UR Global: The Swiss Bank of the Crypto World

TechFlow Selected TechFlow Selected

UR Global: The Swiss Bank of the Crypto World

Here, there is no difference between cryptocurrency and fiat currency because "money is money."

Author: Black Apple, epoch_

Translation: TechFlow

Every cryptocurrency holder experiences the same nightmare. You have $50,000 in USDC in your MetaMask wallet, and tomorrow is your mortgage payment deadline. Yet standing between you and that payment is a series of exchanges, wire transfers, conversion fees, and a grueling three-day wait that feels like three years.

This so-called "off-ramp problem" may not be glamorous, but it's why your "average" friends still see crypto as Monopoly money. This friction prevents digital assets from becoming real money.

UR Global isn't trying to bridge two worlds—it’s proving those two worlds were never truly separate to begin with.

The "Magic" in Two Steps

In crypto, most teams don’t even dare attempt this challenge, but UR Global took it on—and succeeded. A FINMA-regulated financial account that’s also a self-custodial crypto wallet. A Mastercard that spends directly from on-chain balances. A savings account offering 5% APY on stablecoins. All accessible with just a Google login.

While others force users to choose between security and convenience, UR Global solves both. And the Swiss entity behind UR, SR Saphirstein AG, is officially recognized by the Swiss Financial Market Supervisory Authority (FINMA).

Here’s how elegantly simple it works:

-

Step 1: Sign up via Google or email. No need to memorize seed phrases or master complex MetaMask tutorials. Under the hood, Turnkey uses secure elements and biometric authentication to generate a self-custodial wallet. You own the keys, but they’re intelligently managed.

-

Step 2: Your wallet becomes a bank account instantly. All deposits are tokenized and mapped onto the Mantle Network. Your dollars become on-chain assets—trackable on Etherscan and spendable at Starbucks. This is “full transparency” meets “everyday usability.”

-

Step 3: This Mastercard doesn’t require pre-loading funds like other crypto cards. When you swipe, smart contracts instantly convert the required amount of crypto into fiat. That $5 coffee? Exactly $5 worth of USDC gets swapped. The rest keeps earning yield.

This is the obvious solution we’ve been waiting for.

Mantle’s Masterstroke

UR Global’s choice of Mantle Network reveals its forward-thinking strategy. While others crowd Arbitrum or Base, competing for block space and driving up fees, UR chose BitDAO’s modular L2, Mantle—a perfect fit.

Mantle enables high-scale speed and cost optimization at minimal fees. Every card swipe, currency conversion, and yield payout happens on-chain at fractions of a cent.

Yet UR Global’s core challenge lies in liquidity. Mantle lacks Arbitrum’s deep liquidity pools or Base’s Coinbase backing. This is a potential risk. But UR’s strategy is different: they’re betting that payment volume itself will generate liquidity. They aren’t trying to be a trading platform reliant on massive DEX pools. Instead, they’re building payment rails where steady, predictable transaction volume naturally attracts market makers.

Besides, Mantle’s treasury—one of the largest in crypto thanks to BitDAO—gives UR the ability to incentivize liquidity when needed. It’s a calculated gamble: start with an underutilized chain, help it grow, and capture outsized share in a smaller but expanding market.

USDe Integration: Bridging DeFi and Traditional Banking

The integration with Ethena is a smart, strategic move. By incorporating USDe, UR immediately bridges the gap between DeFi innovation and retail banking.

Through the UR Global app, users can hold USDe as a dollar alternative and earn up to 5% APY—without staking or locking assets. But the real advantage? The platform waives all fees for converting USDe to fiat.

Consider the implications. Other platforms typically charge 1–3% to convert stablecoins into spendable fiat. On a $10,000 conversion, UR saves you $100–300. Do this monthly, and you save more than most savings accounts earn in a year.

The Swiss Advantage

Switzerland’s regulatory environment is clear. While U.S. regulators treat crypto as a threat, Switzerland sees it as an opportunity.

Under Article 1b of the Swiss Banking Act, SR Saphirstein AG holds a fintech license and operates as a financial institution. They don’t aim to be a bank—they aim to be better. They provide technical services that integrate traditional banking infrastructure with blockchain technology.

Customer funds are segregated and held at the Swiss National Bank. UR itself never touches these funds. They’ve created a perfect regulatory structure: compliant enough to work with traditional finance, yet innovative enough to deliver the crypto future we’ve always promised.

This is regulatory innovation at its finest. Switzerland is taking the first step, showing the world how it’s done right.

Seamless Reality

UR Global solves crypto’s most critical user experience issue: making complexity invisible.

-

No exchange account needed—your UR wallet is the exchange.

-

No settlement delays—all transactions are instant and recorded on-chain.

-

No trade-off between yield and liquidity—your funds earn yield and remain spendable anytime.

With full KYC compliance, UR Global already serves over 45 countries—and counting. This isn’t a gray-area workaround. It’s a fully compliant, fully regulated, fully usable solution.

High limits for Pro members aren’t restrictions—they’re smart risk management. This model allows gradual user onboarding: start small, validate the model, then scale.

Why This Changes Everything

While other crypto companies try to replace traditional finance, UR Global takes a smarter approach: upgrade it.

-

Your parents don’t need to understand blockchain—they just need to know it’s a better savings account.

-

Your friends don’t need to buy ETH for gas—they just need to download an app.

-

Your local café doesn’t need to accept crypto payments—they already accept Mastercard.

This is true mass adoption: not through revolution, but evolution. Not forcing people to learn new systems, but making the old ones work better.

From October 7 to January 6 next year, new users who complete KYC get three months of free Pro membership. This shows UR’s confidence in its product. They’re not luring users with airdrops—they’re letting the premium experience convince users to stay.

Network Effects

UR Global has first-mover advantage in this space.

-

Once users experience the zero-friction spending straight from their crypto wallet, going back to Coinbase → bank → wait → spend feels like dial-up internet.

-

Once users earn 5% APY on their balance, Chase’s 0.01% feels like robbery.

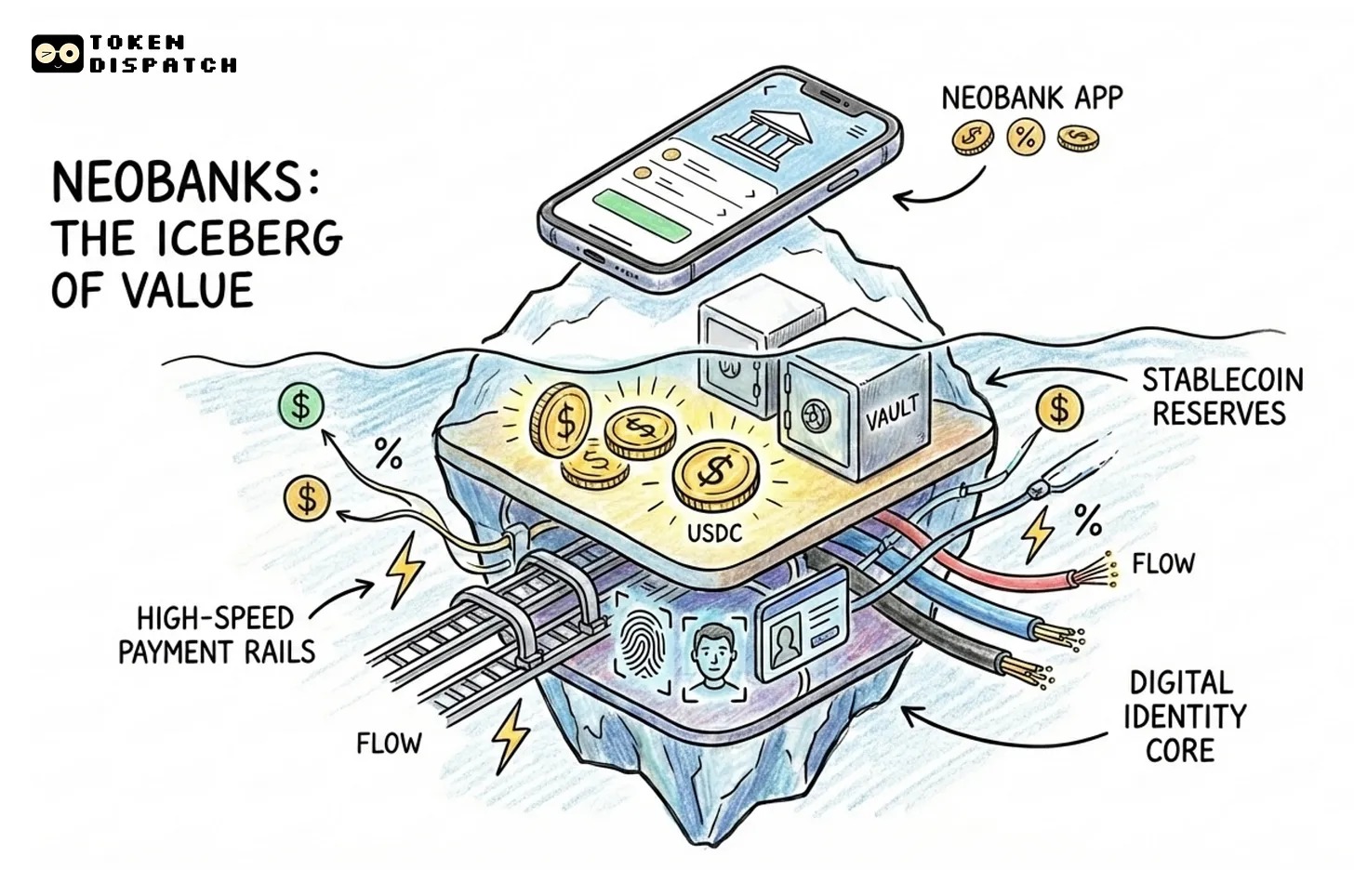

Every new user makes the network more valuable. Every transaction validates the model. Every day of operation builds trust with regulators. UR is creating a new category: Blockchain-Native Neobank (BNN). This category will have winners—and UR is positioning itself as one.

Strategic Positioning

Traditional finance sees a Swiss-regulated fintech firm with strong compliance and Mastercard integration: safe, familiar, acceptable.

Crypto sees a self-custodial wallet, on-chain transparency, and DeFi yields: revolutionary, decentralized, powerful.

Users see a “good” app: money earns more, spends easier, moves faster. They don’t have to pick sides in the crypto vs. traditional finance battle—UR has signed a “peace treaty” for both.

This isn’t compromise—it’s strategy. Revolution doesn’t come from destroying the old system, but from building something so clearly better that the old system becomes irrelevant, and switching becomes inevitable.

Why Now Is the Perfect Time

The timing couldn’t be better. Neobanking is already mainstream. Stablecoin volumes are surging. Every major financial institution is exploring blockchain. Consumers are comfortable with digital payments. Infrastructure is ready.

But most importantly, people are ready. After years of promises, they want crypto to finally work in daily life—not as an investment, but as money.

That’s exactly what UR Global delivers. With Swiss precision, clear regulation, and cutting-edge tech, they hide the complexity.

Looking Ahead

In five years, we’ll look back at today’s systems and laugh. The era of needing three apps, two bank accounts, and a tax advisor just to use crypto will seem as outdated as writing checks or waiting for banks to open on Monday.

UR Global is building the financial architecture of the future. One where the distinction between crypto and fiat becomes meaningless because “money is just money.” Your savings automatically optimize yield. Boundaries no longer limit what you can buy or who you can pay.

Critics might point to dependencies: Mastercard’s network, Mantle’s growth, USDe’s stability. But that’s like criticizing early internet for relying on phone lines. Infrastructure evolves.

And UR has already begun. They didn’t claim to disrupt banking with grand promises. They simply asked: What if your money could just work better?

The crypto industry’s “off-ramp problem” has plagued us for 15 years. UR Global didn’t solve it by building a better off-ramp—they eliminated the need for off-ramps altogether.

Your wallet is your bank. Your bank is your wallet. Welcome to the future of money. It looks so familiar—and that’s precisely the point.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News