8 Months, $5 Million: Analyzing Profits of HyperEVM's Top Arbitrage Bot

TechFlow Selected TechFlow Selected

8 Months, $5 Million: Analyzing Profits of HyperEVM's Top Arbitrage Bot

How to build the ultimate HyperEVM arbitrage bot?

Author: CBB

Translation: TechFlow

In March 2025, the crypto market looked shaky. The impact of tariffs made the situation even worse, prompting us to consider where the next best opportunity might lie.

With 40% of $HYPE in the HyperEVM ecosystem still unallocated to the community, we thought this could be a potential opportunity. In February, we had tested some market-making strategies on UNIT assets, but only superficially and at a small scale.

HyperEVM had just launched, accompanied by several decentralized exchanges (DEXs). My brother suggested: "What if we try arbitrage between HyperEVM and Hyperliquid? Even if it might lose us money, could it pave the way for Hyperliquid’s third-season liquidity mining?"

We decided to give it a shot. Arbitrage opportunities did exist, but we weren't sure whether we could truly compete successfully.

Why Are There Arbitrage Opportunities on HyperEVM?

HyperEVM has a 2-second block time, meaning the price of $HYPE updates every 2 seconds. During those 2 seconds, the price of $HYPE may fluctuate. As a result, $HYPE on HyperEVM frequently becomes either "undervalued" or "overvalued" compared to its price on Hyperliquid.

Initial Attempts and Results

We built our first version—very basic. Whenever a price difference emerged between an AMM DEX pool on HyperEVM and the spot market on Hyperliquid, we would send a trade on HyperEVM while hedging on Hyperliquid.

For example:

-

If $HYPE rose in price on Hyperliquid but was undervalued on HyperEVM:

-

Action: Buy the “cheap” $HYPE with USDT0 on HyperEVM → Sell $HYPE for USDC → Exchange USDC back to USDT0 on Hyperliquid.

In the first few days, our daily trading volume on Hyperliquid was around $200k–$300k, with no losses. Even better, we earned a few hundred dollars in profit.

Initially, we only executed arbitrage trades with profits exceeding 0.15% (after deducting fees from both the AMM DEX and Hyperliquid). Two weeks later, as profits grew, we saw more potential and also spotted two competitors using similar strategies, though they were not large-scale. We decided to “take them out.”

In April 2025, Hyperliquid launched $HYPE staking for trading fee rebates. This was a perfect upgrade: we had more capital than our competitors. We staked 100,000 $HYPE, earning a 30% fee discount, and lowered our arbitrage profit threshold from 0.15% to 0.05%.

We began pressuring our competitors harder, trying to force them out so we could dominate the market. At the same time, our goal was to exceed $500 million in trading volume within two weeks to improve our fee tier on Hyperliquid.

As both volume and profits grew, we surpassed $500 million in volume, making it hard for competitors to keep up. I remember one day when both of our rivals shut down their bots. My brother and I were flying from Paris to Dubai, obsessively watching our bot “printing money.” That 24-hour period brought us $120,000 in profit.

Despite high trading fees, our competitors didn’t give up and forced us to lower our margin, down to about 0.04%, essentially the gap between their costs and ours. Still, trading volume remained strong, and our daily profit stabilized between $20,000 and $50,000.

Scaling Challenges

As we scaled, bottlenecks emerged. HyperEVM has a gas limit of 2 million per block, and each arbitrage transaction consumes about 130,000 gas, allowing only 7–8 arbitrage transactions per block. This became insufficient once more pools and DEXs launched. Some transactions got stuck, and we needed to resolve issues quickly to avoid queue buildup and ledger imbalances. To address this, we implemented the following:

-

Create over 100 wallets, each sending arbitrage transactions independently to prevent long transaction queues on any single wallet.

-

Limited to executing a maximum of 8 arbitrage transactions per block.

-

Gas management: When gas prices on HyperEVM spiked, we raised the required ROI threshold to avoid transactions getting stuck due to high gas fees.

-

Rate limiting: If the number of transactions sent in the past 12 seconds exceeded a certain threshold, we increased the profit requirement before sending new transactions.

The Era of Improvements

As we continued to profit, our trading volume reached 5–10 times that of our competitors, and we became obsessed with optimization. This wasn’t our first attempt. Today you might be “printing money” while drinking beer; tomorrow you could be sent straight to hell by a new player.

Becoming a Maker on Hyperliquid

In June 2025, my brother proposed an idea he’d been developing for weeks: initiate arbitrage trades as a Maker (order placer) on Hyperliquid instead of a Taker (order taker).

Two major benefits:

-

Focus on HYPE price spikes → creating more arbitrage opportunities.

-

Saving 0.0245% in fees per trade → increasing profitability.

This was a challenging update because we were placing a trade on Hyperliquid without certainty that the opposite trade could go through on HyperEVM (someone else might beat us).

Previously, we initiated arbitrage by sending a transaction on HyperEVM. If it failed, we did nothing on Hyperliquid; if it succeeded, we then executed the trade on Hyperliquid.

But as a maker, we had to take on risk: an order placed on Hyperliquid might get filled, but there was no guarantee we could complete the corresponding trade on HyperEVM. This could lead to ledger imbalances and potential losses.

At first, every test caused HYPE balances to swing by 10,000. We couldn’t understand why these imbalances occurred—sometimes sending 100 trades within 20 seconds—without proper data analysis tools to trace the root cause. It was pure chaos.

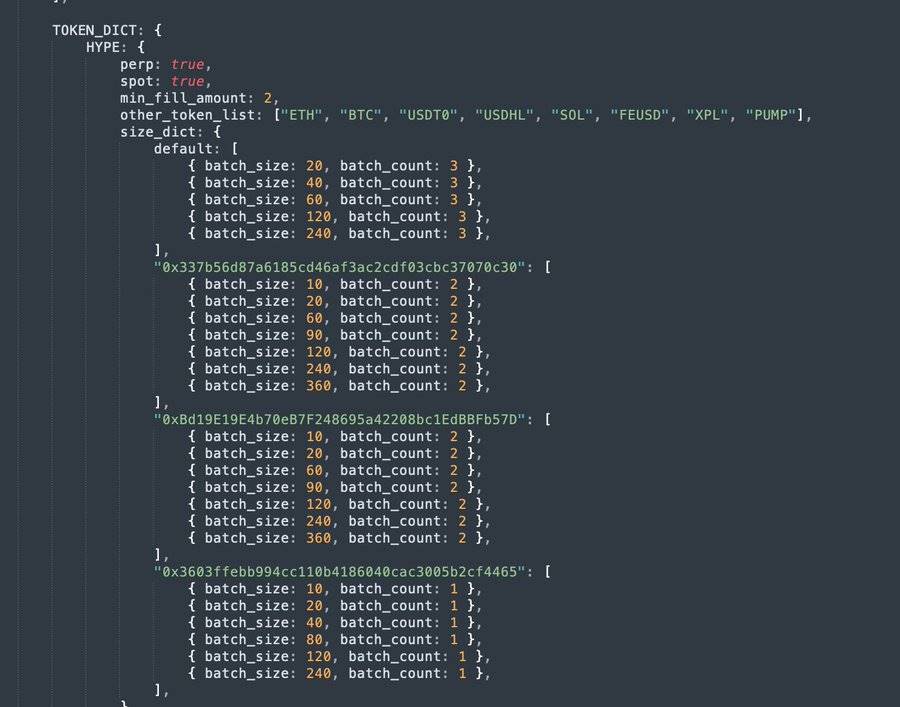

To execute maker-based arbitrage, we introduced new concepts and translated them into new code and parameters:

-

Profit range: Determine when to create, hold, cancel, or replace orders.

-

AMM pool selection: Specify which AMM pools we’re willing to trade as makers (e.g., the HYPE/USDT0 0.05% pool on HyperSwap or the HYPE/UBTC 0.3% pool on PRJX).

-

Order size and count: Set limits on order size and number per AMM pool.

Parameters for taker-side trading:

After days of fine-tuning, we finally avoided most ledger imbalances. Even when imbalances occurred, we immediately used TWAP (Time-Weighted Average Price) strategies to rebalance risk quickly. This change was a game-changer. Meanwhile, competitors still relied solely on taker strategies, while we increased our trading volume to 20 times theirs.

Skipping USDT/USDC Trades on Hyperliquid

The next challenge involved a specific issue with USDT0.

On Hyperliquid, USDC is the top stablecoin, while on HyperEVM, USDT0 leads.

The largest and most active pool on HyperEVM is the HYPE-USDT0 pool. But since we needed USDT0 on HyperEVM and USDC on Hyperliquid, we had to execute two trades on Hyperliquid to balance the two assets.

For example, when HYPE price rises:

-

Maker order fills → sell HYPE for USDC (0% fee)

-

Buy HYPE with USDT0 on HyperEVM

-

Taker trade on Hyperliquid to exchange USDC back to USDT0 (0.0245% fee)

But this third step was problematic:

-

We had to pay taker fees (reducing profits and competitiveness)

-

The USDT0/USDC market on Hyperliquid was immature, with wide spreads and inaccurate pricing

We decided to skip this step whenever possible. To do so, we developed new parameters and logic:

-

USDC threshold: Only skip the USDT0→USDC trade if USDC balance exceeds $1.2 million.

-

USDT0 threshold: Only skip the USDC→USDT0 trade if USDT0 balance exceeds $300,000.

-

Real price data: Fetch real-time USDT0/USDC prices from Cowswap API every minute instead of relying on Hyperliquid's order book.

Introducing Perpetual Contracts into Arbitrage

A disclaimer: throughout our entire crypto trading career, we’ve almost never used leverage or perpetual contracts (except for one failed attempt on Bitmex in 2018, which is kind of funny now). So we didn’t fully understand how they worked.

However, we noticed that at one point, trading volume for the HYPE perpetual contract far exceeded that of the spot market, and fees were slightly lower (0.0245% for spot vs. 0.019% for perps).

So we decided to try incorporating perps into our strategy. No other competitors were using perps, meaning we wouldn’t compete directly for the same order book liquidity.

During testing, we found we could profit from funding rates and gain additional arbitrage opportunities when the HYPE perp traded at a premium or discount to spot. This was uncharted territory for competitors.

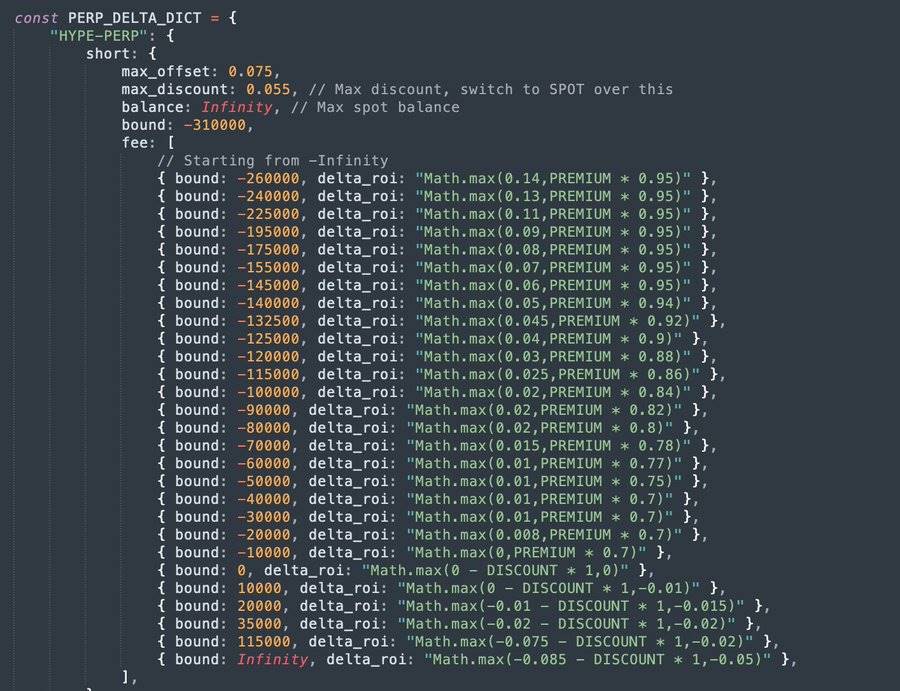

We designed a completely new set of system parameters:

-

Bands: Maximum long/short position size for HYPE → to avoid liquidation or draining USDC/HYPE balances.

-

Premium/discount: Current premium or discount of the perpetual contract.

-

Max premium/discount: If the premium becomes too high, we stop creating long orders and switch to spot trading.

-

Progressive ROI: As long/short positions grow, we increase profit requirements to avoid building unfavorable positions too quickly.

-

ROI formula: Dynamically adjusted based on the perp’s premium/discount and position size.

This is the parameter interface for configuring HYPE short positions—looks pretty complex:

Introducing perpetual contracts was likely one of our most important upgrades. We earned about $600,000 just from funding rates, plus even more from premium/discount arbitrage opportunities.

About Our Brotherly Collaboration and Dynamics

Many people ask how we divide responsibilities. I’m often seen as the “loudmouth” of the team, randomly posting on Crypto Twitter (which I don’t deny); my brother is viewed as the quiet “tech geek” coding in the background.

But it’s much more nuanced. Our dynamic resembles the collaborative incentive model of Blur token distribution. With such an arbitrage bot, you never know what’s coming next. We face challenges and problems daily and must solve them quickly. We discuss improvements constantly, only acting once we reach consensus. He writes the code and also builds tools for me to manage parameters.

I can’t code at all, but I know how to configure the bot; he doesn’t know how to configure the bot, but he writes the code.

Interestingly, we have opposite work personalities. My brother likes frequent updates and trying new features (too frequent, in my opinion), while I tend to be conservative (too conservative, in his view), preferring to stick with the current version as long as it’s still “printing money.”

Typical conversation:

-

Me (very sarcastic): “The bot is acting weird… did you change something???”

-

Him: “No… uh, maybe just a tiny thing.”

When two people collaborate on bot development without formal corporate processes, after 250 updates, you start feeling like you’ve created something you can no longer fully understand or control.

Every time you push a new update, it’s hard to predict all its effects.

Conclusion

Over the past eight months, we’ve fully committed to developing and optimizing this arbitrage bot. Especially in June, when Wintermute entered the arena with massive liquidity and an army of “employees,” we felt intense pressure.

I remember spending five days in July between Istanbul and Bodrum, planning to relax—but ended up locked in a room, continuously improving the bot.

We successfully maintained the top position for eight months, but as our market share gradually declined in October, we felt it was time to exit.

Final results:

-

$5 million in profit

-

$12.5 billion in Hyperliquid trading volume

-

$1.2 million paid in Gas fees on HyperEVM (20% of total since launch)

-

Over 2,000 hours of effort

-

5% of Unit’s total trading volume

We’re looking forward to Hyperliquid Season 3 and Unit Season 1.

Thanks for reading! Hope to see you all again on the next on-chain adventure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News