Rating at the bottom, why doesn't S&P认可 USDT?

TechFlow Selected TechFlow Selected

Rating at the bottom, why doesn't S&P认可 USDT?

S&P warns Tether's Bitcoin exposure has breached safety limits.

By KarenZ, Foresight News

On the evening of November 26, S&P Global Ratings released its stability assessment report on Tether's stablecoin, downgrading Tether (USDT) from Level 4 (Limited) to Level 5 (Weak).

This rating sits at the lowest tier of S&P’s 1–5 scale, marking heightened concern within this evaluation system about the safety of a stablecoin with over $180 billion in circulation.

Why the downgrade?

S&P’s downgrade is not baseless but grounded in multiple concerns regarding Tether’s reserve asset structure and disclosure practices.

1. Bitcoin exposure exceeding safety buffer

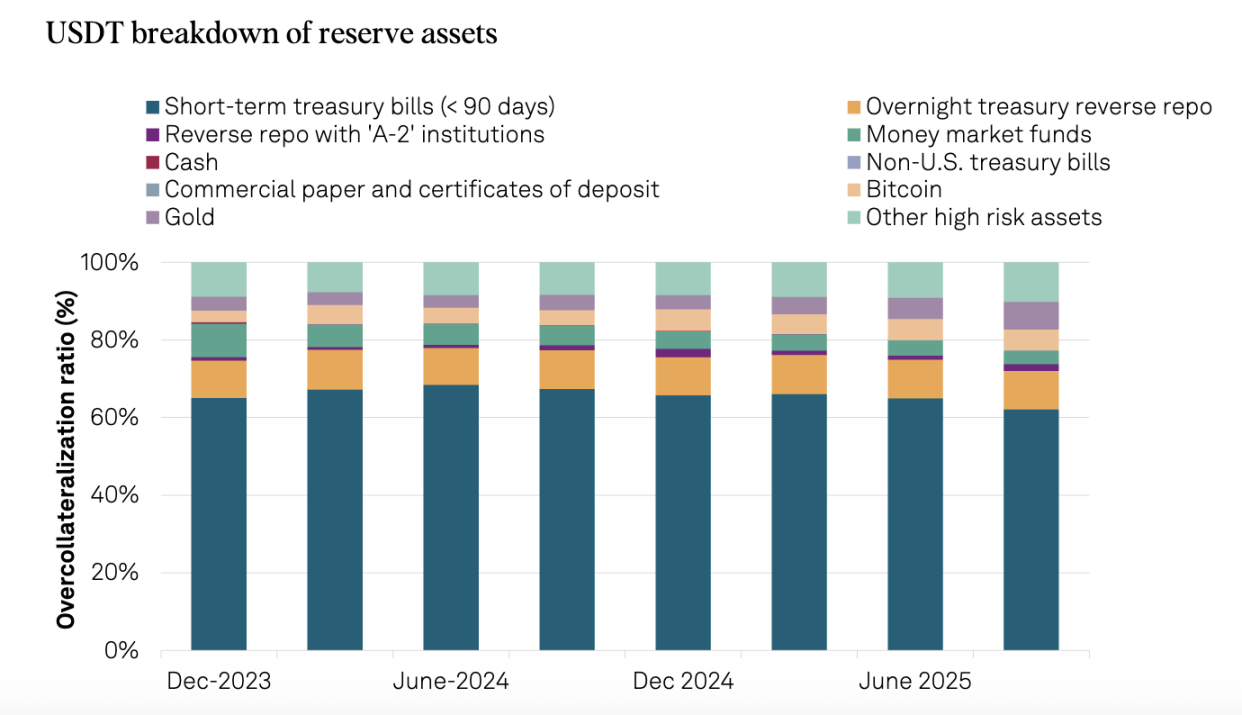

The core issue lies in the uncontrolled growth of bitcoin exposure. As of September 30, 2025, the value of bitcoin held by Tether accounted for 5.6% of outstanding USDT, surpassing the 3.9% excess collateral cushion implied by its 103.9% collateralization ratio.

This comparison is particularly telling: as of September 30, 2024, the same metric stood at just 4%, below the 5.1% excess margin implied by the then 105.1% collateralization ratio. In other words, Tether’s safety buffer has been eroding year-on-year.

When bitcoin underwent significant monthly declines in October and November, this risk shifted from theoretical threat to real vulnerability. If bitcoin continues to fall deeper, Tether’s reserve value could drop below the total value of issued USDT, resulting in under-collateralization. For S&P, this is no longer a hypothetical scenario but an actual risk requiring objective assessment.

2. Sharp rise in high-risk assets

From September 30, 2024, to September 30, 2025, the share of high-risk assets in Tether’s reserves surged from 17% to 24%. These include corporate bonds, precious metals, bitcoin, secured loans, and other investments—exposed to credit, market, interest rate, and foreign exchange risks—with still-limited public disclosure.

Meanwhile, low-risk assets (short-term U.S. Treasury bills and overnight reverse repos) declined from 81% to 75%, while high-risk holdings expanded correspondingly. This clearly reflects rising sensitivity of Tether’s reserve portfolio to market volatility.

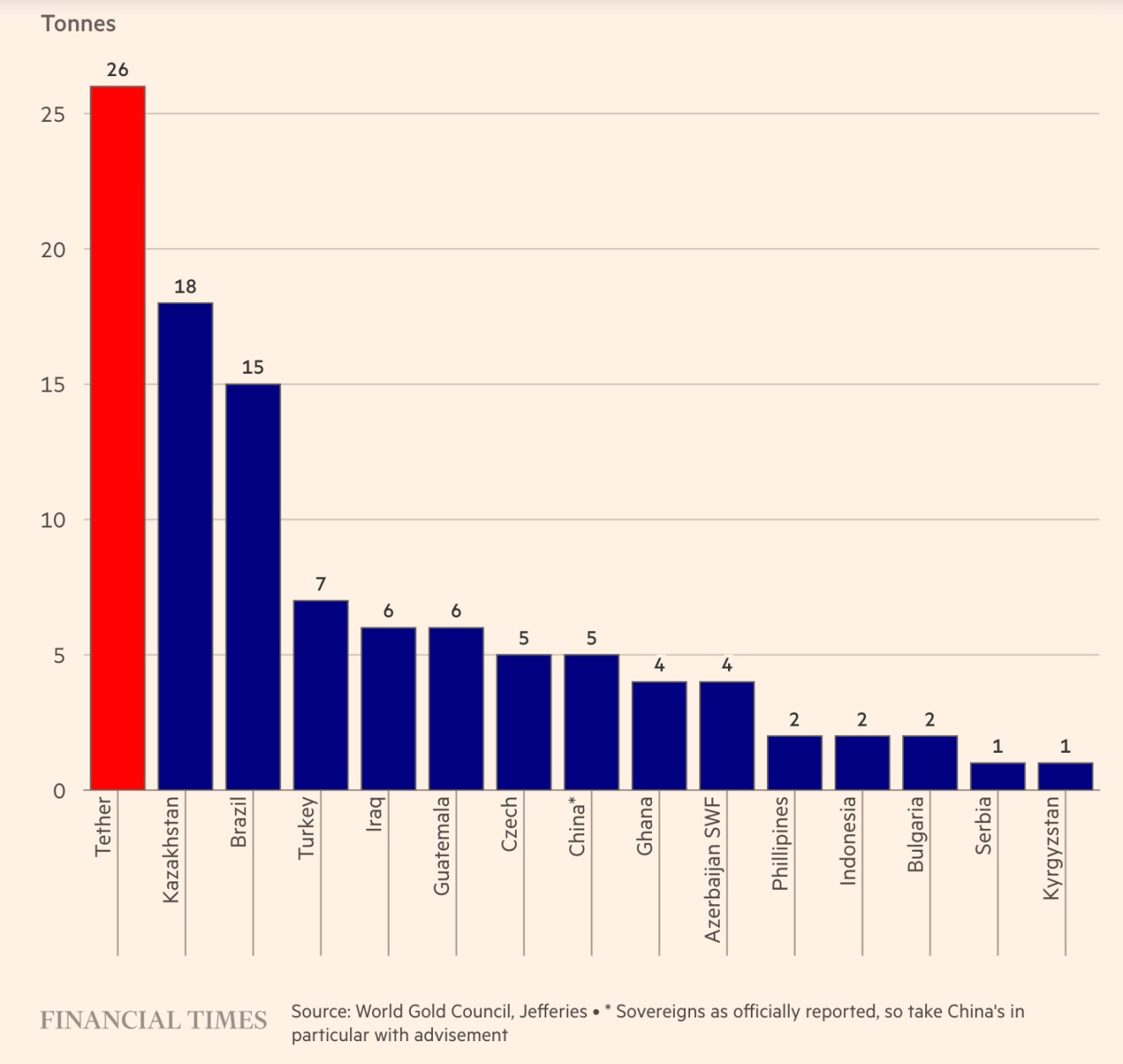

Notably, Tether’s enthusiasm for gold deserves special attention. The company purchased 26 tons of gold in Q3 2025, bringing its total holdings to approximately 116 tons by end-September. Surprisingly, gold reserves ($12.9 billion) now exceed bitcoin holdings ($9.9 billion), making it Tether’s largest non-Treasury asset. Behind this rapid expansion lies Tether’s strategic intent to hedge against fiat depreciation and seek value preservation and appreciation.

Source: Financial Times

3. Relatively weak regulatory framework

After relocating from the British Virgin Islands to El Salvador, Tether falls under the supervision of El Salvador’s National Commission for Digital Assets (CNAD). While CNAD mandates a minimum 1:1 reserve ratio, S&P identifies key flaws in this framework.

First, the rules are too broad. CNAD allows relatively high-risk instruments such as loans and bitcoin, as well as volatile assets like gold, to be included in reserves. Second, there is no requirement for segregation of reserve assets.

4. Opaque management and insufficient disclosure

S&P reiterated long-standing concerns:

-

Lack of credit rating information on custodians, counterparties, and banking providers.

-

Limited transparency in reserve management and risk appetite.

-

Insufficient public disclosure on group-level governance, internal controls, and isolation of activities following the company’s expansion into finance, data, energy, and education sectors.

-

No public information on segregation of USDT assets.

Tether CEO’s response

In response to the downgrade, Tether CEO Paolo Ardoino maintained his characteristic combative stance, arguing that S&P’s rating model was designed for a broken traditional financial system.

He stated, “We take your disdain as honor. Classic rating models designed for legacy financial institutions have historically misled private and institutional investors into placing wealth into companies—rated investment-grade—that eventually collapsed. This forced global regulators to question these models and the independence and objectivity of major rating agencies. Tether has built the first over-capitalized firm in financial history, while maintaining exceptional profitability. Tether stands as living proof that the traditional financial system is so broken that it terrifies its hypocritical rulers.”

This rebuttal holds some merit. Historically, Tether has survived every FUD event. In the first three quarters of 2025 alone, Tether generated $10 billion in net profit and has become one of the world’s largest holders of U.S. Treasuries, with over $135 billion in holdings—this scale itself serves as a form of credit endorsement.

Deeper reflections

What is a stablecoin actually stabilizing?

Tether’s strategy of increasing exposure to bitcoin and gold is essentially a bet on “fiat devaluation.” If future dollar inflation spirals out of control, such a diversified reserve structure might actually offer better purchasing power stability than stablecoins backed purely by Treasuries.

However, under current dollar-anchored accounting standards, this approach is inevitably labeled “high-risk.” This reveals a fundamental question: what should stablecoins stabilize—their face value or their real purchasing power?

Traditional rating systems choose the former, while Tether pursues the latter. Their evaluation criteria are inherently misaligned.

Blurred roles between private firms and central banks

When a private company attempts to perform central bank functions, it inevitably faces the same dilemmas. Tether must balance reserve safety with profit generation.

Tether’s accumulation of bitcoin and gold is both a rational hedge against fiat risk and a commercial move to increase corporate asset value. Yet this mixed motivation contradicts the stablecoin promise of “preserving principal safety.”

Parallel worlds of institutions and retail investors

For retail users, S&P’s downgrade may be just another brief FUD episode; for traditional institutions, however, it could represent an insurmountable compliance barrier.

Compliance-focused large funds and banks may shift toward USDC or PYUSD, whose assets consist primarily of cash and short-term U.S. Treasuries, aligning with traditional risk models. S&P’s criticisms of USDT closely mirror requirements in emerging U.S. stablecoin regulations. This difference in standards directly translates into rating disparities: S&P assigned USDC a “Strong” (Level 2) rating in December 2024.

Generational differences in rating standards

The crypto world prioritizes “liquidity and network effects”—the logic of 21st-century digital finance. USDT has demonstrated the resilience of its network effect over a decade of operation. But will a new rating system emerge—one better suited to the characteristics of crypto-native assets? This remains an open question worth exploring.

Conclusion

S&P’s downgrade of Tether serves as a warning about future risks. As the “liquidity backbone” of the crypto market, any risk event involving USDT would impact not only its own sustainability but also the healthy development of the entire industry.

Yet this will not collapse Tether in the short term, as its massive network effect has already formed a moat. However, it does plant a long-term concern: when a private company relies heavily on risky assets to back a global value anchor, can it truly guarantee absolute safety of holders’ principal?

This question goes beyond Tether’s future—it touches on the sustainability of the entire stablecoin ecosystem. Only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News