Bitget Wallet Research Institute: The Intelligent "Gatekeeper": How "Conditional Liquidity" is Rewriting Solana's Trading Rules

TechFlow Selected TechFlow Selected

Bitget Wallet Research Institute: The Intelligent "Gatekeeper": How "Conditional Liquidity" is Rewriting Solana's Trading Rules

A profound transformation called "Conditional Liquidity" is brewing, aiming to infuse intelligence and rules into the core of liquidity.

Introduction

In the world of decentralized finance (DeFi), liquidity has long been treated as an almost unconditional public good—pools remain open 24/7, welcoming all trades without discrimination. However, this traditional "passive liquidity" model is increasingly revealing its inherent fragility, placing ordinary users and liquidity providers (LPs) at a natural disadvantage when competing against information-savvy players. Now, a profound transformation known as "conditional liquidity" is emerging, aiming to inject intelligence and rules into the core of liquidity. In this article, Bitget Wallet Research will explore how it fundamentally reshapes the risk landscape and fairness contract of DeFi trading.

I. The Hidden Cost of DEXs: The Endogenous Dilemma of Passive Liquidity

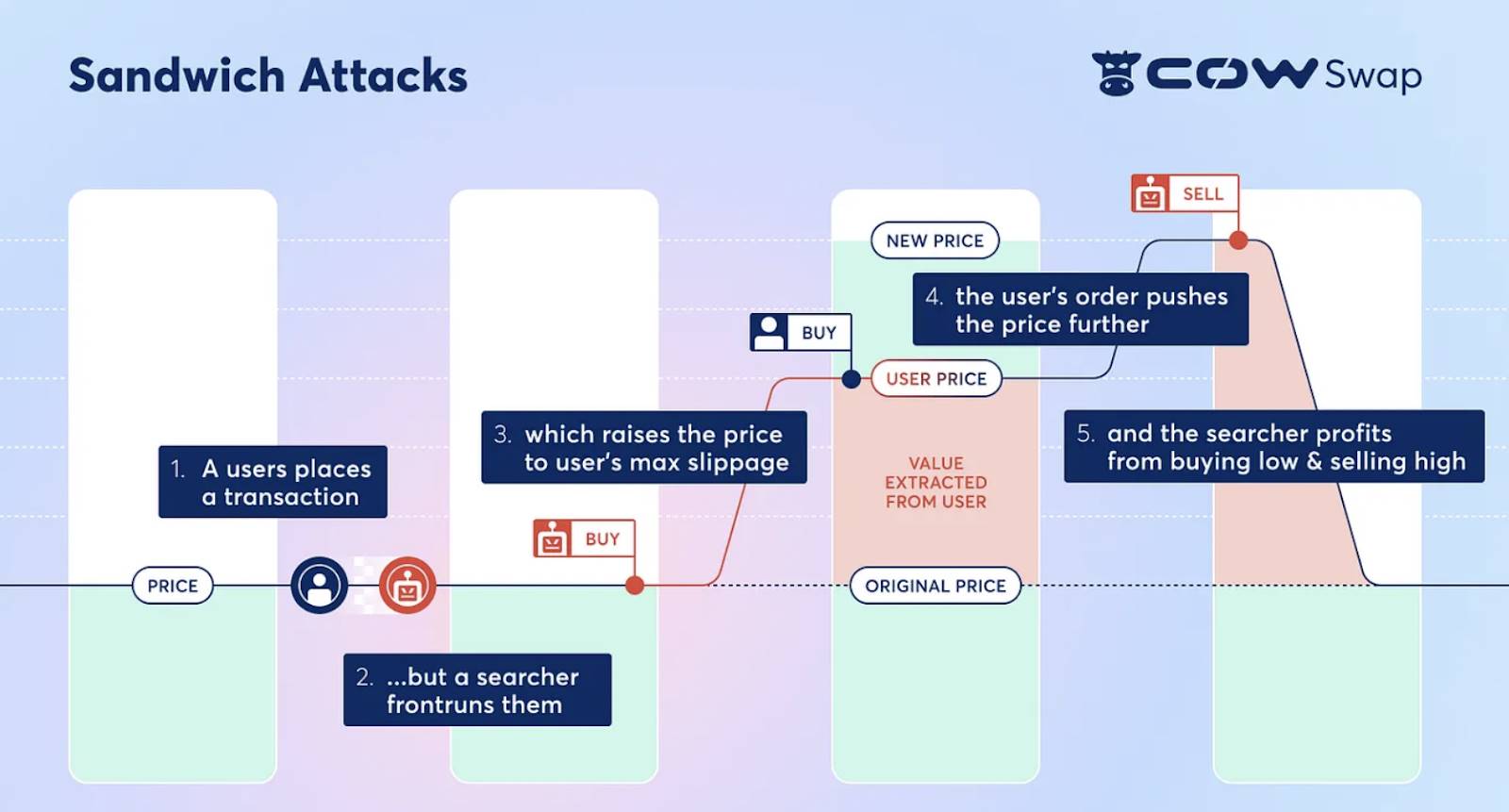

In traditional automated market maker (AMM)-based decentralized exchanges (DEXs), liquidity provider (LP) pools function like a public square open around the clock, treating all traders equally and accepting every trade indiscriminately. While this "passive liquidity" model appears fair on the surface, on high-performance blockchains like Solana where transactions occur within milliseconds, it exposes a fatal vulnerability—complex transaction paths and extremely low latency create ideal conditions for “sandwich attacks,” front-running, and other forms of “toxic order flow.” Professional arbitrage firms with information advantages and powerful computing resources can precisely detect even the slightest market fluctuations or large orders, enabling them to execute profitable arbitrage trades. (See the classic example of a “sandwich attack” below)

Source: CoW DAO

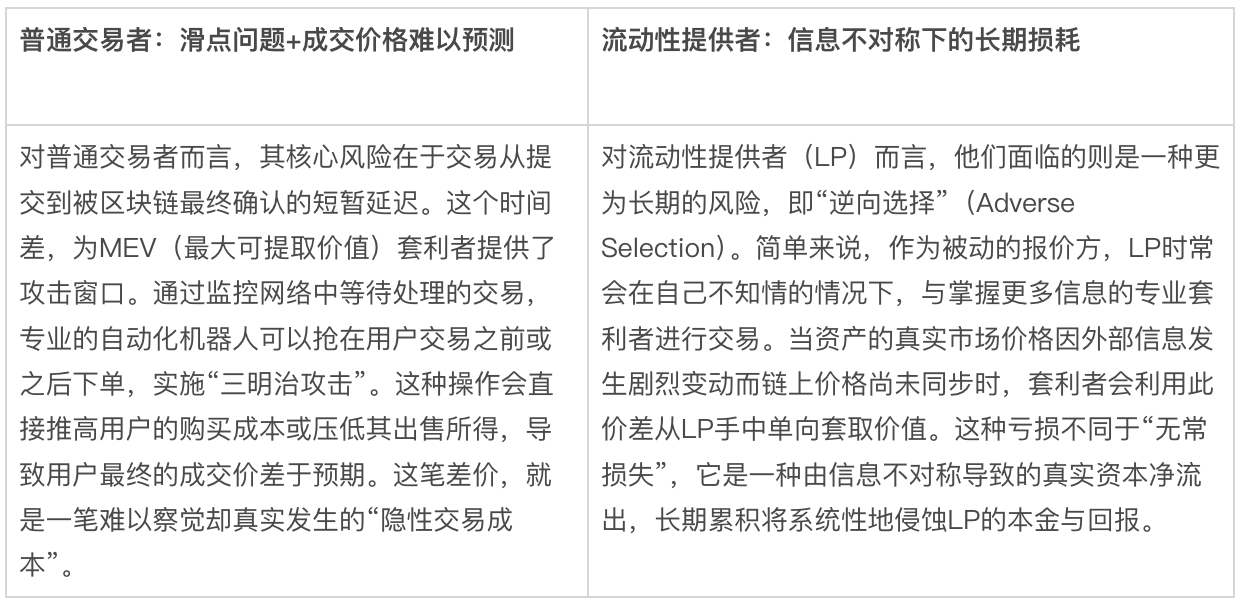

Ultimately, these costs are silently borne by two other groups: ordinary traders suffer from severe slippage and degraded trading experiences, while liquidity providers (LPs) see their long-term returns steadily eroded.

Data source: Compiled from public information

To address this very issue, "conditional liquidity" (Conditional Liquidity, CL) has emerged. First proposed by the DEX aggregator DFlow, this new model aims to transform liquidity from a passive "static pool" into an active "intelligent gatekeeper." Its core idea is clear: liquidity provision should no longer be unconditional, but instead intelligently adjusted based on real-time data such as the "toxicity" of incoming order flows. This rule-based dynamic response fundamentally seeks to rewrite unfair trading dynamics and offer tangible protection for both regular users and LPs.

II. Intelligent Defense: The Dual Filtering Mechanism of Conditional Liquidity

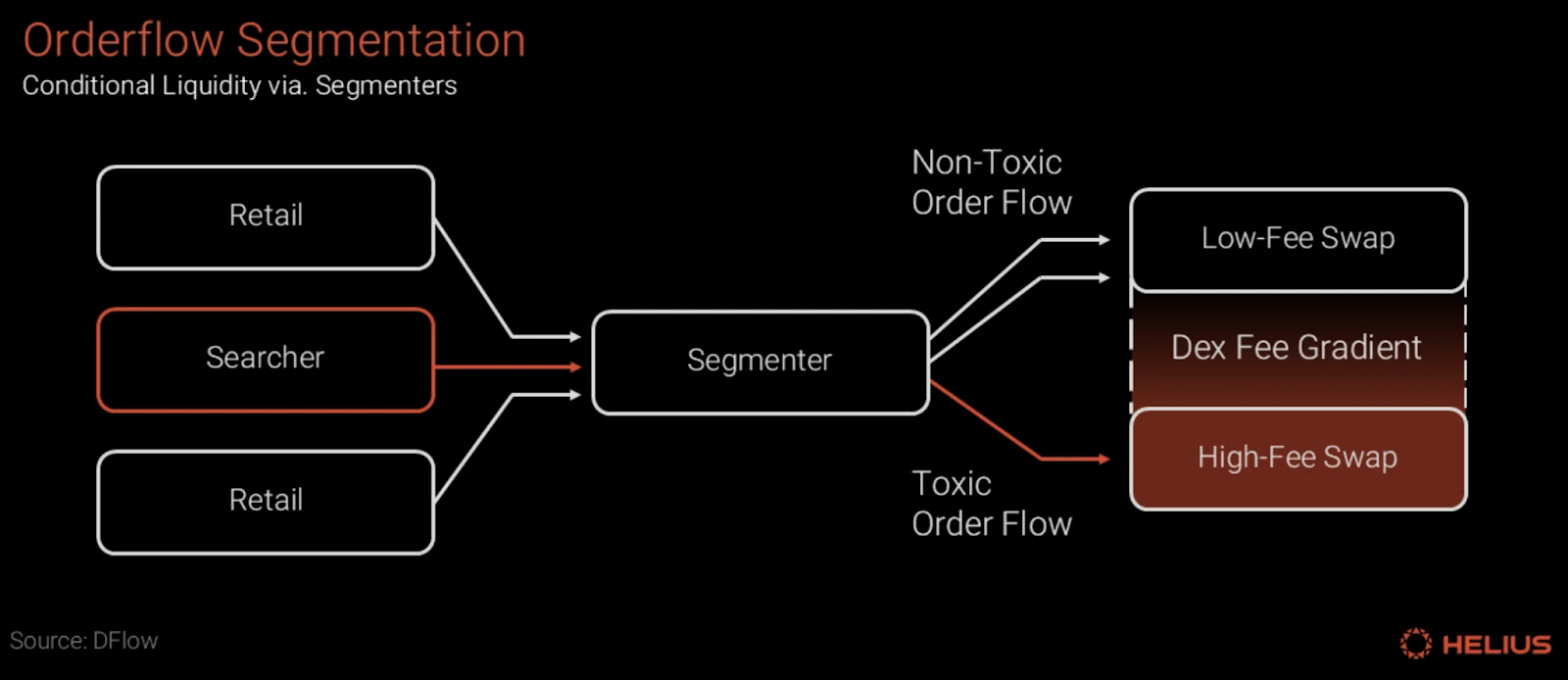

"Conditional Liquidity (CL)" establishes a smarter and more resilient market microstructure by protocolizing complex decision-making logic. Its implementation relies on two key components: first, risk identification and order stratification via a "Segmenter," followed by secure and efficient intent execution through "Declarative Swaps."

-

Segmenter: Risk Identification and Label Endorsement

The Segmenter serves as the "analytical brain" of the conditional liquidity (CL) framework, with its core functions summarized in two steps: risk assessment and label endorsement.

First, the Segmenter performs real-time, behavior-based risk assessments on every order flow entering the system. Dimensions analyzed may include the source path of the transaction request, the historical behavior patterns of the initiator, submission frequency and speed, and whether price probing occurs across multiple platforms—all part of a broader set of metadata.

Second, based on this analysis, the Segmenter attaches a signed endorsement to the order, assigning a final "toxicity label." This label could be a binary judgment ("toxic/non-toxic") or involve multi-tiered ratings. However, this label is not merely a simple "allow/deny" switch; rather, it acts as a critical signal that triggers differentiated services (such as fee structures and routing destinations), guiding liquidity to selectively match orders:

-

For order flows labeled as "non-toxic" (typically considered to originate from retail users or passive strategies), the system directs better pricing, deeper concentrated liquidity, and lower transaction fees, rewarding and protecting benign trading behaviors.

-

For order flows labeled as "toxic," the system applies higher fees, wider bid-ask spreads, stricter trading limits, or outright rejects liquidity provision under predefined extreme conditions, ensuring high-risk activities bear their appropriate transaction costs.

Source: Helius, DFlow

Through this approach, the conditional liquidity system transforms complex risk control strategies previously hidden within AMM backend servers into transparent and standardized protocol-layer capabilities, enabling effective stratification and pricing of traffic across different risk levels, thereby clearly distinguishing between regular users and arbitrageurs.

-

Declarative Swaps: Intent-Driven and Secure Execution

To ensure the Segmenter's analysis is executed accurately and securely, the conditional liquidity (CL) framework adopts "Declarative Swaps," an intent-driven trading model that clearly separates the trading process into two stages: "intent" and "execution":

-

Step One: Intent Declaration (Open-order). Users submit an "intent" expressing their trading goal (e.g., "I want to exchange 100 USDC for as much SOL as possible"), during which their assets are securely held in custody. The key here is that the user’s "intent" does not enter the publicly visible mempool, eliminating the possibility of frontrunning attacks at the source.

-

Step Two: Bundle and Execute (Fill). The protocol's execution layer (typically an aggregator or specialized solver) calculates the optimal execution path based on the user's intent and the order flow label provided by the Segmenter, then bundles the user's intent with execution instructions into a single atomic transaction, submitting it directly to the blockchain as one unit.

This "intent-first, bundle-to-chain" model drastically reduces the attack window, making it nearly immune to sandwich attacks and other frontrunning behaviors. Market makers can confirm a benign trade and then precisely inject and withdraw liquidity within the same block, significantly improving capital efficiency while offering participants reliable, protocol-scheduled, on-demand liquidity services.

III. Outlook: The Evolution from Single Pricing to Multi-Dimensional Conditions

Conditional liquidity is not a concept born out of thin air, but a logical evolution in DeFi’s pursuit of higher capital efficiency and robustness. It can be seen as a dimensional upgrade of the "concentrated liquidity" concept pioneered by Uniswap v3. While Uniswap v3 first allowed LPs to deploy capital based on a single condition—the "price range"—conditional liquidity expands this notion, extending the scope of "conditions" beyond price to include order flow quality, timing characteristics, market volatility, and other complex risk models, embedding these decision-making and execution capabilities deeper into the protocol layer.

The implementation of this model represents a precise correction to the longstanding trading pain points within high-performance ecosystems like Solana, potentially bringing structural, mutually beneficial optimizations to the entire DEX ecosystem. Ordinary users will most directly experience reduced trading costs and enhanced MEV protection; liquidity providers gain more sophisticated risk management tools, allowing them to allocate capital precisely toward "healthy" order flows for more sustainable returns; ultimately, this will reshape the competitive landscape between DEXs and aggregators, elevating competition from mere price comparisons to broader contests over "execution quality" and "security experience."

Nevertheless, while the vision painted by this emerging model is undoubtedly compelling, in practice it faces significant challenges beyond typical issues like ecosystem coordination and cold-start adoption. Its central challenge lies squarely with the "Segmenter," the entity holding the power to define labels—who decides what is "toxic"? This is a fundamental governance dilemma: if the Segmenter's algorithm is too conservative, it risks falsely flagging legitimate traders; if too lenient, it fails to defend against sophisticated attackers. This strikes at the heart of trust in decentralized systems, as a "black box" arbiter controlled by a single entity with opaque algorithms could easily become a new centralization bottleneck—or worse, enable rent-seeking collusion with specific interest groups.

Addressing the "black box" problem of the Segmenter makes the design of its governance framework crucial. Future exploration may follow a more decentralized and verifiable path—for instance, allowing multiple independent Segmenters to operate in parallel, letting protocols or LPs choose and weight them based on historical reputation; mandating that Segmenters produce audit logs available for community oversight to enhance transparency; and building a post-hoc evaluation and incentive mechanism that rewards accurate models and penalizes those with high false-positive rates. While these ideas point toward decentralized risk control, a truly mature, balanced, and consensus-driven solution remains to be developed through ongoing industry experimentation.

IV. Conclusion: From "Black Box Art" to "Protocol Science"

Conditional liquidity is far more than a technical innovation—it represents a profound restructuring of fairness and efficiency in DeFi markets. At its core, it enables more rational pricing for participants with different intents and risk profiles within a permissionless environment, transforming previously implicit and unequal game rules into explicit, programmable protocol logic. In essence, it shifts market-making decisions from the "black box art" reliant on individual expertise toward a more open and verifiable "protocol science." Despite formidable challenges ahead, this direction undeniably opens up valuable possibilities for the future evolution of DeFi.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News