“Woodstock”’s Annual Blockbuster: ARK’s 2026 Big Idea

TechFlow Selected TechFlow Selected

“Woodstock”’s Annual Blockbuster: ARK’s 2026 Big Idea

ARK’s annual research report, *Big Ideas*, has been published for ten consecutive years. It is not merely an industry outlook but rather a “technology roadmap for the next decade.”

If you follow global tech investment, it’s nearly impossible to ignore one name—Cathie Wood, known to Chinese investors as “Wood Sister.”

Over the past decade, she and her firm ARK Invest have pursued a strategy that is anything but popular on Wall Street: ignoring short-term noise and betting instead on long-term, extreme, and nonlinear technological transformations.

ARK’s annual research report, Big Ideas, has now been published for ten consecutive years. It is not merely an industry outlook—it functions more like a “technology roadmap for the next decade.”

You may disagree with its conclusions, but it’s hard to ignore the questions it raises.

This year’s ARK Big Ideas 2026 features a striking overarching title: The Great Acceleration.

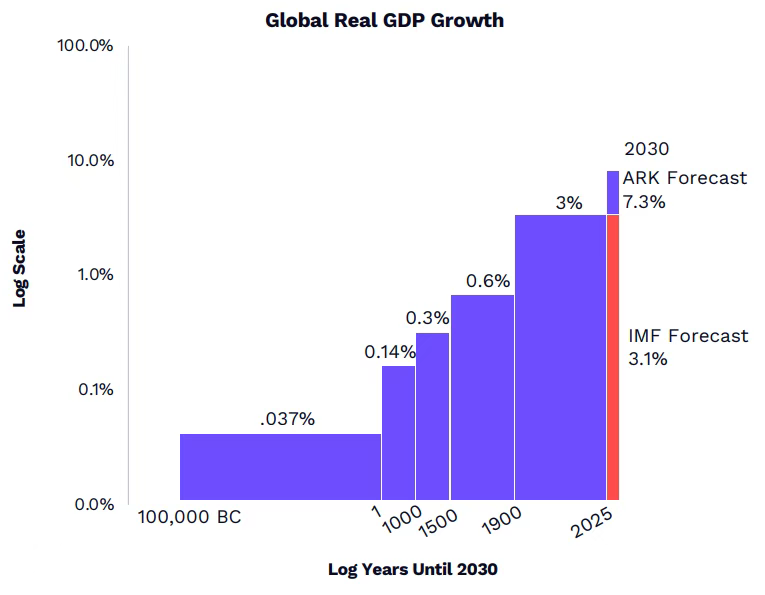

The report focuses on 13 major innovation areas and advances a core thesis: Five innovation platforms—centered on artificial intelligence (AI)—are converging at accelerating speed, poised to trigger a step-change in global economic growth by the end of this decade. Real GDP growth in 2030 could reach 7.3%, exceeding the International Monetary Fund’s forecast of 3.1% by four percentage points.

The report’s most critical insight is that AI is not just another important technological advancement—it is a “Central Dynamo” simultaneously accelerating multiple technology curves. For decades, technological innovation largely followed a linear pattern: one technology → one industry → one capital cycle. ARK argues this paradigm is now obsolete. At present, technologies are no longer parallel; they are highly coupled and mutually enabling:

AI’s computational demands are driving revolutions in next-generation cloud infrastructure, energy storage, and data centers; blockchain and digital wallets provide AI agents with a trusted settlement and execution layer; robotics and autonomous vehicles are pushing AI from the “digital world” into the “physical world”; multi-omics and programmable biology supply AI with high-dimensional biological data, which in turn accelerates model capabilities

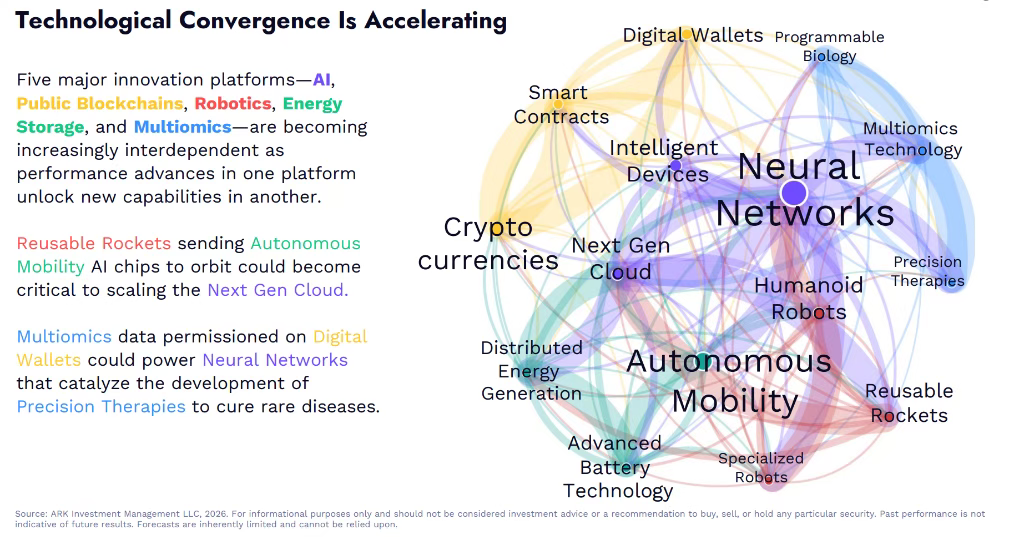

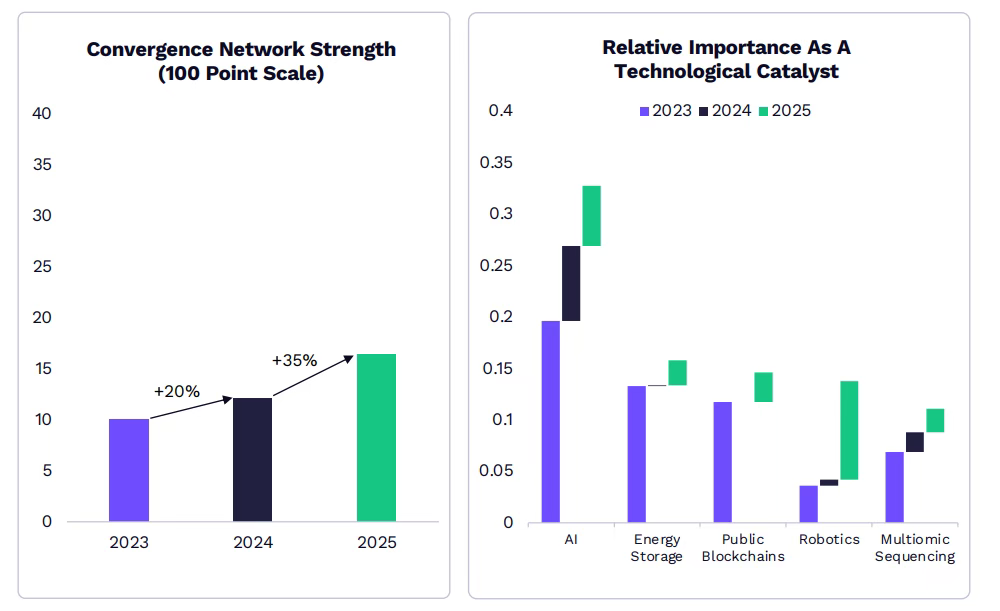

ARK uses one metric to describe this state: Convergence Network Strength. By 2025, this metric will have increased year-on-year by 35%—indicating markedly faster mutual catalysis among different technologies. This is why ARK calls 2026: The Great Acceleration.

ARK research shows that reusable rocket launches delivering AI chips into orbit, multi-omics data driving precision therapy development, and smart contracts enabling AI agents to coordinate real-world resources—these seemingly independent innovations are generating unprecedented synergies. The importance of robotics as a catalyst reached an inflection point in 2025, while energy storage and distributed energy systems have become key drivers of next-generation cloud infrastructure deployment.

The report states that the direct impact of this technological revolution includes:

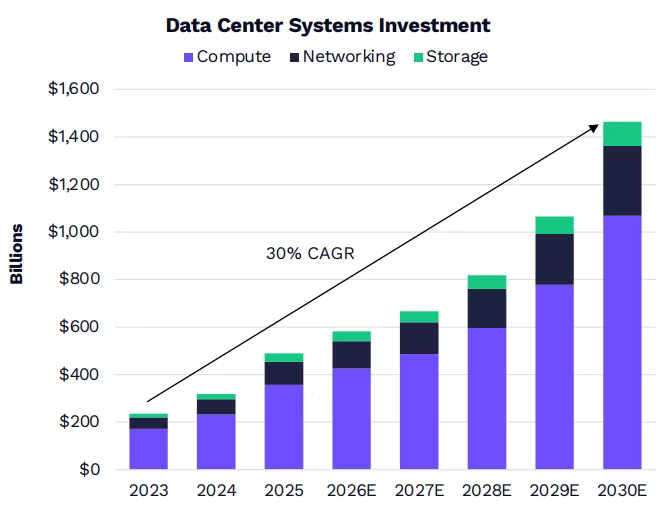

The market share of innovation-oriented assets is projected to grow from ~20% in 2025 to ~50% in 2030, with their market value potentially expanding from ~$5 trillion today to ~$28 trillion. Investment in data center systems is expected to rise from ~$500 billion in 2025 to ~$1.4 trillion in 2030, representing a 30% compound annual growth rate (CAGR). Commercialization is accelerating rapidly in sectors including autonomous ride-hailing, AI-driven drug discovery, and consumer humanoid robots—with some already entering large-scale deployment.

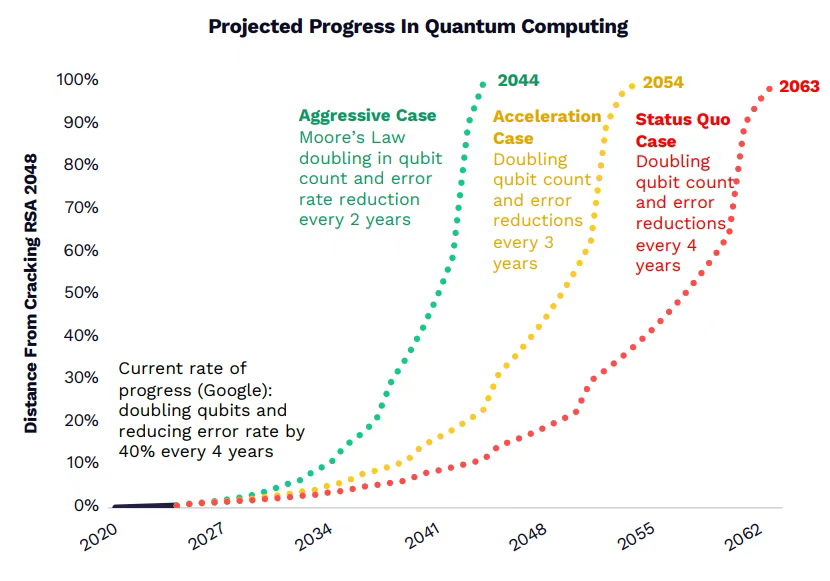

However, ARK explicitly notes that not all eye-catching technologies possess true disruptive potential. Citing quantum computing as an example, the report concludes that—even under the most aggressive development assumptions—its practical utility for cryptographic decryption won’t materialize until the 2040s. Truly disruptive technologies must meet three criteria: sharply declining costs, compelling unit-level economics across multiple industries, and the ability to serve as a foundational platform for other technological innovations.

AI Leads the “Great Acceleration” Era

The report states that ARK dubs this technological revolution “The Great Acceleration,” asserting that interdependence among five innovation platforms—AI, public blockchains, robotics, energy storage, and multi-omics—is intensifying, such that performance gains in one platform unlock new capabilities in another.

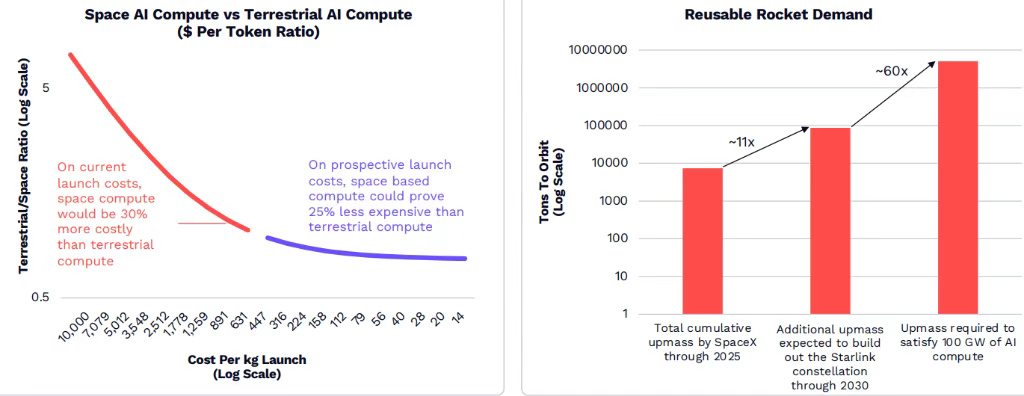

The most striking case highlighted in the report is the convergence of reusable rockets and AI compute. Neural networks’ demand for next-generation cloud computing capacity is hitting physical limits on Earth—and reusable rockets may be the solution.

Space-based AI compute, delivered at competitive cost, could offer cloud infrastructure computing power unbounded by terrestrial electricity and cooling constraints.

ARK’s analysis shows that growth in AI chip demand could increase the need for reusable rockets by roughly 60x compared to current models. At projected launch costs, space-based computing could be ~25% cheaper per unit than ground-based computing.

According to the report, this technological convergence is fueling an unprecedented investment cycle. ARK research indicates that capital investment alone could contribute 1.9 percentage points annually to real GDP growth over this decade. A new capital base—including autonomous ride-hailing fleets, next-generation data centers, and enterprise investments in AI agents—should lift return on invested capital (ROIC). As additional innovations begin influencing growth trajectories, realized growth may exceed consensus forecasts by more than four percentage points annually.

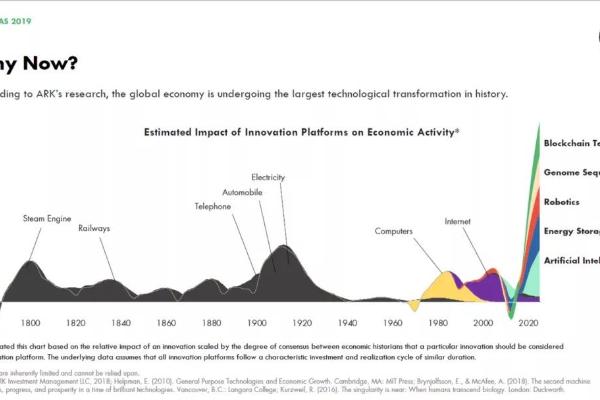

From a historical perspective, paradigm shifts in technology have repeatedly driven structural changes in GDP growth rates. ARK’s data shows global real GDP growth rising from ~0.037% in 100,000 BCE, through the Agricultural and Industrial Revolutions, to ~3% today. This AI-centered technological revolution may push that figure above 7%.

Surge in AI Infrastructure Investment

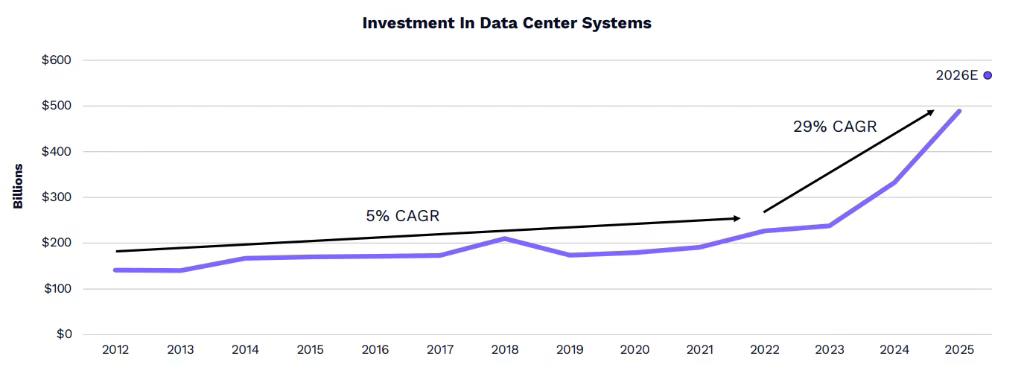

Investment in data center systems is accelerating rapidly. Since ChatGPT’s release, annualized growth in such investment has surged from ~5% to 29%.

In 2025, global data center system investment is expected to reach ~$500 billion—nearly 2.5x the average annual level between 2012 and 2023. ARK forecasts this figure could grow to ~$1.4 trillion by 2030.

The core driver behind this investment surge is explosive AI demand. Inference costs have fallen by over 99% in the past year, prompting exponential growth in AI usage by developers, enterprises, and consumers. On the OpenRouter platform, for instance, computational demand for large language models (LLMs) has grown ~25x since December 2024.

Yet, compared to the dot-com bubble era, valuations across the tech sector today are far more rational. While capital expenditures (capex) in information technology and communication services as a share of GDP have reached their highest level since 1998, the tech sector’s price-to-earnings (P/E) ratio remains well below its dot-com peak.

The average P/E ratio of six companies—NVIDIA, Alphabet (Google’s parent), Apple, Amazon, Meta, and Microsoft—is only a fraction of their historical highs, indicating that today’s investment boom is grounded in real-world application demand—not speculative frenzy.

Competitive dynamics are also shifting. NVIDIA’s early investments in AI chip design, software, and networking gave it an 85% GPU sales share and gross margins of 75%. However, competitors like AMD and Google have caught up in certain domains—especially small-language-model inference.

ARK data shows AMD’s MI355X delivers ~38 million tokens per dollar of total cost of ownership (TCO), outperforming NVIDIA’s B200 in small-model performance. Still, NVIDIA’s Grace Blackwell rack-scale system retains leadership in large-model inference, powering the most advanced foundation models.

AI Consumer Operating Systems Reshape Business Models

AI models are converging into a new consumer operating system, fundamentally altering how people interact with the digital world. Consumers are adopting AI far faster than the internet’s original adoption pace—AI chatbots have achieved ~25% penetration among smartphone users within seven years of launch, whereas the internet took longer to reach equivalent PC-user penetration.

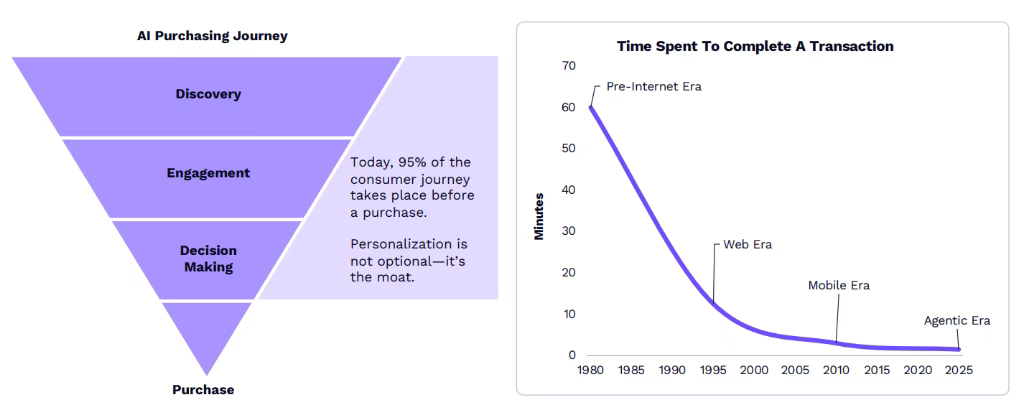

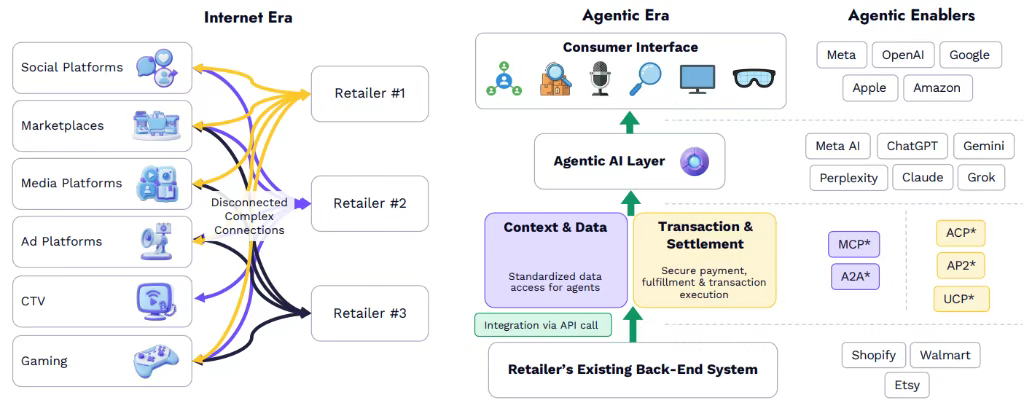

This shift is compressing the shopping funnel. Completing a purchase took ~1 hour in the pre-internet era, shrank to minutes in the mobile era, and is now further compressed to ~90 seconds in the AI agent era. AI shopping agents are transforming the purchase funnel with unprecedented personalization and speed. Today, 95% of the consumer journey occurs before purchase—personalization is no longer optional, but a moat.

This transformation is underpinned by new protocol standards. Anthropic’s open-source Model Context Protocol (MCP) enables agents to seamlessly access real-time information across the entire internet, while OpenAI’s Agent Commerce Protocol (ACP) secures end-to-end transactions. These protocols are streamlining and accelerating commerce in the AI era.

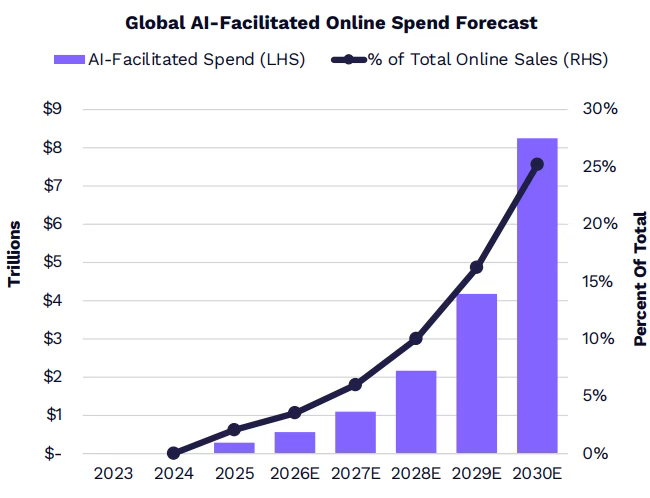

The market opportunity is staggering. ARK forecasts that AI-agent-facilitated global online consumer spending will grow from ~2% of online sales in 2025 to ~25% in 2030—reaching over $8 trillion.

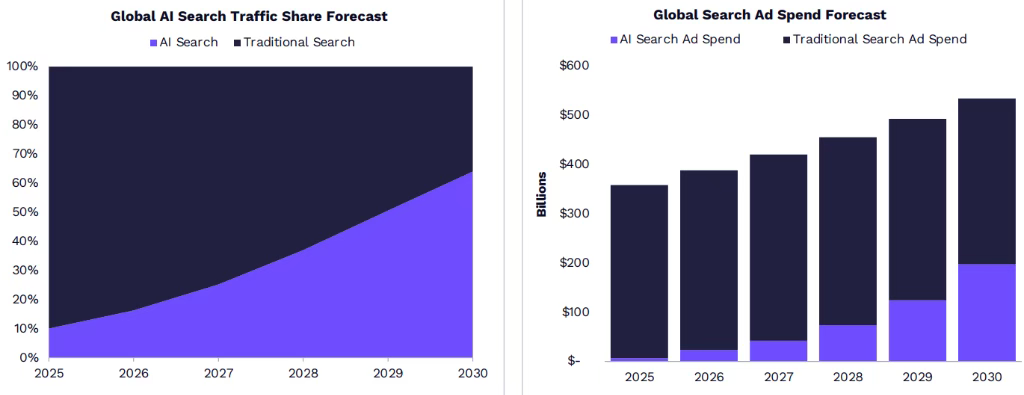

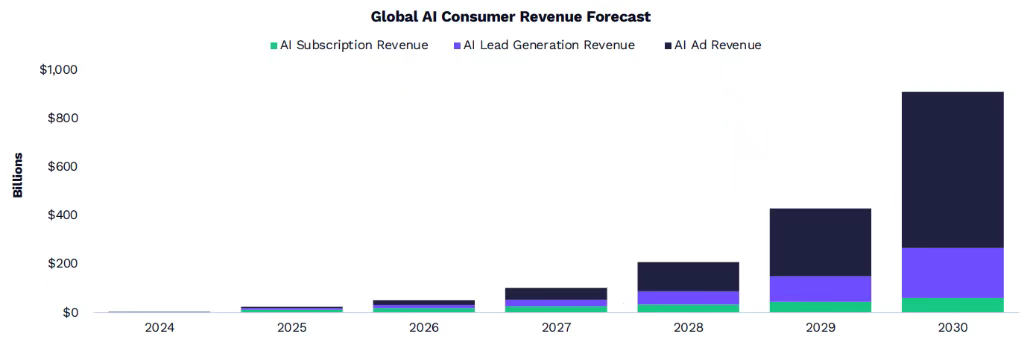

AI search traffic share is projected to grow from 10% in 2025 to 65% in 2030, with AI-related search advertising spend growing at ~50% annually.

By 2030, AI agents may generate ~$90 billion in commercial and advertising revenue, with lead generation and advertising being the dominant growth drivers—far surpassing contributions from consumer subscriptions.

Robotics: A Severely Undervalued GDP Engine

If AI is the Central Dynamo of the digital world, then robotics is its most critical “physical outlet.”

The report emphasizes that AI’s rapid progress is transforming robots from fixed-task, specialized devices into relatively open, general-purpose platforms—a key enabler unlocking industrial and household market potential.

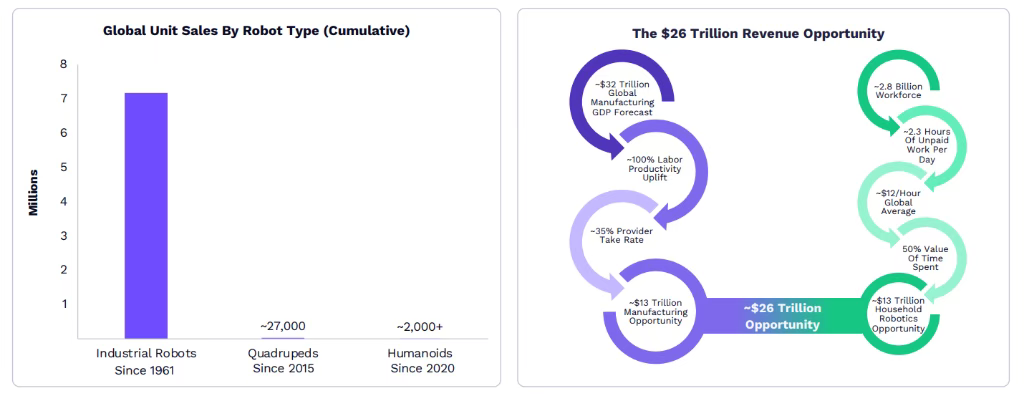

ARK estimates the global robotics market presents a ~$26 trillion revenue opportunity, split across two major segments: manufacturing and home services.

In manufacturing, global manufacturing GDP is projected to reach $32 trillion by 2030. If robotics achieves a 100% labor productivity boost and service providers retain a 35% revenue share, this represents ~$13 trillion in revenue opportunity. In home services, ~2.8 billion global workers perform ~2.3 hours daily of unpaid domestic labor. Valuing that time at the global average hourly wage of $12 and applying a 50% time-value discount yields an equivalent ~$13 trillion market.

ARK especially underscores the macroeconomic significance of humanoid robots.

A frequently overlooked fact is that vast amounts of household maintenance, caregiving, cleaning, and management labor are not counted in GDP today.

ARK’s analysis shows: One household humanoid robot → can convert ~$62,000/year of implicit labor into explicit GDP; if 80% of U.S. households adopt them within five years → annual GDP growth could jump from 2–3% to 5–6%.

The report frames this not as “job replacement,” but as converting non-market activity into market activity—and freeing time for productive use.

Autonomous Driving Reaches an Inflection Point

ARK judges that humanoid robots are ~200,000x more complex than autonomous vehicles. This complexity ratio defines the theoretical capability required for full autonomy. Nevertheless, by mapping Tesla’s Full Self-Driving (FSD) computational requirements and performance gains, ARK forecasts that Optimus humanoid robots may achieve human-level task execution capability around 2028, assuming continued AI compute expansion and hardware advancement.

Autonomous ride-hailing services are beginning to erode traditional ride-hailing market share. In San Francisco’s operational zones, Waymo’s market share is already pressuring Uber and Lyft. Companies including Waymo, Baidu’s Apollo Go, and Pony.ai have collectively logged billions of autonomous miles, with daily driverless mileage growing rapidly.

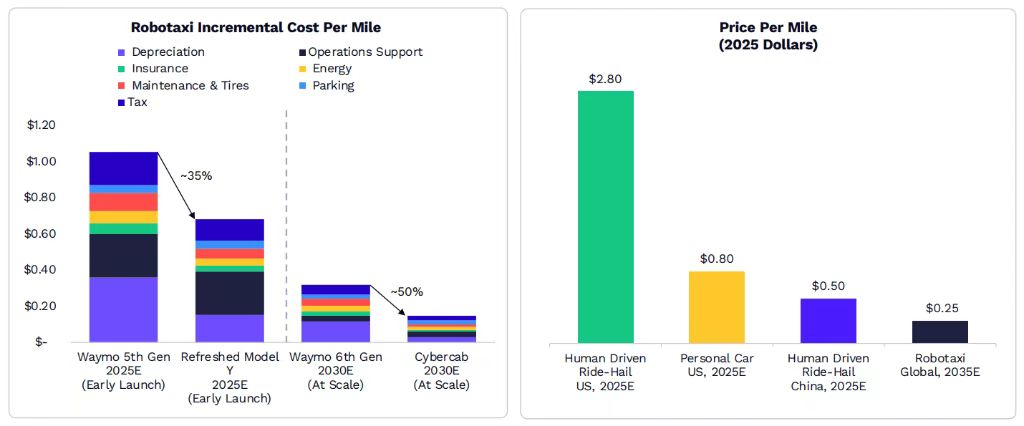

Cost reduction will be the key demand driver. ARK forecasts that by 2035, the per-mile cost of global autonomous ride-hailing could fall to $0.25—far below the $2.80 per mile for U.S. human-driven ride-hailing and $0.80 for private cars in 2025. In early commercialization, vehicle cost dominates unit economics; later, fleet utilization drives down per-mile cost.

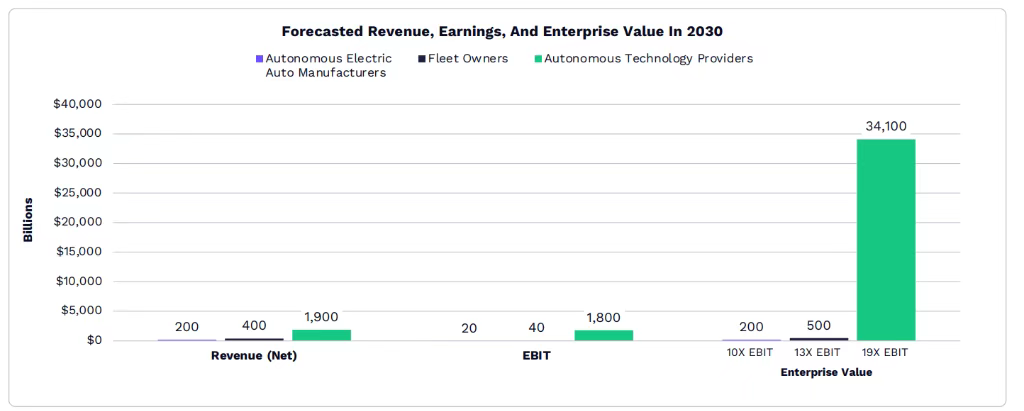

The market value potential is enormous. ARK estimates that by 2030, autonomous ride-hailing could create ~$34 trillion in enterprise value, with autonomous technology providers capturing ~98% of EBIT and enterprise value, while automakers and fleet operators claim relatively small shares. A key risk to this forecast is whether automakers beyond Tesla can scale their autonomous ride-hailing fleets fast enough.

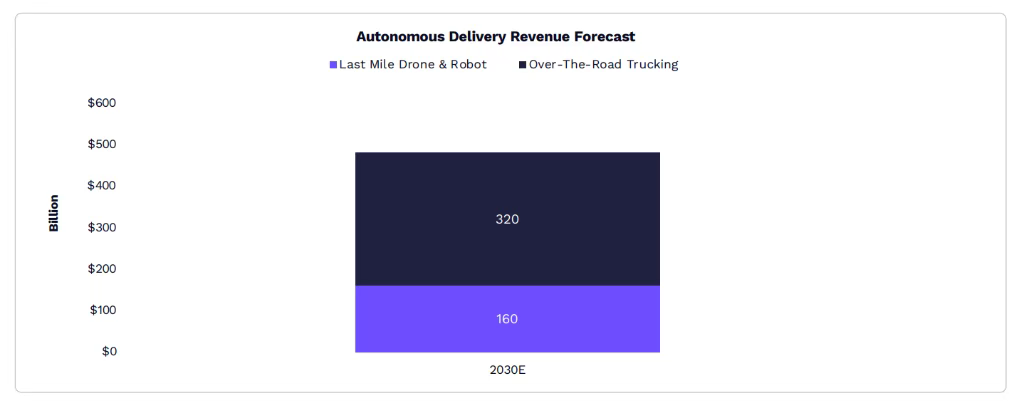

Autonomous logistics holds similarly strong promise. Fully automated last-mile delivery—via drones or ground robots—has already exceeded 4 million annualized trips globally. Autonomous long-haul trucking has launched in the U.S., with operators planning rapid route expansion. ARK forecasts that global autonomous delivery revenue could reach $48 billion by 2030, with regulatory approval and automation of backend loading operations remaining key constraints.

Multi-Omics and AI Drive Biological Breakthroughs

Multi-omics—encompassing genomics, epigenomics, transcriptomics, proteomics, and metabolomics—combined with AI, is triggering a flywheel effect in biological innovation. This flywheel includes: generating richer, lower-cost biological data; conducting more accurate testing; yielding deeper biological insights; developing AI-driven therapeutics; and ultimately curing diseases.

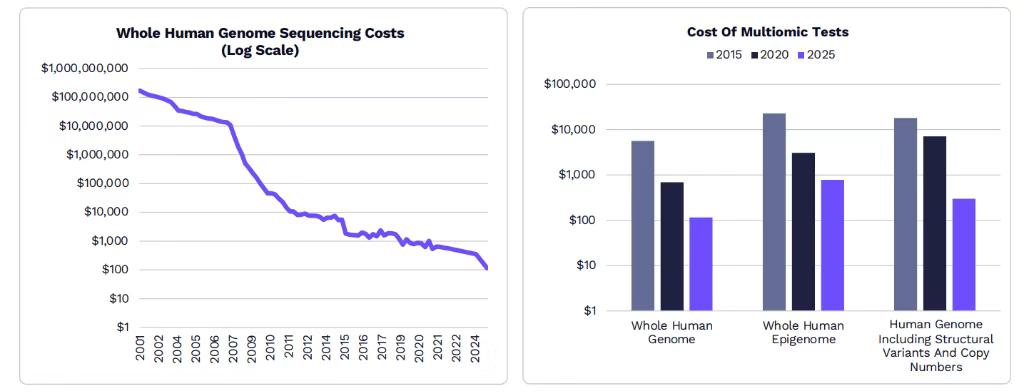

Data generation costs are falling sharply. Whole-genome sequencing costs could drop to $10 by 2030—~10x lower than in 2015.

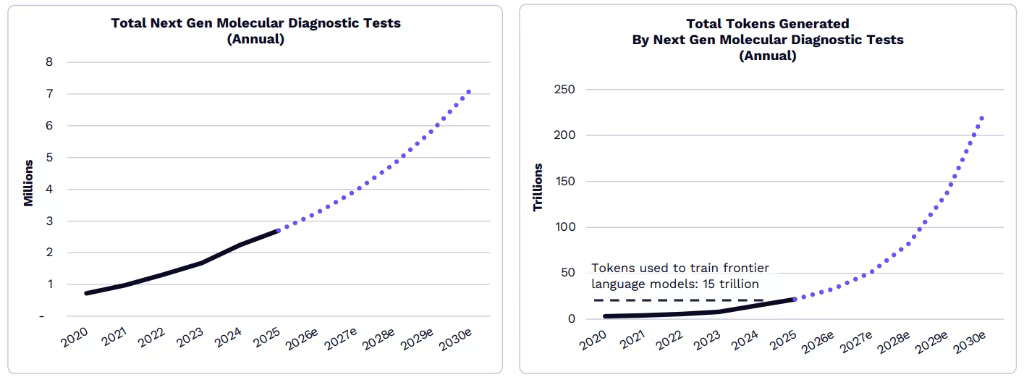

This will drive surging sequencing demand. Next-generation molecular diagnostic tests are projected to grow from under one million annually in 2020 to ~7 million in 2030, generating ~200 billion tokens of data per year—surpassing the ~150 trillion tokens used to train leading LLMs from OpenAI, Google Gemini, Anthropic, and xAI.

AI-powered diagnostics are reaching an inflection point. After ChatGPT’s release, FDA approval success rates for AI-driven tests and devices rose sharply from single-digit percentages. ARK’s best-fit model projects AI-driven diagnostics and devices could account for ~30% of approvals by 2030—and eventually approach 100%.

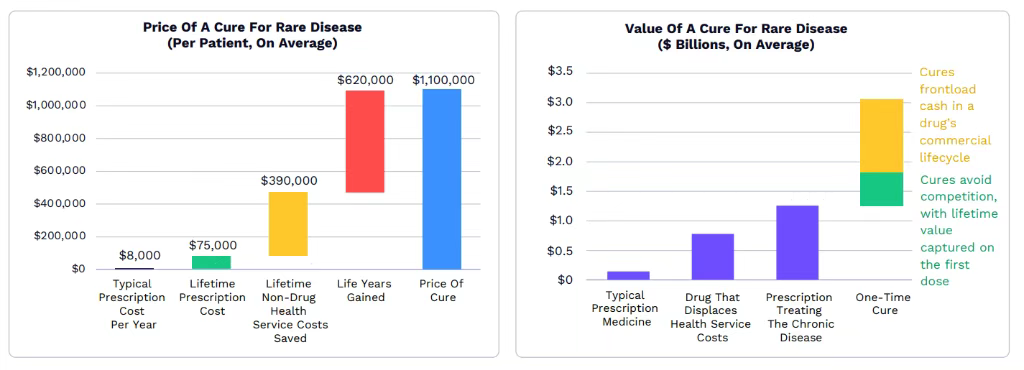

The economics of drug development are being reshaped. AI-driven drug development could shorten time-to-market by ~40%—from 13 to 8 years—and reduce total drug development costs by ~4x—from $2.4 billion to $700 million. Combining AI acceleration and disease cures, AI-designed drugs in Phase I clinical trials could be worth over $2 billion—while traditional drug assets typically recover only capital costs.

The market potential for biological cures is especially staggering. ARK research shows that the average price to cure a rare disease currently exceeds $1 million—nearly 15x the lifetime prescription costs of managing that disease. Cure drugs can capture revenue from most patients before patent expiry, potentially delivering 20x the value of typical drugs and 2.4x the value of chronic-disease prescriptions.

A broader perspective is healthy lifespan extension. If the U.S. population lived to a theoretical maximum lifespan of 120 years in perfect health—but retained existing accident mortality risk—this would yield 11.9 billion quality-adjusted life years (QALYs). Valuing each healthy life year at $100,000, the potential longevity-gain market opportunity would be ~$1.2 quadrillion. Today’s global biotech market represents only ~0.1% of this latent potential.

Reusable Rockets Launch the Space Economy

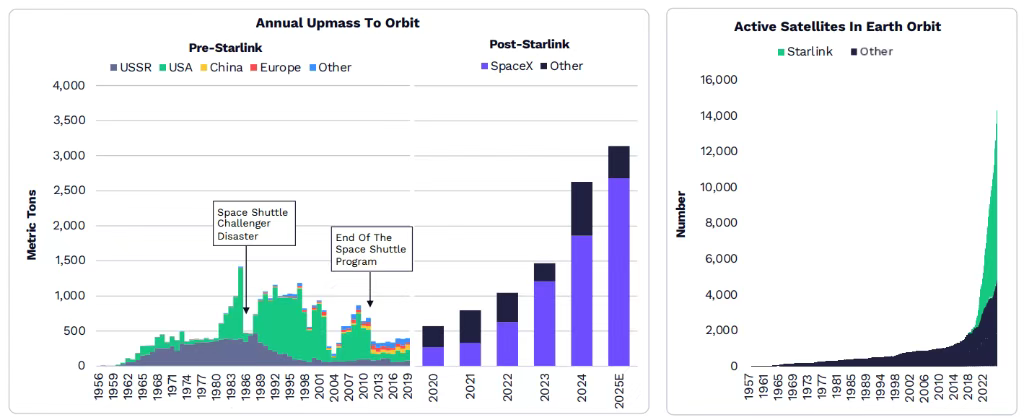

SpaceX’s reusable rocket technology is propelling the economy into the space age. In 2025, annual mass launched to orbit hit a record high—with SpaceX dominating the market. The company operates over 9,000 active Starlink satellites, accounting for ~66% of all active satellites in Earth orbit.

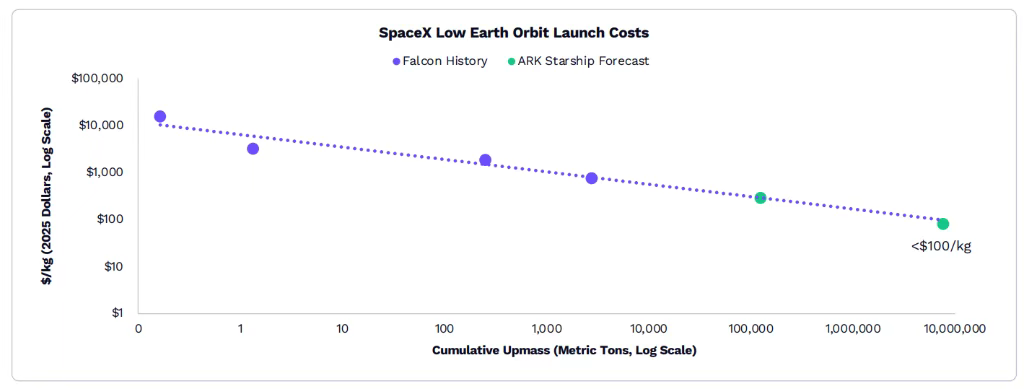

Launch costs continue to decline. Per Wright’s Law, launch cost should fall ~17% every time cumulative launch mass doubles. Over 17 years since 2008, SpaceX has leveraged partial reusability of Falcon 9 to cut costs by ~95%—from ~$15,600/kg to under $1,000/kg. ARK research indicates that Starship could extend this trajectory to under $100/kg at scale.

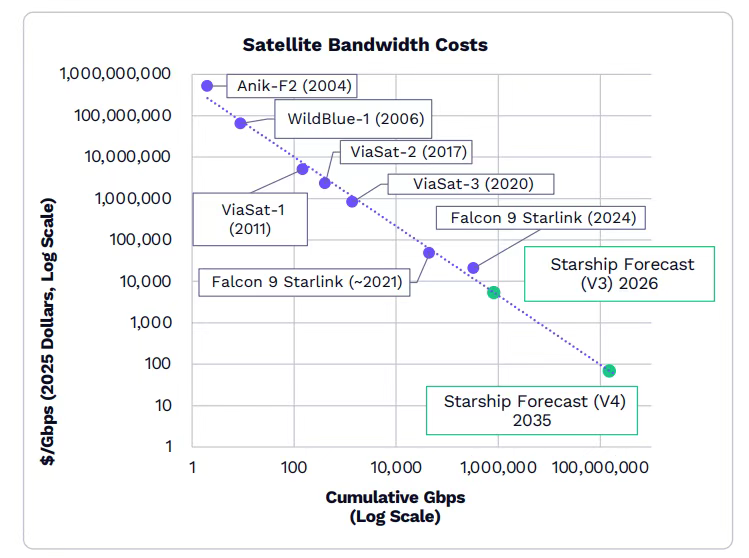

Satellite bandwidth costs are also falling. Per Wright’s Law, satellite bandwidth cost should drop ~44% every time cumulative orbital gigabits-per-second (Gbps) doubles—enabling satellite connectivity to complement cell towers and deliver ubiquitous mobile coverage across the U.S.

Comparison shows U.S. consumer mobile plans cost ~$90/month in 2001 (in 2025 dollars), offering just 0.001GB of data and covering ~1% of U.S. land area; by 2025, plans cost ~$100/month, providing unlimited high-speed internet across ~86% of land; by 2030, 100% coverage is expected at the same price.

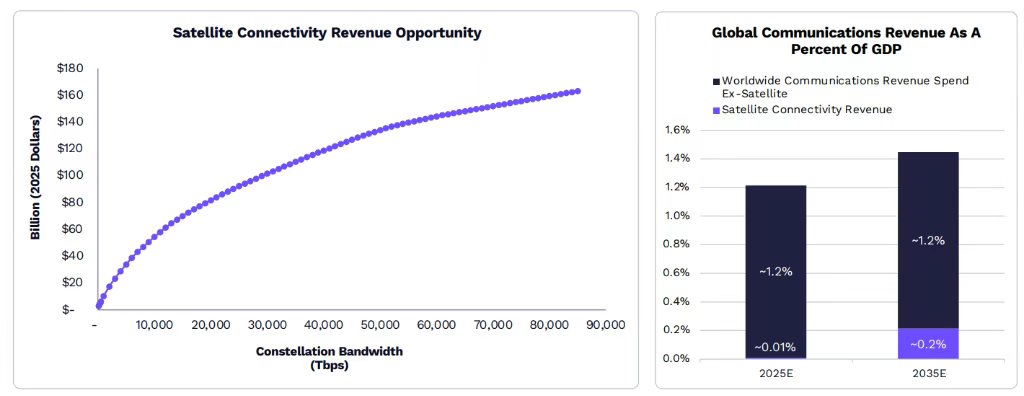

Market opportunity is substantial. Driven by cost reductions and performance gains, scaled satellite connectivity could generate over $160 billion in annual revenue—accounting for ~15% of ARK’s global communications revenue forecast. This projection, based on constellation bandwidth capacity versus revenue potential, reveals exponential growth potential.

Distributed Energy Supports AI Compute Demand

Energy is becoming increasingly efficient at driving economic growth. Although concerns about energy intensity arose during the internet boom, economies actually became more energy-efficient—and the AI era may replicate this dynamic. Major economies—including China, the U.S., Japan, India, and Germany—have seen consistent declines in energy intensity (kWh per dollar of GDP) over the past 30 years.

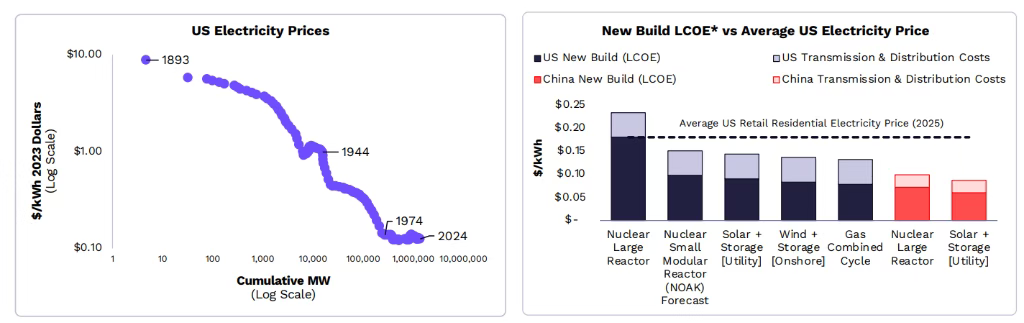

Multi-omics data costs are collapsing. Solar and battery costs continue to follow Wright’s Law downward; nuclear cost declines were interrupted in the 1970s by regulatory changes, but recent U.S. executive orders should restore nuclear’s prior cost-reduction trajectory. Historically, solar and nuclear costs (per MW) and battery costs (per MWh) have dropped sharply every time cumulative installed capacity doubled.

Electricity prices are poised to resume their downward trend. Per Wright’s Law, ARK research shows U.S. retail electricity prices fell steadily from the late 19th century to 1974—then plateaued due to regulatory tightening and rising nuclear construction costs. Absent such regulation, ARK estimates today’s prices would be ~40% lower. As low-cost generation scales to serve power-hungry AI data centers, retail electricity prices should begin falling again after a 50-year pause.

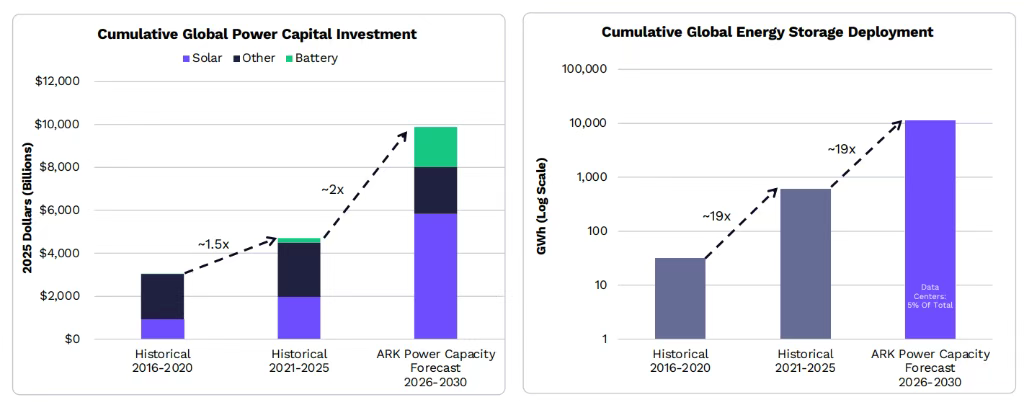

Investment demand is immense. Given ARK’s rapid GDP growth forecast, cumulative global power-generation capex must roughly triple to ~$10 trillion by 2030 to meet electricity demand. Accordingly, stationary energy storage deployment must expand ~19x. Between 2026 and 2030, data centers are projected to account for ~5% of total power-generation investment.

Digital Asset Markets Show Evolutionary Trends

Stablecoin activity surged significantly in 2025, influenced by the potential regulatory framework introduced by the GENIUS Act. Several firms and institutions announced stablecoin-related initiatives; BlackRock disclosed preparations for an internal tokenization platform. Stablecoin issuers and fintech firms—including Tether, Circle, and Stripe—launched or supported Layer 1 blockchains optimized for stablecoins.

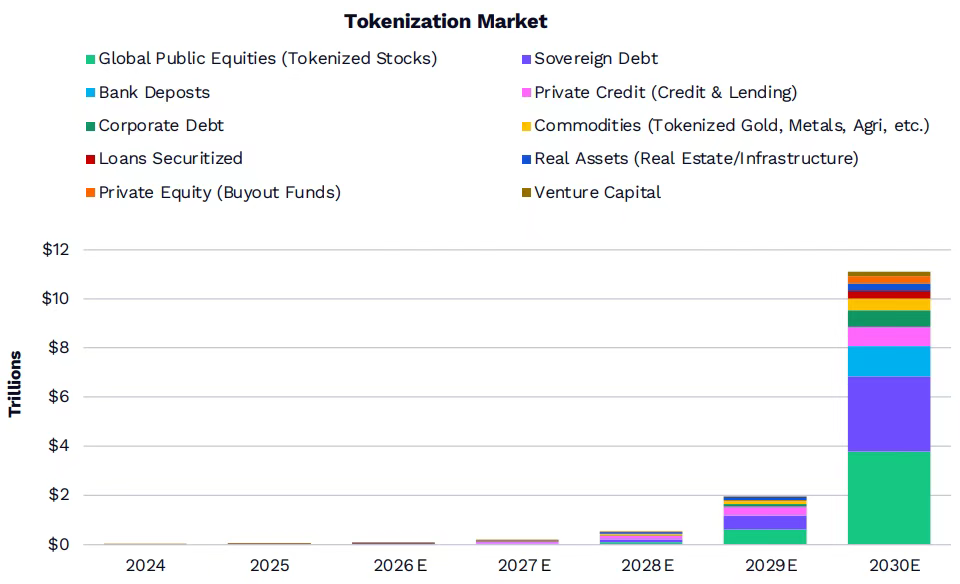

Data shows the market value of tokenized real-world assets (RWA) grew ~208% in 2025, reaching ~$18.9 billion. BlackRock’s BUIDL money market fund reached ~$1.7 billion—representing ~20% of the estimated $9 billion U.S. Treasury tokenization market. Tether’s XAUT and Paxos’ PAXG held ~$1.8 billion and ~$1.6 billion respectively in the tokenized commodities market.

ARK forecasts that tokenized asset volume could grow from $19 billion to ~$11 trillion by 2030, though this projection carries high uncertainty. While sovereign debt currently dominates the tokenized market, future pathways remain unclear.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News