Starting from 20 companies: understanding Tether's investment landscape

TechFlow Selected TechFlow Selected

Starting from 20 companies: understanding Tether's investment landscape

We are standing at the edge of a digital empire built on USDT, an empire that has grown too big to fail.

Author: 100y.eth

Translation: TechFlow

Key Takeaways

-

The order of empire is inseparable from the status of currency, and the sustained growth of USDT signals the rise of a vast digital financial empire.

-

This article reviews Tether's recent investments in 20 companies and analyzes its strategy for building a digital financial empire.

-

Tether consistently follows three strategies: 1) establishing trust through Bitcoin and gold, 2) pursuing global strategic expansion, and 3) enhancing accessibility for retail and institutional users through services and products.

1. Tether and the Digital Financial Empire

1.1 Currency and Empire

Source: Dyken Wealth Strategies

Currency is a widely accepted medium of exchange and unit of value in daily life. However, from the perspective of empire, the role of currency extends far beyond simple transactions—it can be understood as a tool of power encompassing political, cultural, and social functions. Throughout imperial history, currency has played the following additional roles:

-

Symbol of Imperial Order: Figures or imperial emblems on coins visually represent imperial authority, serving as symbolic objects that display imperial order to users.

-

Tool of Imperial Control: By centralizing minting and monetary issuance within the imperial core, external regions become dependent on the central monetary system, thereby reinforcing imperial order.

-

Standardization Tool for Resource Aggregation: Empires accumulate regional resources through taxation and tribute, with currency acting as a key medium to standardize and transport these resources.

Without exception, the status of currency is always closely tied to the status of empire. When an empire rises and reaches its peak, its currency becomes strong and sustains imperial prosperity; when the empire declines, its currency weakens accordingly, accelerating imperial collapse.

Today, words like "empire" or "colony" have disappeared from the surface, yet we remain bound by these concepts. The United States plays the role of a modern empire through its powerful economy and military, with the U.S. dollar becoming the world’s dominant currency.

Many countries have attempted to challenge the dollar’s dominance in modern society but failed. The dollar accounts for about 57% of global foreign exchange reserves and around 50% of SWIFT international settlements, firmly cementing its position.

1.2 The Unstoppable Growth of USDT

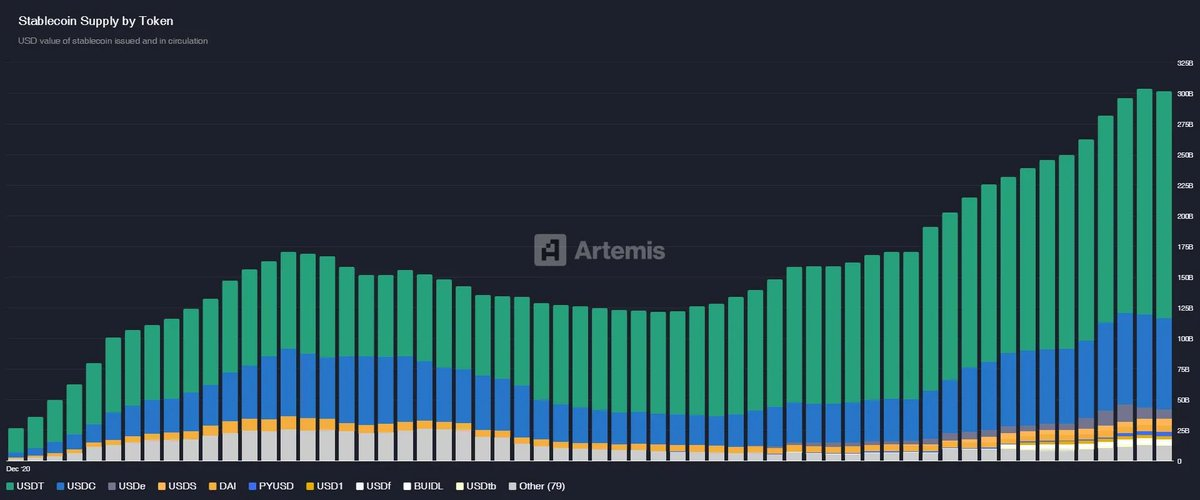

Source: Artemis

As information technology (IT) advances, the global economy is gradually migrating online. The emergence of blockchain technology enables secure online use of money, driving rapid growth in the on-chain economy—and with it, stablecoins have rapidly expanded to a scale of approximately $300 billion.

Among all stablecoins, Tether’s USDT stands out most prominently. USDT allows people in countries with highly unstable fiat currencies easy access to the U.S. dollar—the “imperial currency.” Even without credit history or bank accounts, anyone with an internet-connected mobile device can easily access dollars. This opens the door to rapid growth for USDT, especially in developing and third-world countries.

More notably, despite the introduction of the GENIUS Act and increasing regulatory integration of blockchain, USDT’s market share has not significantly declined. USDT still maintains a market share above 60%, more than double that of the second-largest stablecoin, USDC.

1.3 Toward a Vast Digital Financial Empire

Tether is building its own vast empire, powered at its core by the strong currency USDT. Yet building an empire has never been easy.

Although pegged to the U.S. dollar, Tether’s reserves include not only highly liquid cash equivalents such as cash, U.S. Treasuries, and repurchase agreements, but also relatively less stable assets such as precious metals, Bitcoin, government bonds from non-U.S. countries, and corporate bonds. In major jurisdictions where stablecoin regulations are established, these types of assets are typically not legally recognized as reserve collateral.

In fact, under the EU’s MiCA (Markets in Crypto-Assets) regulation, USDT fails to meet certain conditions for stablecoins categorized as EMT (Electronic Money Tokens). As a result, exchanges operating in Europe have delisted USDT, effectively excluding USDT from the EU market.

However, Tether has not retreated. As a company, Tether acquires equity stakes by investing in various startups and firms, and sometimes donates to nonprofit organizations. By examining these actions, we can infer Tether’s strategic direction and how it strives to build a vast digital financial empire. Next, let’s explore how Tether overcomes challenges in empire-building through its investment cases.

2. What Types of Companies Has Tether Invested In?

2.1 Before We Begin

Tether is a company closely watched by the crypto community. This attention is understandable—Tether issues the world’s largest stablecoin, USDT, and is also known as the highest revenue-per-capita company globally.

Yet the crypto community appears less interested in Tether’s startup and corporate investments. More precisely, greater focus is placed on token-issuing protocols supported by Tether. Representative examples include chains built specifically for USDT, such as Stable and Plasma. However, neither project was directly invested in by Tether itself, but rather by affiliated entities such as Bitfinex, USDT0, and Tether CEO Paolo Ardoino.

Tether is highly active in corporate investments, but most portfolio companies do not issue tokens nor exhibit distinct regional characteristics, so these investments have not drawn widespread attention from the crypto community. Nevertheless, analyzing Tether’s investment portfolio reveals clues about its future direction.

2.2 What Types of Companies Has Tether Invested In?

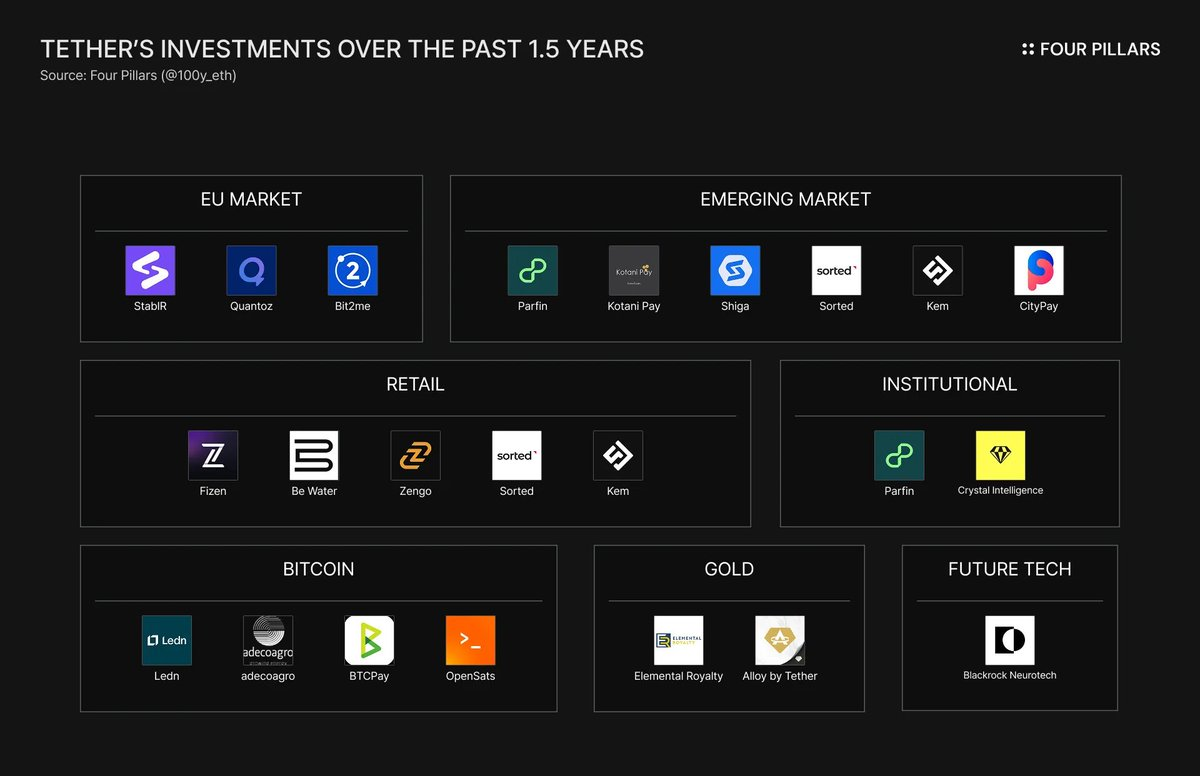

Tether announces its investment activities via press releases on its official website. After analyzing about one and a half years of investment announcements, I’ve identified the following key themes:

-

European Market: Despite being effectively excluded from the EU market, Tether seeks entry through investments in European issuers and platforms.

-

Emerging Markets: USDT’s product-market fit (PMF) in emerging markets has already been proven. Tether is strategically expanding its influence in these regions.

-

Retail Users: Tether has invested in several non-custodial wallet developers to ensure retail users can easily access and use USDT.

-

Institutional Users: Beyond retail and emerging markets, Tether invests in enterprise solution providers to help institutions access USDT more conveniently.

-

Bitcoin: Tether continues to invest in BTC and the broader Bitcoin ecosystem.

-

Gold: Tether views gold as a critical geopolitical asset, just like BTC, and is accelerating its dual-axis strategy centered on Bitcoin and gold.

-

Future Technologies: Tether invests not only in currency-related businesses but also in advanced technologies capable of advancing human society.

These investment themes reflect a clear strategic direction behind the digital financial empire Tether aims to build.

2.3 Indirect Strategy to Enter the European Market

StablR @StablREuro

Source: StablR

StablR is a stablecoin issuer compliant with the EU’s Markets in Crypto-Assets Regulation (MiCA), headquartered in Malta, issuing EURR (pegged to the euro) and USDR (pegged to the U.S. dollar). In addition to receiving investment, StablR plans to use Tether’s tokenization platform Hadron.

Hadron is a SaaS platform designed to easily tokenize various assets—including stocks, bonds, commodities, and stablecoins—with robust capabilities supporting full token lifecycle management, KYC (Know Your Customer), AML (Anti-Money Laundering), monitoring, and other compliance infrastructure.

-

Quantoz @Quantoz

Source: Quantoz

Quantoz is a MiCA-compliant stablecoin issuer offering EURQ and EURD (both euro-pegged) and USDQ (dollar-pegged).

EURD is designed for closed-loop systems and, compared to EURQ, can be seen as a general-purpose stablecoin. Quantoz also plans to use Tether’s Hadron tokenization platform.

Bit2Me @bit2me

Source: Bit2Me

Bit2Me is the largest digital asset platform in the Spanish-speaking world. Individuals, enterprises, and institutions can trade and invest in a wide range of cryptocurrencies and participate in remittances, payments, lending, and other financial activities.

Founded in 2014, Bit2Me has operated for over ten years and serves more than 1.2 million users—an important platform. Notably, Bit2Me operates under MiCA compliance and holds a CASP (Crypto Asset Service Provider) license, making it a highly strategic investment target for Tether.

2.4 Investment Strategy Focused on Emerging Markets

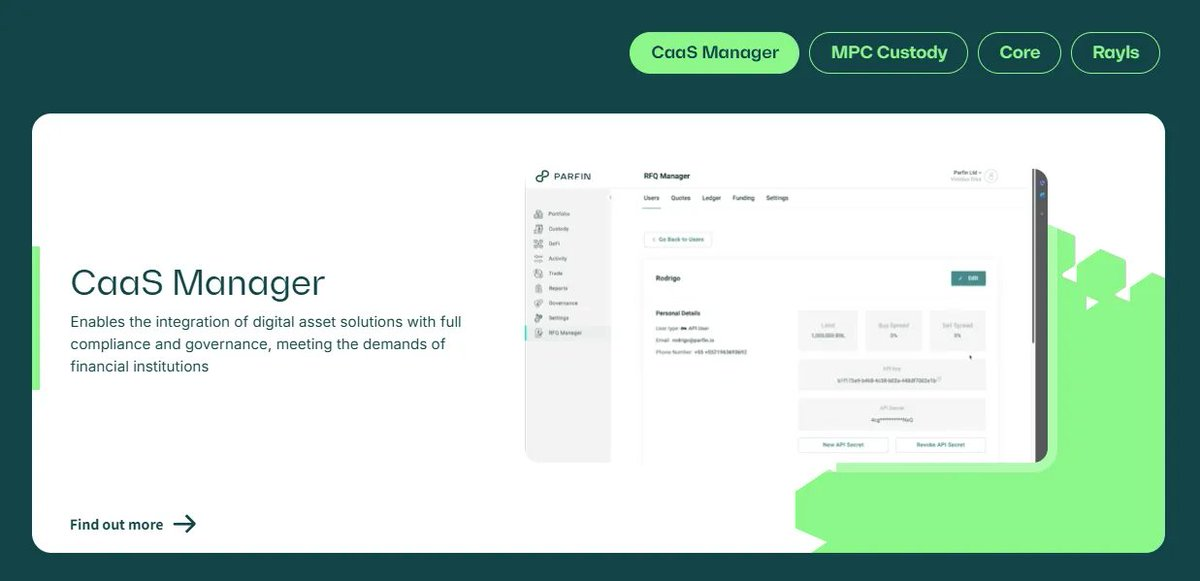

Parfin @parfin_io

Source: Parfin

Parfin is a Latin America-based institutional blockchain infrastructure firm. It offers management and workflow platforms enabling financial institutions to easily adopt blockchain technology and cryptocurrencies, along with secure MPC (Multi-Party Computation) wallet solutions and asset tokenization services.

Parfin has also received investments from leading global venture capital firms such as Framework, Valor, Accenture, and ParaFi. Through this investment, Tether aims to help Latin American financial institutions access USDT more easily.

Kotani Pay @kotanipay

Source: Kotani Pay

Kotani Pay is an Africa-based Web3 payment infrastructure company offering crypto on/off ramps, stablecoin settlement and payments, and SMS-based blockchain wallets.

Through this investment, Tether plans to expand on/off-ramp infrastructure, enabling Africans to access USDT more easily.

Shiga @ShigaDigital

Source: Shiga

Shiga is an Africa-based blockchain financial solutions company offering multiple blockchain services, including local currency-to-stablecoin on/off ramps, OTC trading, corporate virtual accounts, treasury management, and blockchain solution development.

These services enable African individuals and enterprises to easily access the U.S. dollar economy via on-chain finance. Tether identifies Africa as a key region for USDT adoption and is actively expanding operations there through its investment in Shiga.

Sorted @sortedwallet

Source: Sorted

Sorted is a wallet solutions company based in Africa and South Asia, providing non-custodial wallets that run smoothly on basic feature phones and low-end smartphones—greatly improving financial access for the poor and unbanked.

Users can easily conduct crypto remittances, payments, and on/off-ramp services. Through this investment, Tether expands its footprint in Africa and gains deeper access to South Asia.

Kem @kem_app

Source: Kem

Kem is a widely used crypto remittance, payment, and financial management app in the Middle East. Users can send remittances and make payments using crypto assets via the Kem app, link it to physical cards, and even invest in assets like gold.

Similar to Africa and Latin America, the Middle East hosts a large number of migrant workers, so USDT-based crypto remittances can greatly stabilize their lives. Tether plans to use its investment in Kem as a foundation to grow USDT’s market share in the Middle East.

CityPay @citypayio

Source: CityPay

CityPay is a Georgia-based crypto payment company. Beyond Georgia, it is actively expanding into Eastern Europe—including Armenia, Azerbaijan, Kazakhstan, and Uzbekistan—offering wallet services, launching payment cards, and onboarding crypto merchants.

Through this investment, Tether aims to strategically consolidate USDT’s share in the Eastern European payments market.

2.5 Retail Strategy

Note that Sorted and Kem mentioned above are also non-custodial wallet solution providers and fall under the retail strategy.

Fizen @fizenapp

Source: Fizen

Fizen is a consumer-facing crypto super app. Users can store, transfer, and pay with cryptocurrencies using self-custodial wallets. Fizen offers features like payments, shopping, and gift cards, allowing users to seamlessly integrate crypto into daily life.

Through this investment, Tether hopes to provide high-quality USDT usage experiences, enabling broad adoption of USDT in everyday payments.

Be Water

Source: Be Water

Be Water is an Italy-based media and content company involved in film, television, and documentary production and distribution, as well as operating a news brand.

Tether acquired a 30.4% stake in Be Water for €10 million, laying the foundation for expanding from finance into the global content ecosystem.

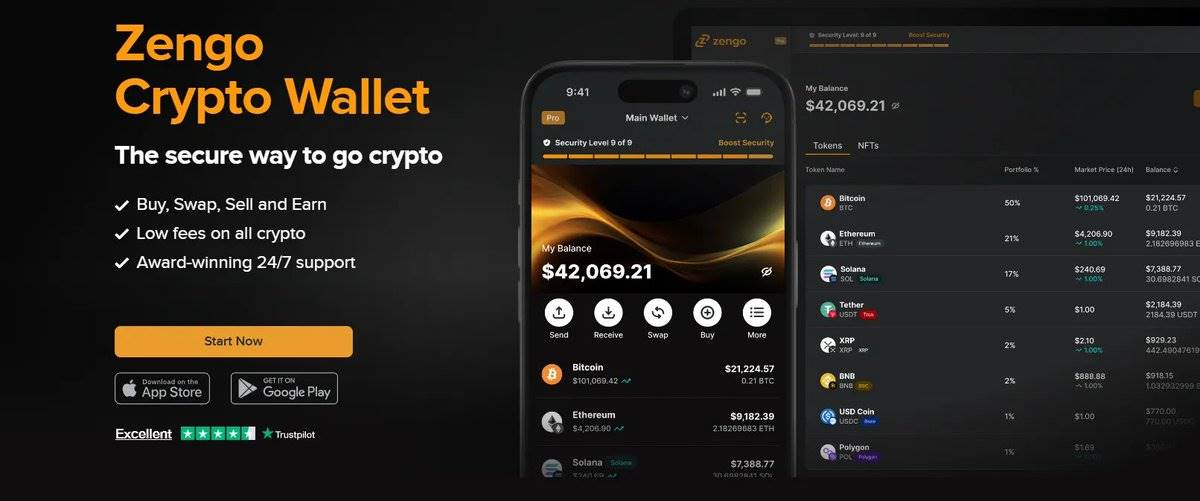

Zengo @ZenGo

Source: Zengo

Zengo is a wallet solution based on MPC (Multi-Party Computation) technology, enabling users to securely use self-custodial wallets without managing complex recovery phrases. Through this investment, Tether helps users securely store, send, and spend assets issued by Tether.

2.6 Institutional Strategy

Note that Parfin, which serves financial institutions in Latin America, is also included in the institutional strategy.

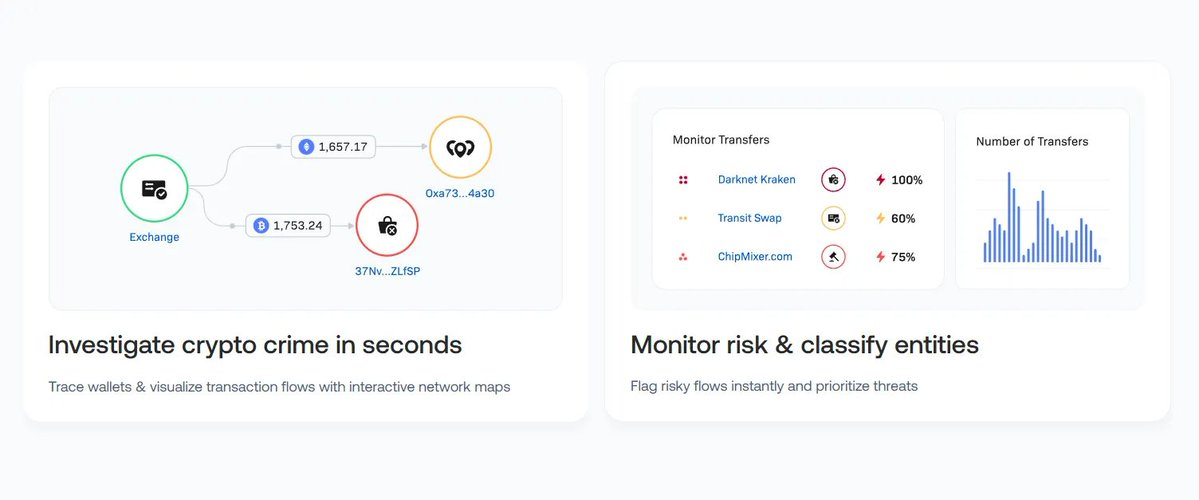

Crystal Intelligence @CrystalPlatform

Source: Crystal Intelligence

Crystal Intelligence is a blockchain intelligence firm offering fraud detection, risk monitoring, real-time wallet address analysis, compliance support, illicit fund tracking, and criminal response services.

Through this investment, Tether plans to strengthen collaboration and enhance capabilities to prevent illegal use of USDT—a key strategic move to establish USDT as an institution-friendly stablecoin.

2.7 Investments in the Bitcoin Industry

Ledn @hodlwithLedn

Source: Ledn

Ledn is a Bitcoin-backed lending platform allowing individuals and enterprises to borrow stablecoins using BTC as collateral without selling their Bitcoin.

Tether has long focused on building infrastructure connecting crypto assets with real-world financial applications, and Ledn is pioneering new financial markets based on Bitcoin—making it a natural investment target.

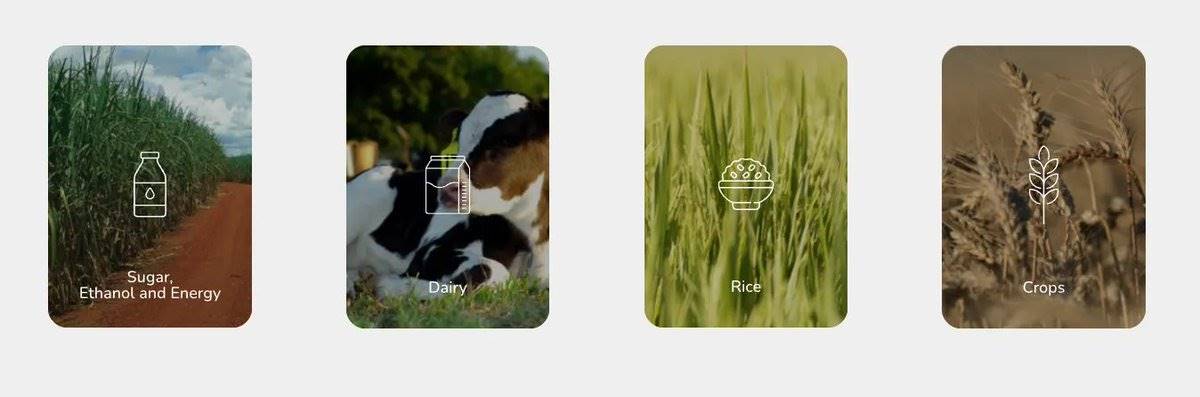

adecoagro @adecoagro_

Source: adecoagro

adecoagro is South America’s largest sustainable agriculture and renewable energy company, publicly listed on the NYSE. adecoagro sells part of its electricity output into spot markets, but due to price volatility, its revenues may be unstable.

From this perspective, Bitcoin mining can serve as a fixed demand source for electricity. Tether plans to acquire up to 70% of adecoagro and jointly advance Bitcoin mining projects.

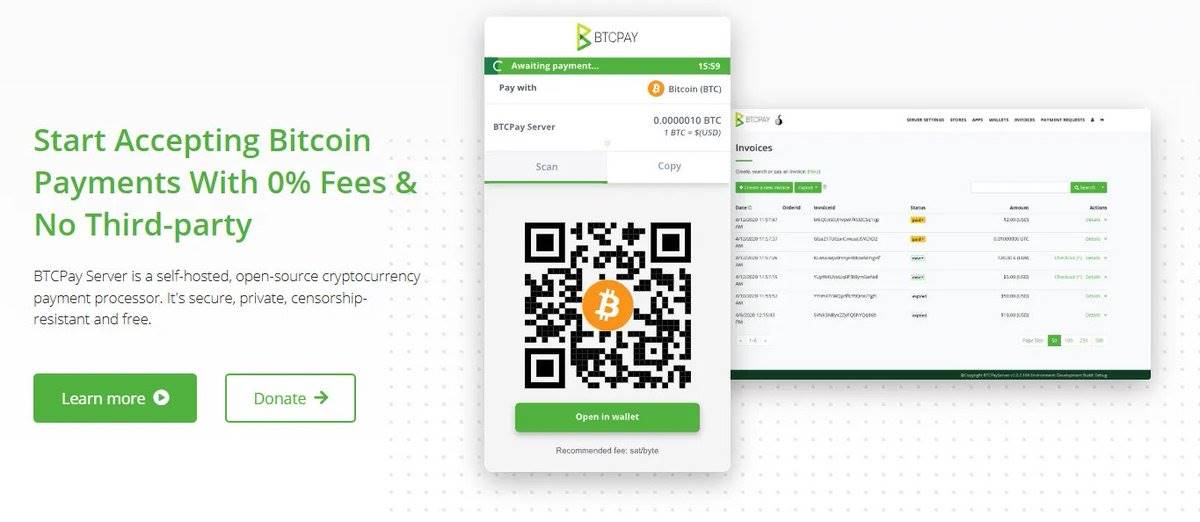

BTCPay Server Foundation @BtcpayServer

Source: BTCPay

BTCPay is an open-source Bitcoin and stablecoin payment processor. Its uniqueness lies in its self-hosted model, allowing users to run it directly on their own servers.

Tether has supported BTCPay for two consecutive years to strengthen censorship-resistant payment infrastructure for Bitcoin and USDT.

OpenSats @OpenSats

Source: OpenSats

OpenSats is a U.S. 501(c)(3) nonprofit charity dedicated to funding Bitcoin and censorship-resistant technologies. It supports the open-source Bitcoin ecosystem through a sustainable model, allocating donations to protocol development, privacy tools, research, and education.

Though not an investment, Tether has consistently donated to OpenSats, demonstrating its ongoing support for Bitcoin and the open-source ecosystem.

2.8 Gold as a Geopolitical Asset

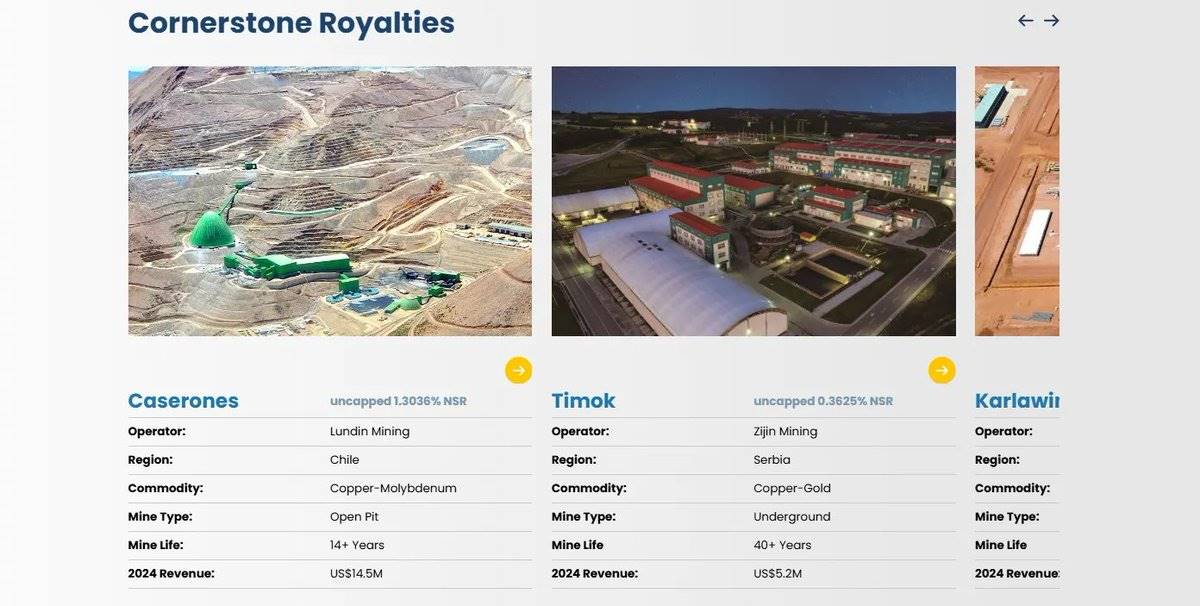

Elemental Altus Royalties @Elemental_Royal

Source: Elemental Royalties

Elemental Altus Royalties is a company related to gold mining, though it does not mine directly. Instead, it generates revenue through royalty agreements with gold mining firms.

Tether views gold as foundational infrastructure for digital currency. To strengthen its gold-related strategy, Tether acquired a 31.9% stake in Elemental Altus Royalties.

Alloy @Alloy_tether

Source: Alloy

Alloy is a service directly launched by Tether, not an investment. However, due to its key role in Tether’s gold strategy, it is included here.

Tether offers a gold-tokenized service called XAUT, while Alloy launched aUSDT—a gold-backed stablecoin collateralized by XAUT. This represents Tether’s attempt to reshape the historical gold standard and further reinforce its dual strategy centered on gold and Bitcoin.

2.9 Investments in Future Technologies

Blackrock Neurotech @BlackrockNeuro_

Source: Blackrock Neurotech

Blackrock Neurotech is a leader in brain-computer interface technology, founded by a research team from the University of Utah. Its technology can convert thoughts into digital signals through implanted brain electrodes.

For individuals with mobility impairments, sensory deficits, or communication difficulties, Blackrock Neurotech’s technology can significantly improve quality of life. Through this investment, Tether becomes a major shareholder, signaling ambitions extending beyond finance into humanity’s most advanced future technologies.

Source: Tether

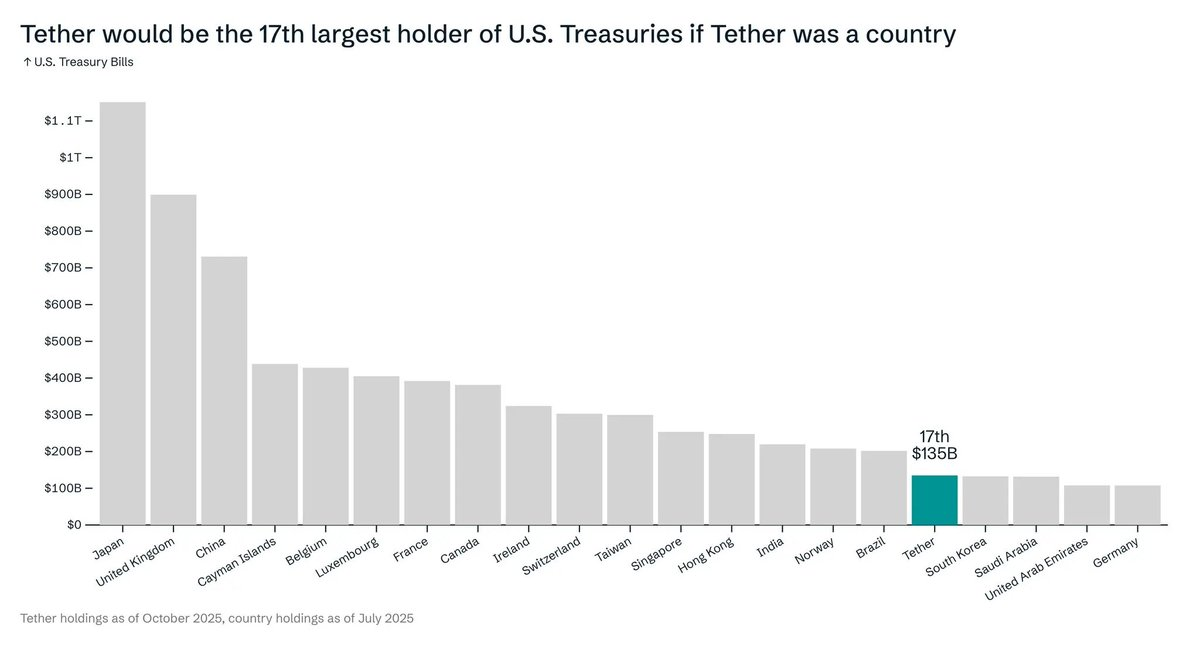

Tether holds $135 billion in U.S. Treasuries—such a massive scale ranks it 17th globally, ahead of South Korea. In reality, Tether has already built a digital empire through its currency, USDT.

From Tether’s recent investment moves, we can see the strategy behind its digital empire:

-

Building Trust: Tether focuses on two core assets—Bitcoin and gold—to earn user trust.

-

Global Expansion: Tether aims to cover every continent—Asia, Africa, South America, Europe, the Middle East, and recently the U.S. market via USAT.

-

Enhancing Usability: Tether aims to make USDT easily usable in daily life and financial activities for retail users, businesses, and institutions through diverse services.

Some predicted that as the blockchain industry becomes increasingly regulated, Tether and USDT would weaken—but this prediction proved wrong. I have no doubt that the U.S.-centered stablecoin industry will continue growing, and I firmly believe Tether and USDT’s influence will accelerate further.

In the end, we stand at the edge of a digital empire built on USDT—one already too big to fail.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News