A Step-by-Step Guide to Identifying DeFi Meme Projects

TechFlow Selected TechFlow Selected

A Step-by-Step Guide to Identifying DeFi Meme Projects

While celebrating, we should remember that exchange public chain projects do not imply endorsement by the exchange. We must maintain independent judgment, acknowledge the high risks behind the high returns of participating in DeFi, and take responsibility for every investment we make.

Have you heard? A new project on XX Chain is offering annualized returns of several thousand percent!

In no time, legions of retail investors—armed with slogans like "go for it," "charge in," and "full send"—rushed into the market, gearing up with the holy trinity of DeFi: "mining," "airdrops," and "referral farming." But survivorship bias has blinded so many to the realities of getting "shovel-broken" or "investment-lost." Countless investors have been mauled by so-called "shitcoins" (or "local mutts"). If you check financial statements before buying stocks, why would you blindly ape into a DeFi project without due diligence? Let’s pull back the curtain on these “mutts.”

A Lazy Person’s Guide to Spotting Shitcoins

You might say: I don’t understand code, I’ve never studied finance, and I can’t be bothered to read whitepapers. What then?

Actually, using just the following tips, you can easily identify whether a project is likely a “shitcoin”:

Assess the UI/Design: For any DeFi project, its website and logo are its "face." Does the color scheme look amateurish or chaotic? Is the interface user-friendly? Are there multilingual options? Does it resemble a website from the Windows 98 era?

These are basic red flags. You shouldn't expect a team that copies website designs to write solid, secure code. As for the logo, simplicity and distinctiveness matter. Even established projects like SUSHI updated their logos after gaining fame to appear more mature and professional.

The evolution of the SUSHI logo

Dive Into the Community: A legitimate project should maintain active official channels—WeChat groups in China, Telegram groups overseas, as well as Weibo and Twitter accounts. The frequency and quality of official communications serve as good indicators. You can even check GitHub to see how often the project's code is being updated.

Beyond that, join the community and observe: How many members are genuinely active? Are discussions filled with mindless hype, or thoughtful analysis? Overzealous fanboys contribute far less to a project’s long-term health than rational, constructive dialogue.

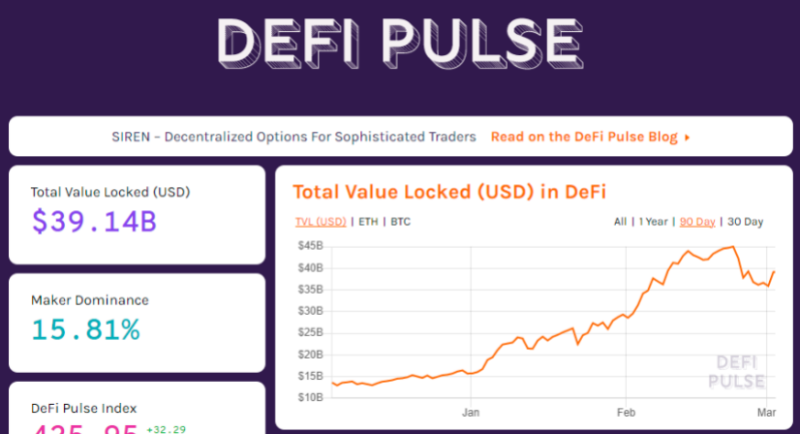

Do Your Own Research (DYOR): Even if you can't fully understand technical details, you can still "count" and "search." For DeFi projects, Total Value Locked (TVL) represents the total assets deposited into the protocol, serving as a strong proxy for credibility. Larger TVL generally means stronger liquidity. You can check TVL via platforms like DeFi Pulse, DeBank, or DeFiBox—all accessible without a VPN.

Source: DeFi Pulse

Additionally, research the founding team: Have they built other projects? Use reverse image search to verify if their photos are stolen from elsewhere. If the project has backing from venture capital, investigate those firms too.

An Expert’s Guide to Identifying Shitcoins

If you have some crypto experience and technical knowledge, and want to maximize your chances of avoiding scams, consider these advanced techniques:

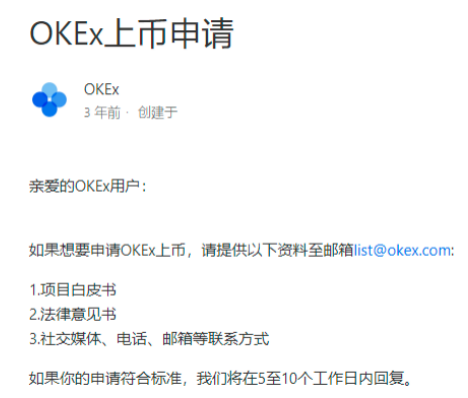

Dissect the Whitepaper: The whitepaper is a key indicator of a project’s legitimacy. Tokens without whitepapers rarely make it onto major exchanges. For example, OKX (formerly OKEx) explicitly requires a whitepaper for listing applications.

Source: OKX Official Website

You can access whitepapers through the project’s official site, Twitter, or third-party platforms like Feixiaohao or Blockchain Eye. Use Google to check whether content is copied from other projects. Does it focus on real value, technology, and vision—or endlessly boast about vague, flashy concepts?

Also, examine the operational mechanics and token distribution model. Are there private sales or vesting schedules? Was the token pre-mined? These factors significantly impact both the project and token value.

What Do Audits Say?: Legitimate DeFi projects should have smart contracts audited by reputable firms, with reports publicly available. Projects lacking audits are highly likely to be scams.

Projects verified by well-known auditors are more trustworthy. For obscure audit firms, do your homework—use tools like Tianyancha (Chinese business registry) to uncover potential conflicts of interest. Recently, an auditing firm for a major exchange’s blockchain was exposed as being owned by the exchange’s own executives—an obvious red flag. Also review the audit report itself: What vulnerabilities were identified? What risk levels were assigned? And how does the team plan to address them?

Trace It On-Chain: Once a project launches, leverage blockchain transparency. Use blockchain explorers to verify token supply, check team wallet balances, and monitor fund movements—cross-checking against claims in the whitepaper. For instance, book.finance was caught dumping tokens secretly—exposed entirely through on-chain address tracking.

By combining these methods, you can drastically reduce the risk of falling victim to a shitcoin.

However, the current boom around centralized exchange blockchains cannot be ignored. Binance Smart Chain, Huobi Heco Chain, and others host numerous mining projects, while OKExChain is preparing EVM compatibility.

Amid the frenzy, remember: a project on an exchange-affiliated chain does NOT mean it’s endorsed by the exchange. Always exercise independent judgment. Recognize that high returns in DeFi come with equally high risks—and take full responsibility for every investment you make.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News