Bitget Daily Morning Report: The Federal Reserve announces a 25 basis point cut to the benchmark interest rate, Bitmine purchases 33,504 ETH

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: The Federal Reserve announces a 25 basis point cut to the benchmark interest rate, Bitmine purchases 33,504 ETH

CBOE has approved the listing and registration of the 21Shares XRP ETF.

Author: Bitget

Today's Outlook

1. Cointelegraph reported that the Chicago Board Options Exchange (CBOE) has approved the listing and registration of the 21Shares XRP ETF.

2. Sygnum survey: 60% of high-net-worth individuals in Asia plan to increase their cryptocurrency purchases.

3. Cointelegraph reported that Japan's Financial Services Agency (FSA) released a report planning to move crypto asset regulation from the Payment Services Act (PSA) to the Financial Instruments and Exchange Act (FIEA), treating them as investment products for regulatory purposes.

Macro & Highlights

1. On December 10 local time, the Federal Reserve announced a 25 basis point cut to its benchmark interest rate, reducing it from the current range of 3.75%–4% to 3.5%–3.75%. This marks the Fed’s third consecutive rate cut, with a cumulative reduction of 75 basis points. Additionally, Trump criticized the Fed's insufficient rate cuts, and "another Kevin" attended his final interview today.

2. The "Fed Whisperer": Three rate cuts fail to resolve internal disagreements; caution against "stagflation risks."

3. Powell: The Fed shifts to a wait-and-see approach; rate hikes are not the baseline expectation at this stage.

4. Analyst Ali: Of the seven FOMC meetings this year, six triggered BTC price corrections.

Market Trends

1. Over the past 24 hours, the total liquidation in the cryptocurrency market reached $423 million, with long positions accounting for $286 million. BTC liquidations amounted to $153 million, while ETH liquidations reached $125 million.

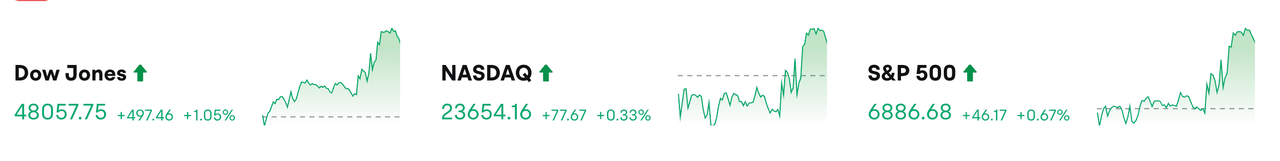

2. U.S. stocks: Dow rose 1.05%, S&P 500 rose 0.67%, Nasdaq Composite rose 0.33%. Meanwhile, NVIDIA (NVDA) fell 0.64%, Circle (CRCL) dropped 0.53%, and Strategy (MSTR) declined 2.3%.

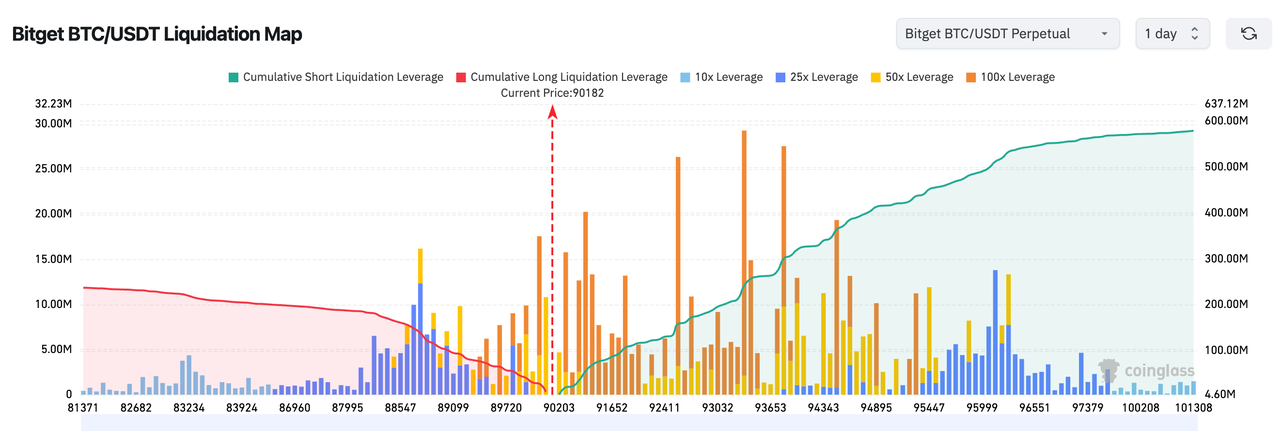

3. Bitget BTC/USDT liquidation map shows: Around the current BTC price (approximately $90,182) is the most concentrated zone for high-leverage long positions (50–100x), where a price drop could trigger significant cascading long liquidations. However, the accumulated short liquidation volume below is far greater than the longs above, meaning if prices continue rising, short squeezes would exert stronger upward pressure, fueling more bullish momentum.

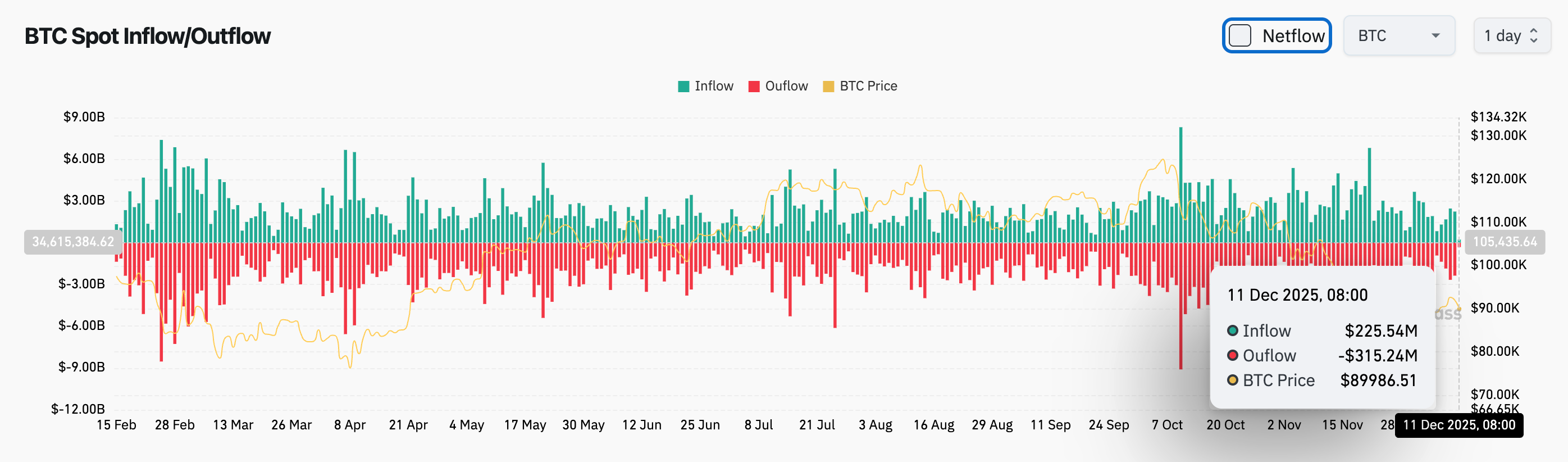

4. In the past 24 hours, BTC spot inflows were approximately $225 million, outflows around $315 million, resulting in a net outflow of $90 million.

News Updates

1. Michael Saylor criticizes MSCI's plan to exclude companies with large crypto holdings from its indices.

2. GameStop (ticker GME) holds Bitcoin worth $519.4 million, with holding losses reaching $9.2 million in Q2–Q3.

3. SpaceX plans an IPO raising over $30 billion, potentially becoming the largest in history. Bloomberg reports that if SpaceX goes public in 2026 at a $1.5 trillion valuation, Elon Musk’s net worth would surge from $460.6 billion to about $952 billion, with his SpaceX stake alone valued at $625 billion.

Project Developments

1. Figure plans to introduce the tokenized stablecoin YLDS to Solana. YLDS is a securities-based stablecoin designed to maintain a fixed dollar value and generate ongoing yield through U.S. Treasuries and Treasury repurchase agreements.

2. The U.S. government transferred 1,934 WETH and 13.58 million BUSD seized from FTX Alameda to a new wallet.

3. State Street Bank and Galaxy plan to launch a tokenized liquidity fund in early 2026, using stablecoins to enable round-the-clock investor capital flows, expanding blockchain use in institutional cash management.

4. VanEck renamed its Gaming ETF to “Degen Economy ETF,” focusing on emerging digital economy models.

5. AI crypto platform Surf raised $15 million in funding led by Pantera Capital.

6. Sei will partner with Xiaomi to pre-install a Web3 payment application on new smartphones globally.

7. ETHZilla acquired a 15% stake in digital mortgage platform Zippy for approximately $21 million.

8. SpaceX transferred 1,021 BTC to a new wallet, worth $94.48 million.

9. Bitmine purchased another 33,504 ETH from FalconX, valued at $112 million.

10. Yesterday, global asset manager Invesco filed Form 8-A with the U.S. Securities and Exchange Commission (SEC) for its Invesco Galaxy Solana ETF, a step typically taken before official product launch. Trading usually begins the day after such filings.

Disclaimer: This report is generated by AI, with human verification only for information accuracy. It does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News