What Signals Does ARK Invest's Increased Stake in Coinbase and Reduced Position in Block Convey, and Why Is It So Bullish on Bitcoin?

TechFlow Selected TechFlow Selected

What Signals Does ARK Invest's Increased Stake in Coinbase and Reduced Position in Block Convey, and Why Is It So Bullish on Bitcoin?

Why is ARK Invest so bullish on Bitcoin?

Author: Weilin, PANews

ARK Invest has recently made frequent moves in its holdings of crypto-related companies: On March 10, it purchased 52,753 shares of Coinbase ($9.4 million) through its ARKK fund and 11,605 shares of Coinbase ($2.1 million) via its ARKF fund. On March 14, the firm added another $5.2 million worth of Coinbase stock through ARKK. These three recent purchases of Coinbase total $16.7 million.

Notably, ARK Invest also significantly reduced its position in payments company Block, with sales totaling approximately $30.355 million on March 11, March 12, and March 17.

In this month’s market action, one standout event was Bitcoin’s sharp drop on March 11. However, ARK Invest founder Cathie Wood’s bullish commentary at the time attracted significant market attention. The firm, which manages $6 billion in assets, stated in a letter to investors that it remains optimistic about Bitcoin’s long-term outlook. Why is ARK Invest so firmly bullish on Bitcoin?

Buying $16.7 Million in Coinbase Amid Broader Market Declines, While Sharply Cutting Block

On March 10, as Coinbase’s share price dropped 17.6%, Ark Invest bought 64,358 shares of Coinbase valued at $11.5 million. Specifically, the Ark Innovation ETF (ARKK) acquired 52,753 shares ($9.4 million), while the Ark Fintech Innovation ETF (ARKF) bought 11,605 shares ($2.1 million). In addition, according to trade filings, ARK Invest increased its position by 29,353 shares of Coinbase through its ARK Innovation ETF (ARKK) on March 13, worth approximately $5.2 million. That day, Coinbase's stock fell 7.43%, closing at $177.49. These three recent purchases of Coinbase by ARK Invest amount to a total of $16.7 million.

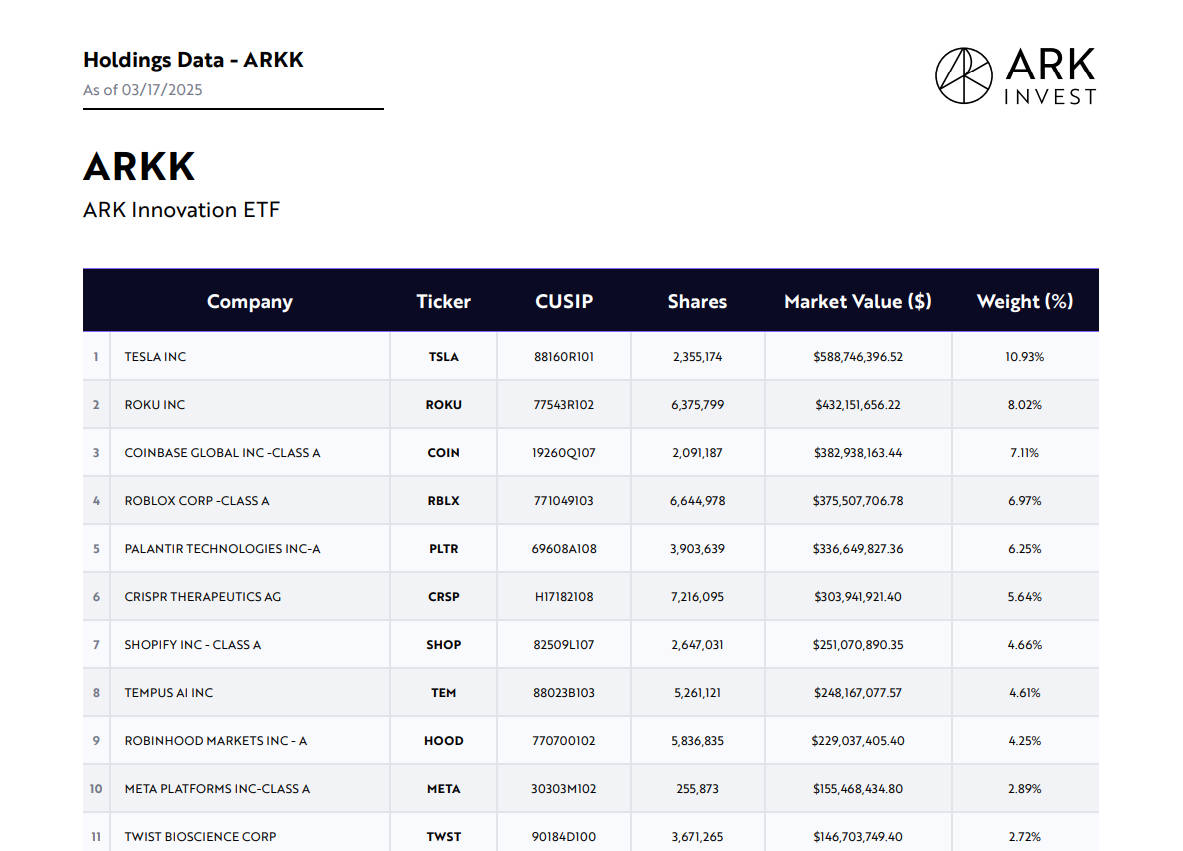

As of March 17, Coinbase ranks as the third-largest holding in ARKK, accounting for 7.11% of the fund with a value of about $383 million, trailing only Tesla and Roku (a U.S. streaming and smart TV company). ARK Invest previously indicated its target is to keep any single stock position below 10% of a fund’s portfolio.

As of March 17, Coinbase is the second-largest holding in ARK’s ARKF fund, representing 7.35% of the fund with a value of approximately $67.17 million, behind only Shopify. In the ARK Next Generation Internet ETF (ARKW), Coinbase ranks fifth after ARK BITCOIN ETF HOLDCO (ARKW), TESLA, Roku, and ROBLOX CORP, with a holding value of about $86.55 million, or 5.78%.

On the sell side, during trading on March 17, ARKW sold 12,881 shares of Block stock. On March 12, Block announced it would become the first North American company to deploy NVIDIA’s DGX SuperPOD and DGX GB200 systems—a major advancement in its open-source generative AI research—with CEO Jack Dorsey forecasting a 30-fold increase in computing power. Nevertheless, Raymond James analyst John Davis noted that the company’s weak Q4 earnings suggest Block stock may not be “for the faint of heart.” ARK Invest sold the shares at $58.65 each on March 17, totaling around $755,000. From March 11 to March 12, ARK Invest sold approximately $29.6 million worth of Block shares.

Bullish on Bitcoin During a Downturn—Why Does ARK Invest Remain Optimistic About Bitcoin’s Long-Term Outlook?

In a recent report to investors, ARK Invest, managing $6 billion in assets, reiterated its optimism about Bitcoin’s long-term prospects. The report states that Bitcoin is currently in an oversold condition. Specifically, in February, Bitcoin’s price declined 17.6%, ending the month at $86,391. As of March 3, Bitcoin’s price sat between the cost basis of short-term holders (STH)—$92,020—and the 200-day moving average—$82,005.

The Fear & Greed Index has reached an “extreme fear” level not seen since mid-2022. Yet ARK Invest believes the market is overreacting to current macroeconomic and geopolitical sentiment, becoming overly pessimistic.

Bitcoin’s Spent Output Profit Ratio (SOPR) has fully retraced to 1. In a bull market, an SOPR of 1 indicates the market is at a breakeven point overall, often coinciding with local bottoms. SOPR tracks realized profits or losses relative to transaction prices.

Additionally, Bitcoin’s rolling four-year compound annual growth rate (CAGR) has dropped to a historic low of just 14%. While this has important implications for Bitcoin as a long-term hold asset, a low CAGR can also signal that Bitcoin is oversold.

Regarding the macro environment, ARK Invest notes that economic indicators—including slowing money velocity and declining consumer confidence—suggest heightened caution among businesses and households during political transitions. According to the University of Michigan Consumer Sentiment Survey, confidence has fallen below pre-election levels. Households appear more cautious, delaying purchases until the impact of new policies becomes clearer. Evidence includes a drop in real consumer spending in January and weaker-than-expected guidance from companies like Walmart and Target.

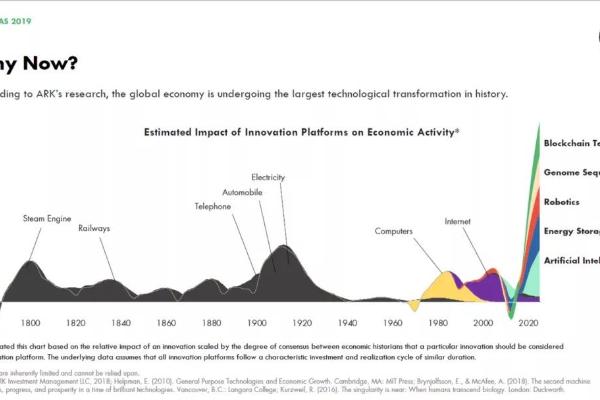

Nearly one-third of the workforce—including federal, state, and local government roles, as well as education and healthcare quasi-government positions—may face concerns over government spending cuts. Despite near-term challenges, potential deregulation in areas such as artificial intelligence (AI) and robotics, tax reductions, and innovation incentives could drive growth and boost productivity over time. Researchers have previously predicted that the convergence of AI and cryptocurrency could add $20 trillion to the global economy by 2030. Earlier, ARK Invest projected in its “Big Ideas 2025” report that Bitcoin could reach between $300,000 and $1.5 million by 2030, with a neutral estimate of $710,000.

In her podcast *In the Know*, Cathie Wood painted a bullish vision in which technological innovation drives real GDP growth beyond historical rates—even as short-term indicators show weakness. She said, “We’re approaching the end of a ‘rolling recession,’” referring to the ongoing sector-by-sector downturn she believes has unfolded since the Federal Reserve began raising rates in 2022. “The bad news is we had to go through this process.” A “rolling recession” describes an economic phenomenon where different industries and sectors experience recessions sequentially, while the broader economy and labor market remain relatively stable.

She later tweeted that the current crisis—the “process” mentioned in her video—could open the door to “deflationary prosperity” by the second half of 2025. Despite present economic softness, Cathie Wood appears aligned with Trump’s optimistic view of America’s economic future, particularly amid the rise of transformative technologies. “We may be standing at the threshold of the most important productivity surge in history,” she said.

Cathie Wood discussed fiscal policy proposals under a potential Trump administration, including a $4.5 trillion tax cut plan already passed by the House Budget Committee. She believes Trump’s fiscal policies, combined with deregulatory efforts, could spark a major economic boom.

She also referenced changes in the cryptocurrency and digital asset space following SEC Chair Gary Gensler’s departure, noting that the industry is now celebrating a “digital asset revolution” at the White House.

To investors, Cathie Wood forecasts a shift in market leadership away from the “Magnificent Seven” tech giants toward a broader set of innovative stocks. She pointed out that while the “Magnificent Seven” have tripled in value over the past five years, truly disruptive innovation stocks have risen only about 30%.

For now, ARK Invest’s optimism about Bitcoin and the U.S. economic outlook appears grounded rather than speculative, offering investors encouragement amid a generally negative market climate. Still, the complexity of markets and real-world uncertainties cannot be ignored. Finding growth drivers within the volatility for the crypto and tech sectors remains a critical challenge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News