$PING rebounds 50%, quick look at the launchpad project c402.market based on $PING

TechFlow Selected TechFlow Selected

$PING rebounds 50%, quick look at the launchpad project c402.market based on $PING

c402.market is more inclined to incentivize token creators in its mechanism design, rather than just benefiting minter and traders.

Author: David, TechFlow

The x402 narrative has been hot for half a month, but few new assets have emerged from it.

There are two main reasons. First, x402 is primarily designed for AI-to-AI payments and doesn't align with the typical crypto pattern of "creating assets."

Second, most crypto projects围绕x402 are infrastructure-focused, benefiting more from the technical narrative's popularity than delivering tangible product progress in the short term.

Yet $PING—the first asset created under x402 (albeit a meme)—has become the first to take action.

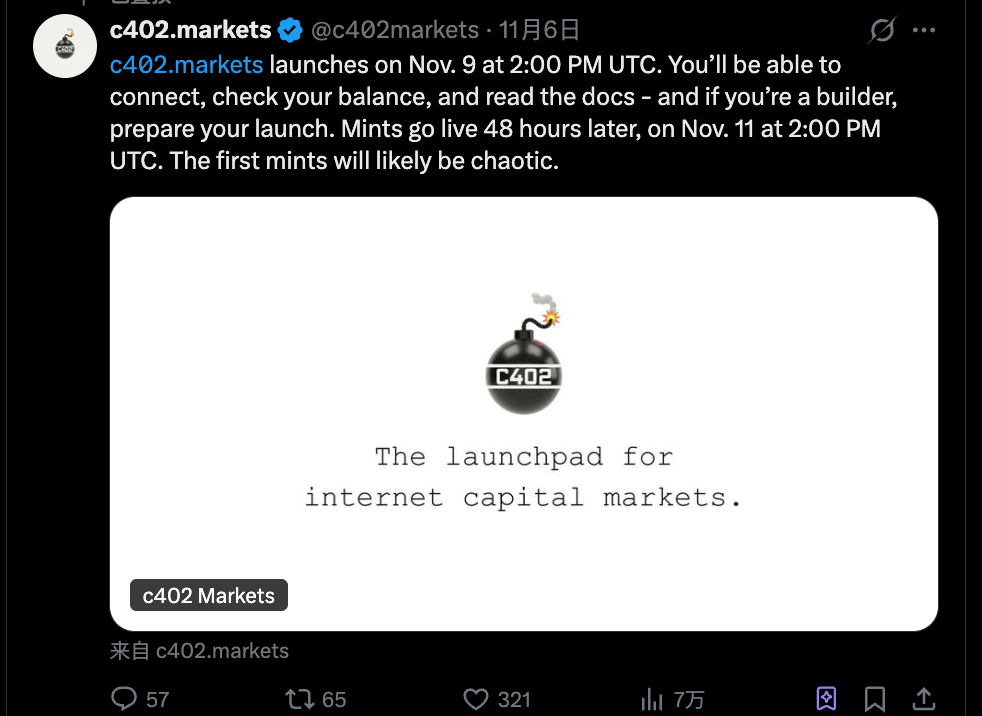

On November 10, PING’s official Twitter account @pingobserver announced the launch of c402.market, a token launchpad built on the x402 protocol, set to go live on the 11th.

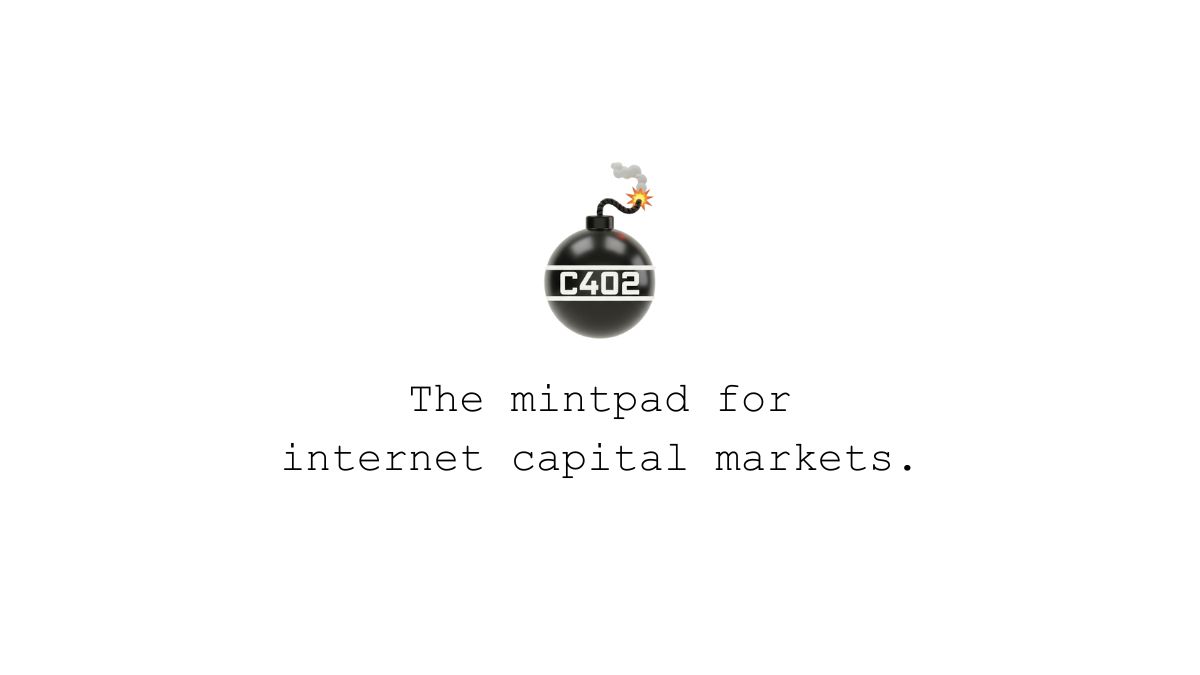

Following the news, PING’s token price surged from its intraday low, gaining nearly 50% within 24 hours.

In short, the core mechanism of c402.market is this: all new tokens launched on the platform will be automatically paired for trading with $PING.

In other words, PING is no longer just a meme token riding the x402 narrative—it’s transforming into the “base currency” of the entire c402 ecosystem. To participate in new projects on the platform, you’ll need to hold PING.

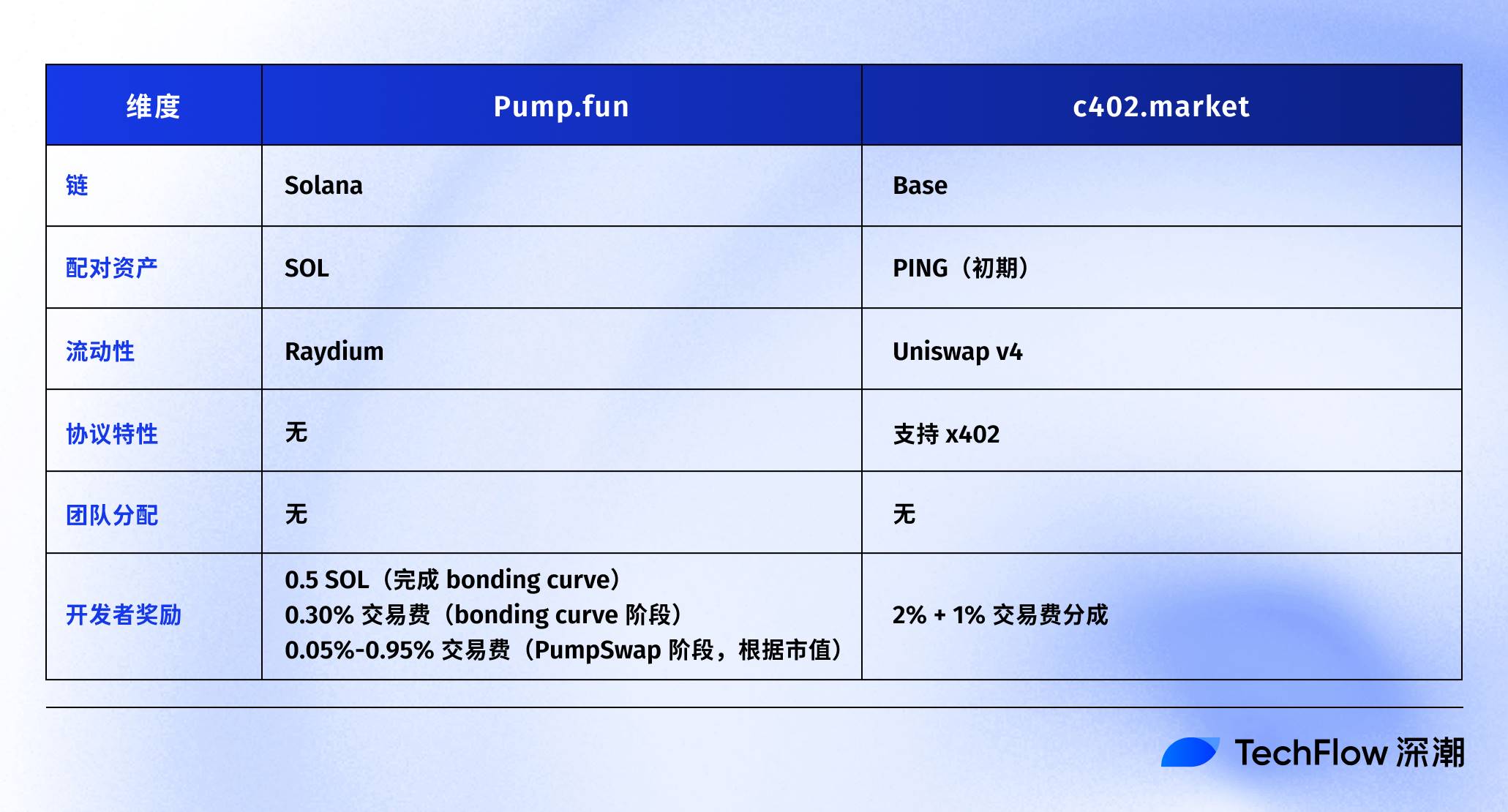

This follows a familiar playbook. Solana’s Pump.fun made SOL essential for meme coin launches; various launchpads on Base gave ETH real utility.

Now, c402.market aims to position PING as a similar cornerstone within the x402 ecosystem.

Right now, the market sits at a bull-bear crossroads. Some believe we’re in a bear market with no new narratives, making new assets unattractive. Others argue that alt season is arriving in an unexpected form, creating localized opportunities.

With x402 protocol transaction data cooling down, launching a new asset-focused launchpad centered on x402 could represent one such opportunity in the current climate.

But can PING successfully transition from a pure meme coin to an “ecosystem currency”? For retail investors, what opportunities exist—and what pitfalls should be avoided?

A Quick Recap of x402 and PING

For those unfamiliar with x402, here’s a quick summary:

x402 is an open payment protocol launched by Coinbase in May 2025 that enables websites, APIs, and AI agents to make direct payments using stablecoins (primarily USDC) without requiring accounts, passwords, or API keys.

Its core mechanism is simple—we covered it a month ago. When accessing a paid service, the server returns an HTTP 402 status code (a long-existing but previously unused internet protocol code meaning "payment required") indicating the cost.

You send an on-chain payment via your wallet, then re-request access. The server verifies the payment and grants access X402. The entire process takes about 2 seconds and incurs zero fees.

(Further reading: Google and Visa Are Investing—What Investment Opportunities Lie in the Underrated x402 Protocol?)

The rise of x402 is inseparable from $PING, which delivered real wealth effects.

$PING was the first token issued via the x402 protocol. Users don’t need to register on a website—just visit a URL, receive a "402 Payment Required" prompt, pay a small amount of USDC, re-request, and receive PING tokens.

The token itself has no real utility and functions more like a meme. But it carries the inherent narrative of “the first token created via x402,” reminiscent of the earlier inscriptions trend. As a result, it’s seen significant speculation over the past month, surging up to 30x at launch and briefly surpassing a $60 million market cap.

However, after PING’s surge, the x402 ecosystem hit a roadblock:

The protocol is impressive, the tech narrative strong, and backed by major players—but aside from the PING meme coin, the ecosystem lacks additional “assets” for broader participation. x402 functions more like a payment infrastructure than a token issuance tool.

Most related projects focus on B2B offerings like AI Agent services and API markets, far removed from retail crypto investors’ desire to “trade coins.”

The market needs a venue to continuously generate new assets and allow retail users to access early-stage projects. This is the context behind c402.market’s emergence.

You may dislike this model, but dismissing it entirely as mere hype would be equally extreme.

c402.market: The Pump.fun of the x402 Ecosystem?

Visit c402.market’s homepage, and you’ll see a bold, concise tagline:

"The mintpad for internet capital markets"

Yes, another classic ICP-style narrative. Combining grand terms like “internet” and “capital markets” to give a simple token launchpad a revolutionary sheen.

In essence, c402.market is a token launchpad built on the x402 protocol, allowing anyone to quickly issue tokens that are automatically paired with $PING for trading.

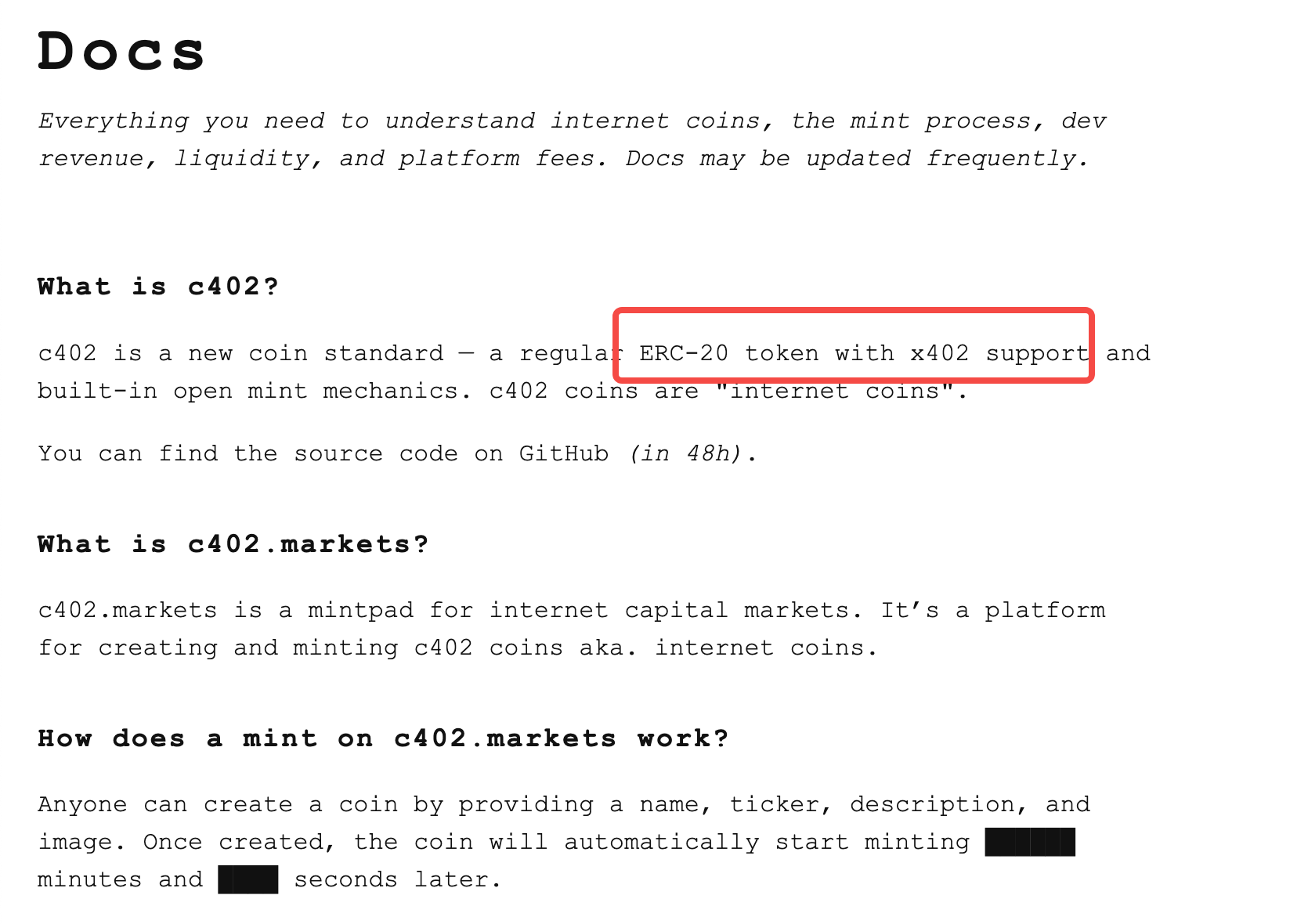

Before diving into the minting mechanism, it’s important to understand what a “c402 token” is. c402 is a newly invented token standard—a variant of ERC-20 that supports the x402 protocol and includes a built-in public minting mechanism. The team calls them “internet coins.”

This means tokens issued on c402.market aren’t just standard ERC-20s—they natively support the x402 payment protocol.

Theoretically, these tokens can be used directly in AI Agent payment scenarios or any application where an HTTP 402 status code triggers a payment. In practice, however, most people care more about their speculative value than technical features.

c402.market’s minting mechanism closely follows Pump.fun’s “Bonding Curve” model, with some tweaks. Each token has a fixed total supply of 1 billion, with no team allocation or reserved shares.

According to official documentation, the token distribution is as follows:

-

49% distributed through public minting, at 1 USDC per mint

-

49% automatically allocated to liquidity

-

2% as developer reward

Minting Process:

-

Create Token: Anyone can create a token by providing a name, symbol, description, and image. A 1 USDC “spam prevention” fee is required

-

Wait for Minting to Begin: After creation, minting starts automatically after a fixed delay (interestingly, the official docs use █ to obscure the exact time—likely ranging from minutes to tens of minutes, details may only be clear upon full launch)

-

Purchase Phase: Users mint tokens by paying 1 USDC each. The number of mints is limited

-

Automatic Listing: Once all mint slots are filled, the collected USDC is processed automatically

The PING Pairing Mechanism: USDC → PING → Liquidity Pool

This is the most crucial part—the core logic enabling PING to benefit.

As described in the project’s GitHub, once a c402 token minting concludes, all collected USDC is used to purchase the designated pairing token (initially only PING), which is then combined with the remaining 49% of the token supply to form and lock liquidity.

Example: Suppose someone creates a token called $COIN, choosing $PING as the pairing asset. The minting phase requires a set number of transactions—say 10,000—collecting 10,000 USDC.

-

Minting Phase: Users pay USDC to mint, collecting 10,000 USDC

-

Auto-Swap: The 10,000 USDC is automatically swapped for $PING via Uniswap

-

Liquidity Provision: The purchased PING and 490 million $COIN (49% of supply) are added to a Uniswap v4 liquidity pool and permanently locked

-

Developer Reward: 20 million $COIN (2% of supply) goes to the token creator

What does this mean for PING?

Every time a new token successfully completes minting on c402.market, it generates a forced USDC → PING buy order. If 10 projects mint daily, each raising 10,000 USDC, that’s 100,000 USDC in daily PING demand.

This likely explains why the announcement of c402.market caused PING’s price to jump 50%—the market is pricing in expectations of sustained future buying pressure or ecosystem success.

Who Makes Money?

c402.market’s fee structure is as follows:

For Minter:

-

Each mint costs 1 USDC

-

2% (0.02 USDC) is taken as platform fee

-

Gas fee (low on Base chain, but still applicable)

For Token Creator:

-

Pay 1 USDC “spam prevention” fee when creating token c402

-

Receive 2% of token supply as reward

-

Earn 1% of trading fees from the liquidity pool (partially paid in tokens) c402

The docs also note that if creators build their own frontend and set themselves as referrer, they can claim the 2% platform fee, effectively enabling zero-fee minting.

While initially only PING is supported as a pairing asset, c402.market’s GitHub repository already has a “whitelist for pairing tokens” submission system github. Any project can submit a PR to add their token as a pairing option, provided they have sufficient (locked) liquidity on Uniswap v3 or v4 and meet JSON and image requirements. After approval, the token must be manually whitelisted on-chain.

This means c402.market could eventually support USDC, ETH, or other tokens as pairing options—not just PING. But at launch, PING is the only option.

Clearly, c402.market’s design favors incentivizing token creators, not just minters and traders. But as many know, this could lead to an influx of low-quality projects, since creators have financial incentives to keep launching new tokens.

At the time of writing, c402.market has just announced its upcoming launch (November 10, 10 PM). Many details in the official docs remain obscured with █, including exact mint count, time window, and “bribery mechanism.”

This may be to prevent bots from preparing early, or because the team hasn’t finalized everything.

The real test will come after the first projects launch, liquidity forms, and traders begin engaging—only then will we see how this mechanism performs in practice.

Finally, asset creation and new launches remain central themes in crypto—now simply shifting to the x402 narrative. In a period lacking fresh stories, cautious participation may be the most pragmatic approach.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News