The real significance of stablecoins for the United States, emerging markets, and the future of money

TechFlow Selected TechFlow Selected

The real significance of stablecoins for the United States, emerging markets, and the future of money

Stablecoins continuously connect institutions, markets, and individuals in ways that traditional systems cannot match.

Author: 0xyanshu

Translator: Block unicorn

Introduction

Over the past few days, I’ve been reflecting on a recent post by Sandeep (co-founder and COO of Polygon).

This prompted me to revisit my notes and dig into some data. The more closely I examine the numbers, the more everything makes sense—far clearer than most people may realize.

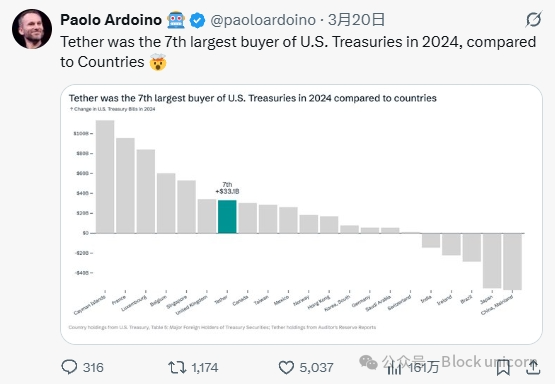

By the end of 2024, Tether had become the seventh-largest foreign buyer of U.S. Treasuries, surpassing countries like Canada and Mexico in annual purchase volume.

To this day, the argument is even stronger. Stablecoins have quietly emerged as one of the largest drivers of global dollar demand, while also serving as a financial lifeline for emerging markets grappling with inflation, currency depreciation, and capital controls.

In this article, I will analyze recent data and trends indicating that “Dollarization 2.0” is on the rise.

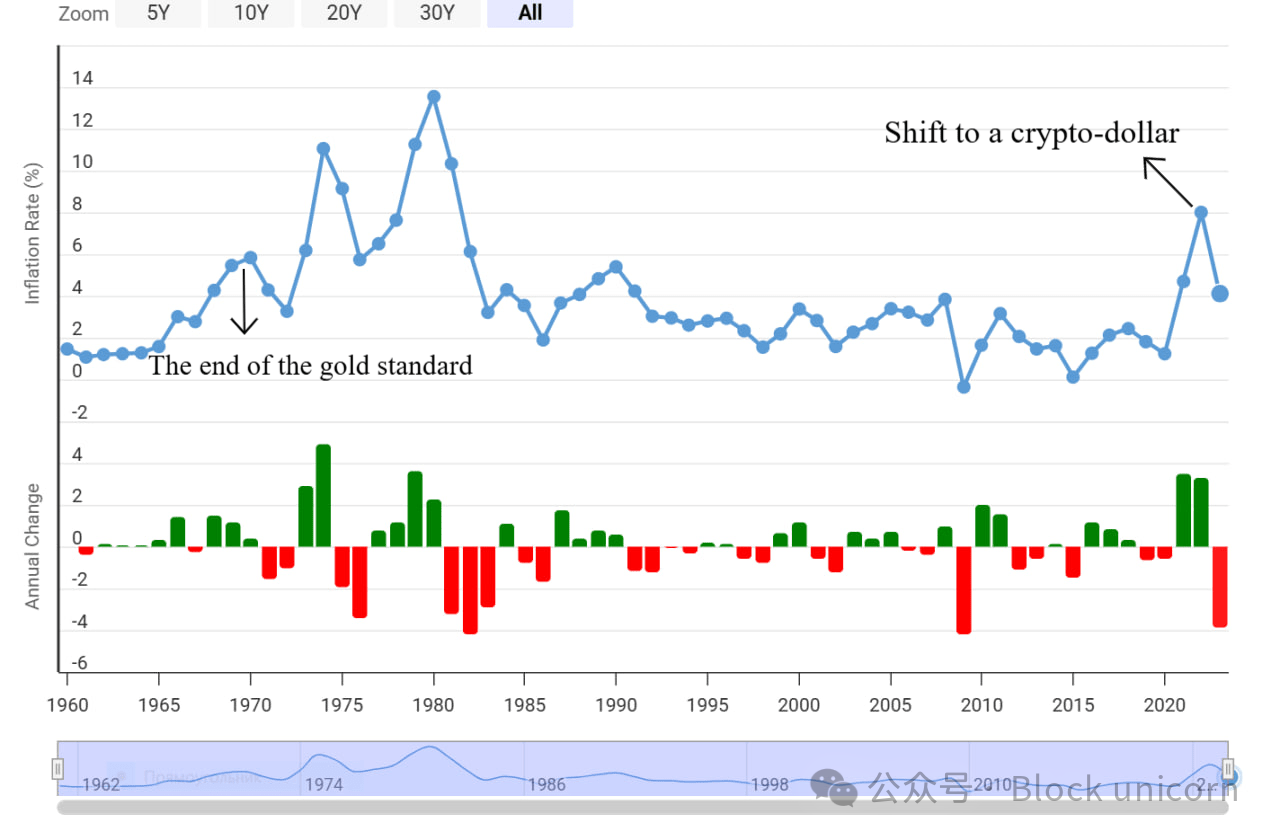

The petrodollar era is over, and this shift is shaping a world where both the United States and emerging economies benefit—at least in the medium to short term.

We will see how stablecoins are rapidly becoming the “lifeline” of global financial markets—not only within cryptocurrency but also as hedges and stores of value in emerging economies with fragile local currencies.

Origins

Stablecoins have rapidly evolved from a niche trading tool into the backbone of global crypto finance. In 2024, on-chain stablecoin transactions reached $15.6 trillion—about 20% higher than Visa’s annual payment volume. Currently, the total supply of stablecoins exceeds $300 billion, representing over 50% year-on-year growth. These dollar-pegged tokens, led by Tether's USDT, support a wide range of applications—from crypto trading and DeFi protocols to remittances and daily payments.

Their appeal is simple yet powerful: stablecoins combine the reliability of fiat money with the speed and borderless nature of cryptocurrencies, enabling near-instant, low-cost settlements worldwide.

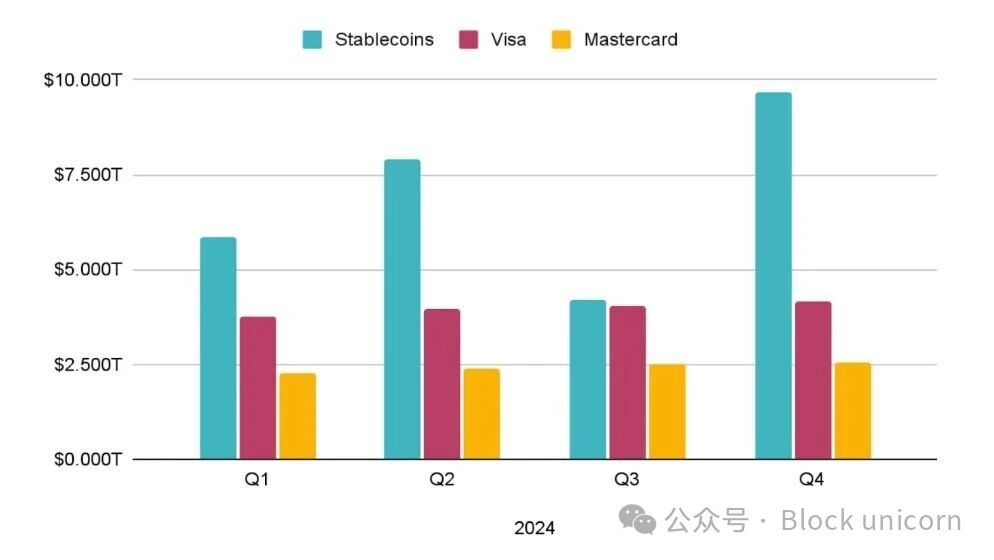

Daily transaction volumes of stablecoins on public blockchains now exceed $100 billion, with their annual transaction volume rivaling or exceeding those of major payment networks. A report from CEX.io noted that stablecoin transfer volume reached $27.6 trillion in 2024—approximately 8% higher than the combined transaction volumes of Visa and Mastercard.

This staggering usage highlights that stablecoins have achieved true product-market fit: users value transacting in currencies pegged to the dollar (or other fiat) without enduring the volatility typical of mainstream cryptocurrencies.

Chart: Quarterly on-chain stablecoin transfer volume in 2024 (blue) compared to Visa (pink) and Mastercard (yellow). By Q4 2024, stablecoin networks processed significantly more value than major card networks.

Several factors explain why stablecoins are so popular and growing so fast:

They offer stability and familiarity through 1:1 pegs to fiat currencies—primarily the U.S. dollar—avoiding crypto volatility while preserving blockchain advantages.

They enable global, 24/7 trading, reducing settlement times from days to minutes—ideal for remittances and cross-border trade.

They feature low fees, typically fractions of a cent per transfer, making both micro and macro payments feasible.

They promote financial inclusion, giving anyone with internet access stable and accessible money—especially crucial in countries suffering from inflation or weak banking systems.

And they’re programmable, seamlessly integrating with DeFi for lending, trading, and yield generation.

Let’s assess the scale of this opportunity

U.S. M2 money supply is a broad measure of economic liquidity, including cash, checking deposits, savings accounts, small time deposits, and retail money market funds. As of mid-2025, M2 stood at approximately $22 trillion—reflecting the vast amount of dollars circulating within the traditional financial system.

Source: Article "Stablecoins Could Become One of the U.S. Government’s Steadiest Financial Allies"

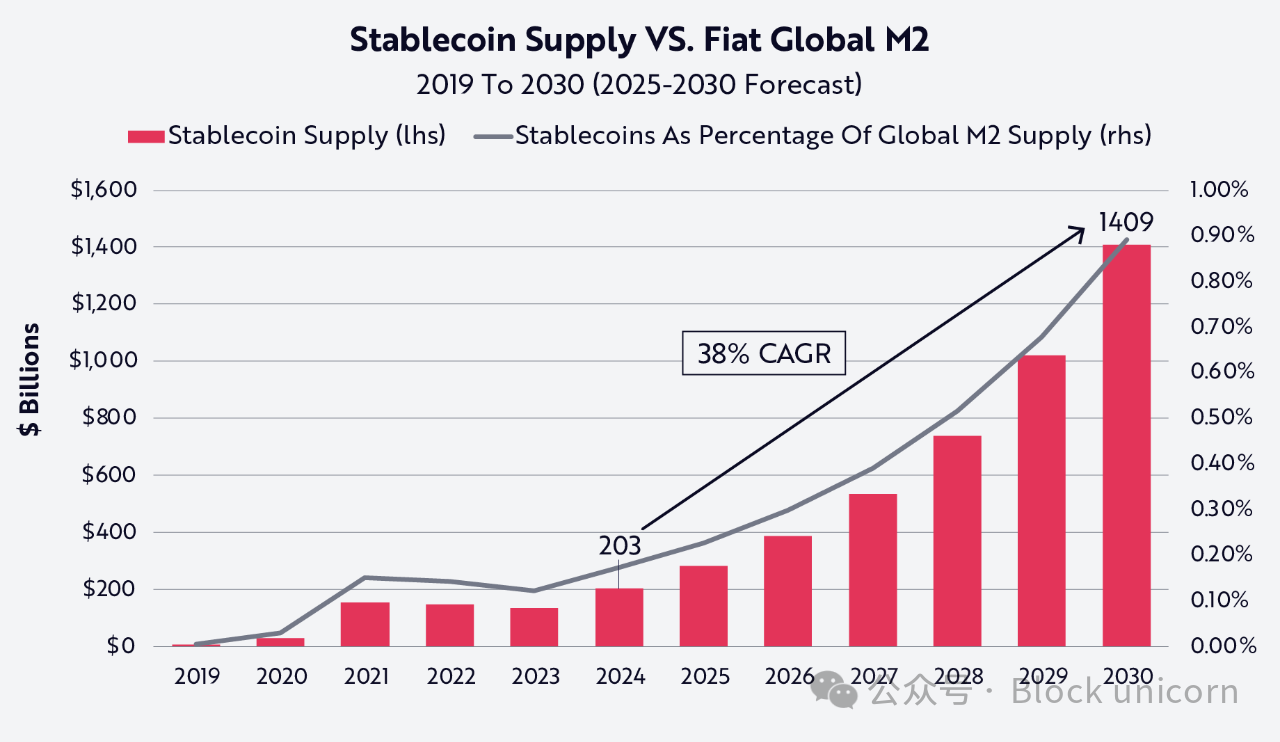

In contrast, the global market cap of stablecoins is around $300 billion—just about 1% of the U.S. M2 money supply. While still small in absolute terms, this comparison underscores the rapid growth of stablecoins and their enormous expansion potential. Stablecoins are essentially digital dollars running on blockchains. If they capture even a small fraction of M2, their market size could reach several trillion dollars, reshaping payments, remittances, and global dollar distribution.

Importantly, stablecoins are becoming complements to traditional payment networks rather than threats.

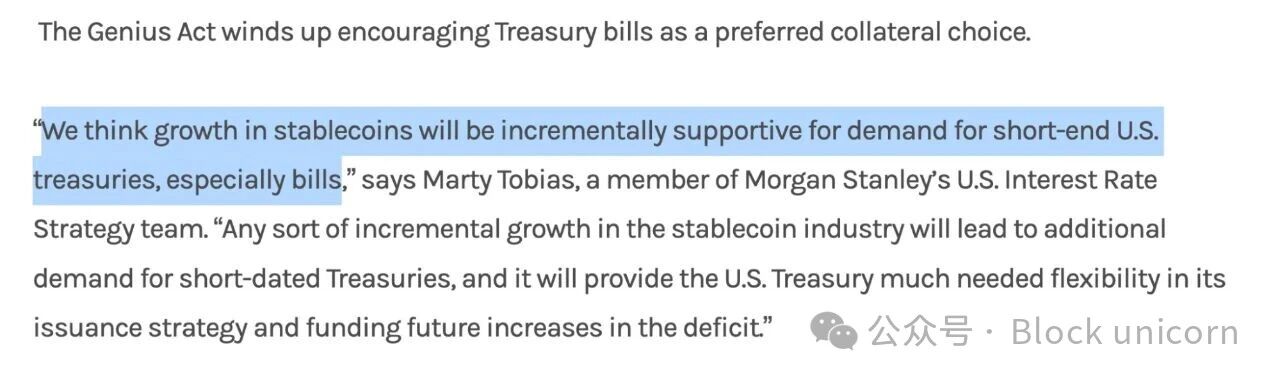

Even Morgan Stanley views stablecoins as an incremental investment opportunity. Notably, the growth of these tokens could boost demand for short-term U.S. Treasuries, giving the Treasury greater flexibility in deficit financing and cash flow management. These tokens can settle large-value transfers—such as interbank or trade settlements—clearing almost instantly, functioning much like digital cash accounts.

This utility has drawn regulatory attention. In the U.S., the recently enacted GENIUS Act (Guidance and Establishment of National Innovation in Stablecoins Act) mandates that stablecoins must be fully backed 1:1 with reserves held in liquid assets such as Treasuries or U.S. dollars, requires monthly disclosures, and prioritizes consumer protection—including safe resolution procedures if an issuer goes bankrupt.

Across the Atlantic, the EU’s MiCA regulations took effect in mid-2024, imposing licensing, transparency, and reserve standards on stablecoins to enhance stability and market integrity.

If properly regulated, stablecoins could trigger a generational transformation in how money moves—making it faster, cheaper, and more seamless—while enhancing rather than replacing traditional payment networks. (We are already seeing this unfold.)

From Petrodollar to Digital Dollar: How Stablecoins Expand U.S. Dominance

For decades, the U.S. has leveraged the dollar’s reserve currency status to solidify its global influence—the petrodollar system being the most prominent example. Under this system, oil exports priced in dollars ensured sustained demand for both the dollar and U.S. Treasuries. Many now believe that dollar-backed stablecoins are repeating history. These crypto tokens—like USDT and USDC—are pegged 1:1 to the dollar and primarily backed by U.S. assets. By promoting dollar stablecoins, the U.S. is effectively exporting dollars at internet speed, cementing dollar hegemony in the digital economy much as the petrodollar once did for the oil economy.

U.S. policymakers have clearly embraced this trend. Under this administration, the U.S. passed the landmark GENIUS Act, establishing a regulatory framework for stablecoin issuance. The intent is clear: reinforce the dollar’s role as the world’s primary reserve currency and increase demand for U.S. Treasuries—which back these stablecoins. In other words, the U.S. government sees dollar stablecoins as a strategic digital ally, strengthening dollar dominance while funding U.S. debt.

The GENIUS Act requires dollar stablecoins to be fully backed by safe, liquid assets such as cash and short-term Treasuries. This means every newly issued stablecoin effectively creates a buyer for U.S. debt—a modern parallel to how petrodollar surpluses were reinvested into Treasuries in the 1970s. Analysts have even described stablecoins as a “Trojan horse” for U.S. debt, guaranteeing growing global demand for American bonds.

Data already confirms this trend. Tether, the largest dollar stablecoin issuer, now holds approximately $180 billion in U.S. Treasuries as reserves—placing it among the world’s largest holders, exceeding many nations’ holdings.

Each USDT token in circulation represents one dollar willingly held by overseas investors. When these dollars are invested in U.S. Treasuries, they effectively provide the U.S. government with an (almost) interest-free loan. Other issuers, such as Circle (issuer of USDC), similarly invest heavily in U.S. bonds.

This trend is so significant that many analysts believe stablecoins could become one of the U.S. government’s most important strategic assets over the next decade—filling the funding gap left by foreign central banks reducing their Treasury holdings. Whenever overseas businesses or individuals choose to hold dollar stablecoins, they reinforce the dollar’s global standing and indirectly finance U.S. fiscal deficits by generating demand for short-term U.S. Treasuries.

For these reasons, U.S. leaders have openly endorsed stablecoins. President Trump stated upon signing the stablecoin bill in 2025: “This is good for the dollar and good for the country.”

The geopolitical logic is straightforward. Just as oil-exporting nations once had to hold dollars, anyone transacting in the digital economy today can opt for U.S. stablecoins. By doing so, they feed what many call the next-generation petrodollar system. The U.S. benefits from seigniorage and debt financing—dollars may flow out, but ultimately return home via investments. In sum, stablecoins extend American financial influence into cyberspace: they sustain the world’s habit of using dollars for trade and savings while channeling global capital into U.S. government bonds.

The Importance of Stablecoins in Emerging Markets

In emerging markets, stablecoins have become financial lifelines—providing accessible, stable, and efficient payment channels when local financial systems often fail. When national currencies collapse due to inflation or capital controls, people turn to the dollar. But instead of paper bills, they increasingly choose digital dollars that flow seamlessly across borders.

Stablecoins address three unmet needs in emerging markets

1) Barrier-free dollar access

In many countries, capital controls and weak banking systems make holding dollars difficult. Stablecoins solve this by allowing anyone with a smartphone to access digital dollars anytime. In places like Nigeria and Ethiopia, businesses already use stablecoins to pay suppliers when banks and forex markets fail.

2) Cheaper and faster payments

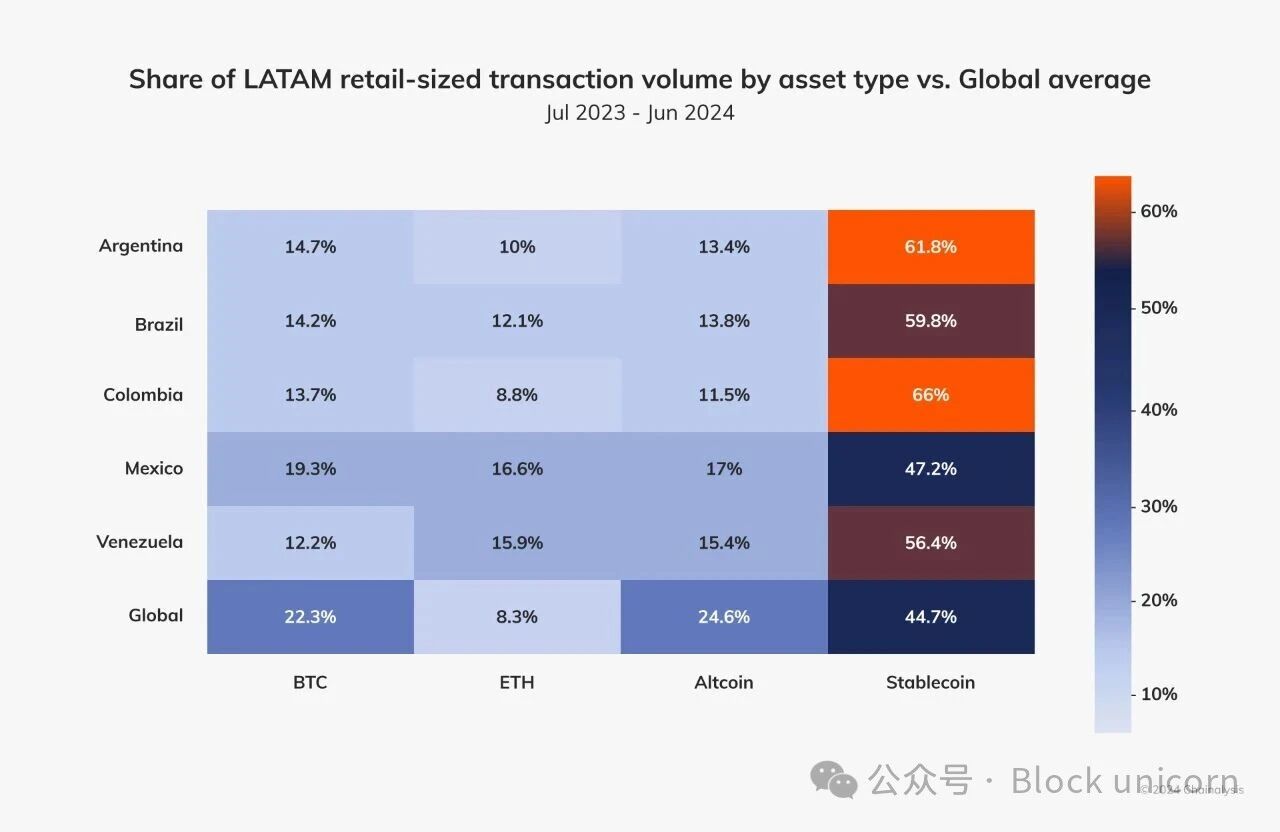

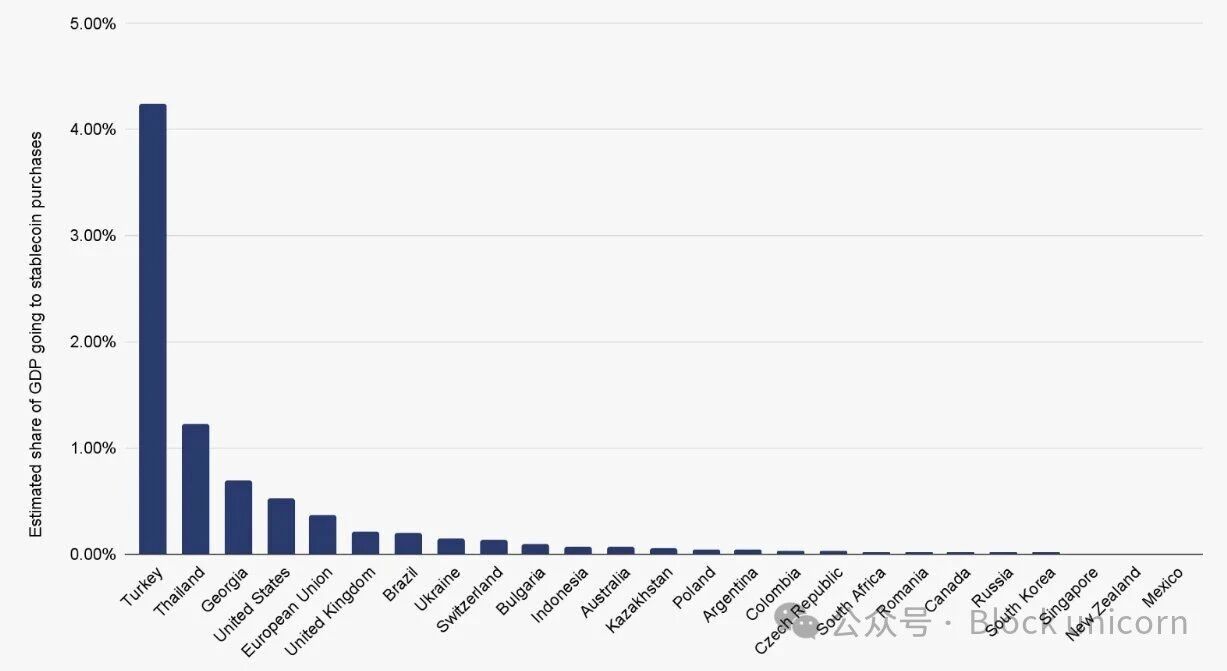

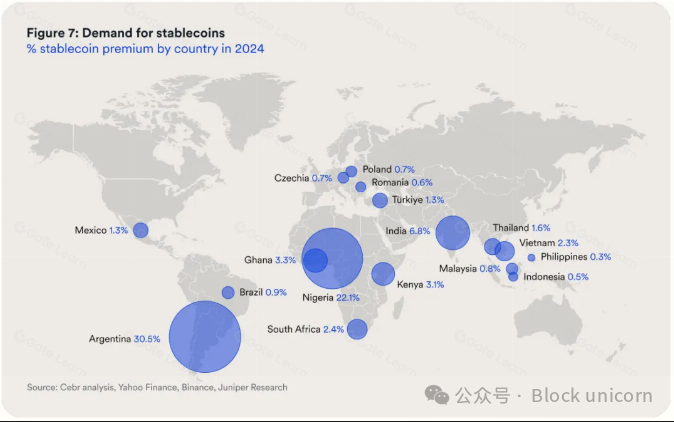

This trend is most pronounced in the most volatile regions. In Argentina, over 62% of crypto transactions now involve stablecoins, up from 45% last year. In Brazil, nearly 70% of exchange outflows are denominated in USDT or USDC, reflecting stablecoins’ growing role in trade, savings, and wage payments. Turkey, facing inflation above 55%, saw over $38 billion in stablecoin transaction volume last year—equivalent to 4.3% of its GDP, the highest share globally.

Turkey’s inflation has also exceeded 60%, and its adoption of stablecoins has reached unprecedented levels. Between April 2023 and March 2024, Turkish stablecoin purchases amounted to 4.3% of GDP—the highest ratio globally. During this period, stablecoin transaction volume was approximately $38 billion. Today, stablecoins account for over half of cryptocurrency trading volume in many emerging markets—even surpassing major assets like Bitcoin.

This year, Africa’s largest payment processor, Flutterwave (processing over $40 billion annually), selected Polygon as its default blockchain for cross-border stablecoin settlements across more than 30 countries. This partnership marks one of the largest real-world deployments of stablecoins in history, supporting consumer and enterprise transactions for major clients like Uber and Audiomack.

The trend is even broader globally. Across Latin America, Africa, and Southeast Asia, Polygon supports over 50% to 70% of non-dollar stablecoin transactions. In regions where traditional financial systems remain slow, costly, and fragmented, millions rely on Polygon’s payment rails for instant remittances, everyday purchases, and gig economy income settlements.

3) A stable unit of account

High inflation makes local pricing nearly impossible. In Argentina, about 62% of crypto trading activity is concentrated in stablecoins, and USDT consistently trades at a premium over the official dollar rate.

In Asia, adoption of Polygon is accelerating in fintech and at the government level. Japan’s JYPC launched the world’s first yen-pegged stablecoin, deployed on Ethereum, Avalanche, and Polygon—with Polygon leading in daily transaction volume and active user addresses.

Demand is exceptionally strong during market stress, with people even paying premiums above face value to obtain tokenized dollars. In Argentina, USDT has traded at a 30% premium over the official exchange rate. This underscores the far greater trust people place in digital currencies compared to local banks or government guarantees.

Today, this momentum extends beyond retail. Polygon has become the preferred platform for institutional entry into stablecoins and real-world assets (RWA). BlackRock’s BUIDL fund—the world’s largest tokenized U.S. Treasury product, valued at $3 billion—has invested $500 million on Polygon, its largest allocation outside Ethereum.

Franklin Templeton’s FOBXX fund (valued at over $300 million) also operates on Polygon, using it as the execution layer for tokenized exposure to U.S. Treasuries.

While Ethereum maintains its position as the institutional-grade network for programmable money, Polygon is emerging as a leader in emerging markets and a top choice for globally scalable, low-cost infrastructure.

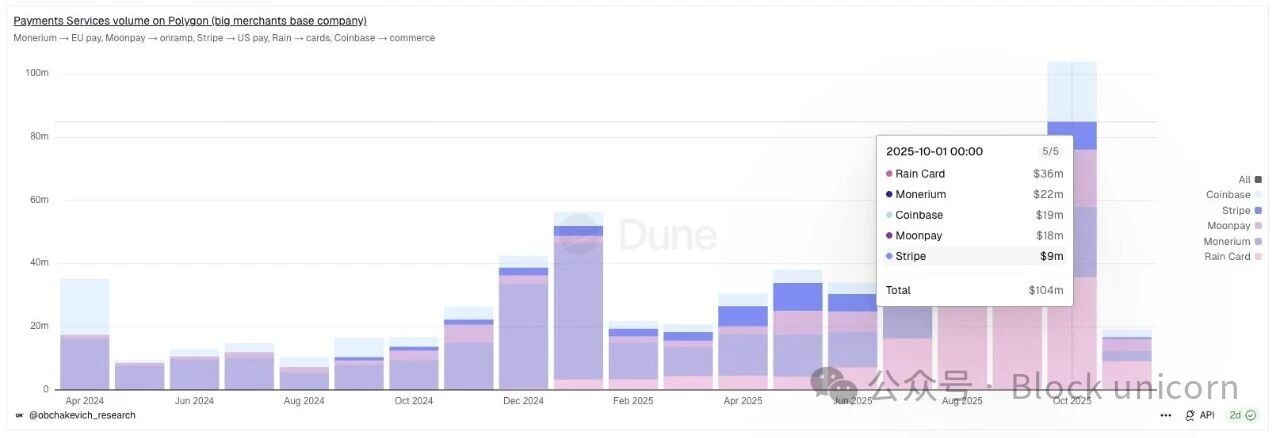

Polygon’s recent payment activity reflects this momentum. In October 2025, the network set record highs in on-chain activity:

Application transaction volume up 20% month-over-month

Deposit and withdrawal activity up 35%

Card payments up 30%

Infrastructure utilization up 19%

The network processed a total of 128.8 million transactions involving 3 million active addresses, with stablecoin market cap reaching $3.1 billion—solidifying its position as the third-largest stablecoin network globally, behind only Ethereum and Tron.

Polygon’s strength lies in its diversification. Stripe, the world’s largest fintech payment processor, currently integrates via Polygon, handling over $8 million in transactions monthly. Coinbase, MoonPay, Rain, and Paxos—all leverage Polygon’s rails for stablecoin and settlement flows.

Conclusion

The story of stablecoins is no longer theoretical—it is unfolding in real time. Billions—and soon trillions—of stablecoins are flowing across networks like Ethereum and Polygon, reshaping how the world stores, transfers, and settles value. From U.S. Treasuries to wages for gig workers in Lagos, the same rails now serve vastly different economies—all anchored by the same digital standard: the dollar.

How this shift unfolds in the medium to long term remains to be seen. Yet it is clear that stablecoins have established themselves as a core component of a new financial internet—one that continuously connects institutions, markets, and individuals in ways traditional systems cannot match.

As I’ve always said,

These numbers aren’t arbitrary—they carry real value and impact for millions in emerging economies who depend on these rails.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News