The Battle for Stablecoin Infrastructure: The Road of Competition and Cooperation between Stable and Plasma

TechFlow Selected TechFlow Selected

The Battle for Stablecoin Infrastructure: The Road of Competition and Cooperation between Stable and Plasma

What are the similarities and differences between Stable and Plasma, the two dedicated stablecoin chains supported by USDT?

By Alex Liu, Foresight News

As stablecoins increasingly dominate crypto payments and cross-border settlements, dedicated infrastructure tailored for them is beginning to emerge. Stable and Plasma are two USDT-backed blockchains designed specifically for stablecoins—each taking a different path and reflecting distinct strategic visions: Should they serve individual users or become central hubs for enterprise settlement? This article examines Stable’s design philosophy and development trajectory, compares it in depth with Plasma, and analyzes the real-world significance and future potential of stablecoin-dedicated chains.

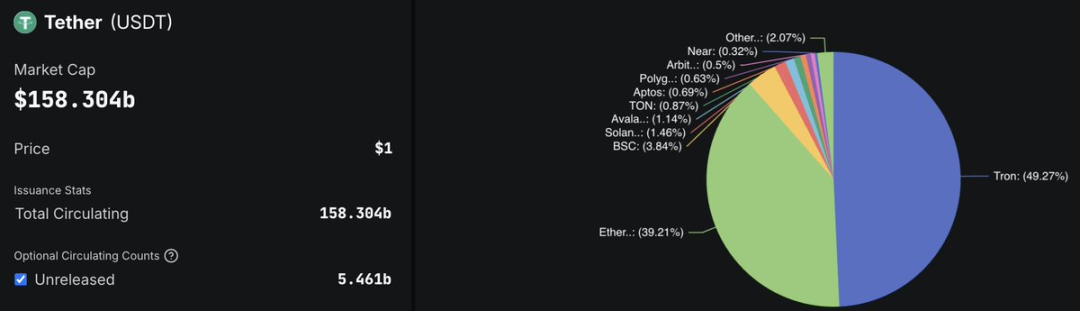

Stablecoins are moving from the financial periphery into the mainstream. Data shows that the global circulation of USDT has surpassed $150 billion, with over 350 million users. In some Latin American countries, supermarkets now price goods directly in USDT. This shift is forcing infrastructure to redefine itself—and Stable has emerged precisely in this context.

Stable: A Dedicated Payment Chain Centered on USDT

Stable is a Layer 1 blockchain purpose-built for stablecoin payment use cases, backed by Bitfinex and USDT0, with Paolo Ardoino, CEO of Tether, serving as advisor. Unlike general-purpose public chains such as Ethereum or Tron, Stable has a clear focus: solving core pain points in current stablecoin usage—unpredictable fee structures, slow confirmation speeds, and complex user interactions—by advocating a “Stablechain” model to transform how stablecoins are technically supported.

At its core, Stable uses USDT as native gas. Users can initiate transactions without holding a platform token, and P2P (peer-to-peer) USDT transfers are completely gas-free. This design simplifies user experience and is ideal for frequent small-value payments and cross-border remittances.

In addition, Stable supports high throughput and sub-second finality. Its consensus mechanism, StableBFT (based on Cosmos’s CometBFT), along with an upcoming DAG architecture, ensures scalability. Enterprise users can request dedicated blockspace, making transaction rates and fees predictable. This “institution-first” design philosophy runs throughout its entire development roadmap.

Stable’s technical roadmap consists of three phases: Phase one uses USDT as the native gas token, achieving sub-second block confirmations; phase two introduces optimistic parallel execution to boost throughput beyond 5,000 TPS (transactions per second); phase three upgrades to a DAG-based consensus mechanism.

To support developer ecosystems, Stable is fully EVM-compatible and provides dedicated SDKs and APIs. On the wallet front, Stable Wallet offers social logins, human-readable addresses, and bank card integration—clearly targeting Web2 users.

Plasma: An Alternative Path Anchored to Bitcoin

Unlike Stable’s “independent sovereignty,” Plasma is a Bitcoin sidechain. It leverages BTC’s anchoring security while operating its own consensus and settlement processes. Plasma uses Bitcoin block timestamps to resist reorganization attacks, writing checkpoints onto the Bitcoin mainnet every 10 minutes. Architecturally, it resembles Liquid but focuses more narrowly on stablecoin use cases.

Plasma’s biggest selling point is “free transfers”: users pay no gas fees when transferring USDT. Other on-chain operations are charged normally—a “free for entry, paid for expansion” business model.

Plasma plans to launch its mainnet in Q3 this year. In terms of funding, Plasma raised $24 million in February 2025, led by Framework Ventures, with PayPal co-founder Peter Thiel participating in the seed round as an individual investor. The team was founded by Paul Faecks, who previously co-founded Alloy, a digital asset operations platform for institutions.

Like Stable, Plasma is fully EVM-compatible, allowing developers to directly deploy Ethereum applications. Additionally, users can pay fees on Plasma using either USDT or BTC, further strengthening its financial linkage with Bitcoin. As a joint initiative by Bitfinex and Tether, Plasma shares the same USDT-centric narrative as Stable, even though their technical implementations differ.

Common Ground: The Logic Behind Stablecoin-Dedicated Infrastructure

Despite differing approaches, Stable and Plasma share many similarities. Both are built around USDT0—an natively cross-chain USDT enabled via LayerZero technology—aiming to reduce stablecoin fragmentation and enable atomic swaps across chains. Currently, USDT0 is available on networks including Arbitrum and HyperEVM, offering stronger liquidity unification at the protocol level.

In terms of privacy, both have planned related features. Plasma proposes Shielded Transactions, while Stable plans to support Confidential Transfers—both enhancing privacy capabilities within regulatory compliance.

Where they truly diverge is in their understanding of “institutional use cases.” Stable offers “Enterprise Blockspace” and a “USDT Transaction Aggregator,” which reserve bandwidth for high-frequency enterprise users and batch-process multiple transfers to achieve lower costs and higher performance. Stable does not aim merely to serve retail users—it seeks to become the technological backbone of multinational corporate settlement networks.

Reality vs. Vision: Are These Chains Really Necessary?

It’s natural to ask: Do we really need blockchains built solely for stablecoins? Over 49% of USDT currently resides on the Tron network, where stablecoins dominate—but Tether itself does not deeply participate in the chain’s operation or governance.

The emergence of Stable and Plasma aims to “draw away” the stablecoin liquidity stuck on legacy networks—not through token incentives, but through tangible improvements like “free,” “faster,” and “more stable” experiences, achieving a form of “gentle vampirism.” If they can build complete ecosystems via gas-free transfers, enterprise-grade services, and native cross-chain functionality, Stable and Plasma may one day play roles akin to SWIFT—issuing stablecoins while also controlling the underlying network.

Current Progress and Key Watch Points

Plasma has already attracted over $1 billion in user deposits through token sales (pre-mining), rising into the top ten public chains by stablecoin liquidity. It has formed several global partnerships, such as enabling USDT transfers in Africa with YellowCard and integrating with BiLira to connect Turkey’s local fiat channels.

Stable remains in early development stages, yet already reveals strong “infrastructure ambitions.” Whether through experimenting with DAG architecture or offering services tailored to enterprises and developers, it demonstrates a clear intent to build a “financial network on-chain, custom-made for stablecoins.”

Conclusion: The Future of Stablecoin Chains Is Taking Shape

The emergence of Stable and Plasma signals that crypto infrastructure is entering an era of “function-specific chains.” They do not seek to replace existing public chains entirely, but rather represent a vertical reconfiguration. Stablecoins, as the most practically valuable asset class in the crypto world, deserve their own sovereign networks—a gap that Stable and Plasma are now striving to fill.

In the coming years, whether these two chains can cultivate truly active and sustainable ecosystems will become a key benchmark for assessing the necessity of stablecoin-dedicated chains. For USDT itself, this architectural evolution could mark a profound transformation—from being passively used to actively governing its own network.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News