Bitget Daily Morning Report: Bitmine purchases over $200 million worth of ETH again, US Q3 real GDP annualized growth rate at initial reading of 4.3%

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Bitmine purchases over $200 million worth of ETH again, US Q3 real GDP annualized growth rate at initial reading of 4.3%

$200 million in long positions liquidated across the cryptocurrency market.

Author: Bitget

Today's Outlook

1. Bitmine purchased another 67,886 ETH worth over $200 million in the past 24 hours.

2. The Central Bank of Russia has released a draft concept for cryptocurrency market regulation, proposing to allow both qualified and non-qualified investors to invest in crypto assets under certain conditions. Non-qualified investors who pass a test may purchase up to 300,000 rubles (approximately $3,800) annually in highly liquid cryptocurrencies through a single intermediary; qualified investors who pass a risk assessment may invest without limits in any cryptocurrency except privacy coins.

3. U.S. Treasury Secretary Bessent supports reconsidering the Fed's 2% inflation target.

Macro & Highlights

1. U.S. Bureau of Economic Analysis: The economy expanded at a 4.3% rate in Q3, the fastest pace in two years.

2. The U.S. Q3 real GDP annualized quarterly growth rate was preliminarily recorded at 4.3%, significantly exceeding expectations of 3.3% and the previous value of 3.8%. The core PCE price index annualized quarterly rate came in at 2.9%, matching market expectations of 2.9% and higher than the prior 2.6%. Real personal consumption expenditures grew at a quarterly rate of 3.5%, notably above the expected 2.7% and prior 2.5%.

3. Spot gold reclaimed $4,522 per ounce; spot silver broke above the $72 per ounce level for the first time, rising over $43 this year.

Market Trends

1. In the past 24 hours, total liquidations in the crypto market reached $254 million, with long positions accounting for $200 million. BTC liquidations amounted to approximately $84 million, while ETH liquidations were around $62 million.

2. On Tuesday, U.S. stocks closed mixed: the Dow rose 0.16%, the Nasdaq gained 0.57%, and the S&P 500 increased 0.46%, setting a new closing high. Nvidia (NVDA.O) rose 3%, Circle (CRCL.N) fell nearly 5%, and MSTR (Strategy) dropped about 3.92%.

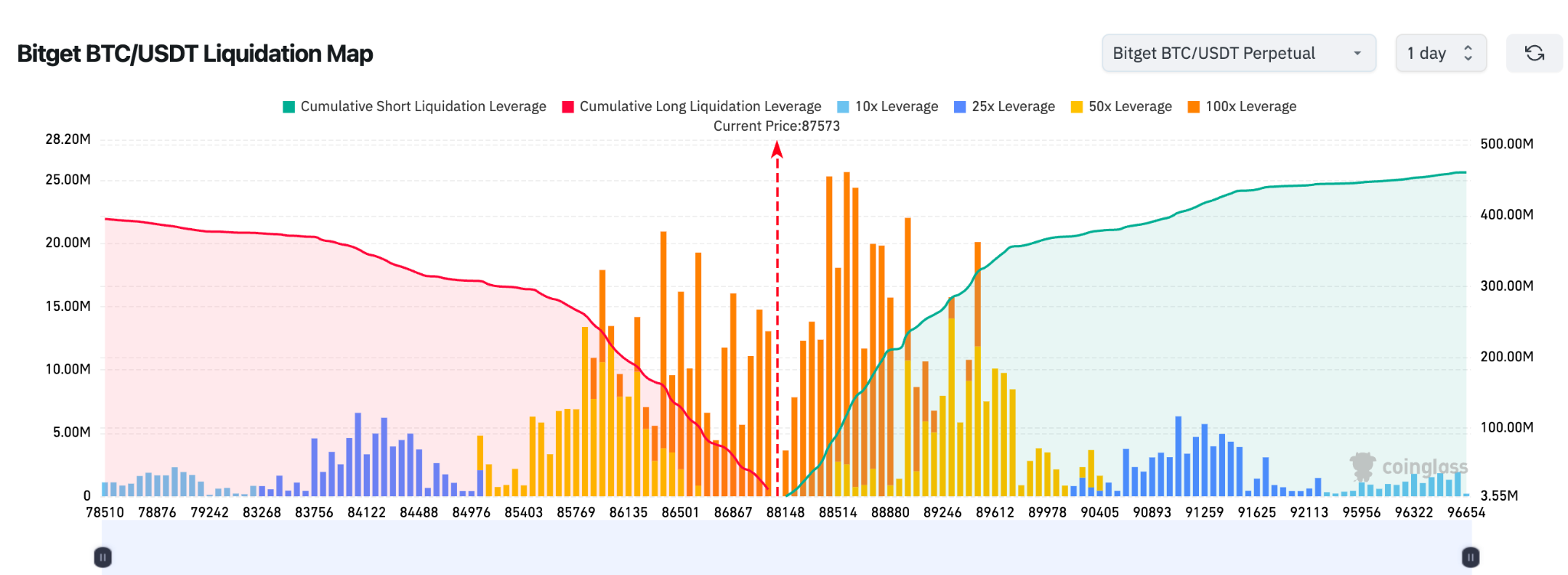

3. Bitget’s BTC/USDT liquidation map shows the current price near ~$87.5k is at a key long-short liquidation boundary. Above, the $88k–$90k range has a large concentration of 50x–100x leveraged longs; a strong breakout could trigger a short squeeze and rapid upward movement. Below, the $85k–$86k zone shows relatively weak short liquidation and support levels; a false breakout and pullback could lead to a sharp decline. Overall, the structure reflects "crowded longs, amplified volatility, and vulnerability to being hunted."

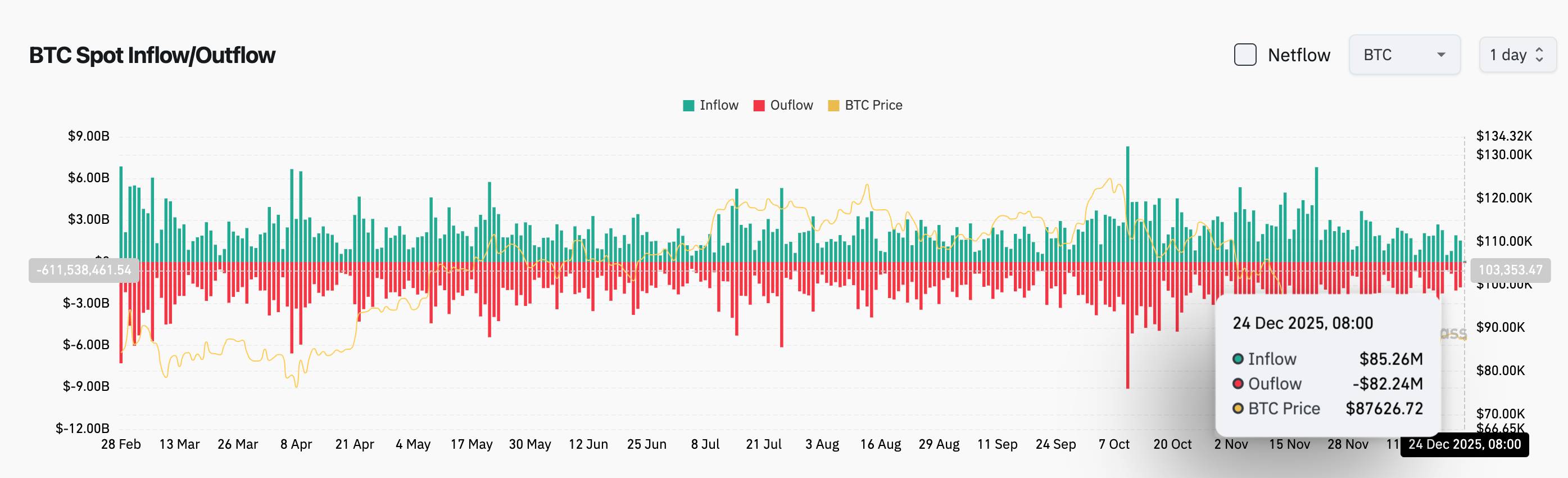

4. Over the past 24 hours, BTC spot inflows were approximately $85 million, outflows $82 million, resulting in a net inflow of $3 million.

News Updates

1. CertiK Annual Report: 248 phishing incidents were recorded in 2025, with losses totaling about $723 million.

2. Yardeni Research: Gold will reach $6,000 by the end of 2026.

3. Asset management firm Amplify ETFs launched two new ETFs: Amplify Stablecoin Technology ETF (STBQ) and Amplify Tokenization Technology ETF (TKNQ), offering investors exposure to stablecoins and asset tokenization.

Project Developments

1. ETH Strategy holds 11,778 ETH, valued at approximately $34.4 million.

2. Fuel and Bubblemaps, both VC-valued at $1 billion, currently have market caps of only $11 million and $6 million respectively. A chart published by CryptoRank comparing VC valuations to current market caps reveals that most projects have seen significant valuation corrections, reflecting market sentiment shifts and adjustments to previously inflated valuations.

3. Fasanara Capital purchased 6,569 ETH within two days and deposited them into Morpho as collateral.

4. USDC Treasury burned 50 million USDC on the Ethereum blockchain.

5. Resolv expands into altcoin markets, with HYPE and SOL as the first supported assets.

6. Bitcoin ETFs saw a one-day net outflow of approximately $60.1 million; Ethereum ETFs had a net outflow of about $358,000; Solana ETFs recorded a net inflow of roughly $6.39 million.

7. Due to a trust crisis, USDe's market cap dropped from $14.7 billion in October to around $6.4 billion after its collapse.

8. Nasdaq-listed iPower secured a $30 million convertible note financing agreement to launch its DAT strategy.

9. SharpLink earned 460 ETH last week through staking rewards, bringing its cumulative staking rewards to 9,701 ETH.

10. Arkham data: Trump Media transferred 2,000 BTC worth approximately $174.8 million eight hours ago.

Disclaimer: This report is AI-generated. Human input was limited to information verification. It does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News