Wintermute Market Analysis: Cryptocurrencies Fall Below $3 Trillion, Market Capital and Leverage Tend to Consolidate

TechFlow Selected TechFlow Selected

Wintermute Market Analysis: Cryptocurrencies Fall Below $3 Trillion, Market Capital and Leverage Tend to Consolidate

Risk sentiment deteriorated sharply this week, and the AI-driven stock market momentum ultimately stalled.

Author: @Jjay_dm

Compiled by: TechFlow

Market Update – November 24, 2025

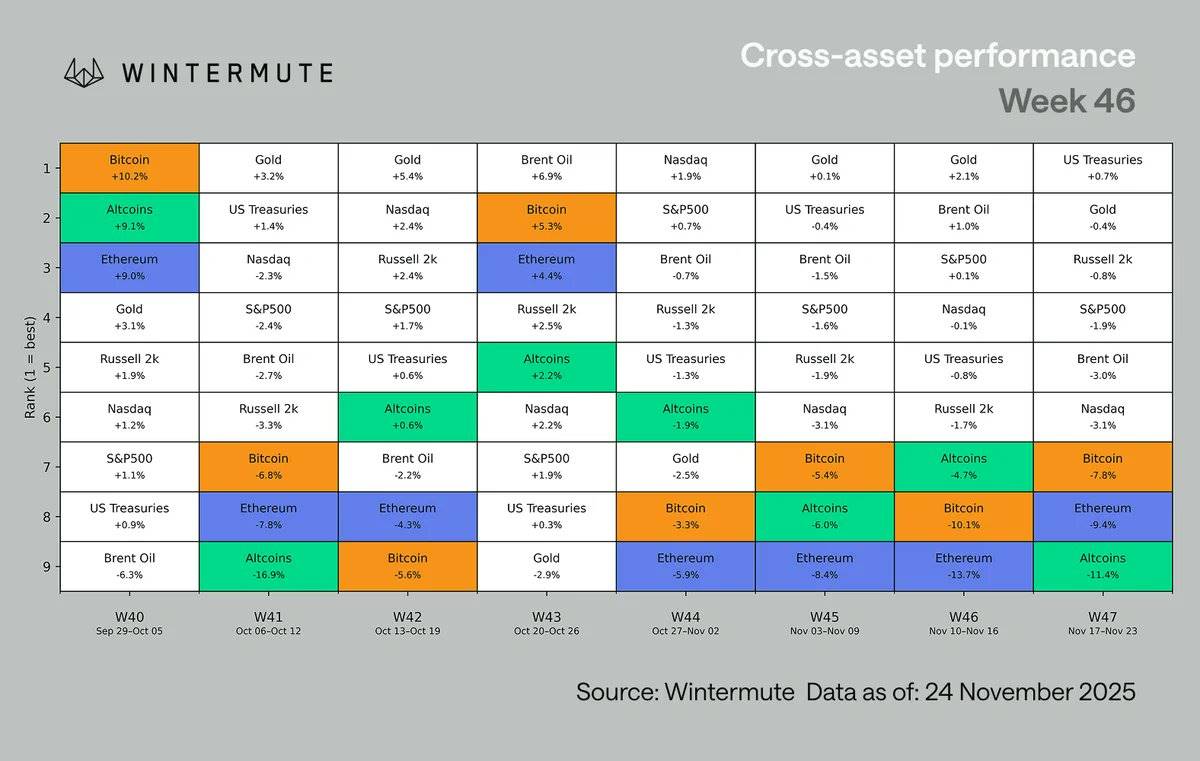

AI-driven market momentum has broken down, triggering a risk-off rotation. Cryptocurrency market capitalization has fallen below $3 trillion, underperforming as the worst-performing major asset class for the third consecutive week. Weak employment data, declining rate cut expectations, and pressures in the Japanese market have added further downward pressure amid thin holiday liquidity. Market positioning in crypto has been reset, funding rates have turned negative, and spot trading volume remains stable.

Macro Update

Risk appetite deteriorated sharply this week as AI-driven equity momentum finally stalled. Despite another strong earnings report from Nvidia, the associated rally was short-lived, with markets quickly selling into the rebound. This reaction marks a clear shift in market behavior: investors are using strength to reduce exposure, indicating that AI-related trades are losing support from new buying interest. As U.S. tech stocks retreated, the pressure spilled directly into the cryptocurrency market, with total market cap falling below $3 trillion for the first time since April.

Macroeconomic data further intensified market fragility:

-

Non-farm payrolls (NFP) rose by 119,000, but the unemployment rate increased to 4.4%

-

December rate cut probability dropped to around 30%

-

Japanese markets came under stress, with the JGB yield curve steepening (bear steepening) and the yen weakening, raising concerns about Japan’s ability to continue absorbing U.S. Treasuries

-

European and Asian markets also showed weakness, with profit-taking in China’s AI sector and renewed real estate sector stress

-

UK inflation eased, but had limited impact amid low liquidity during the U.S. Thanksgiving holiday

As a result, cryptocurrencies were once again the worst-performing major asset class for the third straight week, with broad-based selling and long liquidations leading to outsized losses in altcoins.

Despite ongoing macro instability, internal structures within the cryptocurrency market are showing positive shifts. Funding rates have turned negative for the first time since Bitcoin (BTC) traded near $115,000 at the end of October, marking the longest sustained period of negative funding since October 26. Leveraged positions are now skewed toward short exposure, while capital flows are returning to the spot market. Spot trading volume has held up surprisingly well despite the shortened holiday trading week. This combination suggests the market has completed a comprehensive reset and is better positioned for stability once macro pressures ease.

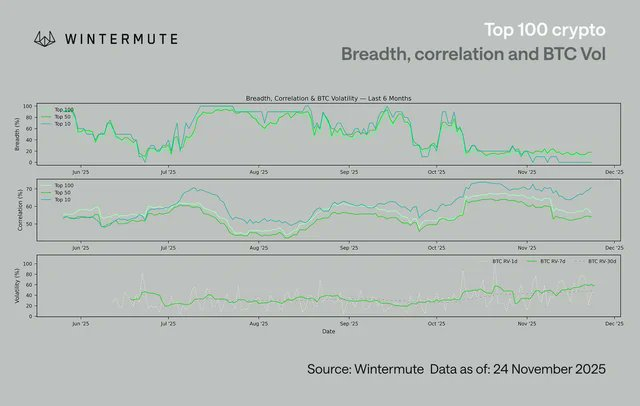

Among the top 100 tokens by market cap, correlations remain concentrated in the top 10, which have also performed the worst. This reflects how the largest assets are trading as a single macro bloc, fully tied to broader risk sentiment. In contrast, tokens ranked 50 to 100 saw relatively smaller declines and show early signs of decoupling, with price action increasingly driven by unique catalysts. This aligns with on-the-ground reality: narrow narratives—such as agent protocols, privacy, and decentralized physical infrastructure networks (DePIN)—are still driving short-term outperformance even amid weak overall market conditions.

In the meantime, Bitcoin's volatility continues to climb, with 7-day realized volatility (RV) rebounding toward the 50 level.

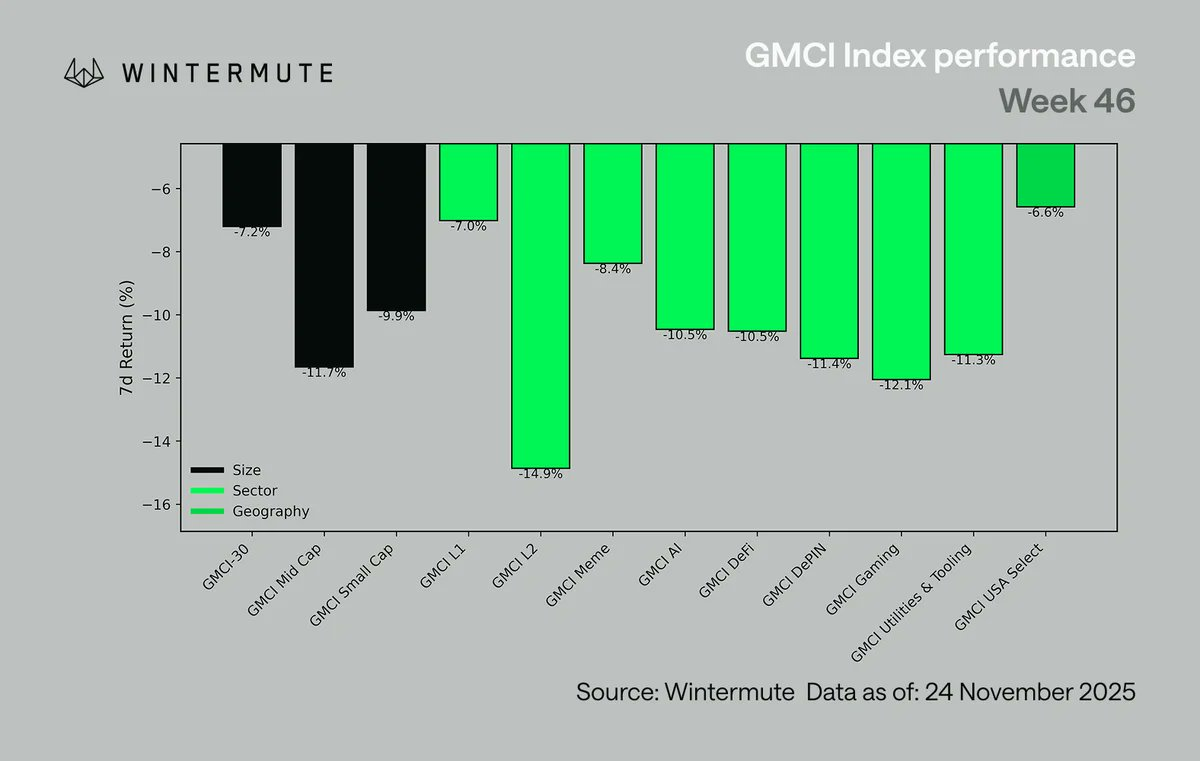

Sector performance broadly weak, with high-volatility areas hit hardest by selling pressure:

-

Layer 2 (L2) declined by 14.9%

-

Gaming sector fell 12.0%

-

Decentralized Physical Infrastructure Networks (DePIN) dropped 11.4%

-

Artificial Intelligence (AI) sector down 10.5%

-

Mid- and small-cap assets also lagged

-

Core Layer 1 protocols (Core L1s) fell 7.0%, GMCI-30 Index (@gmci_) declined 7.2%, showing relatively better performance

This downturn showed little selectivity, clearly reflecting a macro-driven, broad-based de-risking sentiment across all sectors.

The above chart uses Monday-to-Monday data, hence differs from the first chart.

Our View:

Although digital assets remain caught in a macro-driven deleveraging wave, the market is now entering a phase where consolidation appears increasingly possible.

After undergoing macro-driven deleveraging—first due to cooling AI enthusiasm and later due to shifting Fed expectations—the internal structure of the digital asset market has significantly improved. Major assets are showing clearer relative strength, market sentiment has been fully cleared, and leverage risks have substantially decreased. Total perpetual contract open interest has declined from approximately $230 billion in early October to around $135 billion today, primarily due to deleveraging in long-tail assets and systematic outflows. This shift has redirected market activity back to the spot market, where depth and liquidity have held up better than expected despite thin holiday liquidity.

This is crucial: when leverage falls to such low levels and spot markets become the primary channel for trading activity, recoveries tend to be more orderly than the mechanical squeezes seen earlier in the year. Negative funding rates and net short perpetual positions also reduce the risk of further forced liquidations, providing the market with more breathing room—especially if macro conditions stabilize. The coming days will determine how we enter the final month of the year, but after weeks of macro pressure, the market has finally reached a point where consolidation is feasible.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News