Reviewing the Timeline of Stable Deposit Campaign: A Victory of Insider Trading and Market Manipulation

TechFlow Selected TechFlow Selected

Reviewing the Timeline of Stable Deposit Campaign: A Victory of Insider Trading and Market Manipulation

Information asymmetry, insider manipulation, and front-running were particularly evident in Stable's recent event.

Author: David, TechFlow

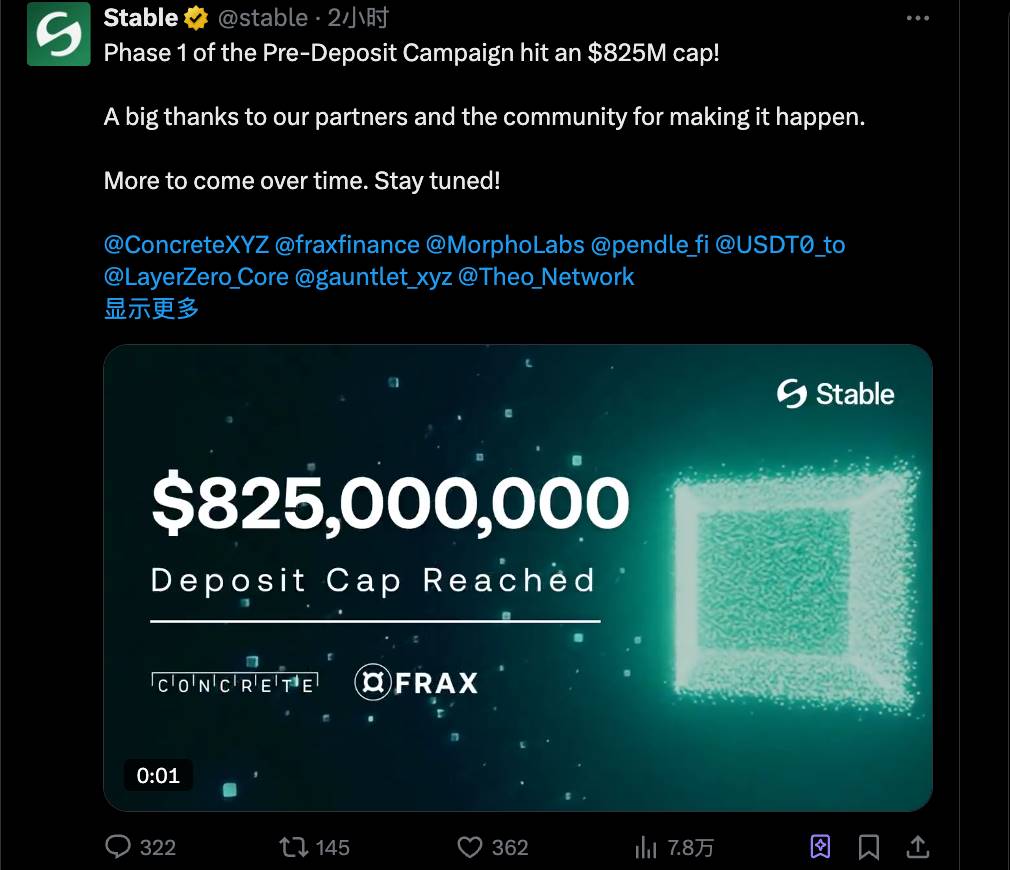

The biggest FOMO and criticism today came from Stable's pre-deposit event.

At 9:13 AM, the stablecoin blockchain project Stable announced a pre-deposit campaign on its official Twitter. The $825 million allocation was sold out in an extremely short time, appearing to be wildly popular and successful.

Under Stable’s celebratory post, the comment section was filled with complaints and frustration. The core reason? Everyone saw through on-chain data that:

Massive funds had already been deposited before the announcement was made, leaving very little quota and opportunity window for general participants.

To be specific:

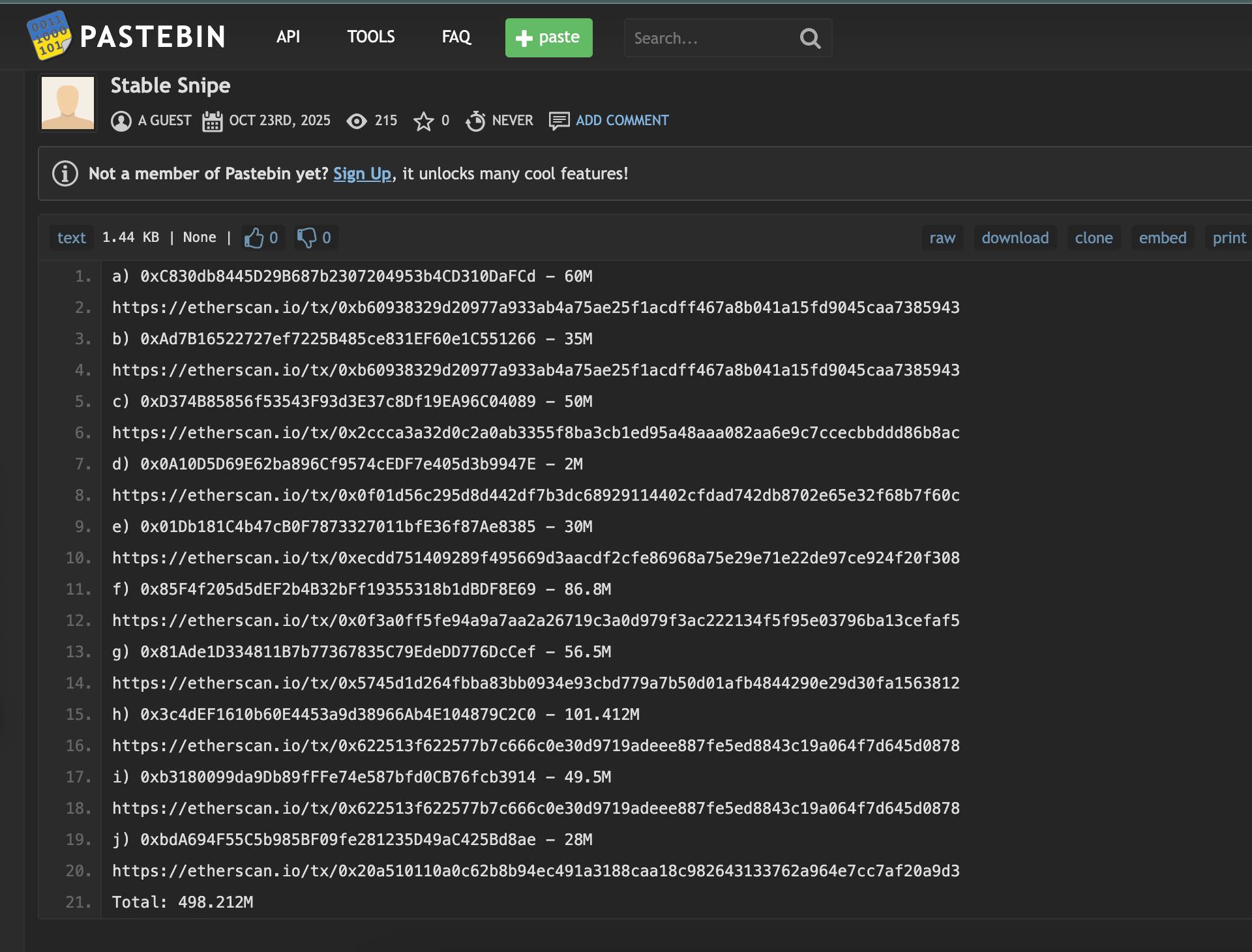

Within 15–20 minutes before the announcement, 90% of the $825 million deposit cap was already filled; 20 addresses had already secured $700 million worth of deposits.

After the announcement, only 192 addresses successfully participated, collectively claiming just $70 million of the quota.

Prior to the announcement, the largest single depositor placed $100 million.

Information asymmetry, insider operations, and front-running were particularly evident in Stable’s event. Further digging into on-chain data revealed that the controller of Stable’s official deposit contract also took a cut.

By consolidating scattered data and reconstructing the full timeline of Stable’s deposit event, it becomes clear this was a victory of insider deals and front-running.

Presales now take the form of frontrunning

First, consider this comparison:

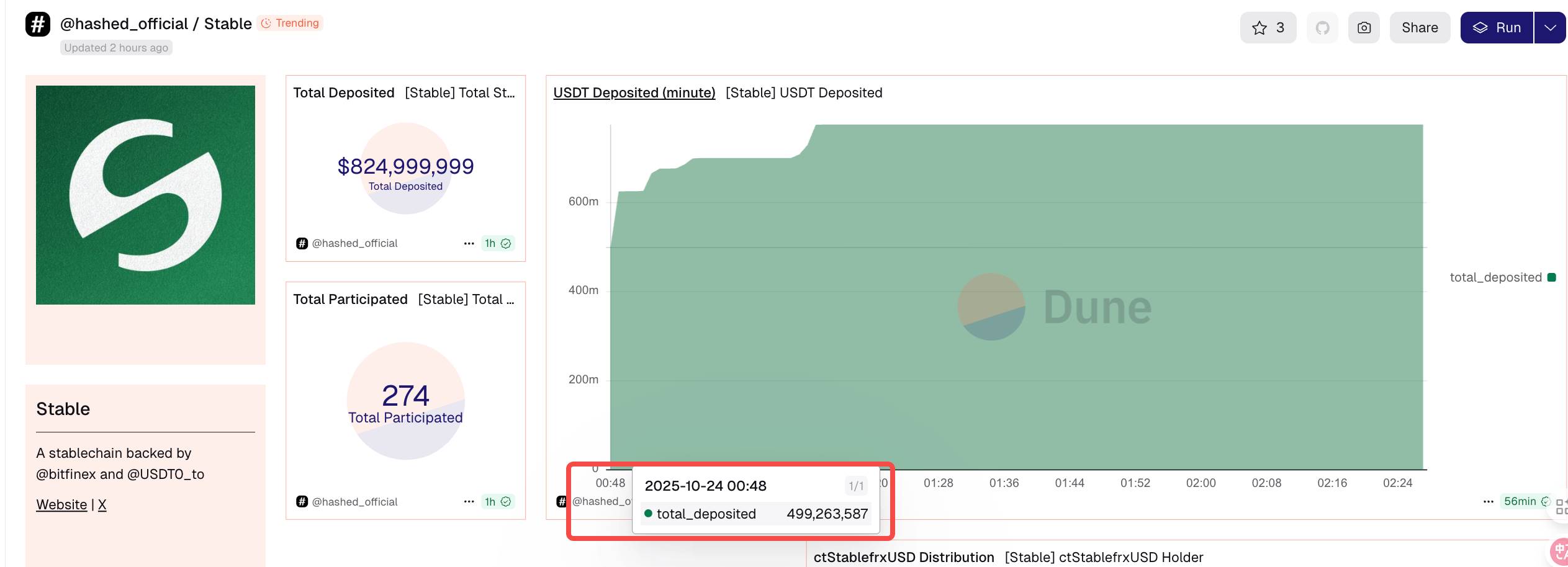

October 24, 8:48:47: First large deposit of 50 million USDT enters the deposit vault

October 24, 9:13:00 UTC+8: Stable officially announces the event on Twitter — “officially starts”

This time gap is about 24 minutes.

What happened during those 24 minutes? On-chain data shows that over 70% of the final deposit quota had already been reserved.

In reality, after the official announcement, less than 30% of the quota remained available for ordinary users. This 30% was quickly consumed within 26 minutes, leaving most users who joined upon seeing the announcement empty-handed.

The Dune dashboard on this incident makes it even clearer: deposit amounts spiked sharply right after 8:48 AM, meaning most opportunities were gone before the event even appeared to start.

When tracing the sources of these early-informed large deposits, one key player emerged: BTSE exchange.

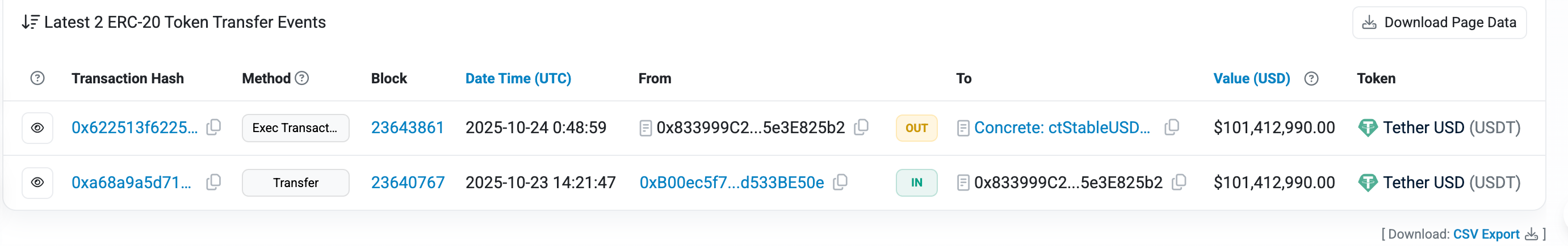

Largest deposit address:

0x833999c2fe99e388c100fab7680a1e45e3e825b2

-

Deposit amount: 101,400,000 USDT

-

Fund source: Transferred from BTSE exchange address on October 23 at 14:21 UTC

(Address: 0xbb4d1dc5c1abec4ea11166ec97e714862863ad1d)

-

Preparation time: Funds ready 18 hours in advance

Second-largest deposit address:

0xfca49ab538972876d79aa0082b265b6b049f0b21

-

Deposit amount: 86,850,000 USDT

-

Fund source: Also originated from internal transfers within BTSE

-

Operation pattern: Distributed through multiple intermediate addresses, but all ultimately trace back to BTSE

Third-largest deposit address:

0x4e1f6753640f87854b377c36efb2af0d0e19a5d2

-

Deposit amount: 60,000,000 USDT

-

Operation pattern: BTSE → intermediate address → deposit address

This funding flow pattern indicates these large deposits did not come from retail investors or typical institutions, but were coordinated operations via the BTSE exchange system. The top three deposit addresses collectively controlled $248 million USDT, accounting for 30% of the total allocation.

Even more telling is the evidence in gas fees. All large deposits used an unusually high gas fee of 50 Gwei, while the network-wide average gas at the time was around 1.14 Gwei.

This cost-no-object high-gas strategy appears to have only one purpose: to ensure transactions are mined immediately, avoiding any delays or failures.

The front-runner was an insider

If a 24-minute head start before the official announcement seems outrageous enough, what followed completely exposed the event as rigged.

Twitter account @aggrnews, using on-chain data analysis, reconstructed a longer timeline: this insider operation had actually begun 20 days earlier.

Moreover, the controller of Stable’s deposit contract may have directly participated in insider trading, leveraging privileged access for personal gain.

Let’s rewind to October 4:

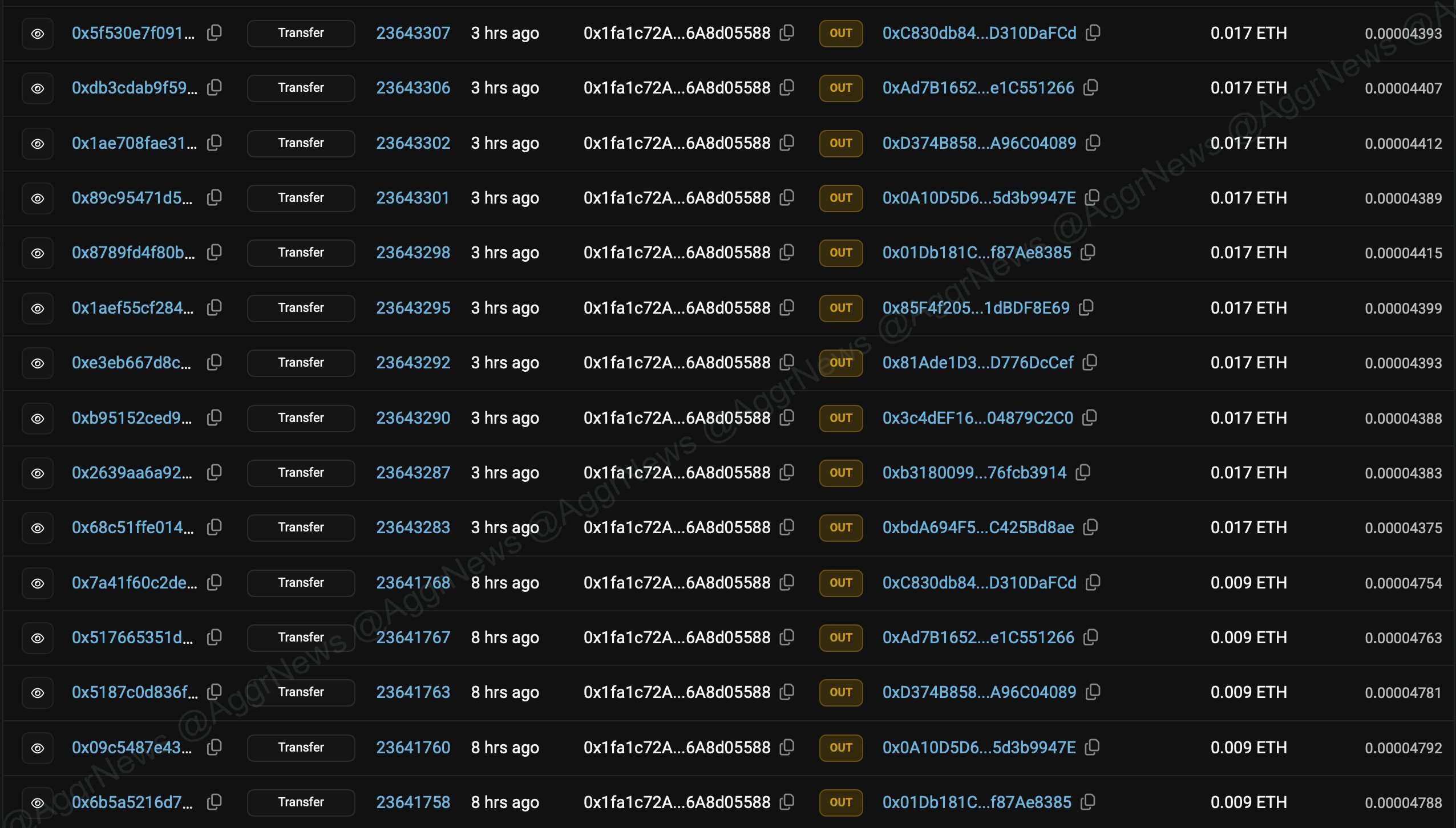

October 4: Fund linkage established. Address 0x1fa1c... transferred ETH to the Owner address (0x1407c35Ad0ed3f9e143Ee6b99CF2da920606e760) of Stable’s deposit contract — the address holding administrative control over the contract.

Notably, this Owner address is actually a 5-signer multi-sig Safe wallet, which controls the entire deposit contract.

October 24: Deployment of sniper matrix. The same 0x1fa1c... address suddenly became active, precisely distributing 0.017 ETH each as gas fees to 10 independent addresses. These 10 addresses previously had no connections, resembling newly created "burner" accounts specifically prepared for the deposit event.

Shortly after, these 10 addresses acted almost simultaneously, completing deposits during the golden window before the official announcement, collectively depositing nearly $500 million — over 60% of the total allocation.

More intriguingly, their operational patterns were highly consistent: identical gas fees, similar deposit timing, and neatly aligned deposit amounts. Such near-military precision would be nearly impossible without insider information.

While we cannot confirm whether the five signers of the multi-sig wallet directly participated in this insider deal, the correlation is strong enough to suggest that at least one entity close to the inner circle had advance knowledge of the exact event timing and contract address.

Ironically, as the Owner of the deposit contract, this address theoretically has the authority to pause/resume the contract and view all deposit data.

When referees wear the same jersey as players, a race to see who can deposit faster is predetermined from the start. Those users rushing in at 9:13 upon seeing the official tweet were merely audience members in a scripted show — possibly even ticket holders who missed the performance entirely.

Where is my opportunity?

Today, various presales and new offering events in crypto projects have increasingly become feasts for insiders and experts. It has become extremely difficult for ordinary users to fairly grab a share.

Looking back at Stable’s first pre-deposit event, how could you increase your chances of securing a spot? There might be two possible answers.

First, become part of the insider circle. You’re connected to the project’s core team and get early information — though obviously, this is hard to achieve.

Second, use on-chain monitoring to frontrun. Diligence compensates for weakness. Monitor on-chain data frequently and develop solid data analysis skills.

For example, when insiders began depositing, different monitoring tools already showed signs. That $100 million stablecoin transfer in advance was likely flagged as "extra-large" by monitoring systems.

Almost simultaneously, several other addresses transferred funds — each over $50 million — to that same receiving address. If you happen to be research-driven and use alert systems, you should have sensed something unusual.

But even then, there’s no guarantee you’d secure a deposit slot. You’d need to further analyze the receiving address — creation time, creator links, contract details — to have any chance of realizing, “This is Stable’s deposit vault.”

In addition, you must make rapid decisions and execute transactions within seconds, paying gas fees far above market rates to ensure confirmation… the entire process may offer only a few minutes’ window, demanding exceptional on-chain analytical ability and execution speed.

Thus, it’s hard to call this a realistic opportunity for average crypto users.

In the end, in a market of extreme information asymmetry, retail investors are always at a disadvantage. Fairness has never been the rule in crypto; information gaps and privilege exploitation are.

Rather than fantasizing about fairness, accept reality and adapt to the rules.

Either work to improve your information access and technical capabilities, climbing up the food chain; or adjust your mindset and strategy, seeking higher-certainty opportunities within your reach.

Stable won’t be the first, nor the last. Front-running will continue, insider advantages will persist — but so will the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News