ARK Invest, known for "Cathie Wood," releases Bitcoin valuation model: starting at $500,000 per coin by 2030

TechFlow Selected TechFlow Selected

ARK Invest, known for "Cathie Wood," releases Bitcoin valuation model: starting at $500,000 per coin by 2030

This model breaks down BTC's value into six major sectors, estimates each separately, and then sums them up (it's not just random price pumping anymore).

Original: David Puell, Analyst at Ark Invest;

Translation: CryptoLeo

Editor's Note:

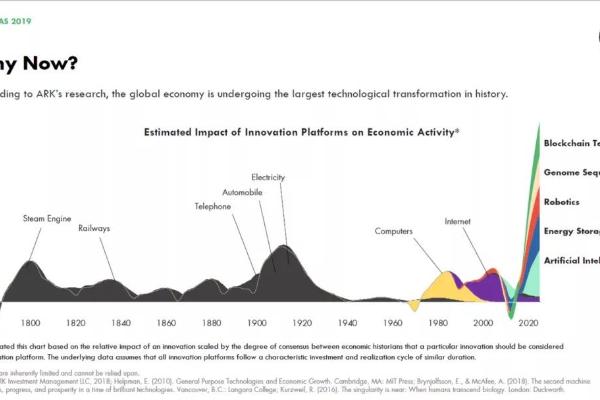

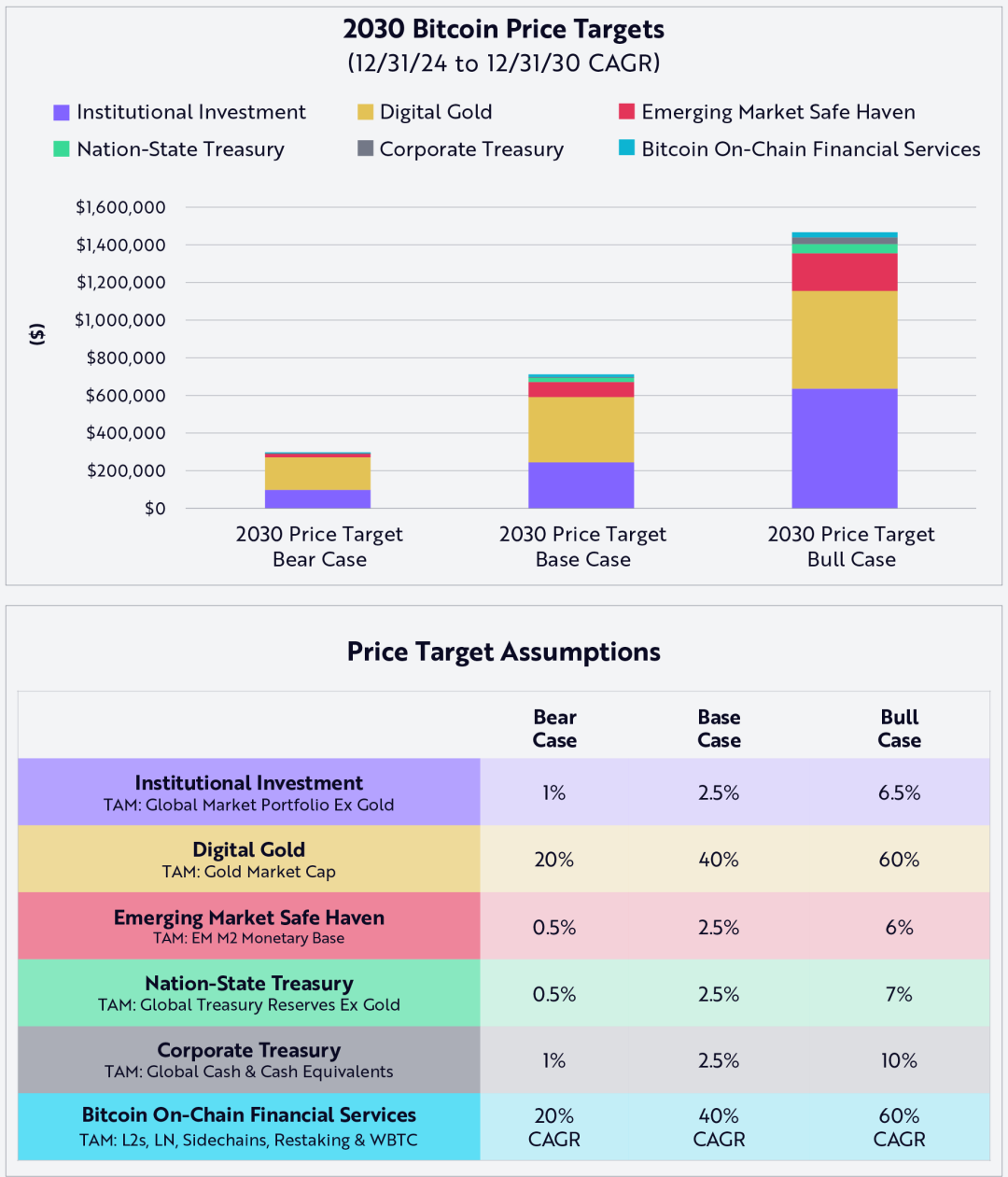

At the beginning of the year, Bitcoin maximalist and Ark Invest led by Cathie Wood released its Big Ideas 2025 report, projecting three potential Bitcoin price targets for 2030: $300,000 (bear case), $710,000 (base case), and $1.5 million (bull case). At that time, these figures were seen as wildly optimistic predictions—similar in spirit to Plan B’s bold claims—without disclosing any detailed modeling methodology.

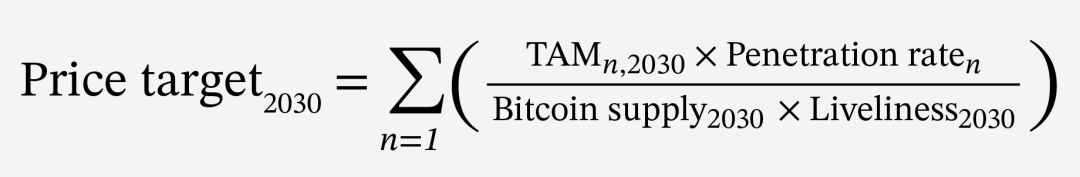

Two months later, Ark Invest has finally revealed the modeling approach and underlying assumptions behind its Bitcoin price target for 2030. The model forecasts Bitcoin's price based on Total Addressable Market (TAM) and adoption rate (penetration or market share).

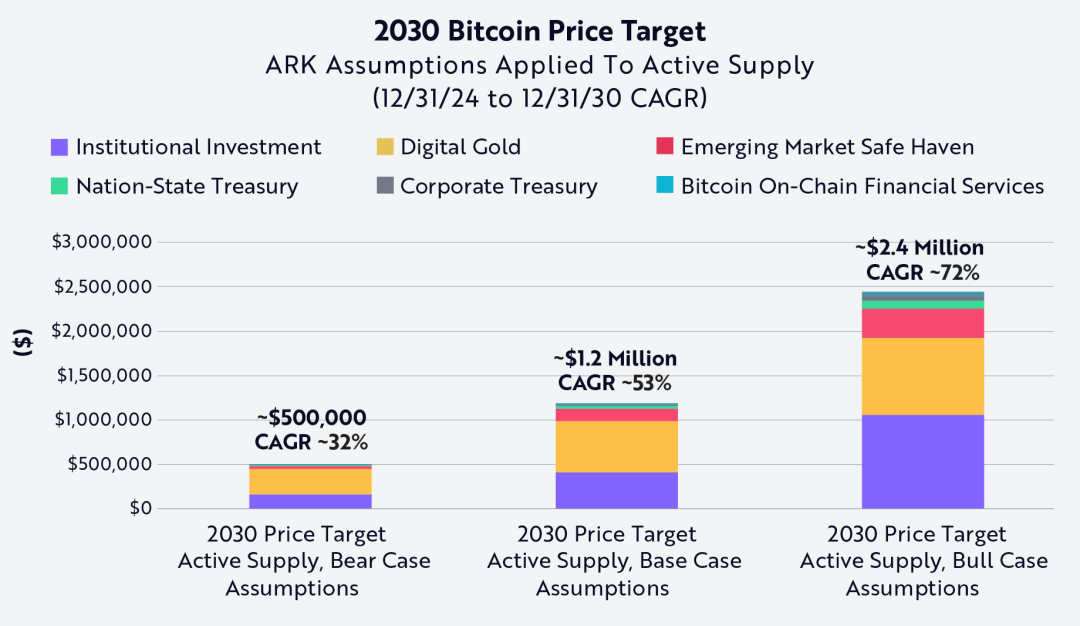

Even more ambitious (or exaggerated) are the results from Ark Invest’s alternative model using Bitcoin’s active supply metric, which projects Bitcoin prices in 2030 at $500,000 (bear case), $1.2 million (base case), and $2.4 million (bull case). If either TAM or adoption fails to meet expectations, Bitcoin may fall short of these targets. Therefore, this model also carries certain risks and biases. Below are the specific details of the Bitcoin price forecast, compiled and translated by Odaily Planet Daily.

Price Targets and Assumptions

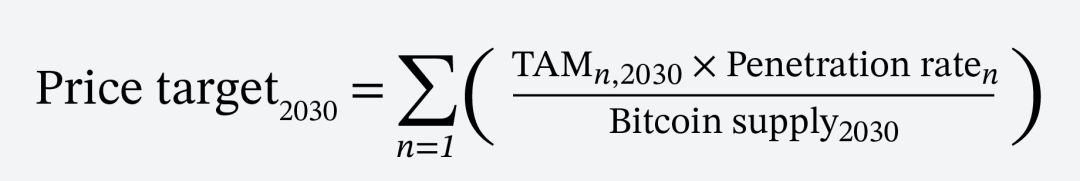

Our price targets represent the sum of contributions from the total addressable market (TAM) by the end of 2030, based on the following formula:

Odaily Planet Daily Note: This formula predicts Bitcoin’s 2030 price by quantifying the dynamic relationship between market demand and Bitcoin circulation. It calculates the price per segment by multiplying each market segment’s maximum dollar-denominated demand base by Bitcoin’s penetration rate within that market, then dividing by Bitcoin’s circulating supply. Summing up all such segment-level prices yields the projected Bitcoin price for 2030.

We estimate supply based on Bitcoin’s circulating supply, with approximately 205 million BTC expected to be mined by 2030. The contribution of each variable to the price target is as follows:

Primary contributors to capital accumulation:

- Institutional investment, primarily through spot ETFs;

- Bitcoin being referred to by some as "digital gold," offering a more flexible and transparent store of value compared to physical gold;

- Investors in emerging markets seeking safe-haven assets to protect against inflation and currency devaluation.

Secondary contributors to capital accumulation:

- National treasury reserves, with other countries following the U.S. example to establish strategic Bitcoin reserves;

- Corporate treasury reserves, as more companies diversify fiat cash holdings into Bitcoin;

- On-chain financial services built on Bitcoin, serving as alternatives to traditional finance.

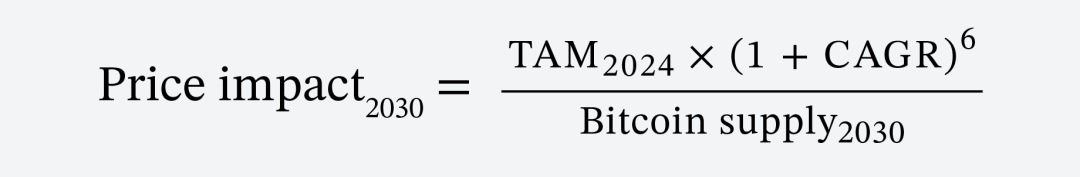

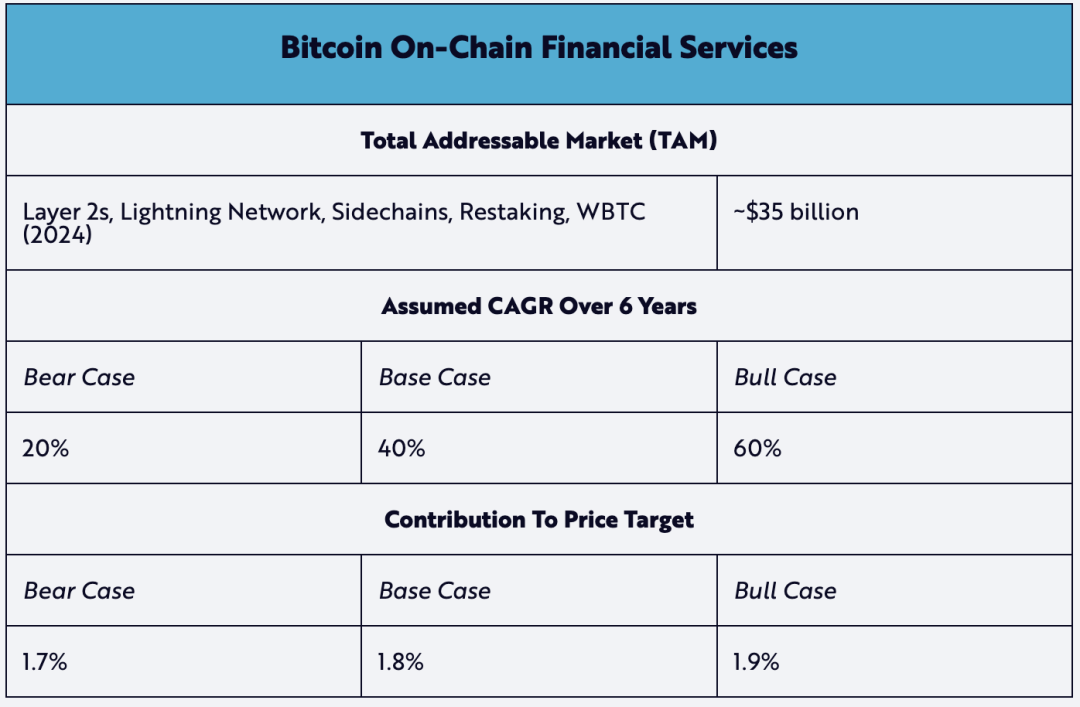

Excluding digital gold (since it represents Bitcoin’s most direct zero-sum competitor, we exclude it from our model), we conservatively assume that the TAM of the above contributors (specifically 1, 3, 4, and 5) will grow at a 3% compound annual growth rate (CAGR) over the next six years. For the sixth contributor—on-chain financial services on Bitcoin—we assume a 6-year CAGR ranging from 20% to 60%, starting from the cumulative value recorded by the end of 2024, as shown below:

Odaily Planet Daily Note: This formula calculates Bitcoin’s TAM six years forward from its 2024 total value using an annual CAGR, then divides by Bitcoin’s projected circulating supply in 2030 to derive its price.

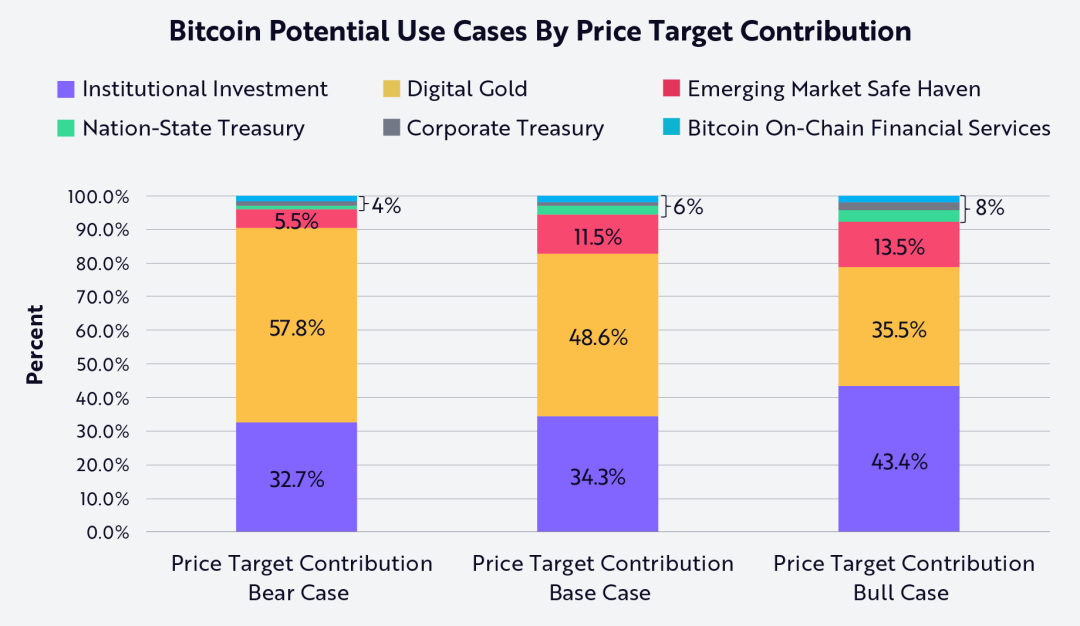

Finally, we break down how TAM and penetration rates contribute to bear, base, and bull case price targets respectively, as illustrated below:

As shown above, “digital gold” contributes most significantly to our bear and base scenarios, while institutional investment drives the bull case scenario. Interestingly, national treasuries, corporate treasuries, and on-chain financial services have relatively minor contributions across all scenarios. In the table below, we detail the relative contributions of each of the six capital accumulation sources under bear, base, and bull cases:

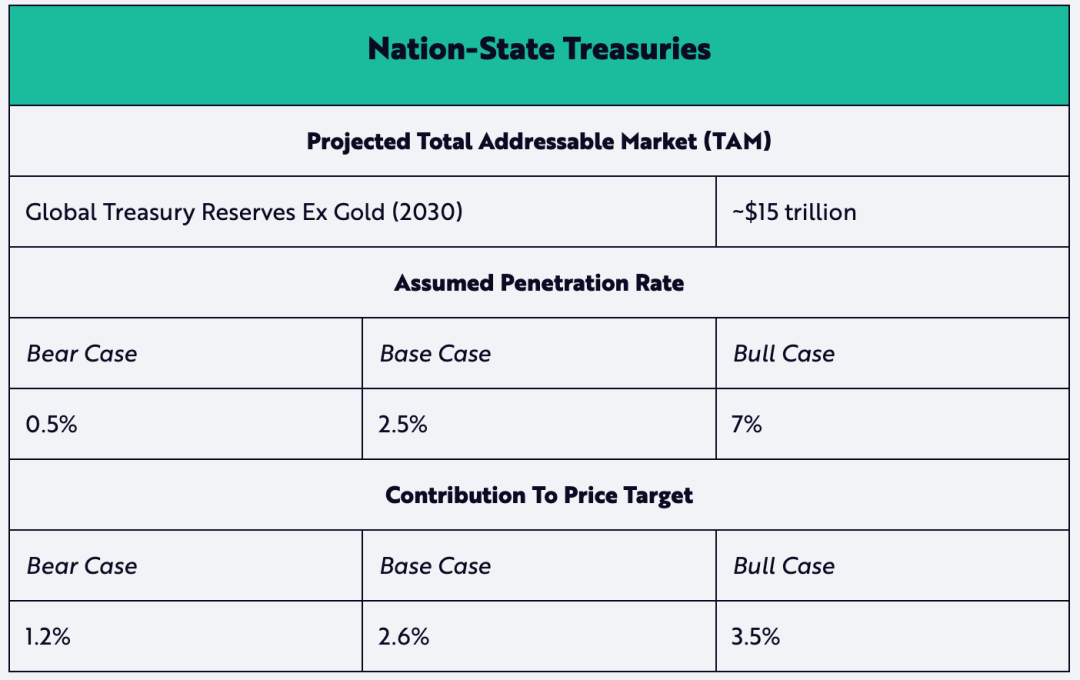

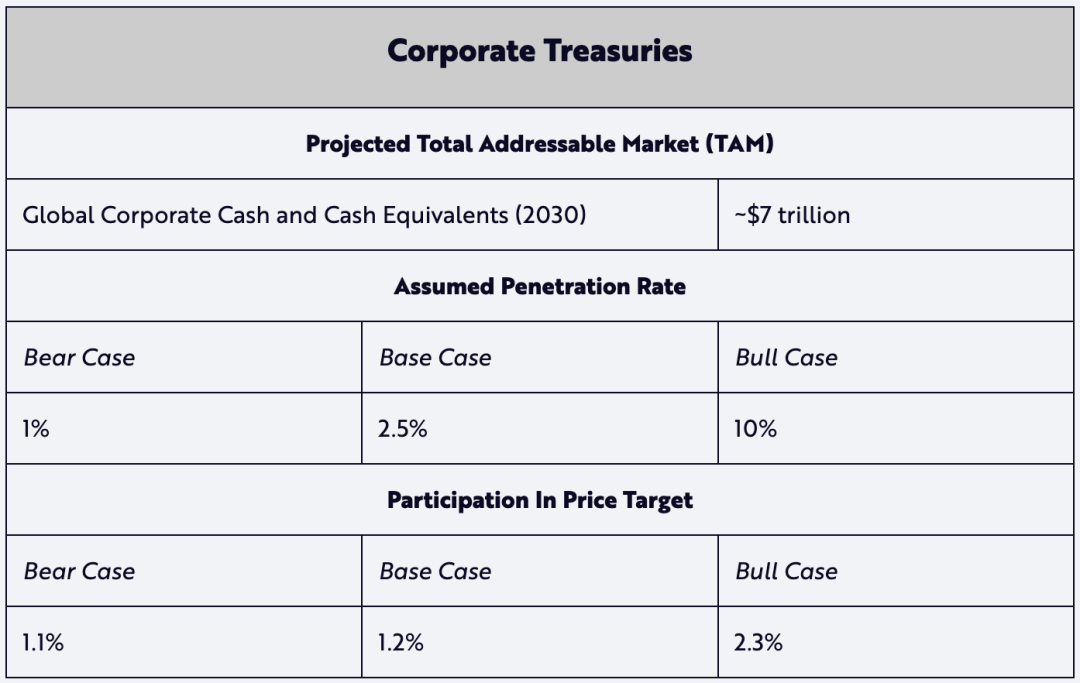

Odaily Planet Daily Note: The following charts show the estimated TAM for each market segment in 2030, Bitcoin’s penetration rate under three market conditions, and the contribution proportions depicted in the chart above.

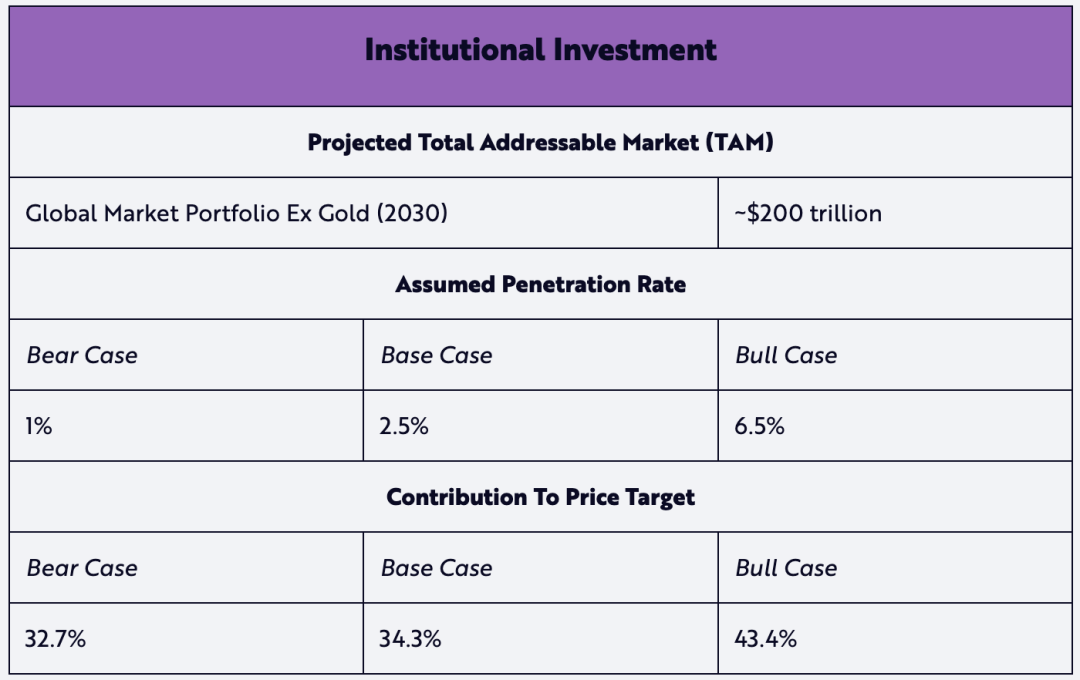

1. Potential Capital Accumulation Contributor: Institutional Investment

According to State Street, the global market portfolio is defined as:

The market capitalization of all investable capital assets divided by the sum of all asset market caps. As the aggregate outcome of collective decisions made by investors, issuers, capital suppliers, and demanders, the global market portfolio can be viewed as a practical representation of the entire set of investable opportunities available globally.

As of 2024, the TAM of the global investment portfolio was approximately $169 trillion (excluding gold’s 3.6% share). Assuming a 3% annual CAGR, its value would reach about $200 trillion by 2030.

We assume penetration rates of 1% and 2.5% for bear and base cases respectively—both below gold’s current 3.6% share—representing conservative views on Bitcoin adoption. In a more aggressive bull case, we assume Bitcoin reaches a 6.5% penetration rate, nearly double gold’s current share.

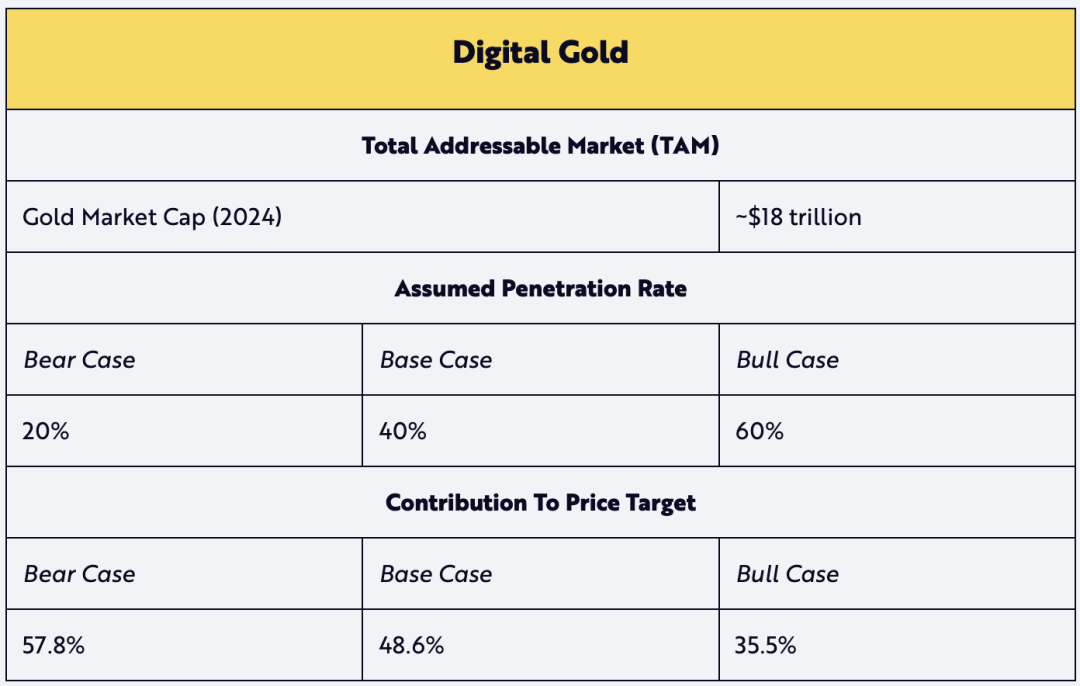

2. Potential Capital Accumulation Contributor: Digital Gold

The digital gold contribution assumes a TAM ratio relative to gold’s current market cap. Given favorable penetration assumptions, we assume no growth in gold’s expected TAM by 2030, effectively lowering its projected value. We believe the narrative of Bitcoin as digital gold remains compelling and will drive higher adoption rates.

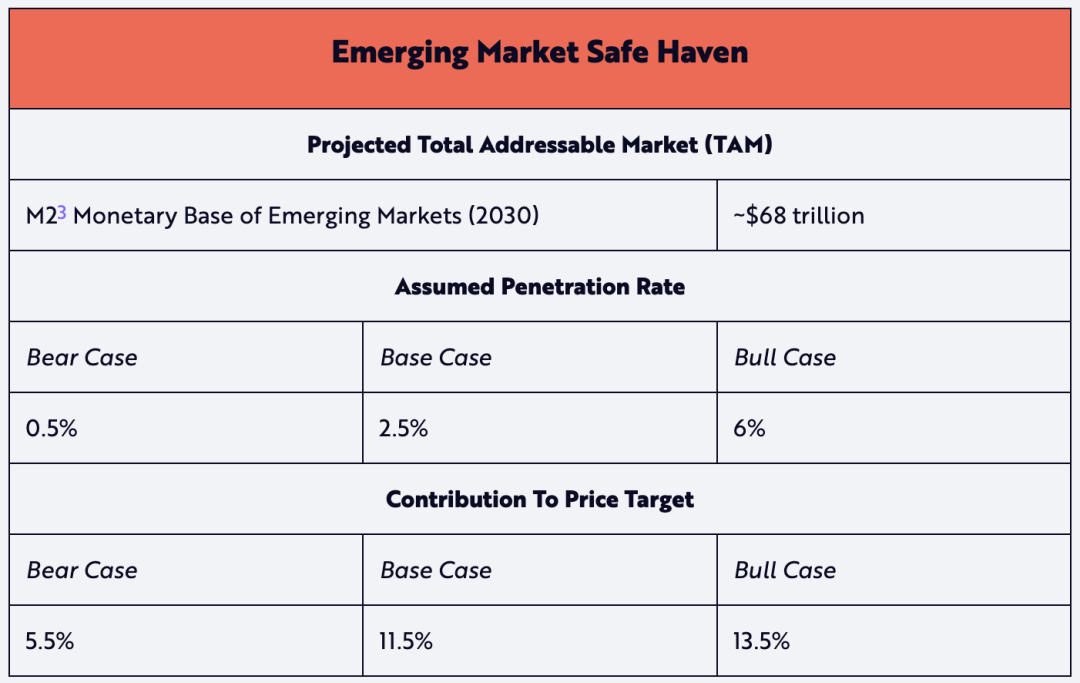

3. Potential Capital Accumulation Contributor: Emerging Market Safe Haven

The TAM for the emerging market safe haven use case is based on the monetary base of all developing countries (defined by IMF/CIA, also known as “non-developed” economies). We believe this use case holds the greatest potential for capital appreciation. Beyond its store-of-value properties, Bitcoin’s low entry barrier offers internet-connected individuals an investment option that could generate long-term capital gains—unlike defensive positions in currencies like the U.S. dollar—thus preserving purchasing power and hedging against local currency depreciation.

Odaily Planet Daily Note: “M2” is a measure of U.S. money supply, including M1 (currency and deposits held by non-bank public, checkable deposits, and traveler’s checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and retail money market mutual fund shares.

4. Potential Capital Accumulation Contributor: National Treasury Reserves

While El Salvador and Bhutan currently lead in national-level Bitcoin adoption, advocates for strategic Bitcoin reserves are growing—especially after Trump took office and issued an executive order on March 6 calling for the establishment of a U.S. BTC reserve. Although our bear and base case assumptions remain conservative, we believe real-world developments in the U.S. could further validate our bull case assumption of 7% penetration.

5. Potential Capital Accumulation Contributor: Corporate Treasury Reserves

Inspired by Strategy (MicroStrategy)'s successful Bitcoin purchases since 2020, other companies have begun adding Bitcoin to their corporate treasury reserves. By the end of 2024, around 74 publicly listed companies held approximately $55 billion worth of Bitcoin on their balance sheets. If this corporate BTC strategy proves successful over the next six years, our conservative penetration assumptions under bear and base cases (1% and 2.5%, respectively) might eventually converge toward the 10% assumed in the bull case.

6. Potential Capital Accumulation Contributor: Bitcoin On-Chain Financial Services

Native financial services on Bitcoin are emerging as new contributors to capital accumulation. Notable examples include Layer 2 solutions like the Lightning Network, which aim to scale Bitcoin’s transaction capacity, and Wrapped BTC (WBTC) on Ethereum, enabling Bitcoin to participate in decentralized finance (DeFi). These on-chain financial services are becoming increasingly important features of the Bitcoin ecosystem. Therefore, we consider a 40% CAGR for the base case scenario from now until 2030 to be a realistic expectation.

ARK’s Assumptions Applied to Active Bitcoin Supply

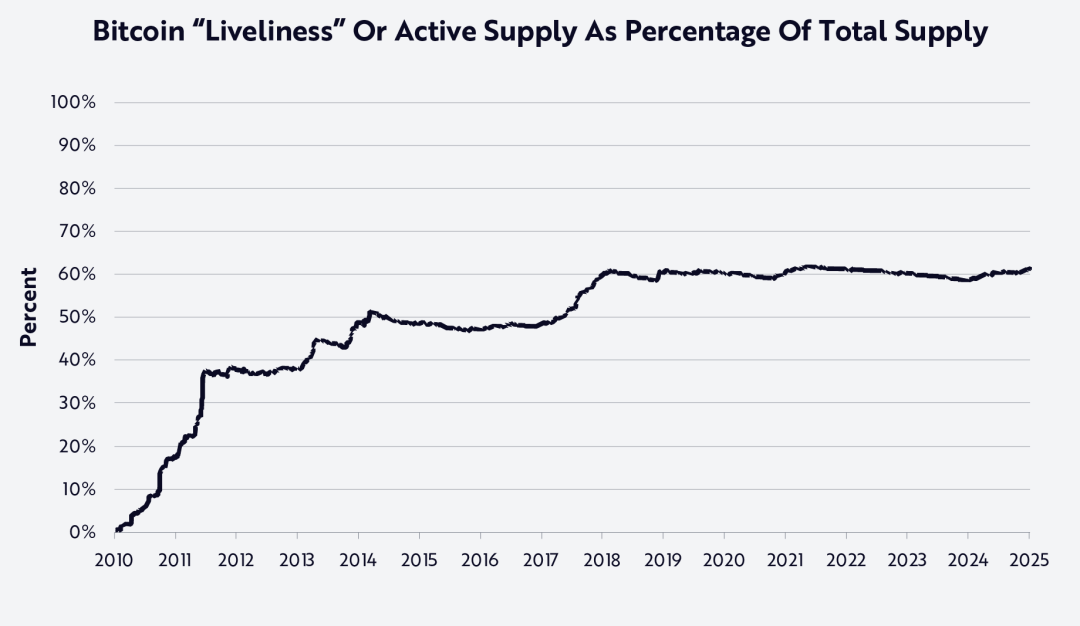

Although not included in ARK’s Big Ideas 2025 report, alternative experimental models have been used to estimate Bitcoin’s 2030 price. One such method involves calculating lost or long-held Bitcoins, leveraging Bitcoin’s on-chain transparency to estimate liquid supply—what we refer to as “active” supply.

Under this approach, active supply can be calculated by multiplying Bitcoin’s projected 2030 supply by a “liveliness” metric, which measures the movement of Bitcoin over time on a scale from 0% to 100%—in other words, the true “float” of the asset—as shown below:

As shown, Bitcoin’s network liveliness has remained around 60% since early 2018. We interpret this level of activity to mean that roughly 40% of the supply is “vaulted”—stored and unlikely to enter the market (e.g., Satoshi Nakamoto’s addresses)—a concept we explore in depth in ARK’s white paper Cointime Economics: A New Framework for Bitcoin On-Chain Analysis (https://www.ark-invest.com/white-papers/cointime-economics).

We then apply the same bear and base case TAM and penetration assumptions to a scenario where active supply reaches 60% by 2030 (assuming stable liveliness over time), as illustrated below:

Based on this adjustment, we arrive at the following price targets—approximately 40% higher than our base model, which does not account for active supply or network liveliness:

This model suggests revised Bitcoin price estimates for 2030 incorporating the active supply metric: $500,000 (bear case), $1.2 million (base case), and $2.4 million (bull case).

Importantly, valuations derived from this more experimental method are significantly more aggressive than those from our standard bear, base, and bull cases. Since our official price targets lean conservative and focus only on total Bitcoin supply, we acknowledge that this experimental approach highlights Bitcoin’s scarcity and supply attrition—factors largely unaccounted for in most current valuation models.

Bonus Section

I briefly reviewed the Cointime Economics framework, which introduces a novel system for analyzing Bitcoin valuation and inflation rates. By measuring Bitcoin’s “liveliness” and “vaultedness,” it assesses economic states and supply dynamics on the network, allowing classification of supply into active and dormant categories.

The framework also proposes a new unit of measurement called the “coinblock.” Coinblocks provide a fresh set of on-chain metrics to gauge Bitcoin activity, calculated as the product of holding duration and quantity of Bitcoin. It introduces three key concepts: “coinblock creation,” “coinblock destruction,” and “coinblock storage,” forming the basis for a suite of new economic indicators—such as Bitcoin’s liveliness and lock-up degree—to capture dynamic changes and economic conditions in the Bitcoin market. Additionally, case studies demonstrate the potential of Cointime Economics to enhance valuation models, measure supply activity, and build new analytical frameworks. The coinblock concept and Cointime Economics framework may become central references for Bitcoin valuation in the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News