Hyperliquid's Journey (Part 2): Creating the Wave with HyperEVM

TechFlow Selected TechFlow Selected

Hyperliquid's Journey (Part 2): Creating the Wave with HyperEVM

Building a chain by gradually selling yourself off.

Author: Zuoye Web3 Mountain

Hyperliquid allies with market makers to provide initial liquidity for HyperCore, but this entire setup is based on the expectation of $HYPE—specifically, that market makers will receive longer-term profit sharing.

As mentioned earlier, HyperBFT nodes gradually expand through token swaps, where the foundation transfers its token share to market maker nodes in exchange for their long-term liquidity commitments.

This makes $HYPE a liability for Hyperliquid, needing to simultaneously satisfy demands from market makers, HLPs, and token holders. It's important to note that these three parties do not have identical interests. If $HYPE’s price remains stagnant over the long term, retail holders will inevitably sell off, harming market makers. However, if the price rises too quickly, high valuations could trigger whale dumps or even economic collapse.

A reasonable $HYPE price would be 10% of $BNB, or $100, but an average trading range around $50 leaves sufficient room for appreciation while providing a lower downside base during bear markets, easing downward pressure.

Before Selling Security

Selling liquidity directly means selling at MM prices—always package it as the dragon-slaying hero.

Every product/business/model in crypto must address two core questions:

1. What asset are you selling?

2. How are you selling it?

Prior to HyperEVM launch, facing criticism over excessive centralization, the Hyperliquid team began expanding HyperBFT nodes by gradually introducing external participants. In early February, they launched HyperUnit to facilitate external capital inflow into HyperCore, laying groundwork for cross-chain integration and HyperEVM.

Much like launching Builder Codes in October 2024, culminating in Phantom integration that引爆 market traffic in July 2025.

Image caption: Main nodes of HyperEVM

Image source: @zuoyeweb3

In February 2025, HyperEVM launched. Subsequently, read/write precompiled contracts between HyperCore and HyperEVM took shape between April and July, followed by gradual rollout of ecosystem projects.

What truly inspires us is that after distributing 31% of tokens via airdrop—setting up massive future sell pressure from the foundation’s swap—the team launched HyperEVM just three months after the HyperCore airdrop. Without prior planning, this timing wouldn’t make sense. A more plausible explanation is they simply picked the right moment:

1. $HYPE node distribution had slightly diversified, meeting public expectations;

2. The price hovered below $25, making it relatively acceptable for new node participants;

3. Reduced "pumping" pressure on the Hyperliquid team.

With broader node distribution, the swap process begins—selling security as an asset to nodes. Before migrating HyperCore's security to HyperEVM, $HYPE completes its first major phase of large-scale transactions.

Projects are built on-chain; assets are issued on exchanges.

Crypto network effects can roughly be divided into public chains and CEXs. Stablecoins are the only outlier that has broken out of crypto into traditional markets and user bases.

Looking back at the crypto timeline post-FTX collapse, the focus for ETH L2s isn't ZK, but high-performance L2s like MegeETH that emulate "Solana." Monad, Berachain, Sonic (Fantom), etc., all revolve around stimulating liquidity using their native tokens—liquidity shows no long-term loyalty.

In exchange competition, dealing with Binance is the central challenge for offshore platforms like OKX, Bybit, Bitget, and compliant ones like Coinbase, Kraken, as well as newcomers like Robinhood. Their shared strategy is "trade everything": Robinhood embraces L2s, prediction markets, and altcoins like $CRV; Kraken expands into wallets, L2s, USDG, and IPOs; Bybit elevates Mantle; OKX restructures XLayer; and Bitget UEX humorously attempts an "omni-exchange."

Whether exchanges or public chains, all aim to close the loop between liquidity and tokens. Before token issuance, one-way stimulation of liquidity via tokens is simple. After issuance, however, the envisioned two-way cycle—where liquidity empowers tokens, and tokens in turn feed back into liquidity—rarely holds true, from Berachain to AC’s Sonic.

All cryptocurrency history is a history of asset creation. Since Bitcoin, public chains have become the birthplace of asset creation and issuance networks. Yet high entry barriers allow fully centralized CEXs to dominate as powerful intermediaries for onboarding users and listing new tokens—even spawning derivative products like exchange-affiliated chains.

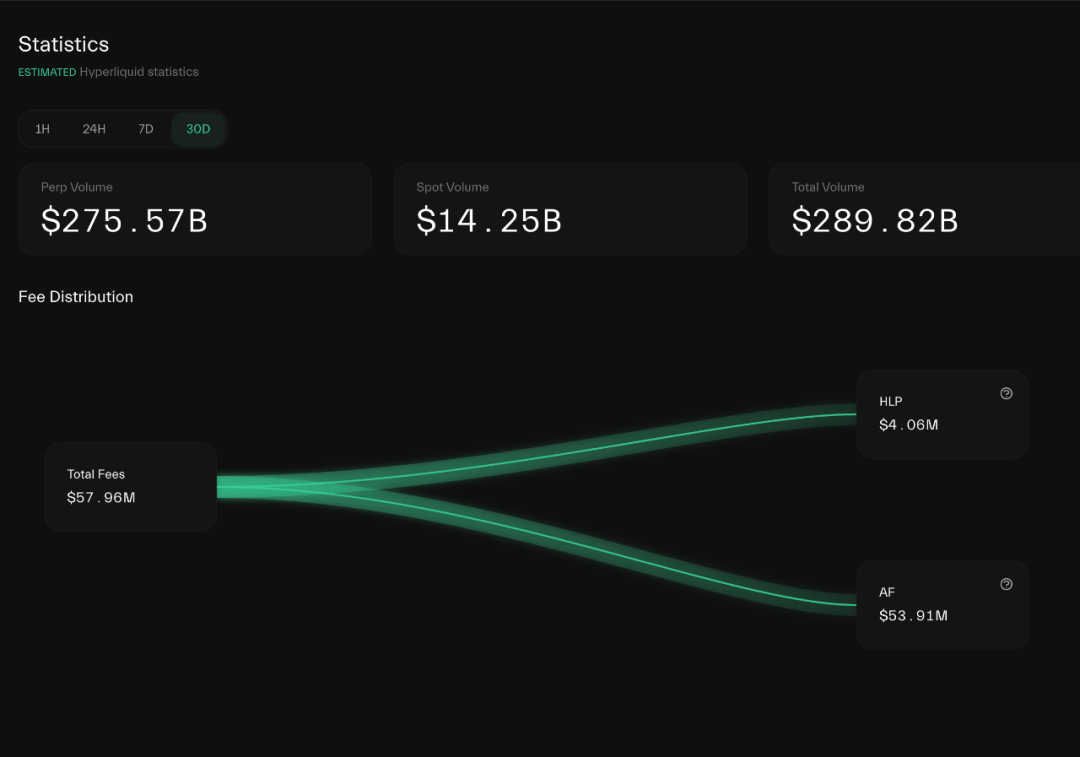

Image caption: Hyperliquid fee flow

Image source: @hypurrdash

If we only observe $HYPE’s market performance, it’s hard to distinguish it from other token-incentivized projects, especially since over 92% of revenue goes toward straightforward buybacks.

Hyperliquid’s liquidity is also incentivized, but through a gentler token swap model, combined with team discipline and the absence of concentrated VC unlock sell-offs, maintaining relative stability in both HyperCore liquidity and $HYPE price.

Thus, after replicating CEX-level liquidity, HyperCore must evolve toward an open public chain architecture, transforming $HYPE into an ETH-like "currency" with real-world utility. Currently, it’s far from achieving this.

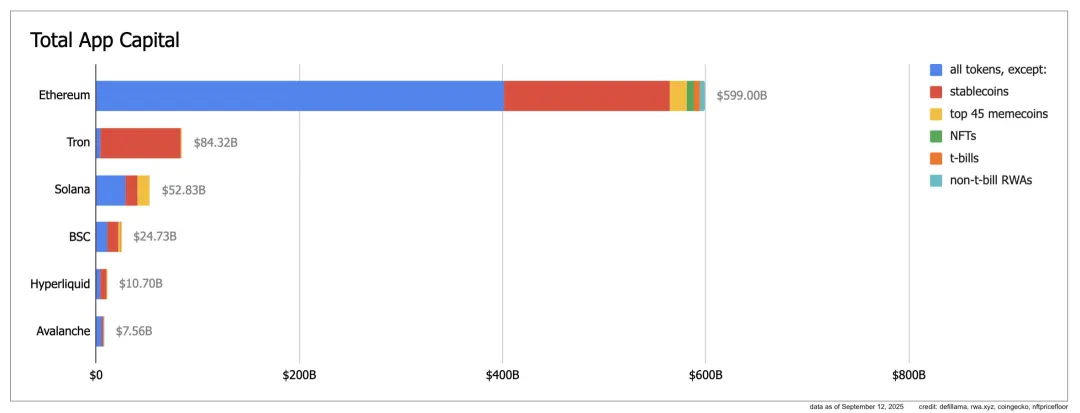

Image caption: App Capital

Image caption: App Capital

Image source: @ryanberckmans

According to the App Capital metric, Ethereum reaches $600 billion in value through altcoins and stablecoins in circulation. Tron stands alone through stablecoins. Solana has a healthier structure, with stablecoins, altcoins, and Memes each holding significant shares, though total scale remains small. Hyperliquid mainly features stablecoins and altcoins, reaching a $10 billion scale.

Note

App Capital measures the real capital flow on a public chain, excluding the value of the chain’s own native token, and only counting circulating value of tokens on the chain—not FDV or TVL.

Alternatively, assets on Hyperliquid, aside from BTC/ETH/SOL bridged via Unit, are primarily powered by $HYPE. This does not contradict the exclusion of native tokens, because $kHYPE wrapped via LST protocols like Kinetiq are considered "DeFi" tokens, and projects like Morpho/HyperLend enter the HyperEVM ecosystem largely due to $HYPE-driven incentives.

We focus here on the latter point. On the surface, HyperEVM doesn't rely on buybacks or subsidies to grow its ecosystem. In reality, however, ecosystem projects show two key traits:

1. LSTs, lending, and yield products mainly revolve around $HYPE-derived assets;

2. Neutral tools like DEXs fail to gain traction—HyperSwap’s TVL remains minimal.

Kinetiq, for example, functions more like an on-chain re-issuer of $HYPE. Starting as an LST akin to Lido, it expanded into lending, stablecoins, and yield products. Its TVL sits around $25 million, and Kinetiq itself is also one of the HyperBFT nodes.

In contrast, HyperSwap, the main AMM DEX on HyperEVM, has only about $44 million in TVL. While there may be some overlap with HyperCore’s positioning, compared to PancakeSwap’s $2.5 billion and Uniswap’s $5.5 billion TVL, it remains extremely weak.

This confirms the importance of App Capital: assets on HyperEVM remain primarily channels for reissuing $HYPE, far from forming an independent ecosystem.

After Selling Liquidity

Choice is an illusion created between those with power and those without.

Although Hyperliquid strives to build a value loop for HyperEVM, so far it still revolves entirely around $HYPE and HyperCore liquidity—HyperEVM’s intrinsic value hasn’t aligned with them.

This contradicts common narratives. In most analyses, HIP-3, Core Writer, and Builder Codes are praised as revolutionary, as if they seamlessly transfer HyperCore’s liquidity to HyperEVM.

But this is an illusion. Through these technical innovations, HyperCore sells a "liquidity deployment right," not transactional liquidity for projects.

More plainly, Hyperliquid is selling HyperCore’s tech stack—similar to Aave’s friendly forks.

Tip

Aave DAO designed a friendly fork model allowing third parties to use Aave’s code directly, provided they share part of protocol revenue with Aave—HyperLend being one such example.

From Read Precompiles to Write Precompiles (i.e., the CoreWriter System), HyperEVM gains the ability to directly read and write HyperCore data. This is actually a general interoperability pattern—opening access to HyperCore.

Access ≠ liquidity initialization. Any HyperEVM project wanting to leverage HyperCore’s liquidity must independently secure funds to bootstrap it.

Hyperliquid offers no subsidies, forcing projects to find their own ways—HyperBeat seeks external funding, Hyperlend sticks to community-led growth.

This creates an asymmetric relationship: Hyperliquid won’t offer $HYPE incentives to HyperEVM projects, yet encourages them to build around $HYPE to drive real usage.

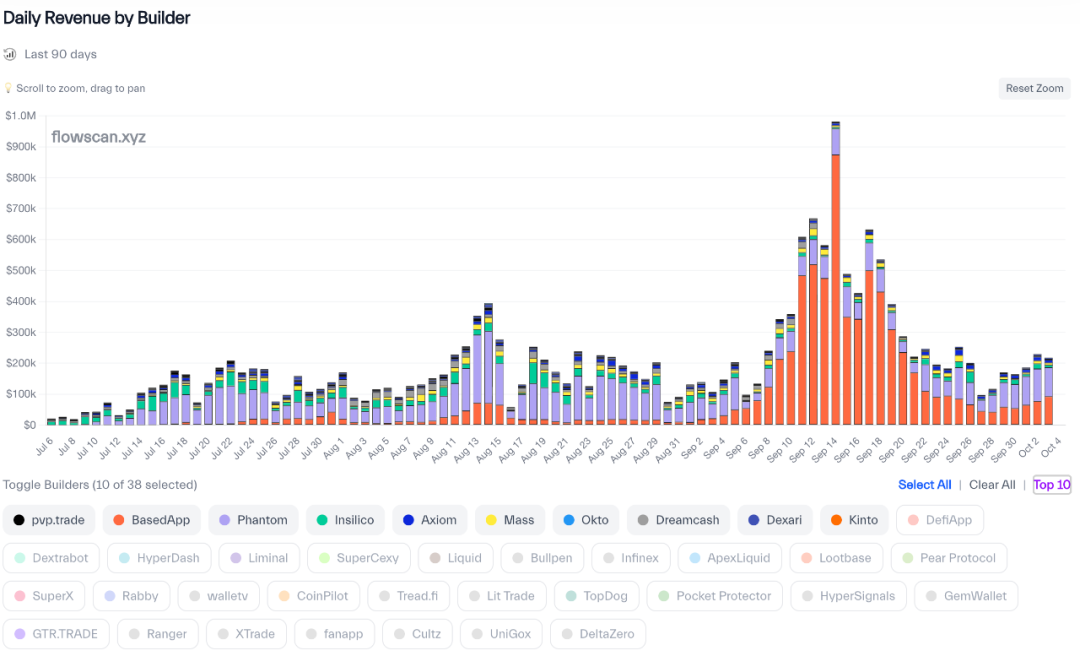

From Invite Code to Builder Codes

In fact, this was already evident in Builder Codes. Traditional CEX referral systems emphasize unique invite codes, testing affiliates’ and community leaders’ "pyramid-style" marketing and conversion skills, leading CEXs to aggressively sponsor KOLs.

Hyperliquid, however, adopts a Taobao-style rebate model—indifferent to rebranding—and actively encourages developers and projects to build businesses and brands around HyperCore’s liquidity, with HyperCore willingly serving as a backend liquidity provider.

Image caption: Builder Codes revenue ranking

Image source: @hydromancerxyz

With HyperCore providing unified liquidity backend, BasedApps can create their own Robinhood-like experiences, Phantom can embed its contracts into its ecosystem—fully customizable, with revenue sharing.

From Fixed Contracts to Custom Contracts

Following the Builder Codes model, Hyperliquid introduced HIP-3, allowing users to create arbitrary contract markets on HyperCore—such as prediction markets, forex, or options.

From a product standpoint, this extends the existing spot auction mechanism into contract auctions, still operating on 31-hour cycles, now requiring a 500,000 $HYPE margin (around $25 million).

However, with the addition of the Core Writer protocol, HIP-3 effectively enables leveraged looping between HyperEVM and HyperCore. HIP-3 was originally proposed by LST protocol Kinetiq, which also runs a HyperBFT node.

Through CoreWriter and HIP-3, $HYPE directed to DeFi protocols on HyperEVM now flows back into HyperCore, creating actual deflation.

Furthermore, Kinetiq offers crowdfunding auctions—groups can pool funds to bid for creation rights. Imagine: $HYPE staked on HyperCore eventually becomes the margin for contracts on HyperCore.

1. Users or projects contribute 500,000 $HYPE to bid;

2. After winning, the project deploys on HyperCore and bootstraps its own initial liquidity;

3. 50% of fees generated go to Hyperliquid, denominated in $HYPE;

4. For misconduct, Hyperliquid slashes a portion of the staked $HYPE.

To put it simply, HyperCore’s trading volume forms the valuation basis for $HYPE, while HyperEVM acts as a valuation amplifier—letting the ecosystem compete on price benchmarks and increasing real usage, reducing reliance on buybacks.

Under this dual-architecture system, a controlled HyperCore needs a free HyperEVM. Only by granting full open permissions can $HYPE’s value spiral upward.

Under HyperCore’s buyback model, Hyperliquid’s growth story is limited to becoming a full-fledged Binance. HyperEVM gives $HYPE itself the chance to spark secondary liquidity.

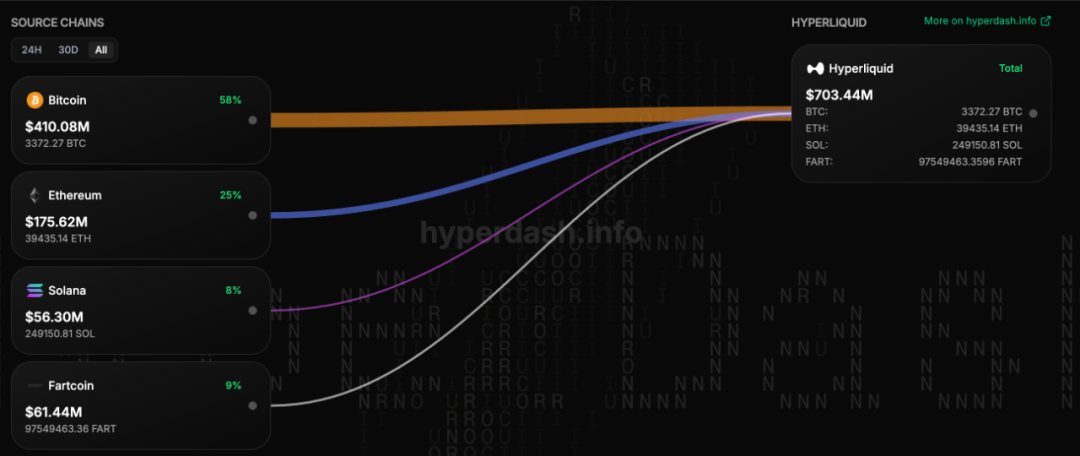

Image caption: Classification of assets bridged via Unit

Image source: @hypurrdash

This is similar to using Unit to bring in BTC/ETH—to boost $HYPE usage as transaction fees. Don’t forget what happened to $FTT as FTX’s primary reserve asset—it collapsed.

HIP-3 and the CoreWriter system fundamentally transform Hyperliquid’s valuation and positioning, enabling $HYPE to compete as a full-fledged hybrid of public chain and exchange.

Conclusion: From S1 to S3

I don’t wear my heart upon my sleeve.

This article focuses on piecing together how Hyperliquid structured HyperEVM’s initial liquidity, paying less attention to HyperEVM’s current ecosystem state.

Currently, HyperEVM can essentially be viewed as a wrapper and leverage amplifier for $HYPE, with no projects or mechanisms yet truly independent of $HYPE—most are merely migrations or imitations of ETH-based projects.

Suddenly, Hyperliquid airdropped NFTs to Season 2 users. Given that Season 1 measured Perp trading volume and Season 2 added spot trading, Season 3 will likely measure HyperEVM trading volume.

Facing attacks from competitors like Aster, Hyperliquid’s “retroactive” S2 NFT drop boosts HyperEVM trading activity while setting the stage for S3—a cleverly interconnected strategy.

First build a controllable HyperCore, then an open HyperEVM. You might think the connector is the CoreWriter system, but in reality, it’s the dual role of $HYPE.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News