From Digital Malls to On-Chain Economies: How Capital Flows Are Reshaping the Crypto World?

TechFlow Selected TechFlow Selected

From Digital Malls to On-Chain Economies: How Capital Flows Are Reshaping the Crypto World?

For early-stage founders, knowing how to balance value capture with the speed of cash flow is the key to survival.

Text: Joel John

Translation: Luffy, Foresight News

Some might call it an addiction, but I often catch myself wondering: "How much coffee is too much?" At some point, the caffeine in your bloodstream reaches a level where another cup offers less return than simply rehydrating. Your brain thinks it needs more of that anxiety-inducing brew, but your body would be better off with humanity’s simplest, most fundamental liquid—water.

Markets are similar. We tend to assume more of a good thing leads to better outcomes. But reverting to a new baseline may be what's urgently needed. When tariffs stabilize at predictable levels, industries adapt and reconfigure toward a new normal; when venture capital slows, weaker companies get culled, creating greater stability for those that remain. Why am I saying this? Just like coffee, we’ve hit a local peak in both the velocity of capital flows and fee extraction. What this industry needs now is to figure out how to sustainably grow both.

The market reflects this fatigue in strange ways. Venture capitalists argue we don’t need more infrastructure; marketers say we should focus on consumers; analysts suggest we need products with sound economic fundamentals; traders want more market volatility. As with many things in life, the truth lies hidden in the motivations driving these perspectives.

Objectively speaking, we can evaluate blockchains not just by scale or throughput, but also by fees per transaction. At their core, blockchains are networks enabling the movement of money—a thriving ecosystem of transactions operating in real time across the globe. Bitcoin fulfills this role well and has earned its status as hard money, but what about other applications?

In other words, what happens to the digital economy when money moves as fast as information travels online? How does capital formation and allocation evolve when transferring funds becomes as easy as a single click? In this article, I attempt to answer these questions.

Digital Malls and Smoke Screens

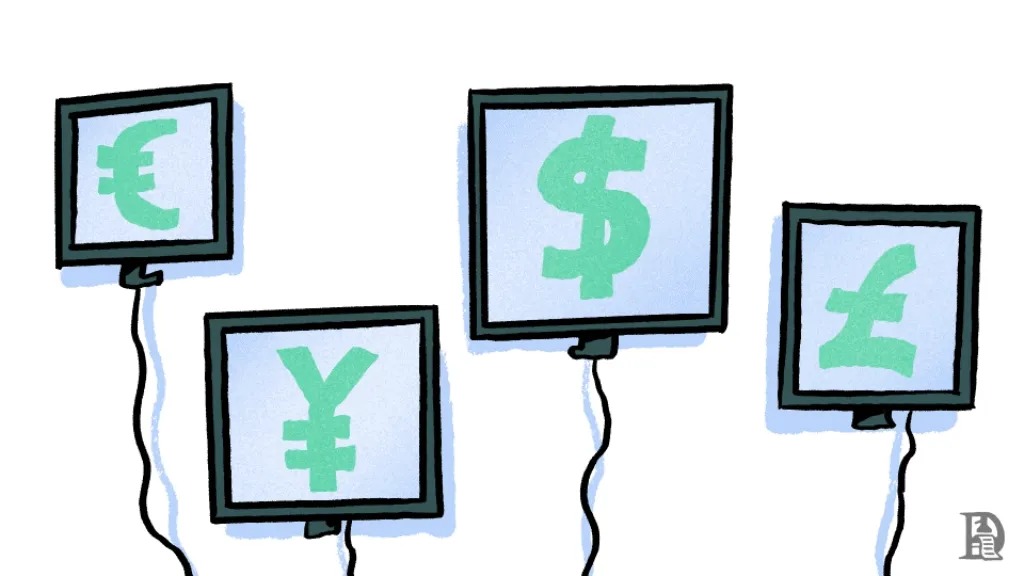

Internet penetration rates, Image source: Bond Capital 2019 Report

The internet is a transaction system—you just don’t realize you’re transacting. In 2001, Google generated $70 million in ad revenue, roughly $1.07 per user. By 2019, that number had surged to $133 billion—$36 per user. In 2004, the year of Google’s IPO, 99% of its revenue came from advertising. In many ways, the evolution of the web has been a story of how an ad network increased per-user value extraction fortyfold over 25 years.

You might think this isn’t a big deal, but every time you scroll, search, or post, you’re creating a commodity: human attention. At any given moment, you can only focus on one thing—maybe two or three at most. The attention economy monetizes this limited resource in two key ways:

-

First, by optimizing data collection from individuals. On social media, this is straightforward—users provide feedback to platforms (like X, Instagram, or TikTok) based on the type of content they spend time consuming.

-

Second, by maximizing user engagement time. When Netflix says sleep is its biggest competitor, it’s not joking. As of 2024, the average person spends two hours daily on the platform, with 18 minutes dedicated just to deciding what to watch.

In short, you’re not the customer—you are the product.

In any given year, you spend the equivalent of four full days scrolling through media apps just to choose what to consume. I dare not calculate how much time people spend on dating apps. The internet is fascinating because we’ve figured out how to extract value by keeping users engaged longer and getting them to share more of their data. Most people don’t understand how this works—and they don’t need to.

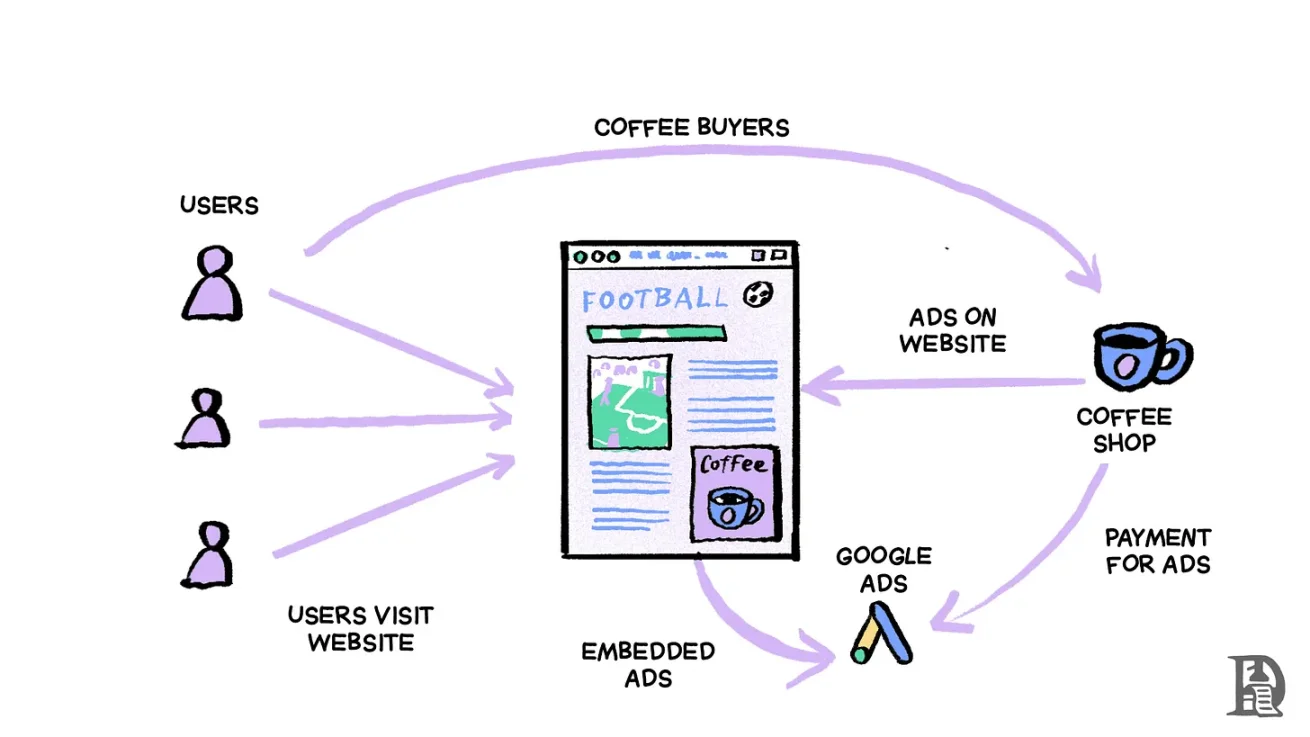

Imagine internet platforms as massive digital malls. When you spend time on apps like X or Meta, businesses pay the mall owners (Musk or Zuckerberg) for the chance that you’ll eventually make a purchase. In these digital malls, attention equals foot traffic. Why does this matter? Because in the early 2000s, these “primitive” malls faced a problem: users didn’t have debit cards, and businesses couldn’t accept direct digital payments. Trust and infrastructure were missing. So instead of charging users directly, platforms monetized indirectly via ads.

Advertising became a workaround for an internet not yet ready for seamless payments. In turn, it created a new economy operating within the digital realm.

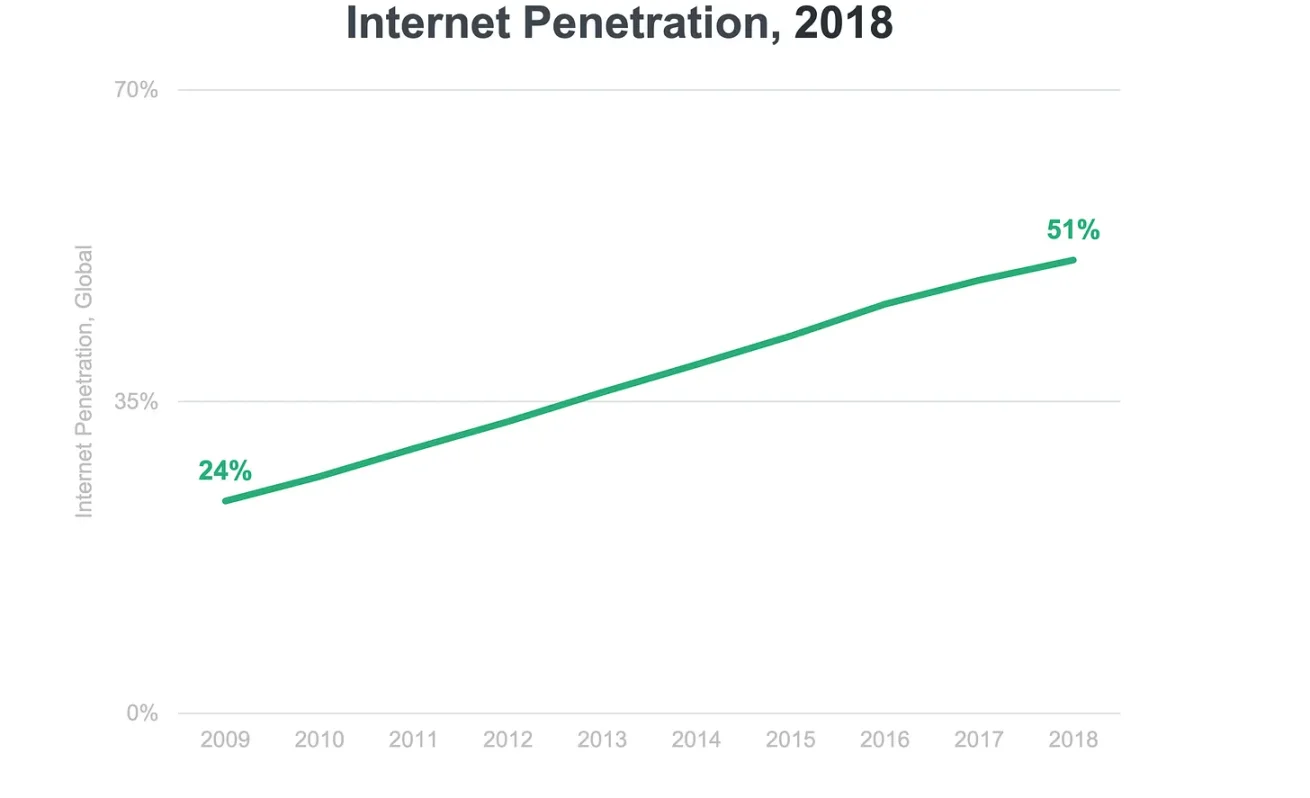

Digital economy’s share of retail. Image source: Bond Capital 2019 Report

How does this system work? Every time you shop online, merchants pay the platform (the digital mall) a cut. On platforms like Google, this takes the form of ad spending. In other words, it doesn’t matter how users pay for products—the key is that platforms receive revenue from merchants via bank transfers and debit cards. Merchants have staff handling payment and logistics. And users? They’re busy dodging malware from LimeWire. So the model works well: platforms don’t need to teach users how to pay—they just need to ensure merchants pay them.

Value flows in today’s web-based attention economy

Fast forward to 2020, when the internet became obsessed with a magical new item called Bored Ape NFTs. OpenSea became the new mall, Ethereum the payment network, and users flocked in droves. But no one truly figured out how to charge these users without requiring complex onboarding processes—on-chain fees, ETH price volatility, transaction signing, private keys, setting up MetaMask, and so on.

In the years that followed, every product that drove market growth shared one trait: it lowered the barrier to entry.

-

Solana made it possible to avoid manually approving multiple transactions

-

Privy allowed users to hold wallets without worrying about private keys

-

Pump.fun enabled people to create meme coins in minutes.

The market’s preference for simplicity is evident in the rise of stablecoins.

Velocity of Capital and Network Moats

Image source: Visa

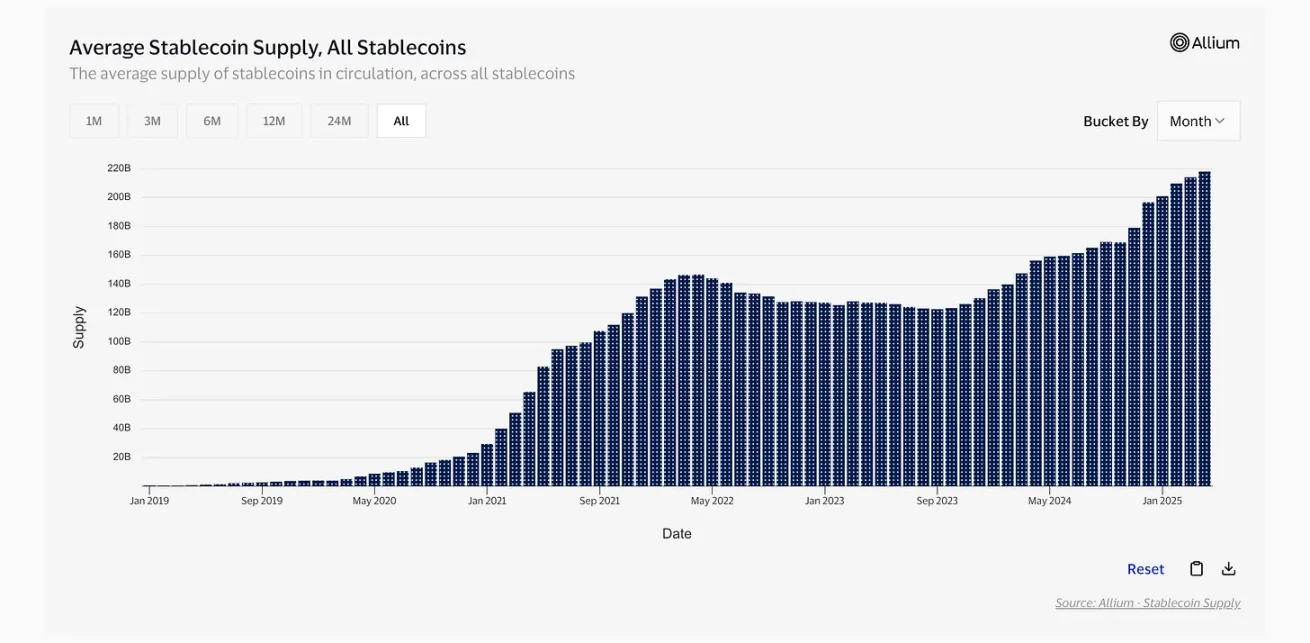

In January 2019, the total supply of stablecoins was just $500 million—roughly comparable to the valuations of some meme coins seen in recent months. Today, it stands at $220 billion. Growing 500x in six years is a pace rarely witnessed over a professional career. But it’s not just supply that has exploded—profitability has risen sharply too. In the past 24 hours alone, Tether and Circle collectively generated $24 million in fees. For comparison: Solana generated $1.19 million, Ethereum $975,000, and Bitcoin $560,000.

This may seem like comparing apples and oranges—one being a financial product (stablecoin), the others payment networks. But consider that these two stablecoin issuers generated nearly $7.5 billion in revenue last year alone. Add in 5.4 billion transactions, 240 million active unique addresses, and $33 trillion in transferred value via stablecoins, and the numbers become even more impressive.

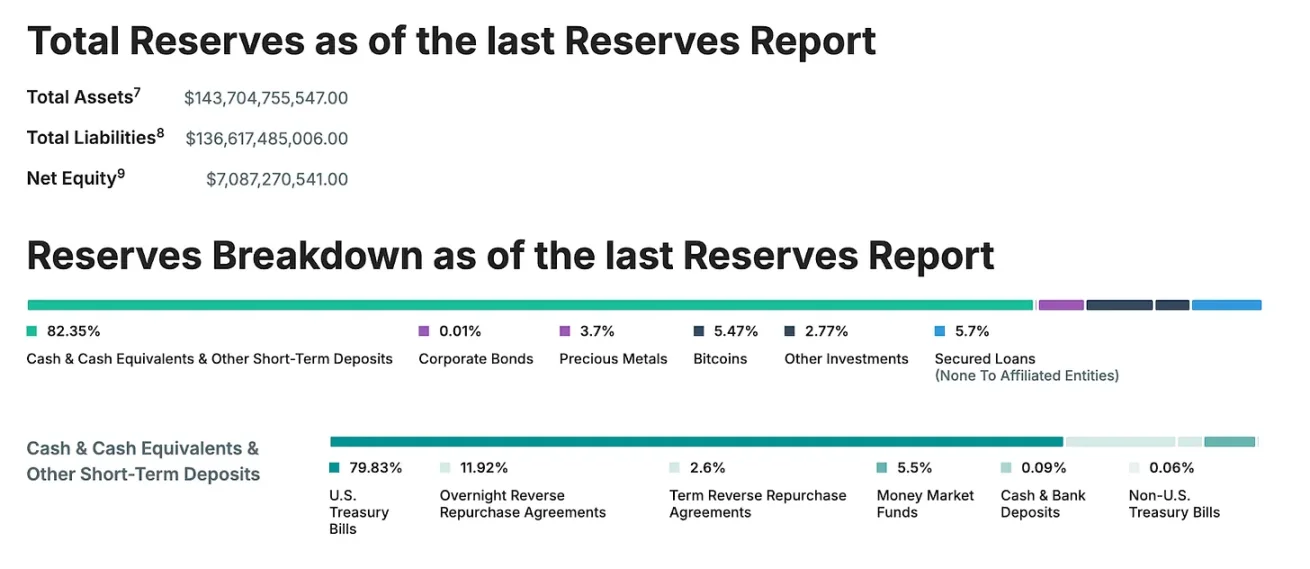

Yet, stablecoin revenue doesn’t come from users—it comes from yields generated by U.S. Treasuries and money market fund portfolios. This doesn’t even include income from minting and burning stablecoins.

When users pay with stablecoins, fees are independent of transaction amount. On Solana, sending $10, $1,000, or $10,000 costs the same $0.05. This differs from Visa or Mastercard, which typically charge 0.5%–1.5% per transaction. Yet, stablecoins remain among crypto’s most profitable businesses. Why? They solve user complexity in three ways:

-

They give people worldwide access to a highly sought-after asset—the U.S. dollar.

-

Stablecoins have the highest velocity. Whether via PayPal, Wise, or bank transfer, they enable faster cross-border transactions.

-

Products like Kast allow you to use stablecoins for real-world expenses. Their network effects mean more users feel comfortable receiving and paying with stablecoins.

I find it striking that in an industry obsessed with decentralization, the most profitable segment earns revenue by centrally holding U.S. Treasuries and issuing dollars on-chain. But that’s technology for you. Ordinary users care less about decentralization than they do about what a product can do; they care less about L2 purity tests than transaction cost. From these angles, stablecoins are simply better dollars.

Their innovation isn’t merely issuing dollars on-chain—it’s abstracting away fee complexity, much like earlier ad platforms did. Stablecoins’ true brilliance lies in finding justification to park vast sums of dollars into U.S. Treasuries and live off the yield.

Image source: Tether Proof of Reserves report

Stablecoins appear to be winners. But if you look at capital velocity, they fall short of traditional payment networks. Compared to the $33 trillion moved on-chain via stablecoins last year, Visa alone processed $13.2 trillion and Mastercard $9.75 trillion—nearly $22 trillion combined. Against stablecoins’ 5.4 billion transactions, Visa handled 233 billion. One might expect on-chain volume to be far higher given lower transaction costs, but traditional networks outperform in both volume and transaction count.

From a pure capital velocity standpoint, traditional payment networks win. Not because their tech is inherently superior, but due to deeply entrenched network effects built over decades. You can walk into a matcha shop in Japan, a baguette bakery in France, or the best cycling spot in Dubai and pay using the same tool—a debit or credit card.

Now try paying with stablecoins stored on Polygon or Arbitrum and tell me how it goes. (Note: I actually tried—spent 20 minutes waiting for a cross-chain bridge transaction to confirm.)

I raise this point because our industry often argues that stablecoins are inherently superior to fiat transactions in all use cases. But in reality, the fees charged by Visa or Mastercard are comparable to those charged by any off-ramp converting on-chain stablecoins into real-world dollars. It’s like arguing digital media is universally better than print newspapers—which isn’t true. If you live in a remote mountain village without internet or computers, print newspapers remain the best way to access news.

Likewise, if you rarely engage in on-chain activity, a debit card remains the optimal payment method. But if you're frequently online or active on-chain, the experience can be significantly better. For founders building the digital economy in the coming years, understanding the distinction between on-chain and off-chain, and recognizing the different forms value capture can take, will likely be critical.

Velocity and Fees

So how should founders think about pricing models and market share expansion? Should we obsess over bringing people on-chain, or find ways to make on-chain elements useful? There are two schools of thought, each with valid arguments.

Assuming 10% fee on generated rewards or interest for lending and staking

One view holds that crypto revenues may be seasonal, but capital velocity is extremely high. In traditional markets, higher fees are assumed to reduce velocity. Yet, some of crypto’s most speculative segments thrive despite high fees. During the NFT boom, OpenSea charged a 5% royalty; Friend-Tech took nearly 50%. Where profit is the main driver, individuals willingly pay higher transaction costs, treating them as the cost of doing business.

Nowhere is this trend clearer than Telegram trading bots. Over recent quarters, products like Photon, GMGN, and Maestrobot have collectively earned hundreds of millions of dollars, driven by three key factors:

-

Seasonality of meme coins gives users a new market (like NFTs in 2020) for speculation and profit-taking.

-

Wallet integration into Telegram and chat-based trading interfaces improve UX, enabling mobile trading.

-

Lower costs and faster speeds on Solana allow users to trade repeatedly in quick succession, compounding profits.

The innovation isn't just the asset—it's behavioral change enabled by cheaper, faster transactions on Solana and distribution via Telegram. Seasonal apps often struggle with retention, but their capital velocity is so high that even if the sector collapses for eight or nine months, it doesn’t matter. Users pay extreme premiums, and those selling picks and shovels during gold rushes tend to do very well. The chart below illustrates Photon’s case.

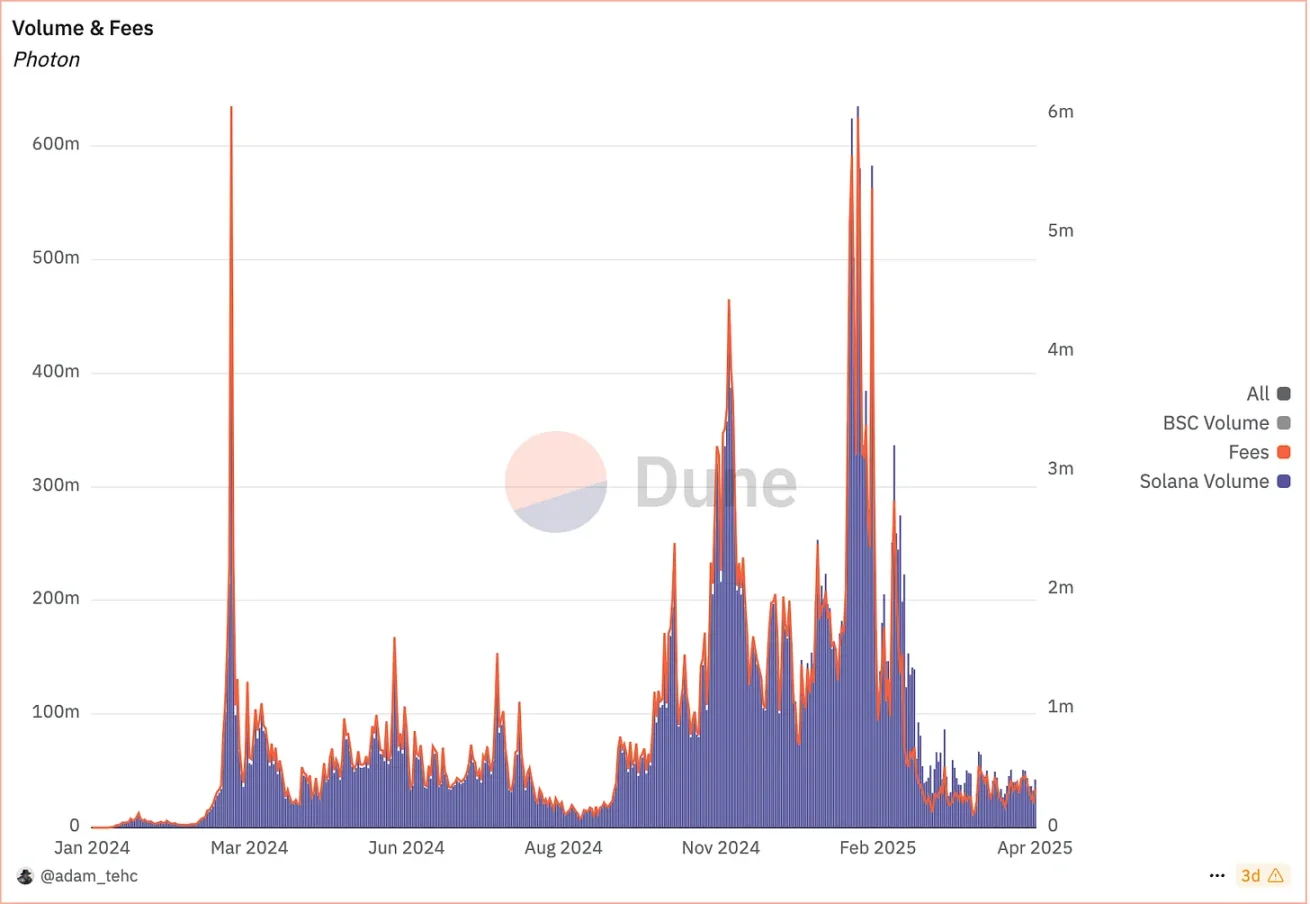

Photon was one of many apps focused on improving trading infrastructure during last year’s meme coin rally. Data source: Dune

A key caveat: charging high fees amid high velocity is only viable in the absence of competition. Given enough time, competition emerges and drives fees down. That’s why perpetual futures exchanges see declining fees. Meme-coin-focused products maintain high fees while competition hasn’t fully arrived and before the market cools. Blur’s disruption of OpenSea exemplifies how fees drop once competition appears.

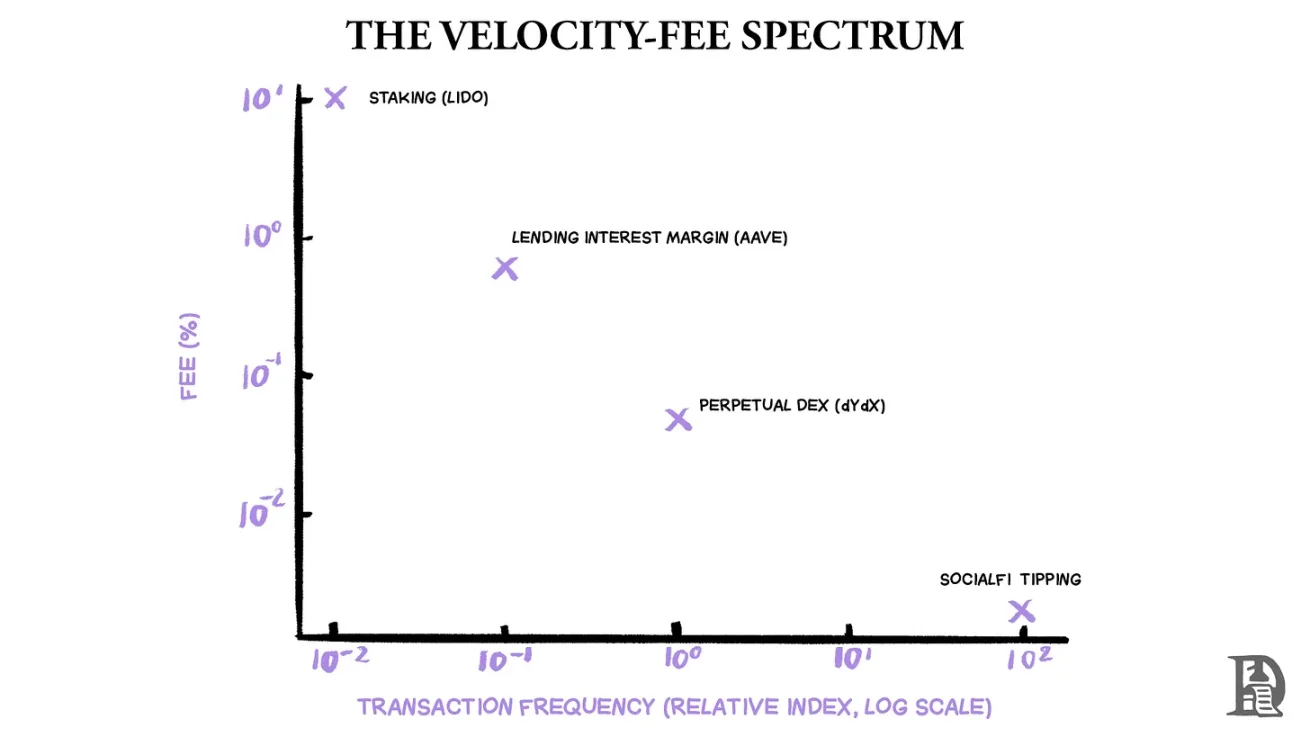

The alternative view sees sticky capital sources—like Uniswap liquidity providers or depositors earning yield on Ethereum via Aave and Lido—as the ideal target. In such products, capital velocity is much lower. Users deposit funds once every few months and forget about them. Hence, fees tend to be higher. Aave takes 10% of earned interest, Lido charges 10% of staking rewards (sharing half with node operators), and Jito also charges 10%.

On the internet, there’s a conservative rule linking capital velocity and extractable fees: the more times capital changes hands, the lower the implied transaction fee.

If capital sits idle, users may tolerate a 10% fee on returns. Seasonal or high-velocity products (like HyperLiquid or Binance) generate hundreds of millions because users repeat trades hundreds of times daily.

Assume zero profit and a 1% cost per trade—an investor making 69 trades retains only 50% of initial capital. At 2% per trade, just 23 trades halve their funds. This partly explains why platform trading fees trend downward. Platforms like Lighter and Robinhood have moved toward zero fees. If this continues, we’ll reach a tipping point where businesses must find alternative revenue models while masking transaction costs—just as dollar-pegged stablecoins do today.

High-velocity products monetize through compounding fees; low-velocity products rely on channel-based revenue. Put differently, the fewer times a protocol touches the same dollar in a day, the higher the return it must earn from that dollar to remain sustainable.

Speculative, seasonally-driven mispricing may let users pay premium fees for high-velocity products. But what about non-seasonal ones—products like on-chain stocks or commodities? I had the chance to discuss this with a founder from one of our portfolio companies. Orogold’s Usman has been building gold-related services on-chain. The following insights stem from a coffee chat with him.

On-Chain Commodities

Many believe tokenization unlocks massive liquidity for financial instruments. This explains why VCs holding illiquid equity advocate for tokenizing VC shares. But if the meme coin market has taught us anything, it’s that in crypto, liquidity fragments across millions of assets. When that happens, fair price discovery barely exists. As a founder, would you want to compete on liquidity with Fartcoin? I doubt it—at least not at seed stage.

Why then are exchanges like Coinbase and Robinhood rushing to bring stocks on-chain? Two forces are at play. First, markets are global and operate 24/7. Assets like Bitcoin have become macro hedges—when equities dip and liquidity hedge funds seek synchronously moving assets, Bitcoin fits the bill. Last year, Bitcoin moved ahead of yen carry-trade unwinds and priced in Trump tariff expectations early. Markets need always-on venues, and on-chain stocks can fill that role.

Second, today’s crypto market cap exceeds $2 trillion. This value needs liquid outlets—it can’t always stay in dollars, nor solely flow into real-world asset (RWA) lending, given differing risk profiles. On-chain commodities and stocks offer safe havens for this capital. Of course, not all commodities and stocks are equal—the uranium market pales next to gold.

This is why we’ll likely see a top-down approach: major assets and commodities get tokenized first. Which is more likely to gain traction on-chain: the S&P 500 or an early-stage VC index? I’d bet on the former.

Regarding commodities, some achieve product-market fit (PMF) more easily than others. Gold, with its long history and global accumulation, will likely see faster adoption than niche alternatives. It’s also a strong hedge against dollar depreciation. But why would someone who can invest in gold ETFs or own physical gold jewelry buy gold on-chain?

Capital velocity is ultimately crypto’s killer use case.

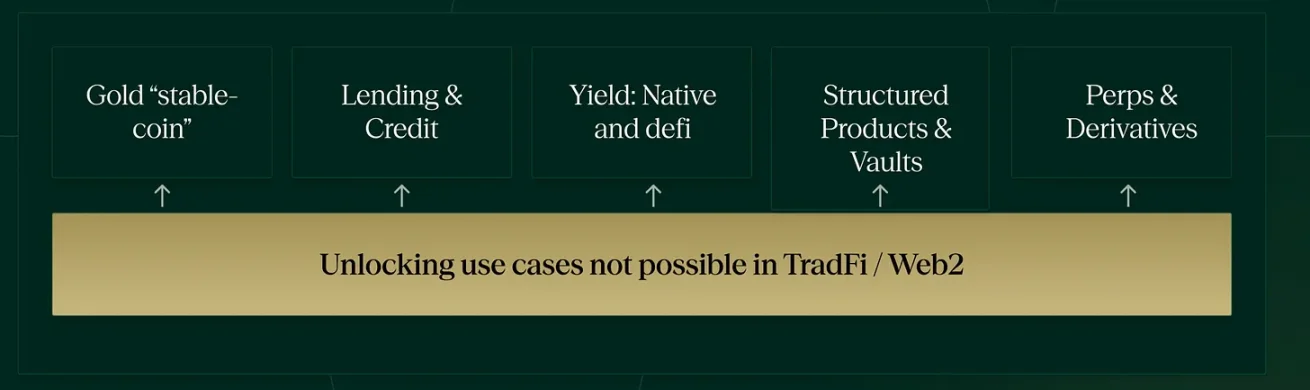

Tokenized gold moves faster across markets than physical bars. It’s composable, making collateralized borrowing easier. With a lending market, traders could leverage loop strategies on-chain gold, just as in DeFi. Gold also enjoys steady demand, efficient early on thanks to a large traditional market providing price discovery—unlike tokenized real estate or startup equity, where pricing lacks consensus and depends on regional or sector-specific nuances. Usman illustrated its Web3 role in the image below. His core argument: any on-chain representation of gold must outperform its Web2 counterpart to be relevant.

Usman’s view on how gold could be used in Web3

Remember the link between velocity and fees? It becomes especially interesting in the context of gold. If a platform (e.g., Orogold) can charge a small basis point fee on each individual gold transaction, it effectively monetizes gold ownership. This could also apply to minting and redemption fees. In the traditional world, this doesn’t happen—ETF trading fees go to issuers or exchanges. Sure, you can lend gold to specific institutions for yield, or banks may offer this service, but do individuals in emerging markets have such access? I doubt it.

Bringing commodities like gold on-chain means individuals in volatile economies can hold exposure to financial instruments without losing control. It also allows instant global transfer with a single click. This may sound far-fetched, but consider that today, anyone can travel anywhere and find someone to convert their stablecoins to local currency. The same could happen with on-chain gold—or one could simply swap it for stablecoins.

Tokenizing commodities like gold isn’t just about asset allocation or trading—it’s about unlocking higher velocity to generate yield. When fintech apps (like Revolut or PayPal) support these tools, we’ll see a new on-chain category emerge. But challenges remain.

First, it’s unclear whether on-chain gold representations can generate sufficient yield through trading or lending to meet user demands.

Second, there’s currently no large-scale digital commodity platform widely adopted by liquidity hedge funds and exchanges, akin to stablecoins in recent years.

All this assumes negligible custody and delivery risk for these instruments—but reality often differs.

Yet, as with most things in life, I’m cautiously optimistic about this space. What about intellectual property, wine, etc.? Well, I don’t know. Is there a market eager to trade wine hundreds of times daily? I don’t think so. Even Taylor Swift probably wouldn’t want her music rights tokenized and traded on-chain. Because you’d have to price things best considered priceless. Sure, analysts might perform DCF analyses on Jay-Z’s albums and assign monetary values. But for artists, opening such a market isn’t in their interest.

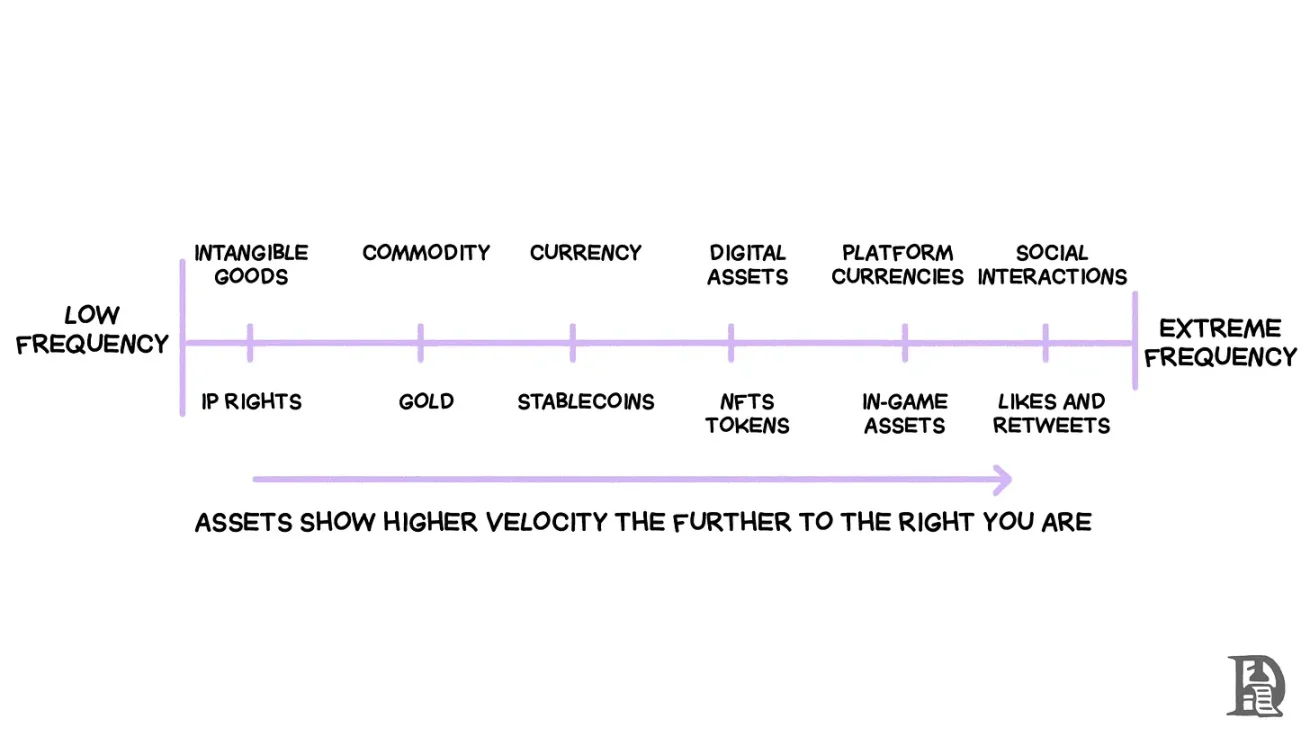

The chart below serves as a mental model showing how on-chain asset trading frequency might vary by context.

For areas like DeSci or any on-chain IP, what matters is a system’s ability to verify and confirm ownership. Blockchain could verify licensed artworks and share revenue with original creators in real time. Imagine Spotify paying artists at day’s end based on daily streams. Or our articles translated into Chinese automatically paying us daily based on traffic. Or a decentralized autonomous organization behind a drug research project receiving proportional payouts based on daily sales.

Such goods can command high fees because verifying a company’s right to transact is complex. This hasn’t materialized yet—legal frameworks take time. But in a world of LLM-generated content and stagnant research, we may soon use on-chain primitives to verify, reward, and incentivize collaborative creation of intellectual property.

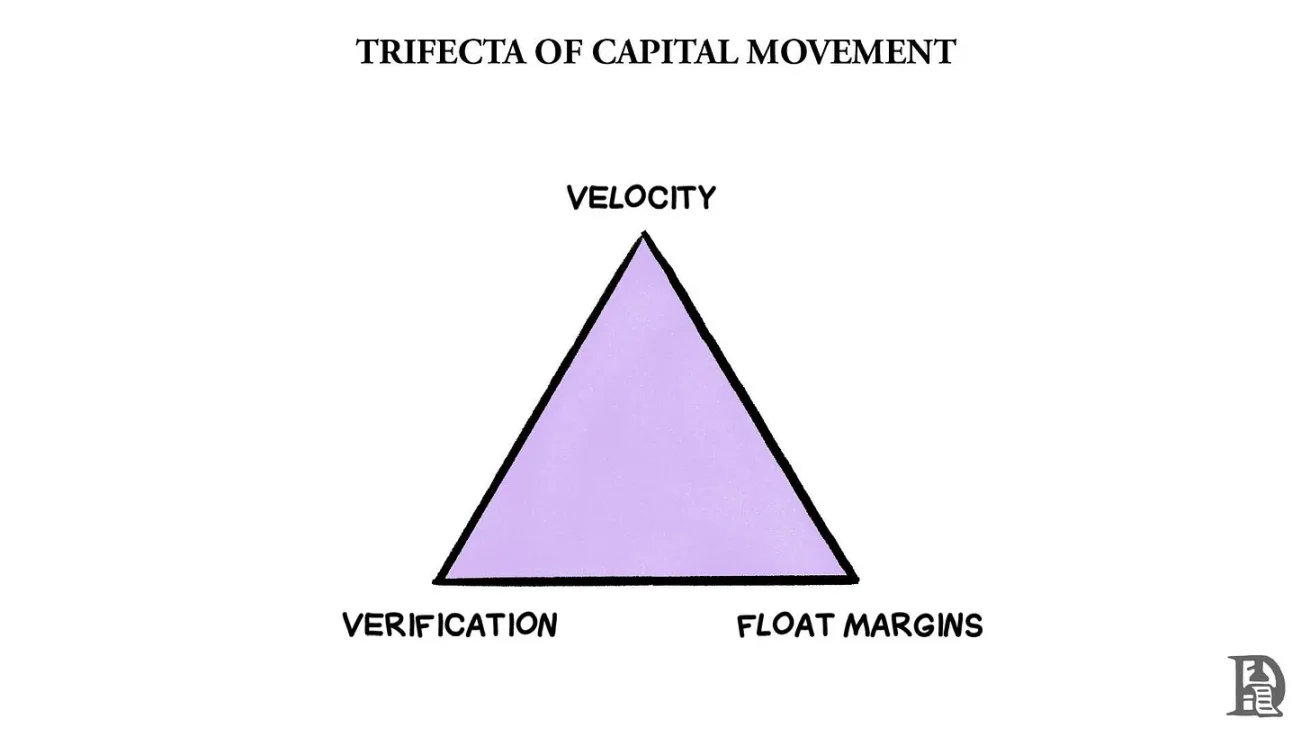

In short, as a payment rail, crypto will serve one of three roles: moving money faster (increasing velocity); rewarding and identifying users (verification); or generating yield from idle assets, like stablecoins and on-chain gold. Great companies almost always master two of these three elements, gaining an edge in Web3 revenue.

When Context Drives Transactions

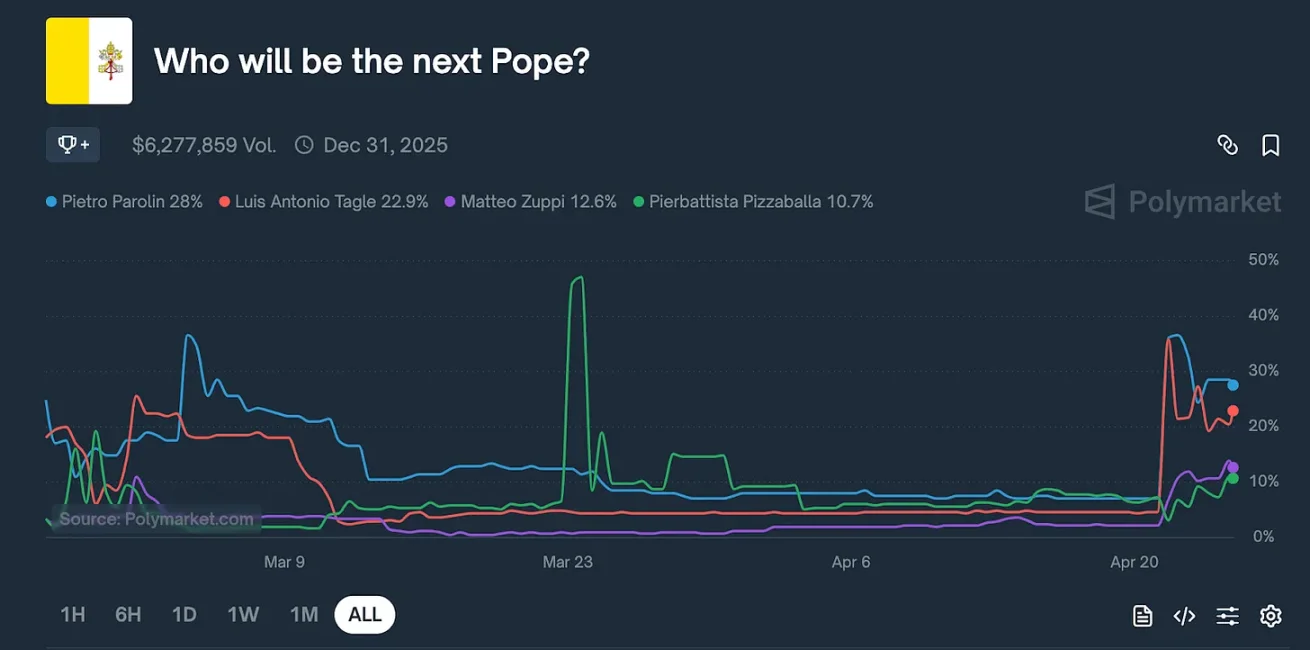

Time to profit from years spent tracking church politics… on Polymarket

Earlier, I described the web as a giant digital mall lacking transaction mechanisms. Blockchains changed that. We now live in a world with a shared global ledger enabling transactions. Most of the time, meme assets are issued in response to news events. Polymarket has become the go-to platform for forecasting real-world outcomes. Imagine believing someone from India could become the next pope? You could create a market and place bets.

Historically, media and much of our social interaction lacked a capital component—at least not one where good performance brings immediate compensation. You do gain social capital—benefits from being seen as kind or friendly, along with associated opportunities. Social media turned our presence into a never-ending performance. That’s partly why on-chain media enthusiasts love making everything mintable—so people can sell digital assets (like NFTs) and profit.

But perhaps there’s a middle ground. As the cost and time of moving money shrink, every online interaction becomes a transaction. Your likes, clicks, scrolls, even DMs, might be rewarded with tokens—worthless but effective at capturing attention.

The evolution of the web is the story of attention economies morphing into capital markets, bypassing intermediaries.

Social protocols like Farcaster can play a role, as can faster networks like Monad and MegaETH. This story is still being written. But one thing is clear: for early-stage founders, mastering the balance between value capture and velocity is the secret to survival. If you don’t know how to sustainably monetize your million users, having them means nothing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News