Cathie Wood: DeFi is hollowing out banks, and ETH staking could become the new "risk-free rate"

TechFlow Selected TechFlow Selected

Cathie Wood: DeFi is hollowing out banks, and ETH staking could become the new "risk-free rate"

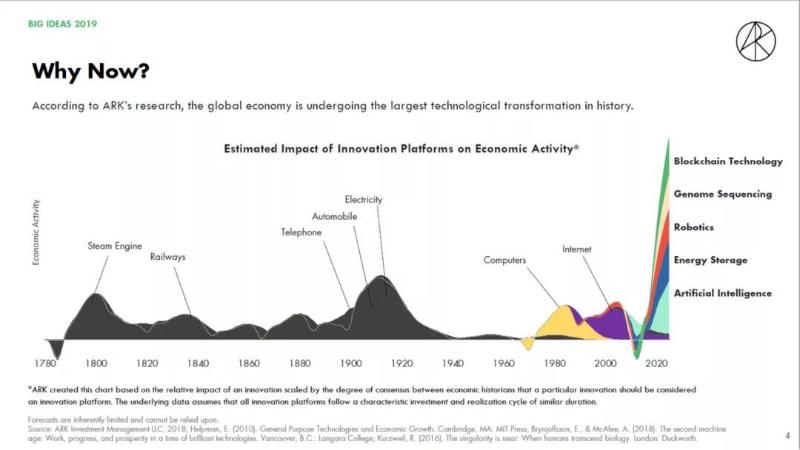

Similar to our Crypto Renaissance theory (that crypto will help usher in a new era of renaissance similar to the 14th-century Renaissance), Cathie Wood believes that humanity is entering the greatest period of technological transformation in history over the next 10 to 20 years.

Written by David Hoffman, co-founder of Bankless

Translated by DeFi之道

Last Friday, Cathie Wood from Ark Invest joined Ryan and me to discuss her views on crypto. (Full podcast here)

Ark does one thing: invest in technologies that define the future.

They do this exceptionally well. More importantly, Ark invests in paradigm-breaking technologies that the broader market fundamentally misprices.

Cathie Wood believes that “the future of investing is investing in the future,” and it’s this thesis that has made Ark a financial powerhouse managing $75 billion in assets.

While older financial institutions look backward—using historical data to build metrics and models to guide investment—Ark looks forward, proactively identifying and investing in technologies shaping tomorrow.

Ark believes we are on the cusp of five paradigm-shifting technologies, all advancing rapidly at the same time—blockchain being one of them.

Similar to our Crypto Renaissance theory—that crypto will usher in a new era of rebirth akin to the 14th-century Renaissance—Cathie Wood believes humanity is entering the greatest period of technological transformation in history over the next 10–20 years.

Five major technology platforms are almost simultaneously entering the growth phase of their S-curves… something that has never happened before in history.

Joining this podcast was Chris Burniske from Placeholder VC, who led Ark into the crypto rabbit hole back in 2014, along with Yassine Elmandjra, Ark’s current crypto analyst.

This may be the best episode we’ve ever recorded—and it’s a must-listen.

Here are three key takeaways from Cathie Wood:

1. DeFi is hollowing out banks (and banks know it)

To understand the broader banking environment, Cathie listened to JPMorgan’s earnings call—and she was surprised to discover that loan growth across banks during economic recovery… was negative.

Why?

Because of crypto! Given DeFi’s superior yield and explosive demand, even minor revenue losses are significantly impacting overall banking sector growth expectations. Stock prices are set at the margin, and marginal growth rates matter.

Consider this

What if recent regulatory pressure stems from banks feeling threatened?

Cathie Wood suggests this might indeed be the case.

Given that the banking system is one of the most entrenched incumbents, this isn’t surprising…

2. ETH staking could become the new "risk-free rate"

Chris Burniske asked Cathie whether she could envision a future where Ethereum’s minimized-risk interest rate becomes a new benchmark for internet asset valuation?

The idea is that ETH staking yields could serve as a new performance benchmark for digital asset portfolios—and Cathie went further, contrasting the reliable returns from staking ETH with central bank monetary policy.

This elevates ETH to the status of a global macro force similar to the U.S. bond market—not just an internet-native economy.

Look at this

In short, Cathie believes ETH could become the bond market of the internet.

3. DeFi will accelerate innovation beyond crypto

I asked Cathie and Chris:

“Do you think Ethereum’s capital coordination capabilities and DeFi’s open financial services will enable faster innovation in other fields?”

One of Ark’s core arguments is that the growth of each technology platform can accelerate the growth of all others.

Cathie linked Ethereum’s capital coordination power to ‘The DAO,’ which raised $150 million in ETH back in 2016, and strongly endorsed how DeFi enables “frictionless funding.”

What happens to the pace of innovation when financial and capital coordination tools are freely accessible?

See how Chris Burniske explains it

Biggest takeaway: Don’t look back

Perhaps my biggest takeaway was Cathie contrasting backward-looking institutions with forward-thinking retail investors.

These institutions aren’t looking to the future to inform their investments. Instead, they rely on historical analysis and financial models to allocate capital—fundamentally assuming that “the future will look like the past.”

No wonder they missed crypto!

If there’s one thing we’ve learned about the 2020s, it’s that our era is far more chaotic than predicted. If you expect history to inform your models about the future, you’re making a fundamental mistake.

This means opportunity remains wide open for retail investors.

We saw this with TSLA… and we’re seeing it again in crypto.

Where institutions resist change, retail embraces it.

Don’t look back.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News