Bitget Daily Morning Report: Uniswap proposal activates protocol fee switch and UNI burning

TechFlow Selected TechFlow Selected

Bitget Daily Morning Report: Uniswap proposal activates protocol fee switch and UNI burning

Monad announces token economics, with 3% airdropped to the community.

Author: Bitget

Bitget Daily Morning Report (November 11) | Uniswap proposal activates protocol fee switch and UNI burn; Monad announces tokenomics with 3% airdropped to community; Strive increases BTC holdings to 7,525

Today's Highlights

1. Uniswap ecosystem sees major governance proposal: Uniswap Labs and Foundation proposed on November 10 to activate the protocol fee switch and implement a UNI burn mechanism. UNI surged over 38% to 41.66% in the past 24 hours, market cap rising to $7.192 billion;

2. Monad reveals tokenomics: total supply of 100 billion tokens, with 7.5% offered at a $2.5 billion FDV, and 3% airdropped to the community;

3. Solayer (LAYER) will unlock approximately 27.02 million tokens worth around $6.6 million on November 11, 2025, representing 9.51% of circulating supply;

Macro & Hot Topics

1. The U.S. Senate approved a bill to end the government shutdown and sent it to the House

2. No net inflow recorded for U.S. Hedera spot ETFs; Litecoin spot ETF saw $2.11 million net inflow in one day;

3. The Depository Trust & Clearing Corporation (DTCC) has listed five XRP spot ETF products for clearing, signaling potential listings;

4. Nasdaq-listed Strive announced purchasing 1,567 bitcoins at an average price of $103,315, increasing its total bitcoin holdings to 7,525;

Market Trends

1. BTC/ETH dip slightly in the short term, indicating bearish sentiment. Total liquidations across the market in the past 24 hours amount to ~$318 million, with $178 million in long positions liquidated;

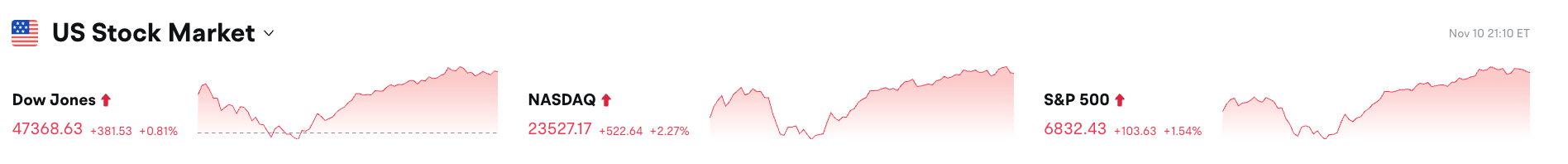

2. U.S. stocks closed higher on Monday: Dow rose 0.81%, Nasdaq jumped 2.27%, S&P 500 climbed 1.54%;

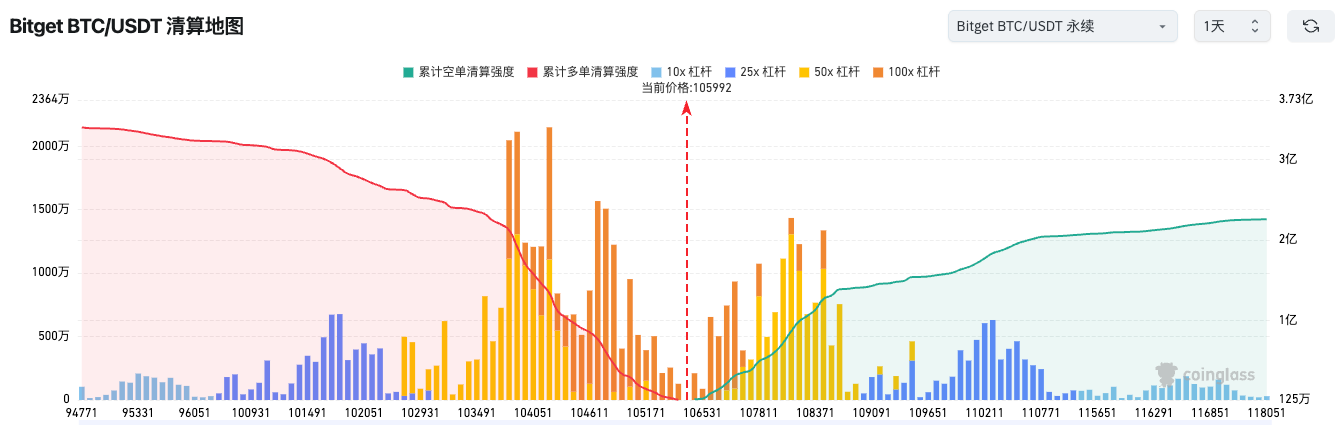

3. Bitget BTC/USDT liquidation map shows BTC currently at 105,992 USDT; high-leverage longs are densely concentrated between 104,000–105,500, posing risk of long squeeze if support breaks;

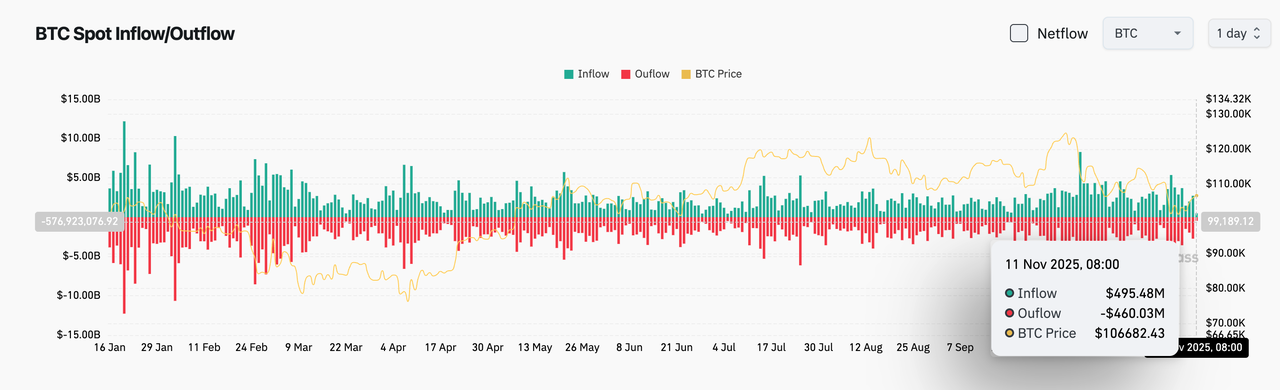

4. In the past 24 hours, BTC spot inflows reached $495 million, outflows were $460 million, resulting in a net inflow of $35 million;

5. Over the past 24 hours, BTC, ETH, USDT, XRP, BNB and other coin futures contracts showed leading net outflows, possibly indicating trading opportunities;

News Updates

1. U.S. Senate Agriculture Committee releases draft crypto regulation bill aiming to grant CFTC new powers to regulate digital commodities;

2. ZK Nation: voting on ZK token upgrade proposal featuring permissionless burning function will begin on November 14;

3. U.S. Treasury and IRS issue new guidance providing clear pathway for staking within crypto ETP products;

4. Brazil’s central bank issues new virtual asset regulations, formally establishing a legal framework for “Virtual Asset Service Providers,” effective February 2026;

Project Developments

1. Starknet (STRK) v0.14.1 upgrade to launch on testnet on November 11, 2025;

2. peaq (PEAQ) will unlock approximately 84.84 million tokens worth about $6 million on November 12, 2025, representing 5.57% of circulating supply;

3. SUI Group partners with Bluefin: provides 2 million SUI loan and receives 5% revenue share from Bluefin;

4. Rumble and Tether enter into a $100 million advertising partnership, spanning two years at $50 million per year;

5. Hourglass project Stable pre-deposit vault Phase II KYC deadline extended, with over 17,000 applications already approved;

6. Aptos (APT) to unlock approximately 11.31 million tokens worth about $33.4 million on November 11, 2025 at 14:00, accounting for 0.49% of circulating supply;

7. Chainlink (LINK) to launch its first-quarter incentive program on November 11, 2025, involving LINK staking and token claims;

8. 23 projects on Solana raised over $211 million cumulatively in Q3, up 70% quarter-on-quarter;

9. Japan’s Financial Services Agency (FSA) plans to mandate registration for third-party crypto custodians to strengthen industry security;

10. Strive increases Bitcoin holdings to 7,525, accelerating digital asset allocation;

Disclaimer: This report is generated by AI, with human verification only for information accuracy. No investment advice is provided.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News