Bitget Daily Morning Report: Trump hints Hassett as next Fed chair, Musk predicts $38.3 trillion "crisis" could trigger BTC price surge

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Trump hints Hassett as next Fed chair, Musk predicts $38.3 trillion "crisis" could trigger BTC price surge

SEC Chair: Cryptocurrency company innovation exemption will take effect in January next year.

Author: Bitget

Today's Outlook

1. USDC Treasury minted an additional 500 million USDC on the Solana chain; earlier, Tether Treasury minted 1 billion USDT on the Tron network.

2. Lock-up period expiration triggered sell-offs; American Bitcoin Corp., the crypto mining firm co-founded by Eric Trump, plunged over 50% in 30 minutes.

3. CME launched a Bitcoin Volatility Index to quantify market uncertainty. The index references implied volatility from Bitcoin and Micro Bitcoin options, similar to the VIX in stock markets, aiming to optimize options pricing and risk management.

Macro & Highlights

1. Trump strongly hinted Kevin Hassett as next Fed Chair, introducing Hassett at a White House meeting by saying, "The potential Fed Chair is right here."

2. Musk predicts $38.3 trillion "crisis" could trigger a surge in Bitcoin price.

3. SEC Chair: Exemptions for crypto innovation will take effect in January next year.

Market Trends

1. Over the past 24 hours, total liquidations in the crypto market reached $430 million, with short positions accounting for $360 million. BTC liquidations amounted to $210 million, ETH to $92 million.

2. U.S. stocks: Dow rose 0.39%, S&P 500 gained 0.25%, Nasdaq Composite increased 0.59%.

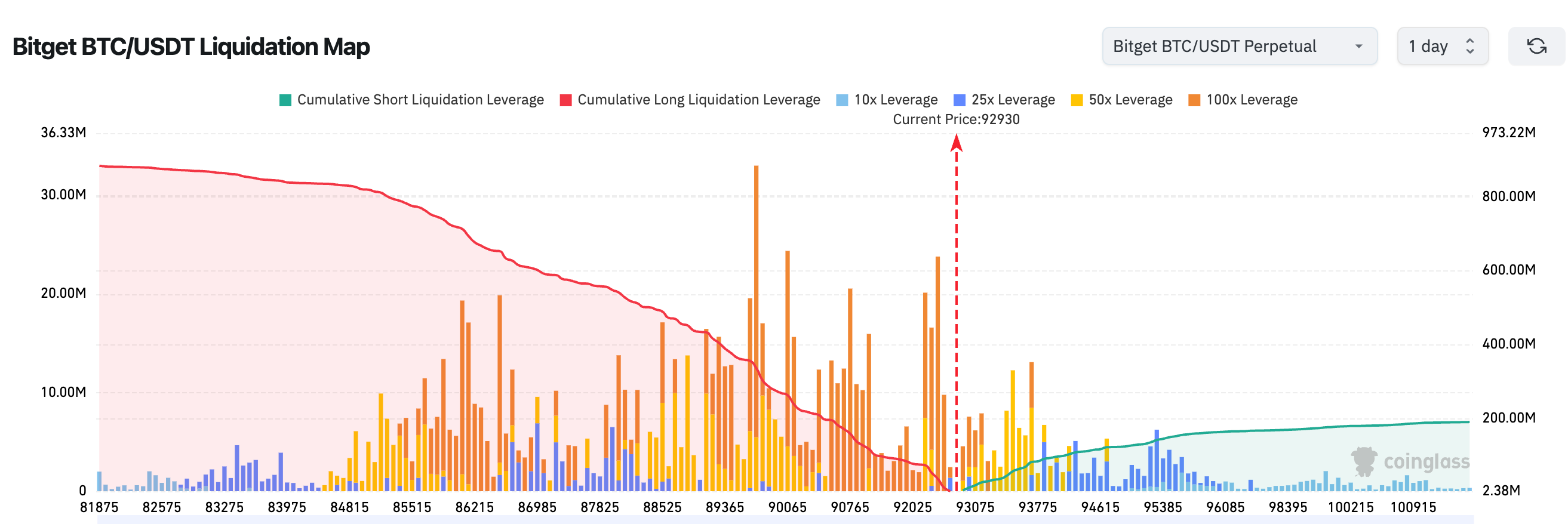

3. Bitget BTC/USDT liquidation map shows: Below the current BTC price (around $92,930), high-leverage longs (50–100x) are densely concentrated in the $89,000–$92,000 range; any pullback may trigger cascading long liquidations, amplifying downside pressure. On the upside, short accumulation is relatively light, with short leverage mainly above $94,000, indicating weaker resistance upward and greater breakout potential.

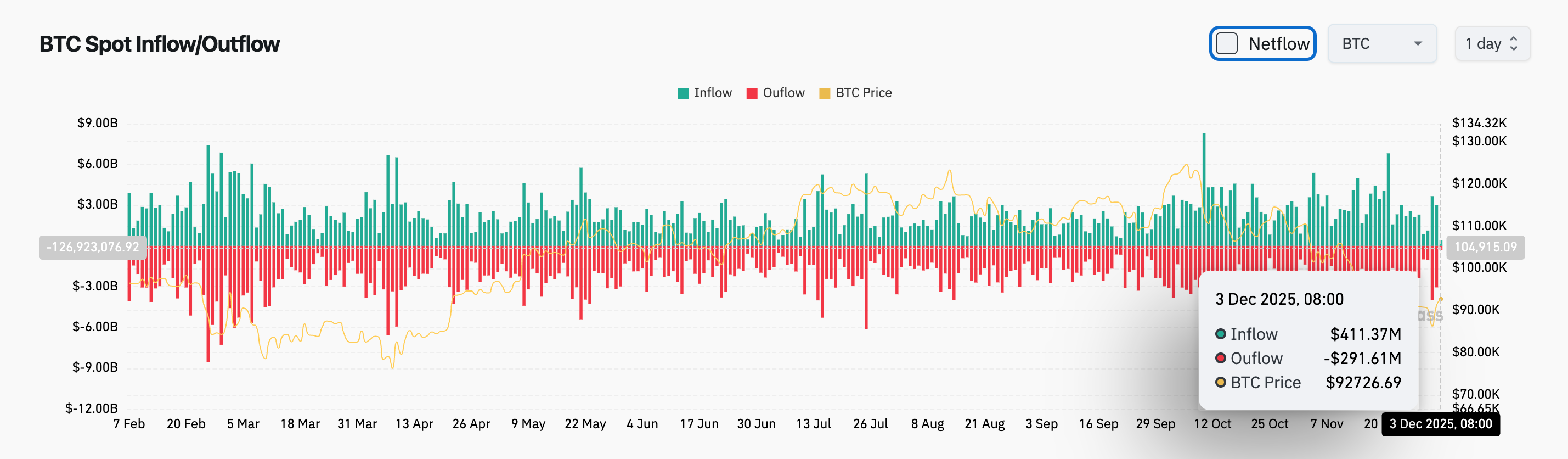

4. In the past 24 hours, BTC spot inflows were $411 million, outflows $291 million, resulting in a net inflow of $120 million.

News Updates

1. SBF posted in support of Trump’s pardon of former Honduran president.

2. Pump.fun transferred another $75 million USDC to Kraken two hours ago, bringing cumulative outflows to $555 million.

3. MetaMask launched "Transaction Shield," a transaction protection service offering up to $10,000 monthly reimbursement.

Project Updates

1. U.S. Solana spot ETF recorded a single-day net inflow of $45.77 million.

2. Ethena received over 46.79 million ENA from Bybit; the source wallet was previously linked to Coinbase.

3. Aave DAO considers scaling back multi-chain deployment, planning to terminate instances on zkSync, Metis, and Soneium.

4. A whale purchased nearly 3 million ASTER tokens within 24 hours, totaling $3 million.

5. Astria Network, built on Celestia, has terminated its shared sequencer network, marking the official shutdown of the shared sequencer.

6. Strategy CEO: Open to lending Bitcoin to enhance financial flexibility.

7. Uniswap Labs collaborates with European fintech app Revolut; Uniswap web app and wallet now support buying crypto via Revolut.

8. Solana-based financial firm Upexi announced completion of a private placement of up to $23 million in common stock and warrants.

9. Yesterday, Ethereum mainnet gas fees dropped as low as $0.02, even lower than some L2 networks.

10. Grayscale Chainlink Trust ETF, a new spot ETP, has listed on NYSE Arca.

Disclaimer: This report is AI-generated; humans only verified information. No investment advice is provided.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News