By: Jin Lu

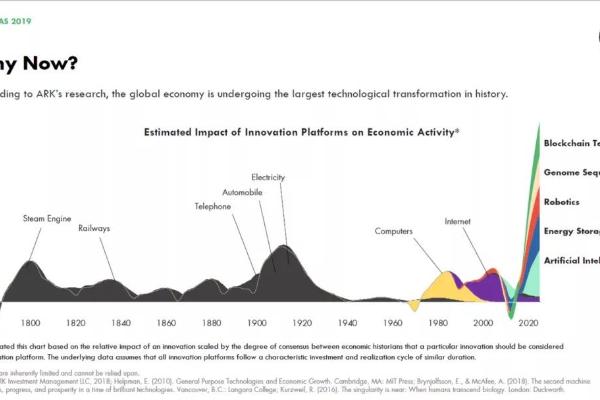

Recently, Cathie Wood's ARK Invest released its annual research report, "Big Ideas 2023." Since its launch in 2017, this series has drawn significant attention from industry professionals.

This year’s report spans 153 pages and provides an overview of the latest global trends in technological convergence, covering 13 innovation sectors including AI, digital wallets, electric vehicles (EVs), and aerospace.

-

The report forecasts that AI training costs will continue to decline at a rate of 70% per year through 2030. For example, training a large language model to GPT-3 levels cost nearly $4.6 million in 2020 but dropped sharply to $450,000 by 2022.

-

Regarding cryptocurrencies, ARK Invest estimates that crypto assets and smart contracts could reach market caps of $20 trillion and $5 trillion respectively over the next decade. The report predicts bitcoin will hit $1 million per coin by 2030.

-

In the EV sector, ARK forecasts prices will fall while sales volumes increase more than sevenfold—or grow at around 50% annually—from approximately 7.8 million units in 2022 to 60 million by 2027.

Below is a condensed version of the report. This article does not constitute investment advice but serves only as a reference for industry trend analysis (click on images for optimal landscape viewing):

01 Technological Convergence Creates Exponential Growth Potential

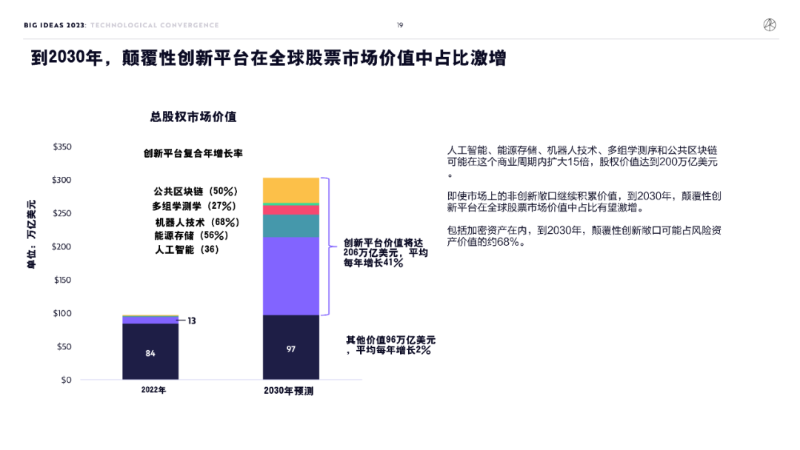

According to ARK’s research, five major innovation platforms are converging, creating unprecedented growth trajectories. Artificial intelligence (AI) acts as the most critical catalyst, cascading1 into all other technologies. Over this business cycle, disruptive innovation platforms are expected to grow at a compounded annual rate of 40%, increasing from today’s $13 trillion to $200 trillion by 2030. By then, market value tied to disruptive innovations may dominate the global stock market.

// Editor’s Note 1: Cascading refers to a key concept in relational mapping where associated objects automatically perform the same operation when the primary object executes an action.

1. Public Blockchains

Once widely adopted, all funds and contracts will migrate onto public blockchains, enabling verification of digital scarcity and ownership. The financial ecosystem may be restructured to accommodate the rise of cryptocurrencies and smart contracts.

These technologies enhance transparency, reduce influence from capital and regulatory controls, and lower contract execution costs. In such a world, as more assets become money-like, businesses and consumers will adapt to new financial infrastructures, making digital wallets increasingly important. Existing corporate structures may also come under scrutiny.

2. Artificial Intelligence

Data-driven computing systems and software can solve complex problems, automate knowledge work, and accelerate integration of technology across every economic sector.

Neural network adoption may prove even more transformative than the introduction of the internet, potentially unlocking $10 trillion in value.

At scale, these systems will demand unprecedented computational resources. AI-optimized hardware is likely to dominate next-generation cloud data centers used for training and running AI models—ultimately delivering massive benefits to end users. AI-powered smart devices will permeate daily life, transforming how people consume, work, and entertain themselves.

AI applications will transform every field, impact every business, and drive progress across all innovation platforms.

3. Multi-Omics Sequencing2

The cost of collecting, sequencing, and interpreting digital biological data is plummeting. Multi-omics technologies provide researchers, therapeutic developers, and health platforms with unprecedented access to DNA, RNA, proteins, and digital health data.

Cancer care should evolve with the development of pan-cancer blood tests. Multi-omics data, combined with emerging gene-editing tools, could fuel precision therapies targeting rare and chronic diseases. Multi-omics may unlock entirely new programmable biology capabilities—including designing and synthesizing novel biological structures with cross-industry applications, especially in agriculture and food production.

// Editor’s Note 2: Multi-omics sequencing involves simultaneous analysis across multiple omics layers—such as proteomics, microbiome, transcriptomics, and metabolomics—and links them via gene expression rules.

4. Energy Storage

Declining costs of advanced battery technologies will enable dramatic changes in form factors, making autonomous mobility systems viable and significantly reducing transportation costs for people and goods. Falling electric drivetrain costs could unlock micro-mobility3 and aerial systems—including flying taxis—enabling business models that reshape urban landscapes.

Autonomous driving could drastically reduce costs for taxis, deliveries, and surveillance, enabling frictionless transport that accelerates e-commerce and reduces car ownership. Combined with large-scale stationary batteries, these innovations will accelerate energy transition, displace liquid fuels, and push power infrastructure toward the edge of the grid.

// Editor’s Note 3: Micro-mobility refers to mobility enabled by vehicles or devices weighing less than 500 kg.

5. Robotics

Fueled by AI, adaptive robots should collaborate closely with humans, reshaping how products are manufactured and sold. 3D printing will digitize manufacturing, improving performance and precision of end-use parts while enhancing supply chain resilience.

Meanwhile, the world’s fastest robot—the “reusable rocket”—should continue lowering satellite network launch costs and enable uninterrupted connectivity. As an emerging innovation platform, robotics can dramatically reduce costs related to hypersonic flight distances, complexity in 3D printing, and production of AI-powered robots.

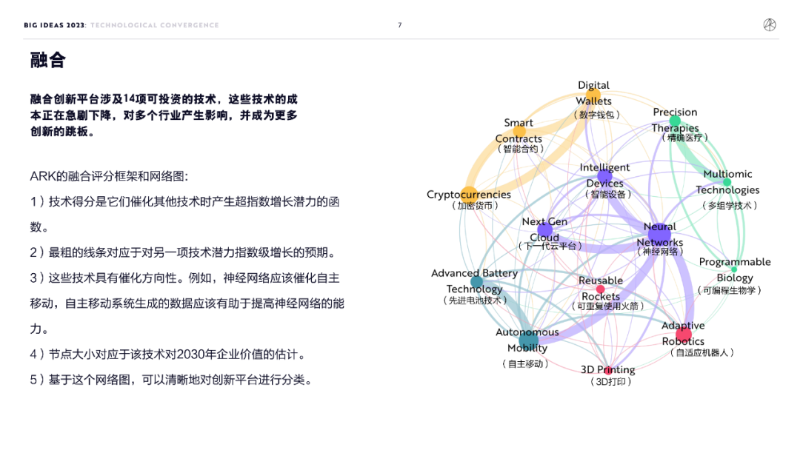

02Convergent Platforms Involve 14 Investable Technologies

Convergent innovation platforms encompass 14 investable technologies whose costs are falling rapidly, impacting multiple industries and serving as springboards for further innovation.

ARK’s convergence scoring framework and network diagram:

1) Technology scores reflect their potential to generate hyper-exponential growth when catalyzing other technologies.

2) The thickest lines represent expectations of exponential potential amplification between technologies.

3) These technologies exhibit directional catalysis. For instance, neural networks should catalyze autonomous mobility, while data generated by autonomous systems should enhance neural network capabilities.

4) Node size corresponds to estimated enterprise value of the technology by 2030.

5) This network diagram enables clear classification of innovation platforms.

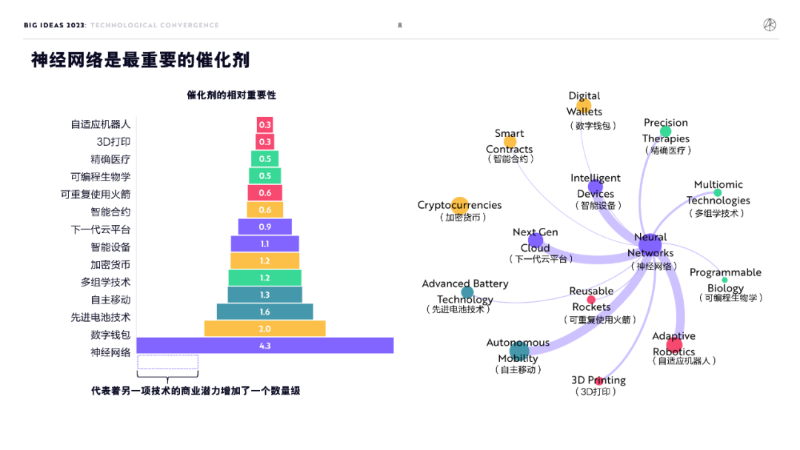

1. Neural Networks Are the Most Important Catalyst

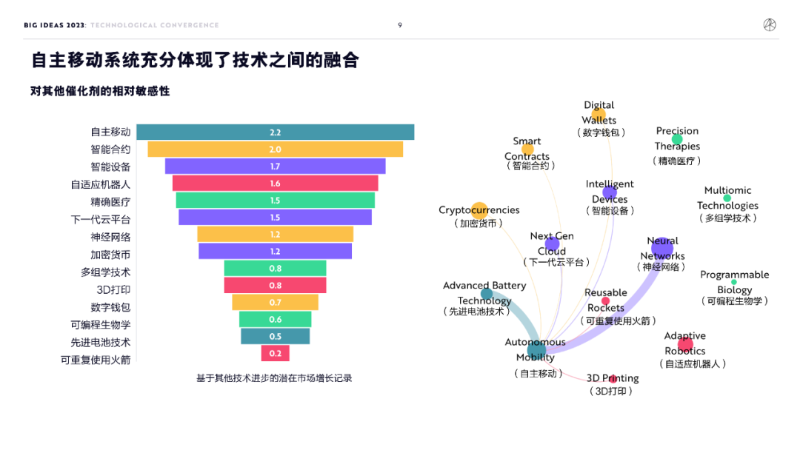

2. Autonomous Mobility Systems Fully Reflect Technological Convergence

3. AI Chatbots Will “Drive” Autonomous Taxis

Tesla applies transformer-based neural networks to language translation solutions to help its vehicles understand complex intersections and drivable roads.

The pace of AI innovation strengthens our confidence in the commercial viability of autonomous taxis and other autonomous mobility systems. Neural network performance is beginning to surpass humans in multiple domains—including autonomous driving. Improvements in neural network performance will make scalable autonomous taxi systems safer than human drivers in almost all scenarios.

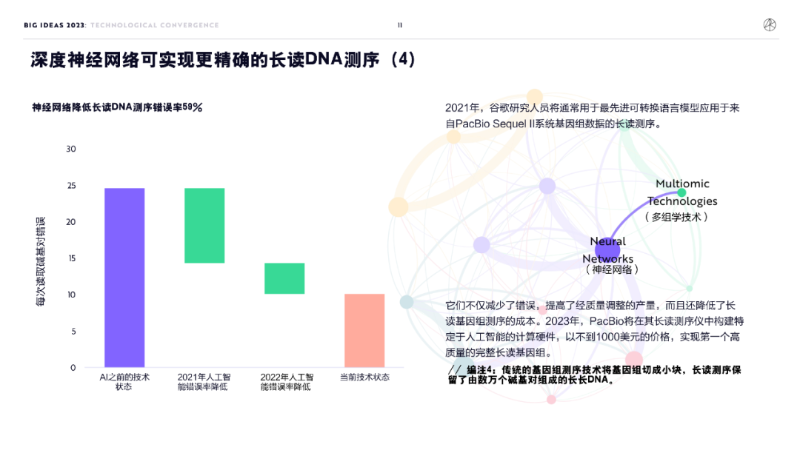

4. Deep Neural Networks Enable More Accurate Long-Read DNA Sequencing4

In 2021, Google researchers applied state-of-the-art transformer language models to long-read sequencing data from PacBio Sequel II systems. This reduced errors, improved quality-adjusted yield, and lowered long-read genome sequencing costs. In 2023, PacBio will integrate AI-specific computing hardware into its long-read sequencers, achieving the first high-quality, complete long-read genome for under $1,000.

// Editor’s Note 4: Traditional genome sequencing fragments the genome; long-read sequencing preserves long DNA strands composed of tens of thousands of base pairs.

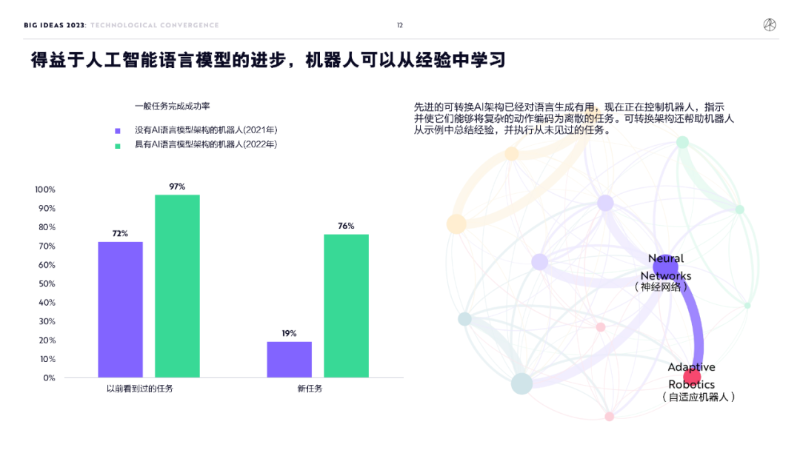

5. Thanks to Advances in AI Language Models, Robots Can Learn from Experience

Advanced transformer AI architectures, initially useful for language generation, are now being used to control robots—directing them and enabling encoding of complex actions into discrete tasks. Transformer architectures also help robots generalize from examples and execute tasks they’ve never seen before.

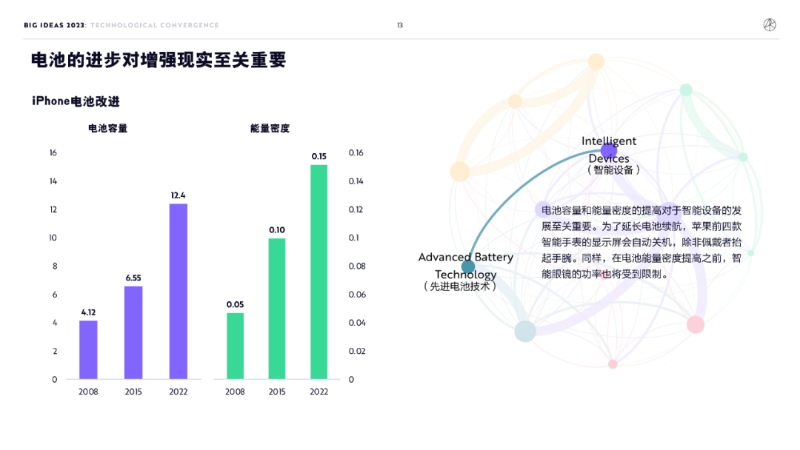

6. Battery Advancements Are Crucial for Augmented Reality

Increased battery capacity and energy density are crucial for smart device development. To extend battery life, Apple’s first four smartwatches automatically turn off displays unless the user raises their wrist. Similarly, until battery energy density improves, smart glasses will remain power-constrained.

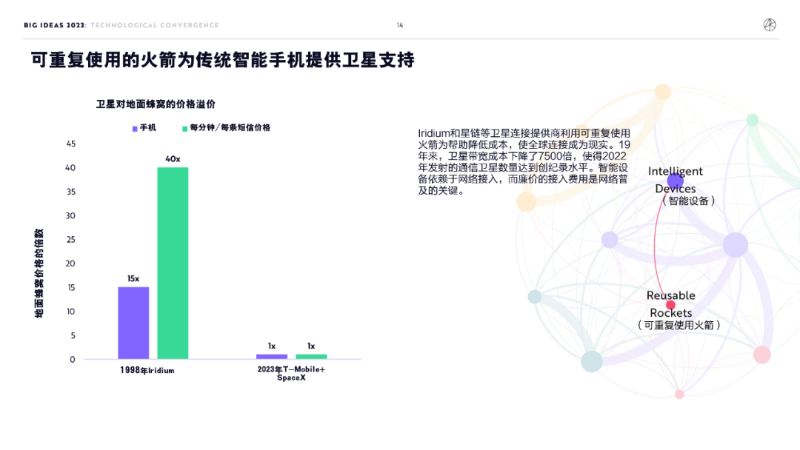

7. Reusable Rockets Provide Satellite Connectivity for Traditional Smartphones

Satellite connectivity providers like Iridium and Starlink use reusable rockets to lower costs and enable global connectivity. Over 19 years, satellite bandwidth costs have dropped 7,500-fold, leading to a record number of communication satellites launched in 2022. Smart devices rely on network access, and affordable connectivity is key to widespread adoption.

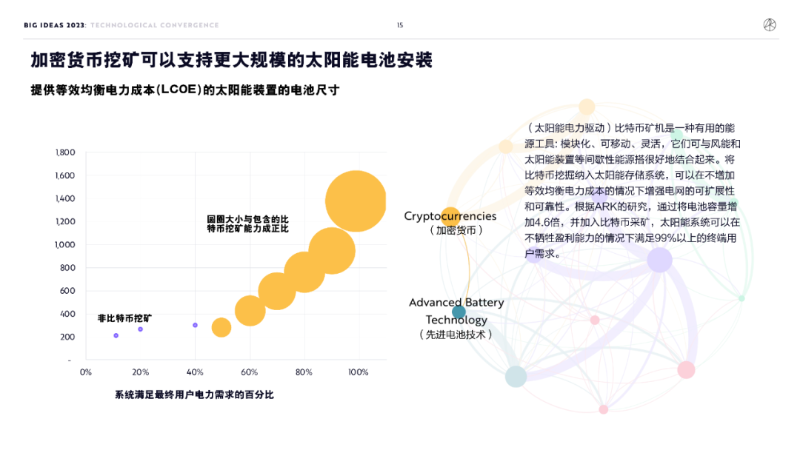

8. Cryptocurrency Mining Can Support Larger-Scale Solar Panel Installations

(Solar-powered) bitcoin miners serve as valuable energy tools: modular, mobile, and flexible, they integrate well with intermittent energy sources like wind and solar. Incorporating bitcoin mining into solar storage systems can enhance grid scalability and reliability without increasing equivalent levelized electricity costs.

According to ARK’s research, by increasing battery capacity 4.6-fold and adding bitcoin mining, solar systems can meet over 99% of end-user demand without sacrificing profitability.

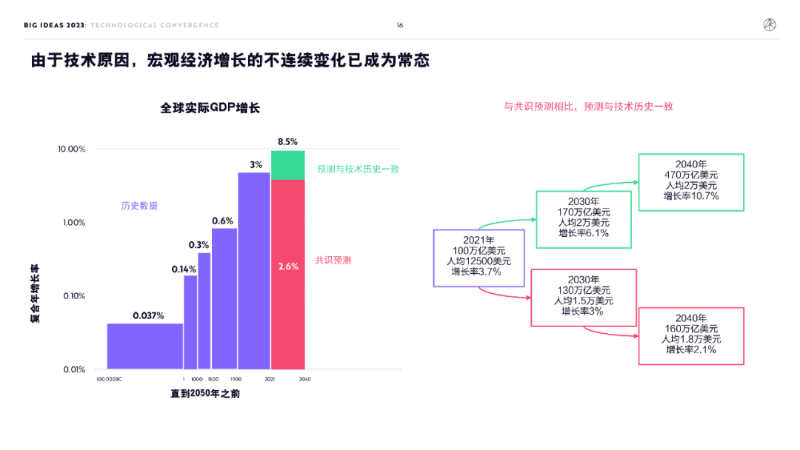

9. Discontinuous Changes in Macroeconomic Growth Have Become Normal Due to Technology

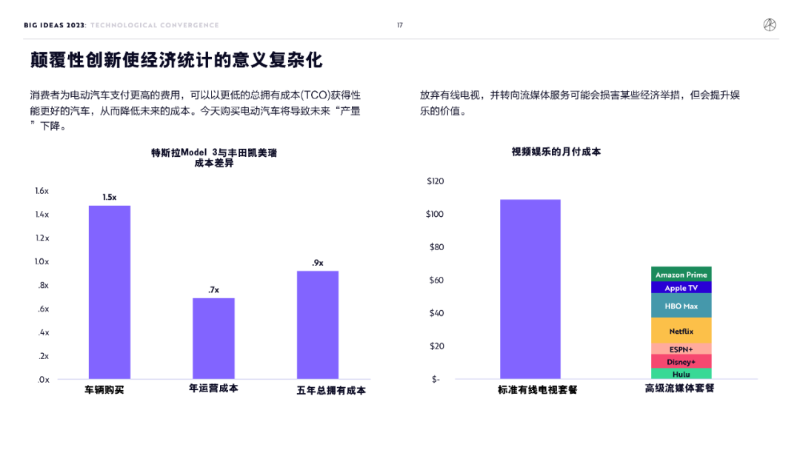

10. Disruptive Innovations Complicate the Meaning of Economic Statistics

Consumers pay higher upfront prices for EVs but gain better-performing cars with lower total cost of ownership (TCO), reducing future expenses. Purchasing EVs today leads to lower “output” in future metrics. Cutting cable TV and switching to streaming services may hurt certain economic indicators but increases entertainment value.

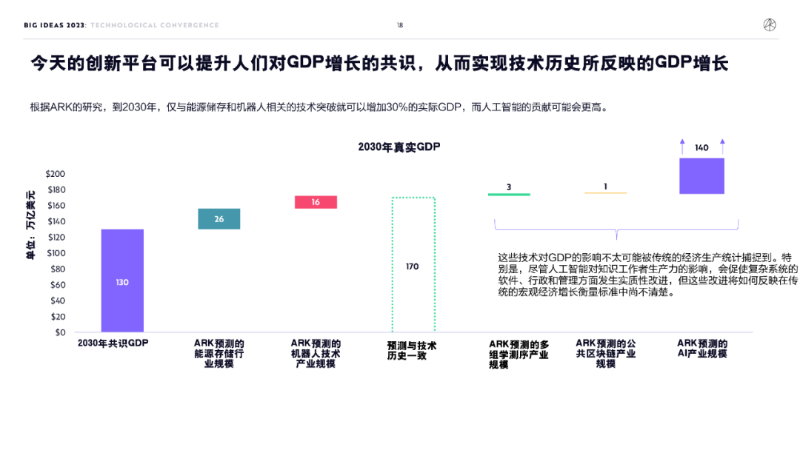

11. Today’s Innovation Platforms Could Lift Consensus on GDP Growth to Match Historical Trends Reflected in Technology

According to ARK’s research, breakthroughs related to energy storage and robotics alone could boost real GDP by 30% by 2030, with AI contributing even more. These impacts are unlikely to be fully captured by traditional economic output statistics. While AI improvements in knowledge worker productivity will lead to substantial advances in software, administration, and management of complex systems, it remains unclear how these will translate into conventional macroeconomic growth measures.

12. By 2030, Disruptive Innovation Platforms Will Surge in Share of Global Stock Market Value

AI, energy storage, robotics, multi-omics sequencing, and public blockchains could expand 15-fold within this business cycle, reaching an equity value of $200 trillion.

Even if non-innovative exposures continue accumulating value, disruptive innovation platforms are poised to surge in share of global stock market value by 2030. Including crypto assets, disruptive innovation exposure could account for about 68% of risk asset value by 2030.

03Electric Vehicles

1. Outperforming Skeptics Through Exponential Growth

Investors once questioned whether the future would be electric. Despite temporary pauses in cost declines due to commodity price volatility, demand for EVs has expanded. Now, investors question whether this growth can remain exponential.

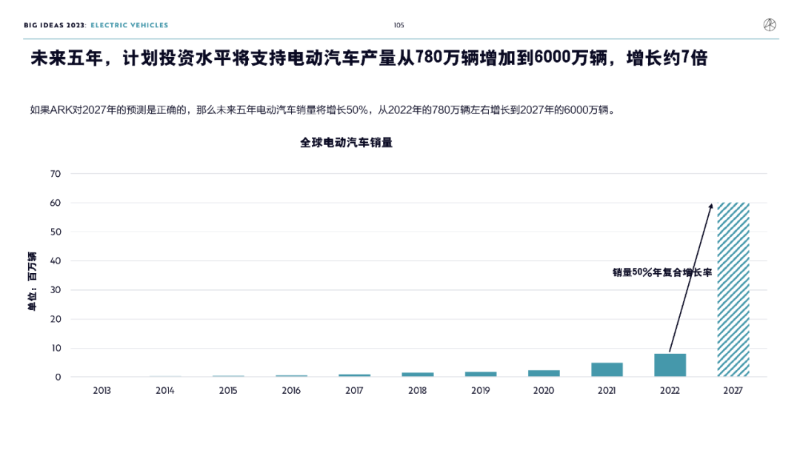

The debate around EVs has shifted from demand to supply. Based on Wright’s Law, ARK predicts EV prices will fall while sales volumes increase more than sevenfold—or grow at ~50% annually—from ~7.8 million in 2022 to 60 million by 2027.

Our biggest downside risk stems from persistent supply constraints affecting pricing and the pace at which legacy automakers transition to EVs.

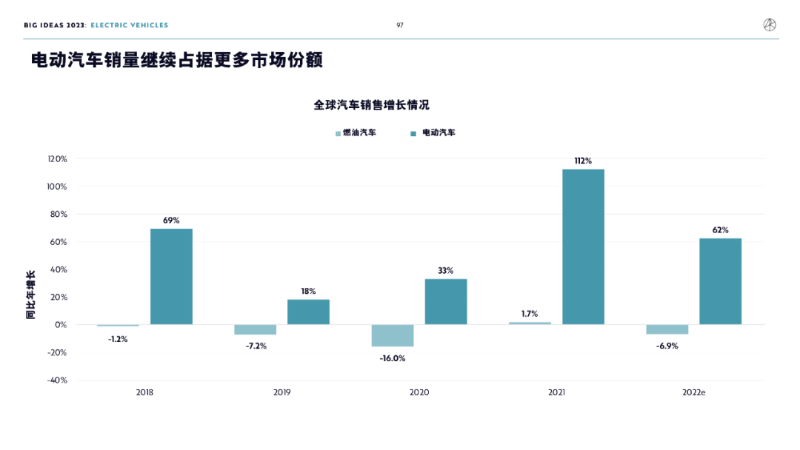

2. EV Sales Continue Capturing Greater Market Share

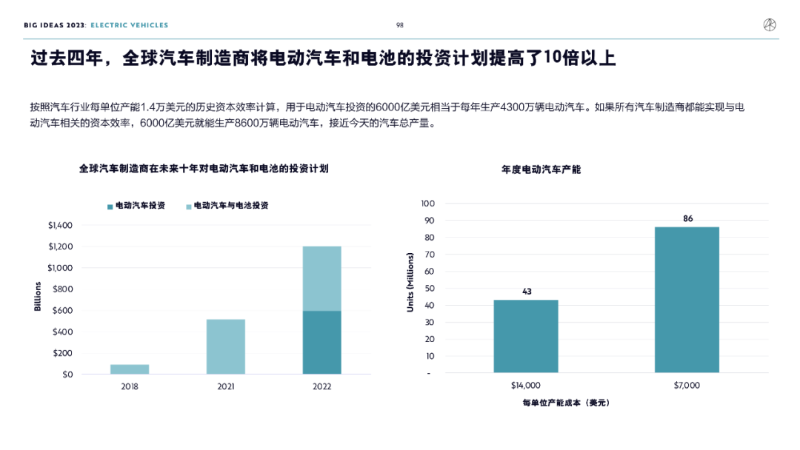

3. Over the Past Four Years, Global Automakers Have Increased Investment Plans in EVs and Batteries by More Than 10x

Based on the historical capital efficiency of $14,000 per unit of capacity in the auto industry, $600 billion invested in EVs equates to annual production capacity of 43 million EVs. If all automakers achieve capital efficiency comparable to EV-focused producers, $600 billion could produce 86 million EVs—approaching today’s total global vehicle output.

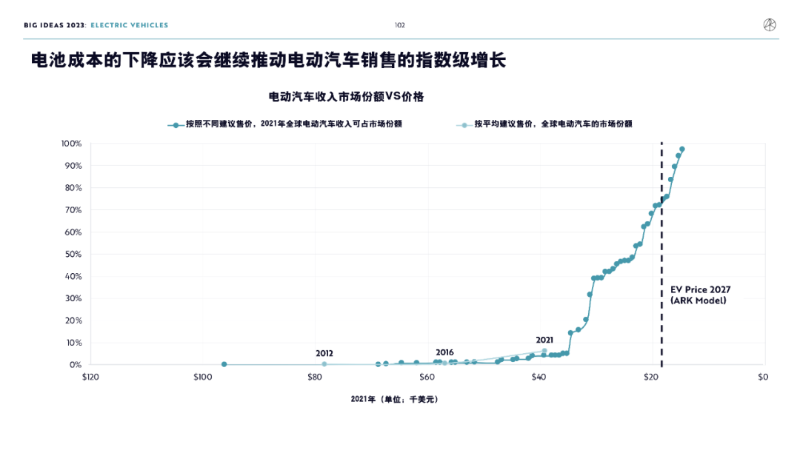

4. Declining Battery Costs Should Continue Driving Exponential Growth in EV Sales

5. Despite Exponential Growth in EV Sales, Common Forecasts Remain Linear

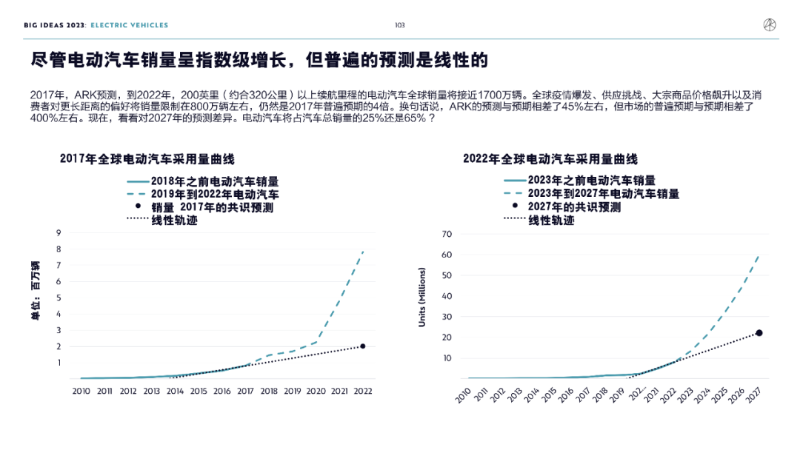

In 2017, ARK predicted that global sales of EVs with over 200-mile (~320 km) range would approach 17 million by 2022.

Global pandemic disruptions, supply challenges, soaring commodity prices, and consumer preference for longer ranges limited sales to around 8 million—still four times higher than common expectations in 2017.

In other words, ARK’s forecast was off by ~45%, while the market consensus was off by ~400%.

Now consider the divergence in 2027 forecasts: Will EVs account for 25% or 65% of total vehicle sales?

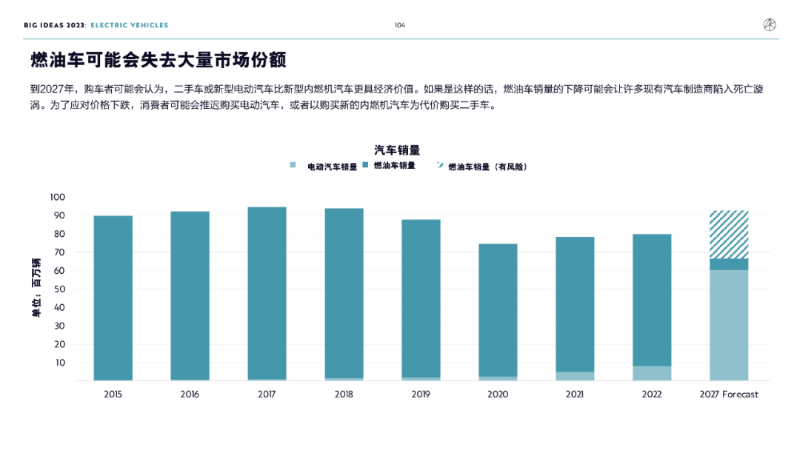

6. Gas-Powered Cars May Lose Significant Market Share

By 2027, buyers may perceive used or new EVs as more economically valuable than new internal combustion engine (ICE) vehicles. If so, declining ICE sales could plunge many incumbent automakers into a death spiral. Facing falling prices, consumers might delay EV purchases or opt for used cars instead of new ICE vehicles.

7. Planned Investment Levels Over the Next Five Years Will Support EV Output Growth from 7.8 Million to 60 Million—An Increase of ~7x

If ARK’s 2027 forecast proves accurate, EV sales will grow ~50% annually over the next five years, rising from ~7.8 million in 2022 to 60 million in 2027.

04Digital Consumption

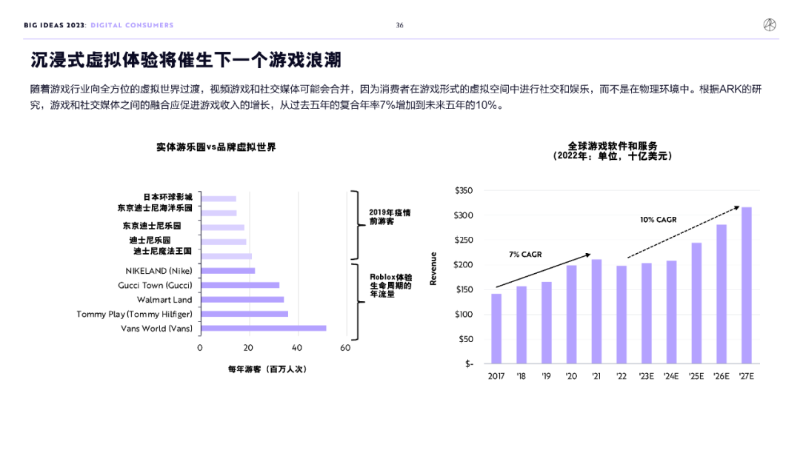

1. Immersive Virtual Experiences Will Spark the Next Wave of Gaming

As the gaming industry transitions toward full virtual worlds, video games and social media may converge, with consumers socializing and entertaining themselves in game-like virtual spaces rather than physical environments. According to ARK, this fusion should boost gaming revenue growth from a 7% CAGR over the past five years to 10% over the next five.

2. NFT Trading and Creation Diverged During the Bear Market

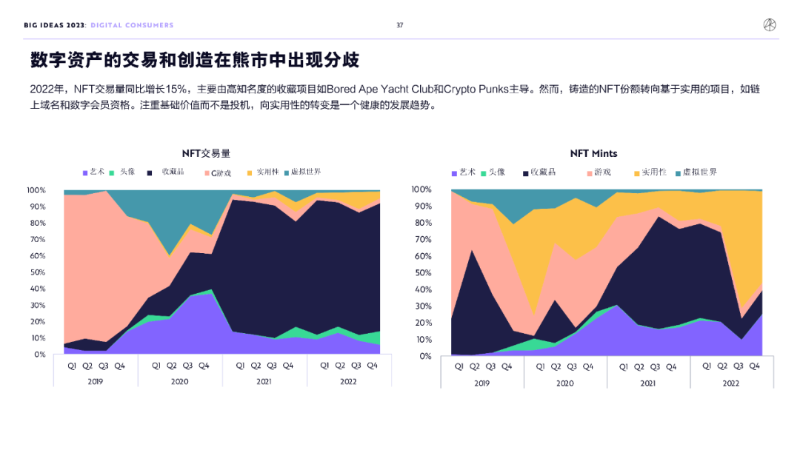

In 2022, NFT trading volume grew 15% YoY, led by high-profile collectible projects like Bored Ape Yacht Club and CryptoPunks.

However, newly minted NFTs shifted toward utility-based projects such as on-chain domains and digital memberships. This shift toward fundamentals over speculation represents a healthy trend.

3. Digital Wallets: Disintermediating Traditional Banks

With billions of consumers and millions of merchants joining, digital wallets could transform economic activity tied to traditional payment transactions, saving nearly $50 billion in costs.

Digital wallets currently have 3.2 billion users, already penetrating 40% of the global population. ARK research suggests user numbers will grow ~8% annually, reaching 65% penetration by 2030.

As consumers and merchants adopt digital wallets, usage of traditional checking accounts, credit/debit cards, and merchant accounts should decline—disrupting traditional payment intermediaries: banks.

By cutting out middlemen, digital wallets could facilitate closed-loop transactions accounting for over 50% of total payments. By 2030, this could add $450 billion to the current $1 trillion enterprise value of digital wallet platforms.

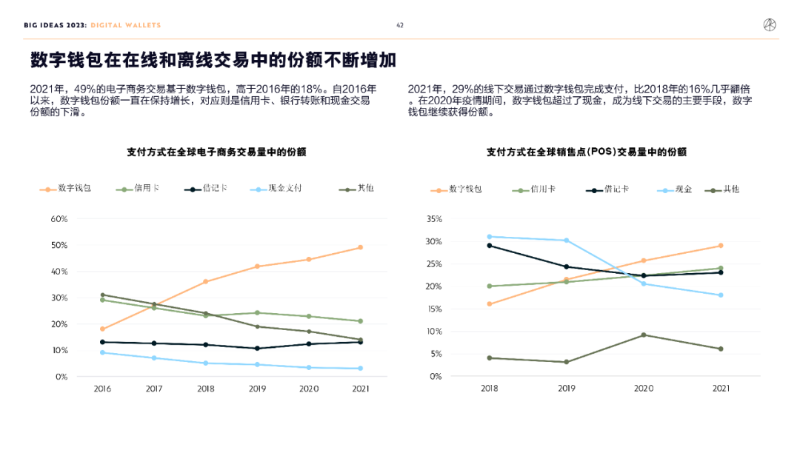

4. Digital Wallets’ Share in Online and Offline Transactions Continues Rising

In 2021, 49% of e-commerce transactions were conducted via digital wallets, up from 18% in 2016. Since 2016, digital wallet share has steadily increased, while shares of credit cards, bank transfers, and cash have declined. In 2021, 29% of offline transactions were paid via digital wallets—nearly double the 16% in 2018. During the 2020 pandemic, digital wallets surpassed cash as the dominant method for offline payments and continue gaining share.

5. Digital Wallets Create Closed-Loop Ecosystems for Consumers and Merchants

After acquiring billions of users, digital wallets are integrating millions of merchants onto their platforms, enabling direct transactions between consumers and merchants outside traditional financial institutions.

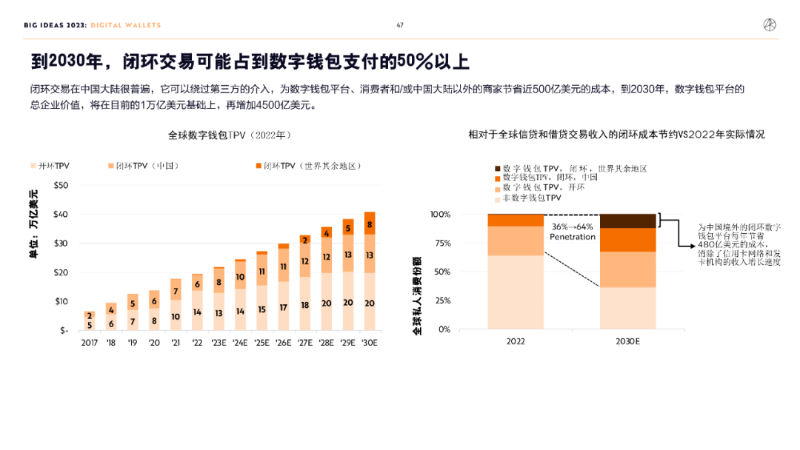

6. By 2030, Closed-Loop Transactions May Account for Over 50% of Digital Wallet Payments

Closed-loop transactions are common in mainland China. By bypassing third-party intermediaries, they save nearly $50 billion in costs for digital wallet platforms, consumers, and/or merchants outside mainland China. By 2030, this could add $450 billion to the current $1 trillion enterprise value of digital wallet platforms.

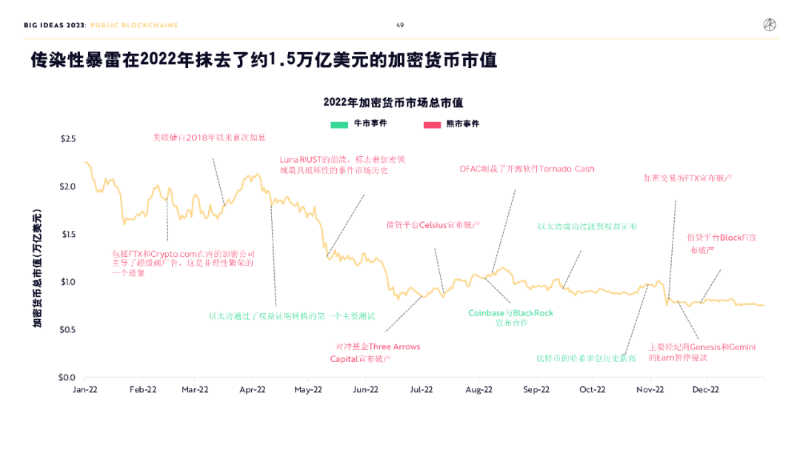

05Public Blockchains: Gaining Momentum Amid Crisis

In 2022, contagious collapses from Terra/LUNA, Three Arrows Capital, Celsius, and FTX/Alameda wiped out around $1.5 trillion in crypto market cap.

Despite the severe downturn, public blockchains continue advancing monetary, financial, and internet transformation. Long-term opportunities in bitcoin, DeFi, and Web3 continue growing.

Cryptocurrencies and smart contracts could reach market values of $20 trillion and $5 trillion respectively over the next decade.

1. Contagious Collapses Wiped Out ~$1.5 Trillion in Crypto Market Cap in 2022

Bear Market Events:

——Crypto firms including FTX and Crypto.com dominated Super Bowl ads, signaling irrational exuberance