Hyperliquid's Journey (Part 3): No Battles in the CLOB

TechFlow Selected TechFlow Selected

Hyperliquid's Journey (Part 3): No Battles in the CLOB

Asset type determines price trend.

Author: Zuoye

Binance life is a cover-up for Aster's anti-farming, an extreme wealth creation effect that, even as sentiment, is enough to make people forget about their position troubles in the rainy depths of late autumn, regardless of long or short.

Beyond the technical specifications and fee table comparisons, what truly intrigues me is why the CLOB architecture (Central Limit Order Book) suits perpetual contracts, and where the limits of CLOB architecture lie?

Assets Determine Price

I was born too late to catch the DeFi Summer era; yet too early to witness CLOB shining across foreign exchange markets.

Traditional finance has such a long history that people have forgotten how markets originally formed.

In short, finance revolves around assets and prices—trading price (buy/sell, long/short) against assets (spot/contracts/options/predictions). Cryptocurrencies merely replayed centuries of financial history within just a few decades, adding their own unique demands or improvements along the way.

CLOB is not simply mimicking Nasdaq or CME. Breaking it down, "central," "limit order," and "order book" each occur on-chain, ultimately contributing to today’s flourishing landscape.

1. Order Book: A mechanism recording buy/sell bid prices.

2. On-chain Limit Order Book: A bidding mechanism with dual sorting by time and price, where “limit” means a set price.

3. On-chain Central Limit Order Book: Refers to storing limit orders in a unified system like a blockchain—the meaning of “central.”

BTC contracts traded on CME, Binance, and Hyperliquid can all be considered CLOBs. However, in this article, we specifically refer to CLOB Perp DEXs built on public chain/L2 architectures.

Following from point three, here is a historical explanation: The technological roadmap debate is a continuation of Ethereum mainnet’s high cost and slow speed issues around 2021. FTX’s collapse in 2022 delayed the Perp War—which had begun at the end of DeFi Summer—until 2025.

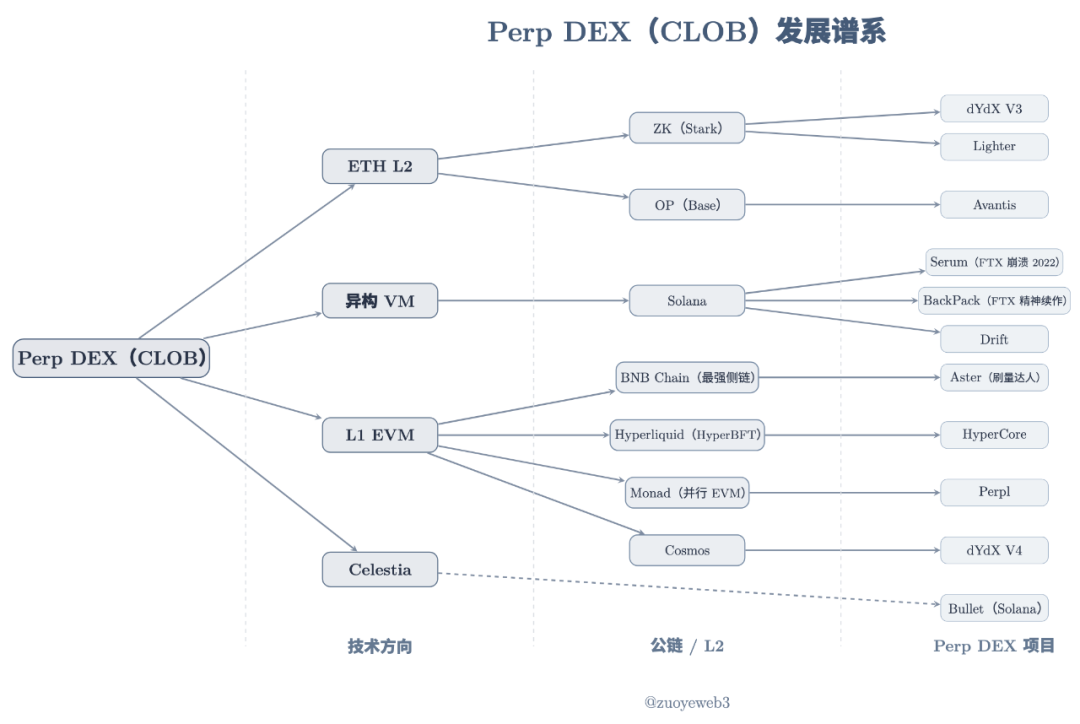

Caption: Perp DEX (CLOB) lineage

Image source: @zuoyeweb3

Perp DEX projects launched at different times but can generally be divided into three technical paths: ETH L2, heterogeneous VM (Solana), and L1 EVM. Celestia belongs to an intrusive DA solution and does not rely on any specific VM architecture.

Historical documents lack practical significance. Today, people don’t care about decentralization—they only care about trading efficiency. Thus, no detailed comparison will be made here. It's hard to say whether Hyperliquid with its 4→16→24 nodes is faster or more decentralized than typical single sequencer L2s, or what difference it actually makes.

Human joys and sorrows are not shared—I simply find them noisy.

Technology investments are lagging. Seeds for DeFi Summer in 2020 were sown back in 2017–18. By the end of 2020, Serum had already begun a slow start on Solana, featuring:

1. Liquidity front-end and revenue sharing

2. Expected support for spot trading

3. High-performance matching依托on Solana’s performance

4. Node staking to earn MegaSerum (MSRM)

5. Collaboration with FTX

6. Partnership with Wormhole for cross-chain support

7. Cross-chain assets with yield mechanisms

8. SRM holders receive fee discounts

9. SRM buyback and burn mechanism

10. Planned SerumUSD stablecoin product line

Of course, the majority of SRM tokens were not widely distributed, but concentrated in FTX and even SBF’s personal hands. Its dramatic collapse in 2022 gave Hyperliquid more time to develop itself.

This isn't to say Hyperliquid is a copy of Serum. Any great product relies either on engineering combinations or original vision. In terms of technology selection, joint market-making for liquidity, token airdrops, and risk control, Hyperliquid far surpasses Serum.

From dYdX/Serum to Hyperliquid, everyone believed moving perpetual contracts on-chain was feasible—though differing in technical architecture, decentralization, and liquidity organization—but still failed to answer what characteristics of CLOB led to this consensus.

So why did perpetuals choose CLOB?

The most reasonable answer is CLOB’s stronger price discovery capability.

This remains a historical answer, tied closely to AMM DEX development—from Bancor to Uniswap and Curve, Ethereum paved the way for exploring on-chain liquidity initialization and applicability.

DEX protocols avoid two major problems—custody of user funds and maintaining liquidity—by relying on LPs (liquidity providers), allowing them to focus solely on protocol security. Stimulated by fee-sharing, LPs deploy liquidity independently.

Later, LPs passed liquidity costs onto users through slippage and fees—that is, liquidity creation shifted from DEX protocols to LPs, then from LPs to users.

However, two residual issues remain: LP impermanent loss and weak AMM price discovery.

-

The root of impermanent loss lies in the exchange of two assets. LPs must deposit equal amounts of both assets, but their value trends often diverge. Most pairs involve stablecoins paired with other assets to enhance stability.

-

AMM prices are a kind of “market price”—neither LPs nor project teams nor DEX protocols can directly define an asset’s price, only influence it indirectly via liquidity.

To address these, Curve improved upon the first issue with USDC/USDT stablecoin trading, minimizing bilateral volatility and relying on higher trade frequency to boost fees. Rather than calling Curve’s suitability for stablecoin pairs a strength, it’s more accurate to call it an inherent flaw. Their latest innovation, Yield Basis, uses economic design and leverage to effectively “erase” impermanent loss.

The improvement limit for the second issue is CoW Swap’s TWAP (Time-Weighted Average Price), which splits large orders into smaller ones to reduce market impact and achieve optimal execution price—Vitalik’s favorite.

But this is where it stops. On-chain Perp trading details are fully transparent. Using AMM mechanisms, manipulating prices via liquidity adjustments would be extremely easy. A 1% price shift might be acceptable in spot trading, but in Perp trading, it’d send you straight to heaven—in a queue.

AMM’s flaws prevent it from being used—or at least widely used—for Perps. We need a technology independent of liquidity changes to control prices, i.e., prices must be pre-set.

Orders must either execute at quoted prices or not at all—no discounted executions—otherwise perpetual markets cannot function properly.

Eliminating impermanent loss is merely a side effect. Different technical architectures lead to different market-making mechanisms.

Perp’s price sensitivity perfectly matches CLOB’s precise control—assets determine price movements, and those movements require corresponding technical architecture.

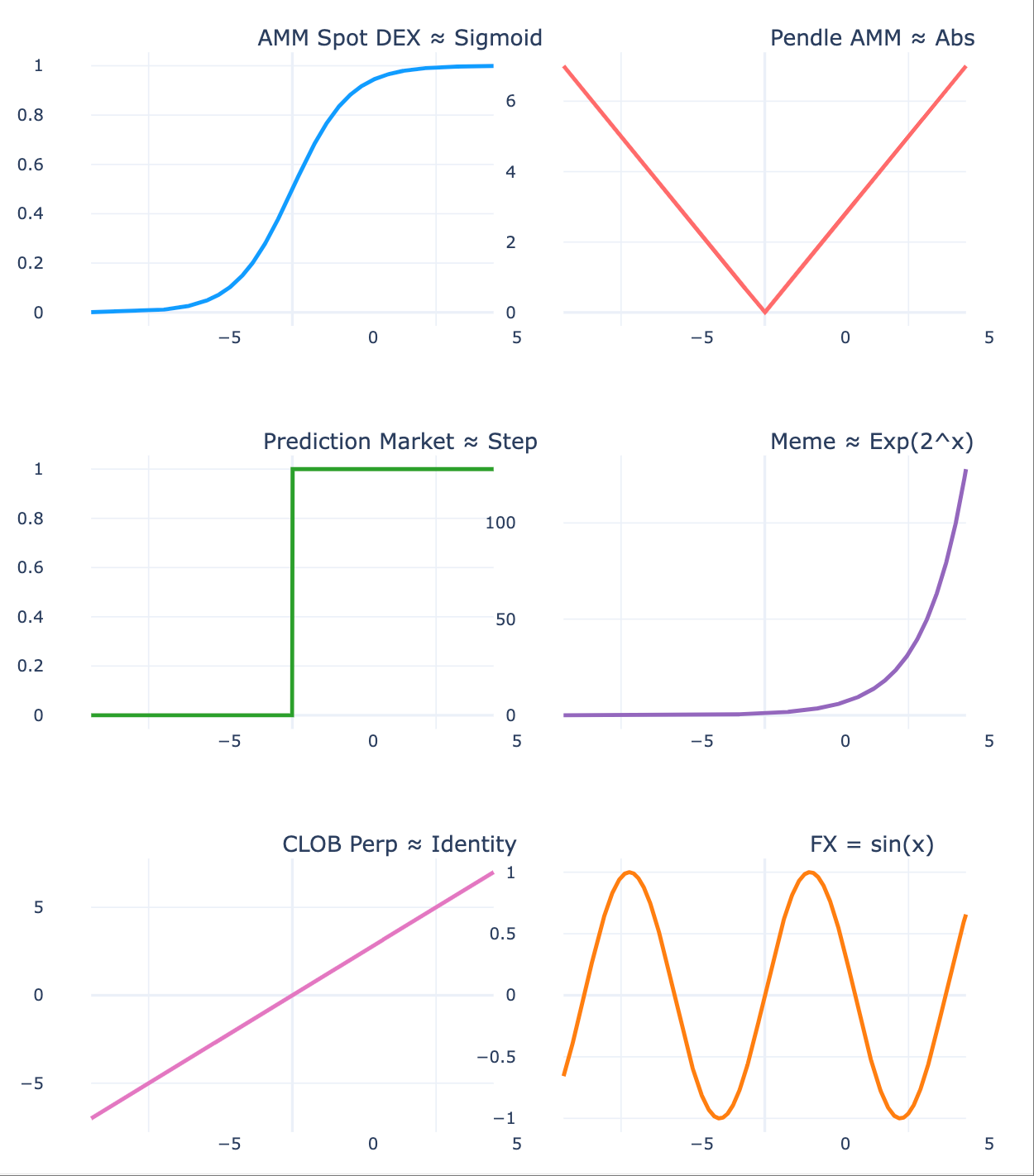

Caption: Assets determine price trends

Image source: @zuoyeweb3

-

Spot prices trend relatively gently, which is why users can “tolerate” slippage and LPs can “tolerate” impermanent loss—losses won’t be too severe;

-

Pendle divides assets by maturity date, creating two distinct price trends, prompting market participants to place different liquidity bets accordingly;

-

Prediction markets are even more extreme, existing in only two states (0,1)—the most discrete form, akin to continuous probabilities collapsing into 0 or 1;

-

Meme markets are even more extreme: a few experience exponential growth while most become zero-value illiquid assets—matching theoretical concepts of inner and outer markets;

-

Perpetual contracts are the most extreme, capable of generating negative balances because price movements aren’t limited to zero—they can go further negative;

-

Foreign exchange prices fluctuate minimally, varying within daily ranges, sometimes even predictably, reflecting the stability of major global economies.

AMM created initial on-chain liquidity, cultivated trading habits, and accumulated capital. CLOB better suits price control and enables more complex trading setups. Unlike AMM’s market-based pricing, CLOB’s buy/sell prices, ordered by time and price, enable precise price discovery when powered by efficient algorithms.

Price Determines Liquidity

"They say forever, but one year, one month, one day, or one hour less doesn’t count as forever."

After CLOB replaces AMM and completes price discovery for Perps, market liquidity still needs to be organized. AMM DEX achieves常态化 existence of individual LPs through double delegation (protocol → LP → user).

Yet between price and liquidity lies Perp’s distinctive scale phenomenon.

Perp DEX issues are relatively complex. AMM only calculates gains and losses upon final execution—before that, both users and LPs hold unrealized profits or losses. The key aspect of perpetual contracts isn’t the contract—it’s the perpetuity.

A funding rate mechanism exists between longs and shorts: when the rate is positive, longs pay shorts; when negative, shorts pay longs.

From a pricing perspective, this keeps contract prices aligned with spot prices. If contract prices fall below spot, indicating bearish sentiment, longs must pay shorts to sustain market existence—otherwise, without shorts, there would be no perpetual market. The reverse holds true as well.

As mentioned earlier, AMM involves trading between two assets. But U-margined BTC contracts don’t actually require exchanging BTC—they exchange expectations about BTC’s price, conventionally denominated in USDC to reduce volatility.

Such expectations require two conditions:

1. The underlying spot asset must enable effective price discovery—such as a deeply traded BTC market. The more mainstream the asset, the more complete its price discovery, making black swan events less likely;

2. Both long and short sides must possess strong capital reserves to counteract extreme moves caused by leverage and handle crises effectively when they occur.

In other words, Perp’s pricing mechanism encourages market scale expansion, and this scale generates liquidity.

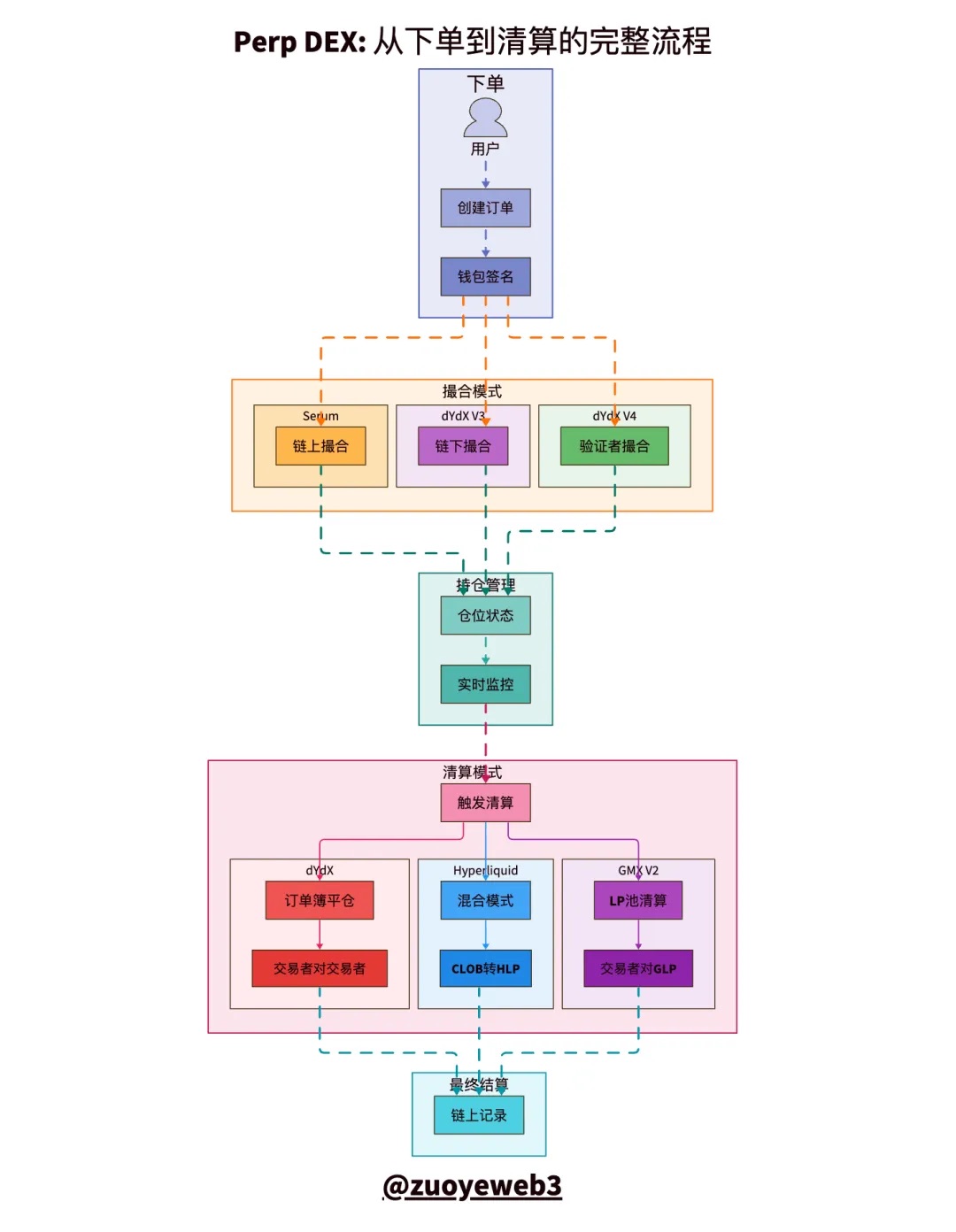

Caption: Comparison of CLOB clearing and settlement process models

Image source: @zuoyeweb3

The entire Perp trading process consists of five stages: order placement, matching, holding, liquidation, and settlement—with matching and liquidation being the most challenging.

-

Matching is a technical issue—how to efficiently match buy/sell orders in minimal time. The market ultimately chose “centralization.”

-

Liquidation is an economic issue. Contracts can be understood as under-collateralized loans—exchanges allow small principal to control large positions, which is the essence of leverage.

On the surface, exchanges let you amplify leverage using collateral, but in reality, you must post margin to maintain that leverage. Once your margin ratio falls below the liquidation threshold, the exchange takes your collateral.

Underneath, liquidation is naturally handled by longs and shorts under normal conditions. But as previously noted, Perp prices can go below zero and extend infinitely, amplified by leverage, potentially resulting in debts far exceeding collateral value.

If the market fails to clear bad debt, manual interventions like topping up margin, forcibly canceling trades, or using insurance funds are required—all essentially socializing debt: everyone shares the burden.

Perp liquidity is an inevitable pursuit of scale, but individual LPs from AMM cannot fulfill this role—not only due to capital limitations, but also the need for professional market makers with high-intensity trading expertise.

The reason is simple: liquidity deployed by individual LPs on AMM DEX doesn’t require frequent operations, whereas Perp DEX must constantly monitor leveraged extremes.

During normal trading, if no extreme conditions are triggered, mechanisms similar to AMM LP incentives exist to stimulate volume, such as GMX imitating AMM DEX’s LP model—using native tokens to incentivize LP activity, developing its GLP pool, where users add liquidity and earn fees and other rewards.

It’s quite an “innovative” mechanism—the first time individual LPs could participate in Perp market making.

Such volume farming causes Perp trading volume to skyrocket abnormally, but OI (Open Interest) drops after token launch as LPs withdraw, eventually leading to a death spiral of declining tokens and liquidity.

We can draw another conclusion: LPs passively bear final liquidation responsibility—a key difference from AMM. In AMM, users “buy and leave,” LPs bear their own profits and losses. But in Perp, LPs substitute for the protocol in performing liquidation duties, which cannot be transferred to users.

The so-called insurance mechanism insures the project, not the LPs themselves.

GMX and Aster’s volume farming schemes both end quickly. Hyperliquid’s HLP runs relatively stably under normal conditions, but still bears losses during $JELLYJELLY events—essentially proving the unreliability of such liquidity creation and insurance mechanisms.

As mentioned above, over 92% of HyperCore’s fees go toward $HYPE buybacks, with only 8% distributed to HLP—indicating Hyperliquid doesn’t see much future in HLP-like mechanisms. HyperCore’s liquidity is primarily maintained by professional market makers, who care more about node rewards and $HYPE appreciation.

The insurance vault mechanism is like an appendix borrowed from AMM by Perp—pulling the plug or increasing depth is more effective.

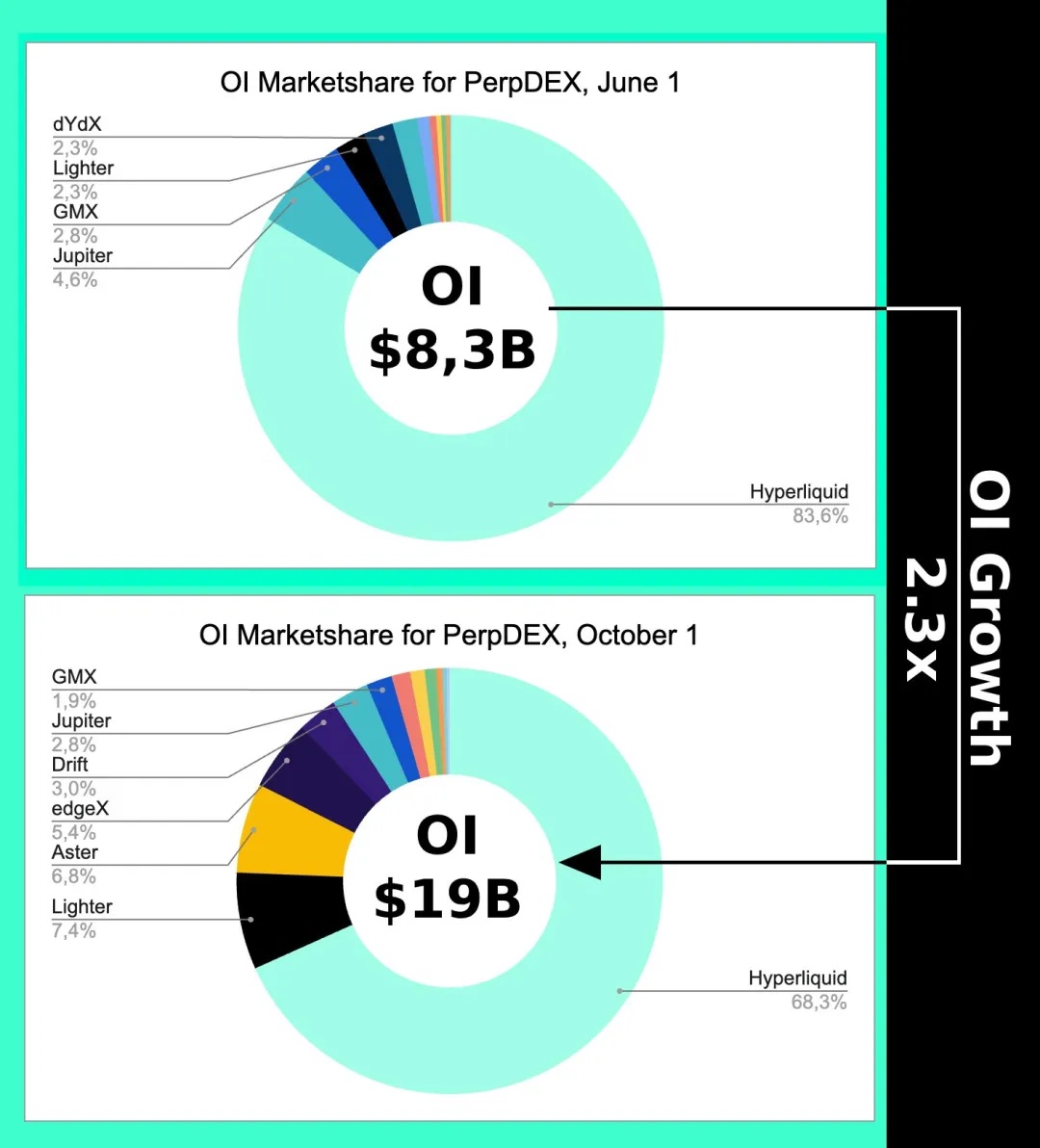

Caption: OI trend

Image source: @Eugene_Bulltime

Even during the peak of Aster’s Perp DEX war in early October, Hyperliquid’s market share only dropped by about 15%, while its volume was surpassed by Aster several times over—proving that the liquidity driven by CLOB’s pricing mechanism and scale effects refers mainly to open interest, not trading volume.

This also indirectly explains why Hyperliquid is developing Unit cross-chain bridge and BTC spot market—not for fees, but for greater price accuracy, ultimately reducing reliance on Binance quotes.

CLOB can also be used for spot trading, and AMM, modified by AC, can be applied to perpetuals.

Focus on asset-price compatibility—don’t get lost in technical parameters.

Conclusion

Life will find its way out.

Binance’s annual $15 trillion is roughly the upper limit for Perp trading, while forex markets see around $10 trillion daily—annual volume 300 times that of Perps. Hyperliquid’s architecture is migrating to HyperEVM, especially with HIP-3/4 paving the way for new assets like forex, options, and prediction markets.

We can assume Perps will eventually hit a ceiling. Amid competition between assets and prices, new technical architectures better suited for next-generation price discovery—like RFQ—will emerge.

But one thing is certain: it won’t be another debate over blockchain centralization. The 2021 tech rivalry was just a tedious callback. Obsessing over blockchain architecture means living in the past.

Whether OI or volume continues to grow, the CLOB battle is already over. 2018 was the real DeFi Summer. Hyperliquid already won in 2022. Now the question is whether HyperEVM can secure a seat at the final public chain dinner. It’ll be boring if Monad still exists after launching its token. What matters is whether HyperEVM can achieve ecosystem closure—and that would be truly interesting.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News