2 Months of Profit Exceeding $200 Million: ARK Invest's Cryptocurrency Timing Strategy

TechFlow Selected TechFlow Selected

2 Months of Profit Exceeding $200 Million: ARK Invest's Cryptocurrency Timing Strategy

In the future of crypto, holding underlying assets may be more valuable than holding platforms that trade these assets.

Author: Prathik Desai

Translation: Luffy, Foresight News

Over the past few months, I’ve been tracking ARK Invest’s daily trading activity in crypto companies. The U.S.-based fund manages assets across several ETFs and a venture fund. Their buy-sell strategy reveals an interesting phenomenon: how they achieve such precise timing in a sector that seems notoriously difficult to time.

One move could be luck, two might be intuition, but ARK’s crypto trades display an unusual sense of timing. This is deliberate, not reactive. Evidence? In just June and July, their trades in Coinbase and Circle stock generated over $265 million in profit.

A closer look shows ARK is shifting capital away from exchanges and trading platforms toward infrastructure and asset reserves.

ARK’s recent trades offer a glimpse into how one of the most watched institutional investors optimizes returns for its crypto investors through swift and often precise entry and exit points. This stands in stark contrast to the “diamond hands” (long-term holding) narrative prevalent in crypto—and is far more nuanced.

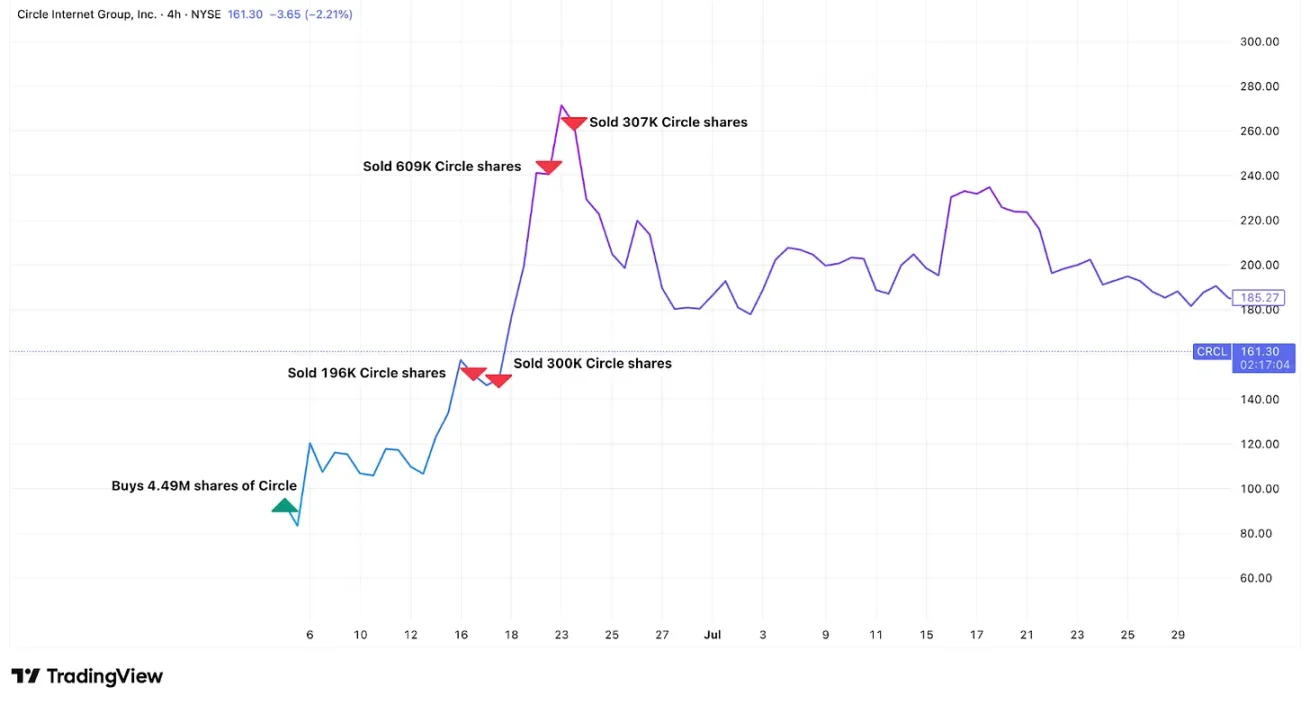

On June 5, 2025, Circle, issuer of the largest regulated stablecoin USDC, listed on the NYSE at $69 per share. As a cornerstone investor, ARK purchased 4.49 million shares through its funds, totaling approximately $373 million.

By June 23, Circle’s stock peaked at $263.45, closing at that level, implying a market cap of about $60 billion—roughly 100% of its then-managed assets. This may reflect optimistic market sentiment around stablecoins, with investors attempting to value Circle at 10x its current assets under management (AUM). But compared to traditional asset managers, this appears wildly inflated. Consider: BlackRock manages $12.5 trillion in assets but has a market cap just above $180 billion—about 1.4% of its AUM. To ARK, this was a signal.

Daily trade filings show that as Circle’s premium surged, ARK systematically sold down its position across multiple funds.

ARK began selling a week before Circle’s peak, offloading around 1.5 million shares (33% of its holdings), cashing out approximately $333 million during the parabolic rise. Compared to their initial cost basis, this yielded over $200 million in profit—a 160% return.

ARK’s interest in hot IPOs didn’t stop there.

Last week, they bought 60,000 shares on Figma’s first trading day. The San Francisco-based design software company disclosed in SEC filings that it holds $70 million in Bitcoin ETFs and has approval to purchase an additional $30 million.

Figma’s stock surged over 200% on its debut, closing at $115.50—a 250% gain. The next day, it rose another 5.8%.

ARK’s recent trades in Coinbase further reveal a systematic profit-taking pattern.

As of April 30, 2025, ARK held 2.88 million shares in the largest U.S. crypto exchange. Since then, they systematically exited positions through late July.

Meanwhile, as Bitcoin hit a record high above $112,000, Coinbase’s stock moved in tandem, briefly surpassing $440—its own all-time high. On July 1, ARK sold $43.8 million worth of shares; on July 21—the very day Coinbase peaked—ARK reduced $93.1 million in stock across three funds. Between June 27 and July 31, ARK sold a total of 528,779 shares (about 20% of its position), valued at over $200 million, at an average price of $385 per share. In contrast, ARK’s weighted average cost basis for accumulating Coinbase over four years was around $260, generating profits exceeding $66 million from these trades.

Over the past two months, Coinbase has ceased to be the top holding in ARK’s fund portfolios.

After markets closed on July 31, Coinbase reported second-quarter earnings that disappointed investors. The next day, its stock plunged 17%, falling from ~$379 to $314. On August 1—the day of the crash—ARK bought $30.7 million worth of Coinbase shares.

These trades are not isolated events, but part of a strategic shift—moving capital from overheated crypto exchange ecosystems into areas only now beginning to attract broad attention.

While selling Coinbase, ARK also reduced its stake in rival Robinhood. Both divestments coincided precisely with ARK’s large-scale investments into BitMine Immersion Technologies, dubbed the “MicroStrategy for Ethereum.” Led by Wall Street veteran Tom Lee, BitMine is building an Ethereum reserve, aiming to hold and stake 5% of the total ETH supply.

On July 22, ARK invested $182 million in BitMine via block trade. But they didn’t stop there—they systematically bought on every significant pullback, pouring over $235 million into the company within just two weeks.

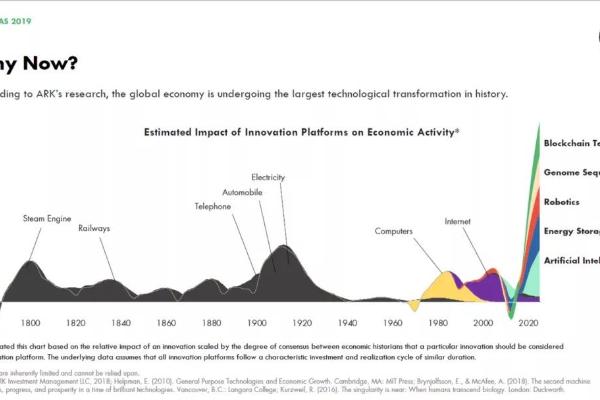

These trades indicate ARK is pivoting from crypto exchanges and payment firms toward what’s known as crypto infrastructure. Coinbase and Robinhood profit from people trading crypto, while BitMine profits from directly holding crypto. Both benefit from crypto adoption, but with different risk profiles.

Exchanges thrive on market volatility and speculation. When crypto prices swing widely, trading volume rises, boosting exchange revenues—but this is cyclical. Reserve-focused firms like BitMine, however, directly benefit from crypto price appreciation: if Ethereum rises 50%, so does BitMine’s asset value, regardless of trading volume or user behavior. Even without capital gains, staking ETH on the network generates steady yield.

But higher returns come with higher risks: reserve firms face direct downside exposure. When ETH falls, BitMine’s asset value declines proportionally, giving reserve strategies a higher beta (risk coefficient).

ARK’s trades reflect a belief in crypto’s evolution: Crypto is transitioning from a speculative trading arena to mature, permanent financial infrastructure. In such a world, holding the underlying assets may be more valuable than holding platforms that facilitate trading them.

The fascinating aspect of these trades is their timing precision. They sold throughout Circle’s euphoric rally, right up to the peak; captured Figma’s 250% IPO surge; exited Coinbase at its top and re-entered after a 17% post-earnings crash; bought BitMine repeatedly on pullbacks.

ARK’s methodology blends traditional value investing with tactical timing: when Circle’s market cap reached 100% of its AUM, it may have been overvalued; when Coinbase dropped 17% on weak earnings, it may have been undervalued. ARK also appears to time trades around predictable events—earnings releases, regulatory decisions, market volatility.

There’s a deeper question: why do these stocks trade at such massive premiums to their underlying assets? Circle’s market cap once equaled the value of its managed assets; BitMine’s stock trades at a multiple above the ETH it holds. This premium exists largely because most investors can’t easily buy crypto directly; even when they can, onboarding and offboarding experiences for retail remain clunky. If you want to allocate to Ethereum within a retirement account to capture its upside, buying a company that holds ETH is far easier than acquiring ETH itself.

This creates a structural advantage for companies holding crypto assets. ARK’s trades suggest they understand this well: buy when the premium is reasonable, sell when it becomes excessive.

ARK’s strategy proves investing in crypto stocks doesn’t have to be simple buy-and-hold—especially if you aim to optimize returns. For anyone trying to track ARK’s crypto moves, knowing what they bought isn’t enough—you must understand why they bought it, when they might sell, and where they’ll go next.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News