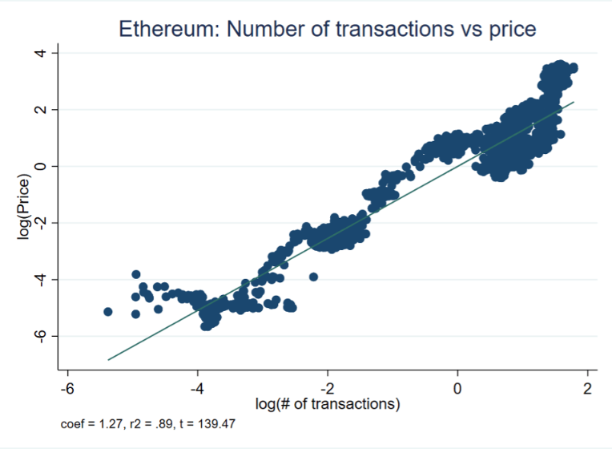

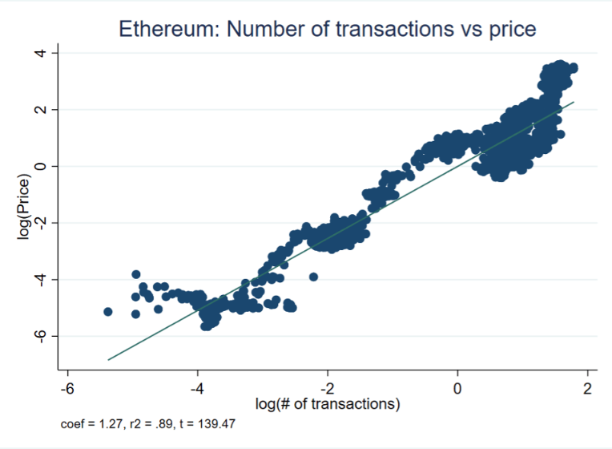

Data shows, as shown below, that over the long term, activity growth is the most important driver of ETH price. Using transaction count (txn) as a rough proxy for the size of the ETH economy, you can see a clear correlation—indeed, txn growth correlates significantly with price growth: approximately 10% txn growth corresponds to about 13% price growth.

(This is a fundamentals-driven long-term relationship. Short-term price volatility is excluded due to its excessive noise.)

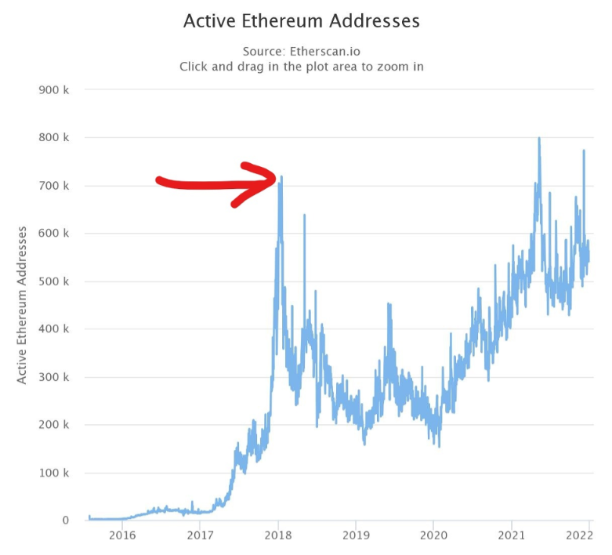

Given this correlation, has anyone wondered why ETH prices have stagnated over the past six months? Since May, high gas fees have hindered on-chain activity on Ethereum, while other L1 blockchains flourished during this period, causing Ethereum's txn volume to decline—currently, economic activity is even lower than previous cycle peaks.

Another measure of activity level—"active wallet addresses"—has also declined since May.

If EIP-1559 hadn’t introduced the token gas fee burning mechanism in August—creating de facto supply scarcity—we would already be seeing a much steeper drop in ETH price.

To solve scalability and congestion issues, Ethereum is adding Layer 2s and rollups: letting ETH L1 serve as a security/settlement layer, while executing contracts and hashing on L2s—this greatly improves end-user speed and drastically reduces costs.

But as an investor, what matters to you is—will this structural change increase or decrease activity on ETH L1? (Because activity → demand → price growth, remember my earlier analysis?)

All things considered, the answer is decreased activity—at least in the medium to short term.

ETH L1 currently processes 1.3 million txns per day. Before submitting to L1, ZK rollups can batch process 60k–80k txns. If we moved all end-user txns from ETH L1 to rollups today, and all L2 batches were full, it would mean the number of txns on ETH L1 needs to drop to just 1/20th of current levels.

L2 rollups can bundle 60k txns at once—transactions that ETH L1 would otherwise have to process individually. Even with exponential growth on L2, gas costs will be dramatically lower compared to current levels.

Most importantly, ETH is shifting from exponential growth to linear growth—the difference between these two is huge.

https://t.co/aKmSA69usn

— Tascha (@TaschaLabs) December 28, 2021

Some argue: 1) Proof verification is a high-value, complex transaction that consumes more gas than most others. 2) Because costs are so low on L2, there will be far more activity—that’s the whole point of scaling. If L2 activity grows exponentially, it will greatly stimulate verification demand, thereby increasing activity on ETH L1 as well.

My thoughts:

Regarding point 1: The L1 verification cost per ZK rollup batch is around 600k gas. On current ETH L1, a simple wallet transaction costs 21k gas. So if a rollup batch contains more than 28 simple wallet txns, the total gas consumed on L1 is already reduced. With a batch capacity of 80k txns—and basic math tells us 80k > 28—you can imagine how much gas savings this enables.

Regarding point 2: Current activity levels on popular alt-L1 chains provide useful benchmarks for predicting actual activity on new ETH L2s. Solana, the most active among alt-L1s, achieves a TPS (transactions per second) of about 1,000 (excluding consensus voting txns).

Other chains/L2s have much lower realized TPS. For example, Polygon—the model all new ETH L2s emulate—has a TPS of about 85. Note that this low TPS isn't due to technical limitations (at least not yet). These chains could achieve higher throughput, but there simply isn't enough on-chain activity demand.

Yes, one day if the Web3 economy becomes massive enough that many ETH-L2s operate at high capacity and keep growing rapidly, this would indeed boost activity on ETH-L1. But that day is not today, and no one can tell you exactly when it will come.

By the way, right now—and in the promised future of L2s—Ethereum must cross a "no-man's land," where L2 growth pulls existing txns away from ETH L1, but L2s aren't yet active enough to generate sufficient proof verifications on L1 to compensate for the lost activity.

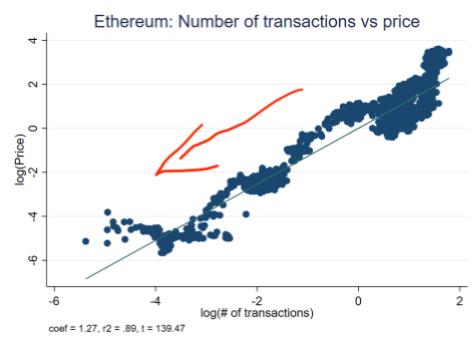

As shown in the chart below, while ETH traverses this no-man's land, activity growth on ETH L1 may stall or turn negative. This means ETH's trajectory moves leftward and downward on the chart. For investors in the ETH ecosystem, the rational move is to sell ETH and go long on high-growth L2 tokens.

You might say: What about institutional investors? They prefer large-cap, lower-risk assets. So when institutions flood into crypto soon, they’ll support demand for BTC and ETH.

That might happen. But don’t count too heavily on selling tokens we ourselves don’t believe in to institutions—unless you really think they’re foolish.

The truth is, whether institutions or individuals, people enter crypto for returns, not capital preservation—and large caps aren’t “safer.”

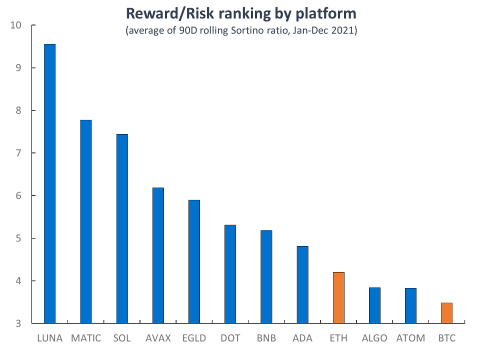

Here’s the current Sortino ratio for major Layer 1s, which measures return per unit of downside risk. LUNA scored highest in 2021. ETH and BTC rank lower.

There’s another less obvious but equally important issue regarding ETH valuation.

The network effect of L1 tokens comes from broad participation by token holders. BTC and ETH have become the most popular collateral in DeFi, held by nearly every crypto user. This leads to high trading volumes and strong liquidity on exchanges.

And to use smart contracts, you must hold some ETH—resulting in today’s 1.8 million ETH wallet addresses.

With the rise of alt-L1s, people no longer need to hold ETH. And with the arrival of ETH L2s, even within Ethereum’s own ecosystem, you won’t necessarily need ETH. For example, you can buy ZK tokens on a centralized exchange, transfer them to your ZK Metamask wallet, and spend ZK on the ZK L2 chain—all without touching the ETH token.

In other words, as Ethereum transitions from a B2C to a B2B model, direct interaction with end users may decrease—meaning ETH token ownership reach, liquidity, and volume could all decline. All of these are critical metrics for token valuation.

You might say: As Ethereum’s security layer, the importance of the ETH token is paramount, and users will surely value that. Yes, you're right. But if “importance” were the decisive factor in token value, then ChainLink and The Graph would have higher market caps than Doge and Shiba Inu.

In reality, direct engagement with as many end users as possible is a valuable advantage for a token. (Keep this in mind when evaluating any crypto project serving only “enterprise use cases.”)

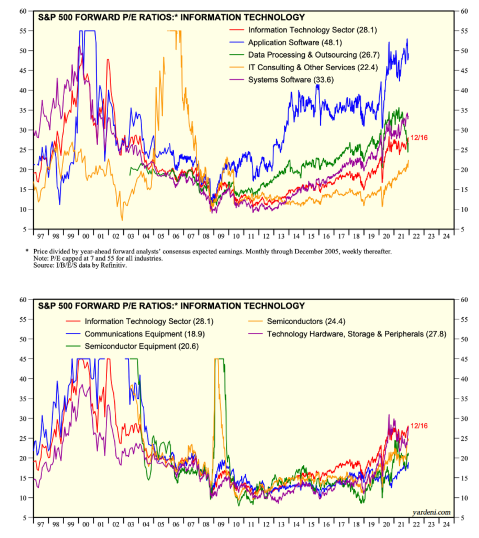

This isn’t unique to crypto. In tech stocks, software companies with high-quality application software trade at higher P/E ratios than system software or semiconductor firms. The former receive greater market attention—even without superior growth prospects.

As a regular investor, buying stock in Zoom or Slack is far easier—because you know and use them regularly—than investing in something like “Paragon Database Solutions.”

For L2s, to compete with alt-L1s, they need native tokens so users can participate and share in the value created on their platforms. This shifts attention away from ETH—just like other L1 tokens—and means they will siphon off many token users who would otherwise belong to ETH.

You don’t need ETH to go from a centralized exchange to an L2, and you don’t need ETH to withdraw from an L2. In such cases, the L2 effectively becomes an alt-L1.

At that point, all ETH gets is transaction fees—without actually expanding the network. In other words, ETH becomes something that just sits and decays. https://t.co/Onx2P0RX8B

— Tascha (@TaschaLabs) November 28, 2021

You might say: But other alt-L1s have the same problem. For example, Avalanche subnet tokens dilute AVAX’s value capture.

True—but AVAX, ATOM, or ALGO don’t have $400 billion market caps. They’re much smaller, and their L1 ecosystems remain on high-growth trajectories. Any L2 attached to them won’t alter their growth dynamics the way Ethereum’s L2s do. So the initial equilibrium matters.

Crypto is a fast-evolving industry, and my view on Ethereum will certainly continue to evolve. But I hope this gives you something to think about.

Summary:

On-chain activity growth determines L1 token price appreciation.

The shift from ETH L1 to an L1-L2 architecture may lead to stagnant or negative activity growth on ETH L1.

The transition from B2C to B2B reduces direct end-user interaction with ETH, negatively impacting ETH token liquidity, trading volume, and price.

Postscript:

Later, Paradigm’s CTO @gakonst pushed back, arguing that the article incorrectly assumes scaling reduces L1 transaction volume and fees, hence bearishness. He contends that scaling solutions still pay fees to L1. L2s will always pay X for ETH’s security, and the fees L2s collect from users will exceed Y, creating a virtuous cycle.

Others commented that without L1, L2 cannot exist—so L1 will always derive value from L2 usage.

However, some rebutted @gakonst, arguing: First, if scaling efficiency is too high—if they become too good at utilizing block space—then L1 demand drops sharply. Second, exponential growth in L2 transactions only leads to linear growth in L1 transactions, meaning the more L2 grows, the more L1 loses relatively—a kind of Matthew effect.

So, what’s your take?

TechFlow is a community-driven deep content platform dedicated to delivering valuable information and thoughtful perspectives.

Community:

WeChat Official Account: TechFlow

Telegram: https://t.me/TechFlowPost

Twitter: TechFlowPost

To join WeChat group, add assistant WeChat: TechFlow01

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News