HYPE, just hitting a new all-time high, could be the most undervalued token among L1s?

TechFlow Selected TechFlow Selected

HYPE, just hitting a new all-time high, could be the most undervalued token among L1s?

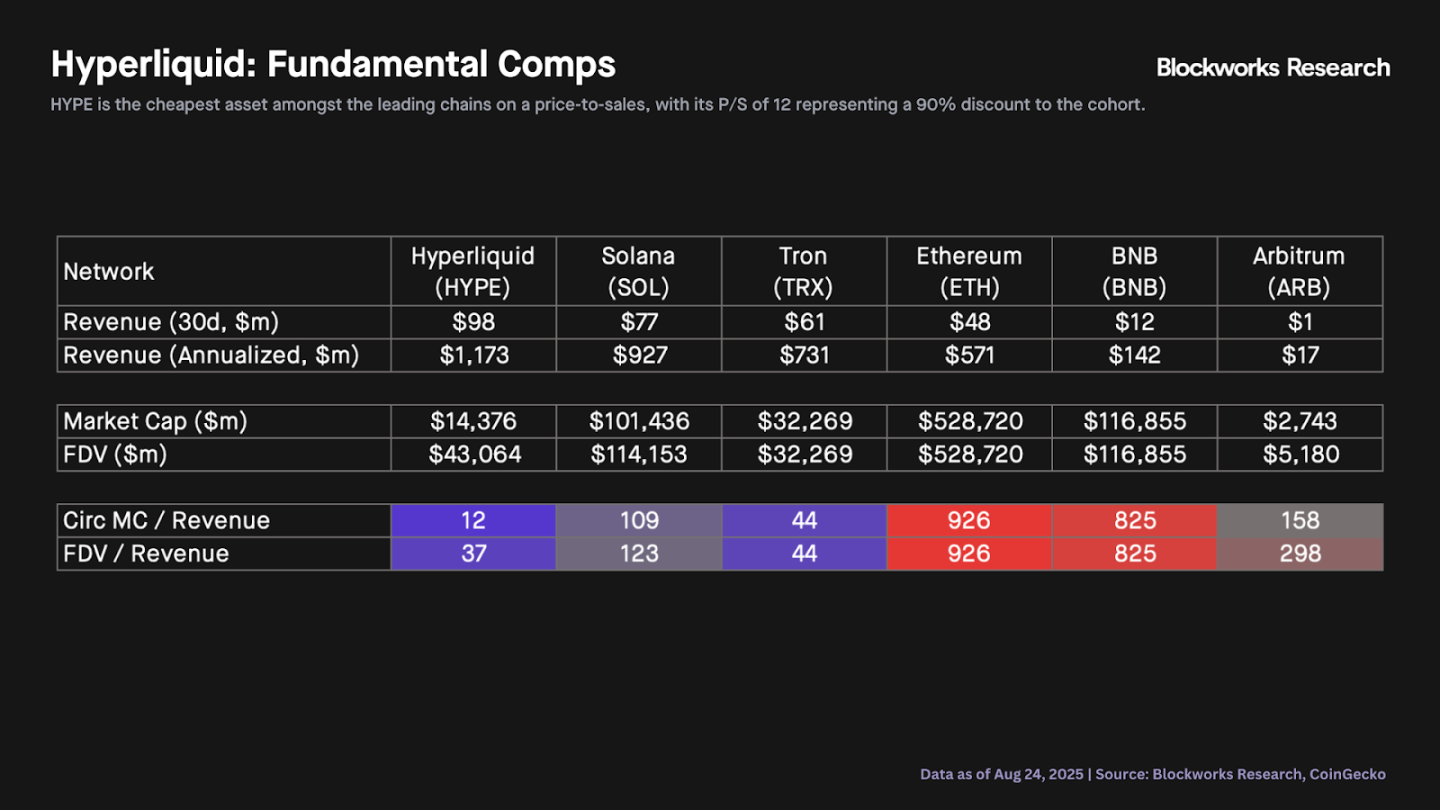

HYPE is the cheapest asset among mainstream public blockchains based on price-to-sales ratio (P/S), with a P/S ratio of 12x, which is 90% lower than its peers.

Author: Carlos

Translation: AididiaoJP, Foresight News

Hyperliquid's fundamentals continue to improve, yet its valuation remains undervalued compared to other L1s.

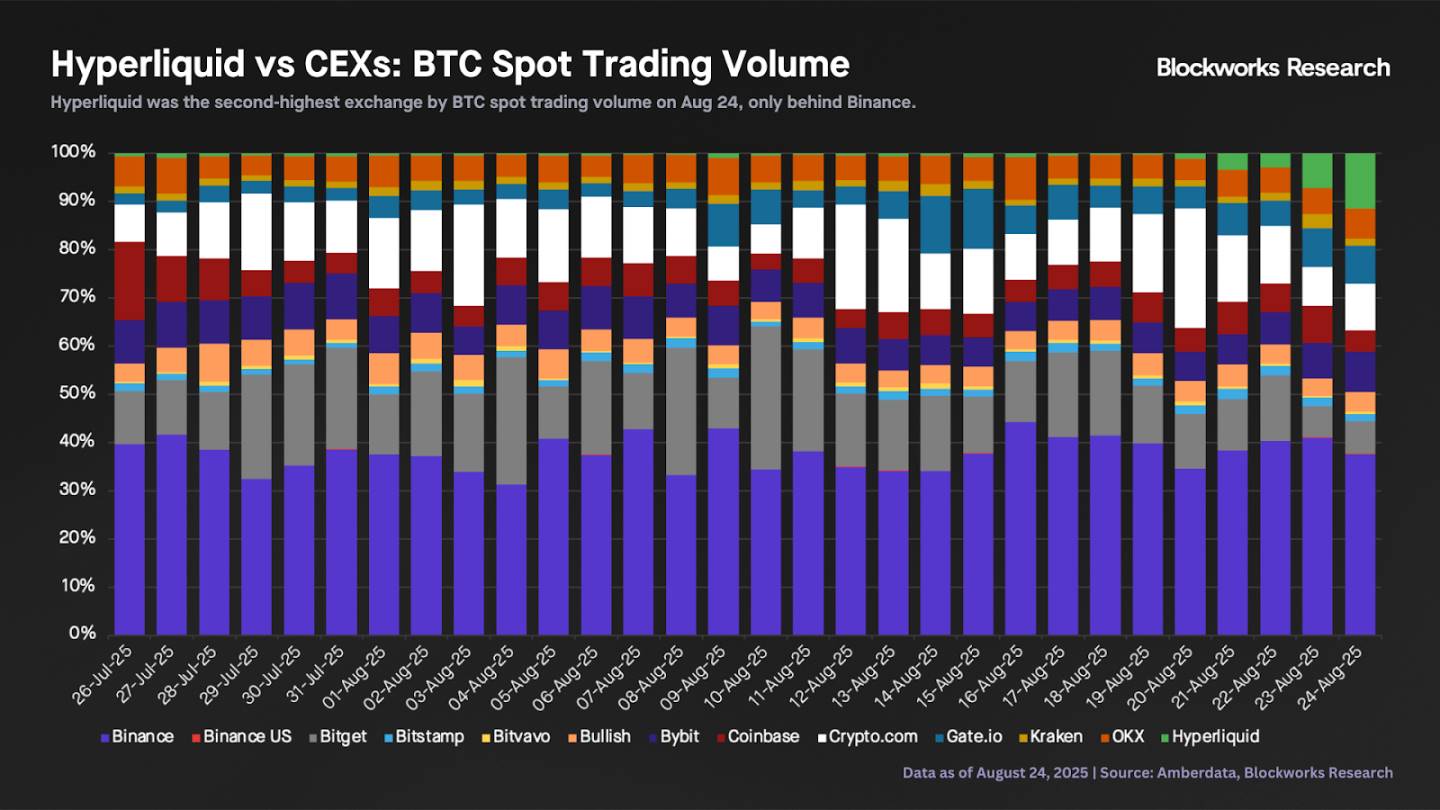

Hyperliquid has seen a significant increase in spot trading volume, especially when compared to centralized exchanges. Last weekend, an unknown entity deposited and sold approximately 22,100 BTC on Hyperliquid, using the proceeds to buy around 555,000 ETH, amounting to over $2.4 billion. This surge in spot volume made Hyperliquid the second-largest exchange by BTC spot volume on August 24, capturing a 12% market share, trailing only Binance (38%). This marks a substantial jump from Hyperliquid’s average daily market share of about 1% over the past 30 days.

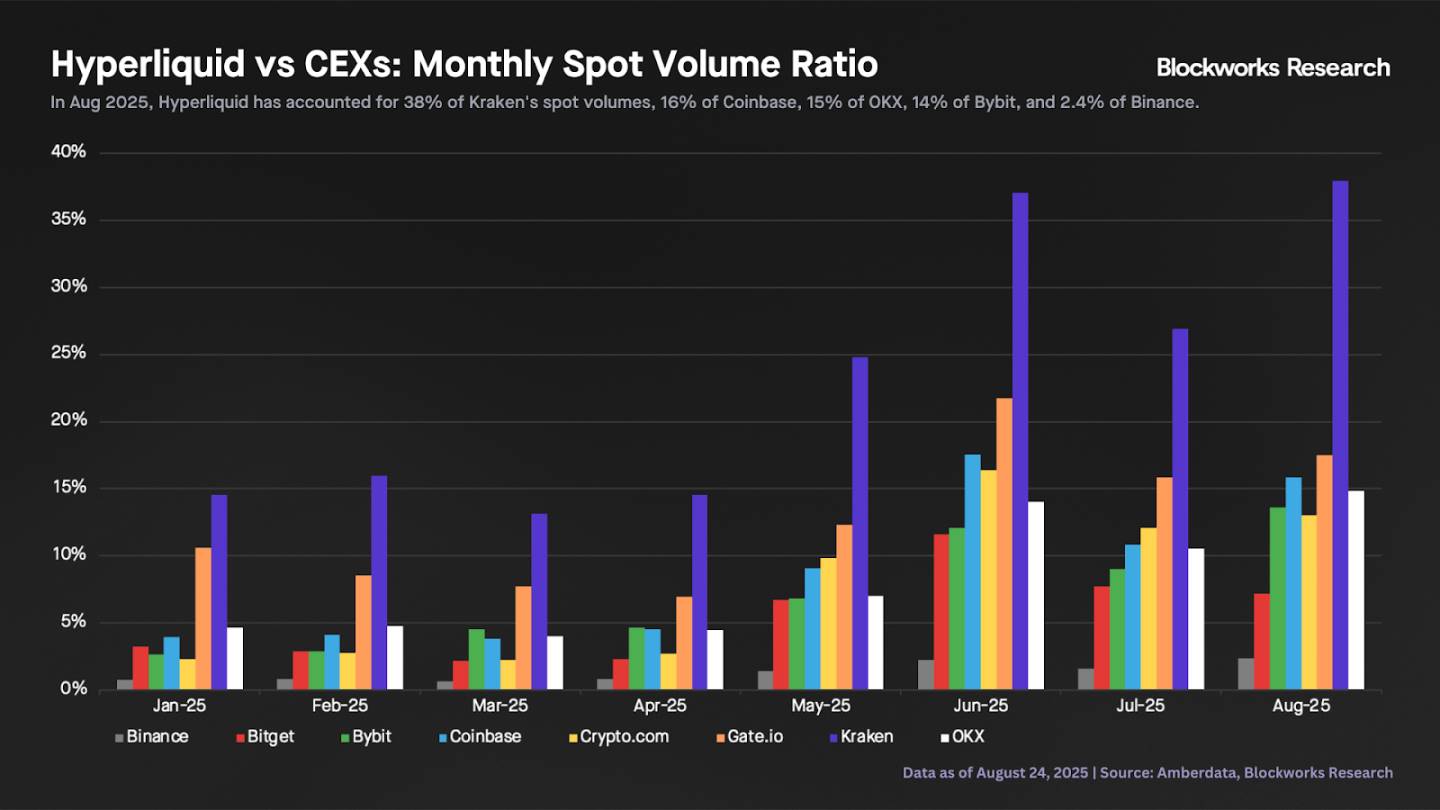

We can compare Hyperliquid’s monthly spot trading volume against several CEXs (across all assets, not just BTC). We observe that Hyperliquid’s share of spot trading volume has been steadily increasing throughout the year. This month, Hyperliquid’s spot volume reached 38% of Kraken’s, 16% of Coinbase’s, 15% of OKX’s, 14% of Bybit’s, and 2.4% of Binance’s. While all figures have risen significantly since the beginning of the year, they also indicate that Hyperliquid still has a long way to go before overtaking some of the larger CEXs.

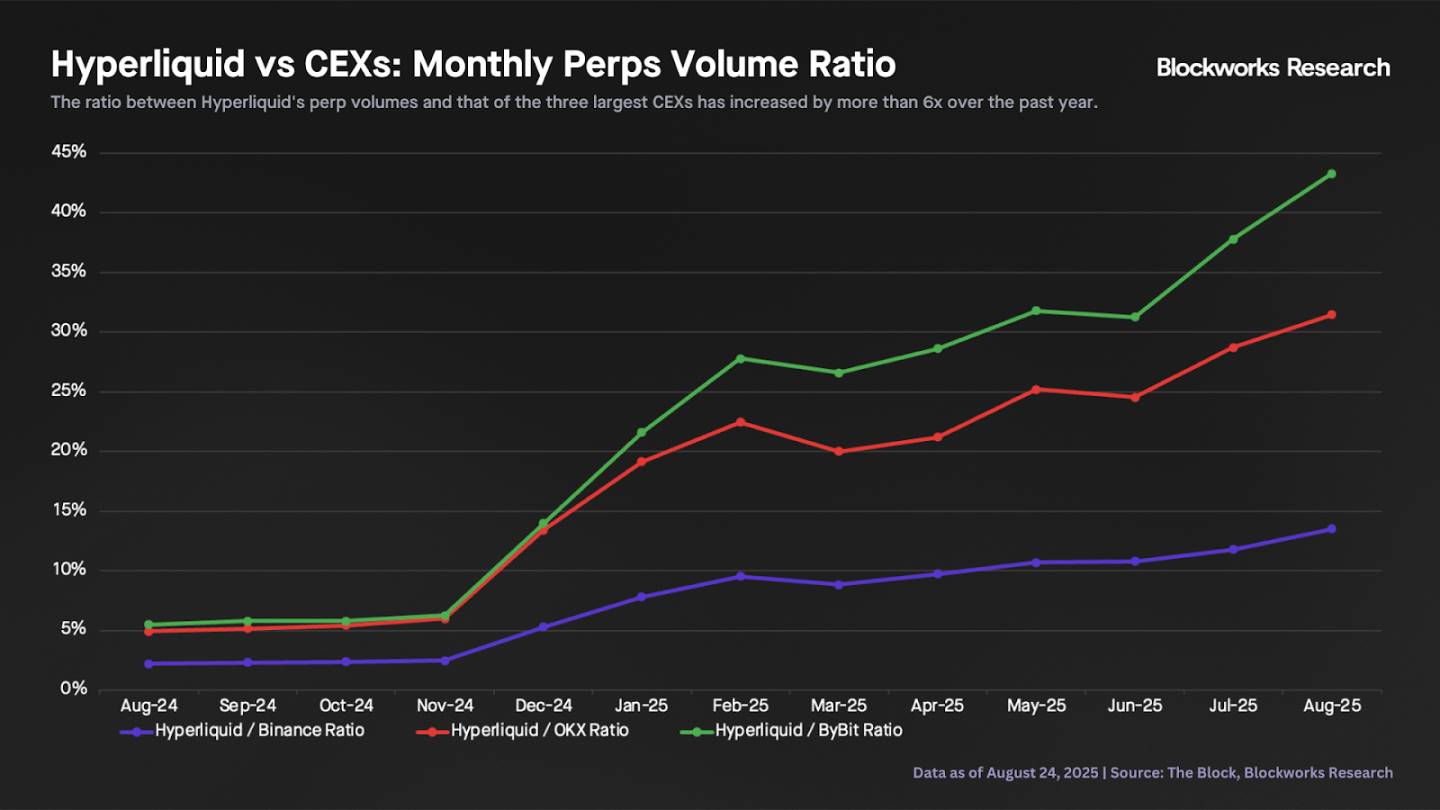

In terms of perpetual futures trading volume, Hyperliquid is growing much faster than its centralized competitors. The chart below shows that over the past year, Hyperliquid’s perpetual contract volume relative to three major CEXs has increased more than sixfold. Hyperliquid’s monthly perpetual volume now accounts for nearly 14% of Binance Futures’ volume, up from just 2.2% a year ago.

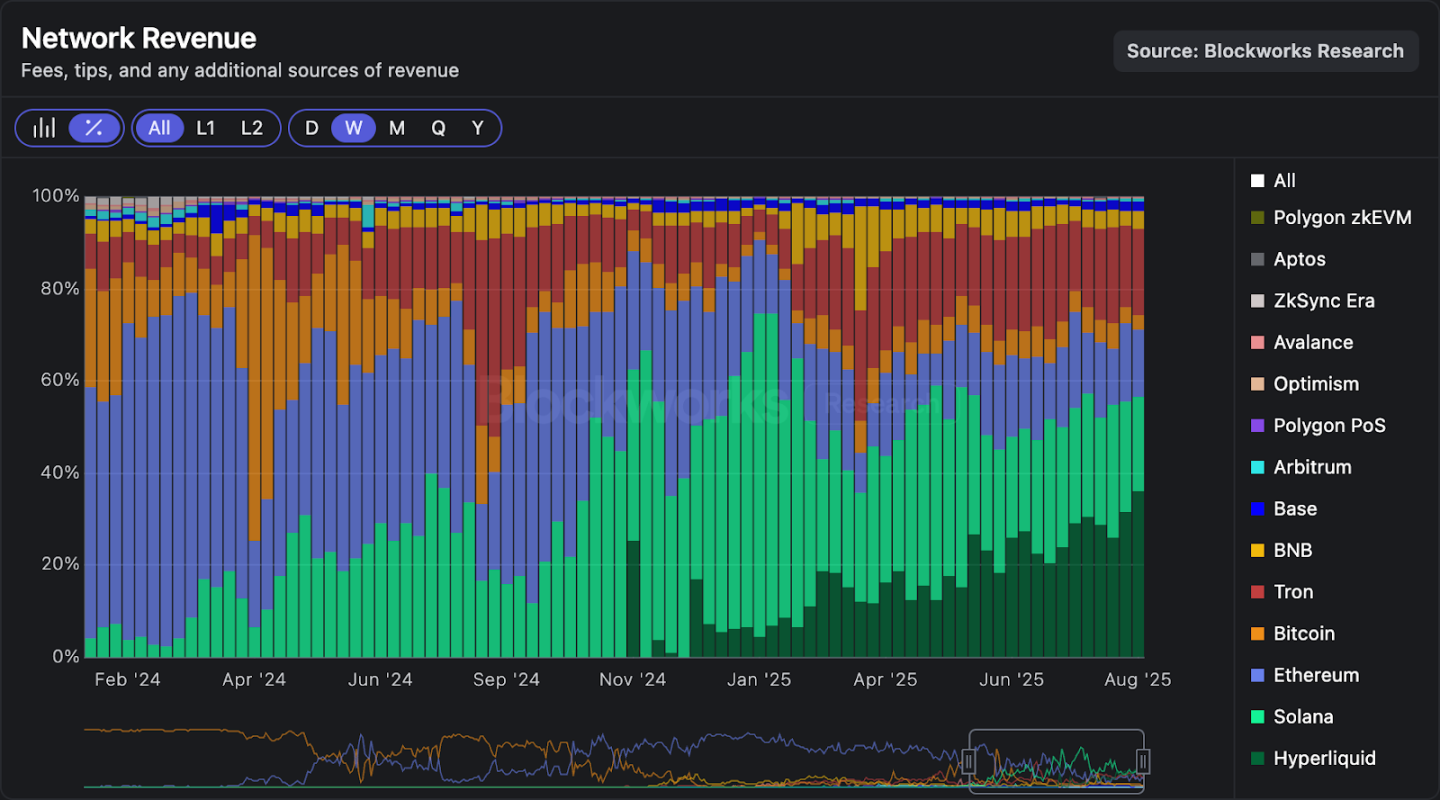

The growth in trading volume is impressive. But how does revenue compare to other chains? Hyperliquid (HyperCore + HyperEVM) has reported weekly revenue of around $28 million for two consecutive weeks, reaching $98 million in revenue over the past 30 days. These figures annualize to between $1.2 billion and $1.4 billion. The chart below shows that Hyperliquid has been the highest weekly revenue-generating chain over the past two weeks, achieving a record high market share of 36%.

The chart below shows that based on price-to-sales ratio (P/S), HYPE is the cheapest asset among major public blockchains, with a P/S of 12x—90% lower than its peers. Even when measured by fully diluted valuation to sales (FDV/sales), HYPE remains the cheapest L1. While we endlessly debate whether L1s should command a premium or be valued based on revenue, the fact is that by this single metric alone, HYPE’s current price appears more attractive than all other L1s.

What happens if the so-called "L1 premium" disappears? What if buying pressure from DATCOs weakens? Is HYPE truly undervalued, or are other L1s priced at unbelievably high valuations? We can't say for sure, but these are certainly questions worth pondering.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News