Kraken to IPO soon, what assets can be speculated on?

TechFlow Selected TechFlow Selected

Kraken to IPO soon, what assets can be speculated on?

Kraken's funding reignites上市 expectations.

By kkk, BlockBeats

On July 30, news emerged that cryptocurrency exchange Kraken is seeking to raise around $500 million at a $15 billion valuation, sparking significant market attention. This development comes amid a gradual thaw in the U.S. regulatory environment: in March 2025, the U.S. Securities and Exchange Commission (SEC) officially dropped its securities violation charges against Kraken, and just last week, Fortune magazine reported that the FBI has also concluded its investigation into Kraken's founder, lifting multiple regulatory shadows over the company. Meanwhile, Kraken’s official social media channels have been frequently hinting at potential上市 plans, further fueling market speculation.

Prior to this, CRCL saw gains of up to 10x from its IPO in June, creating a strong contrast for market expectations. If Kraken successfully goes public, it could trigger another wave of market enthusiasm—crucially, which assets will emerge as the "front-runners" in this rally?

Pre-IPO Investment Frenzy Arrives: Retail Investors Can Join Before上市

As top-tier companies like OpenAI and SpaceX remain private for extended periods, many early employees and investors are seeking ways to cash out their equity before上市. Forge serves precisely as the marketplace connecting these “sellers” with investors who want to “get in early.” With rising上市 expectations around Kraken, if employees or institutions begin offloading shares, private equity trading platforms like Forge could become indirect gateways for retail participation.

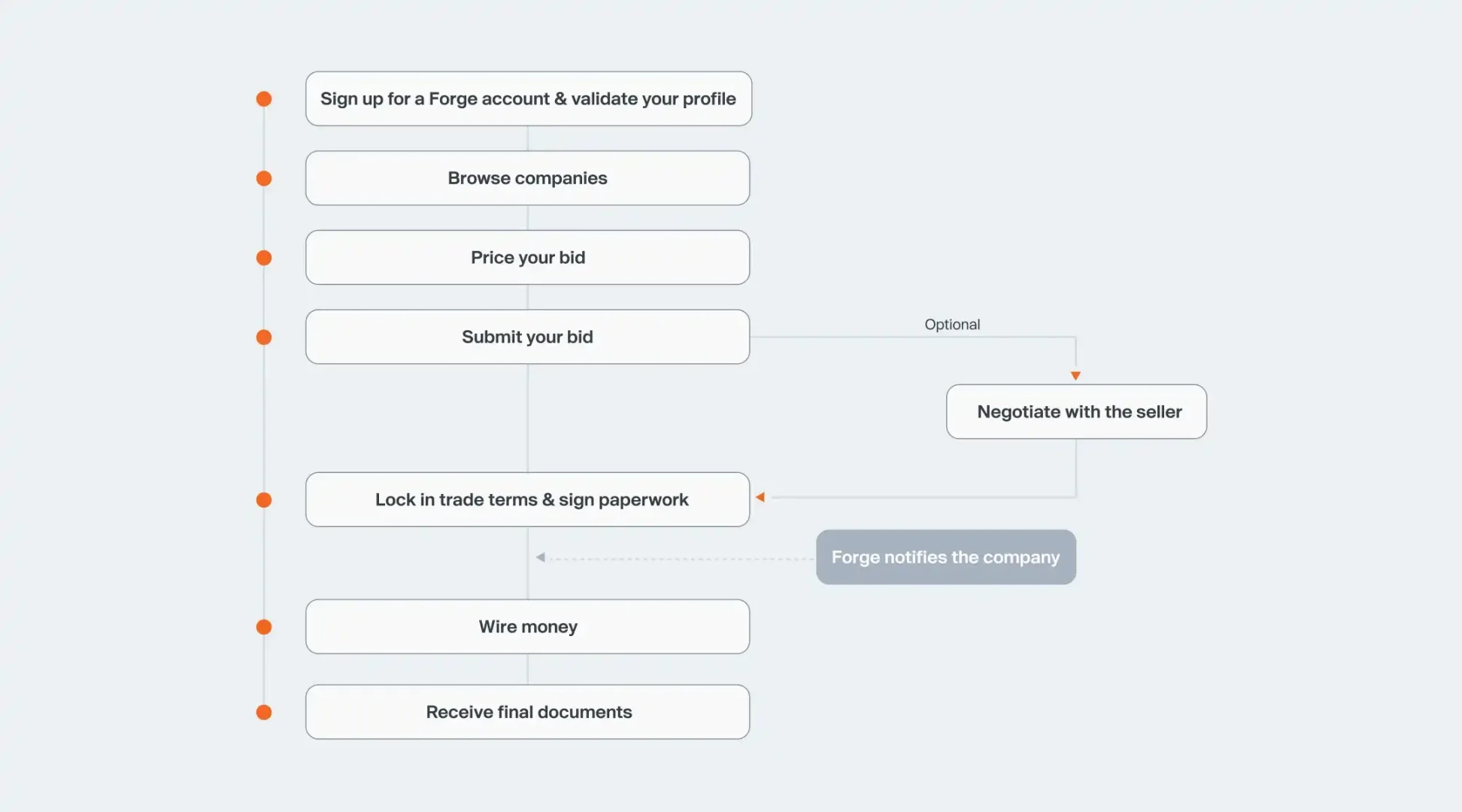

On Forge, investors typically access pre上市 company shares in two ways. The first is direct trading—finding an individual willing to sell their Kraken shares and negotiating a price. Forge assists with KYC, due diligence, and contract signing. The second method is via SPV transactions (Forge Funds), where Forge sets up a special purpose vehicle (SPV) to pool investor funds and acquire shares collectively. In this case, you own a share of the SPV rather than direct company stock. This approach bypasses rights of first refusal (ROFR) and suits investors aiming for faster entry, sometimes completing within days. Once Kraken eventually IPOs, the SPV may also achieve liquidity.

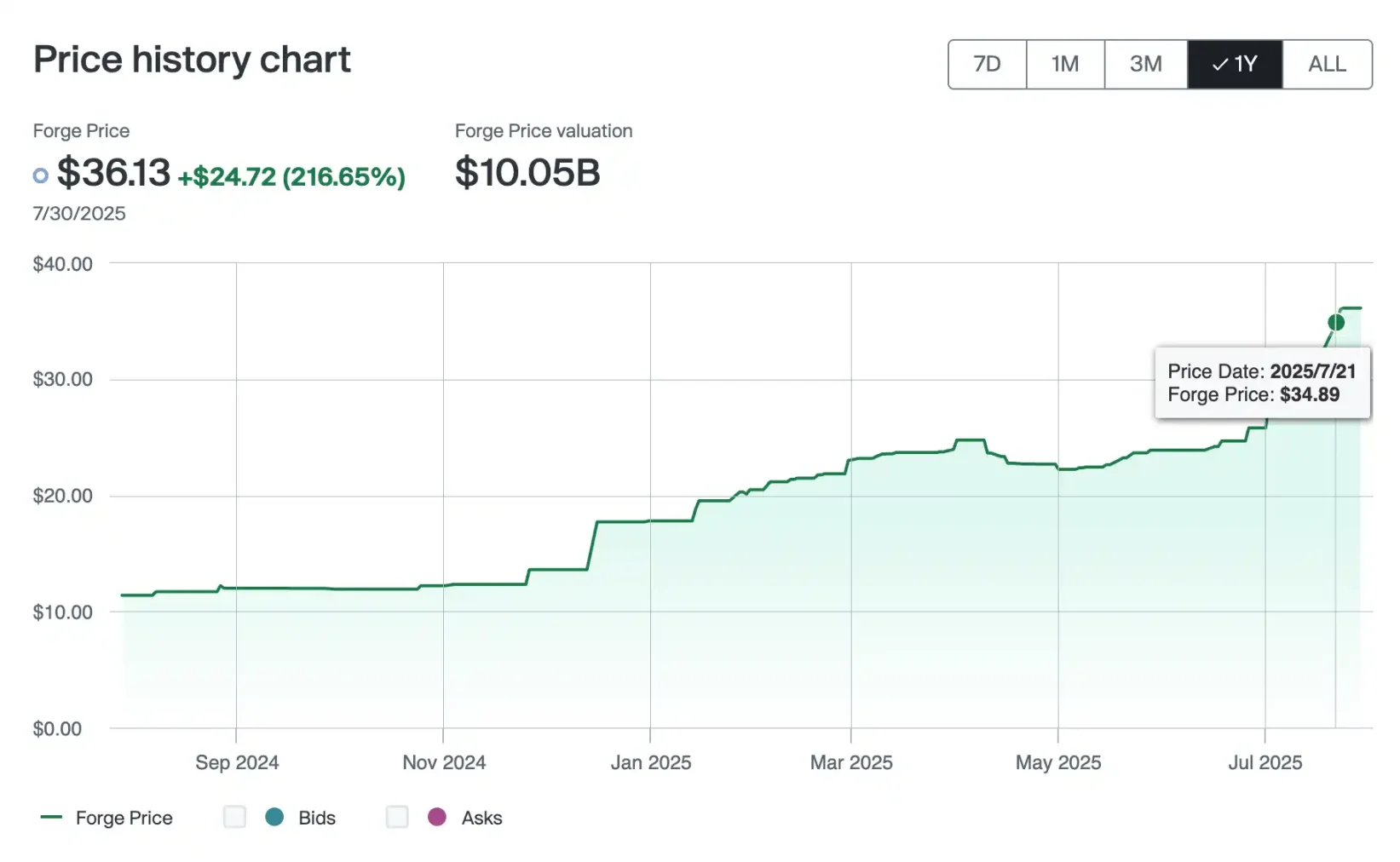

Currently, Kraken shares on Forge trade at $36.13, representing a 200% gain over the past year—reflecting strong market enthusiasm for its上市 prospects. At a current valuation of approximately $10 billion, if Kraken achieves its targeted $15 billion上市 valuation, early entrants could realize over 50% excess returns.

Moreover, tokenization of private equity is opening new investment avenues for retail investors. Platforms such as Republic and Robinhood already support stakes in tech giants like OpenAI and SpaceX. Whether they will extend support to Kraken in the future remains a development worth watching.

Ink Emerges as Next-Gen L2 Narrative, Mirroring Coinbase’s Base Chain

Following Coinbase’s Base chain becoming a central hub for Layer 2 traffic, Kraken has now officially entered the arena with Ink Network, launching its Layer 2 strategy. Ink is an Ethereum OP Stack-based Layer 2 blockchain designed for high throughput, low latency, and native EVM compatibility. It aims to serve as the DeFi hub within the Superchain ecosystem, providing robust infrastructure for future trading, payments, and on-chain financial systems. Spearheaded by Kraken, its native token $INK will be issued by subsidiary Ink Foundation and distributed via airdrop on the Kraken exchange to qualified active users and ecosystem participants. While specific distribution criteria and timelines remain unannounced, the news has already captured market focus.

On June 17, the Ink Foundation announced that the total supply of $INK will be permanently capped at one billion tokens, with no future minting and no governance rights. Positioned more as a “fuel” token for ecosystem incentives and user-level usage rather than a traditional governance token, its first confirmed use case is a native liquidity protocol powered by Aave—a key step in building Ink’s onchain capital stack. This protocol natively integrates lending mechanisms directly on the Ink chain, offering users efficient and seamless on-chain capital management.

Kraken co-CEO Arjun Sethi stated that Ink’s mission is to deeply integrate “production-grade on-chain systems” into Kraken’s product suite, advancing the strategic shift from centralized platforms toward on-chain finance. The Ink Foundation board called this “a pivotal moment,” viewing Ink’s launch as the beginning of CeFi-DeFi convergence and a tangible step toward a unified global capital market.

With the mainnet now live, Ink’s ecosystem is taking shape. The platform has launched a memecoin deployment tool called Inkypump. Its first mascot token, $ANITA, briefly surged to an $8 million market cap and now stabilizes around $4 million. Although $INK’s TGE date remains unannounced, the success of projects like Base has already built strong market anticipation for Ink’s potential.

Given Base’s rapid growth in ecosystem activity, TVL, and number of projects—and the performance of ecosystem tokens like $VIRTUAL and $ZORA—Ink, backed directly by the Kraken team and poised to inherit substantial traffic and resources, clearly stands as a candidate for the next major L2 narrative. Once $INK begins circulation and trading, it is expected to become a “canonical” representative within the CeFi hype cycle, especially as Kraken intends to tightly integrate its exchange capabilities with on-chain use cases. In this context, Ink is not merely an L2—it could become the core of Kraken’s onchain strategy. For investors aiming to position themselves ahead of Kraken’s IPO and the next L2 wave, Ink and its ecosystem projects warrant close attention.

Conclusion

Beyond crypto trading and Layer 2 network development, Kraken has recently expanded into broader financial services. In 2025, Kraken acquired Ninja Trader, a leading U.S. retail futures trading platform, for $1.5 billion, securing Futures Commission Merchant (FCM) status and officially entering the CFTC-regulated derivatives market—bridging a critical gap between CeFi and TradFi. At the same time, Kraken launched its payment app Krak, enabling instant payouts across more than 300 crypto and fiat assets, with future plans to expand into lending and credit card services, delivering a full-spectrum crypto payment experience. These strategic moves not only lay the foundation for Kraken to become a super-financial platform but are also seen as key precursors to its long-gestating IPO plan. As its product lines grow, revenues rise, and the regulatory climate continues to improve, Kraken is drawing ever closer to上市.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News