What have the payment giants been doing over the past month?

TechFlow Selected TechFlow Selected

What have the payment giants been doing over the past month?

Mastercard, Google, Visa, and Stripe almost simultaneously announced major moves in the fields of AI payments and stablecoins within the same time window.

By: Sleepy.txt

Editor: Kaori

If you haven't been following the payments industry over the past month, you might have missed some major news.

On September 29, Stripe and OpenAI jointly announced that ChatGPT users can now shop directly within the chat window, without needing to jump to merchant websites. The next day, Visa launched a stablecoin pre-funding pilot, allowing financial institutions to use USDC and EURC for cross-border settlements. One day later, Stripe struck again, unveiling a platform called "Open Issuance" that enables any business to issue its own stablecoin.

On October 9, market reports emerged that Mastercard and Coinbase are competing to acquire BVNK, a stablecoin infrastructure company, with bids ranging from $1.5 to $2.5 billion. Just last December, the company was valued at only $750 million.

This is just the tip of the iceberg. If we extend the timeline across all of September, we see that Mastercard, Google, Visa, and Stripe almost simultaneously rolled out major initiatives in AI-powered payments and stablecoins.

Recap of Key News Events

Let’s first review the key events of this past month.

Nine major announcements in one month—an unusually high concentration for the payments industry. More importantly, these are not isolated product launches; they echo each other and build upon one another.

Who Will Regulate AI Agents?

When AI agents begin initiating payments on behalf of humans, tough questions arise—who authorizes them, who takes responsibility, and how do we prevent an AI from completing a transaction based on hallucination?

Traditional payment systems rely on a simple premise: a human personally clicks the buy button. But when that assumption breaks down, the entire authorization and accountability framework must be rebuilt.

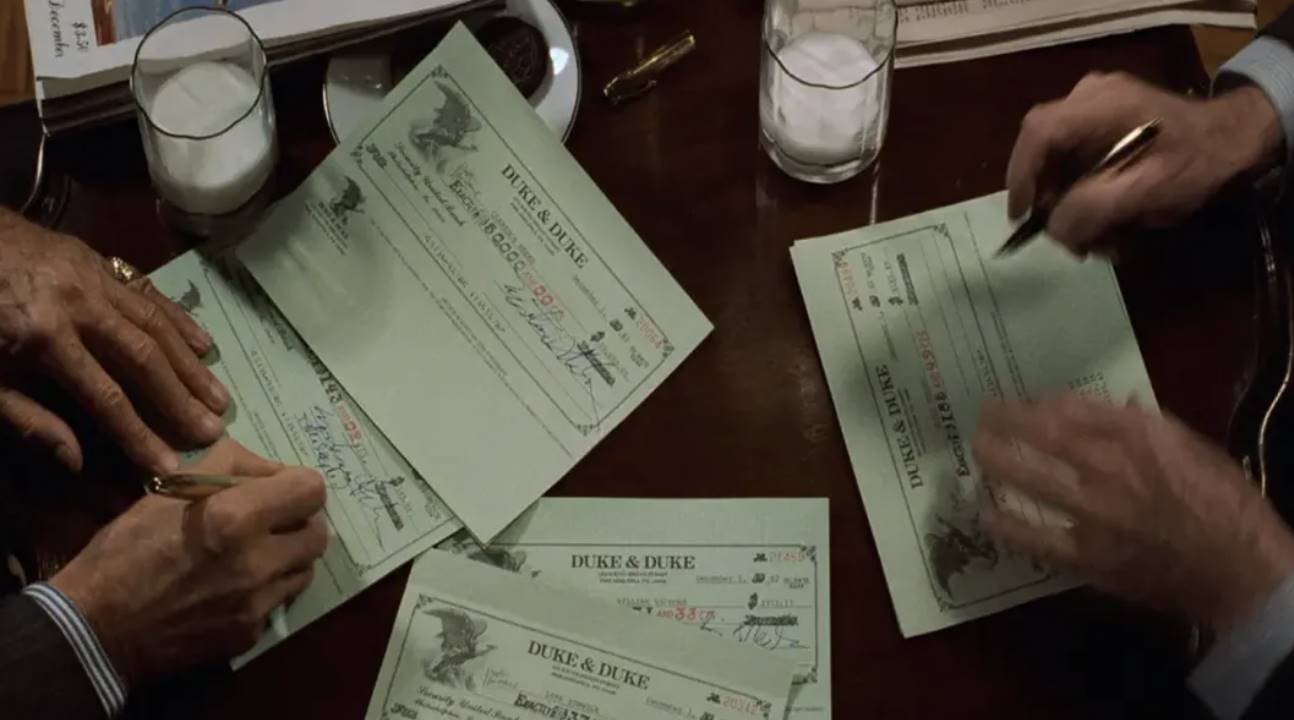

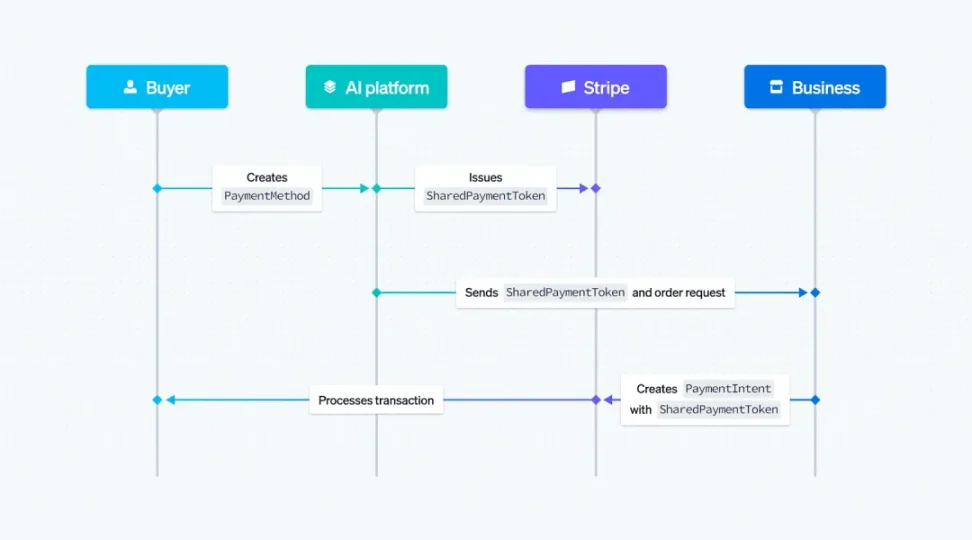

Stripe and OpenAI's solution is "Shared Payment Tokens" (SPT), a new payment primitive that allows AI agents to initiate payments on a user’s behalf while never accessing their real account or card details. Each SPT is restricted to a specific merchant and a defined cart value, granting AI sufficient payment authority while safeguarding user privacy and security.

Stripe facilitates transactions, applies fraud detection, and enforces token controls in real time|Image source: Stripe

ChatGPT's instant checkout feature is built on this technology, enabling users to purchase items from Etsy directly within the chat. Soon, the feature will expand to Shopify merchants, including brands like Glossier, Vuori, Spanx, and SKIMS.

Google has taken a different approach. It introduced the AP2 protocol, which uses three verifiable digital credentials: Intent Mandate, Cart Mandate, and Payment Mandate. The Intent Mandate defines the conditions under which a user authorizes an agent to make purchases; the Cart Mandate is a cryptographic signature authorizing a specific shopping cart; and the Payment Mandate signals to payment networks and issuers that the transaction involves an AI agent.

This system offers fine-grained control and auditable traceability. Google emphasizes that AP2 is an open protocol, extending A2A and Model Context Protocol, and belongs to no single company.

Mastercard’s strategy is more pragmatic. "Agent Pay" doesn’t emphasize technological innovation—its core strength lies in compatibility. Mastercard is collaborating with platforms like Stripe, Google, and Ant International’s Antom to ensure its network seamlessly integrates into mainstream AI agent ecosystems.

The three protocols were nearly launched at the same time. They aim to solve the same problem but through entirely different paths. Stripe focuses on capturing use cases first, then promoting standards; Google establishes standards first, then drives adoption; Mastercard doesn’t seek dominance but aims not to be left behind.

History has repeatedly shown that whoever controls the standard controls the future. This battle over protocols is quietly reshaping the power map of the AI commerce era.

The Battle for Stablecoin as Utility Infrastructure

Stablecoin transaction volumes have already surpassed the combined totals of Visa and Mastercard. This figure has jolted the industry awake—stablecoins are no longer experimental tools in crypto but are becoming foundational infrastructure for the global financial system. With the rise of AI agent payments, this trend is accelerating.

AI agents require a payment method that is available 24/7, enables instant settlement, incurs low costs, and supports programmability. Traditional bank wire transfers can take days, especially cross-border ones involving multiple intermediaries. Stablecoins naturally meet these needs—settlements complete in seconds, fees are minimal, and they can integrate with smart contracts to execute complex payment logic.

Google's AP2 protocol explicitly positions stablecoins as the primary payment method. In their design, stablecoins serve as the common language between AI agents—offering both digital throughput and monetary stability.

Traditional payment giants have adopted different responses.

Visa launched a stablecoin pre-funding pilot, allowing financial institutions to top up Visa Direct accounts using USDC and EURC. In effect, stablecoins are no longer external competitors to Visa’s ecosystem but are being absorbed into it. Mark Nelsen, Visa's head of product, told Reuters that rebuilding the underlying software of global payment systems is extremely difficult, so integrating stablecoin technology into existing processes is a more realistic path.

Stripe’s Open Issuance goes further. The platform not only supports stablecoin payments but also enables any business to issue its own stablecoin—and crucially, allows enterprises to share in the yield generated by reserve assets.

Previously, issuers like Circle and Tether would invest user deposits in low-risk assets such as government bonds and keep all returns for themselves. Stripe disrupts this model by sharing yield between issuers and businesses.

Stripe President William Gaybrick believes clearer regulatory frameworks have significantly lowered the barrier for enterprises entering the stablecoin space. He expects dozens or even hundreds of enterprise-issued stablecoins to emerge. Open Issuance supports multiple blockchains, including Ethereum, Solana, and Stripe’s proprietary Tempo blockchain.

The bidding war for BVNK reveals the true value of stablecoin infrastructure.

Founded in 2021, BVNK specializes in helping businesses seamlessly convert between fiat and stablecoins. With extensive banking partnerships and financial licenses across multiple jurisdictions, it has processed over $20 billion in transactions.

Last December, BVNK was valued at just $750 million. In under a year, its valuation has surged to between $1.5 and $2.5 billion. Both Mastercard and Coinbase are vying for the company, while Visa and Citi are participating via investment.

BVNK founders from left to right: Chris Harmse, Jesse Hemson-Struthers, and Donald Jackson|Image source: BVNK

BVNK matters because it bridges two worlds—one side being traditional fiat systems, the other the rapidly expanding stablecoin network. In the context of AI payments, the value of such a bridge is redefined. Whoever controls it gains access to a critical conduit between old and new financial systems.

For Mastercard, acquiring BVNK means rapidly closing the gap in stablecoin infrastructure and avoiding marginalization in the next wave of technological change. For Coinbase, it represents a strategic expansion opportunity—from exchange to broader payments—and a chance to build a Stripe-like entity for the crypto world.

BVNK’s soaring valuation reflects the market’s re-pricing of stablecoin infrastructure. In the age of AI payments, these companies play roles akin to clearing banks in traditional finance—they handle not just transactions, but the underlying pipelines of value flow.

The Battle for Traffic Entry Points

Protocols and infrastructure are the arms race, but the real battlefield is at the application layer. Whoever gets users accustomed to shopping within AI platforms will hold the chokepoint of future commerce.

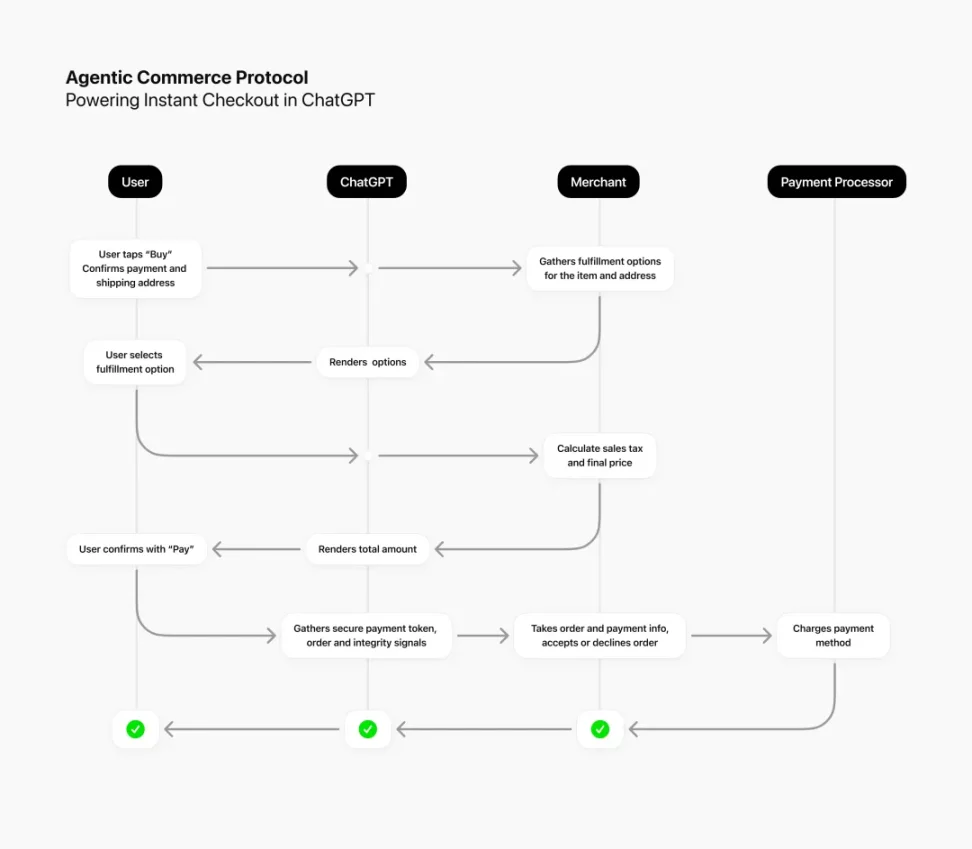

ChatGPT’s instant checkout is a milestone. It marks the first real-world implementation of AI agent payments. Users can now buy products from Etsy directly within a ChatGPT conversation, with no redirection to merchant websites. Stripe provides the payment backbone; OpenAI provides the traffic gateway. Together, they’ve created a completely new shopping experience.

Interaction between user, ChatGPT, merchant, and payment processor|Image source: ChatGPT

This feature will soon expand to Shopify merchants, with brands like Glossier, Vuori, Spanx, and SKIMS preparing to onboard. Sam Altman calls this the beginning of AI Commerce.

Google is moving fast too. It announced plans to enhance its AI Mode interface in the coming months with price tracking and direct purchasing. Users will browse, compare, and place orders within AI Mode, with transactions finalized via Google Pay.

Perplexity isn’t falling behind either. The AI search engine launched “Buy with Pro,” partnering with PayPal to enable in-chat checkouts. It also integrated Firmly.ai, a backend platform that makes merchant onboarding seamless.

A key dataset was revealed in a report released by BCG on October 6. In July 2025, U.S. retail website traffic from GenAI browsers and chat services surged 4700% year-over-year. These users behave differently from traditional visitors—they spend 32% more time on sites, view 10% more pages, and have a 27% lower bounce rate.

More importantly, they often arrive at websites already deep into the buying journey. Adobe’s data further confirms this: over half of consumers expect to use AI assistants for shopping by the end of 2025.

Traffic gateways are being rewritten. In the past, people reached e-commerce sites via search engines or direct visits. Now, AI platforms are becoming the new entry points. When consumers get used to shopping within ChatGPT or Google AI Mode, retailer websites may gradually lose relevance.

The implications are profound. Decades-long brand efforts to build direct customer relationships could be taken over by AI platforms. Consumer behavior data and transaction records will no longer belong to retailers but will instead flow into AI databases.

A War Over Rules

In the past month, we’ve seen payment giants launch coordinated offensives across three fronts.

At the protocol layer, Stripe’s ACP, Google’s AP2, and Mastercard’s Agent Pay are all fighting for one central question: Who sets the rules for AI agents? These protocols define how AI agents initiate payments, gain authorization, and are held accountable. Whoever controls the protocol holds the话语权 in the AI Commerce era.

At the infrastructure layer, Visa’s stablecoin pilot, Stripe’s Open Issuance, and the bidding war over BVNK answer another question: Who controls the pipes of value flow? Stablecoin transaction volumes have already surpassed traditional payment networks, making them the preferred tool for AI agent payments. Whoever owns stablecoin infrastructure gains clearing and minting rights in the new era.

At the application layer, ChatGPT’s instant checkout and Google’s AI Mode compete for the final frontier: who becomes the new traffic gateway. As users grow accustomed to shopping within AI platforms, retailer websites and brand portals are being quietly replaced. Traffic shifts mean power shifts.

These seemingly scattered moves all point toward one goal: redefining the foundational rules of commerce at the moment AI agents become new consumers.

This is a restructuring of power—from humans to agents, from brands to algorithms, from payment networks to stablecoin infrastructure. Every technological revolution redraws the power map, and AI payments are no exception.

In this war, what matters most may not be who wins, but who gets left out.

BVNK’s valuation tripled in less than a year—a signal impossible to ignore. The market is re-pricing the entire payments ecosystem. Companies still hesitating may find they’ve already missed their chance to enter.

What happened over the past month isn’t the start of change—it’s the acceleration phase. Regulatory contours are forming, technical capabilities are mature, and market demand is evident. What remains is execution and competition.

A new commercial order is emerging. Those who fail to realize their position has already shifted will pay the price during this reconstruction.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News