The "harvest" at 5 a.m.—who's orchestrating Hyperliquid XPL's extreme market moves?

TechFlow Selected TechFlow Selected

The "harvest" at 5 a.m.—who's orchestrating Hyperliquid XPL's extreme market moves?

Crazy 5 minutes, the market is like a roller coaster.

Author: KarenZ, Foresight News

Starting at 5:50 AM on August 27, the decentralized derivatives trading platform Hyperliquid experienced a heart-stopping extreme market event: the token XPL (pre-market), listed on its platform, surged nearly 200% within just five minutes before rapidly retreating, triggering massive short liquidations and sparking community controversy.

Event Recap: A Crazy Five Minutes, a Rollercoaster Ride

According to Hyperliquid market data, XPL's price began sharply rising from around $0.60 at 5:50 AM Beijing time on August 27, quickly soaring to a peak of $1.80—an almost 200% gain in minutes. However, this rally did not last long—the price plunged back shortly after hitting its high and is now fluctuating around $0.061.

Data from Coinglass shows that within the past four hours, short positions on XPL/USD on Hyperliquid suffered liquidations totaling $17.67 million.

Notably, during the same period, XPL prices on centralized exchanges such as Binance and Bitget, which also offer pre-market contracts for XPL, showed no significant fluctuations. This discrepancy has triggered community skepticism regarding potential price manipulation.

The Masterminds: Two Addresses Profited $27.5 Million

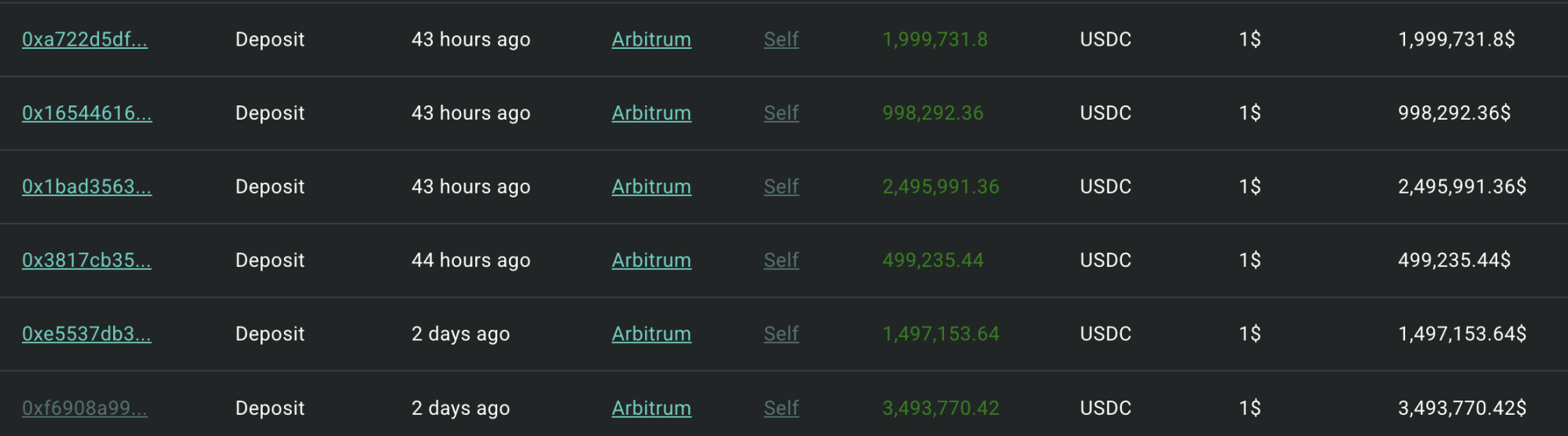

Further on-chain analysis via HypurrScan reveals that an address starting with 0xb9c began positioning two days earlier (August 24), initially depositing a total of 10.98 million USDC into Hyperliquid through six transactions, then accumulating long positions in XPL. In the early morning of today at 5:35 AM, it deposited another 4.993 million USDC into Hyperliquid.

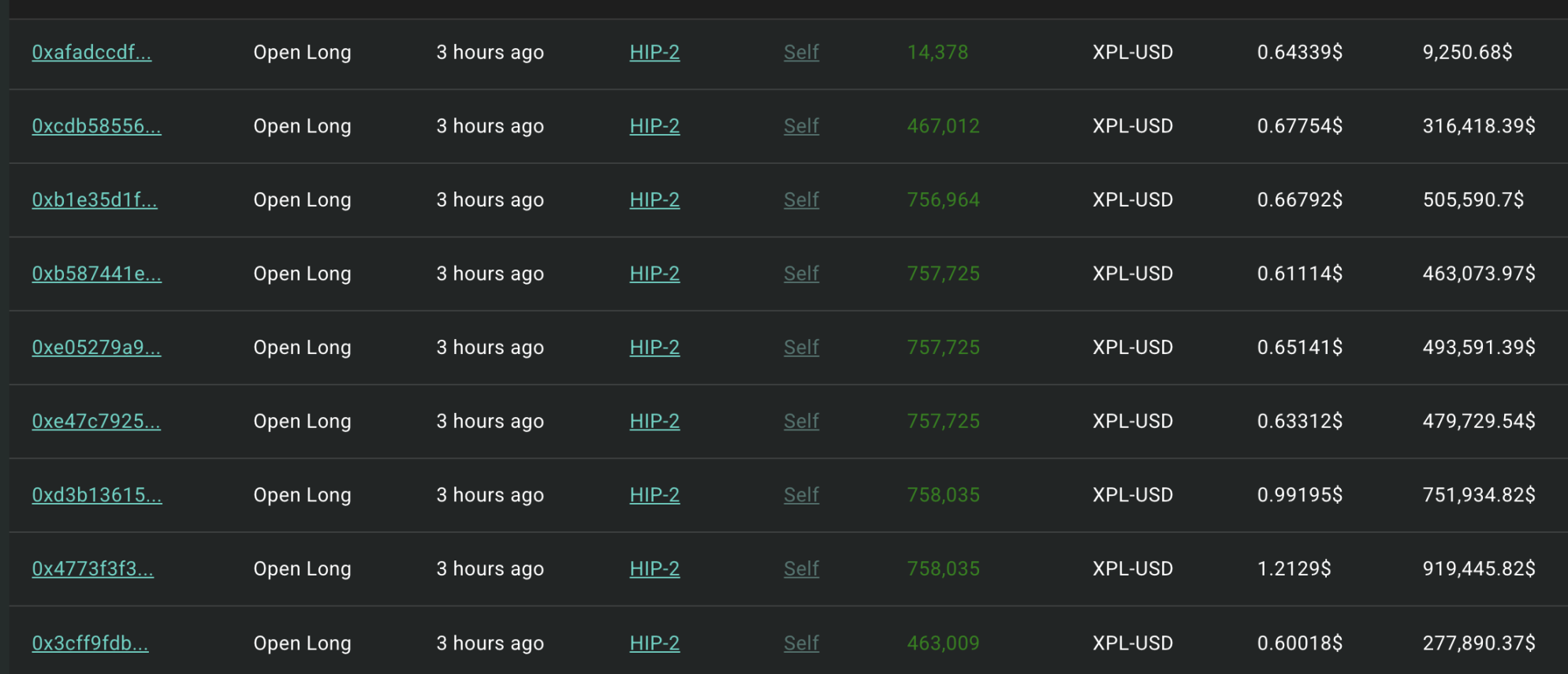

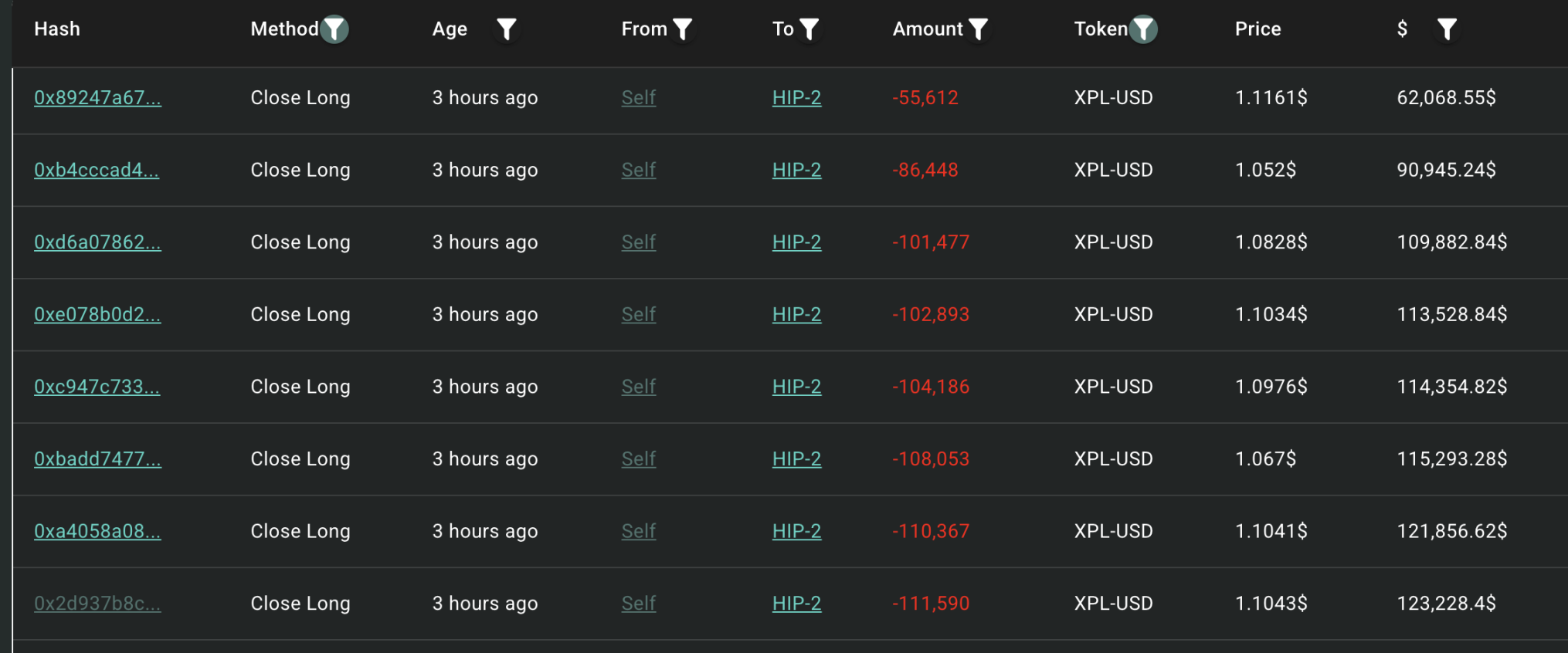

Subsequently, starting at 5:36 AM on August 27, the 0xb9c address placed multiple large long orders for XPL (each ranging from tens of thousands to hundreds of thousands of dollars), and began closing its long positions at 5:53 AM. When XPL dropped back to around $0.60, the address went long again. Currently, the 0xb9c address holds XPL contract positions valued at $8.28 million on Hyperliquid.

At approximately 8:10 AM, the 0xb9c address withdrew nearly 600,000 USDC in two transactions and took no further actions afterward.

According to @ai_9684xtpa, the address swept the entire order book clean, squeezing out all short positions (mostly 1x hedging positions), making $16 million in profit in just one minute.

Additionally, based on analysis by Yujing, the manipulator behind the XPL liquidation on Hyperliquid likely used two wallets to first accumulate long positions and then drive up the price, triggering cascading auto-liquidations and ultimately securing profits as high as $27.5 million. Specifically, the 0xb9c address pushed up XPL’s price, causing chain liquidations and eventually triggering automatic position closures between $1.10 and $1.20. On DeBank, a user named "silentraven" (address starting with 0xe417) had accumulated a long position of 21.1 million XPL over the past three days at an average price of $0.56, investing $9.5 million on Hyperliquid. After the liquidation cascade, their position was automatically closed at an average price of about $1.15, yielding a profit of $12.5 million.

Some community members have pointed fingers at Justin Sun. @ai_9684xtpa noted, “The rumor linking this to Brother Sun stems from tracing back the fund sources—this address transferred ETH to an address linked to Justin Sun five years ago—but there is no direct evidence proving it was Sun.”

Core Issues Exposed: Structural Risks in DeFi Perpetual Contracts

This incident highlights several critical vulnerabilities in DeFi perpetual contract platforms:

-

Reliance on a single oracle makes price manipulation 'child's play': Hyperliquid's perpetual contract pricing does not rely on any external data; its funding rate is determined by a moving average of the Hyperp mark price. As a pre-launch token, XPL depends solely on a single price oracle, making its price highly susceptible to manipulation. Whales can easily push prices past liquidation thresholds using large buy orders.

-

Lack of position concentration controls: Whales can 'control the market': most DeFi contract platforms currently do not impose position limits on individual users, enabling whales to manipulate market prices and liquidation mechanisms through large holdings.

Many users believed that '1x leverage hedging' carried extremely low risk and was a stable strategy, thus lowering their guard against extreme market moves. Yet, under the high volatility of crypto markets, even seemingly 'safe' strategies prove 'fragile' in the face of price manipulation or black swan events. The mass liquidation of numerous 1x leverage hedge positions in this case serves as a prime example.

@Cbb0fe stated, “In this XPL liquidation event, I performed a 10% hedge on my XPL token assets on the HyperliquidX platform, using 1x leverage shorting with substantial collateral for protection, yet still incurred a $2.5 million loss.” The user added, “I will never touch such isolated markets again.”

Takeaways

This 'five-minute storm' was not only a classic case of market manipulation but also exposed weaknesses in risk control, oracle mechanisms, and position management within DeFi derivatives protocols. If unaddressed, similar issues could easily emerge on other DeFi perpetual or synthetic equity platforms.

For traders, the key takeaway is clear: in the largely unregulated and inadequately protected crypto market, even seemingly robust hedging strategies can 'vanish instantly' when faced with whale manipulation or extreme volatility. The 'tuition fees' of the crypto market are often steep—respecting risk and making rational decisions remain essential for long-term survival.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News