Figma's 250% surge on its first trading day: The deep logic behind why collaboration platforms are more indispensable than ever in the AI era?

TechFlow Selected TechFlow Selected

Figma's 250% surge on its first trading day: The deep logic behind why collaboration platforms are more indispensable than ever in the AI era?

Artificial intelligence technology is not eliminating collaboration platforms, but rather making genuine collaboration platforms even scarcer and more valuable.

Have you ever wondered why, in an era when AI can generate everything, a "drawing tool" has become even more valuable? On July 31, Figma officially debuted on the New York Stock Exchange, closing its first day with a market capitalization of $56.3 billion and a P/S multiple exceeding 60x. In contrast, the average P/S multiple for the SaaS industry is only 7x—this figure not only far surpasses valuation levels of mature SaaS companies like Adobe and Salesforce, but is even more staggering than Adobe’s attempted acquisition offer of $20 billion two years ago. More thought-provoking is that this valuation comes amid an explosion of AI-powered design tools, where ChatGPT can rapidly produce design drafts and Midjourney generates stunning images. Logically, when AI automates design work, the value of traditional design tools should diminish—but reality suggests the opposite.

Why are investors willing to assign such a high valuation to a collaborative design platform? What future outlook does this reflect? As I delved into Figma’s IPO prospectus, analyzing its impressive metrics—over $900 million in annual recurring revenue, a 46% year-over-year growth rate, and a 132% net revenue retention rate—I uncovered a颠覆认知 insight: Artificial intelligence is not eliminating collaboration platforms; it is making true collaboration platforms increasingly scarce and valuable. This scarcity is redefining the value logic across the entire software industry and offers a new lens through which to understand global tech investment trends. Within this transformation, strategically significant, high-quality assets are waiting to be rediscovered.

The Business Secret Behind a Stunning Statistic: Two-Thirds of Users Are Non-Designers

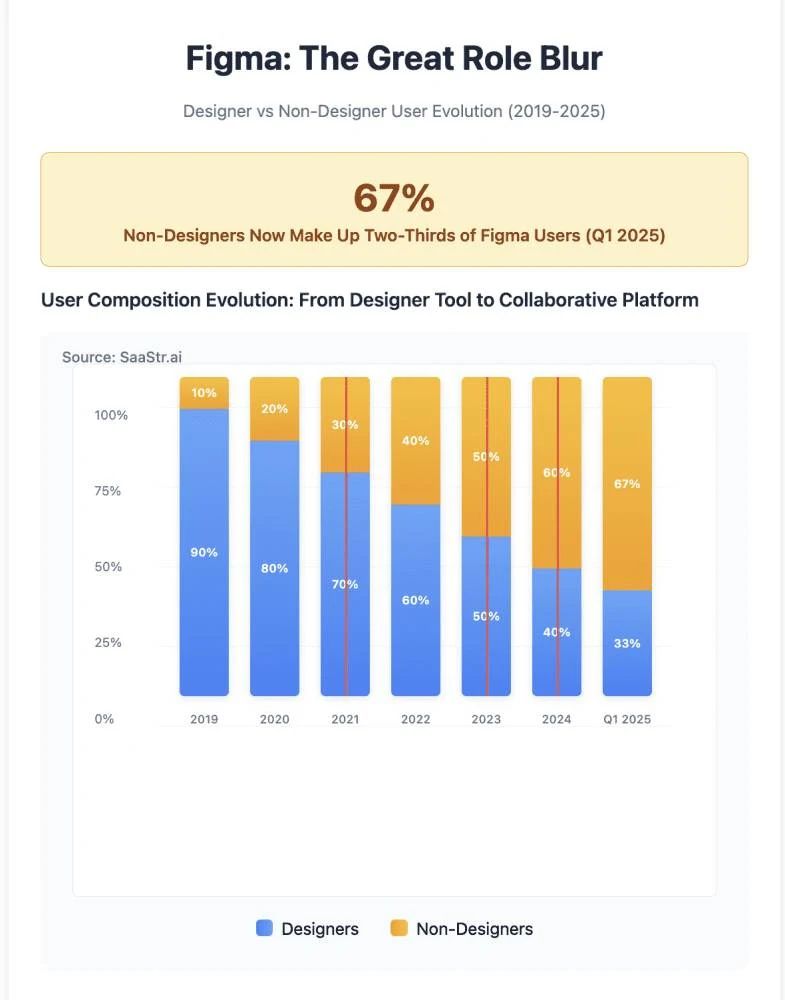

What's most disruptive about Figma isn't its revenue or features, but its user composition: two-thirds of its 13 million users are not professional designers. This reflects a profound shift in corporate collaboration—from workflows centered on job roles to systems centered on collaboration. Figma is no longer just a design tool; it has evolved into a cross-functional collaboration platform. In the AI era, enterprises are willing to pay for tools that enhance teamwork—not solitary productivity.

Let me share a striking fact: two-thirds of Figma’s 13 million monthly active users are not designers. This means product managers, developers, marketers, operations staff, and even CEOs use this software originally defined as a “design tool.” If you think this is merely natural user expansion, you’re missing the point. This statistic reveals a fundamental transformation in how modern businesses operate—and signals an upcoming paradigm shift in the software industry.

In traditional business workflows, design was a relatively isolated, specialized function. Designers created within their dedicated software, then handed off files to product managers for review, followed by developers for implementation, and finally marketers for promotion. This linear, siloed workflow worked in early internet days when product complexity and iteration cycles were low. But in today’s world, where product lifecycles are measured in weeks or even days, this model has become a major efficiency bottleneck.

According to Deloitte research, 57% of business leaders predict AI will “substantially change” their companies within three years—but this change isn’t simply about replacement. Figma’s shifting user base reflects enterprises’ urgent need for real-time, cross-functional collaboration. When product managers can annotate requirements directly on design files, developers can instantly access design specs, and marketing teams can quickly create campaign materials, the entire product development process undergoes a qualitative leap. More importantly, this mode eliminates information loss and miscommunication, ensuring the final product aligns closely with original design intent.

I’ve found that this shift in user composition signals a broader trend: software boundaries are disappearing. We once categorized software by function—design tools, development environments, project management apps, communication platforms. But with AI advancement, these lines blur. A superior collaboration platform no longer just offers specific functions—it becomes the infrastructure supporting entire workflows. The value of such infrastructure far exceeds the sum of traditional functional software.

From a business model perspective, this user shift fundamentally optimizes revenue structure. Enterprises pay not just for designer tools, but for management and collaboration itself. Traditional design software relies primarily on designer subscriptions—a clear ceiling. But when two-thirds of users are non-designers, scalability becomes nearly infinite. While a company may have only a few designers, it often has dozens of product managers, developers, and operations staff. This shift in user composition unlocks exponential revenue potential—and explains why investors assign Figma such a high valuation premium.

The Counterintuitive Reality of the AI Era: Exponential Growth in Collaboration Needs

Many assume AI reduces collaboration needs, but reality is counterintuitive: AI increases information complexity, compresses decision cycles, and brings more non-design roles into the loop. Design is no longer about “creating one version,” but “iteratively refining multiple versions in real time.” Figma ensures brand consistency through design systems and has become a central hub for intelligent collaboration. Rather than diminishing, collaboration evolves into a foundational layer of AI systems.

As I analyzed Figma’s strategic positioning and user behavior shifts during the AI wave, I discovered a highly counterintuitive yet logical phenomenon: rather than weakening collaboration platforms, AI strengthens their strategic importance in unprecedented ways. This reveals a fundamental cognitive bias in how we perceive AI’s impact—and provides critical clues for forecasting software industry evolution.

The conventional view holds that when AI auto-generates designs, code, or charts, the value of corresponding specialized software and collaboration tools declines. This logic seems sound: if AI delivers results directly, why maintain complex tools and cumbersome workflows? Yet Figma’s actual data completely contradicts this expectation. In 2024, Figma launched 180 new feature updates, most integrating AI capabilities—auto-layout optimization, smart component recommendations, design rule checking, and more. These AI features didn’t reduce collaboration frequency—in fact, they significantly boosted team engagement.

The key lies in understanding the essence of “design work.” Design is never just “generating graphics” or “creating visuals.” It’s a complex problem-solving process involving requirement analysis, user insights, strategy formulation, solution exploration, feedback integration, and iterative refinement. AI indeed supercharges the “solution generation” phase, enabling designers to explore more possibilities rapidly—but this makes other phases more critical and complex. When AI generates ten design options, how does the team evaluate their trade-offs? How do they select the best option based on user feedback and business goals? How do they ensure correct implementation? These questions demand stronger collaboration mechanisms.

AI also compresses the timeline of design work. Traditionally, a design project might take weeks, allowing ample time for gradual communication and adjustments. But when AI rapidly generates design options, timelines shrink dramatically—requiring teams to collaborate in real time. Asynchronous email threads and periodic meeting reviews can no longer keep pace. Real-time platform-based collaboration, instant feedback, and rapid iteration become essential.

Moreover, this compression introduces a deeper challenge: while AI boosts productivity across tasks, it’s also prone to errors and inaccuracies. When multiple roles use AI to generate content quickly, ensuring brand consistency and design quality becomes paramount. This is precisely where collaboration platforms shine—Figma maintains cohesion across roles via online collaboration and design systems, preserving consistency in enterprise software, user experience, and branding.

Further, AI increases the complexity of design decisions. This complexity demands stronger collective intelligence and decision-making frameworks. Collaboration platforms serve as the vehicle for this collective intelligence—not only hosting diverse AI-generated outputs, but also providing effective evaluation, discussion, and decision tools to help teams make optimal choices among many options.

From a commercial standpoint, AI-driven collaboration growth opens new revenue streams. Traditional SaaS models charge based on user count and usage duration. But in AI-enhanced collaboration, platforms can price based on collaboration complexity, AI processing volume, and intelligent service value. This multidimensional value creation and capture model expands the commercial potential of collaboration platforms.

The New Logic of Platform Economics: From Feature Stacking to Ecosystem Synergy

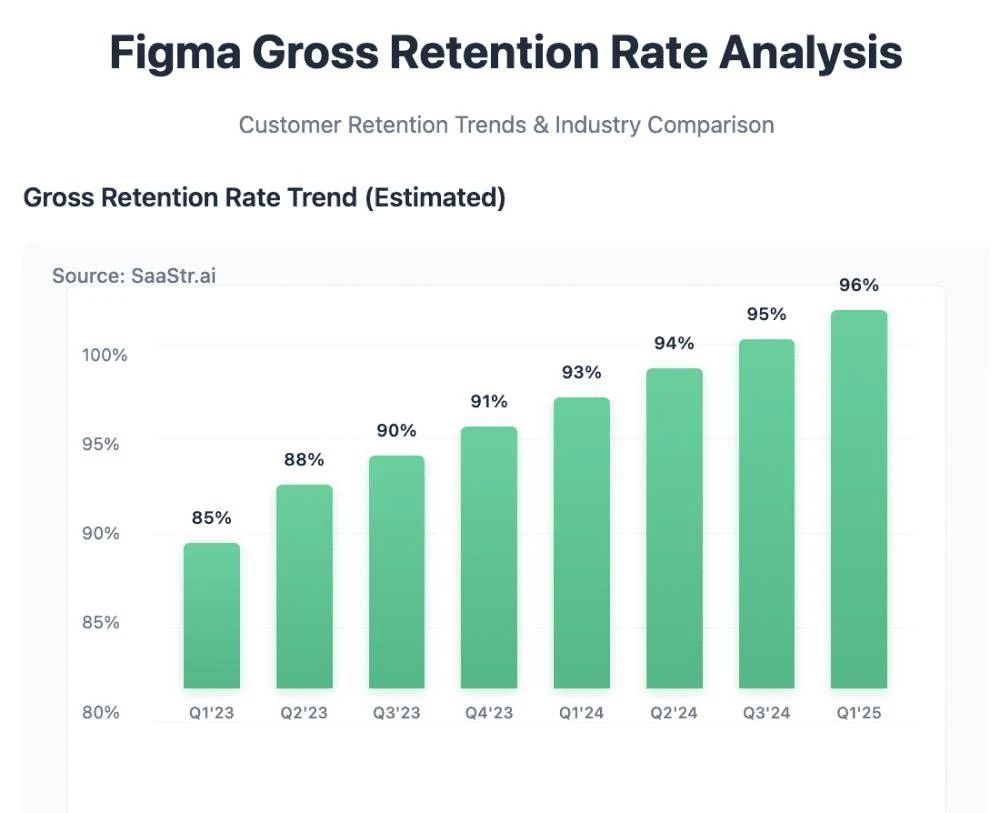

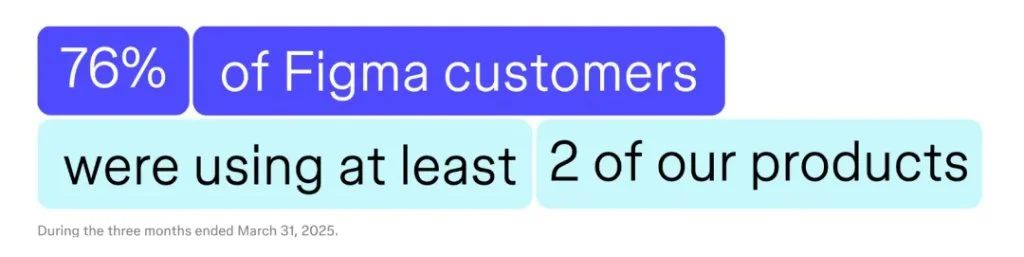

76% of Figma users employ multiple products—not because of feature quantity, but due to strong synergy. AI enables data, processes, and permissions to span roles and scenarios. The deeper users engage with the ecosystem, the higher the switching cost. The number of customers paying over $100,000 annually surged 47%, indicating enterprises now view Figma as a “high-stickiness collaboration platform,” not just a point tool. This represents a new moat paradigm for platform companies.

Studying Figma’s business model evolution reveals a key trait of today’s platform economy: multi-product synergy is becoming the core determinant of platform value, while traditional feature competition fades. This shift redefines software companies’ product strategies and offers fresh insights into platform economics.

Among Figma users, 76% use two or more products. Behind this simple number lies a profound shift in enterprise software consumption. In the traditional SaaS era, companies bought specialized software for each need: design tools for design, project management tools for PM, messaging apps for communication. This “point solution” approach worked when functions were independent. But in today’s deep digital transformation, fragmented software usage hampers efficiency. Siloed data, disconnected workflows, and inconsistent experiences impose massive hidden costs.

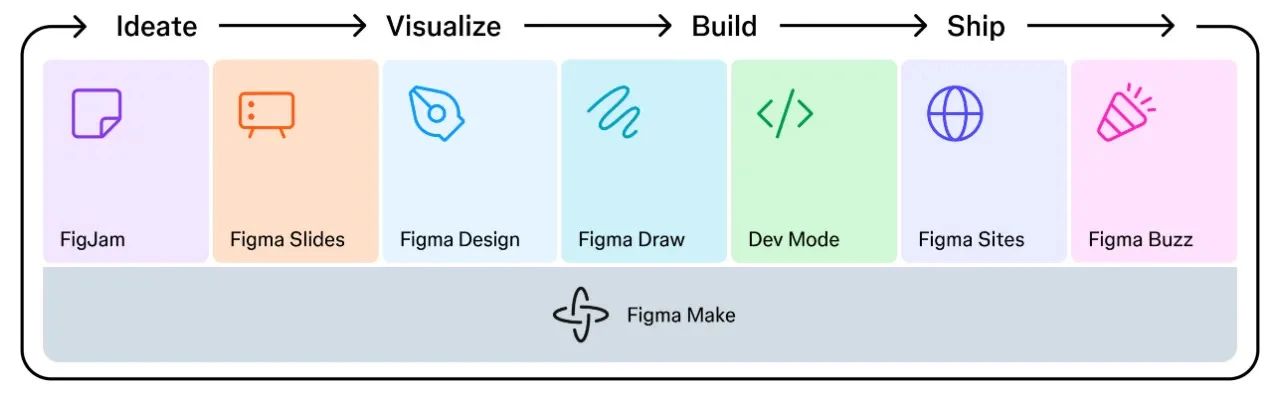

Figma’s multi-product strategy builds a complete digital product lifecycle ecosystem. From initial brainstorming (FigJam) to detailed design (Figma Design), from development delivery (Dev Mode) to content marketing (Figma Buzz), from website building (Figma Sites) to presentations (Figma Slides)—each product covers a critical stage of digital product development. Crucially, these products aren’t just stacked features—they form organic synergies: ideas from FigJam become design elements in Figma Design, components in Design auto-generate code specs in Dev Mode, and design assets seamlessly transfer to Slides presentations.

The value of this synergy is amplified by AI. AI enables smoother data flow and intelligent processing across products. User behavior and preferences in one product can be learned by AI and applied to optimize experiences in others. For example, color and font combinations frequently used in Figma Design can be recognized by AI and recommended in FigJam templates; coding preferences in Dev Mode can influence layout suggestions in Design; presentation styles in Slides can guide AI content generation elsewhere. This cross-product AI synergy creates user experiences unattainable with traditional tools.

From a stickiness perspective, multi-product usage exponentially increases migration costs. When users rely on multiple interconnected products, migration isn’t just moving individual tools—it includes rebuilding systemic interconnections. More importantly, accumulated workflows, collaboration habits, and data relationships—the “soft assets”—are harder to migrate than files or settings. These soft assets form the platform’s strongest moat.

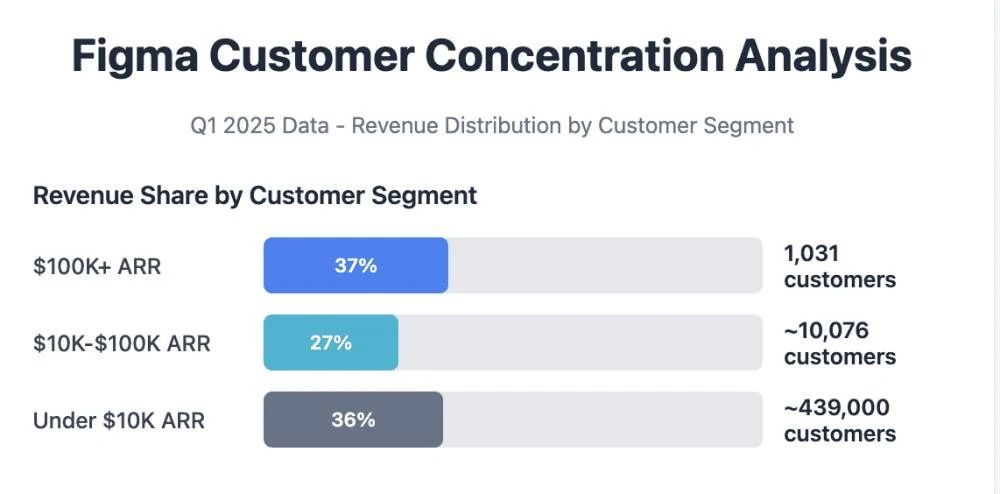

I note that the number of Figma’s enterprise customers paying over $100,000 annually grew 47% to 1,031, contributing 37% of total revenue. This revenue concentration reflects the Matthew effect of platform value: larger organizations with complex cross-departmental collaboration gain more from multi-product synergy and are willing to pay more. Large enterprises typically have dedicated design, product, engineering, and operations teams—inter-team collaboration efficiency directly impacts competitiveness, so their perceived value and willingness to pay for collaboration platforms are stronger.

The deeper business logic is that multi-product platforms redefine competitive dimensions. In the platform era, competition centers on ecosystem completeness and collaboration efficiency. Users care less about individual feature strength and more about whether the platform supports end-to-end workflows, delivers consistent UX, and enables seamless data and process integration.

Looking at global software trends, I predict future enterprise software markets will be dominated by such multi-product collaboration platforms. This forces every software company into a strategic choice: evolve into a platform, join a platform ecosystem, or risk obsolescence.

China’s Unique Opportunity: Rediscovering Strategic Value

China’s large designer population and vibrant digital economy create unique opportunities for local collaboration platforms. MasterGo, the only domestic platform comparable to Figma, possesses technical strength, top-tier client validation, localization advantages, and policy tailwinds. In AI deployment, it’s even ahead of Figma—representing a strategically valuable asset.

Shifting focus from Figma to the global software landscape, I observe a fascinating and opportunity-rich phenomenon: while the U.S. birthed Figma as a benchmark, China’s unique market complexity has created a large, relatively independent value pool for local innovation. This gap exists not just in demand, but across technology paths, business model innovation, and ecosystem building. Within this pool, a strategically significant domestic player awaits rediscovery.

China’s design software market uniqueness begins with scale. China boasts a vast designer workforce and a dynamic digital economy. From e-commerce product page design to HMI design in new energy vehicles to enterprise system digitization, China’s design demands lead globally in volume, variety, complexity, and iteration speed. This environment provides rich use cases and fast growth for collaboration tools—and imposes higher demands on performance, stability, and adaptability.

In this context, MasterGo, China’s only collaboration design platform capable of matching Figma, shows remarkable potential. Technologically, MasterGo adopts a web-native collaborative architecture supporting real-time multi-user editing, version control, and design systems. After years of technical accumulation, MasterGo now reliably supports large-scale team collaboration with hundreds online simultaneously and handles projects with over 100,000 layers—achieving international standards in performance and stability. More importantly, MasterGo offers private deployment, ideal for finance and government clients with high security requirements.

Deeper opportunities arise from cultural and operational differences. Chinese corporate culture emphasizes collective decision-making and cross-department collaboration, creating unique demands for design tools. For instance, Chinese firms prefer group discussions to refine designs, prioritize real-time communication and quick feedback, and require tools that support massive concurrent collaboration. Additionally, faster decision cycles and shorter iteration periods demand tools that handle frequent version updates and rapid design changes—needs distinct from overseas markets. MasterGo has built strong product advantages in these areas.

Market performance shows strong client validation. Through its “co-creation program,” MasterGo has deeply partnered with leading enterprises like China Telecom, China Merchants Bank, Meituan, Baidu, and iFlytek. Within three years, it captured nearly 80% of the enterprise market, with over 100 top-tier clients paying. This client base provides stable revenue and, more crucially, builds powerful word-of-mouth and industry influence. MasterGo’s NPS exceeds 50, and 63% of users rank it #1—exceptional satisfaction levels in enterprise software.

In payment capacity and commercial potential, China reveals vast value-creation space. An interesting Figma data point: while international users account for 85% of total users, they contribute only 53% of revenue. This mismatch highlights differences in purchasing power, payment habits, and value perception. Chinese enterprises show strong willingness and ability to pay for tools that significantly boost efficiency and competitiveness. Especially in Tier-1 cities and leading firms, investing in professional design tools has become standard in digital transformation—providing solid ground for MasterGo’s monetization.

Policy shifts offer unprecedented opportunities for domestic software. Implementation of laws like the Data Security Law and Cybersecurity Law has turned software autonomy from an “option” into a “must.” For government agencies, financial institutions, and state-owned enterprises, using domestically developed, IP-controlled software is now a compliance requirement. Figma previously posed supply risks to Chinese firms like DJI, raising awareness of the need for self-reliant design tools. MasterGo, as a flagship Chinese collaborative design platform, not only fills this gap but also addresses core concerns around data security and business continuity.

An even more strategic opportunity lies in deep integration of AI with local needs. In AI capability development, MasterGo demonstrates impressive foresight and execution. Public information shows MasterGo acted swiftly in the AI wave—launching AI Coding Agent features for generating website code earlier than Figma, and ranking among the first globally to support and expand MCP (Model Context Protocol). This proactive, fast-executing approach reflects deep technological understanding and product innovation agility.

Design needs in Chinese contexts, interaction habits of Chinese users, and collaboration patterns in local enterprises provide unique data and use cases for training AI design assistants that “understand Chinese users better.” When such localized AI capabilities integrate with a robust collaboration platform, they create differentiated value that overseas products struggle to replicate. Leveraging deep market understanding, MasterGo has the chance to break through in localized AI applications and build stronger competitive moats.

From an ecosystem perspective, China has a complete and unique digital toolchain. From DingTalk and WeChat Work to various project management, code hosting, and CI/CD tools, Chinese enterprises’ digital stacks differ significantly from overseas counterparts. A successful collaboration design platform must deeply integrate with these local tools, enabling seamless data flow and workflow continuity. This local ecosystem integration capability is a core strength hard for foreign players to replicate quickly—and a key advantage of MasterGo over Figma.

Most importantly, China remains in the early adoption phase of collaborative design tools, offering massive growth potential. While top internet firms and design studios already use advanced tools, countless SMEs and traditional enterprises still rely on outdated design methods. As these companies accelerate digital transformation, demand for collaborative design tools will surge. In this growth phase, locally advantaged platforms will gain user trust and market share more easily than foreign alternatives.

Considering all factors, I believe MasterGo represents a strategically significant product in China’s collaborative design software market. It not only matches Figma in technical capability and product strengths but also possesses localization advantages and policy benefits that Figma lacks. When Figma closed its first trading day at a $56.3 billion valuation, it set a clear value benchmark for the entire collaborative design platform industry. As the only domestic platform capable of rivaling Figma, MasterGo’s strategic value is waiting to be rediscovered.

Final Thoughts: Seizing the Moment of Opportunity and Value Discovery

Figma’s success sets a value benchmark for collaborative design platforms, signaling a shift from the tool era to the platform era. China’s market uniqueness offers local players a chance to leapfrog—this is a pivotal moment where AI redefines software value.

After completing my deep dive into Figma’s IPO, several clear insights emerge:

Software value is being重构 in the AI era. We stand at a critical inflection point in software industry evolution. Collaboration platforms aren’t weakened by AI—they become essential infrastructure connecting people and AI, with value being redefined and amplified. Figma’s $50+ billion market cap isn’t just recognition of one company; it’s a rediscovery of the entire collaborative platform sector’s value.

Technical architecture determines commercial fate. Web-native, cloud-first architectures hold decisive advantages in the AI era—more important than mere feature stacking. Companies built on traditional desktop software architectures, no matter how feature-rich, struggle to adapt to AI-era speed and collaboration demands.

Platform economics exhibit new traits. Successful software firms are no longer just the most powerful tool providers, but platform companies that build intelligent collaboration ecosystems and connect diverse user groups. Multi-product synergy, ecosystem integration, and collaboration stickiness are now core valuation drivers.

China presents unique opportunities. With its large designer base and vibrant digital economy, combined with distinct work cultures and rapid decision-making, China offers local collaboration platforms differentiated advantages. Policy emphasis on self-reliance further grants historically significant opportunities to capable domestic platforms.

I believe we are at a crucial juncture to reassess the strategic value of collaborative design platforms. Figma’s successful IPO clearly demonstrates their infrastructure-level importance in the digital age. As the only domestic product capable of matching Figma, MasterGo holds significant strategic value—one that transcends the product itself. In an era where AI redefines software boundaries, Chinese enterprises accelerate digital transformation, and self-reliance becomes a hard requirement, MasterGo represents not just a product platform, but a strategic move in China’s critical software domain.

True strategic value often emerges at pivotal moments of transformation. When an industry’s foundational logic shifts, companies that grasp the direction and possess core capabilities often become cornerstones of a new era. Figma’s success marks the transition of collaborative software from the tool era to the platform era—and MasterGo stands as China’s key representative in this shift. As AI deepens and collaboration demand grows, the importance of such strategic assets will only increase.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News