Crypto Treasury Company Bubble Warning: From "Financial Alchemy" to Countdown to Liquidation

TechFlow Selected TechFlow Selected

Crypto Treasury Company Bubble Warning: From "Financial Alchemy" to Countdown to Liquidation

From premium to discount, Saylor's financial alchemy will come to an end.

Author: Joseph Ayoub, former Head of Crypto Research at Citigroup

Translation: TechFlow

Introduction

The last time crypto experienced a "traditional" bubble was in Q4 2017, when the market saw jaw-dropping double- and even triple-digit percentage daily gains, exchanges buckled under surging demand, new participants flooded in, speculative ICOs (initial coin offerings) proliferated, trading volumes hit record highs, and the market embraced a new paradigm, new heights—and even first-class luxury. This was the last mainstream, traditional retail bubble in crypto, occurring nine years after the birth of the first "trustless" peer-to-peer currency.

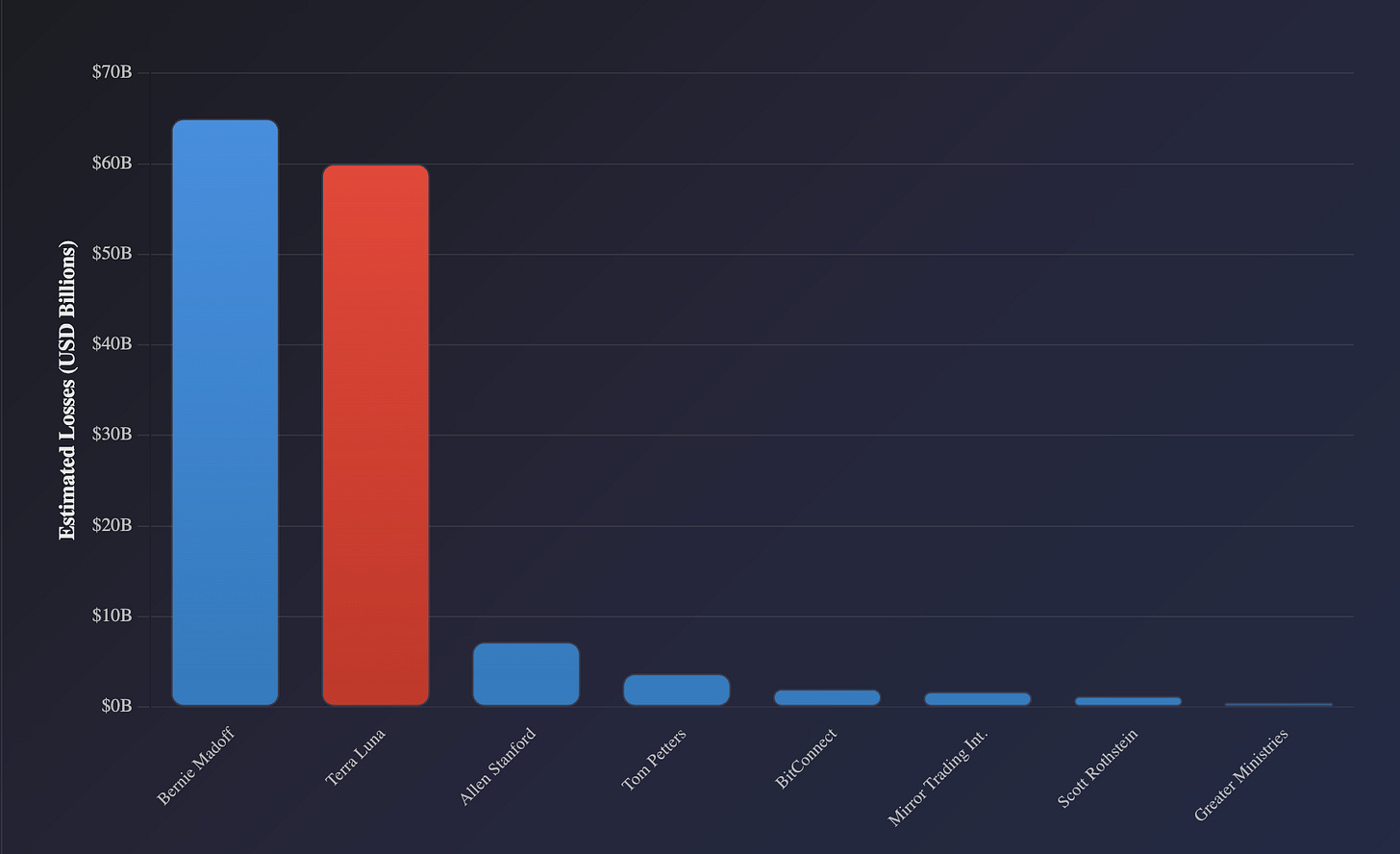

Fast forward four years, and crypto entered its second major bubble—larger in scale, more complex in structure, incorporating algorithmic stablecoins (like Luna and Terra) as a new paradigm, along with some "re-mortgaging" crimes (such as FTX and Alameda). This so-called "innovation" was so complex that few truly understood how the largest Ponzi schemes operated. Yet, as with every new paradigm, participants believed it to be a novel form of financial engineering, a new model of innovation—and if you didn't understand it, no one had time to explain.

The collapse of the largest retail Ponzi scheme

The DAT Era Arrives (2020–2025)

We didn’t realize at the time that Michael Saylor’s MicroStrategy, founded in 2020, would become the seed for institutional capital reallocation into Bitcoin—a shift catalyzed by Bitcoin’s sharp crash in 2022 [1]. By 2025, Saylor’s “financial alchemy” had become the core driver of marginal buyer demand in crypto. As in 2021, very few people truly understood the mechanics of this new paradigm in financial engineering. Still, those who had lived through previous episodes of “dangerous vibes” were becoming increasingly wary; yet, the occurrence of this phenomenon and its secondary effects precisely mark the difference between “knowing something might be wrong” and “profiting from it.”

A new paradigm of financial wisdom..?

What is the basic definition of a DAT?

Digital Asset Treasuries (DATs) are relatively simple instruments. They are traditional equity companies whose sole purpose is to buy digital assets. New DATs typically operate by raising funds from investors, selling shares in the company, and using the proceeds to purchase digital assets. In some cases, they continue issuing equity, diluting existing shareholders, to raise more capital for further asset purchases.

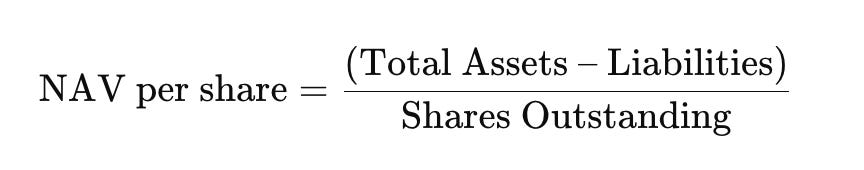

A DAT’s net asset value (NAV) is calculated simply: assets minus liabilities, divided by number of shares. However, what trades in the market is not NAV but mNAV—the market’s valuation of these shares relative to their underlying assets. If investors pay $2 for $1 of Bitcoin exposure, that’s a 100% premium. This is where the “alchemy” lies: under premium conditions, the company can issue shares and buy BTC in a value-accretive way; under discount conditions, the logic reverses—buybacks or pressure from activist investors take over.

The core of this “alchemy” lies in the fact that these are new products with the following characteristics:

A) Exciting (SBET surges 2,000% intraday)

B) Highly volatile

C) Perceived as a new paradigm in financial engineering

The Reflexivity Flywheel Mechanism

Thus, thanks to this “alchemy,” Saylor’s MicroStrategy has traded at a premium to its NAV over the past two years, enabling him to issue shares and buy more Bitcoin without significantly diluting shareholder equity or undermining stock price premiums. In this case, the mechanism is also highly reflexive:

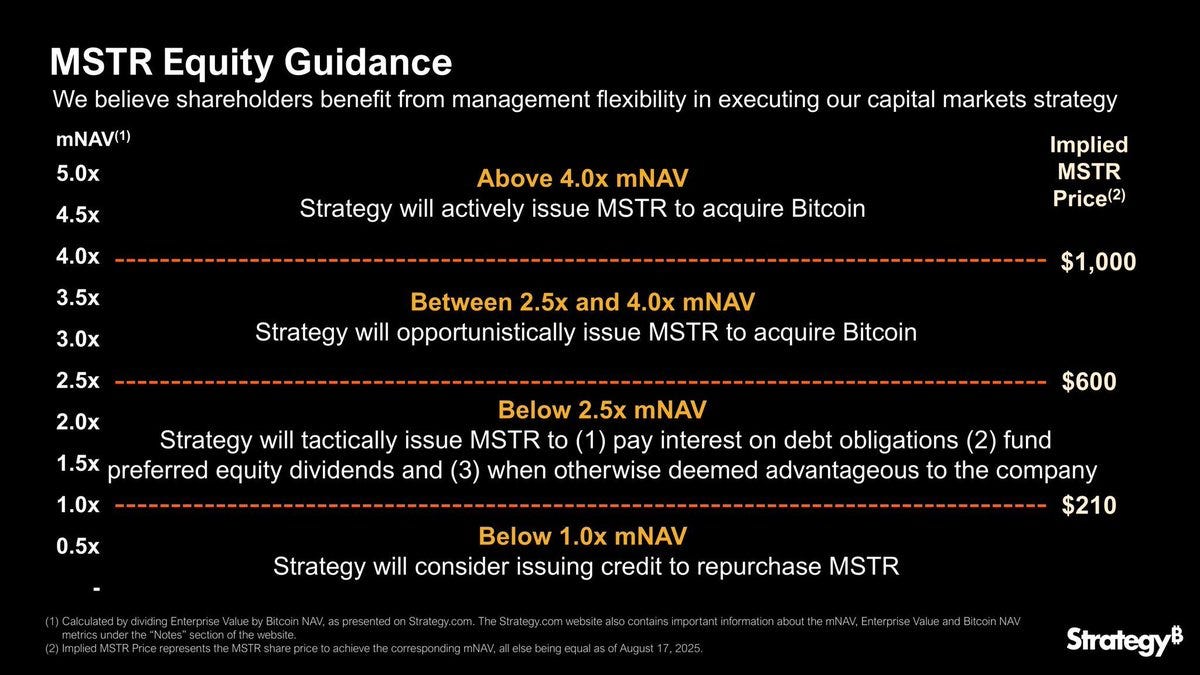

MicroStrategy can act more aggressively during premium periods. During discount periods, debt and convertible bonds become the main drivers.

mNAV premium allows Saylor → issue shares → buy BTC → BTC price rises → increases NAV and share price → attracts more investment at stable premium → further funding and more purchases.[2]

However, a notable divergence has emerged: the strong correlation between discount and Bitcoin price seems to have broken down—possibly due to the launch of other DATs in the market. Yet this could mark a critical turning point, as MicroStrategy’s ability to sustain this flywheel through fundraising has weakened, and its premium has declined substantially. This trend deserves close attention; in my view, such a premium is unlikely to return significantly.

MSTR Premium/Discount vs. Bitcoin Price

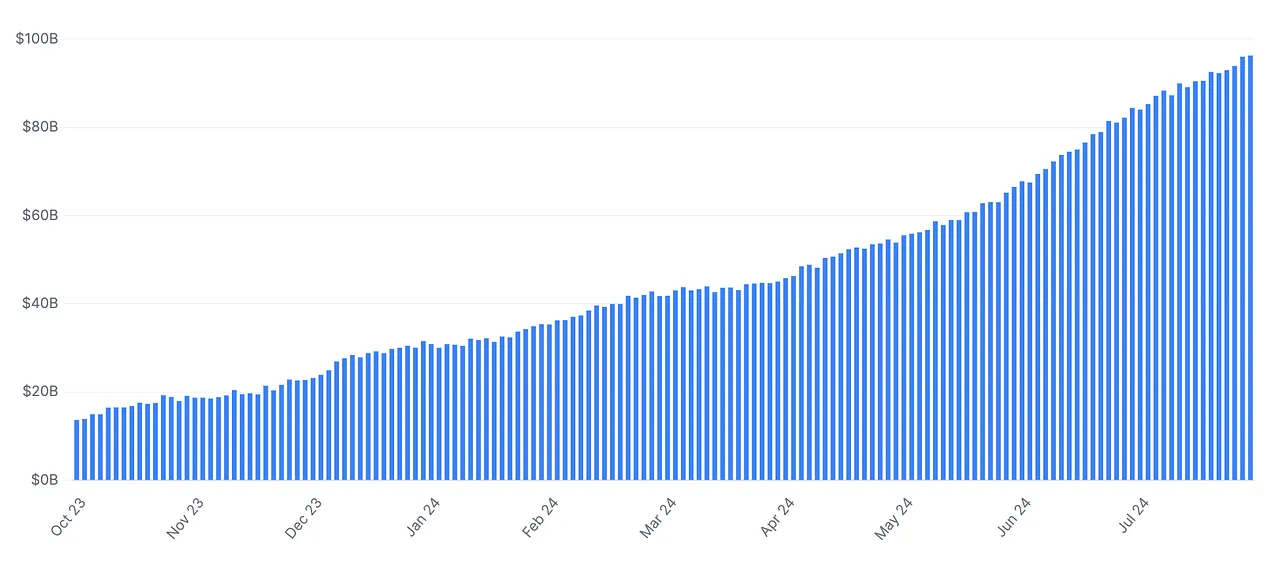

Undoubtedly, as the NAV of DATs has grown from $10 billion in 2020 to over $100 billion today, these instruments have provided significant liquidity to the market—comparable to the total $150 billion of all Bitcoin ETFs combined. Under favorable risk conditions, this mechanism injects a highly reflexive pricing dynamic into the underlying asset, like all risk assets including Bitcoin [3].

Total Net Asset Value of Crypto Treasury Companies

Why It Will Collapse

I don’t think the path this will take is complicated. To me, there are only three paths and one logical conclusion:

-

DATs continue trading above mNAV premium, the flywheel keeps spinning, and unmet demand pushes crypto prices higher. This is a new paradigm driven by financial alchemy.

-

DATs begin trading at a discount, leading to gradual unwinding until forced liquidation and bankruptcy protection (Chapter 11), ultimately collapsing completely.

-

DATs begin trading at a discount, forcing them to sell underlying assets to repurchase shares, repay debt, and cover operating costs. This unwinding becomes recursive until DATs shrink in size and eventually become “ghost companies.”

I believe the likelihood of DATs continuing to trade at a premium is extremely low. In my view, such premiums are a result of loose liquidity benefiting risk assets—conditions that also helped Nasdaq stocks and overall equity valuations perform well. However, when liquidity tightened in 2022/2023, MSTR clearly did not trade at a premium and even went briefly into discount territory. This, to me, is the first area of mispricing—DATs should not trade at a premium. In fact, these companies should trade at a deep discount to NAV.

The reason is that the implied equity value of these companies depends on their ability to create value for shareholders; traditional firms do this via dividends, buybacks, acquisitions, business expansion, etc. DATs lack such capabilities. Their only tools are issuing shares, issuing debt, or minor financial maneuvers like staking—which have negligible impact. So what is the value of holding these equities? Theoretically, the value of DATs lies in their ability to return NAV to shareholders; otherwise, their equity value is meaningless. But given that none of these instruments have delivered this possibility—and some have even pledged never to sell their underlying assets—the value of these shares now depends solely on what the market is willing to pay.

Ultimately, equity value now depends on:

-

The probability of future buyers creating a premium (based on DATs’ ability to continuously raise capital at a premium).

-

The price of the underlying asset and market liquidity absorbing sales.

-

The implied probability that shares can be redeemed at NAV.

If DATs could return capital to shareholders, they would resemble ETFs. But since they cannot, I believe they are closer to closed-end funds (CEFs). Why? Because they are vehicles holding underlying assets but lack any mechanism to distribute those asset values to investors. For those with good memories, this clearly recalls GBTC and ETHE, which underwent similar dynamics during their major unwind in 2022, when CEF premiums rapidly turned into steep discounts [4].

This unwinding is essentially priced based on liquidity and the implied probability of future conversion. Since neither GBTC nor DATs offer redemption, in times of ample liquidity and high demand, the market prices them at a premium. But when the underlying asset price falls and begins contracting, the discount becomes glaring—trusts can trade at up to a 50% discount to NAV. Ultimately, this NAV “discount” reflects what investors are willing to pay for an asset that cannot logically or predictably distribute NAV value to holders—thus pricing is based on the potential to achieve this in the future and on liquidity demand.

Market confidence wanes and liquidity tightens, Grayscale Bitcoin Trust premium collapses

Debt and Secondary Risks

Likewise, beyond capital return, the only ways DATs can create value for shareholders are through financial management (e.g., staking) or through debt issuance. If we see DATs beginning to issue large amounts of debt, this would signal that a major unwind may be imminent—though I believe the likelihood of heavy leverage is low. In either case, these value-creation methods are far inferior compared to the equity value of holding the assets themselves, making this situation reminiscent of GBTC. If this analysis holds, investors will eventually realize it, the confidence bubble will burst, leading to a shift from premium decay to discount—and potentially triggering sales of the underlying assets.

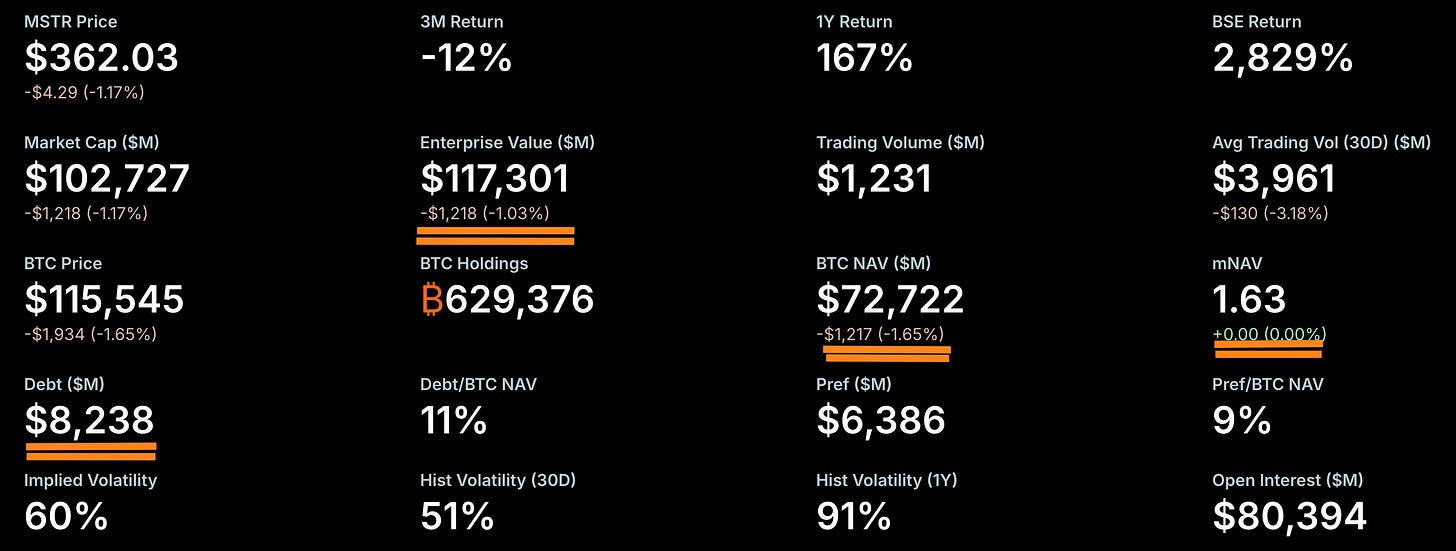

Now, I believe the probability of forced liquidation or bankruptcy protection due to leverage or debt is also very low. Current debt levels are insufficient to threaten MicroStrategy or other DATs, especially since these trusts prefer equity financing. Take MicroStrategy: $8.2 billion in debt against 630,000 BTC held—Bitcoin would need to fall below $13,000 for debt to exceed assets, a scenario I consider extremely unlikely [5]. BMNR and other Ethereum-focused DATs have almost no leverage, so forced liquidation is unlikely to be a primary risk. Instead, other DATs besides MSTR are more likely to undergo gradual wind-down via aggressive acquisition or shareholder votes, returning capital to shareholders. All acquired Bitcoin and Ethereum could re-enter circulation directly into the market.

Saylor’s Options

Although Saylor owns only about 20% of MicroStrategy’s equity, he holds over 50% of voting power. Therefore, it is nearly impossible for activist funds or investor coalitions to force share sales. A likely consequence of this is that if MSTR begins trading at a steep discount and investors cannot compel buybacks, there may be lawsuits or regulatory scrutiny, which could further negatively impact the stock price.

Debt remains far below net asset value, mNAV still in premium.

Overall, I am concerned the market may reach a saturation point where additional DATs no longer impact prices, weakening the reflexivity of these mechanisms. Once market supply is sufficient to absorb artificial and immature DAT demand, the unwind will begin. In my view, such a future may not be distant. It seems just around the corner.

Still, Saylor’s “debt” narrative is greatly exaggerated. His current holdings are not large enough to pose a significant problem in the short term. In my view, his convertible bonds will ultimately have to be redeemed in cash at face value, because if adjusted NAV (mNAV) turns negative, his equity could fall sharply.

A key point to watch is whether Saylor will issue more debt to repurchase shares when mNAV falls below 1. I believe this method is very unlikely to resolve mNAV issues, as investor confidence, once damaged, is hard to restore. Thus, continuously issuing debt to patch mNAV problems could be a risky path. Moreover, if mNAV continues to decline, MSTR’s ability to issue more debt to cover its obligations will become increasingly difficult, further affecting its credit rating and investor demand for its product. In this case, issuing more debt could trigger a reflexive downward spiral:

mNAV declines → investor confidence drops → Saylor issues debt to buy back shares → investor confidence remains low → mNAV continues to fall → pressure increases → more debt issuance (debt must reach significant leverage levels before becoming dangerous).

Saylor considers debt-financed share buybacks—a potentially dangerous path

Regulation and Historical Precedents

In the current environment, two scenarios are more likely:

-

MicroStrategy faces class-action lawsuits demanding shareholder capital be returned to NAV;

-

Regulatory scrutiny. The first scenario is relatively straightforward and could occur at a significant discount (below 0.7x mNAV). The second is more complex and has historical precedents.

History shows that when companies appear to be operating businesses but effectively function as investment vehicles, regulators may step in. For example, in the 1940s, Tonopah Mining was ruled an investment company because it primarily held securities [6]. In 2021, GBTC and ETHE traded at extreme premiums before crashing to 50% discounts. Regulators looked away while investors profited, but when retail investors began losing money, the narrative shifted, ultimately forcing conversion into ETFs.

MicroStrategy’s situation is similar. While it still claims to be a software company, 99% of its value comes from Bitcoin. In reality, its equity functions as an unregistered closed-end fund with no redemption mechanism. This distinction can only be maintained during strong markets.

If DATs continue trading at a discount, regulators may reclassify them as investment companies, restricting leverage, imposing fiduciary duties, or mandating redemptions. They might even shut down the equity issuance “flywheel” entirely. What was once seen as financial alchemy during premium periods could be labeled predatory during discount periods. This may be Saylor’s true vulnerability.

What’s the headline?

I’ve hinted at what might happen—now I’ll make some direct predictions:

-

More DATs will launch targeting higher-risk, more speculative assets, signaling the liquidity cycle is nearing its peak.

-

Pepe, Bonk, Fartcoin, and others

-

-

Competition among DATs will dilute and saturate the market, causing mNAV premiums to decline significantly.

-

DAT valuation dynamics will gradually converge toward closed-end fund behavior

-

This trend can be captured via “short equity / long underlying asset” trades to bet on mNAV premium compression

-

Such trades carry funding costs and execution risk. Using OTM (out-of-the-money) options is a simpler alternative.

-

-

-

Within the next 12 months, most DATs will trade at a discount to mNAV, marking a key inflection point for crypto prices entering a bear market.

-

Share issuance halts. Without new capital inflows, these companies become static “zombie firms” on their balance sheets. No growth flywheel → no new buyers → discount persists.

-

-

MicroStrategy may face class-action lawsuits or regulatory review, potentially challenging its “never sell Bitcoin” pledge.

-

This marks the beginning of the end

-

-

As falling prices exert reflexive downward pressure on the underlying assets, positive sentiment toward financial engineering and “alchemy” will rapidly turn negative.

-

Perceptions of Saylor, Tom Lee, and others will shift from “geniuses” to “scammers”

-

-

Some DATs may use debt instruments during market unwinds—to repurchase shares or buy more assets → a sign of impending collapse.

-

A related strategy is to leverage debt and increase short premium positions

-

-

An activist fund may acquire a DAT’s shares at a discount and pressure or force its liquidation and asset distribution.

-

At least one activist fund (e.g., Elliott or Fir Tree) will buy DAT positions at steep discounts, push for liquidation, and force BTC/ETH return to shareholders. This would set a precedent.

-

-

Regulatory intervention:

-

The SEC may enforce disclosure rules or investor protections. Historically, persistently discounted closed-end funds have prompted regulatory reform.

-

Sources

[1] MicroStrategy Press Release

[2] MicroStrategy SEC 10-K (2023)

[3] Bloomberg – “Crypto Treasury Companies Now Control $100bn in Digital Assets”

[4] Financial Times – “Grayscale Bitcoin Trust Slides to 50% Discount” (Dec 2022).

[5] MicroStrategy Q2 2025 10-Q filing.

[6] SEC v. Tonopah Mining Co. (1940s ruling on investment company status).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News