BTC loses 110k level, is market capital quietly retreating?

TechFlow Selected TechFlow Selected

BTC loses 110k level, is market capital quietly retreating?

View insights from experts and institutions on market trends.

Author: 1912212.eth, Foresight News

The market is celebrating the wealth effect brought by XPL, while the broader market remains shaky.

In the early hours of September 26, Bitcoin finally lost its crucial support level of $110,000, dropping as low as $108,631. ETH also broke below $4,000, reaching a low of $3,815. SOL fell below $200, hitting a minimum of $191.32. Most altcoins saw broad declines once again.

According to Coinglass data, total liquidations across all open contracts reached $1.191 billion in the past 24 hours, with long positions accounting for $1.073 billion. Among these, 75% were altcoin-related, with ETH alone accounting for nearly 45%. The largest single liquidation occurred on Hyperliquid's ETH-USD pair, valued at $29.1176 million.

In macro U.S. markets, Nasdaq dropped 0.5%, Dow Jones declined 0.38%, and S&P 500 fell 0.5%. Spot gold price stood at $3,741 per ounce, down slightly by 0.08%.

As key support levels continue to break down, the long-awaited altseason dream has once again been shattered, quickly turning bullish hopes into growing fears of a bear market. Alternative data shows the current Fear & Greed Index has dropped to 28, indicating widespread market fear.

Fed rate cut uncertainty, Trump wields tariff threat again

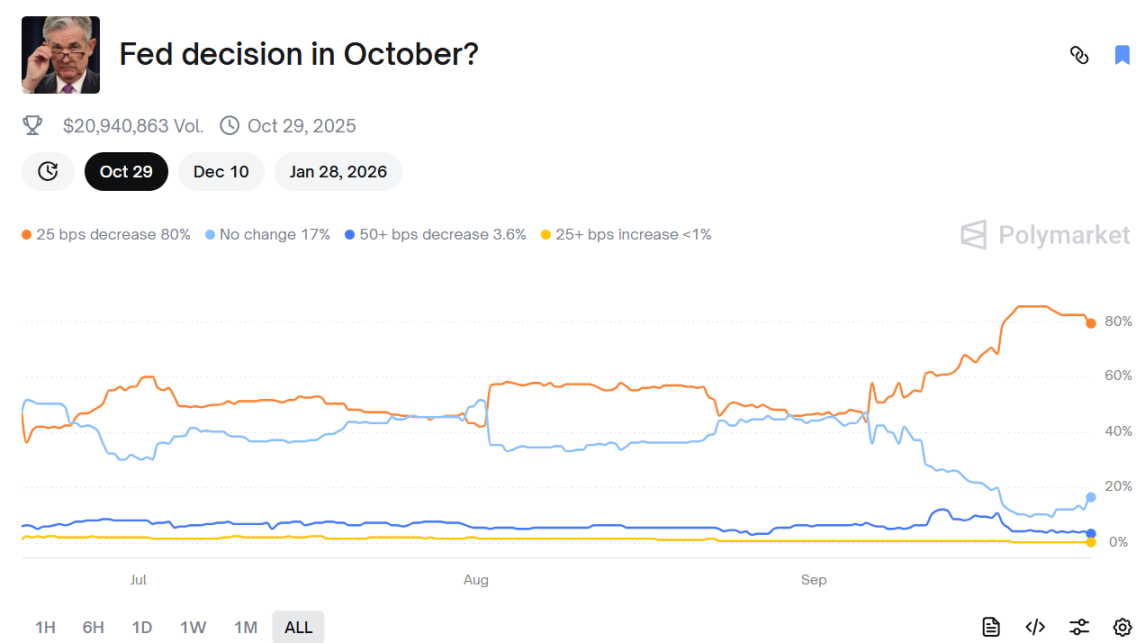

According to CME's "Fed Watch" tool, after the release of U.S. initial jobless claims and other data, the probability of a 25 basis point rate cut by the Fed in October has dropped to 83.4% (down from 91.9% yesterday), while the chance of holding rates steady has risen to 16.6%.

On Polymarket, the implied probability of a 25 basis point Fed rate cut has fallen to 80%, while the probability of no rate cut has increased to 17%.

Additionally, internal turmoil within the Federal Reserve remains unresolved. Trump intends to fire Fed Governor Lisa Cook. On Thursday, all living former Fed chairs, along with several former U.S. Treasury Secretaries, former White House economic advisors, and economists, urged the U.S. Supreme Court not to allow Trump to dismiss Fed Governor Lisa Cook.

Moreover, Trump stated on September 23 that the U.S. is ready to wield tariffs again, further intensifying market concerns. Historically, risk assets tend to decline when Trump resorts to tariff threats.

With weak sentiment in macro markets, how will crypto assets perform going forward? Analytical firms and industry figures have shared their views.

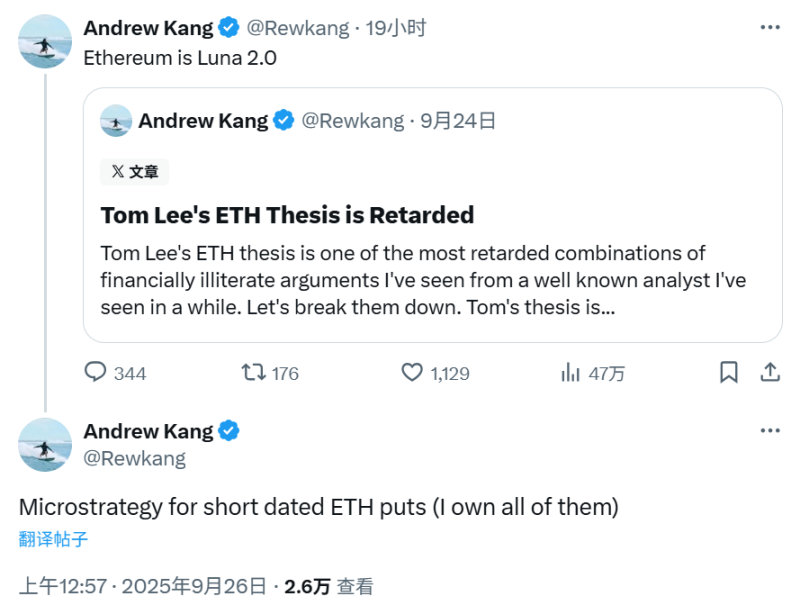

Andrew Kang: ETH technically bearish, heavily bought short-term put options on ETH

Andrew Kang, founder of crypto venture firm Mechanism Capital, bluntly called Tom Lee's theory about ETH "sounding like an idiot," and countered with five arguments, sparking debate in the industry: the widespread adoption of stablecoins and RWAs won't necessarily deliver expected returns; the analogy of Ethereum as "digital oil" is inaccurate; the idea that institutions will buy and stake ETH is pure fantasy; equating ETH’s value to the combined worth of all financial infrastructure companies is absurd;

ETH's technical outlook is bearish. I don’t rule out the possibility that it may trade sideways between $1,000 and $4,800 over a longer period. Just because an asset had parabolic gains before doesn't mean it will continue indefinitely.

The long-term ETH/BTC chart is also misunderstood. It is indeed within a long-term range, but the past few years have been dominated by a downtrend, with only a recent rebound at long-term support. The downtrend is driven by saturated narratives around Ethereum and fundamentals that fail to justify valuation growth—factors that remain unchanged.

Altcoin Vector: Market risk-off sentiment remains stable

Data analytics firm Altcoin Vector stated that this rotation hasn't ended hopes for altcoin rallies. Bitcoin is the "oxygen" for altcoins: once Bitcoin stabilizes and forms a bottom, it could push altcoins higher. Despite Bitcoin falling below $110,000, market risk-off signals remain stable. No signs of structural fragility = early signs of a potential bottom formation.

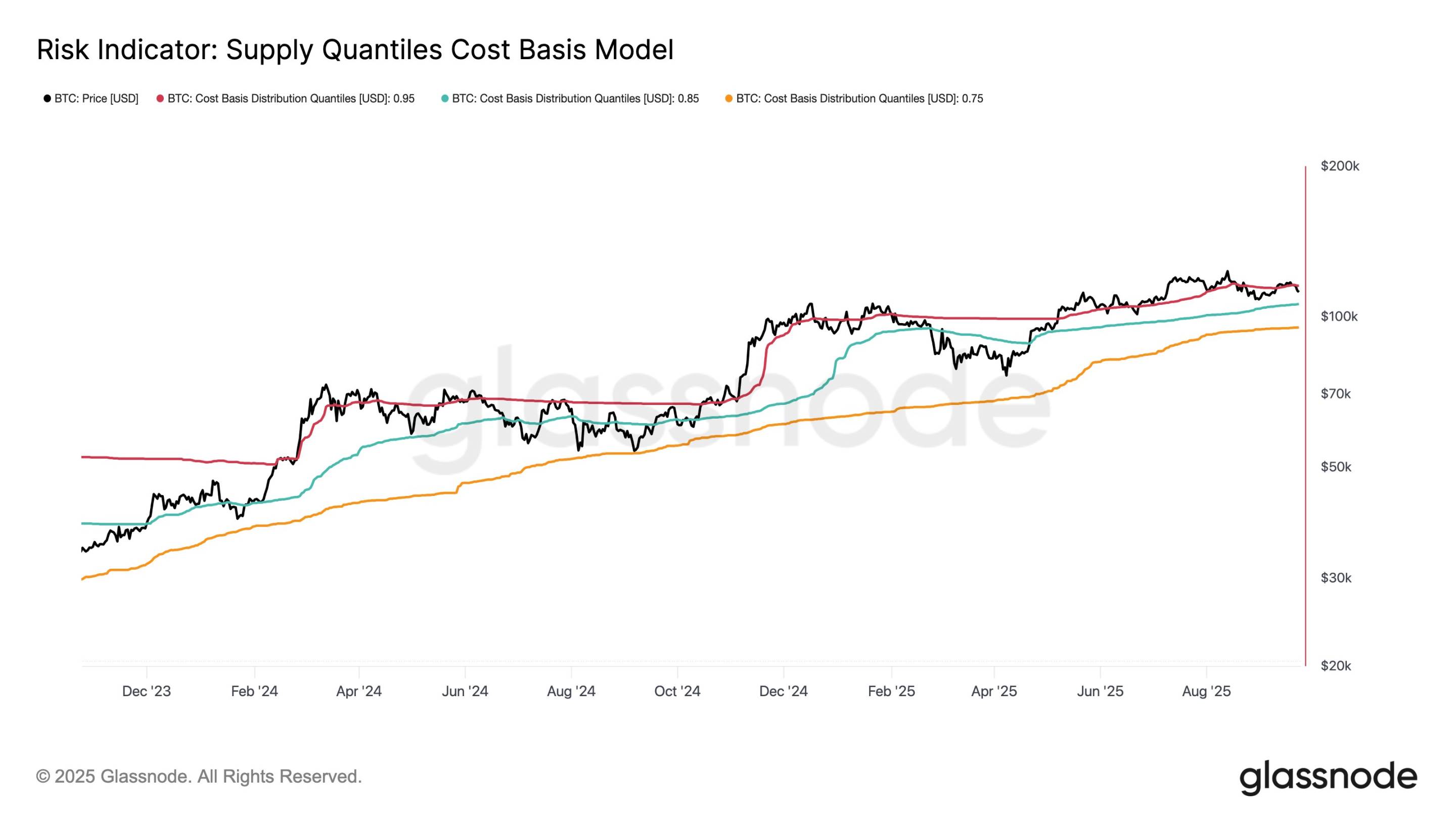

glassnode: BTC could fall toward $90K–$105K range

glassnode recently tweeted that Bitcoin has now broken below the 0.95 cost basis quantile—a critical risk zone that often signals the onset of profit-taking. If the price can reclaim this level, it would indicate renewed market strength; however, failure to do so raises the risk of a drop toward lower support levels in the $105,000 to $90,000 range.

Matrixport: As long as BTC holds above $109,899, bull market remains intact

Matrixport stated that the fifth Bitcoin bull market is different from previous ones, driven this time by institutions rather than retail investors. A notable feature of this cycle is three embedded mini-bull markets within the broader upward trend—compared to just two during 2020–2021. A simple yet effective indicator of trend health is the 21-week moving average, which acts as the dividing line between bull and bear markets. This level currently stands at $109,899. As long as Bitcoin remains above this level, the bull market remains intact—but a breakdown below it could mark the beginning of a more challenging phase.

Santiment: The real time to buy the dip comes when the crowd stops being optimistic and starts capitulating

According to data tracking platform Santiment, mentions of "buy the dip" on social media surged recently to their highest level in nearly a month, a typical signal of retail bullish sentiment. The platform monitors keyword frequencies on Reddit, Telegram, and X (formerly Twitter). Santiment considers such spikes in mentions a contrarian indicator, suggesting the current BTC pullback may deepen.

In its market analysis report, Santiment noted: "Price movements often contradict popular expectations. If retail investors believe $112,200 is a good entry point, the market may need to endure further pain. The real time to buy the dip comes when the crowd stops being optimistic and starts capitulating."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News