Bitcoin Stuck at $117,000 Level: Can the Fed Decision Spark a New High?

TechFlow Selected TechFlow Selected

Bitcoin Stuck at $117,000 Level: Can the Fed Decision Spark a New High?

The risk lies more in timing than in direction.

Writing: Prathik Desai

Translation: Block unicorn

*Article published on September 16

Gold has hit a new all-time high, equities have broken through earnings warnings, and the dollar is starting to weaken. Risk assets appear poised to continue climbing. Yet Bitcoin, typically most active during periods of ample liquidity, has now fallen to slightly below $117,000.

Despite strong market momentum—ETFs have absorbed billions of dollars, stablecoins are piling up on exchanges, and long-term holders are gradually reducing supply.

What's missing?

The answer becomes clear when we examine week 37 of 2025 (September 8–14).

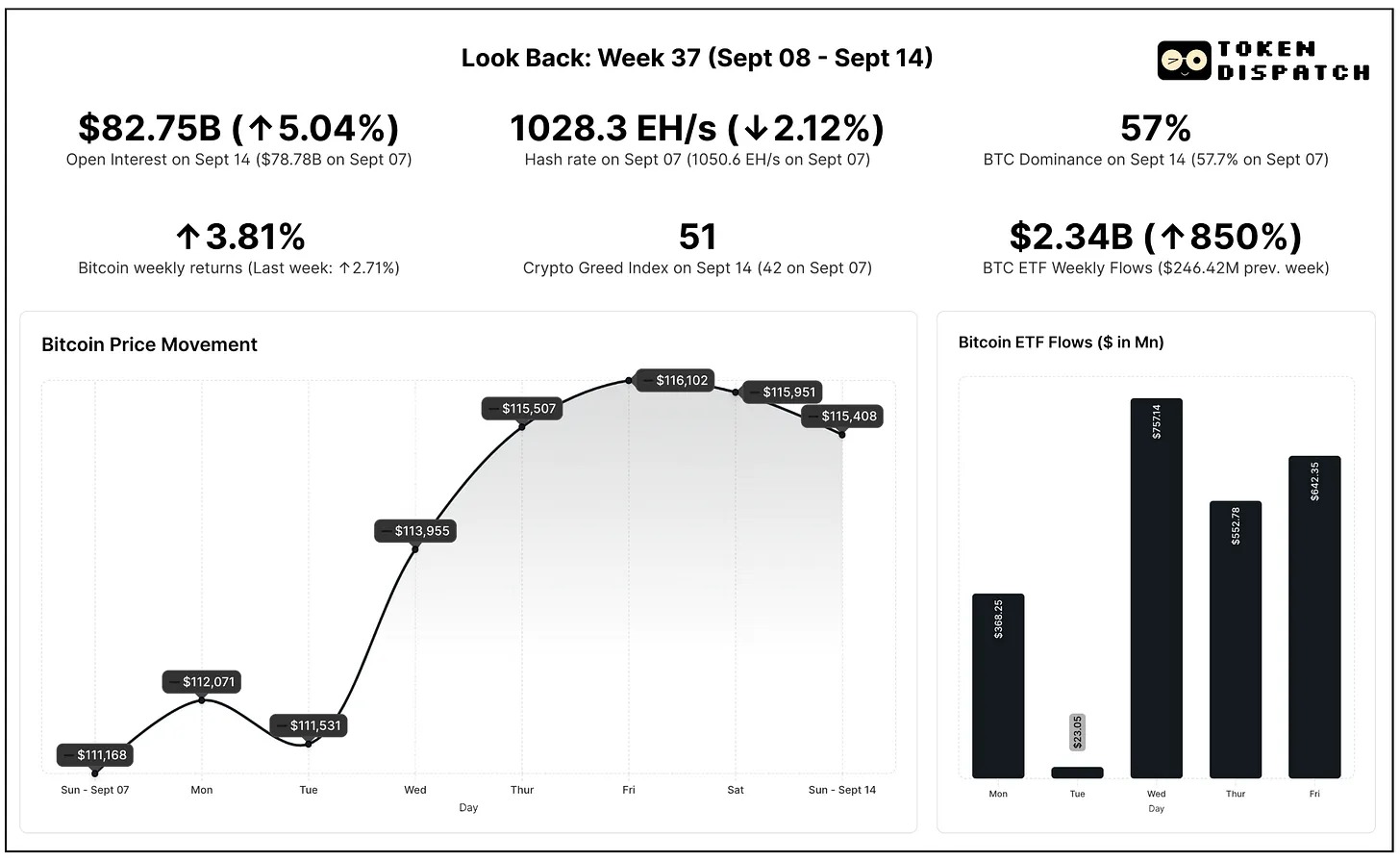

Last week, Bitcoin filled the gap left by the Chicago Mercantile Exchange (CME) August futures at $117,000, then paused its rally between accumulation and price discovery after two weeks of major macroeconomic developments.

The market rose, recording its first back-to-back weekly gains in over two months. However, it struggled to break above the $117,000 resistance level, with markets awaiting a key event: the Federal Reserve’s decision on September 17.

This situation unfolds against a backdrop of economic uncertainty. First, U.S. employment data released two weeks ago came in weaker than expected.

Now, inflation data presents mixed signals. The Producer Price Index (PPI) cooled, turning negative month-on-month, indicating easing cost pressures in the supply chain. However, the Consumer Price Index (CPI) showed divergence. August CPI rose 0.4% month-on-month, with an annualized rate reaching 2.9%, the highest since February. This remains well above the Fed’s 2% target, suggesting inflation is far from tamed.

PPI data hints at weakening future inflation pressure, but CPI shows households are still under strain. Combined with a softening labor market, the case for rate cuts remains strong. CME’s FedWatch tool indicates markets have priced in over 95% probability of a rate cut.

Meanwhile, other assets are grabbing attention.

Gold surged to a record high above $3,640 per ounce. In equities, both the S&P 500 and Nasdaq indices hit new all-time highs ahead of the upcoming Fed meeting.

Bitcoin attempted to follow the same path.

It rebounded from near $108,000 at the end of August to above $116,000 last week. However, unlike gold or stocks, Bitcoin failed to break through this level. The gap has been filled, upward momentum is building, yet the $117,000 resistance remains stubborn.

Bitcoin stayed above $110,000 throughout the week, closing Sunday with a weekly gain of 3.81%.

Cash Bitcoin ETFs absorbed over $2.3 billion in just five days—the strongest weekly inflow since July and the fifth-best week of 2025. Institutional investors are supporting demand, establishing positions with fresh capital.

Yet, the derivatives market does not reflect the same confidence.

Bitcoin futures open interest saw slight growth, but speculative energy has shifted toward Ethereum and other altcoins. Bitcoin’s dominance dropped by 0.7 percentage points, reflecting this shift.

The Crypto Fear & Greed Index rose 9 points into neutral territory, moving away from the fear zone, indicating strengthening investor sentiment.

On-chain data aligns with this, showing liquidity waiting for market conviction.

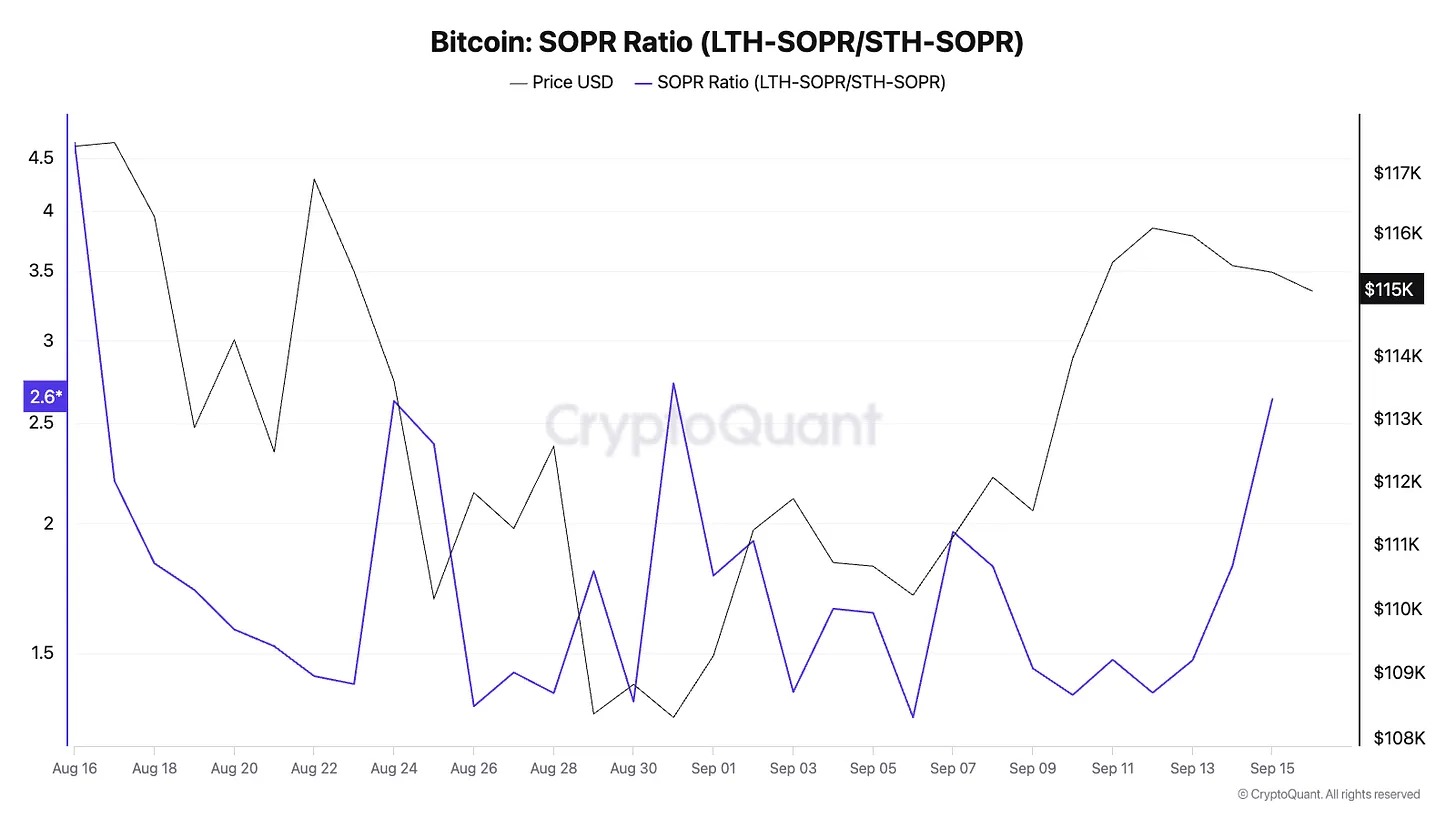

The Spent Output Profit Ratio (SOPR) indicates long-term holders continue selling into strength, while short-term holders are realizing profits rather than losses. This suggests healthy market liquidity, sustained supply flow, and no stress signals being triggered.

The Long-Term Holder / Short-Term Holder SOPR ratio remains elevated, indicating selling pressure comes primarily from experienced wallets, not nervous new entrants.

This week, the Market-Value-to-Realized-Value (MVRV) ratio rose from 2.09 to 2.17, placing Bitcoin in mid-cycle territory. Historically, MVRV levels between 3.5 and 4 typically signal market overheating. At 2.2, the market is neither cheap nor excessively expanded. Valuation is stable, not bubbly.

The Stablecoin Supply Ratio (ratio of total crypto market cap to total stablecoin supply) has dropped to its lowest level in four months. This suggests increased idle stablecoin liquidity on exchanges relative to Bitcoin balances.

The short-term Relative Strength Index (RSI) has also dropped to around 50, indicating neutral momentum with upside potential. All these metrics support the broad view of ample liquidity, yet the market still lacks conviction.

What Comes Next?

Rate cuts aren’t always good news for Bitcoin.

In March 2020, the Fed slashed rates dramatically in response to the pandemic. Bitcoin initially crashed alongside risk assets, then surged as liquidity flooded in. A similar pattern emerged at the end of 2024: the first rate cut triggered volatility and profit-taking, followed by a loose monetary cycle laying the foundation for another rally.

At that time, on-chain indicators like MVRV and whale ratios showed short-term fluctuations before entering a prolonged uptrend. If history repeats, this week’s initial cut could bring volatility rather than a straight-line rise—even if the overall outlook remains favorable.

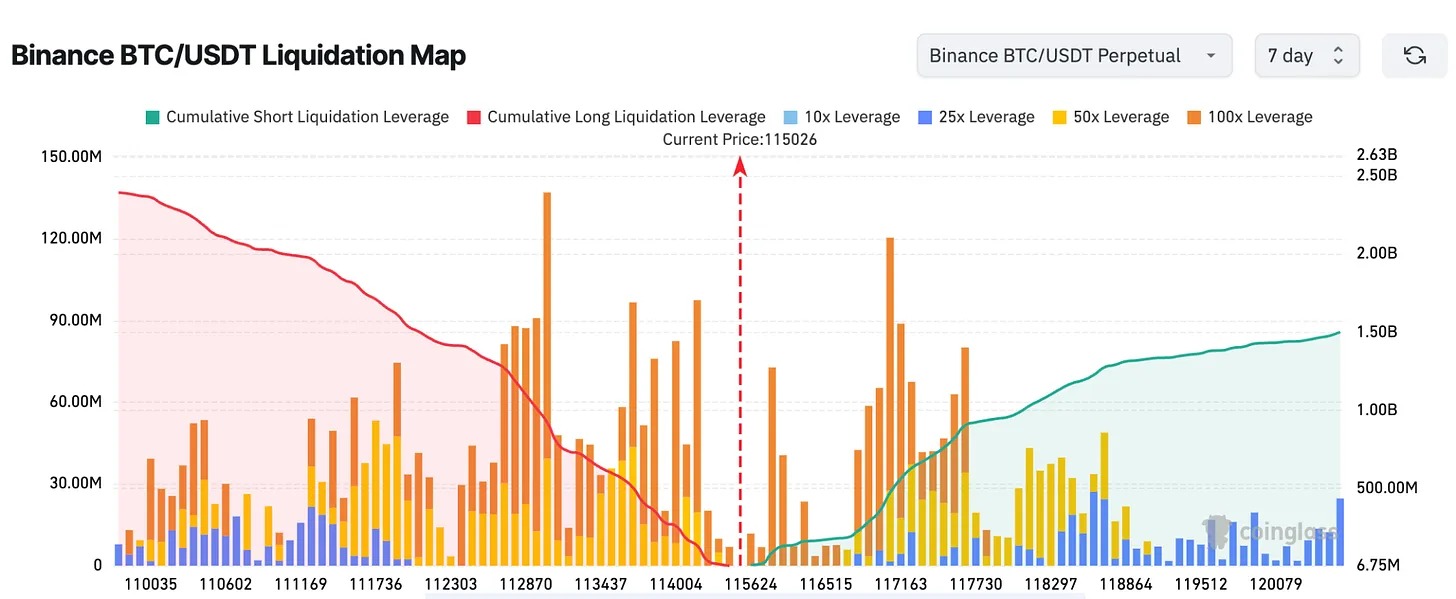

If Bitcoin reclaims and holds above $117,000, it could quickly open the path to new highs. However, if the Fed delays cuts due to recent inflation data, the market might fall back to $113,000 or lower. Order books show significant liquidity at these levels, and traders are prepared for sweeps.

Institutions clearly favor Bitcoin ETFs as an investment vehicle, while speculative traders are shifting funds to Ethereum and Solana.

If Bitcoin breaks out after the Fed decision, this momentum is expected to spread. Ethereum has already attracted substantial leverage and may outperform Bitcoin. However, if Bitcoin stalls, altcoins could be the first domino to fall as speculative capital reverses.

With ETFs absorbing supply, stablecoin balances expanding, and long-term holders gradually selling, liquidity is accumulating. Yet, market confidence remains absent, still waiting for a catalyst.

If Powell signals the start of a loosening cycle without caveats, Bitcoin is likely to rebound to $117,000 and enter a phase of price discovery above that level. If he remains cautious, warning of persistent inflation or external risks, the market may continue oscillating within its current range, possibly until the next data release in October.

For investors, on-chain indicators suggest the current phase is healthy—but caution is warranted. Institutional and corporate capital is flowing into ETFs. The risk lies more in timing than direction.

The coming week will reveal whether this waiting-for-confidence phase is about to end. All eyes are on Powell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News