Farewell to Platform Fees: USDT as Native Gas, Tether Builds a New Foundation

TechFlow Selected TechFlow Selected

Farewell to Platform Fees: USDT as Native Gas, Tether Builds a New Foundation

Tether has launched its first Layer 1 network "Stable," with USDT as the native gas currency, and is implementing a "dual-chain parallel" strategic layout by operating both Plasma and Stable public chains simultaneously. This move aims to reduce reliance on platforms like Ethereum and Tron, addressing issues of value leakage and platform risk.

Author: Luke, Mars Finance

A seemingly routine roadmap announcement is stirring a profound undercurrent beneath the surface of the crypto world. In early July, Stable—the first Layer 1 network to use USDT as its native gas—unveiled a three-phase development plan. On the surface, it appeared to be just another new entrant vying for space in an overcrowded public blockchain race. But when we peel back the layers and connect this thread with Tether’s recent series of seemingly unrelated moves—a mysterious development team, another Bitcoin sidechain called "Plasma," and CEO Paolo Ardoino’s nuanced statements amid regulatory storms—a far grander and more sophisticated strategic picture begins to emerge.

This is not merely a product launch, but a fundamental strategic pivot by stablecoin giant Tether. The company, which built its billion-dollar empire by issuing “digital dollars” on foreign blockchains like Ethereum and Tron, is quietly launching an “independence movement.” No longer content being just a “super app” on others’ networks, it is stepping into the arena to build its own financial infrastructure—the world's financial rail.

The core question behind this open strategy is: Why would a company that earns billions annually under its current model choose to dismantle the very system that made it successful? What internal pressures and external threats are compelling it to transform from a light-asset “application-layer” player into a heavy-asset “infrastructure-layer” titan? And what does its carefully crafted “dual-chain” strategy reveal about Tether’s ultimate ambition to dominate global digital finance?

The Trillion-Dollar “Platform Tax”

Tether’s motivation stems from the Achilles’ heel at the heart of its otherwise glittering business model: its success is fundamentally parasitic and symbiotic. As the de facto hard currency of the crypto world, USDT brings massive transaction volume and users to public chains like Ethereum and especially Tron, serving as the cornerstone of their ecosystem vitality. Yet Tether itself resembles a stateless “tenant,” living on someone else’s land and paying a steep “rent.”

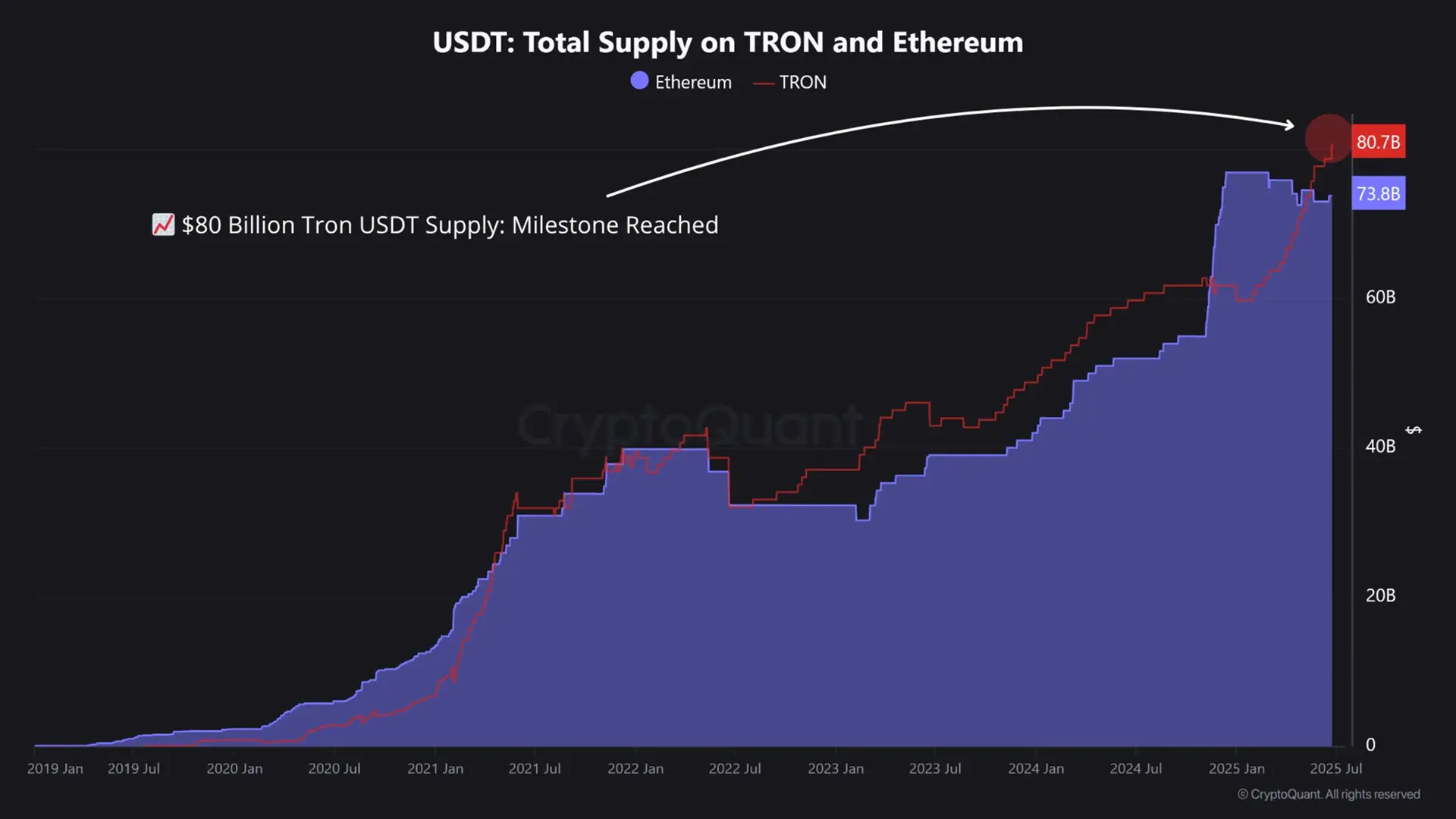

This “rent” isn’t paid directly, but extracted indirectly through value leakage siphoned off by platform operators. With daily settlement volumes exceeding $100 billion—most of which flows through Tron—the astronomical transaction activity generates enormous fee revenues for the Tron network. Yet not a single dollar of these fees goes to Tether. This is Tether’s central dilemma: it creates immense value but cannot capture any of it. All ecosystem benefits are taxed away by the underlying infrastructure platforms.

A deeper crisis lies in platform dependency. This deep reliance means Tether’s lifeline is firmly held by its “landlords.” Any policy shift on their part could pull the rug out from under Tether. These concerns aren’t hypothetical—evidence suggests Tron is actively reducing its dependence on USDT by promoting USD1, a native stablecoin linked to the Trump family, effectively nurturing a direct competitor within its most critical distribution channel. Moreover, rising transaction fees on Tron are eroding its core advantage as a low-cost settlement network. The conclusion is clear: Tether’s move to build its own infrastructure is less an aggressive expansion than a defensive maneuver against existential risk. It must establish its own sovereign territory.

Dual-Track Counteroffensive: Two Blockchains, One Grand Strategy

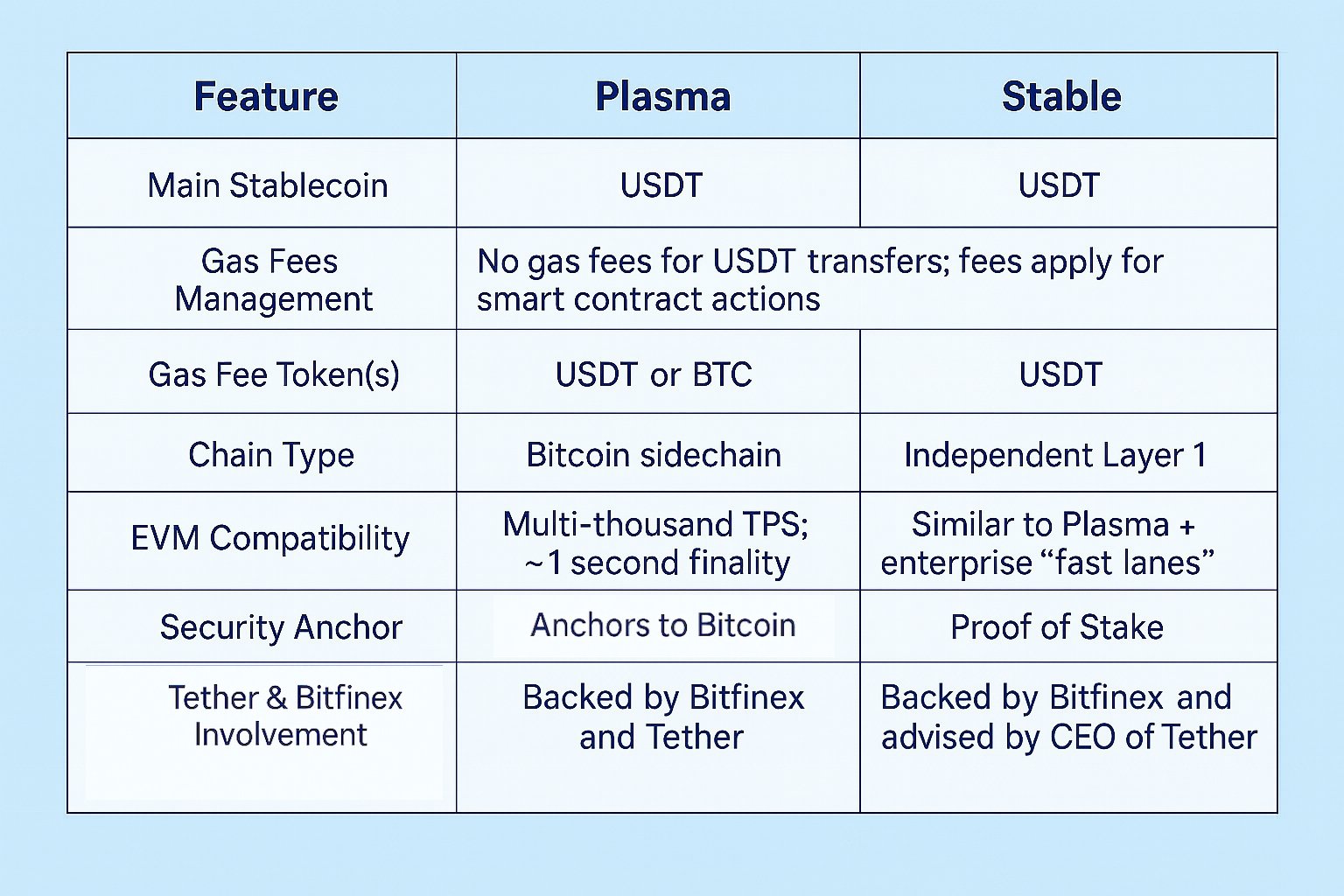

Tether’s response is not a gamble, but a precisely calculated “dual-track” strategy. While the “Stable” network came into view, another project named “Plasma” also received strong backing from Tether executives and its affiliate Bitfinex. Though appearing independent, these two projects are in fact complementary, targeting different institutional market segments and together forming the twin pillars of Tether’s infrastructure empire.

Plasma: The Bitcoin-Anchored Financial Fortress

Plasma has a crystal-clear mission: a dedicated financial layer purpose-built for large-scale, high-security stablecoin settlements. Its core architecture functions as a Bitcoin sidechain, periodically anchoring its state roots to the Bitcoin mainnet, thereby inheriting Bitcoin’s unparalleled security and finality. This offers irresistible appeal to traditional institutions—banks, sovereign wealth funds, and multinational corporations—for whom security is paramount. Its functionality is fully aligned with this “settlement fortress” identity: zero-fee peer-to-peer USDT transfers, support for BTC or USDT as gas payment, and full EVM compatibility. Plasma’s strategic goal is to precisely wrest high-value B2B payments, cross-border remittances, and commodity trade settlements from Ethereum and Tron.

Stable: The Highway to Future Finance

In contrast to Plasma’s specialization, the “Stable” network harbors broader ambitions. Designed as a fully functional, independent Layer 1, it aims to become the “highway” for next-generation on-chain finance. Its ambitious three-phase roadmap clearly outlines a path toward extreme performance: beginning with a base layer using USDT as native gas and sub-second finality, progressing to an experience layer enhanced with “optimistic parallel execution” for vastly improved throughput, and ultimately evolving into a consensus mechanism based on Directed Acyclic Graph (DAG) technology, pushing speed and resilience to their limits. Stable targets institutions requiring high-performance, customizable infrastructure—such as DeFi hedge funds and real-world asset (RWA) tokenization platforms.

This “one-two punch” strategy reflects Tether’s deep understanding of institutional markets. Rather than naively assuming one chain fits all, it offers two distinct foundational infrastructures with different risk-return profiles and functional emphases, providing tailor-made solutions for everyone from the most conservative banks to the most aggressive DeFi funds.

Ghosts in the Machine: Unmasking Tether’s Hidden Architects

A key contradiction arises: Tether CEO Paolo Ardoino has repeatedly stated in public interviews that there will be “no Tether chain.” Yet, a vast infrastructure ecosystem centered entirely around Tether is rapidly taking shape. Behind this apparent contradiction lies a meticulously designed organizational structure engineered for “strategic control” coupled with “legal separation.”

Several key players form the “ghosts in the machine,” operating behind the scenes to build the empire:

-

Bitfinex: As Tether’s sister company, it serves as the primary capital provider and project incubator, leading investments in both Plasma and Stable, thus avoiding direct financial involvement by Tether itself.

-

USDT0: This is the technological linchpin of the entire strategy. Built on LayerZero’s OFT standard, it uses a “lock-mint” mechanism to bridge Tether’s existing circulation system with its emerging proprietary chains, ensuring unified liquidity.

-

Everdawn Labs: This enigmatic software development firm, registered in the British Virgin Islands, is the actual manager and operator of the USDT0 protocol. It is highly likely the real developer behind the “Stable” network and a key technical partner for Plasma.

This four-part structure—“Tether (brand and liquidity) – Bitfinex (capital) – Everdawn Labs (technology) – USDT0 (protocol)”—perfectly explains Ardoino’s seemingly contradictory statements. Legally speaking, Tether Inc. itself does not directly operate a blockchain. Yet, through this network of affiliated companies and partners, it maintains absolute control and strategic direction over the entire ecosystem. This is a masterful legal and business architecture, born out of necessity to navigate complex global regulatory environments.

Deconstructing the Engine Room: Tether’s New Financial Tech Stack

Tether’s ambition extends beyond strategy—it’s reflected in its meticulous selection of underlying technologies. Far from chasing tech fads, Tether operates like a seasoned chief engineer, handpicking the most mature and reliable components to assemble a “super engine” optimized specifically for institutional-grade finance.

For interoperability, Tether adopted LayerZero’s OFT standard to build its cross-chain USDT (i.e., USDT0). Unlike traditional “wrapped” assets, OFT uses a “burn-mint” model, ensuring that every USDT0 circulating on any chain remains a standardized, issuer-controlled asset. This fundamentally solves the problems of fragmented liquidity and security risks posed by third-party bridges. In sharp contrast to Circle’s private CCTP protocol, Tether aims to build a more open and composable financial rail, while Circle leans toward a closed “walled garden.”

On performance, Tether similarly demonstrates its “integrative innovation” approach. The “optimistic parallel execution” feature deployed on “Stable” is a proven method used by next-gen high-performance chains like Monad and Sei, capable of exponential throughput gains. Meanwhile, Plasma employs the PlasmaBFT consensus protocol—a customized implementation based on the mature Fast HotStuff framework—to deliver lower latency and faster finality ideal for payment settlements. This pragmatic, efficient tech stack dramatically shortens time-to-market for delivering reliable infrastructure to institutional clients.

Geopolitical Endgame: Dancing in a Regulated World

As Tether intensifies its infrastructure push, the global regulatory landscape is undergoing dramatic shifts. Notably, the U.S. Congress is advancing the GENIUS Act, which could profoundly reshape the stablecoin industry. At its core, the bill proposes a strict regulatory framework requiring issuers to hold 1:1 high-quality liquid assets as reserves, subject to rigorous audits and oversight.

Facing this potentially transformative regulatory storm, Paolo Ardoino and Tether have demonstrated remarkable strategic agility, executing a textbook-perfect “combination strike”:

-

Consolidating Offshore Dominance: Continue positioning existing USDT as the core product for emerging markets and the unbanked. The newly established Plasma and Stable networks will serve as ultra-efficient, low-cost settlement rails for this vast offshore dollar ecosystem.

-

Expanding Onshore Presence: Ardoino has explicitly stated Tether plans to launch a new, fully compliant stablecoin in the United States, adhering strictly to all requirements of the GENIUS Act. This “U.S.-version Tether” will directly compete with Circle’s USDC in the domestic compliance arena.

This “dual-front” strategy enables Tether to simultaneously serve diverse institutional needs. Global traders needing efficient, borderless settlement can use offshore USDT and dedicated chains, while Wall Street asset managers requiring full compliance and U.S. legal protection can adopt the future onshore stablecoin. Thus, Tether is not passively reacting to regulation—it is actively leveraging it. A regulatory act that could have threatened its survival instead becomes a strategic catalyst for a global “pincer offensive.”

Conclusion: The Empire’s New Foundation

Looking back at the initial roadmap for the “Stable” network, we now see clearly that it was never an isolated blueprint, but rather the founding declaration of a vast empire’s new foundation. Tether is undergoing a profound transformation—from a dependent “application” into a vertically integrated financial infrastructure platform with its own sovereign territory.

By building two dedicated blockchains, Plasma and Stable, Tether simultaneously resolves its long-standing issues of value leakage and platform risk. It is reclaiming the hundreds of millions—or even billions—of dollars in implicit “platform taxes” that previously flowed to Ethereum, Tron, and others, internalizing that value into its own ecosystem. More importantly, it has erected a formidable technological and commercial moat—one built upon trillion-dollar liquidity, two proprietary chains, and a sophisticated strategy of dancing with global regulators—that no rival can easily breach.

The far-reaching implications of this transformation have only just begun to unfold. For Ethereum and Tron, the risk of losing their most vital “tenant” looms large. For Circle, the adversary is no longer merely a dominant offshore player, but a powerful force capable of attacking simultaneously on both compliant and non-compliant global fronts. A private entity is constructing an independent financial backbone—one that may carry the majority of future global value transfers outside the traditional banking system. Tether’s grand design is now unmistakable: a “Tether economy,” with USDT as its native currency, is rising steadily on the horizon.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News