Why does Naval say: ZCash is insurance for Bitcoin's privacy?

TechFlow Selected TechFlow Selected

Why does Naval say: ZCash is insurance for Bitcoin's privacy?

Investors speculate that after the "uncertainty" of high inflation disappears, ZEC might follow Bitcoin's early trajectory.

Author | Max Wong @IOSG

Introduction

In recent months, Zcash ($ZEC) has taken center stage, surging from $47 to $292 within 30 days in September 2025—an increase of 620%. It has now reached an all-time high of $429, the highest level in eight years, pushing its FDV beyond $8 billion.

In an era of increasing financial regulation, privacy-focused projects are back in the spotlight within cryptocurrency. As one of the pioneers of privacy coins, Zcash (ZEC) has regained significant attention. This surge has reignited interest in "freedom money"—a term often used to describe private, censorship-resistant digital cash. As a rising privacy coin, Zcash extends Bitcoin’s vision by delivering true financial privacy through cryptographic technology.

This report aims to deeply explore Zcash's technology and infrastructure, compare it with other privacy-focused projects, and analyze the catalysts behind the recent resurgence of the Zcash ecosystem.

Zcash – What It Is and How It Works?

Zcash is a privacy-preserving digital currency launched in October 2016 as a fork of Bitcoin’s codebase. It intentionally adopts many of Bitcoin’s monetary principles; Zcash operates on a proof-of-work blockchain,

with the following features:

-

Fixed supply: A cap of 21 million and a predictable halving schedule.

-

Fair emission: No pre-mine, similar issuance pattern to Bitcoin.

-

Decentralization: Permissionless, no central authority, no reliance on intermediaries.

Privacy Standard

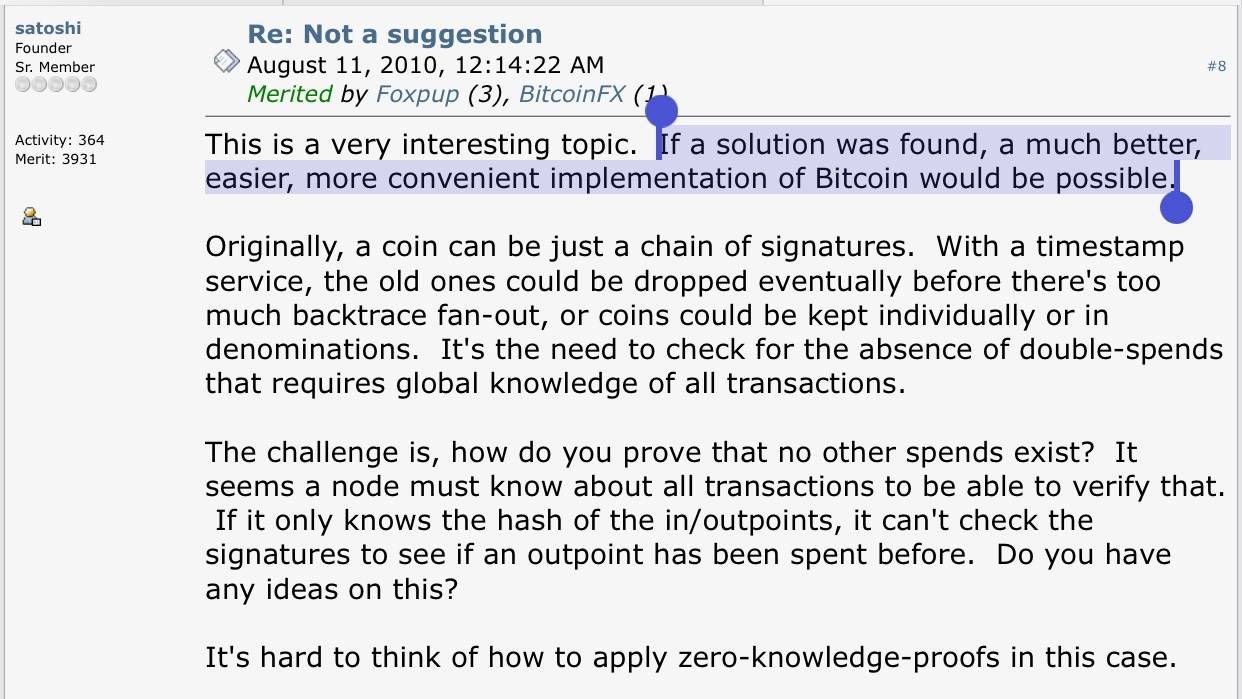

Zcash uses zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge), which allow transaction validation without revealing any details about the sender, receiver, or amount. In simple terms, Zcash enables users to conduct fully encrypted transactions, concealing data on-chain—something impossible with Bitcoin’s transparent ledger. In fact, this privacy mechanism using ZK was what Satoshi Nakamoto originally intended to explore for Bitcoin but was technically unfeasible at the time.

#Transaction Details Encryption

When users make shielded transactions, key details such as sender address, receiver address, and transaction amount are fully encrypted on-chain.

#Creating ZK Proofs

The sender (prover) generates a zk-proof (zk-SNARK) using their private key, confirming several conditions without revealing sensitive data:

-

The sender has sufficient funds to cover the transaction.

-

The spent funds were legitimately generated in prior transactions.

-

The sum of transaction inputs equals outputs, preventing counterfeit coins.

-

The sender has rightful ownership of the funds (possesses the correct private key).

-

The funds have not been previously spent (using a mechanism called “nullifier”).

#Instant Verification

Other nodes on the Zcash network (validators) use public verification keys to instantly validate the zk-SNARK proof. The proof is very small (a few hundred bytes) and can be verified in milliseconds, making the process highly efficient.

Dual Transaction Types

Notably, Zcash’s privacy is optional—users can remain transparent to meet compliance or auditing needs, or choose full confidentiality at their discretion.

ZEC uses a dual-address system, including transparent addresses (t-addresses) and shielded addresses (z-addresses). Transactions between transparent addresses resemble those on any non-private chain, while transactions involving shielded addresses are encrypted and private. When sending ZEC, the ledger shows no information about parties or value—only that a valid transaction occurred. Only participants (and those with whom they share optional viewing keys) can see the details.

This gives Zcash fungibility (each unit is interchangeable), unaffected by past history, enabling true financial confidentiality when shielded transactions are used.

Three Major Pools

Implementing private transactions at scale presents major technical challenges. Zcash has undergone three major upgrade iterations to improve its cryptography and efficiency:

#Sprout (2016)

--The initial release proved that zk-SNARK-based privacy was feasible on a public blockchain. However, Sprout transactions were computationally intensive (requiring gigabytes of RAM, impractical on mobile devices) and required a trusted setup (one-time parameter generation). Figures like Edward Snowden, pseudonymously known as "John Doe," participated in this famous ceremony designed to ensure no single party could compromise the parameters. Traditional Sprout z-addresses (typically starting with zc...) are now deprecated but still usable.

#Sapling (2018)

--A major upgrade that greatly improved performance and usability. Sapling reduced proof generation time and memory requirements by over 100x, finally making private ZEC transactions feasible on everyday devices—even smartphones. It also introduced key features such as diversified addresses (allowing one key to control multiple shielded addresses, enhancing privacy) and viewing keys (enabling users to share read access to transaction details for auditing or compliance). Sapling still relied on multi-party trusted setup, but it marked a significant step toward practical private payments. Sapling z-addresses (Bech32, zs...) remain supported, allowing users to spend legacy tokens.

#Orchard (2022)

--The latest generation, achieving trustless privacy. Orchard leverages the Halo 2 proving system (developed by Zcash engineers), eliminating the need for any new trusted setup. It further improves efficiency, supporting batch transactions and enhanced synchronization. With Orchard, Zcash’s privacy is not only stronger (no setup assumptions) but also more scalable—it's designed to support future Layer 2 solutions like ZK-rollups. It also introduces Unified Addresses (UA, u1...), bundling receivers across Orchard (and optionally Sapling + transparent) into a single address. Wallets typically default to routing new funds to Orchard. Thus, Orchard is now the default shielded pool in modern Zcash wallets.

A common summary of Zcash’s evolution: Sprout proved private money was possible, Sapling made it usable, and Orchard made it trustless and scalable.

Upcoming Upgrades

Crosslink: Zcash’s technical infrastructure continues to evolve. The project is currently undergoing a major upgrade called Crosslink, which will introduce a hybrid Proof-of-Stake (PoS) layer atop its Proof-of-Work consensus. This will allow ZEC holders to stake their coins for yield and participate in block finality, while miners continue producing blocks—combining the strengths of PoW and PoS. This hybrid approach aims to boost network throughput and security (by enabling fast finality and making 51% attacks harder).

Project Tachyon: Zcash developers (notably cryptographer Sean Bowe) are leading Project Tachyon—aimed at dramatically improving the scalability of Zcash’s shielded protocol. Project Tachyon targets eliminating performance bottlenecks (such as every wallet needing to download and scan every coin) through innovations like proofs carrying data, enabling “planetary-scale” private payments.

ZCash vs Monero

Zcash (ZEC) positions itself as a Bitcoin-like currency with optional encrypted privacy. Its shielded transfers use zk-SNARKs, allowing validators to verify correctness without seeing sender, receiver, or amount. With UAs, wallets can send funds to the correct recipient while maintaining auditability: users can still transact transparently or share viewing keys with accountants or regulators. The trade-off is user choice; privacy is strongest when shielded pools are actively used.

Monero (XMR) uses a different toolkit, providing privacy by default in every transaction: Ring Signatures (mixing the original transaction among many decoys so observers cannot identify the actual sender), RingCT (hiding amounts), and Stealth Addresses (receivers get payments via one-time hidden addresses that cannot be linked back to their real wallet). This makes usage simpler, but privacy is probabilistic: strength depends on ring size (e.g., 16), decoy selection, and user behavior. In practice, privacy is high, but there’s no selective disclosure for audits, and due to compliance friction, some exchanges avoid listing it.

Generally: Ring signatures anonymize transactions by placing them among multiple decoys (some argue Monero merely provides plausible deniability), whereas zk-SNARKs prove the truth of a statement without revealing anything beyond its validity. Initial hesitation around ZCash stemmed from its trusted setup requirement, but with the recent Halo 2 upgrade, ZCash can now generate recursive zero-knowledge proofs without trusted setup. Despite challenges, research in the paper “Monero Traceability Heuristics” has shown Monero exhibits some traceability: “Wallet app bugs and Mordial-P2Pool insights.”

So Why Did the Market Choose ZCash?

What Happened?

Over the past two months, from early September to now, $ZEC has been in a relentless upward trend, rising from a low of ~$40 to ~$429—an increase exceeding 1000%. So, what triggered this surge? What are the reasons?

Introduction of Zashi

One of the biggest contributors to ZCash’s recent growth is ECC (Electric Coin Co.)’s renewed focus on consumers. Previously, the protocol primarily focused on ZCash’s core—building cryptography and technology—but now places greater emphasis on user experience and onboarding. A major part of this effort has been developing Zashi, the official ZCash wallet.

Josh Swihart—CEO of ECC:

"When I took over as CEO of ECC in February 2024, we decided to truly focus on user experience... We built a wallet called Zashi. After Zashi launched, you can see the total number of shielded transactions and the amount of ZEC in shielded pools grow exponentially."

The launch of Zashi significantly improved the Zcash user experience. It offers a smooth interface comparable to popular EVM wallets, supports secure storage features like viewing keys and hardware wallet integration, and even plans to enable shielded staking and delegation post-launch. More importantly, Zashi is specifically designed for ZEC shielded transactions, meaning all transactions sent via Zashi are private by default. If users receive transparent ZEC, the wallet prompts them to shield it before spending. Additionally, Zashi supports single-address multi-pool functionality across all pools (Sprout, Sapling, Orchard), allowing users to easily migrate funds between pools.

This represents a dramatic shift from a few years ago, when privately using Zcash required juggling multiple specialized software tools. Due to these UX breakthroughs, shielded pool usage has grown parabolically, indicating that many users do opt for privacy when convenient options exist.

By simplifying private transactions to just a few taps and abstracting away technical complexity, these wallets have driven adoption among less technical users. Improved wallet UX is considered a primary driver behind ZCash’s recent growth.

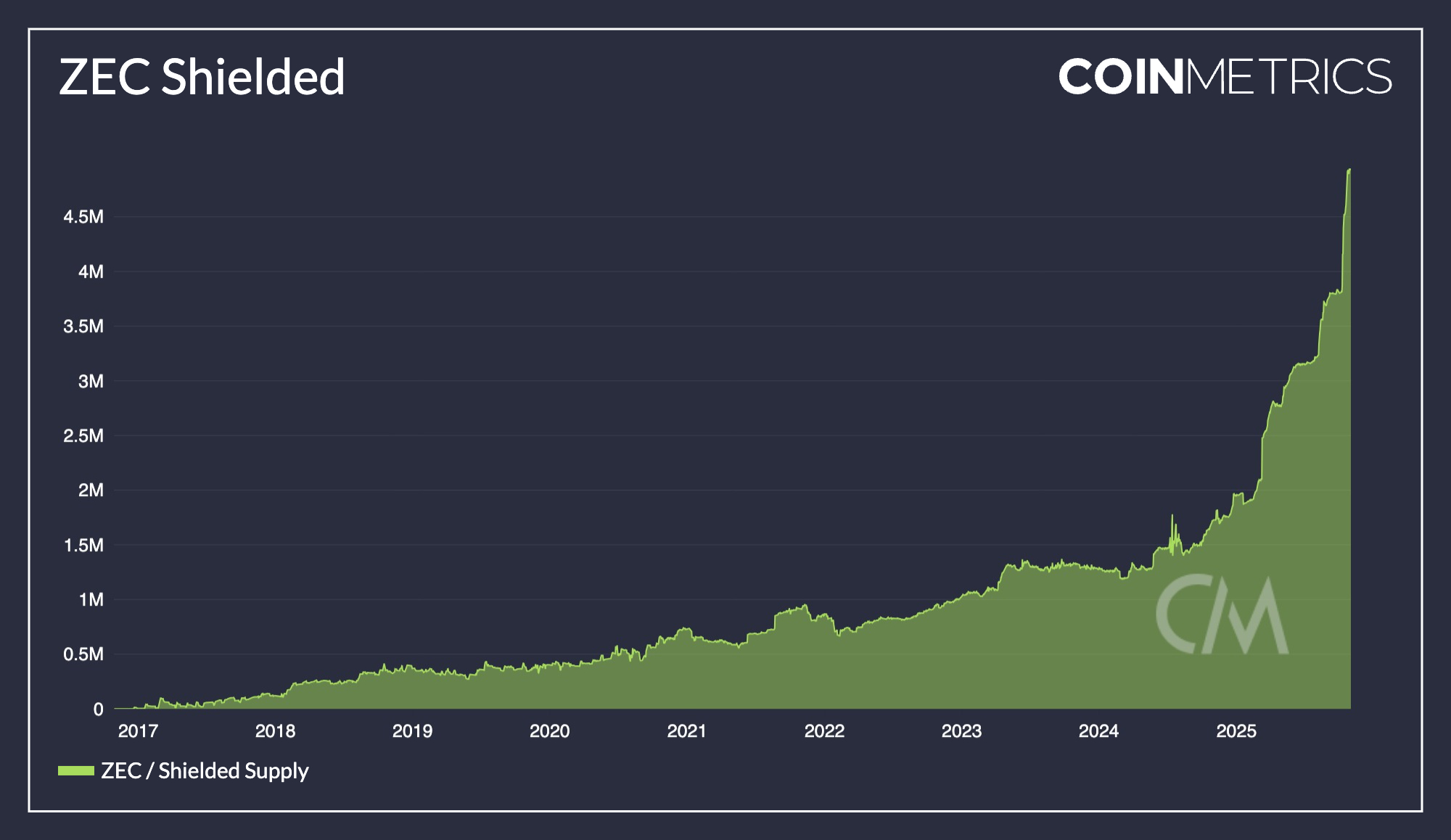

One of the clearest indicators of Zashi’s impact on Zcash ecosystem momentum is the explosive growth in on-chain shielded usage. As of Q4 2025, over 4.5 million ZEC are stored in shielded addresses—approximately 28% of total supply. This is a record high, compared to just 5% a few years ago. The chart above illustrates how the shielded pool began a parabolic rise around 2024, directly aligning with Zashi’s release timeline.

This means more ZEC is flowing into Zcash’s encrypted pools, which in turn strengthens privacy protection for everyone on the network (larger anonymity set). Practically, this also tightens circulating liquidity (since shielded funds are harder to track and often held long-term for privacy), creating positive effects on price dynamics.

Introduction of NEAR Intents – Crosspay

Zashi’s CrossPay also acts as a mass onboarding mechanism, fundamentally enabling interoperability for the Zcash ecosystem.

CrossPay is a cross-chain bridging/exchange solution leveraging NEAR Intents, allowing users to swap in or out of ZEC from another chain while preserving privacy. Zashi also uses NEAR to integrate decentralized off-ramping, enabling users to convert ZEC to another chain (or fiat gateway) without exposing their ZEC address—completely eliminating the need for CEXs. This has driven significant capital and user inflow into the ZEC ecosystem recently.

NEAR Intents is a chain abstraction protocol: users (or agents) state what they want (e.g., “swap BTC→ZEC” or “pay 50 USDC to this address”), and a decentralized network of solvers competes across chains to execute it; users only need to sign one approval. It hides bridge/DEX hops and optimal price/liquidity routing.

-

User requests “swap X → ZEC” or “pay Y USDC on chain Z”.

-

NEAR Intents solvers compete, returning the best quote.

-

User approves once in Zashi; solver executes cross-chain route; ZEC is shielded or recipient receives exact tokens.

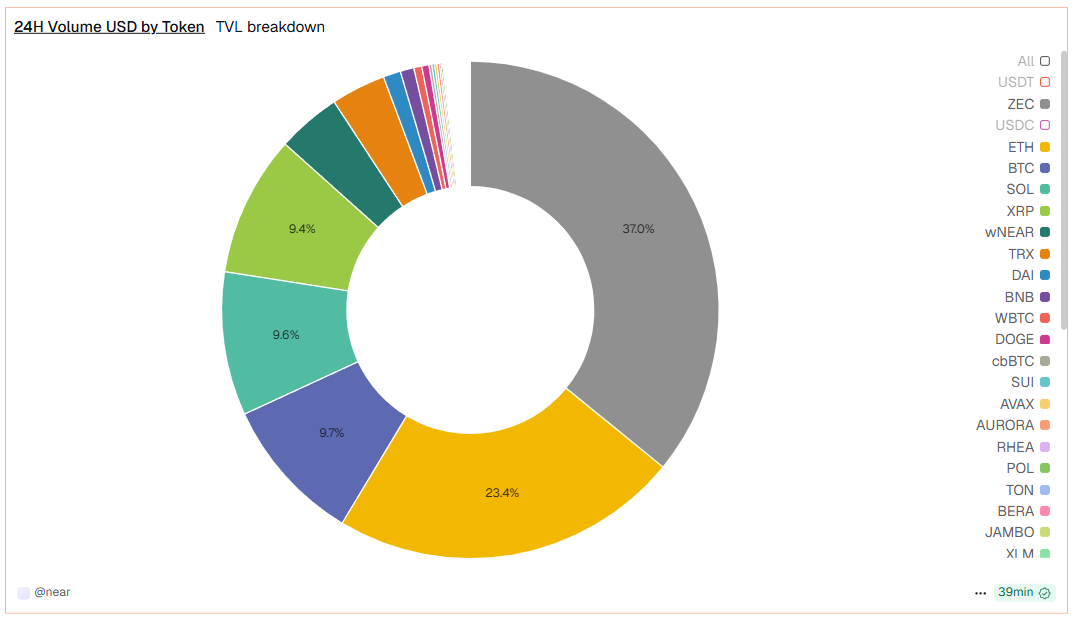

Excluding USDC and USDT volumes; currently, ZEC NEAR Intent volume accounts for over 30% of total NEAR Intent volume.

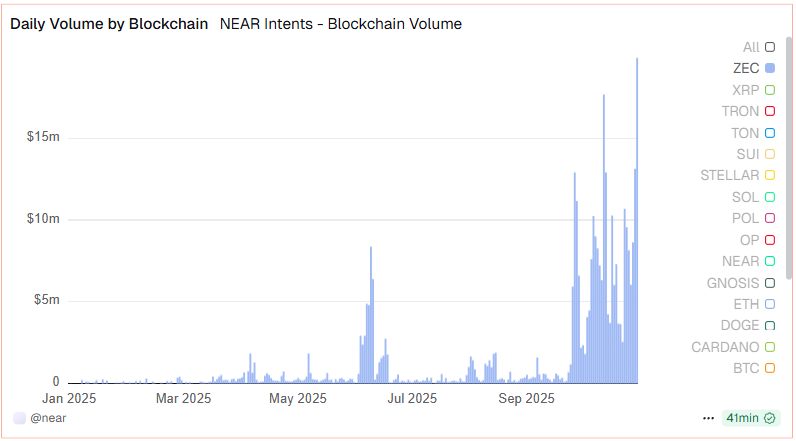

Overall, we can infer that the integration of Zashi with CrossPay is also one of the main drivers of market share growth, with ZEC NEAR Intent volume sharply increasing starting September 2025—the same period CrossPay launched.

New Importance of Dual Transaction Privacy—Narrative

As governments and regulators push hard for surveillance measures (from stricter KYC/AML to tracking CBDCs), the cypherpunk spirit is back in focus. Zcash offers a hedge tool for those concerned about these trends—a form of encrypted, unmonitorable money.

Arjun Khemani - https://www.arjunkhemani.com/

"They only watch the numbers go up, but fail to notice freedom going down."

As mainstream crypto users become aware of eroding privacy (e.g., Tornado Cash and other mixers being blacklisted), many are seeking on-chain privacy alternatives. Zcash stands out as a battle-tested L1 with stronger privacy capabilities than mixer protocols (reportedly broader usage than Tornado Cash).

In short, the rise of the “freedom narrative” positions Zcash as a key asset for preserving financial freedom—one that resonates with both ideological investors and those simply seeking a hedge against “Big Brother.”

Post-Halving Supply Dynamics

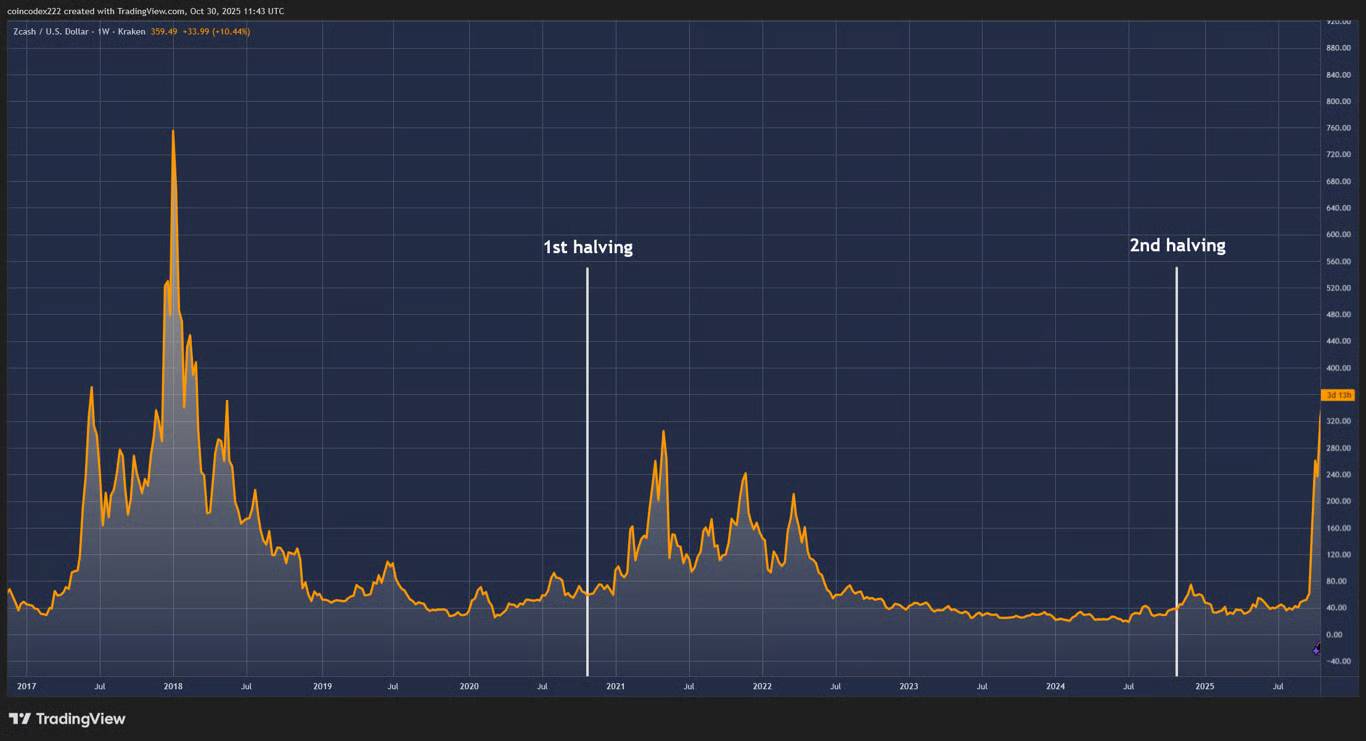

Zcash’s second halving (November 2024) drastically reduced its new coin issuance, and we are now seeing its effects. Block rewards dropped from 3.125 ZEC to 1.5625 ZEC, halving annual inflation. Historically, Bitcoin’s price did not sustainably exceed $1,000 until after its second halving—after which it entered a parabolic rise. Zcash’s supply curve is identical to Bitcoin’s, merely shifted by a few years, and has just crossed the same milestone.

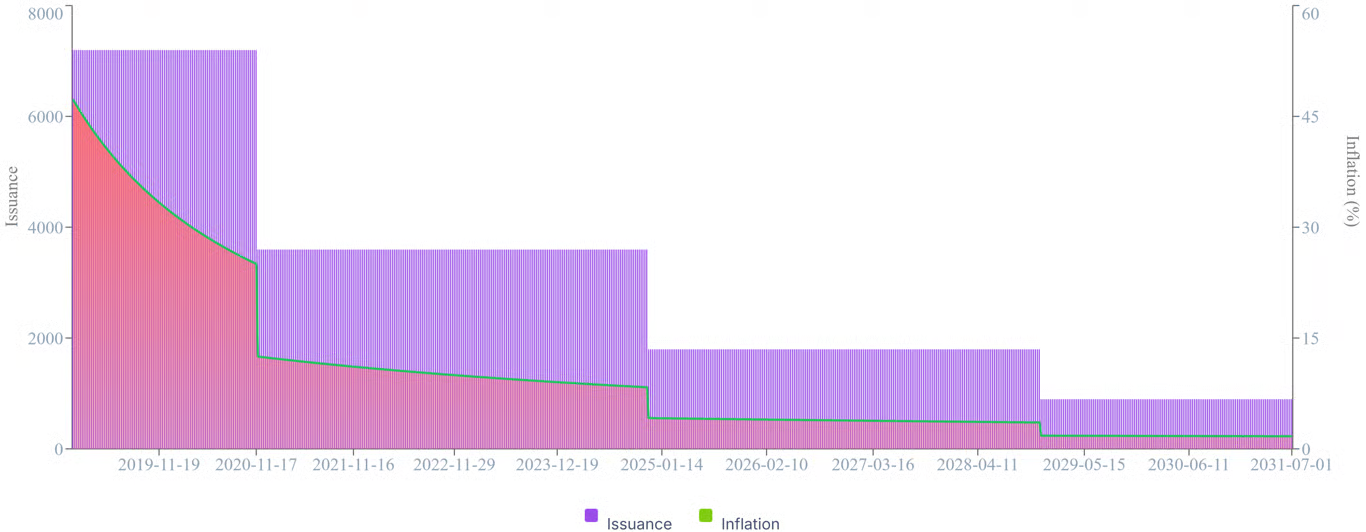

▲ ZEC USD issuance and inflation timeline

With rising demand and tightening circulating supply, this is a classic supply-demand squeeze. Investors speculate that, with the high-inflation “overhang” gone, ZEC may follow Bitcoin’s early trajectory. Indeed, in Q4 2025, ZEC has outperformed most major cryptocurrencies. Some of this is market timing, but fundamentally, Zcash’s tokenomics are becoming increasingly attractive as it matures: fixed cap, declining emissions, and approaching end of miner rewards—mirroring Bitcoin’s path.

▲ ZEC USD price and halving timeline

The halving narrative—even if misunderstood by some traders (rumors of a 2025 halving are false)—still draws attention to the Zcash story.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News